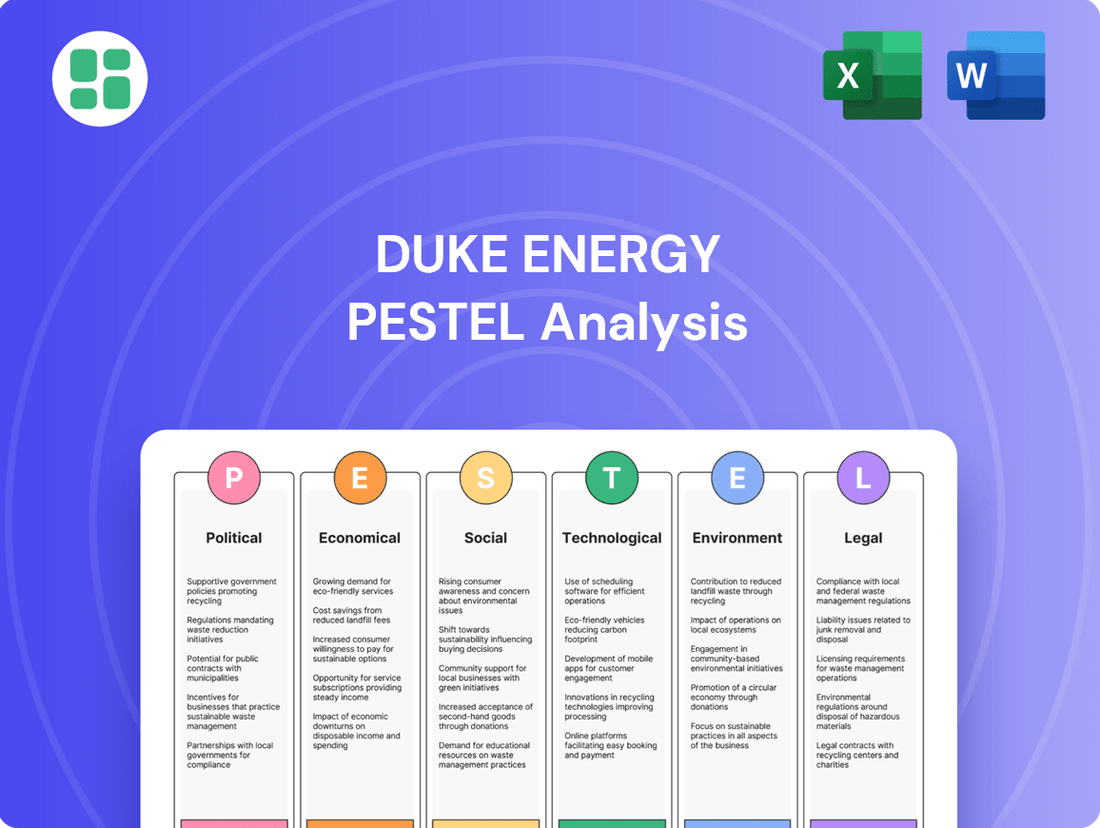

Duke Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duke Energy Bundle

Navigate the complex external landscape impacting Duke Energy with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping their operations and future growth. Gain a strategic advantage by leveraging these expert insights to refine your own market approach. Download the full report now for actionable intelligence.

Political factors

Duke Energy navigates a complex web of regulations from state utility commissions and federal bodies, impacting everything from energy pricing to environmental standards. These agencies are crucial in shaping the company's operational landscape and investment strategies.

A prime example is the North Carolina Utilities Commission's November 2024 approval of Duke Energy's Carbon Plan. This plan, a critical regulatory directive, maps out the company's strategy for achieving carbon reduction targets, with a stated commitment to maintaining both grid reliability and customer affordability.

The Carbon Plan greenlights substantial capital expenditures, estimated in the billions, for the development of new, cleaner energy generation sources and significant upgrades to the existing grid infrastructure. This regulatory endorsement is key to Duke Energy's transition towards a lower-carbon future.

Government mandates significantly influence Duke Energy's strategic direction. North Carolina's ambitious clean energy goals, including a 70% carbon emission reduction by 2030 and net-zero by 2050, necessitate substantial investments in renewable energy sources and grid modernization.

While the North Carolina Utilities Commission (NCUC) recently permitted a revised timeline for the 2030 carbon reduction goal, pushing it to at least 2034 to prioritize grid reliability, the overarching commitment to decarbonization remains a key driver for Duke Energy's long-term planning.

Duke Energy is actively adapting by increasing its portfolio of solar power, battery storage solutions, and leveraging natural gas as a transitional fuel to comply with these evolving regulatory requirements and achieve its emission reduction targets.

Federal initiatives like the Infrastructure Investment and Jobs Act (IIJA) and energy tax credits from the Inflation Reduction Act (IRA) are major drivers for Duke Energy's clean energy investments. These acts provide substantial financial support, making cleaner energy projects more economically viable.

Duke Energy is actively leveraging these opportunities, having submitted 15 applications for IIJA funding. This demonstrates a strategic approach to utilizing federal resources for developing and deploying clean energy technologies and improving grid infrastructure, aiming to lower costs for customers.

Government Relations and Lobbying

Duke Energy actively engages with policymakers and regulators to shape energy policies, particularly concerning its clean energy transition. This involves significant lobbying efforts aimed at securing approvals for infrastructure investments and ensuring favorable regulatory frameworks for cost recovery. For instance, in 2024, the company continued its dialogue with state utility commissions regarding its multi-year rate plans, which are crucial for funding its grid modernization and renewable energy projects. The company's success in these engagements directly impacts its ability to achieve its projected earnings and capital expenditure targets.

The company's financial health is intrinsically linked to its capacity to recover costs through rate cases and other regulatory mechanisms. These processes allow Duke Energy to recoup investments in new technologies and infrastructure upgrades. In 2024, Duke Energy received key regulatory approvals for its capital plans in several states, such as North Carolina and South Carolina, which will enable substantial investments in cleaner energy sources and grid resilience. These approvals are a testament to the company's persistent efforts in demonstrating the necessity and benefits of its proposed rate adjustments to stakeholders and regulators.

Mitigating regulatory lag and ensuring adequate returns on investment are paramount for Duke Energy's strategic objectives. The company's proactive approach to regulatory relations aims to streamline approval processes and minimize the time between capital expenditure and cost recovery. For example, recent settlements and approvals in 2024 for performance-based rate-making mechanisms in certain jurisdictions are designed to incentivize efficiency and align regulatory outcomes with shareholder value. These initiatives are critical for maintaining investor confidence and supporting the company's ambitious clean energy goals.

Key aspects of Duke Energy's government relations and lobbying include:

- Advocacy for Clean Energy Policies: Supporting legislation and regulations that facilitate renewable energy deployment and grid modernization.

- Rate Case Filings: Presenting detailed proposals to state utility commissions to recover costs for infrastructure and operational investments.

- Regulatory Approvals: Securing necessary permits and approvals for capital projects, including power generation and transmission upgrades.

- Stakeholder Engagement: Maintaining open communication with policymakers, regulators, and customer groups to build consensus on energy policy.

Political Stability and Regional Growth

Duke Energy's operational success is closely tied to the political and economic stability of its core service areas in the Southeast and Midwest. These regions are experiencing robust economic development and population increases, which directly translates to higher energy demand.

For instance, North Carolina, a key state for Duke Energy, saw its population grow by approximately 1.4% between 2022 and 2023, according to U.S. Census Bureau estimates. This ongoing growth necessitates significant, long-term capital investments in new generation capacity and modernized grid infrastructure to reliably serve a larger customer base. The company's 2024 capital plan includes substantial investments in grid modernization and clean energy projects to meet this rising load.

- Population Growth: Continued population increases in Duke Energy's service territories directly boost energy demand.

- Economic Development: Favorable economic conditions encourage business expansion, further increasing electricity consumption.

- Infrastructure Investment: Meeting growing demand requires consistent capital allocation for new generation and grid upgrades.

Government policies and regulatory frameworks are paramount to Duke Energy's operations and strategic direction. Federal initiatives like the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) provide significant financial incentives for clean energy investments, which Duke Energy is actively pursuing, having submitted 15 applications for IIJA funding in 2024. State-level regulations, such as North Carolina's Carbon Plan, dictate the pace and nature of the company's decarbonization efforts, influencing billions in capital expenditures for new generation and grid upgrades.

Duke Energy's success hinges on its ability to navigate these political landscapes, engaging in lobbying and stakeholder dialogue to secure favorable regulatory approvals for its multi-year rate plans and infrastructure projects. For instance, the company's 2024 capital plan, designed to meet rising energy demand from population growth in key states like North Carolina (which saw an estimated 1.4% population increase between 2022-2023), relies heavily on these regulatory approvals to ensure cost recovery and achieve projected earnings.

The company's proactive approach to regulatory relations aims to streamline approval processes and minimize regulatory lag, as evidenced by recent settlements in 2024 for performance-based rate-making mechanisms. These efforts are crucial for maintaining investor confidence and supporting Duke Energy's transition to a cleaner energy future while ensuring grid reliability and customer affordability.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Duke Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, highlighting key trends and potential impacts on Duke Energy's operations and future growth.

The Duke Energy PESTLE analysis offers a clear and concise overview of external factors, acting as a pain point reliever by providing readily digestible information for strategic planning and risk assessment.

Economic factors

Duke Energy is seeing a substantial increase in electricity demand, largely fueled by new economic development. A key driver is the projected surge in data center operations in North Carolina, expected to ramp up significantly between 2027 and 2028.

The company anticipates peak load growth by 2030 to be eight times greater than what was projected just two years ago. This dramatic rise in demand requires significant capital investment in new generation capacity and grid infrastructure to maintain reliable service.

The fluctuating cost of natural gas presents a considerable economic challenge for Duke Energy. This is particularly true as the company phases out coal-fired power plants and increases its reliance on natural gas for electricity generation.

Research suggests Duke Energy's planned expansion of natural gas infrastructure could lead to substantial increases in customer bills. Under a high-price forecast, monthly natural gas expenses for ratepayers might surge by as much as 175% by 2031, underscoring the company's vulnerability to commodity market swings.

Duke Energy's financial health is robust, enabling a significant capital investment program. The company has outlined an ambitious $83 billion capital plan spanning from 2025 to 2029, primarily targeting upgrades to its transmission and distribution networks, new power generation facilities, and modernization of its natural gas infrastructure.

This substantial investment is supported by strong financial performance and strategic asset sales. For instance, the sale of its Piedmont Natural Gas Tennessee business for $2.48 billion provides crucial funding for these capital expenditures, enhancing financial flexibility.

Duke Energy projects a long-term Earnings Per Share (EPS) growth rate of 5-7% through 2029, a target directly supported by the planned capital deployments and their expected operational efficiencies and revenue generation.

Customer Affordability and Rates

Duke Energy navigates the delicate balance between essential infrastructure upgrades and maintaining customer affordability. The company is investing heavily in grid modernization and clean energy transitions, aiming to manage the impact of these investments on customer rates. For instance, in Florida, while base rate increases have been requested in certain jurisdictions, projections indicate a decrease in overall customer bills starting January 2025. This anticipated reduction is attributed to declining natural gas cost forecasts and the conclusion of specific cost recovery mechanisms.

This situation highlights a key economic factor: customer affordability directly influences the pace and scope of utility investments.

- Infrastructure Investment vs. Affordability: Duke Energy faces the ongoing challenge of funding necessary grid modernization and clean energy initiatives while keeping customer bills manageable.

- Florida Rate Outlook (Jan 2025): Despite some base rate increase requests, Florida customers are projected to see lower bills due to falling natural gas prices and expiring recovery costs.

- Economic Sensitivity: Customer affordability is a critical economic driver that shapes how quickly and extensively utilities can implement capital-intensive projects.

Market Competition and Diversification

While Duke Energy operates mainly as a regulated utility, it still encounters indirect competition and the necessity for strategic diversification. The company's move to divest its unregulated Commercial Renewables segment, signaling a pivot towards a fully regulated utility model, is a strategic play. This aims to capitalize on rate-based returns and align with broader decarbonization objectives.

This strategic shift is designed to bolster Duke Energy's balance sheet and enhance capital efficiency. By concentrating on its core utility operations, the company can more effectively direct investments towards infrastructure upgrades and clean energy transitions, which are crucial for long-term growth and stability in the evolving energy landscape.

- Focus on Regulated Assets: Duke Energy's sale of its Commercial Renewables business in late 2023 for $2.2 billion exemplifies this strategy.

- Decarbonization Alignment: The move supports the company's commitment to reducing carbon emissions, aligning with regulatory mandates and investor expectations.

- Balance Sheet Strength: By exiting a more volatile unregulated market, Duke aims for a more predictable revenue stream and improved financial flexibility.

- Capital Efficiency: This allows for more targeted capital deployment into regulated infrastructure, such as grid modernization and renewable energy integration within its service territories.

Duke Energy is experiencing a significant increase in electricity demand, largely driven by new economic development, especially the projected surge in data center operations in North Carolina between 2027 and 2028. The company now anticipates peak load growth by 2030 to be eight times greater than just two years ago, necessitating substantial capital investment in generation and grid infrastructure.

The fluctuating cost of natural gas is a major economic challenge, particularly as Duke Energy transitions away from coal and increases its reliance on gas. Under a high-price forecast, customer natural gas expenses could rise by as much as 175% by 2031, highlighting vulnerability to commodity market swings.

Duke Energy's financial health supports an ambitious $83 billion capital plan from 2025-2029, focusing on grid upgrades, new generation, and natural gas infrastructure modernization. The sale of its Piedmont Natural Gas Tennessee business for $2.48 billion bolsters this investment, with projected EPS growth of 5-7% through 2029.

Customer affordability remains a key economic consideration, influencing investment pace. While Florida customers may see lower bills in early 2025 due to falling gas prices, the company must balance infrastructure investments with rate impacts across its service territories.

| Economic Factor | Impact on Duke Energy | Key Data/Projections |

|---|---|---|

| Demand Growth | Requires significant capital investment | Peak load growth 8x higher than 2 years ago; Data centers driving NC demand |

| Natural Gas Prices | Increases operating costs and customer bills | Potential 175% rise in monthly bills by 2031 (high forecast) |

| Capital Investment Program | Drives future revenue and operational efficiency | $83 billion planned 2025-2029; $2.48 billion from Piedmont sale |

| Customer Affordability | Influences investment pace and rate approvals | Florida bills projected to decrease Jan 2025; Balancing act with rate requests |

Same Document Delivered

Duke Energy PESTLE Analysis

The preview shown here is the exact Duke Energy PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Duke Energy, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing valuable insights for strategic planning.

Sociological factors

Public demand for cleaner energy is a major driver for Duke Energy, pushing them to invest more in solar and battery storage. For instance, in 2023, Duke Energy announced plans to invest $14 billion in clean energy and grid modernization through 2027, with a significant portion allocated to renewables.

Despite this, environmental groups often criticize the pace of this transition and Duke Energy's continued reliance on natural gas. This creates a delicate balancing act for the company as it navigates public opinion and regulatory pressures.

Duke Energy's strategy aims to meet these evolving public expectations while ensuring grid reliability and keeping energy costs affordable for its customers. This involves a complex mix of existing infrastructure and future clean energy investments.

Duke Energy prioritizes community engagement through its foundation, which has awarded over $500 million to more than 20,000 nonprofits in the last 40 years. This support targets key areas like economic vitality, climate resilience, and inclusive opportunities, fostering strong local partnerships.

Employee volunteerism is also a cornerstone of Duke Energy's community strategy. By encouraging its workforce to dedicate time and skills to local causes, the company not only addresses community needs but also cultivates a sense of shared purpose and strengthens its local presence.

These multifaceted engagement efforts are crucial for building trust and maintaining positive relationships within Duke Energy's service territories. Such community support is vital for operational stability and long-term social license to operate.

The shift towards cleaner energy sources brings important environmental justice issues to the forefront, especially regarding where new energy facilities are built and how these decisions affect communities that are already vulnerable. Duke Energy recognizes that addressing environmental justice is key to involving communities in this energy transition.

Duke Energy is actively developing its approach to environmental justice by translating principles into tangible actions. This includes collaborating with various stakeholders to ensure that social considerations are taken into account as the company transforms its operations and infrastructure.

Customer Program Adoption

Customer engagement with new energy initiatives significantly impacts the pace of the energy transition. Duke Energy's programs, like the PowerPair Program in North Carolina, are designed to encourage this adoption by offering tangible benefits such as reduced installation costs and monthly bill credits for solar and battery systems. This direct financial incentive aims to make clean energy solutions more accessible and appealing to residential customers.

For businesses, Duke Energy's Green Source Advantage (GSA) program provides another avenue for participation in renewable energy. These programs collectively empower customers, both individuals and corporations, to actively contribute to a cleaner energy future by making it financially viable and practically achievable to adopt innovative energy solutions.

- Residential Solar Adoption: Duke Energy's PowerPair Program in North Carolina incentivizes solar plus battery installations, offering savings and bill credits to homeowners.

- Business Renewable Energy: The Green Source Advantage (GSA) program enables businesses to procure renewable energy, supporting corporate sustainability goals.

- Customer Empowerment: These initiatives are crucial for driving widespread adoption of clean energy technologies, fostering customer participation in the energy transition.

Workforce Transformation and Skill Development

The transition to cleaner energy sources necessitates a significant overhaul of Duke Energy's workforce. This involves upskilling existing employees and cultivating new talent to handle the complexities of advanced grid technologies and renewable energy infrastructure. For instance, in 2024, Duke Energy continued its focus on developing a skilled workforce for its expanding solar and battery storage projects across the Carolinas.

Duke Energy's commitment to workforce development is evident in its investment in training programs. These initiatives aim to equip employees with the competencies needed for emerging roles in areas like smart grid management and distributed energy resources. By 2025, the company plans to have trained an additional 1,500 employees in specialized areas related to the clean energy transition.

This strategic focus on talent ensures Duke Energy possesses the necessary expertise to achieve its ambitious clean energy goals. Furthermore, these development programs contribute to local economies by creating new job opportunities and fostering a skilled labor pool capable of supporting the evolving energy landscape.

- Workforce Transformation: Adapting to new energy technologies requires significant reskilling and upskilling of the existing workforce at Duke Energy.

- Talent Development Investments: The company is investing in training and development programs to prepare employees for roles in advanced grid management and renewable energy operations.

- Next-Generation Workforce: Duke Energy is actively working to develop the next generation of energy professionals to manage future energy systems.

- Economic Impact: These initiatives support local economies by creating skilled jobs and fostering a capable workforce for the clean energy transition.

Sociological factors significantly influence Duke Energy's operations, driven by public demand for cleaner energy and growing awareness of environmental justice. The company's community engagement, including substantial foundation grants and employee volunteerism, aims to build trust and maintain its social license to operate.

Customer participation is vital for the energy transition, with Duke Energy actively encouraging adoption of renewable solutions through programs like PowerPair and Green Source Advantage. These initiatives are designed to make clean energy accessible and appealing to both residential and business customers.

The workforce is also a key sociological consideration, necessitating upskilling and talent development for new energy technologies. Duke Energy is investing in training programs to equip its employees for roles in advanced grid management and renewable energy operations, supporting local economies through job creation.

| Sociological Factor | Duke Energy Initiatives/Impact | Data/Statistics (2023-2025) |

|---|---|---|

| Public Demand for Clean Energy | Investment in renewables, grid modernization | $14 billion investment planned through 2027 in clean energy and grid modernization. |

| Environmental Justice Concerns | Developing actionable approaches, stakeholder collaboration | Focus on ensuring vulnerable communities are considered in energy transition decisions. |

| Customer Engagement in Renewables | PowerPair Program, Green Source Advantage | Programs designed to incentivize solar and battery adoption, and facilitate business procurement of renewables. |

| Workforce Development | Upskilling, training for new energy roles | Planned training for an additional 1,500 employees in specialized clean energy areas by 2025. |

Technological factors

Duke Energy is making substantial investments in smart grid technologies, focusing on self-healing grid systems and advanced power distribution platforms. These innovations are designed to automatically detect and reroute power around faults within seconds, proactively addressing potential issues and dramatically improving grid reliability.

This technological advancement is already yielding significant benefits for Duke Energy's customers. As of 2025, over 75% of Duke Energy Florida customers are experiencing the advantages of these smart grid capabilities, which have demonstrably reduced outage durations by millions of hours, particularly during severe weather events.

Battery energy storage systems (BESS) are critical to Duke Energy's shift towards cleaner energy, enhancing grid stability and incorporating variable renewable power sources. The company is set to deploy 2,700 megawatts of energy storage by 2031, a significant increase approved by regulators. This expansion includes replacing retired coal facilities with substantial battery installations, like the 50 MW/200 MWh system at the Allen Steam Station, slated for completion by late 2025.

Duke Energy is making substantial investments in renewable energy, with a strategic plan to integrate over 6,000 megawatts of new solar, hydro, and onshore wind capacity within the next ten years. This aggressive expansion is a cornerstone of their commitment to a cleaner energy future.

The company's long-term vision includes achieving 30,000 megawatts of regulated renewable energy by 2035, demonstrating a significant shift in their generation portfolio. As part of this, Duke Energy is actively developing 14 new solar facilities in Florida, slated for completion by 2027, highlighting their commitment to regional renewable growth.

This substantial integration of renewable sources is crucial for Duke Energy to meet its ambitious carbon reduction targets and to create a more resilient and diversified energy supply for its customers.

Carbon Capture and Hydrogen Technologies

Duke Energy is actively investing in cutting-edge technologies to achieve its decarbonization goals, with a particular focus on carbon capture and hydrogen. These advancements are crucial for the company's long-term sustainability and its commitment to reducing greenhouse gas emissions.

The company is collaborating with industry leaders like GE Vernova to integrate hydrogen-ready gas turbines into its operations. This strategic partnership aims to ensure future fuel flexibility, allowing for the use of hydrogen as a cleaner energy source and enhancing compatibility with carbon capture systems. This forward-thinking approach positions Duke Energy to adapt to evolving energy landscapes and regulatory requirements.

Further demonstrating its dedication to innovative emissions reduction, Duke Energy is also engaged in pilot projects involving algae systems for carbon dioxide capture and sequestration. These initiatives explore novel biological pathways for CO2 management, complementing its investments in technological solutions.

- Hydrogen-Ready Turbines: Partnerships like the one with GE Vernova are key to Duke Energy's strategy for integrating hydrogen fuel into its power generation mix, aiming for compatibility with carbon capture technologies.

- Carbon Capture Pilots: Duke Energy is exploring algae-based systems for CO2 capture, signaling a commitment to diverse decarbonization pathways beyond traditional technological solutions.

- Decarbonization Investment: The company's exploration and investment in these advanced technologies underscore a significant financial commitment towards achieving its ambitious emissions reduction targets.

Digitalization and Predictive Analytics

Duke Energy is heavily investing in digitalization and predictive analytics, exemplified by its new patented Advanced Power Distribution Platform. This technology enables sophisticated computer modeling to simulate future grid operations, forecast electricity demand with greater accuracy, and optimize power dispatching. For instance, in 2024, the company reported significant improvements in grid reliability metrics directly attributable to these advanced analytics, leading to fewer and shorter outages for customers.

This enhanced digital infrastructure allows Duke Energy engineers to proactively identify potential grid issues before they impact service. By forecasting demand and optimizing resource allocation, the platform facilitates more efficient grid management and smoother integration of distributed energy resources like solar and battery storage. This proactive approach is crucial as the energy landscape shifts towards cleaner, more complex power generation.

- Advanced Power Distribution Platform: Patented technology for grid simulation and forecasting.

- Operational Efficiency: Improved grid management and optimized power dispatching.

- Predictive Maintenance: Identification and resolution of potential grid problems.

- Distributed Energy Integration: Enhanced ability to incorporate renewable energy sources.

Technological advancements are central to Duke Energy's strategy, particularly in grid modernization and decarbonization efforts. The company's investment in a patented Advanced Power Distribution Platform, utilizing sophisticated modeling and predictive analytics, significantly enhances grid reliability and operational efficiency. This focus on smart grid technology, including self-healing systems, is already benefiting customers, with over 75% of Duke Energy Florida customers experiencing reduced outage durations as of 2025.

Duke Energy is also heavily investing in energy storage, planning to deploy 2,700 megawatts of battery capacity by 2031, a move critical for integrating variable renewables and stabilizing the grid. Furthermore, the company is exploring hydrogen-ready turbines and carbon capture technologies, such as algae-based systems, to meet ambitious emissions reduction goals.

| Technology Area | Key Initiatives/Investments | Impact/Goals |

|---|---|---|

| Smart Grid | Advanced Power Distribution Platform, Self-healing grids | Improved reliability, reduced outage durations (e.g., millions of hours saved by 2025), optimized dispatching |

| Energy Storage | 2,700 MW deployment by 2031, BESS at Allen Steam Station (50 MW/200 MWh by late 2025) | Grid stability, renewable integration, replacing retired coal capacity |

| Decarbonization | Hydrogen-ready turbines, carbon capture (algae pilots) | Fuel flexibility, greenhouse gas emission reduction, long-term sustainability |

| Renewable Integration | 6,000 MW new solar, hydro, wind within 10 years; 30,000 MW regulated renewables by 2035 | Achieving carbon reduction targets, diversified energy supply |

Legal factors

Duke Energy operates under a complex web of environmental regulations, particularly concerning coal ash disposal and carbon emissions. North Carolina mandates the excavation of all 14 of its coal ash pits by 2038, a significant undertaking. The company has faced legal battles related to historical coal ash spills, underscoring the financial and operational risks associated with non-compliance.

The regulatory landscape is dynamic, with Duke Energy, like other utilities, actively engaging with the EPA. In late 2023 and early 2024, there were notable requests from utilities to potentially ease certain carbon pollution and coal ash regulations. This highlights the continuous negotiation and potential shifts in environmental compliance requirements that Duke Energy must navigate.

Duke Energy regularly engages in utility rate case filings with state public service commissions to secure approval for cost recovery related to significant infrastructure investments and ongoing operational expenses. These filings are fundamental to maintaining the company's financial health and its capacity to execute its substantial capital expenditure plans.

For instance, in Florida, recent rate case filings proposed adjustments to base rates and fuel costs, directly impacting customer electricity bills. These proposals undergo rigorous review by regulators, highlighting the significant legal and regulatory oversight governing Duke Energy's revenue streams and investment recovery.

North Carolina's law mandates a 70% reduction in carbon emissions by 2030, compared to 2005 levels, directly impacting Duke Energy's operational strategy. This legal framework requires the company to invest heavily in renewable energy sources and cleaner technologies to meet these stringent targets.

Although regulatory bodies like the NC Utilities Commission have offered some flexibility in the implementation timeline, the overarching legal commitment to achieve carbon neutrality by 2050 remains firm. Duke Energy's progress and plans are reviewed and potentially revised every two years, ensuring ongoing compliance with these environmental mandates.

Permitting and Siting Laws

Building new energy facilities, from natural gas plants to solar farms and battery storage, involves navigating a complex web of permitting and local land use regulations. This process is fundamental to Duke Energy's operational expansion and existing infrastructure management.

A key legal hurdle for new generation projects is securing a Certificate of Public Convenience and Necessity (CPCN). For instance, in 2023, North Carolina's Utilities Commission reviewed multiple Duke Energy applications for new solar and battery storage projects, underscoring the importance of this legal gateway.

Duke Energy, like other utilities, frequently faces challenges from environmental organizations and local communities regarding project siting and environmental impact. These can significantly affect project timelines and overall feasibility. In 2024, several proposed transmission line upgrades faced local opposition, leading to extended review periods and potential rerouting considerations.

- Permitting Complexity: Obtaining permits for new energy infrastructure is a multi-stage process involving federal, state, and local authorities.

- CPCN Requirement: Certificates of Public Convenience and Necessity are legally mandated for new power generation facilities, ensuring public need and feasibility.

- Stakeholder Opposition: Environmental and community concerns can lead to project delays, increased costs, and potential project cancellations.

- Land Use Laws: Adherence to zoning ordinances and land use regulations is critical for siting all types of energy projects.

Safety and Reliability Standards

Duke Energy operates under a stringent framework of federal and state safety and reliability standards, crucial for maintaining the integrity of its extensive electricity and natural gas infrastructure. These regulations mandate continuous operational uptime and the prevention of service disruptions.

To meet these legal obligations, Duke Energy is actively investing in grid modernization and hardening initiatives. For instance, the company's 2024-2028 capital investment plan includes billions allocated to upgrade infrastructure, such as replacing aging wooden poles with more resilient steel or concrete alternatives and strategically undergrounding power lines in vulnerable areas. These efforts are directly responsive to legal mandates aimed at bolstering resilience against increasingly frequent and severe weather events, like hurricanes and ice storms that have impacted its service territories in recent years.

Regulatory oversight bodies, including the Federal Energy Regulatory Commission (FERC) and various state public utility commissions, rigorously monitor Duke Energy's adherence to these safety and reliability benchmarks. Performance is assessed through regular audits and reporting, with non-compliance potentially leading to significant fines and mandated corrective actions, underscoring the critical nature of these legal factors for the company's operations and financial health.

Key areas of compliance and investment include:

- Infrastructure Hardening: Investments in replacing aging infrastructure, such as wooden poles with steel or concrete, to improve resilience against extreme weather.

- Grid Modernization: Deployment of advanced technologies like smart grid components and automated switching to enhance reliability and reduce outage durations.

- Cybersecurity Standards: Adherence to federal regulations like NERC CIP (Critical Infrastructure Protection) to safeguard digital infrastructure from cyber threats.

- Emergency Preparedness: Maintaining robust emergency response plans and resources as mandated by regulatory bodies to ensure swift restoration of services after disruptions.

Duke Energy's legal obligations heavily influence its capital allocation and operational strategies, particularly concerning environmental mandates and infrastructure reliability. The company must comply with North Carolina's 2030 carbon reduction target and a 2050 carbon neutrality goal, driving significant investments in renewables and cleaner technologies. Navigating permitting processes for new energy projects, including obtaining Certificates of Public Convenience and Necessity (CPCN), is a critical legal gateway that can impact project timelines and costs, as seen in the 2023 solar and battery storage project reviews in North Carolina. Furthermore, adherence to federal and state safety and reliability standards, such as NERC CIP for cybersecurity, requires ongoing investment in grid modernization and hardening, with billions allocated in their 2024-2028 capital plan to upgrade infrastructure and enhance resilience against extreme weather.

Environmental factors

Duke Energy has established significant carbon emission reduction targets, aiming for net-zero carbon emissions from its electricity generation by 2050. This commitment extends to its natural gas operations, with a goal of achieving net-zero methane emissions by 2030.

The company has demonstrated tangible progress, having already reduced carbon emissions from its electric generation by 48% compared to 2005 levels. Duke Energy is well-positioned to meet its interim objective of a 50% reduction by 2030, showcasing a consistent effort towards its long-term climate goals.

Detailed updates on Duke Energy's advancements toward these environmental targets are readily available in its annual Impact Reports, providing transparency and quantifiable data on its sustainability initiatives.

Duke Energy is actively retiring its coal-fired power plants, aiming to have all coal generation cease by 2036. This strategic move is a cornerstone of their environmental plan, reflecting a significant shift in the company's energy portfolio.

The company is replacing coal capacity with a blend of cleaner alternatives. This includes expanding natural gas, solar, and wind power, alongside investments in battery storage and nuclear energy. For instance, Duke Energy has committed to significant renewable energy growth, targeting thousands of megawatts of solar and wind by 2035.

While the move away from coal is a positive environmental step, the continued reliance on natural gas as a transitional fuel has sparked debate among environmental groups. They express concerns about methane emissions and the long-term sustainability of natural gas infrastructure.

Duke Energy is prioritizing climate resilience and grid hardening to safeguard its infrastructure against escalating severe weather, like hurricanes. The company is investing heavily in measures such as replacing aging wooden poles with stronger materials and burying distribution lines underground to better withstand extreme conditions. These proactive steps are designed to minimize power outages and accelerate recovery efforts following weather-related disruptions.

Water Resource Management

Duke Energy faces significant environmental challenges in managing its water resources, especially given its reliance on water for power generation and the legacy of coal ash. The company is actively engaged in initiatives to ensure responsible water usage and adhere to stringent water quality regulations. For instance, as of early 2024, Duke Energy has been involved in ongoing remediation efforts at various coal ash sites across its service territories, aiming to mitigate potential groundwater contamination and ensure compliance with state and federal environmental standards.

These efforts are crucial for maintaining operational sustainability and public trust. The company's commitment extends to developing and implementing sustainable water practices across its diverse portfolio of energy generation assets. This includes exploring advanced water treatment technologies and optimizing water use in cooling processes for its power plants. Duke Energy's 2023 sustainability report highlighted investments in water stewardship programs, underscoring the financial and operational importance of effective water resource management.

Key aspects of Duke Energy's water resource management include:

- Compliance with Water Quality Standards: Adhering to regulations like the Clean Water Act to protect aquatic ecosystems and public health.

- Coal Ash Site Remediation: Addressing historical coal ash disposal sites to prevent and manage groundwater pollution, a process that involves significant capital expenditure and long-term monitoring.

- Sustainable Water Use: Implementing strategies to reduce water withdrawal and consumption in power generation, particularly in water-stressed regions.

- Investment in Water Technology: Exploring and adopting innovative technologies for water treatment and recycling to enhance efficiency and minimize environmental impact.

Biodiversity and Land Stewardship

Duke Energy's commitment to biodiversity and land stewardship is a key component of its environmental strategy, aiming to conserve natural resources within its operational regions. The company actively works to protect biodiversity, as outlined in its sustainability reports, which detail its environmental management systems and land use practices. This focus is crucial for minimizing the ecological impact of new infrastructure, such as transmission lines or power generation facilities, ensuring that development proceeds with careful consideration for local ecosystems.

In 2023, Duke Energy reported progress on its land management goals, including the restoration of over 1,500 acres of habitat across its service territories. The company's approach involves detailed environmental impact assessments for all new projects, with a particular emphasis on areas with sensitive ecological features. These efforts are guided by established environmental policies designed to reduce the company's overall environmental footprint.

- Habitat Restoration: Duke Energy aims to restore and enhance natural habitats on company-managed lands, contributing to biodiversity conservation.

- Environmental Impact Assessments: Rigorous assessments are conducted for all new infrastructure projects to identify and mitigate potential impacts on biodiversity and land use.

- Sustainable Land Management: Policies are in place to ensure responsible land use, minimizing disturbance and promoting ecological health across operational areas.

Duke Energy is actively managing its environmental impact, setting ambitious goals for emissions reduction and renewable energy integration. The company aims for net-zero carbon emissions from electricity generation by 2050 and net-zero methane emissions from its natural gas operations by 2030. As of early 2024, Duke Energy had already achieved a 48% reduction in carbon emissions from its electric generation compared to 2005 levels, positioning it to meet its 2030 target of a 50% reduction.

The company's strategy involves phasing out coal-fired power plants by 2036, replacing them with a mix of natural gas, solar, wind, battery storage, and nuclear energy. Duke Energy plans to add thousands of megawatts of solar and wind capacity by 2035. However, the continued use of natural gas as a transition fuel has drawn scrutiny from environmental advocates concerned about methane emissions.

Duke Energy is also focusing on climate resilience, investing in grid hardening to withstand severe weather events. This includes upgrading infrastructure like replacing wooden poles and burying power lines. Furthermore, the company is addressing environmental challenges related to water resource management and the remediation of coal ash sites, underscoring a commitment to compliance with water quality standards and sustainable land management practices.

PESTLE Analysis Data Sources

Our Duke Energy PESTLE Analysis is informed by a comprehensive review of government regulatory filings, industry-specific market research reports, and publicly available financial statements. We ensure each factor is grounded in verifiable data from official sources.