DPR Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

Explore DPR Construction's strategic positioning through our insightful BCG Matrix preview, revealing how their projects stack up as Stars, Cash Cows, Dogs, or Question Marks. This glimpse offers a foundational understanding of their market performance and resource allocation.

Unlock the full potential of this analysis by purchasing the complete DPR Construction BCG Matrix. Gain access to detailed quadrant breakdowns, actionable insights, and a clear roadmap for optimizing their project portfolio and driving future growth.

Stars

The Advanced Technology & Data Centers sector is a clear star for DPR Construction. This segment is experiencing explosive growth, fueled by the insatiable demand for AI, advanced manufacturing facilities, and the critical infrastructure that powers them. DPR's significant market share here underscores their ability to capitalize on these trends.

DPR is demonstrating its leadership by securing and executing large-scale data center projects. Their expertise in rapid and efficient delivery is crucial in this fast-paced market. For instance, DPR consistently ranks among the top contractors for mission-critical facilities, a testament to their deep understanding of the sector's unique requirements.

While some areas of the life sciences market are experiencing a slowdown, the biopharmaceutical manufacturing sector is booming, particularly for large-scale facilities and the production of GLP-1 drugs. DPR Construction is a major player in this space, adept at managing complex projects and witnessing sustained demand for their expertise.

In 2024, the demand for specialized biopharmaceutical manufacturing capacity remains high, driven by advancements in biologics and the increasing need for therapies like GLP-1s. DPR's experience with technically intricate builds positions them well to capitalize on this ongoing growth, with many projects involving advanced containment and sterile processing requirements.

DPR Construction's commitment to sustainability is evident in their development of net-zero energy offices and a strong focus on carbon reduction and regenerative design principles. This strategic emphasis positions them favorably within the market.

The increasing global regulatory push for green buildings, coupled with a growing market demand for sustainable construction, signifies a high-growth trajectory for this sector. DPR's leadership in this area is a key differentiator.

In 2024, the green building sector continued its robust expansion, with projects prioritizing energy efficiency and reduced environmental impact. DPR's proactive investment in net-zero and sustainable technologies aligns perfectly with these market dynamics, projecting significant future revenue streams.

Integrated Project Delivery (IPD) & Prefabrication

DPR Construction's strategic emphasis on Integrated Project Delivery (IPD) and prefabrication positions them strongly in high-growth construction segments. These methods, coupled with Virtual Design & Construction (VDC), enhance predictability and speed, crucial in a dynamic market.

DPR's commitment to VDC and prefabrication is a key differentiator, enabling them to tackle complex projects with greater efficiency. This focus on innovation directly addresses the industry's demand for faster, more reliable project completion.

- DPR's IPD and prefabrication strategies align with market trends favoring off-site construction and collaborative project execution.

- In 2024, the global prefabrication construction market was valued at approximately $165.8 billion, with projections indicating continued robust growth.

- DPR's investment in VDC technologies allows for early clash detection and improved coordination, reducing costly rework and schedule delays.

- The company's experience in delivering projects using these advanced methodologies contributes to a competitive edge in securing complex, high-value contracts.

Regional Expansion in High-Growth Markets

DPR Construction's strategic expansion into high-growth markets like Texas, Arizona, and the Southeast is a key indicator of its potential as a 'Star' in the BCG matrix. The company has demonstrated a robust capability to not only enter these burgeoning regions but also to secure significant projects, especially within the advanced technology and commercial sectors. This success points to a strong and growing market share in geographically expanding territories.

For instance, in 2024, DPR Construction continued to make significant inroads in these areas. Texas, in particular, has seen substantial investment in data centers and advanced manufacturing, sectors where DPR has a proven track record. The Southeast also presents a compelling growth narrative, driven by population influx and economic diversification.

- DPR's 2024 project wins in Texas's advanced technology sector highlight its dominance in a rapidly expanding market.

- The company's market share in Arizona's commercial construction segment is growing, fueled by new business development.

- DPR's strategic focus on the Southeast aligns with regional economic forecasts predicting continued expansion in key industries.

- The firm's ability to secure large-scale projects in these diverse, high-growth markets solidifies its position as a 'Star'.

DPR Construction's positioning as a Star in the BCG matrix is strongly supported by its leadership in the Advanced Technology & Data Centers sector. This segment is experiencing rapid growth, driven by AI and advanced manufacturing. DPR's substantial market share here is a clear indicator of their ability to leverage these trends.

The company's expertise in delivering complex data center projects efficiently solidifies its star status. DPR consistently ranks high in mission-critical facility construction, demonstrating a deep understanding of sector-specific demands. Their strategic focus on integrated project delivery and prefabrication further enhances their competitive edge in these high-demand areas.

DPR's expansion into high-growth markets like Texas and the Southeast, particularly in the advanced technology sector, underscores its star potential. The company has secured significant projects in these regions, showcasing a growing market share and a strong ability to capitalize on economic expansion. This strategic geographical focus, combined with their technological and methodological advancements, positions them for continued success.

What is included in the product

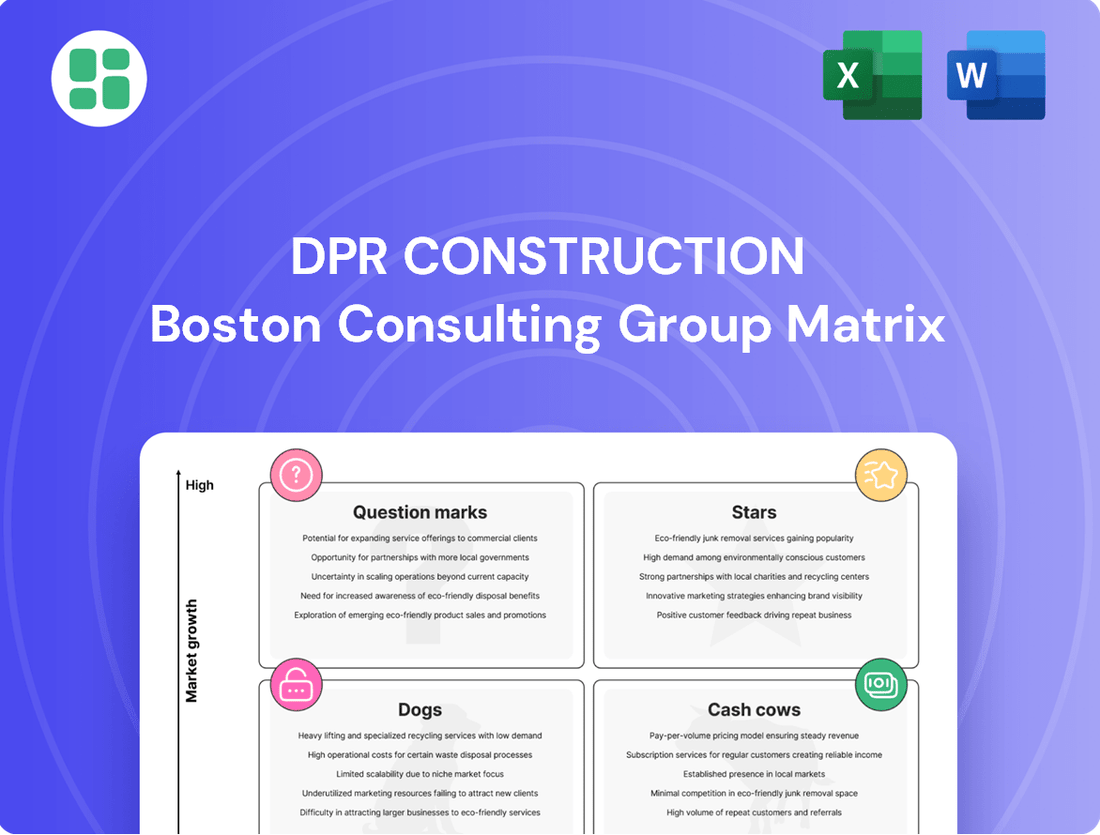

This BCG Matrix overview for DPR Construction analyzes their business units as Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investing in Stars and Question Marks, holding Cash Cows, and divesting Dogs.

A clear, one-page BCG Matrix visually categorizes DPR Construction's business units, simplifying strategic decision-making.

Cash Cows

Established life sciences R&D facilities in mature hubs like Massachusetts and California represent stable cash cows for DPR Construction. While these regions boast a strong long-term outlook, the current R&D construction market faces headwinds from excess commercial real estate and a reduction in speculative development.

DPR Construction holds a significant market share in these established areas, benefiting from ongoing demand for upgrades and specialized facilities. However, the immediate growth prospects are more modest compared to emerging markets, positioning these projects as reliable income generators. For instance, Massachusetts alone saw over $3 billion in life sciences construction projects underway or planned in 2024, highlighting the sheer scale of investment even with market adjustments.

Core Healthcare Infrastructure Projects are DPR Construction's established Cash Cows. The healthcare sector remains a robust and high-volume market, with health systems continuing to invest in capital projects even amidst financial strains.

These ventures, encompassing new bed towers, patient care wings, and extensive renovations, demonstrate DPR's high market share within a stable, mature industry. This consistent demand translates into predictable and steady cash flow for the company. For instance, in 2024, healthcare construction spending in the US was projected to reach over $100 billion, highlighting the sector's resilience and ongoing investment.

Traditional higher education facilities, including lecture halls and student housing, can be considered Cash Cows for firms like DPR Construction. While growth in these areas might be slower compared to cutting-edge STEM facilities, they represent a stable and predictable revenue stream for established institutions. DPR's extensive history and proven track record in constructing and renovating these essential campus buildings allow them to maintain a significant market share.

In 2024, the higher education construction market saw continued investment in modernization and upgrades, even for traditional spaces. For instance, projects focused on enhancing energy efficiency and updating learning environments in older buildings are prevalent. DPR's ability to deliver these projects reliably, often within budget and on schedule, solidifies their position as a go-to contractor, ensuring consistent cash flow from these mature market segments.

Large-Scale Commercial Office Developments (Class A)

Large-scale commercial office developments, particularly Class A spaces, are currently seen as cash cows within the construction industry, including for firms like DPR Construction. The market is showing a measured optimism, with a clear preference for premium, amenity-rich environments. DPR, leveraging its extensive experience in these significant projects, commands a substantial share in this established sector. This strong position translates into steady revenue streams, even as the broader market experiences a period of stabilization rather than rapid growth.

DPR Construction's involvement in Class A office spaces reflects a mature market segment where consistent demand for quality fuels reliable earnings. This stability is a hallmark of a cash cow, where established market presence and expertise allow for predictable revenue generation.

- Market Share: DPR Construction maintains a high market share in the large-scale commercial office development sector.

- Revenue Generation: These projects provide consistent and stable revenue streams for the company.

- Market Maturity: The demand for Class A office spaces indicates a mature market segment.

- Demand Drivers: High-quality, amenity-rich spaces are the primary drivers of demand in this segment.

Self-Perform Work Capabilities

DPR Construction's self-perform work capabilities, particularly in critical trades such as concrete, drywall, and mechanical/electrical systems, function as significant cash cows within its business model. These in-house skills offer a consistent and predictable revenue stream, shielding the company from some of the volatility inherent in subcontracted labor markets.

This internal expertise allows DPR to maintain greater control over project timelines and quality, directly impacting profitability and client satisfaction. For instance, in 2024, DPR reported a substantial portion of its project revenue derived from these self-perform activities, highlighting their role as a foundational element of its financial stability. This capability acts as an internal engine, generating reliable cash flow that can be reinvested or utilized to support other, more growth-oriented segments of the business.

- Stable Revenue Generation: Self-perform work provides a consistent income source, less susceptible to external market fluctuations.

- Quality and Schedule Control: In-house teams enhance project execution, leading to improved margins and client retention.

- Cost Efficiency: Direct management of labor and materials in self-perform trades can lead to cost savings compared to subcontracting.

- Risk Mitigation: Reduced reliance on third-party labor minimizes risks associated with subcontractor availability and performance.

DPR Construction's established life sciences R&D facilities in mature markets like Massachusetts and California represent key cash cows. While these sectors are stable, growth is moderate, making them reliable income generators.

Core healthcare infrastructure projects are also significant cash cows for DPR. The consistent demand for hospital upgrades and new facilities ensures predictable, steady cash flow, with U.S. healthcare construction spending projected to exceed $100 billion in 2024.

Traditional higher education facilities and large-scale Class A office developments also function as cash cows. These segments benefit from DPR's strong market share and consistent demand for quality, providing stable revenue streams. In 2024, the higher education sector saw continued investment in modernization, with energy efficiency upgrades being a key focus.

DPR's self-perform work capabilities in concrete, drywall, and mechanical/electrical systems are crucial cash cows. This internal expertise offers a predictable revenue stream and greater control over project execution, contributing significantly to financial stability.

| Category | Market Maturity | DPR's Position | Revenue Stability | 2024 Data Point |

|---|---|---|---|---|

| Life Sciences R&D (MA, CA) | Mature | High Market Share | Stable | MA Life Sciences Construction: >$3 Billion |

| Healthcare Infrastructure | Mature/Stable | High Market Share | Very Stable | US Healthcare Construction: >$100 Billion |

| Traditional Higher Education | Mature | Significant Market Share | Stable | Focus on modernization and energy efficiency |

| Class A Office Developments | Mature | Strong Market Share | Stable | Preference for premium, amenity-rich spaces |

| Self-Perform Work | Internal Capability | Core Strength | Highly Stable | Substantial portion of project revenue |

What You’re Viewing Is Included

DPR Construction BCG Matrix

The DPR Construction BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you get the complete strategic analysis without any watermarks or sample content, ready for immediate application in your business planning.

Dogs

The life sciences sector is currently experiencing a shift, with a noticeable downturn in smaller, speculative projects. Larger, more established ventures are increasingly taking precedence, drawing significant investment and attention. This trend suggests a market consolidation where scale and proven viability are paramount.

For a company like DPR Construction, focusing on these small-to-medium sized speculative life sciences opportunities would likely place them in a position of low market share. The growth prospects within this specific niche appear limited, making it a less attractive segment for resource allocation. Pursuing these ventures could potentially divert valuable resources from more promising, larger-scale projects.

Legacy Commercial Class B and C office renovations represent a challenging segment for construction firms like DPR. These properties often contend with high vacancy rates, with national office vacancy reaching approximately 18.2% in Q1 2024, and a substantial amount of sublease space available, indicating a soft demand.

Focusing on this area would likely place DPR in a low market share position within a low-growth or even declining market. This scenario aligns with the characteristics of a Dog in a BCG matrix, suggesting these projects may not offer significant growth potential or profitability compared to other market segments.

The general K-12 education construction market presents a different picture than higher education for DPR Construction. While DPR has a strong presence in higher education, the K-12 sector is projected for more significant growth. For instance, the K-12 construction market was valued at approximately $40 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2028.

If DPR holds a relatively low market share within this growing K-12 segment, it would likely be categorized as a question mark or potentially a dog in the BCG matrix. This means it's a low-growth, low-share area for the company, requiring careful consideration of investment versus divestment strategies.

Projects with High Reliance on Traditional, Non-Integrated Methods

Projects heavily reliant on traditional, non-integrated construction methods would likely fall into the 'Dog' category within a BCG matrix framework for a company like DPR Construction. This is because DPR's strategic focus on innovation, Virtual Design and Construction (VDC), and prefabrication signifies a move away from these older, less efficient techniques. Projects that don't embrace these advanced methodologies represent a low market share in terms of modern construction practices and may also exhibit lower profitability due to inherent inefficiencies and a higher propensity for rework.

- Low Market Share in Advanced Practices: Projects sticking to traditional methods don't leverage DPR's core strengths in VDC and prefabrication, indicating a limited presence in the market segment that values these innovations.

- Potential for Lower Profitability: Traditional approaches often involve more manual labor, longer timelines, and increased risk of errors, leading to potentially reduced profit margins compared to integrated, technology-driven projects.

- Limited Growth Potential: As the construction industry increasingly adopts advanced technologies, projects that do not integrate these methods may face stagnant or declining growth opportunities.

Geographical Regions Without Strategic Focus or Established Presence

Geographical regions where DPR Construction lacks a strategic focus or established presence, and where the construction market is experiencing low growth, would be categorized as Dogs in the BCG Matrix. These areas represent a drain on resources with little potential for future returns. For instance, if DPR were to consider a region with a projected annual construction market growth rate of less than 2% and a market share below 5%, it would fit this description.

These "Dog" regions are characterized by:

- Low Market Share: DPR has minimal penetration in these areas, making it difficult to gain traction.

- Low Market Growth: The overall demand for construction services in these regions is stagnant or declining, offering limited upside potential.

- Resource Drain: Continued investment in these areas without a clear path to profitability can detract from resources needed for more promising ventures.

- Lack of Competitive Advantage: DPR may not possess unique capabilities or a strong value proposition that differentiates it in these markets.

Projects that are heavily reliant on outdated, non-integrated construction methods would likely be classified as Dogs for DPR Construction. These ventures do not align with DPR's commitment to innovation and advanced techniques like Virtual Design and Construction (VDC) and prefabrication, indicating a low market share in forward-thinking construction practices.

These "Dog" segments, characterized by low market share and low growth potential, represent areas where DPR might see reduced profitability due to inherent inefficiencies and a higher risk of rework, diverting resources from more lucrative opportunities.

Geographical areas with minimal DPR presence and sluggish market growth also fit the Dog profile. For instance, a region with less than 2% annual construction market growth and DPR's market share below 5% would be considered a Dog, draining resources without significant future returns.

The K-12 education construction market, while growing at an estimated 4.5% CAGR through 2028, could also house Dog segments for DPR if the company maintains a low market share within it. This scenario highlights the need for strategic evaluation of investment versus divestment in such areas.

Question Marks

While traditional data centers are clearly Stars for DPR Construction, the real excitement is in AI's expanding role across other infrastructure. Think smart grids, AI-powered transportation networks, and intelligent buildings. These are burgeoning high-growth sectors.

DPR's involvement in these emerging AI-driven infrastructure projects likely positions them as Question Marks. Their market share in these specialized, rapidly evolving areas is probably still growing, requiring substantial investment to capture future potential.

DPR Construction actively seeks new geographic markets with untapped potential, aligning with the Question Mark quadrant of the BCG matrix. These are typically high-growth urban or regional areas where DPR currently holds a minimal market share. Significant investment is required to build brand recognition and secure a dominant position in these emerging territories.

DPR Construction, like many in the industry, is observing a surge in interest regarding the integration of IoT and advanced robotics on job sites. While the potential for increased efficiency and safety is clear, the actual widespread implementation across all projects is still in its nascent stages.

If DPR's current market share in fully integrated, widespread IoT and robotics deployment is currently low, this signifies a Stars or Question Mark category within a BCG-like analysis. The construction sector is projected to grow significantly, with the global construction robotics market expected to reach $12.9 billion by 2027, indicating substantial future growth. This presents a high-growth potential area for DPR, but one that requires considerable investment to achieve scale and competitive advantage.

Modular Construction Beyond Prefabrication

While DPR Construction demonstrates strength in prefabrication, the burgeoning market for fully modular construction presents a distinct growth opportunity. This highly innovative segment, where entire building modules are manufactured off-site, is experiencing significant expansion.

If DPR's current market share within this specific, cutting-edge construction method is relatively modest when viewed against its broader project portfolio, it positions modular construction as a 'Question Mark' within the BCG framework. This classification suggests it warrants careful consideration for future investment and strategic focus.

- Market Growth: The global modular construction market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a substantial growth trajectory.

- Innovation Potential: Fully modular construction allows for greater design flexibility and faster project completion times, appealing to clients seeking efficiency and advanced building solutions.

- Strategic Consideration: DPR's investment in developing expertise and securing a stronger foothold in this high-growth segment could yield significant returns, aligning with its overall strategic objectives.

Niche or Highly Specialized Healthcare Technologies Integration

Within the healthcare sector's evolving landscape, DPR Construction might be focusing on niche technologies like AI-driven diagnostics imaging integration or robotic surgery suites. These areas represent significant growth potential but require specialized knowledge and execution, placing them in a potential question mark category on a BCG matrix.

The demand for advanced healthcare facilities is projected to continue its upward trajectory. For instance, the global digital health market was valued at approximately $371.3 billion in 2023 and is expected to grow substantially by 2030, indicating a strong market for specialized technological integrations.

- AI-Powered Diagnostics: Integrating AI for faster, more accurate medical image analysis and predictive health insights.

- Robotic Surgery Suites: Building advanced operating rooms designed for minimally invasive robotic procedures.

- Telehealth Infrastructure: Developing specialized facilities to support remote patient care and virtual consultations.

- Personalized Medicine Labs: Constructing advanced laboratories for genetic sequencing and tailored treatment development.

Question Marks for DPR Construction represent areas with high market growth potential but currently low market share. These are strategic opportunities that require significant investment to develop and capture market dominance. For DPR, this could include emerging technologies in construction or new geographic markets where their presence is still minimal.

These ventures demand careful analysis to determine if they have the potential to become Stars or if they should be divested. The key is identifying sectors where DPR can build a competitive advantage through focused investment and innovation.

The construction industry's embrace of advanced technologies like AI, robotics, and modular building solutions are prime examples of potential Question Marks. These segments are experiencing rapid growth, as evidenced by the global construction robotics market projected to reach $12.9 billion by 2027, but require substantial upfront investment for DPR to establish a strong market position.

DPR Construction's exploration into new geographic markets with high growth potential but limited current market penetration also fits the Question Mark profile. Success in these areas hinges on building brand recognition and operational capacity, mirroring the investment needed for technological adoption.

| Area | Market Growth Potential | Current Market Share (Estimated) | Strategic Consideration |

| AI & Robotics Integration | Very High (e.g., Construction Robotics Market to reach $12.9B by 2027) | Low to Moderate | Requires significant R&D and adoption investment. |

| Fully Modular Construction | High (Global market valued at ~$100B in 2023, projected to exceed $200B by 2030) | Low to Moderate | Focus on innovation and scaling production. |

| Emerging Geographic Markets | High (Dependent on specific region) | Low | Requires market entry strategy and brand building. |

| Advanced Healthcare Facilities (Niche Tech) | High (e.g., Digital Health Market ~$371.3B in 2023) | Low to Moderate | Specialized expertise and project execution needed. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.