Duke Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duke Energy Bundle

Duke Energy, a major player in the energy sector, faces a dynamic landscape. While its established infrastructure and diversified energy portfolio represent significant strengths, potential regulatory shifts and the ongoing transition to renewables present notable challenges and opportunities.

Want the full story behind Duke Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Duke Energy's extensive regulated asset base is a significant strength, encompassing a diversified portfolio of electric and natural gas utilities across key regions like the Southeast and Midwest. This vast network serves millions of customers, providing essential services that are fundamental to daily life.

The regulated nature of these operations offers a crucial advantage: stable and predictable revenue streams. Unlike competitive markets, regulated utilities operate under frameworks that allow for recovery of costs and a reasonable rate of return, effectively insulating Duke Energy from significant market volatility. This stability is a cornerstone of its financial performance.

As of the first quarter of 2024, Duke Energy reported approximately $150 billion in regulated utility assets. This substantial regulated footprint directly contributes to its consistent financial results, underpinning its ability to invest in infrastructure and meet customer demand reliably.

Duke Energy has outlined a substantial capital investment plan, earmarking $83 billion for the period of 2025 through 2029. This ambitious spending is among the highest in the regulated utility sector, signaling a strong commitment to future development.

The majority of these funds will be channeled into critical areas such as grid modernization, improving overall reliability, and expanding generation capabilities to satisfy increasing energy needs. This strategic deployment of capital is designed to foster sustained growth and boost operational effectiveness.

Duke Energy is showing impressive financial strength, with adjusted earnings per share (EPS) on the rise in the second quarter of 2025. The company has also confirmed its 2025 EPS forecast, aiming for a range of $6.17 to $6.42, and is projecting a steady long-term growth rate of 5-7% annually through 2029.

Key strategic moves are bolstering Duke Energy's financial foundation. A significant $6 billion investment from Brookfield Infrastructure into Duke Energy Florida, alongside the divestiture of its Tennessee Local Distribution Company (LDC) business, has demonstrably improved the company's balance sheet and creditworthiness.

Commitment to Clean Energy Transition

Duke Energy is making substantial strides in its clean energy transition, a key strength that positions it favorably in the evolving energy landscape. The company has set ambitious goals, including achieving net-zero methane emissions by 2030 and net-zero carbon emissions from its electricity generation by 2050. This forward-thinking approach is backed by significant capital allocation towards renewable energy sources.

The company's strategic investments are geared towards a substantial increase in renewable energy capacity. By 2035, Duke Energy plans to integrate over 30,000 megawatts of regulated renewable energy into its portfolio. This includes a strong focus on solar power and the exploration of advanced nuclear technologies, demonstrating a diversified approach to decarbonization.

- Net-Zero Methane Emissions Target: 2030

- Net-Zero Carbon Emissions Target (Electricity Generation): 2050

- Regulated Renewable Energy Integration Target by 2035: Over 30,000 MW

Advanced Grid Modernization and Reliability

Duke Energy is making substantial investments in modernizing its grid infrastructure, a key strength that enhances reliability and customer service. These efforts include deploying smart grid technologies and advanced distribution automation, which are designed to preemptively identify and resolve issues.

These grid modernization initiatives have already demonstrated tangible results. For instance, Duke Energy reported a significant reduction in the duration of customer outages in recent years, directly attributable to these technological upgrades. This improved resiliency is vital for handling the growing demand for electricity and the increasing integration of renewable energy sources.

- Significant investment in smart grid technologies.

- Implementation of self-healing grid capabilities.

- Demonstrated reduction in customer outage durations.

- Enhanced grid resiliency to manage demand and renewables.

Duke Energy's substantial regulated asset base, valued at approximately $150 billion as of Q1 2024, provides stable and predictable revenue streams, insulating it from market volatility. The company's commitment to future development is evident in its $83 billion capital investment plan for 2025-2029, primarily focused on grid modernization and generation expansion.

Financially, Duke Energy is demonstrating strength, with projected 2025 adjusted EPS between $6.17 and $6.42 and a long-term growth rate of 5-7% through 2029. Strategic actions, like Brookfield Infrastructure's $6 billion investment in Duke Energy Florida, have bolstered its balance sheet.

The company is aggressively pursuing a clean energy transition, aiming for net-zero methane emissions by 2030 and net-zero carbon emissions from electricity generation by 2050, with plans to integrate over 30,000 MW of regulated renewable energy by 2035.

Duke Energy's grid modernization efforts, including smart grid technologies and self-healing capabilities, have led to a demonstrable reduction in customer outage durations, enhancing overall reliability.

| Metric | Value | Year/Period |

| Regulated Assets | ~$150 billion | Q1 2024 |

| Capital Investment Plan | $83 billion | 2025-2029 |

| Projected 2025 Adjusted EPS | $6.17 - $6.42 | 2025 |

| Long-Term EPS Growth Rate | 5-7% | Through 2029 |

| Regulated Renewable Energy Target | >30,000 MW | By 2035 |

What is included in the product

Analyzes Duke Energy’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats in the evolving energy landscape.

Offers a clear, actionable framework to identify and address Duke Energy's critical challenges and opportunities.

Weaknesses

Duke Energy carries substantial debt, a common trait for large utilities. As of March 2025, its net debt to equity ratio stood at 166%. This significant leverage means the company is quite sensitive to fluctuations in interest rates and broader economic downturns.

The high debt load directly impacts Duke Energy's financial flexibility. It can lead to a downgrade in credit ratings, which in turn would increase the cost of borrowing for crucial future investments. These investments are essential for funding the company's ambitious capital expenditure plans, particularly in grid modernization and clean energy transitions.

Duke Energy's strategy includes adding approximately 5 gigawatts of new natural gas generation capacity by 2029. This move is intended to address projected load growth, notably from the burgeoning data center sector. The company is investing in natural gas turbines to meet these anticipated energy demands.

However, this continued reliance on natural gas presents a significant weakness. Despite Duke Energy's stated decarbonization ambitions, adding substantial natural gas capacity runs counter to aggressive state-level carbon reduction mandates. This reliance could lead to challenges in achieving these targets and may attract increased environmental scrutiny.

Duke Energy has faced challenges with increasing operational and maintenance (O&M) expenses, which have partially offset its earnings growth. For instance, in the first quarter of 2024, the company reported higher O&M costs alongside interest expenses, impacting its financial performance. Effectively controlling these rising costs is crucial for Duke Energy to maintain profitability and ensure its significant capital investments yield the desired financial returns.

Exposure to Regulatory Challenges

Duke Energy's operations are inherently subject to significant regulatory oversight, posing a notable weakness. The company faces ongoing scrutiny and challenges, particularly regarding environmental liabilities such as the costly remediation of coal ash, which can impose substantial financial burdens. For instance, as of early 2024, Duke Energy was still addressing coal ash management across several states, with projected costs running into the billions of dollars.

While Duke Energy has achieved some success in recent rate cases, securing constructive outcomes that allow for cost recovery, the landscape of future regulatory changes presents a persistent headwind. Potential shifts in energy policies, evolving cost recovery mechanisms, and adjustments to rate structures could negatively impact the company's financial performance and strategic flexibility. The uncertainty surrounding these future regulatory decisions remains a key area of concern for investors and management alike.

Key regulatory challenges include:

- Environmental Compliance Costs: Significant financial outlays are required for managing and remediating environmental liabilities, such as coal ash disposal and water quality improvements, impacting profitability.

- Rate Case Outcomes: While recent cases have been favorable, future rate increase approvals and the allowed rate of return are subject to regulatory discretion and can vary significantly.

- Energy Policy Shifts: Changes in state and federal energy policies, including those related to renewable energy mandates, carbon pricing, and grid modernization, can alter business models and investment requirements.

- Permitting and Approval Processes: Delays or denials in obtaining necessary permits for new infrastructure projects can hinder growth and increase capital expenditures.

Complexity of Large-Scale Project Execution

Duke Energy's substantial capital expenditure plans, projected to be around $14 billion to $15 billion annually through 2028, while necessary for grid modernization and clean energy transitions, introduce significant execution risks. The sheer magnitude of these large-scale infrastructure projects means they are susceptible to delays and cost overruns.

These challenges can directly impact Duke Energy's financial health and postpone the expected returns from these critical investments. For instance, the company has previously navigated issues with large transmission projects, highlighting the inherent complexities.

- Project Delays: Large infrastructure undertakings are prone to unexpected setbacks, pushing back completion dates.

- Cost Overruns: Unforeseen material costs, labor issues, or regulatory hurdles can escalate project budgets beyond initial estimates.

- Technical Challenges: Implementing new technologies or integrating complex systems in existing infrastructure can present unforeseen technical hurdles.

- Regulatory Hurdles: Obtaining permits and approvals for major projects can be a lengthy and unpredictable process.

Duke Energy faces significant operational and maintenance cost pressures. In Q1 2024, these costs, alongside higher interest expenses, impacted earnings. Effectively managing these rising expenses is critical for maintaining profitability and ensuring capital investments deliver expected returns.

The company's substantial debt, with a net debt to equity ratio of 166% as of March 2025, makes it vulnerable to interest rate hikes and economic downturns, potentially increasing borrowing costs and limiting financial flexibility for essential investments.

Duke Energy's continued investment in natural gas generation, including adding 5 GW by 2029, poses a weakness. This strategy may conflict with aggressive state-level decarbonization goals, potentially leading to increased environmental scrutiny and challenges in meeting its own stated climate targets.

The company is also susceptible to regulatory changes and environmental compliance costs. Managing liabilities like coal ash remediation, which incurred billions in projected costs as of early 2024, and navigating potential shifts in energy policies and rate structures present ongoing financial and strategic challenges.

What You See Is What You Get

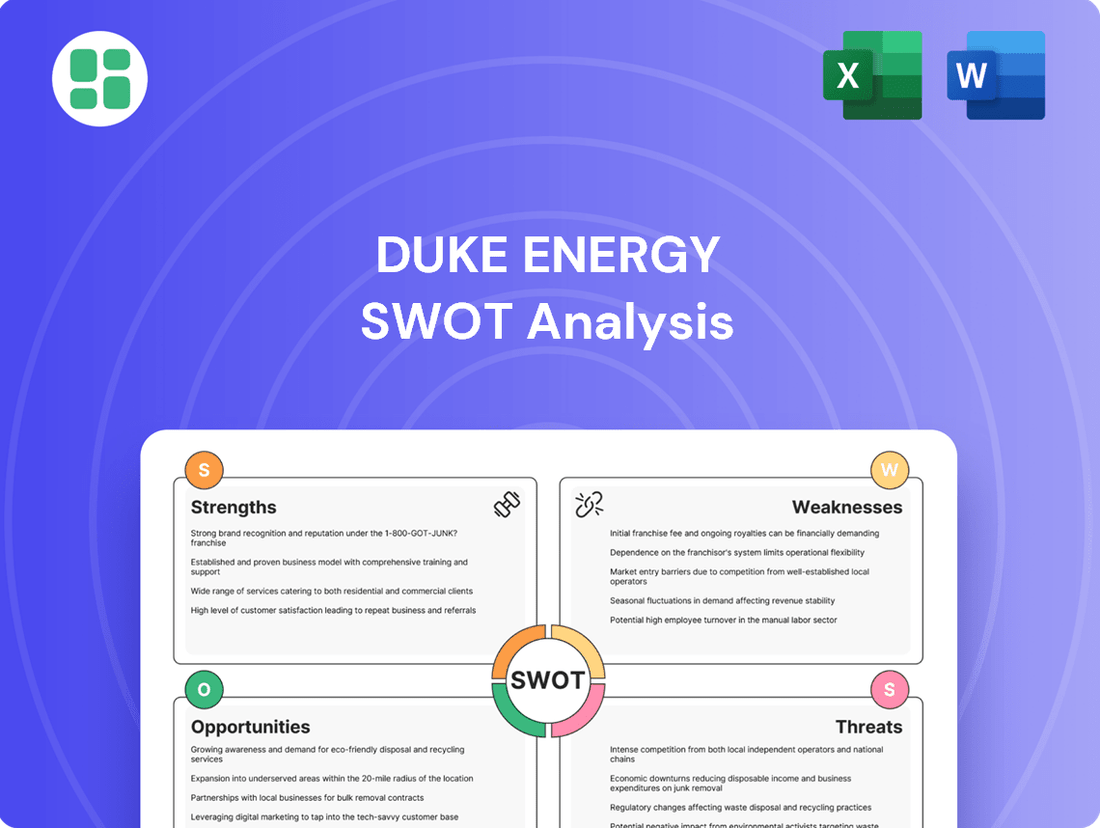

Duke Energy SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Duke Energy's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Duke Energy's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a thorough breakdown of Duke Energy's market landscape.

Opportunities

Duke Energy is strategically located in areas experiencing robust economic expansion and population increases. This growth is fueled by new commercial enterprises and a surge in demand from data centers, a trend expected to continue. For instance, North Carolina, a key state for Duke Energy, saw its GDP grow by an estimated 2.8% in 2024, significantly above the national average.

This unprecedented load growth translates directly into a substantial opportunity for higher electricity sales. It also allows for the more efficient deployment and utilization of new generation capacity and grid modernization investments. The company anticipates significant capital expenditures in the coming years, partly to meet this burgeoning demand.

Duke Energy is strategically positioned to capitalize on the growing demand for renewable energy, with a clear objective to reach 30,000 megawatts of regulated renewables by 2035. This expansion includes significant investments in new solar power generation, a key driver for decarbonization.

Beyond solar, the company is actively investigating advanced nuclear technologies and pumped hydro storage solutions. This diversification of its energy portfolio not only strengthens its commitment to national decarbonization targets but also enhances energy grid reliability and resilience.

Duke Energy is actively optimizing its asset portfolio to fuel future growth and enhance its financial standing. A significant move was the $6 billion equity investment from Brookfield Infrastructure into Duke Energy Florida, alongside the divestiture of its Tennessee natural gas business. These strategic actions are designed to bolster the company's balance sheet, decrease leverage, and generate capital for crucial regulated investments.

Leveraging Customer-Centric Energy Programs

Duke Energy is actively enhancing customer engagement through innovative energy programs. For instance, the company is expanding incentives for energy efficiency and rolling out new voluntary solar options like the Clean Energy Connection (CEC). These efforts are designed to drive customer participation in the clean energy transition.

These customer-centric initiatives offer tangible benefits such as bill credits and greater control over energy consumption. This focus on affordability and customer empowerment is a key opportunity for Duke Energy to strengthen its market position and build loyalty.

- Customer Engagement: Programs like CEC aim to increase customer involvement in renewable energy adoption.

- Bill Credits: Incentives for efficiency and solar participation provide direct financial benefits to customers.

- Affordability Focus: Initiatives are structured to help customers manage and potentially reduce their energy costs.

- Clean Energy Transition: These programs directly support Duke Energy's broader goals for a cleaner energy future.

Continued Grid Modernization and Smart Technologies

Duke Energy's ongoing commitment to grid modernization, with significant investments in smart grid technologies, presents a substantial opportunity. These upgrades, including advanced metering infrastructure and self-healing grid capabilities, are designed to boost efficiency and reliability. For instance, Duke Energy has been actively deploying smart meters across its service territories, aiming to enhance two-way communication and provide customers with better energy usage data.

The integration of these smart technologies is pivotal for Duke Energy to effectively manage the increasing penetration of distributed energy resources, such as solar and battery storage. This modernization effort directly addresses the evolving energy landscape, allowing for greater flexibility and resilience in power delivery.

Key opportunities stemming from continued grid modernization include:

- Enhanced Grid Efficiency: Smart grid technologies enable real-time monitoring and control, reducing energy losses and operational costs.

- Improved Reliability: Self-healing systems can automatically reroute power during outages, minimizing downtime and customer impact.

- Integration of Renewables: Advanced infrastructure is essential for seamlessly incorporating intermittent renewable energy sources into the grid.

- Customer Engagement: Smart metering empowers customers with data to manage their energy consumption and participate in demand-response programs.

Duke Energy is well-positioned to benefit from significant load growth driven by economic expansion and the burgeoning data center sector, particularly in states like North Carolina where GDP growth was projected at 2.8% for 2024. This increased demand translates directly into higher electricity sales and more efficient utilization of planned capital investments in generation and grid modernization.

The company's aggressive renewable energy targets, aiming for 30,000 megawatts of regulated renewables by 2035, coupled with explorations into advanced nuclear and pumped hydro, present a substantial opportunity to diversify its energy mix and meet decarbonization goals. Strategic financial moves, such as the $6 billion equity investment from Brookfield Infrastructure into Duke Energy Florida, are bolstering its financial capacity for these critical investments.

Duke Energy's focus on customer engagement through programs like Clean Energy Connection (CEC) and expanded energy efficiency incentives offers a pathway to increase customer participation and loyalty. These initiatives, which include bill credits and greater energy management control for customers, align with a broader trend towards customer empowerment in the energy transition.

Continued investment in grid modernization, including the deployment of smart meters and self-healing grid technologies, is a key opportunity to enhance operational efficiency, improve reliability, and better integrate distributed energy resources. This modernization is crucial for managing the evolving energy landscape and delivering value to customers.

| Opportunity Area | Description | Supporting Data/Initiative |

|---|---|---|

| Load Growth | Capitalizing on increased electricity demand from economic expansion and data centers. | North Carolina GDP growth projected at 2.8% for 2024; significant data center investments. |

| Renewable Energy Expansion | Achieving ambitious renewable energy generation targets and diversifying the energy portfolio. | Target of 30,000 MW regulated renewables by 2035; exploration of advanced nuclear and pumped hydro. |

| Customer Engagement & Affordability | Enhancing customer participation and loyalty through innovative energy programs and cost management. | Clean Energy Connection (CEC) program; expanded energy efficiency incentives; bill credits. |

| Grid Modernization | Improving grid efficiency, reliability, and integration of renewables through smart technologies. | Active deployment of smart meters; development of self-healing grid capabilities. |

Threats

Duke Energy faces significant threats from potential shifts in state and federal regulatory policies. Changes in environmental mandates, particularly those concerning climate change and emissions, could necessitate costly upgrades and operational adjustments. For instance, stricter carbon regulations, if enacted in 2024 or 2025, might force accelerated retirement of coal-fired plants and increased investment in renewables, impacting capital expenditure plans and potentially delaying returns on existing assets.

Furthermore, unfavorable rulings or prolonged delays in rate case approvals represent a substantial risk. In 2024, utility companies like Duke Energy often rely on timely rate adjustments to recover investments in infrastructure and clean energy projects. A denial or significant reduction in requested rate increases, as seen in some utility cases in late 2023 and early 2024, could directly impair profitability and the company's capacity to fund future growth initiatives, while also affecting its ability to maintain competitive pricing for its customers.

While Duke Energy has seen robust load growth recently, the specter of economic uncertainty looms. A slowdown in economic activity or a significant shift in industrial energy consumption could directly impact the company's revenue streams and overall profitability. For instance, a widespread economic contraction in 2024 could reduce industrial electricity usage, a key revenue driver for utilities.

Furthermore, the volatility of natural gas prices presents a significant operational challenge. Given Duke Energy's substantial reliance on natural gas for electricity generation, fluctuations in this commodity directly affect its operating expenses. In 2024, natural gas prices have shown considerable swings, impacting the cost of fuel for power plants and potentially squeezing profit margins if not effectively hedged.

Duke Energy faces significant threats from the sheer scale of its ambitious infrastructure plans. For instance, the company has committed to substantial investments in grid modernization and clean energy generation, with capital expenditures projected to be in the tens of billions of dollars over the coming years. These massive undertakings are inherently prone to delays and unexpected cost increases.

The complexity of modernizing an aging grid and integrating new, large-scale renewable energy sources presents substantial technical hurdles. Should these projects encounter significant setbacks, it could result in substantial financial penalties, such as liquidated damages for missed deadlines, directly impacting profitability. Furthermore, such execution risks can hinder Duke Energy's ability to achieve its strategic clean energy transition goals.

Moreover, persistent project execution issues can erode investor confidence. A track record of significant cost overruns or prolonged delays on major capital projects could lead to a reassessment of Duke Energy's financial stability and future growth prospects by the investment community, potentially impacting its stock valuation and cost of capital.

Intensified Competition in the Energy Sector

The energy sector is becoming increasingly crowded, with new competitors emerging from renewable sources, localized power generation, and innovative technologies. Duke Energy's significant investments in clean energy, like its plans to invest billions in grid modernization and renewables through 2028, position it well, but the pace of adaptation is crucial. Failure to swiftly navigate these evolving competitive pressures and technological shifts could erode its market share and jeopardize its long-term standing.

Specifically, the rise of distributed generation, such as rooftop solar and battery storage, directly challenges traditional utility models. For instance, by the end of 2024, it's projected that distributed solar capacity will continue its upward trajectory, directly impacting the demand for centralized power. Furthermore, advancements in energy storage and smart grid technologies are creating new market entrants and service providers who can offer more flexible and potentially cheaper energy solutions, forcing established players like Duke Energy to innovate continuously.

- Increased competition from renewable energy sources: The global renewable energy market is projected to reach over $2 trillion by 2030, presenting a significant competitive threat to traditional fossil fuel-based energy providers.

- Growth of distributed generation: Rooftop solar and behind-the-meter storage solutions are becoming more accessible, allowing consumers to generate and manage their own power, reducing reliance on utility companies.

- Emerging energy technologies: Innovations in areas like green hydrogen, advanced battery technology, and small modular nuclear reactors could disrupt the existing energy infrastructure and create new competitive landscapes.

- Pace of adaptation: Duke Energy's ability to integrate these new technologies and business models into its operations will be critical for maintaining its competitive edge and market relevance in the coming years.

Environmental Liabilities and Remediation Costs

Duke Energy is exposed to significant financial risks stemming from its environmental liabilities, particularly concerning coal ash remediation. The company has committed substantial resources to address these legacy issues, impacting its capital allocation priorities. For instance, as of the first quarter of 2024, Duke Energy reported approximately $3.1 billion in environmental reserves, with a considerable portion allocated to coal ash management. This ongoing financial commitment could divert funds from growth initiatives and potentially affect future earnings and shareholder returns.

The financial strain from these environmental obligations is a notable threat. These remediation costs can be unpredictable, with potential for cost overruns or unforeseen challenges during the cleanup process. Such scenarios could place further pressure on Duke Energy's balance sheet and profitability, requiring careful financial planning and risk management to mitigate adverse impacts. The company's 2024 guidance indicated ongoing capital expenditures related to environmental compliance and remediation.

- Ongoing Coal Ash Remediation: Duke Energy faces substantial financial implications and potential liabilities associated with ongoing coal ash remediation efforts, with billions allocated to these projects.

- Financial Strain and Capital Diversion: These environmental obligations could impose significant financial strain, diverting capital from other strategic investments and potentially impacting the company's balance sheet and profitability.

- Unpredictable Costs: Remediation expenses can be unpredictable, posing a risk of cost overruns that could further strain financial resources.

- Impact on Future Investments: Significant outlays for environmental cleanup may limit the company's capacity for new investments in renewable energy or grid modernization.

Duke Energy's significant capital expenditure plans, estimated to be in the tens of billions through 2028 for grid modernization and clean energy, carry inherent risks of delays and cost overruns. These large-scale projects, crucial for its clean energy transition, could face substantial financial penalties if execution falters, potentially impacting profitability and investor confidence.

The competitive landscape is intensifying with the rise of distributed generation, like rooftop solar, which directly impacts traditional utility revenue. By the end of 2024, distributed solar capacity is projected to continue its growth, potentially reducing demand for centralized power and forcing Duke Energy to adapt quickly to new energy solutions and market entrants.

Environmental liabilities, particularly for coal ash remediation, represent a significant financial threat. As of Q1 2024, Duke Energy had approximately $3.1 billion in environmental reserves, with ongoing remediation costs potentially diverting capital from growth initiatives and impacting profitability due to unpredictable expenses.

The company also faces risks from economic downturns, which could reduce industrial electricity usage, a key revenue driver. Furthermore, natural gas price volatility directly affects operating expenses, potentially squeezing profit margins if not effectively managed through hedging strategies.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including Duke Energy's official financial filings, detailed market research reports, and expert commentary from industry analysts to ensure a robust and informed assessment.