DPR Construction SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

DPR Construction leverages its strong reputation for quality and client satisfaction, but faces potential headwinds from an increasingly competitive market and evolving labor dynamics. Understanding these internal capabilities and external pressures is crucial for strategic planning.

Want the full story behind DPR Construction's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DPR Construction's strength lies in its mastery of technically demanding sectors like advanced technology, life sciences, and healthcare. This specialization allows them to build a reputation for handling complex projects that require cutting-edge solutions.

For instance, DPR's involvement in constructing AI data centers and critical healthcare infrastructure, such as new hospital bed towers, showcases their ability to execute projects with high levels of precision and technical know-how. This focus on specialized markets differentiates them in the construction industry.

DPR Construction demonstrates a significant strength in its unwavering commitment to sustainability and innovation. They actively champion regenerative design principles, focusing on reducing carbon footprints and managing resources responsibly across all their projects. This dedication is evident in their investment in net-zero-energy office spaces, showcasing a forward-thinking approach to environmental stewardship.

Leveraging cutting-edge technologies is another core strength, with DPR’s adoption of virtual design and construction (VDC) and artificial intelligence. These tools are instrumental in boosting efficiency, enhancing site safety, and streamlining project delivery, ensuring high-quality outcomes. Their proactive embrace of innovation not only improves operational performance but also positions them as a leader in the evolving construction landscape.

DPR Construction excels with its comprehensive service suite, encompassing preconstruction planning, design-build, general contracting, and integrated project delivery. This end-to-end capability allows them to steer projects from initial concept through completion, ensuring predictable results and efficient workflows for clients.

Their strength lies in managing the entire project lifecycle, which is crucial for complex builds. For instance, in 2023, DPR reported revenues of $7.5 billion, reflecting their capacity to handle large-scale, multifaceted projects across various sectors.

Furthermore, DPR’s ability to self-perform work and utilize prefabrication significantly boosts their control over project scope, sequencing, and timelines. This vertical integration, evident in their consistent project execution, directly contributes to client satisfaction and project success rates.

Strong Reputation and Employee-Centric Culture

DPR Construction's strong reputation as a top employer is a significant asset. Consistently ranked among the best companies to work for by publications like U.S. News & World Report, DPR emphasizes a supportive corporate culture, competitive pay, and a focus on employee growth and welfare. This commitment to its people is a key differentiator in attracting and keeping skilled professionals, which is vital in the construction sector.

This employee-centric approach translates directly into tangible benefits for the company. A positive work environment cultivates collaboration and boosts team performance, ultimately contributing to better project outcomes. For instance, DPR's dedication to employee development was evident in its 2023 initiatives focused on advanced training in sustainable building practices, enhancing their workforce's capabilities.

- Industry Recognition: Consistently named a 'Best Company to Work For' by U.S. News & World Report.

- Talent Acquisition & Retention: Strong culture and compensation attract and retain high-caliber employees.

- Performance Enhancement: Positive work environment fosters collaboration, leading to improved project success rates.

- Employee Development: Investment in training, such as 2023's focus on sustainable building, strengthens the workforce.

Leveraging Advanced Technology for Project Management

DPR Construction's commitment to advanced technology is a significant strength, particularly in project management. They actively integrate cutting-edge tools such as AI for predictive analytics and enhanced safety measures. This focus on innovation directly impacts their operational efficiency and project outcomes.

Their adoption of cloud-based preconstruction platforms and reality capture technologies, like drone-based site scanning and laser scanning, facilitates more precise estimating and real-time progress monitoring. For instance, in 2024, DPR reported a significant reduction in rework on projects utilizing their advanced reality capture systems, attributing it to improved clash detection and adherence to design intent.

This technological prowess translates into tangible benefits, including greater precision in project delivery and more informed, data-driven decision-making. By leveraging these tools, DPR can better anticipate potential issues, optimize resource allocation, and ensure projects align closely with initial specifications, ultimately leading to enhanced client satisfaction and profitability.

- AI Integration: Enhances predictive analytics for risk mitigation and resource optimization in 2024 projects.

- Reality Capture: Tools like drone scanning improve accuracy in progress monitoring and design verification.

- Cloud Platforms: Facilitate seamless collaboration and data sharing across project stakeholders.

- Data-Driven Decisions: Technology enables more precise estimating and proactive problem-solving.

DPR Construction's core strength lies in its deep expertise within highly specialized and technically complex sectors, including advanced technology, life sciences, and healthcare. This focus allows them to consistently deliver on projects demanding sophisticated solutions and precision, such as AI data centers and advanced hospital facilities. Their ability to navigate these intricate environments sets them apart in the construction industry.

A significant differentiator for DPR is their robust commitment to sustainability and innovation, actively promoting regenerative design principles to minimize environmental impact. They invest in forward-thinking solutions like net-zero-energy buildings, demonstrating a proactive approach to environmental responsibility and resource management.

DPR Construction's strategic advantage is amplified by its comprehensive integration of advanced technologies, including virtual design and construction (VDC) and artificial intelligence. In 2024, their use of reality capture technologies like drone scanning led to a notable reduction in project rework by improving clash detection and ensuring adherence to design intent.

The company also boasts a strong reputation as an employer, consistently recognized as a top workplace. This focus on employee well-being and development, including training in sustainable practices in 2023, fosters a collaborative environment that enhances project execution and client satisfaction.

| Strength Area | Key Capabilities | 2023/2024 Data/Facts |

|---|---|---|

| Technical Specialization | Advanced Technology, Life Sciences, Healthcare | Expertise in complex projects like AI data centers and hospital bed towers. |

| Sustainability & Innovation | Regenerative Design, Net-Zero Buildings | Focus on reducing carbon footprints and responsible resource management. |

| Technology Integration | VDC, AI, Reality Capture | 2024: Reduced rework via improved clash detection with reality capture. |

| Workforce & Culture | Employee Development, Positive Environment | 2023: Training in sustainable building practices; consistently ranked a 'Best Company to Work For'. |

What is included in the product

Delivers a strategic overview of DPR Construction’s internal and external business factors, highlighting its strengths in innovation and market position alongside potential weaknesses and external threats.

Offers a clear, actionable framework to identify and address key challenges and opportunities for DPR Construction.

Weaknesses

DPR Construction's focus on specialized sectors like advanced technology and life sciences, while a strength, also presents a significant weakness. A downturn in these technically demanding markets could severely impact their project pipeline and revenue streams. For instance, a slowdown in semiconductor manufacturing construction, a key area for DPR, could directly affect their earnings.

The construction sector, including specialized areas, continues to grapple with a shortage of skilled workers, especially for critical craft roles such as electricians, HVAC technicians, and pipefitters. This scarcity directly impacts DPR Construction by making it harder to find qualified personnel, driving up labor expenses, and potentially causing delays in project timelines. These challenges are particularly pronounced for large, intricate projects, especially those situated in less accessible locations. DPR's Q2 2025 earnings call specifically identified this ongoing labor deficit as a significant hurdle.

DPR Construction, like many in the industry, navigates the inherent complexities of global supply chains. This exposes the company to significant risks from disruptions, fluctuating material prices, and the impact of tariffs, all of which can directly affect project schedules and budgets. For instance, the construction materials price index saw a notable increase in early 2024, impacting project costs for many firms.

The intricate nature of sourcing materials from a wide array of international vendors means that events such as geopolitical tensions, severe weather patterns, or shifts in trade policies can rapidly inflate expenses and cause delays in material delivery. This necessitates a proactive and strategic approach to sourcing to mitigate these risks.

High Project Complexity and Associated Risks

DPR Construction's specialization in highly complex projects, while a market advantage, introduces substantial risks. These intricate builds often involve sophisticated designs and demanding site conditions, increasing the likelihood of unforeseen issues that can impact timelines and budgets. For instance, the average cost overrun on large-scale, complex construction projects globally was estimated to be around 10-15% in recent years, a figure DPR must actively manage.

The inherent technical demands of these projects necessitate exceptionally detailed planning and precise execution. Any deviation from stringent specifications, which are common in sectors like healthcare and advanced technology where DPR is active, can lead to significant financial penalties and damage the company's reputation. This requires a constant focus on quality control and risk mitigation throughout the project lifecycle.

- Technical Complexity: Projects often involve advanced engineering, intricate systems integration, and specialized materials, increasing the potential for errors.

- Unforeseen Challenges: Site-specific conditions, regulatory changes, or supply chain disruptions can create unexpected hurdles that require costly solutions.

- Cost Overruns: The margin for error is slim; even minor miscalculations in a complex project can lead to substantial budget increases, impacting profitability.

- Reputational Risk: Failure to deliver on time and within budget on high-profile, complex projects can severely damage DPR's standing in the industry.

Dependence on Economic Stability for Investment

DPR Construction's growth is intrinsically linked to the health of the economy. A slowdown in economic activity, marked by rising interest rates or decreased consumer confidence, directly impacts the demand for new construction projects. For instance, the Federal Reserve's decision in early 2025 to maintain interest rates at a higher level than anticipated in late 2024 could dampen capital investment in large-scale developments.

This reliance on external economic factors presents a significant weakness. Economic volatility can lead to project delays or cancellations, directly affecting DPR's revenue streams and project pipeline. The construction sector's sensitivity to economic cycles means that periods of recession or uncertainty can disproportionately affect companies like DPR, even if their operational efficiency remains high.

Key economic indicators that influence DPR's investment dependence include:

- GDP Growth: Slowing GDP growth in major markets can reduce overall construction spending.

- Interest Rates: Higher borrowing costs make financing new projects more expensive, potentially deterring clients.

- Investor Confidence: A decline in investor sentiment can lead to reduced private sector investment in construction.

- Inflationary Pressures: Persistent inflation can increase material and labor costs, impacting project feasibility and profitability.

DPR Construction's reliance on specialized, high-tech sectors means a downturn in these areas can significantly impact their business. For example, a slowdown in advanced manufacturing or life sciences construction, key markets for DPR, could directly reduce their project pipeline and overall revenue. This specialization, while a strength, creates a vulnerability to sector-specific economic shifts.

The ongoing shortage of skilled labor in the construction industry presents a significant hurdle for DPR. This scarcity drives up labor costs and can lead to project delays, especially for complex projects. DPR's Q2 2025 earnings report highlighted this labor deficit as a persistent challenge impacting operational efficiency and project timelines.

Global supply chain complexities expose DPR to risks from disruptions and price volatility for construction materials. Geopolitical events, trade policy changes, or severe weather can inflate costs and delay deliveries, directly impacting project budgets and schedules. The construction materials price index saw a notable increase in early 2024, underscoring this vulnerability.

The intricate nature of DPR's specialized projects, while a market advantage, also introduces substantial risks of cost overruns and schedule delays. These complex builds often encounter unforeseen site conditions or regulatory changes that require costly solutions. Global data suggests large, complex projects can experience cost overruns of 10-15%, a risk DPR must actively manage.

Preview the Actual Deliverable

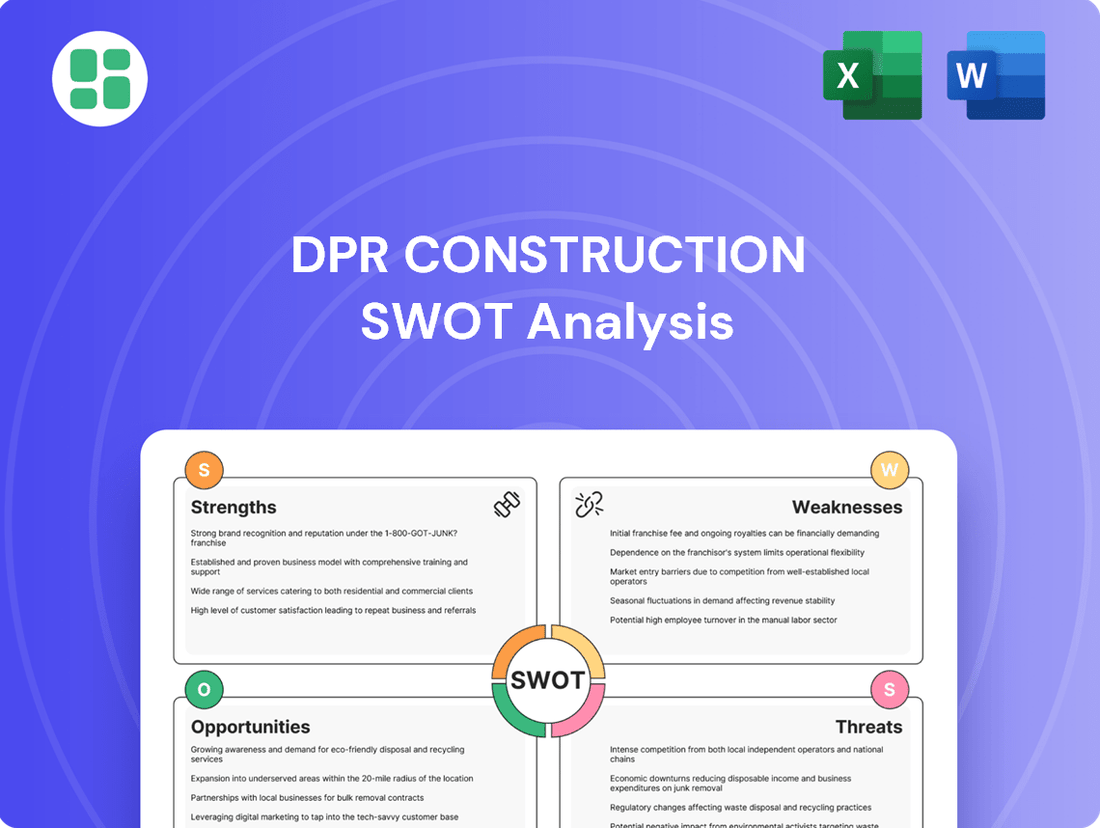

DPR Construction SWOT Analysis

The file shown below is not a sample—it’s the real DPR Construction SWOT analysis you'll download post-purchase, in full detail. You'll gain a comprehensive understanding of their internal strengths and weaknesses, alongside external opportunities and threats. This ensures you receive exactly what you need to inform your strategic decisions.

Opportunities

The burgeoning demand for advanced technology infrastructure, fueled by AI, electrification, and reshoring, presents a significant growth avenue. DPR Construction's established expertise in building data centers and manufacturing facilities positions them to secure a substantial share of this expanding market.

The construction industry's shift towards sustainability presents a significant opportunity for DPR Construction. There's a growing demand for energy-efficient buildings, low-carbon materials, and regenerative design principles from both clients and the broader market. DPR's existing expertise in green building practices and its commitment to environmental performance, evidenced by its LEED-certified projects, positions it to capitalize on this trend, securing more environmentally focused contracts.

The healthcare sector, despite economic headwinds, is a consistent growth area, with demand for outpatient facilities and specialized care centers on the rise. This trend is fueled by an aging demographic and shifting patient preferences for more accessible and focused medical services.

The life sciences industry is also a significant opportunity, witnessing a boom in large-scale, intricate construction projects. DPR Construction's established expertise in both these vital markets places them in a strong position to capitalize on continued capital expenditures and necessary facility modernizations within these sectors.

Leveraging Technological Advancements in Construction

The construction sector's rapid embrace of technologies like artificial intelligence and digital twins offers significant avenues for DPR Construction to boost efficiency and project outcomes. By integrating these tools, DPR can streamline operations and gain a competitive advantage. For instance, the global construction technology market was valued at approximately $11.4 billion in 2023 and is projected to grow substantially, highlighting the increasing adoption of such innovations.

DPR can capitalize on these advancements by implementing cloud-based estimating platforms and reality capture for progress monitoring. These solutions enable more intelligent, expedited, and reliable project execution, directly contributing to faster delivery times and improved predictability. In 2024, companies that effectively leverage these technologies are seeing tangible benefits in reduced project costs and enhanced safety protocols.

- Enhanced Operational Efficiency: AI-driven scheduling and resource allocation can optimize workflows.

- Improved Project Predictability: Digital twins offer real-time insights for better risk management.

- Competitive Edge: Early adoption of advanced technologies differentiates DPR in the market.

- Data-Driven Decision Making: Reality capture provides accurate progress data for informed choices.

Strategic Geographic Expansion and Market Penetration

DPR Construction's recent leadership appointments across key regions, coupled with a steady stream of new project wins, highlight a significant opportunity for strategic geographic expansion. By leveraging these transitions, the company can push into new markets and deepen its presence in existing ones.

Focusing on regions demonstrating robust growth in DPR's core sectors, such as advanced technology facilities and healthcare, presents a clear path to market penetration. Establishing new offices and empowering regional leadership teams are crucial steps to spearhead this expansion and diversify the company's project portfolio.

- 2024 Market Growth: Projections indicate continued strong demand in sectors like life sciences and technology, with some regions expected to see double-digit growth in construction spending for these areas through 2025.

- Regional Investment: DPR's strategic placement of new leadership in markets like the Pacific Northwest and Southeast, areas showing significant infrastructure development, positions them to capture a larger share of upcoming projects.

- Diversification Strategy: Expanding into underserved geographic markets can reduce reliance on any single region, mitigating risk and opening new revenue streams.

The increasing demand for specialized construction services in sectors like life sciences and advanced technology offers substantial growth prospects for DPR Construction. These industries require highly technical and precise building, areas where DPR has demonstrated considerable expertise and a strong project pipeline.

The company is well-positioned to benefit from the ongoing trend of reshoring and the expansion of domestic manufacturing capabilities, particularly in the semiconductor and advanced manufacturing sectors. This trend is driving significant investment in new facilities, creating a robust market for DPR's services.

Sustainability initiatives and the drive for energy efficiency in construction present a key opportunity. DPR's commitment to green building practices and its experience with LEED-certified projects align with growing client and regulatory demands for environmentally conscious construction.

The healthcare sector's continued expansion, particularly in outpatient facilities and specialized medical centers, offers a stable and growing market. DPR's established presence and expertise in healthcare construction enable it to capture a significant share of this demand.

| Opportunity Area | Market Driver | DPR's Advantage | 2024/2025 Data Point |

|---|---|---|---|

| Advanced Technology & Manufacturing | AI, electrification, reshoring | Expertise in data centers, manufacturing facilities | Global construction technology market projected to reach $20.5 billion by 2025. |

| Healthcare Facilities | Aging demographics, outpatient care demand | Established healthcare construction experience | US healthcare construction spending expected to grow by 5-7% annually through 2025. |

| Life Sciences Construction | Biotech and pharmaceutical R&D boom | Experience with complex, large-scale projects | Life sciences construction market expected to see 8-10% CAGR through 2026. |

| Sustainable Construction | Environmental regulations, client demand | LEED expertise, commitment to green building | Green building market expected to grow 9.5% annually, reaching $171.8 billion by 2027. |

Threats

The broader economic landscape, particularly rising inflation and interest rates, presents a substantial threat to DPR Construction. For instance, the US Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a target range of 5.25%-5.50% by July 2023, directly impacts borrowing costs for clients, potentially slowing capital investment in new projects. This economic uncertainty can lead to project delays or outright cancellations, affecting DPR's project pipeline and revenue forecasts.

The construction sector, including companies like DPR Construction, continues to grapple with escalating material prices and a scarcity of skilled labor. These pressures are amplified by persistent supply chain disruptions and broader inflationary trends, directly impacting project profitability and the ability to offer competitive bids.

DPR Construction's Q2 2025 earnings call specifically cited the volatility in material costs and the ongoing labor deficit as significant headwinds, posing challenges to project execution and timely completion. For instance, the Producer Price Index for construction materials saw a year-over-year increase of 7.2% in April 2025, according to the Bureau of Labor Statistics.

DPR Construction faces a fiercely competitive landscape in commercial construction, with many established general contractors vying for projects. This intense rivalry means competitors can undercut pricing, directly affecting DPR's project acquisition and profitability. For instance, in 2024, the U.S. construction industry saw a 2.1% increase in nonresidential construction spending, a sector DPR is heavily involved in, yet this growth also attracts more players.

This market dynamic necessitates constant innovation and differentiation for DPR to maintain its competitive edge. Competitors often offer comparable services, leading to price wars that can erode margins. Staying ahead requires not just efficiency but also unique value propositions and a strong reputation for quality and reliability, especially as the industry adapts to new technologies and sustainability demands.

Regulatory Changes and Permitting Delays

Evolving building codes and stricter environmental regulations, such as those concerning carbon emissions in new construction, present a significant hurdle. For instance, the U.S. Green Building Council's LEED v4.1 standards are increasingly influencing project requirements, demanding more sustainable materials and processes which can add to upfront costs and necessitate design modifications. These changes can directly impact project timelines and budgets, requiring adaptive strategies from DPR Construction.

Navigating the patchwork of local permitting processes across diverse geographic markets adds another layer of complexity. Permitting delays have consistently been cited as a major pain point in the construction industry, with some regions experiencing average permit approval times extending beyond 90 days for complex commercial projects. This can disrupt project schedules and increase overhead costs, particularly for large-scale, multi-state operations like those undertaken by DPR.

- Increased Compliance Costs: Adapting to new environmental standards, like those mandating reduced embodied carbon in materials, can inflate project expenses.

- Extended Project Timelines: Delays in obtaining permits, which can stretch for months in some jurisdictions, directly impact project completion dates and revenue recognition.

- Geographic Regulatory Variance: Managing compliance across differing state and local building codes and environmental laws requires significant administrative effort and expertise.

Supply Chain Disruptions and Geopolitical Instability

Global geopolitical tensions, including ongoing conflicts and regional instability, pose a significant threat to construction supply chains. These disruptions can lead to extended lead times for essential materials and components, directly impacting project schedules and increasing overall costs. For instance, the ongoing conflicts in Eastern Europe continued to affect global energy and material prices throughout 2024, with projections indicating persistent volatility into 2025.

The ripple effect of these supply chain issues can manifest as material shortages and escalating shipping expenses. DPR Construction's internal market assessments in late 2024 highlighted these persistent challenges, noting that the cost of key materials like steel and lumber remained elevated due to these global pressures. This necessitates proactive risk mitigation strategies to maintain project profitability and delivery timelines.

- Geopolitical Instability: Conflicts in regions vital for manufacturing and resource extraction create uncertainty and potential supply bottlenecks.

- Material Cost Volatility: Geopolitical events directly influence the prices of raw materials and finished construction goods, impacting project budgets.

- Extended Lead Times: Disruptions in global shipping and production can significantly lengthen the time required to procure necessary materials.

- Project Delays and Cost Overruns: The combined effects of material shortages and increased costs can lead to significant project delays and budget overruns.

Intensifying competition within the commercial construction sector remains a significant threat, as numerous established general contractors vie for projects. This rivalry often leads to price wars, directly impacting DPR's ability to secure contracts and maintain healthy profit margins. For instance, in 2024, the U.S. nonresidential construction market, a key area for DPR, saw a 2.1% increase in spending, which, while positive, also attracted more participants.

Escalating material costs and a persistent shortage of skilled labor continue to pressure DPR Construction's profitability. These challenges are exacerbated by ongoing supply chain disruptions and broader inflationary trends, making it difficult to accurately forecast project expenses and maintain competitive bidding. DPR's Q2 2025 earnings call highlighted these issues as significant headwinds impacting project execution.

Evolving building codes and stricter environmental regulations, such as those focused on reducing carbon emissions in construction, present another substantial threat. Compliance with new standards, like LEED v4.1, can increase upfront project costs and necessitate design modifications, potentially impacting timelines and budgets. Navigating the varying permitting processes across different jurisdictions also adds complexity and can lead to project delays.

| Threat Category | Specific Challenge | Impact on DPR Construction | Relevant Data/Example |

|---|---|---|---|

| Market Competition | Intense rivalry among general contractors | Pressure on pricing, reduced profit margins | 2.1% growth in U.S. nonresidential construction spending in 2024 attracting more players |

| Operational Costs | Rising material prices and labor shortages | Increased project expenses, difficulty in competitive bidding | Producer Price Index for construction materials up 7.2% year-over-year in April 2025 |

| Regulatory Environment | Stricter environmental codes and permitting delays | Higher compliance costs, potential project delays | LEED v4.1 standards influencing project requirements; average permit approval times exceeding 90 days in some jurisdictions |

SWOT Analysis Data Sources

This analysis draws from DPR Construction's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to provide a well-rounded perspective.