Duke Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duke Energy Bundle

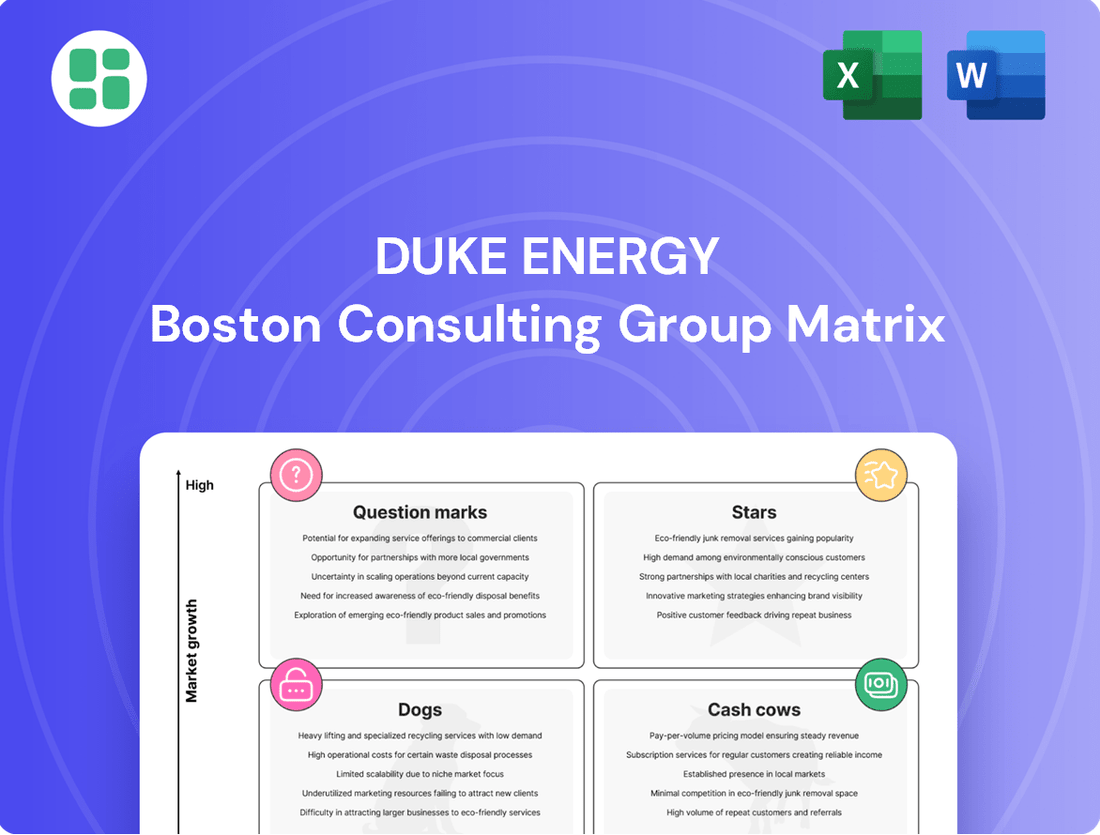

Duke Energy's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of energy assets. Understand which segments are fueling growth and which require careful management to unlock maximum shareholder value.

This snapshot is just the beginning. Purchase the full Duke Energy BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for your investment strategy.

Don't miss out on the detailed quadrant analysis and strategic recommendations that the full Duke Energy BCG Matrix provides. Elevate your decision-making and capitalize on opportunities by securing your copy today.

Stars

Duke Energy is aggressively expanding its regulated renewable energy capacity, aiming to add 30,000 megawatts by 2035. This includes significant investments like 14 new solar plants in Florida by 2027, demonstrating a clear strategy to capture growth in clean energy under predictable regulatory structures.

The company's proactive approach involves doubling its renewable energy portfolio by 2025 and tripling it by 2030, positioning Duke Energy as a leader in a rapidly expanding market segment driven by both demand and policy.

Duke Energy is prioritizing grid modernization, earmarking an impressive $83 billion for its capital plan spanning 2025 through 2029. This substantial investment is designed to bolster reliability and seamlessly integrate emerging energy sources into its network.

The company is deploying advanced technologies like smart grid solutions and self-healing systems. These innovations have already demonstrated their effectiveness by reducing the frequency and duration of power outages, a critical improvement as electricity demand continues to climb, driven by factors such as data center growth and widespread electrification efforts.

Duke Energy is actively pursuing strategic partnerships to bolster its clean energy initiatives. A prime example is the significant $6 billion investment from Brookfield Super-Core Infrastructure Partners in Duke Energy Florida. This capital infusion is earmarked for advancing the company's clean energy goals and modernizing its grid infrastructure, demonstrating a shared commitment to a sustainable energy future.

These collaborations are crucial for Duke Energy, providing substantial financial backing that strengthens its credit profile. This improved financial standing allows for an acceleration of investments in high-growth sectors, particularly regulated renewables and cutting-edge infrastructure projects. Such alliances are instrumental in positioning Duke Energy as a leader in the ongoing energy transition.

Meeting Accelerated Load Growth from Economic Development

Duke Energy is confronting a surge in electricity demand, especially in the Carolinas, largely due to substantial economic development like the construction of major data centers. This is a critical period for the company as it navigates this accelerated load growth.

The projected peak load growth by 2030 is a staggering eight times greater than what was anticipated just two years ago. This dramatic increase underscores the urgent need for Duke Energy to expand its generation capacity and transmission infrastructure.

This situation places Duke Energy in a high-growth, high-market share position, as it becomes instrumental in supporting regional economic expansion. The company's proactive investments in infrastructure are essential to meet this burgeoning demand.

- Accelerated Load Growth: Driven by new economic development, particularly data centers, in the Carolinas.

- Projected Peak Load Increase: Eight times higher by 2030 compared to two years prior.

- Strategic Imperative: Requires significant expansion of generation capacity and transmission networks.

- Market Position: High-growth, high-market share endeavor as a key economic enabler.

Advanced Nuclear and Energy Storage Development

Duke Energy's foray into advanced nuclear, particularly Small Modular Reactors (SMRs), positions it as a potential high-growth star. This strategic pivot aims to complement its existing nuclear fleet, which historically serves as a cash cow, by developing next-generation, cleaner energy sources.

The company's commitment to energy storage development, including battery projects, further bolsters this star quadrant. These investments are crucial for grid modernization, enabling better integration of intermittent renewables and providing essential baseload power. For instance, Duke Energy has been actively pursuing battery storage projects, with several utility-scale facilities operational or under development across its service territories.

- Advanced Nuclear: Duke Energy is exploring SMRs as a path to carbon-free baseload power, a significant departure from its traditional large-scale nuclear operations.

- Energy Storage: Investments in battery storage are expanding, with projects like the 62 MW W.S. Lee Solar Station in South Carolina demonstrating a commitment to grid flexibility.

- Growth Potential: These initiatives are designed to capture future market demand for reliable, clean energy and position Duke as a leader in energy innovation.

- Strategic Alignment: The combination of advanced nuclear and storage addresses the growing need for grid resilience and decarbonization, aligning with broader energy transition goals.

Duke Energy's investments in advanced nuclear, specifically Small Modular Reactors (SMRs), and energy storage, like battery projects, position these as its Stars in the BCG Matrix. These initiatives represent significant growth potential, aligning with the company's strategy to lead in clean energy innovation and grid modernization.

The company is actively developing and deploying battery storage solutions, with projects like the 62 MW W.S. Lee Solar Station in South Carolina showcasing its commitment to grid flexibility and renewable integration. Furthermore, Duke Energy's exploration of SMRs aims to provide carbon-free baseload power, a key element in meeting future energy demands and decarbonization goals.

These "Star" segments are crucial for Duke Energy's long-term growth, addressing the increasing need for reliable, clean, and flexible energy infrastructure. The company's strategic focus on these areas is designed to capture emerging market opportunities and solidify its leadership in the evolving energy landscape.

Duke Energy's capital plan for 2025-2029 includes substantial investments in grid modernization and clean energy, which directly support these Star initiatives. This forward-looking approach is vital for meeting projected load growth, driven by economic development and electrification trends.

| Initiative | Description | Growth Potential | Market Share | Strategic Focus |

|---|---|---|---|---|

| Advanced Nuclear (SMRs) | Development of next-generation, carbon-free baseload power. | High | Emerging | Innovation, Decarbonization |

| Energy Storage (Battery Projects) | Deployment of utility-scale battery facilities for grid flexibility. | High | Growing | Grid Modernization, Renewable Integration |

What is included in the product

Duke Energy's BCG Matrix analysis categorizes its business units to guide investment strategies.

It identifies which units to invest in, hold, or divest based on market growth and share.

A clear Duke Energy BCG Matrix overview helps strategists quickly identify underperforming units, alleviating the pain of resource misallocation.

Cash Cows

Duke Energy's regulated electric utilities, serving 8.6 million customers across states like North Carolina, South Carolina, and Ohio, are classic cash cows. These operations benefit from established infrastructure and regulatory frameworks that allow for consistent revenue generation.

In 2024, Duke Energy's regulated electric segment is expected to continue its trend of stable performance. For instance, the company has been investing heavily in grid modernization, which is often supported by regulatory approvals, leading to predictable capital recovery and thus, cash flow. This segment's financial strength is crucial, underpinning the company's ability to fund growth initiatives in other areas.

Duke Energy's existing nuclear fleet, comprising six plants in the Carolinas, is a definitive cash cow. These facilities generate over 80% of the region's carbon-free electricity, highlighting their environmental significance and operational importance.

The nuclear assets provide a consistent and substantial cash flow due to their reliability and low operating costs, acting as a stable baseload power source. Minimal new investment is needed for these mature facilities, allowing them to generate significant profits for Duke Energy.

In 2023, Duke Energy reported that its nuclear fleet generated approximately 54,000 gigawatt-hours (GWh) of electricity, underscoring its massive contribution to the company's energy mix and financial performance. This output solidifies their position as a key contributor to Duke's profitability and low-carbon intensity goals.

Duke Energy's natural gas utilities are a classic cash cow, serving 1.7 million customers with a solid grip on their service areas. This segment reliably churns out revenue and income thanks to the regulated distribution and transport of natural gas.

Compared to other business units, this operation demands less capital for expansion, contributing significantly to Duke Energy's overall financial steadiness. For instance, in 2023, Duke Energy's regulated gas utilities reported strong, stable earnings, underpinning the company's robust financial performance.

Hydroelectric Power Generation

Duke Energy's hydroelectric power generation assets represent a classic Cash Cow within its portfolio. These facilities, which formed the bedrock of the company's early operations, continue to provide a steady and predictable revenue stream. Their established infrastructure and low operating expenses, especially compared to newer energy sources, translate into consistent profitability and a significant contribution to Duke Energy's overall cash flow. In 2023, Duke Energy reported that its regulated utilities generated approximately 14,000 GWh of hydroelectric power, highlighting its continued reliance on this stable resource.

The inherent stability of hydroelectric power generation makes it a dependable source of income. These plants benefit from long-term operational lifespans and minimal fuel costs, ensuring consistent cash generation. This reliability is crucial for funding investments in other, more growth-oriented segments of Duke Energy's business.

- Stable Revenue: Hydroelectric assets provide a predictable income stream due to established infrastructure and low variable costs.

- Carbon-Free Generation: These plants offer a consistent, environmentally friendly power source, aligning with sustainability goals.

- Low Operational Expenses: Once built, hydroelectric plants have significantly lower operating and maintenance costs compared to fossil fuel or even some renewable alternatives.

- Baseload Power Contribution: Hydroelectric facilities are vital for providing reliable baseload power, ensuring grid stability.

Transmission and Distribution Network

Duke Energy's transmission and distribution network functions as a classic Cash Cow within the BCG Matrix. This extensive infrastructure, crucial for delivering electricity and natural gas across its vast service territories, represents a mature asset with deep market penetration.

The consistent, regulated revenue streams generated by this network are a hallmark of a Cash Cow. Despite ongoing modernization efforts, the core business of transmitting and distributing energy provides stable income with significant competitive advantages due to high entry barriers.

- Stable Revenue: The regulated nature of transmission and distribution ensures predictable revenue streams, contributing significantly to Duke Energy's overall financial stability.

- High Barriers to Entry: The immense capital investment and regulatory hurdles required to build and maintain such a network effectively deter new competitors.

- Mature Market: While modernization is ongoing, the fundamental service provided by the network is in a mature market, allowing for efficient operations and cash generation.

- 2024 Performance Indicator: For the first quarter of 2024, Duke Energy reported adjusted earnings from regulated utilities, which heavily rely on this network, showing resilience despite economic fluctuations.

Duke Energy's regulated electric and natural gas utilities are prime examples of cash cows. These segments benefit from established infrastructure and regulatory frameworks, ensuring consistent revenue generation and stable earnings. For instance, in 2023, Duke Energy's regulated utilities reported strong, stable earnings, underpinning its robust financial performance.

The company's hydroelectric and nuclear power generation assets also function as significant cash cows. These mature, reliable energy sources provide substantial and predictable cash flow with minimal need for new investment. In 2023, Duke Energy's nuclear fleet generated approximately 54,000 GWh, while its hydroelectric facilities produced around 14,000 GWh, underscoring their vital role in the company's financial health.

Duke Energy's transmission and distribution network is another key cash cow. This essential infrastructure, serving millions of customers, generates stable, regulated revenue streams with high barriers to entry for competitors. The resilience of these regulated segments is critical for funding growth initiatives in other parts of the business.

| Business Segment | BCG Classification | Key Characteristics | 2023 Contribution (Illustrative) |

| Regulated Electric Utilities | Cash Cow | Stable revenue, regulatory support, grid modernization investments | Significant portion of total revenue and earnings |

| Regulated Natural Gas Utilities | Cash Cow | Reliable revenue, low capital needs, established customer base | Consistent income generation |

| Nuclear Fleet | Cash Cow | Low operating costs, carbon-free generation, baseload power | 54,000 GWh generated |

| Hydroelectric Assets | Cash Cow | Low variable costs, long operational life, predictable cash flow | 14,000 GWh generated |

| Transmission & Distribution Network | Cash Cow | Regulated revenue, high entry barriers, mature market service | Foundation for stable utility operations |

What You’re Viewing Is Included

Duke Energy BCG Matrix

The Duke Energy BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis, designed for strategic insight, will be delivered in its entirety, ready for immediate application in your business planning. You can be confident that the professional formatting and detailed market data presented here are precisely what you'll gain access to, enabling you to make informed decisions about Duke Energy's portfolio.

Dogs

Duke Energy is phasing out approximately 8,000 megawatts of its coal-fired power generation by 2036. This strategic move reflects the reality that these older, less efficient plants operate in a market increasingly shaped by decarbonization efforts, leading to a shrinking and less competitive position.

These assets, though still contributing to current energy needs, are considered to be in a declining phase. They face increasing environmental regulations and economic headwinds, making them prime candidates for divestment or eventual retirement as they represent a diminishing market share and require capital for maintenance without substantial future growth prospects.

Duke Energy's recent divestiture of its unregulated Commercial Renewables business, encompassing over 3,400 MW of solar, wind, and battery storage assets for $2.8 billion, places this segment in the Dogs category of the BCG Matrix.

This strategic move indicates that while the renewable energy sector is experiencing robust growth, Duke's unregulated ventures held a comparatively smaller market share and were not considered as strategically vital as its regulated operations.

The sale underscores a deliberate exit from this particular business model, aligning with a focus on core, regulated utility services where market dominance and predictable returns are prioritized.

Segments of Duke Energy's older grid infrastructure that have not yet undergone modernization efforts can be considered Dogs. These components operate in a low-growth, low-innovation market, are prone to inefficiencies and outages, and require significant capital for maintenance without contributing to future growth or competitive advantage.

Non-Core, Legacy Small-Scale Operations

Duke Energy’s portfolio includes non-core, legacy small-scale operations. These are typically older assets that don't fit the company's primary strategy of focusing on regulated utilities and the transition to cleaner energy sources. They often have limited market share and growth prospects.

These legacy operations may require significant maintenance for relatively low returns, making them prime candidates for simplification or even divestment. Duke Energy's recent financial disclosures do not highlight these minor operations, suggesting their diminished strategic importance within the larger corporate structure.

- Low Growth Potential: These units often operate in mature or declining markets with little opportunity for expansion.

- Disproportionate Maintenance Costs: Older infrastructure can lead to higher upkeep expenses relative to the revenue generated.

- Strategic Misalignment: They do not align with Duke Energy's stated goals of investing in regulated utilities and renewable energy.

- Potential for Divestment: Such operations are often considered for sale or closure to streamline the business and focus resources on core areas.

Certain Less Profitable Gas LDC Businesses (Divested Tennessee LDC)

Duke Energy's divestiture of its Tennessee local distribution company (LDC) business to Spire for $2.48 billion in 2023 highlights a strategic move away from certain less profitable gas LDC operations. This particular segment, while contributing to the broader natural gas business, likely fell into the 'Dog' category within Duke's BCG Matrix.

The sale suggests this Tennessee LDC had a lower relative market share or growth potential compared to other Duke Energy assets. By divesting, Duke Energy freed up capital, evidenced by the substantial $2.48 billion transaction, to reinvest in areas offering higher growth and more aligned with its core strategy, such as regulated utility operations.

- Divested Asset: Piedmont Natural Gas Tennessee LDC.

- Sale Price: $2.48 billion.

- Acquiring Company: Spire.

- Strategic Rationale: Reallocation of capital to higher-growth, regulated opportunities.

Duke Energy's older coal-fired power plants, representing approximately 8,000 megawatts, are being phased out by 2036. These assets are categorized as Dogs due to their declining market position and increasing operational costs in an evolving energy landscape.

The company's sale of its unregulated Commercial Renewables business for $2.8 billion also places this segment in the Dog category, indicating a strategic shift away from smaller market share ventures.

Similarly, the divestiture of the Tennessee local distribution company (LDC) business to Spire for $2.48 billion in 2023 signifies a move from less profitable gas LDC operations that likely had limited growth potential.

Legacy grid infrastructure not yet modernized also fits the Dog profile, characterized by low growth and high maintenance costs, misaligned with Duke's strategic focus on regulated utilities and cleaner energy.

| Duke Energy Business Segment | BCG Matrix Category | Rationale | Key Financial/Operational Data |

|---|---|---|---|

| Coal-fired Power Plants (approx. 8,000 MW) | Dog | Declining market, high operational costs, phase-out by 2036. | Phase-out by 2036. |

| Unregulated Commercial Renewables | Dog | Divested for $2.8 billion; smaller market share compared to regulated assets. | Sale Price: $2.8 billion. |

| Tennessee LDC Business | Dog | Divested in 2023; lower profitability and growth potential within gas LDCs. | Sale Price: $2.48 billion (to Spire). |

| Legacy Grid Infrastructure (unmodernized) | Dog | Low growth, high maintenance, strategic misalignment. | Requires significant capital for maintenance. |

Question Marks

Duke Energy is strategically allocating around $5 billion towards hydrogen-enabled natural gas technologies, signaling a significant commitment to its clean energy future. This investment positions the company to explore its potential role in a nascent, yet rapidly expanding, market segment.

While Duke Energy is actively building capabilities in this emerging technology, its current market share remains low. This reflects the early stage of development for hydrogen-enabled natural gas solutions, presenting both challenges and opportunities for the company.

Substantial capital deployment is crucial to assess the long-term viability of these technologies within Duke Energy's future energy portfolio. The success of this initiative hinges on careful evaluation and adaptation as the market matures and technological advancements unfold.

Duke Energy is actively exploring Small Modular Reactors (SMRs) as a key component of its future carbon-free energy strategy, collaborating with entities like GE Hitachi and the Tennessee Valley Authority (TVA). This positions SMRs as a question mark in Duke's BCG matrix – a high-potential growth market, but one where the company currently holds a minimal market share due to the nascent stage of commercialization. Significant capital investment is necessary to bridge the gap from research and development to widespread operational deployment, a characteristic of question mark investments.

Duke Energy's pursuit of carbon capture and storage (CCS) technologies aligns with its ambitious decarbonization objectives. This sector holds significant growth potential, fueled by global net-zero commitments, though it remains largely in the developmental or pilot stage.

Currently, CCS technologies exhibit a low market share, necessitating substantial research and development investment to demonstrate scalability and economic feasibility. For instance, in 2024, the U.S. Department of Energy announced over $1.2 billion in funding for CCS projects, highlighting the industry's nascent but supported growth trajectory.

Community Solar Programs (Newer Initiatives)

Duke Energy is actively developing its presence in the burgeoning community solar market, a segment characterized by high growth potential. Initiatives like the Green Source Advantage Choice program and the planned subscription-based Clean Energy Connection in North Carolina highlight this expansion. These programs represent a strategic move into a rapidly evolving sector, though Duke's current market share within community solar is still establishing itself.

The demand for community solar is experiencing significant growth. For instance, by the end of 2023, the U.S. had over 2.5 gigawatts of installed community solar capacity, with projections indicating continued strong expansion. Duke Energy's investment in these newer programs positions them to capture a portion of this expanding market, even as they navigate customer adoption and build out their operational footprint.

- High Growth Potential: Community solar is a rapidly expanding segment within the renewable energy sector.

- New Market Entry: Duke Energy's programs are relatively new, focusing on building market presence and customer adoption.

- Strategic Expansion: Initiatives like Green Source Advantage Choice and Clean Energy Connection signal a commitment to this growing area.

- Establishing Market Share: Despite rapid growth, Duke is in the early stages of establishing its market share in community solar.

Electrification and EV Infrastructure Development

Duke Energy is strategically positioning itself within the burgeoning electric vehicle (EV) sector, recognizing its high-growth potential. The company is making significant investments to foster EV adoption and build out the necessary charging infrastructure. A key initiative is the planned electrification of over 10,000 vehicles in its own fleet by 2030, coupled with substantial investment in hundreds of charging stations.

While the EV market is experiencing rapid expansion, Duke Energy's direct participation and market share in EV charging infrastructure and related services are still in their nascent stages. This segment represents a developing area for the company, contrasting with its established and dominant position in its core utility operations. For instance, by the end of 2023, Duke Energy had deployed over 1,000 public charging ports across its service territories, a number poised for significant growth.

- Market Growth: The global EV market is projected to reach over 30 million units sold annually by 2025, indicating a substantial opportunity.

- Duke's Fleet Electrification: Aiming for 100% EV conversion of its 10,000-vehicle fleet by 2030 underscores a commitment to leading by example.

- Infrastructure Investment: Planned investment in hundreds of charging stations signifies a tangible step towards supporting widespread EV adoption.

- Nascent Market Share: Duke's current market share in the EV charging space is minimal compared to its core utility business, highlighting a clear growth frontier.

Duke Energy's ventures into Small Modular Reactors (SMRs), carbon capture and storage (CCS), community solar, and electric vehicle (EV) charging infrastructure all represent potential growth areas. These sectors are characterized by high future growth prospects but currently have low market penetration for Duke Energy. Significant investment is required to develop these nascent markets and establish a stronger competitive position.

| Category | Market Growth Potential | Duke Energy's Current Market Share | Investment Focus | Key Initiatives/Data |

| Small Modular Reactors (SMRs) | High | Minimal | R&D, Partnerships (GE Hitachi, TVA) | Exploring SMRs for carbon-free energy. |

| Carbon Capture & Storage (CCS) | High | Low | R&D, Pilot Projects | US DOE funding over $1.2 billion in 2024 for CCS projects. |

| Community Solar | High | Establishing | Program Development (Green Source Advantage Choice) | US had over 2.5 GW installed capacity by end of 2023. |

| Electric Vehicle (EV) Charging | High | Minimal | Infrastructure Investment, Fleet Electrification | Aiming for 100% EV fleet conversion by 2030; deployed over 1,000 charging ports by end of 2023. |

BCG Matrix Data Sources

Our Duke Energy BCG Matrix is built on a robust foundation of verified data, integrating financial disclosures, regulatory filings, market growth projections, and expert industry analysis for strategic clarity.