Duke Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duke Energy Bundle

Duke Energy operates in a dynamic utility sector where bargaining power of buyers, particularly large industrial customers, can significantly impact pricing. The threat of new entrants, while historically low due to high capital requirements, is evolving with advancements in distributed generation and energy storage.

The complete report reveals the real forces shaping Duke Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Duke Energy's bargaining power of suppliers is impacted by the concentration of key fuel providers. For instance, in 2023, natural gas accounted for approximately 38% of Duke Energy's electricity generation, highlighting its reliance on this fuel source. A limited number of large natural gas suppliers can exert considerable influence over pricing and availability, potentially driving up operating costs for the company.

Suppliers of highly specialized equipment, like massive turbines and advanced grid technology, hold significant sway. This is because there are often few other companies that can produce these complex, proprietary items, and switching to a different supplier can be very expensive for Duke Energy.

Duke Energy's substantial investments in modernizing its grid and expanding clean energy sources, such as battery storage and nuclear power, mean it must depend on these niche manufacturers. For instance, the company's planned capital expenditures for grid modernization and clean energy projects are projected to be in the billions of dollars annually through 2025, highlighting this reliance.

The availability of skilled labor and specialized engineering or maintenance services significantly influences supplier power in the utility sector. When there's a scarcity of qualified professionals or unique service providers essential for complex utility operations, their bargaining power increases. This can lead to higher labor costs and elevated service fees for companies like Duke Energy.

In 2024, the utility industry, including Duke Energy, is grappling with staffing and retention challenges. For instance, a report from the U.S. Bureau of Labor Statistics indicated a shortage of electrical engineers, a critical role for utility operations, with projected demand outpacing supply. This dynamic can empower labor suppliers and specialized service providers, potentially impacting Duke Energy's operational costs.

Regulatory and Environmental Compliance Suppliers

Suppliers of environmental compliance and regulatory adherence services wield significant bargaining power over Duke Energy. This is driven by the critical need for Duke Energy to meet stringent emissions standards and safety protocols, making these specialized offerings indispensable. For instance, Duke Energy's commitment to achieving net-zero methane emissions by 2030 and net-zero carbon emissions by 2050 necessitates reliance on such specialized suppliers for critical functions like coal ash remediation and carbon reduction technologies.

The specialized nature of these environmental services, coupled with increasing regulatory demands, amplifies supplier leverage. Companies providing solutions for carbon capture, renewable energy integration, and emissions monitoring are in a strong position. In 2023, Duke Energy reported significant investments in grid modernization and clean energy infrastructure, highlighting the ongoing demand for these specialized, compliance-driven services.

- High Demand for Specialized Expertise: Suppliers offering unique technologies for emissions control and environmental remediation are essential for Duke Energy's compliance efforts.

- Regulatory Imperatives: Strict environmental regulations, such as those concerning methane and carbon emissions, create a captive market for compliance-focused suppliers.

- Strategic Importance of Net-Zero Goals: Duke Energy's ambitious net-zero targets by 2030 and 2050 directly increase the bargaining power of suppliers enabling these transitions.

- Investment in Clean Energy: Duke Energy's substantial investments in clean energy infrastructure in 2023 underscore the critical role and leverage of suppliers in this sector.

Supply Chain Disruptions and Costs

Ongoing supply chain bottlenecks and rising costs for essential components like transformers directly bolster supplier power. These disruptions can significantly hinder grid modernization projects and inflate operational expenses for utilities such as Duke Energy, as seen in the increasing price of specialized electrical equipment.

The global utility services market's projected expansion, with an estimated growth rate of 5.2% annually through 2028, suggests sustained demand for raw materials and manufactured goods. This persistent demand can maintain or even increase the leverage suppliers hold over utility companies needing critical infrastructure components.

- Supply Chain Strain: Persistent global supply chain issues in 2024 continue to affect the availability and cost of key utility components.

- Cost Inflation: Utilities are facing increased prices for materials like copper and specialized transformers, impacting project budgets.

- Market Demand: The growing need for grid upgrades and renewable energy integration fuels demand for supplier goods, strengthening their negotiating position.

- Supplier Leverage: Limited availability of specialized parts and increasing demand empower suppliers to dictate terms and pricing.

Duke Energy's suppliers, particularly those providing specialized equipment and environmental compliance services, hold significant bargaining power. This is exacerbated by ongoing supply chain issues and the utility's substantial investments in grid modernization and clean energy initiatives, which are projected to continue through 2025.

The reliance on a limited number of providers for critical components like advanced grid technology and specialized turbines, coupled with the high cost of switching suppliers, strengthens their negotiating position. Furthermore, the increasing demand for environmental services to meet stringent regulatory requirements, such as net-zero emissions goals by 2030 and 2050, empowers these niche suppliers.

In 2024, the utility sector faces labor shortages, particularly for skilled engineers, which elevates the bargaining power of labor suppliers and specialized service providers. This dynamic can directly impact Duke Energy's operational costs and project timelines.

| Supplier Type | Key Factors Influencing Power | Impact on Duke Energy | 2024/2025 Relevance |

|---|---|---|---|

| Fuel Providers (e.g., Natural Gas) | Concentration of suppliers, price volatility | Increased operating costs | Natural gas was ~38% of generation in 2023; ongoing price sensitivity |

| Specialized Equipment Manufacturers (Turbines, Grid Tech) | Proprietary technology, high switching costs | Potential for higher equipment prices, project delays | Billions in annual capital expenditures for modernization and clean energy |

| Environmental Compliance Services | Stringent regulations, specialized expertise | Essential for meeting emissions targets, potential for premium pricing | Net-zero goals by 2030/2050 drive demand for carbon capture, remediation services |

| Skilled Labor & Engineering Services | Labor shortages, specialized skills | Higher labor costs, potential operational disruptions | Shortage of electrical engineers projected to impact utility operations |

What is included in the product

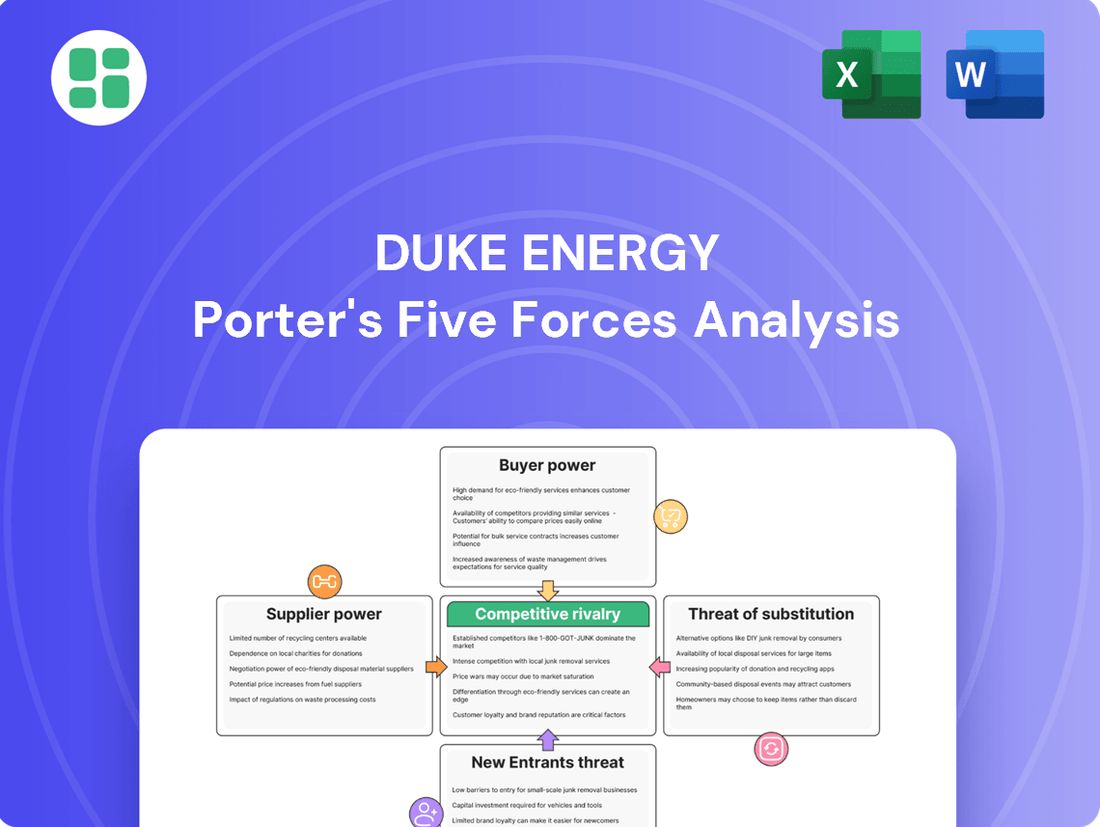

This Porter's Five Forces analysis for Duke Energy dissects the competitive intensity within the utility sector, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Duke Energy's competitive landscape to identify key pain points.

Customers Bargaining Power

Duke Energy's position as a regulated monopoly in most of its service areas significantly curtails the bargaining power of its customers. With no alternative providers available for electricity and natural gas in their designated territories, customers are essentially captive, with limited ability to negotiate rates or terms directly. This regulatory structure means that pricing and service conditions are primarily determined by state utility commissions rather than customer-driven negotiations.

Duke Energy's customer base is quite varied, with residential, commercial, and industrial users each reacting differently to prices and holding distinct levels of sway. For instance, large industrial clients, due to their substantial energy needs, can exert some influence by engaging with regulators or opting into specific clean energy initiatives.

While individual residential customers have limited direct power, their collective voice and the broader public sentiment can significantly impact regulatory decisions during rate increase proceedings. In 2023, Duke Energy reported serving approximately 8.3 million retail customers across its service territories, highlighting the sheer scale of its residential segment.

The rise of distributed generation, like rooftop solar and battery storage, gives customers more sway. In 2024, Duke Energy's service areas saw continued growth in residential solar installations, with some regions experiencing double-digit percentage increases year-over-year. This allows customers to generate their own electricity, reducing their dependence on the utility.

Energy efficiency measures further amplify this customer power. By using less energy, customers decrease demand, which can impact Duke Energy's revenue projections and grid management strategies. Duke Energy itself is actively exploring these trends, as evidenced by their pilot programs in 2024 that incentivized customers to adopt solar and battery storage solutions.

Regulatory Oversight and Public Advocacy

The bargaining power of Duke Energy's customers is significantly influenced by regulatory oversight and public advocacy. State utility commissions, such as the North Carolina Utilities Commission and the Public Service Commission of South Carolina, are critical in approving Duke Energy's rates and service quality standards. These commissions act as proxies for customer interests, and their decisions are often shaped by public opinion and the efforts of advocacy groups.

Public advocacy organizations play a vital role in representing customer concerns during rate increase requests and service standard deliberations. For instance, in 2023, Duke Energy filed for rate increases in North Carolina, which were subject to scrutiny by the North Carolina Utilities Commission and advocacy groups like the Natural Resources Defense Council (NRDC) and the Public Staff of the North Carolina Utilities Commission. These groups can mobilize public sentiment, leading to adjustments in proposed rates or service improvements.

- Regulatory Approval: Duke Energy's rates are subject to approval by state utility commissions, which consider customer impact.

- Public Advocacy Influence: Consumer advocacy groups and public opinion can sway commission decisions on rates and service.

- Stakeholder Engagement: Duke Energy engages with federal, state, and local stakeholders to shape policies affecting customers.

- 2024 Rate Case Example: In North Carolina, Duke Energy sought a rate increase in 2024, highlighting ongoing customer influence through regulatory channels.

Demand Management Programs and Incentives

Duke Energy actively engages customers through demand management programs and incentives, aiming to boost energy efficiency and provide greater control over energy consumption. These initiatives can translate into financial savings for customers, thereby strengthening their bargaining power. For instance, programs like the Green Source Advantage Choice program for large commercial clients empower them to opt for renewable energy sources and better manage their usage patterns.

These customer-centric approaches foster increased satisfaction and loyalty by delivering tailored energy solutions. In 2023, Duke Energy reported significant participation in its energy efficiency programs, with customers saving millions of dollars on their energy bills. Such programs can shift the balance, giving customers more leverage in their relationship with the utility provider.

- Customer Empowerment: Demand-side management programs allow customers to actively participate in energy consumption, offering them a degree of control and potential cost savings.

- Financial Incentives: Duke Energy's initiatives often include rebates and financial benefits for adopting energy-efficient practices or participating in load-shifting programs.

- Renewable Energy Options: Programs like Green Source Advantage Choice allow large businesses to directly support renewable energy projects, aligning with their sustainability goals and influencing their energy procurement decisions.

While Duke Energy operates as a regulated utility, limiting direct customer bargaining, the growing adoption of distributed generation, such as rooftop solar, is a notable factor. In 2024, solar installations in Duke's service areas continued to expand, providing customers with alternatives and thus a degree of leverage. Energy efficiency programs also empower customers by reducing overall demand, potentially impacting utility revenue and strategic planning.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example |

|---|---|---|

| Regulation | Lowers bargaining power due to monopoly status and rate oversight by commissions. | State utility commissions approve rates, limiting direct negotiation. |

| Distributed Generation | Increases bargaining power by offering alternatives to utility supply. | Continued growth in residential solar installations in 2024 service areas. |

| Energy Efficiency | Enhances bargaining power by reducing demand and dependence on utility. | Customers saved millions in 2023 through Duke's efficiency programs. |

| Customer Scale | Large industrial customers have more influence than individual residential users. | Duke served 8.3 million retail customers in 2023, with industrial clients representing significant usage. |

Preview the Actual Deliverable

Duke Energy Porter's Five Forces Analysis

This preview shows the exact Duke Energy Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector. This professionally formatted document is ready for your immediate use, providing actionable insights without any placeholders.

Rivalry Among Competitors

Duke Energy's competitive rivalry is notably shaped by geographic and regulatory monopolies. As a regulated utility, it holds exclusive rights to provide electricity and natural gas in its defined service territories. This structure inherently limits direct competition from other large utility providers within these areas, creating a near-monopoly scenario.

This exclusivity significantly dampens traditional market-based rivalry, as new entrants are largely prohibited. For instance, in 2023, Duke Energy served approximately 8.4 million customers across six states, operating within these protected service areas. While direct competition is minimal, the company must still navigate evolving regulatory landscapes and economic fluctuations that can impact its operational environment.

Duke Energy faces significant competition in the wholesale power generation market from Independent Power Producers (IPPs) and renewable energy developers. These companies are increasingly capable of constructing and operating power plants, including substantial solar and wind farms, and selling the generated electricity into wholesale markets. This directly challenges Duke Energy's existing generation portfolio and its ability to secure favorable wholesale contracts.

For instance, in 2024, the United States saw continued robust growth in renewable energy capacity additions, with solar and wind power leading the charge. IPPs were instrumental in this expansion, often leveraging favorable tax credits and declining technology costs to offer competitive pricing in wholesale electricity auctions. This dynamic puts pressure on Duke Energy's generation margins as it competes with these often more agile and specialized entities.

The push towards renewable energy significantly intensifies competition for Duke Energy. Companies like NextEra Energy, a major player in wind and solar, and numerous specialized solar and battery storage developers are actively vying for prime project locations and capital. This means Duke Energy faces a crowded field when trying to secure sites and funding for its own clean energy expansion plans, a critical part of its strategy to achieve net-zero emissions by 2050.

Decentralized Energy Solutions and Grid Modernization

The rise of decentralized energy solutions, like microgrids and sophisticated energy management systems, presents an indirect competitive challenge. These alternatives offer customers choices beyond traditional grid dependence, pushing Duke Energy to enhance its services and invest in modernizing its infrastructure.

Duke Energy is actively addressing this by undertaking its most extensive infrastructure build-out to date. This initiative is designed to support anticipated increases in energy demand, ensuring the company can meet future load growth and maintain its competitive position in a rapidly evolving energy landscape. For instance, Duke Energy has committed to investing billions in grid modernization projects, including smart grid technologies and advanced metering, to improve reliability and integrate distributed energy resources.

- Grid Modernization Investments: Duke Energy plans to invest approximately $14 billion in grid modernization and infrastructure improvements over the next five years, aiming to enhance reliability and integrate new energy technologies.

- Customer Expectations: Evolving customer demand for cleaner energy and greater control over their consumption necessitates Duke Energy's adaptation and innovation in its service offerings.

- Load Growth Anticipation: The company's significant infrastructure expansion is a direct response to projected increases in electricity demand, driven by factors such as electrification and economic growth.

High Fixed Costs and Strategic Acquisitions/Divestitures

The utility sector, including Duke Energy, faces intense competitive rivalry driven by substantial fixed costs tied to maintaining extensive infrastructure like power grids and pipelines. These high capital expenditures act as significant barriers to entry and exit, shaping how companies compete and manage their operations.

Duke Energy's strategic decisions, such as divesting its Commercial Renewables business in 2023 for $2.0 billion and previously its Ohio utility operations, underscore a deliberate strategy to concentrate on its core regulated utility businesses. This focus on regulated assets, which offer more predictable revenue streams, aims to bolster financial stability and facilitate investments in essential grid modernization and clean energy transitions.

- High Fixed Costs: The utility industry requires massive upfront investment in infrastructure, leading to high operating leverage and significant barriers to exit.

- Strategic Divestitures: Duke Energy's sale of non-core assets, like its Commercial Renewables portfolio, allows for capital reallocation towards regulated infrastructure and debt reduction.

- Portfolio Optimization: By shedding less profitable or non-strategic businesses, Duke Energy aims to enhance its overall financial health and ability to fund necessary capital expenditures.

- Focus on Regulated Assets: This strategic shift supports long-term growth by concentrating on businesses with stable, predictable earnings, crucial for funding infrastructure upgrades.

Duke Energy's competitive rivalry is a complex interplay of its regulated monopoly status in core service areas and increasing competition in generation and emerging energy solutions. While direct competition within its defined territories is minimal, the company faces pressure from Independent Power Producers (IPPs) and renewable energy developers in the wholesale market, as seen in the robust growth of solar and wind capacity additions in 2024.

The company's strategic divestitures, such as the $2.0 billion sale of its Commercial Renewables business in 2023, highlight a focus on strengthening its regulated utility operations. This strategic pivot aims to bolster financial stability and support significant investments in grid modernization, with plans for approximately $14 billion in such improvements over the next five years.

Duke Energy must also contend with evolving customer expectations for cleaner energy and the rise of decentralized energy solutions like microgrids, which offer alternatives to traditional grid reliance.

| Competitive Factor | Duke Energy's Position | Key Developments (2023-2024) |

|---|---|---|

| Regulated Monopoly | Dominant in defined service territories, limiting direct utility competition. | Served ~8.4 million customers in 2023 across six states. |

| Wholesale Generation | Faces competition from IPPs and renewable developers. | US saw strong renewable capacity growth in 2024, with IPPs leveraging tax credits. |

| Renewable Energy Expansion | Competes for projects and capital with specialized developers. | Focus on net-zero emissions by 2050 necessitates strategic site and funding acquisition. |

| Decentralized Energy | Indirect challenge from microgrids and energy management systems. | Requires investment in grid modernization to integrate distributed resources. |

| Infrastructure Investment | Undertaking extensive build-out for demand growth and modernization. | Planned ~$14 billion in grid modernization over five years. |

SSubstitutes Threaten

The most significant substitute for Duke Energy's electricity is customer self-generation, primarily through rooftop solar photovoltaic systems and integrated battery storage. As solar technology continues to advance in affordability and efficiency, both residential and commercial customers are increasingly able to reduce their dependence on traditional grid power, with some even becoming net energy exporters.

This growing trend of distributed generation represents a long-term threat to Duke Energy's traditional sales volume and overall demand for its services. For instance, in 2023, the U.S. saw a significant increase in residential solar installations, with capacity growing by over 20% compared to the previous year, indicating a clear shift in consumer behavior towards energy independence.

Improvements in energy efficiency present a significant threat of substitutes for Duke Energy. For instance, enhanced building codes in North Carolina, a key market, mandate higher insulation standards, directly reducing the need for heating and cooling, which are core services. This trend is amplified by the increasing availability and affordability of energy-saving technologies like smart thermostats and LED lighting, which empower consumers to lower their energy consumption independently.

For Duke Energy's natural gas services, the threat of substitutes is significant, with electric heat pumps and geothermal systems gaining traction. As consumers and businesses increasingly prioritize environmental concerns and embrace technological advancements, the shift away from natural gas furnaces and water heaters to electric alternatives directly impacts the demand for Duke Energy's natural gas transportation and storage services. This trend is further amplified by rising natural gas prices, which can make electric options more economically appealing over the long term.

Battery Storage and Microgrids

The increasing sophistication of battery storage technology presents a significant threat by enabling customers to store self-generated power or capitalize on fluctuating grid prices. This directly diminishes their real-time dependence on Duke Energy's supply. For instance, by the end of 2023, residential battery storage capacity in the United States had seen substantial growth, with some regions reporting a doubling of installations year-over-year, driven by falling costs and increased awareness of energy resilience.

Microgrids, capable of operating independently from the main grid, offer a compelling substitute by providing a more resilient and localized energy source. These systems can serve entire communities or large industrial sites, effectively bypassing the need for traditional utility services for critical loads. The U.S. Department of Energy has been actively supporting microgrid development, with over $200 million allocated to various projects aimed at enhancing grid resilience and integrating renewable energy sources by 2024.

Duke Energy itself is acknowledging and investing in this evolving landscape. As part of its clean energy transition, the company is actively pursuing expanded energy storage solutions. In 2023, Duke Energy announced plans to deploy several large-scale battery storage projects, totaling hundreds of megawatts, to enhance grid stability and integrate renewable energy, signaling a strategic response to the growing threat of distributed energy resources and microgrids.

- Advancing Battery Storage: Customers can store solar energy or exploit price differences, reducing reliance on Duke Energy.

- Microgrid Independence: Localized energy systems offer resilience and an alternative to central utility services for campuses or communities.

- Duke Energy's Investment: The company is actively investing in energy storage as part of its clean energy strategy to meet evolving market demands.

Fuel Switching by Industrial and Commercial Customers

Large industrial and commercial customers possess the potential to switch between different fuel sources for their energy needs. This capability, while often requiring substantial capital investment and being sensitive to price volatility, grants them a degree of substitution power against Duke Energy's existing natural gas and electricity services. For instance, a large manufacturing plant might evaluate transitioning from natural gas to electricity or even exploring on-site renewable generation if economically viable.

Duke Energy recognizes this dynamic and is actively developing innovative rate structures designed to better meet the evolving clean energy demands of its major business clients. This proactive approach aims to retain these crucial customers by offering tailored solutions that align with their sustainability goals and operational flexibility. In 2024, Duke Energy reported serving over 1.5 million residential customers and more than 200,000 commercial and industrial customers across its service territories.

The threat of fuel switching is particularly pronounced for energy-intensive industries where fuel costs represent a significant portion of their operating expenses. These customers are more likely to invest in dual-fuel capabilities or explore alternative energy procurement strategies. For example, a large data center might consider the total cost of ownership for natural gas versus electricity, factoring in potential carbon pricing or future regulatory changes.

- Customer Flexibility: Industrial and commercial clients can shift between fuels like natural gas and electricity based on operational needs and cost.

- Capital Investment: Switching fuels typically involves significant upfront costs for infrastructure upgrades.

- Price Sensitivity: Fuel switching decisions are heavily influenced by fluctuating energy market prices.

- Duke Energy's Response: The company is introducing new rate plans to address the clean energy needs of large business customers.

The threat of substitutes for Duke Energy's electricity services is primarily driven by customer self-generation, particularly rooftop solar and battery storage systems. As these technologies become more affordable and efficient, customers are increasingly reducing their reliance on traditional grid power, with a notable 20% year-over-year growth in U.S. residential solar installations reported in 2023.

Energy efficiency improvements also act as a significant substitute, with enhanced building codes in states like North Carolina reducing overall energy demand. Furthermore, the growing adoption of electric heat pumps and geothermal systems for heating and cooling presents a direct substitute for Duke Energy's natural gas services, especially as natural gas prices fluctuate.

The increasing sophistication and decreasing cost of battery storage technology, evidenced by a doubling of residential installations in some regions by the end of 2023, allows customers to store self-generated power and further diminish their dependence on utility supply.

Microgrids, capable of independent operation, offer another compelling substitute, providing localized and resilient energy sources that can bypass traditional utility infrastructure, supported by over $200 million in U.S. Department of Energy funding for development by 2024.

| Substitute Type | Impact on Duke Energy | Supporting Data/Trend |

|---|---|---|

| Customer Self-Generation (Solar) | Reduced electricity sales volume | 20%+ growth in U.S. residential solar installations (2023) |

| Energy Efficiency | Lower demand for heating/cooling services | Stricter building codes, increased adoption of smart thermostats |

| Electric Heat Pumps/Geothermal | Decreased demand for natural gas services | Growing consumer preference for electric alternatives |

| Battery Storage | Diminished real-time reliance on grid supply | Regional doubling of residential battery installations (end of 2023) |

| Microgrids | Potential bypass of traditional utility services | $200M+ in U.S. DOE funding for microgrid development (by 2024) |

Entrants Threaten

The utility sector presents a formidable barrier to entry due to the sheer scale of capital required for essential infrastructure. Establishing new generation facilities, extensive transmission lines, and robust distribution networks demands investments often in the billions of dollars, effectively deterring smaller or less capitalized entities from entering the market.

For instance, Duke Energy has outlined an ambitious $83 billion capital plan through 2028 to support new generation projects and meet escalating customer demand, underscoring the substantial financial commitments necessary to operate and expand within this industry.

New entrants into the utility sector, like Duke Energy operates in, confront a formidable array of regulatory hurdles. Obtaining necessary operating licenses, securing environmental permits, and gaining approval from state utility commissions are all essential but time-consuming and intricate processes. These requirements, often involving public hearings and rigorous compliance standards, act as a substantial barrier, protecting existing players.

Existing utilities like Duke Energy enjoy substantial economies of scale across generation, transmission, and customer service. This means their massive infrastructure and existing customer base allow for lower per-unit operating costs compared to any potential new, smaller competitor. For instance, in 2023, Duke Energy reported total operating revenues of $27.5 billion, underscoring the sheer scale of their operations.

Established Infrastructure and Network Effects

Duke Energy operates a vast and intricate network of electricity transmission and distribution lines, alongside a robust natural gas pipeline system, across several U.S. states. This established infrastructure represents a significant hurdle for any potential new entrant aiming to compete in the energy utility sector. Replicating such a complex and geographically dispersed network would require immense capital investment and years of development, making it exceedingly difficult for new companies to establish a comparable operational footprint.

The existing infrastructure also benefits from powerful network effects. As more customers are connected to Duke Energy's grid, the overall value and efficiency of the system increase for all users. This creates a self-reinforcing cycle that further solidifies Duke Energy's market position, making it challenging for newcomers to attract a sufficient customer base to achieve economies of scale and compete effectively on price or service.

- Infrastructure Investment: In 2023, Duke Energy reported capital expenditures of approximately $15.6 billion over the previous three years, highlighting the substantial investment required to maintain and expand its existing infrastructure.

- Geographic Reach: Duke Energy serves over 8.4 million customers across six states, demonstrating the extensive scale of its network.

- Regulatory Hurdles: New entrants would also face significant regulatory approval processes to build or acquire rights-of-way for new infrastructure, adding further complexity and cost.

Access to Transmission and Distribution Networks

Even if a new firm could establish generation capacity, securing access to Duke Energy's established transmission and distribution networks presents a considerable hurdle. These networks are critical for delivering electricity to consumers, and despite regulatory mandates for open access, practical constraints like interconnection expenses and grid congestion can create substantial barriers for new competitors.

Duke Energy, like many utilities, is grappling with the complexities of aging infrastructure and supply chain disruptions. These ongoing challenges can further complicate the process for new entrants seeking to establish grid interconnections, potentially increasing costs and lead times.

- Interconnection Costs: New entrants may face significant upfront costs to connect their generation facilities to Duke Energy's existing grid infrastructure. These costs can include studies, equipment upgrades, and construction, acting as a deterrent.

- Grid Congestion: Existing transmission lines can become congested, limiting the ability of new, potentially intermittent, renewable energy sources to deliver power reliably to the market.

- Infrastructure Modernization: Duke Energy's ongoing investments in grid modernization, while beneficial long-term, can also create temporary complexities and capacity constraints for new interconnections. For example, in 2023, Duke Energy reported capital expenditures of approximately $14.5 billion, with a significant portion allocated to grid modernization and reliability improvements.

The threat of new entrants for Duke Energy is significantly low due to immense capital requirements for infrastructure and stringent regulatory landscapes. Existing players benefit from substantial economies of scale and established networks, making it extremely difficult for newcomers to compete. For instance, Duke Energy's 2023 revenue of $27.5 billion highlights its operational magnitude.

| Factor | Impact on New Entrants | Duke Energy Context (2023/2024 Data) |

| Capital Intensity | Extremely High Barrier | $15.6 billion capital expenditures over 3 years (2021-2023) for infrastructure maintenance and expansion. |

| Regulatory Hurdles | Significant Barrier | Requires extensive licensing, environmental permits, and state commission approvals. |

| Economies of Scale | Major Advantage for Incumbents | $27.5 billion in operating revenues in 2023, serving over 8.4 million customers. |

| Infrastructure Access | Challenging | High interconnection costs and potential grid congestion for new generation sources. |

Porter's Five Forces Analysis Data Sources

Our Duke Energy Porter's Five Forces analysis is built upon a foundation of publicly available information, including annual reports, SEC filings, and investor presentations. We also incorporate insights from reputable industry research firms and energy sector publications.