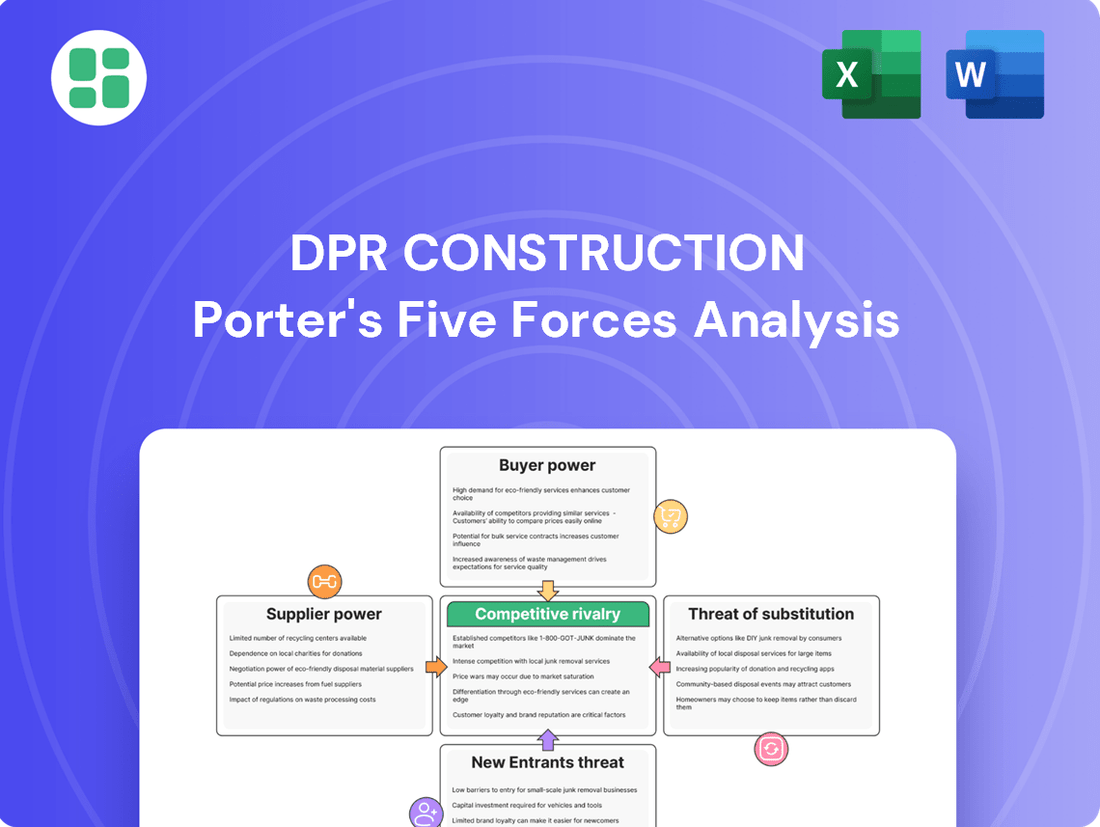

DPR Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

DPR Construction operates within a dynamic construction landscape, where the bargaining power of buyers and suppliers can significantly influence project profitability. Understanding the intensity of rivalry among existing competitors and the threat of new entrants is crucial for maintaining market share.

The complete report reveals the real forces shaping DPR Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DPR Construction's involvement in highly specialized projects, such as those in advanced technology and life sciences, means they often require unique materials and sophisticated equipment. This reliance on niche suppliers, who may have a limited customer base, can give them considerable bargaining power. For example, if a critical component for a semiconductor fabrication plant is only produced by one or two manufacturers, DPR's ability to negotiate favorable terms is diminished.

The scarcity of specialized suppliers for these technically demanding sectors means alternative sourcing options are frequently unavailable. This lack of substitutes directly translates to increased leverage for the suppliers, impacting pricing and delivery timelines for DPR Construction. In 2023, the construction industry globally faced persistent supply chain disruptions, with lead times for specialized equipment extending significantly, further amplifying supplier influence.

The availability of highly skilled labor and specialized subcontractors is a significant factor for DPR Construction. When these trades are in high demand or short supply, their bargaining power increases, allowing them to negotiate higher wages and rates, which can directly affect project costs and schedules.

For instance, in 2024, the construction industry continued to grapple with labor shortages. Reports indicated that nearly 70% of construction firms were experiencing delays due to a lack of skilled workers, empowering those available to demand premium compensation.

DPR Construction, like many in the industry, can face situations where complex projects necessitate the use of proprietary technologies or specialized systems. This reliance can significantly shift bargaining power towards the suppliers of these unique solutions. For instance, if a particular building information modeling (BIM) software or a specialized prefabrication technology is critical for project execution and is patented or exclusively licensed, DPR's dependence grows.

When suppliers possess patents or exclusive rights to essential technologies, their bargaining power is amplified because direct substitutes are scarce. This lack of alternatives means DPR may have to accept higher costs for these vital components or software licenses. In 2023, the global construction technology market was valued at over $11 billion, with a significant portion driven by specialized software and digital platforms, indicating the substantial investment and potential supplier leverage in this area.

Fluctuations in Raw Material Prices

The construction sector, including companies like DPR Construction, is significantly exposed to the unpredictable swings in the cost of essential raw materials. Prices for vital components such as steel, concrete, and advanced chemical compounds can fluctuate dramatically, directly affecting project budgets and profit margins.

Suppliers of these critical commodities wield considerable influence, particularly when market demand surges beyond available supply or when broader global economic trends lead to cost escalations. This power dynamic means DPR Construction must actively implement strategies to mitigate the impact of these price volatilities on its financial performance.

- Steel prices saw significant volatility in 2024, with benchmarks like U.S. Midwest Hot-Rolled Coil (HRC) experiencing price swings of over 15% within a single quarter due to supply chain disruptions and fluctuating demand from automotive and construction sectors.

- The global average price for cement, a key component of concrete, remained elevated throughout early 2024, with some regions reporting increases of 5-8% year-over-year, driven by energy costs and environmental regulations impacting production.

- Specialty chemical prices, crucial for advanced construction materials like high-performance adhesives and sealants, also faced upward pressure in 2024, with some categories seeing cost increases of 7-10% attributed to raw material sourcing challenges and increased R&D investment.

Supplier Switching Costs

Supplier switching costs can significantly impact DPR Construction's bargaining power. When it's difficult or expensive for DPR to change suppliers, those suppliers gain leverage. This is particularly true for specialized subcontractors or material providers where DPR has invested in training its workforce or integrating specific product lines.

The effort and expense involved in switching can deter DPR from exploring alternative vendors, thus reinforcing the position of existing suppliers. For example, if DPR has to re-qualify a new subcontractor or retrain its teams on a different product, these costs can outweigh the potential benefits of a new relationship. In 2024, the construction industry continued to see rising material costs, making supplier stability a key consideration for firms like DPR.

- High switching costs deter DPR from seeking alternative suppliers.

- Re-qualification processes and retraining add to the expense of changing vendors.

- Established supplier relationships can become entrenched due to these costs.

- Potential project delays also factor into the cost of switching.

DPR Construction faces significant supplier bargaining power when dealing with specialized materials and equipment, particularly in sectors like advanced technology and life sciences. This leverage is amplified by the scarcity of alternative sources, a situation exacerbated by ongoing supply chain disruptions. For instance, in 2023, lead times for specialized construction equipment saw substantial extensions, giving suppliers more control over pricing and delivery.

The cost and complexity of switching suppliers also contribute to this power imbalance. When DPR invests in training its workforce or integrating specific product lines, the effort and expense involved in changing vendors can reinforce existing supplier relationships. This was evident in 2024, as rising material costs made supplier stability a paramount concern for construction firms.

| Factor | Impact on DPR Construction | Supporting Data (2023-2024) |

|---|---|---|

| Specialized Materials/Equipment Scarcity | Increased supplier leverage, diminished negotiation power for DPR. | Extended lead times for specialized equipment in 2023 due to supply chain issues. |

| High Switching Costs | Reinforces existing supplier relationships, deters vendor changes. | Rising material costs in 2024 emphasized supplier stability for DPR. |

| Proprietary Technologies/Patents | Suppliers with exclusive rights gain significant leverage. | Global construction tech market over $11 billion in 2023, with substantial software/platform reliance. |

| Skilled Labor Shortages | Empowers specialized labor providers to demand higher rates. | Nearly 70% of construction firms reported delays due to skilled worker shortages in 2024. |

What is included in the product

This analysis unpacks the competitive forces shaping the construction industry for DPR Construction, examining threats from new entrants, the bargaining power of suppliers and buyers, industry rivalry, and the threat of substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, empowering DPR Construction to proactively address market pressures.

Customers Bargaining Power

DPR Construction's customers are often large, well-funded organizations, particularly in sectors such as advanced technology, healthcare, and higher education. These clients, by their nature, possess robust procurement departments and significant experience in overseeing substantial capital projects.

This client sophistication translates into a strong bargaining position. They are adept at negotiating aggressively on crucial aspects like pricing, contract terms, and the precise specifications of the construction projects themselves. For instance, in 2023, the average capital expenditure for major healthcare systems in the US exceeded $500 million, indicating the scale of projects DPR undertakes and the leverage these clients hold.

The considerable size and high value of DPR Construction's projects mean clients are major revenue sources, granting them significant bargaining power. For instance, in 2023, DPR reported revenues of $7.2 billion, highlighting the substantial financial impact of each contract.

A single large project can constitute a significant portion of DPR's project pipeline, making the company more attuned to client needs and the possibility of project delays or cancellations. This dependence naturally amplifies the customer's negotiating leverage.

The commercial construction market, even for specialized firms like DPR Construction, is characterized by a significant number of large, reputable general contractors. This means clients often have multiple viable options when seeking to undertake complex projects, directly impacting contractor competition.

Customers commonly engage in a bidding process, soliciting proposals from several qualified firms. This practice inherently intensifies competition, as contractors vie for each project opportunity, ensuring clients have a strong position.

For instance, in 2024, the U.S. construction industry saw a robust pipeline of projects, with general contractors actively competing for market share. The ability of clients to select from a diverse pool of competent providers significantly bolsters their bargaining power, allowing them to negotiate more favorable terms.

Client's Ability to Delay or Cancel Projects

Clients undertaking large capital expenditure projects often possess the ability to postpone or entirely abandon them. This flexibility is particularly pronounced when economic landscapes shift or their own strategic objectives are re-evaluated.

This inherent client flexibility translates into substantial bargaining power. The potential for a client to withdraw their business can pressure contractors, including DPR Construction, to concede more advantageous terms to secure or maintain ongoing projects.

For instance, in 2024, the construction industry faced fluctuating demand. The U.S. Census Bureau reported a 2.1% decrease in construction spending in April 2024 compared to March, highlighting how easily projects can be put on hold.

- Client Project Flexibility: Clients can delay or cancel major capital projects due to economic or strategic shifts.

- Contractor Concessions: This flexibility empowers clients to negotiate better terms with contractors like DPR.

- 2024 Market Impact: A 2.1% month-over-month drop in U.S. construction spending in April 2024 illustrates project deferrals.

Emphasis on Long-Term Relationships and Performance

DPR Construction's clients often prioritize long-term partnerships with reliable contractors, especially for complex and strategically vital projects. This client expectation for consistent high performance, budget adherence, and on-time delivery grants them significant leverage. A single lapse in these areas can jeopardize future contracts, reinforcing the customers' bargaining power.

For instance, in 2024, the construction industry continued to see clients demanding more integrated project delivery methods, which inherently fosters closer, longer-term relationships. This trend means that a contractor's reputation for delivering on promises is paramount. DPR's success in securing repeat business, a key indicator of client satisfaction, directly influences its ability to mitigate this customer bargaining power.

- Client Retention: DPR's ability to maintain high client retention rates, often exceeding 80% in key sectors like healthcare and advanced technology, demonstrates their success in managing customer expectations and fostering loyalty.

- Performance Metrics: Clients evaluate contractors not just on initial project cost but also on long-term operational performance and lifecycle costs, giving them leverage to demand ongoing quality and efficiency.

- Relationship Value: The strategic importance of facilities for many DPR clients means they are willing to invest in building strong, enduring relationships with contractors they trust, further empowering those clients.

- Market Feedback: Negative project outcomes or missed deadlines can quickly damage a contractor's reputation in a close-knit industry, providing clients with a powerful tool to negotiate favorable terms.

DPR Construction's clients, often large organizations in sectors like advanced technology and healthcare, possess substantial bargaining power due to their project scale and sophisticated procurement processes. These clients are adept at negotiating pricing and contract terms, leveraging the significant capital expenditure involved in their projects, which can exceed $500 million for major healthcare systems in 2023.

The competitive landscape, with numerous qualified general contractors, further empowers clients. They frequently utilize bidding processes, soliciting proposals from multiple firms, which intensifies competition and allows them to secure more favorable terms. For instance, the U.S. construction industry in 2024 saw active competition among general contractors for market share.

Clients also benefit from the flexibility to postpone or cancel projects, especially given the 2.1% decrease in U.S. construction spending in April 2024 compared to March, illustrating project deferral trends. This ability to withdraw business pressures contractors like DPR to offer concessions, thereby enhancing customer leverage.

| Client Characteristic | Impact on Bargaining Power | Supporting Data/Example |

| Project Scale & Client Sophistication | High | Average capital expenditure for major US healthcare systems exceeded $500 million in 2023. |

| Competitive Contractor Market | High | Active competition among general contractors for market share in the US construction industry (2024). |

| Client Project Flexibility | High | US construction spending decreased by 2.1% month-over-month in April 2024, indicating project deferrals. |

What You See Is What You Get

DPR Construction Porter's Five Forces Analysis

This preview showcases the complete DPR Construction Porter's Five Forces Analysis, offering an in-depth examination of industry competitiveness. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The commercial construction sector is quite fragmented, meaning there are many players. Think of local builders, bigger regional companies, and even national general contractors all competing for the same construction jobs. This sheer volume of businesses means intense competition.

Even in areas where DPR Construction focuses, like specialized healthcare or advanced technology facilities, you'll find plenty of other firms that can do similar work. This abundance of capable competitors really heats up the race for projects, making it harder to win bids.

For instance, in 2023, the U.S. Census Bureau reported over 300,000 employer firms in the construction industry. This large number directly contributes to the fierce rivalry DPR faces daily as they pursue new contracts.

The commercial construction sector's growth rate is closely tied to broader economic health, meaning it can see significant swings. While niche areas like high-tech facilities might be booming, the general market faces cyclical pressures. This slower growth environment naturally heats up competition, as companies like DPR Construction vie for a more limited selection of available projects.

A healthy pipeline of future work is crucial for easing this competitive strain. However, during economic downturns, even a strong project pipeline can be tested, intensifying the fight for every contract and increasing pressure on margins.

DPR Construction distinguishes itself by focusing on complex and sustainable building projects, employing innovative approaches like Integrated Project Delivery. This specialization helps them stand out from general contractors, though other specialized firms also vie for similar projects.

Sustaining this competitive edge necessitates ongoing investment in specialized expertise and cutting-edge technology. For instance, DPR's commitment to innovation is evident in their early adoption and refinement of Building Information Modeling (BIM), a technology that streamlines design and construction processes, contributing to efficiency and cost savings for clients.

High Fixed Costs and Exit Barriers

Construction companies like DPR Construction often face intense competitive rivalry driven by high fixed costs. These costs, encompassing heavy machinery, specialized labor, and extensive project overhead, necessitate consistent project flow to achieve profitability. This can pressure firms to bid aggressively, even when margins are thin, simply to keep operations running and cover their substantial fixed expenses.

Furthermore, high exit barriers in the construction sector significantly exacerbate this rivalry. Divesting specialized equipment and fulfilling contractual obligations can be complex and costly, making it difficult for underperforming companies to leave the market. Consequently, these firms may persist in operation, albeit at reduced profitability, thereby intensifying competition for all players.

- High Fixed Costs: Construction firms invest heavily in equipment, skilled labor, and project management infrastructure.

- Aggressive Bidding: The need to cover fixed costs can lead to price competition, even in mature markets.

- Exit Barriers: Challenges in selling specialized assets and completing ongoing projects make exiting the industry difficult.

- Market Persistence: Struggling firms may continue operating, adding to competitive pressure.

Bidding Processes and Price Sensitivity

Competitive bidding is a cornerstone of commercial construction, often making clients highly sensitive to price. While DPR Construction focuses on delivering value, quality, and fostering collaborative partnerships, the ultimate cost remains a significant determinant in project awards. This competitive landscape frequently leads to intense bidding wars, which can squeeze profit margins and heighten the operational efficiency demands placed on contractors.

The pressure to win bids can lead to situations where contractors must trim costs aggressively. For instance, in 2024, the construction industry experienced ongoing material cost volatility, making accurate bidding even more challenging. This environment necessitates a keen focus on lean operations and supply chain management to remain competitive without sacrificing quality.

- Price Sensitivity: Clients often prioritize the lowest bid in commercial construction projects.

- Value Proposition: DPR Construction balances price with its emphasis on quality and collaboration.

- Margin Compression: Intense bidding can reduce profitability for contractors.

- Operational Efficiency: The need to win bids drives a focus on cost-effective execution.

The commercial construction market is highly fragmented, with numerous companies of varying sizes vying for projects, creating intense rivalry. DPR Construction faces competition not only from general contractors but also from other specialized firms, particularly in sectors like healthcare and technology. This crowded field, evidenced by over 300,000 employer firms in the U.S. construction industry as of 2023, means constant pressure to secure contracts.

High fixed costs associated with equipment and skilled labor compel construction firms to maintain a steady project pipeline, often leading to aggressive bidding even when margins are slim. Coupled with significant exit barriers, which make it difficult for struggling companies to leave the market, this intensifies competition. The pressure to win bids, especially with clients often prioritizing price, can compress profit margins and necessitates a strong focus on operational efficiency.

| Factor | Impact on DPR Construction | 2024 Industry Trend |

|---|---|---|

| Market Fragmentation | Increased number of competitors for projects. | Continued high density of small to medium-sized construction firms. |

| Specialization Competition | Rivalry from other specialized firms in niche markets. | Growing demand for specialized builders in tech and healthcare sectors. |

| Price Sensitivity | Bids heavily influenced by cost, impacting margins. | Ongoing material cost volatility makes accurate bidding challenging. |

| High Fixed Costs & Exit Barriers | Pressure to maintain project flow; market persistence of weaker firms. | Companies focus on lean operations to cover overhead and remain competitive. |

SSubstitutes Threaten

Large corporations with significant real estate holdings might possess the capability to manage smaller construction or renovation projects using their internal resources. This in-house capacity can act as a substitute, particularly for less complex or routine tasks that might otherwise be outsourced to general contractors like DPR Construction.

While DPR Construction typically focuses on larger, more intricate projects, the ability of some clients to self-perform certain construction or project management functions represents a degree of substitution. This means that for a portion of the market, the need for external specialized construction services is diminished.

For instance, in 2024, the construction industry saw a trend where companies with established facilities management departments explored bringing more project execution in-house for cost control, especially on smaller-scale renovations. This trend is driven by a desire for greater control over project timelines and budgets on non-core construction activities, potentially impacting the market share for specialized contractors on these smaller scopes.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional general contracting. These methods, which involve building components or entire structures off-site, can drastically cut project timelines and labor costs. For instance, the global modular construction market was valued at approximately $101.2 billion in 2023 and is projected to grow substantially.

Clients increasingly see these off-site solutions as viable alternatives, especially for projects like schools, hotels, or residential buildings where speed and cost efficiency are paramount. If a substantial portion of the market shifts to fully prefabricated solutions, it could diminish the demand for the comprehensive, on-site general contracting services that DPR Construction specializes in, impacting revenue streams.

Clients increasingly consider renovating or adaptively reusing existing structures as a viable alternative to new construction. This trend, driven by cost savings and sustainability goals, presents a significant threat. For instance, the U.S. construction industry saw renovation and repair expenditures reach an estimated $490 billion in 2023, indicating a substantial market for these alternatives.

While DPR Construction offers renovation services, a pronounced shift towards adaptive reuse, particularly in commercial real estate, could divert demand from their core new construction business. The demand for adaptive reuse projects is projected to grow as companies seek to reduce their environmental footprint and leverage existing infrastructure, potentially impacting the volume of new large-scale projects awarded.

Technological Solutions Replacing Physical Space

Technological advancements are increasingly creating substitutes that can lessen the demand for traditional physical construction. For instance, the widespread adoption of remote work, accelerated by events in recent years, has directly impacted the need for new office buildings. Companies are re-evaluating their real estate footprints, potentially reducing the volume of new construction projects DPR Construction might undertake in the commercial sector.

Similarly, the rise of telemedicine offers an alternative to in-person healthcare services, which could slow the expansion of physical medical facilities. This shift means fewer new hospitals or clinics might be built, impacting a segment of the construction market. By mid-2024, reports indicated a significant portion of the workforce continuing hybrid or fully remote schedules, a trend that directly influences commercial real estate demand.

- Remote Work Impact: A 2024 survey found that approximately 30% of U.S. employees worked remotely full-time, with another 30% on a hybrid schedule, reducing the overall need for new office construction.

- Telemedicine Growth: Telehealth utilization remained elevated in early 2024, with some estimates suggesting it accounts for over 20% of outpatient visits, potentially curbing the pace of new physical healthcare facility development.

- Digital Infrastructure Demand: While physical construction may be impacted, there's a growing demand for data centers and specialized facilities to support these digital services, presenting a counterbalancing opportunity.

Decision Not to Build or Delay Projects

The most significant substitute for a construction project, and thus a threat to DPR Construction, is the client's decision to simply not build or to postpone the project. This "non-consumption" is a critical factor that can directly impact DPR's future business and income streams.

Economic downturns, shifts in a company's strategic direction, or changes in consumer demand can all lead clients to halt or delay construction plans. For instance, during periods of economic uncertainty, many businesses reassess capital expenditures, potentially shelving new facilities or renovations.

Consider the impact of rising interest rates. In late 2023 and into 2024, higher borrowing costs made financing new construction projects more expensive, leading some developers and businesses to delay or cancel planned builds. This directly reduces the demand for construction services like those offered by DPR.

- Non-Consumption Threat: Clients opting out of construction entirely represents the most fundamental substitute.

- Economic Sensitivity: Downturns and market shifts directly influence project decisions, impacting DPR's pipeline.

- Financing Costs: Increased interest rates in 2024, for example, made projects less feasible, leading to delays or cancellations.

- Strategic Realignments: Changes in client business strategies can also lead to project deferrals or abandonment.

Clients may opt for in-house capabilities or alternative construction methods like modular building, which can reduce the need for specialized general contractors. Furthermore, adaptive reuse of existing structures and shifts towards digital services, impacting physical infrastructure demand, also serve as substitutes.

The most significant substitute remains the client's decision to postpone or cancel projects altogether, often influenced by economic conditions such as rising interest rates seen in 2024, which directly impact project feasibility and demand for construction services.

| Substitute Type | Description | 2023/2024 Impact/Data Point |

|---|---|---|

| In-house Construction | Clients managing projects internally | Trend observed in 2024 for smaller renovations. |

| Modular/Prefabricated Construction | Off-site construction methods | Global market valued at ~$101.2 billion in 2023. |

| Adaptive Reuse | Renovating/repurposing existing buildings | US renovation & repair expenditures estimated at $490 billion in 2023. |

| Remote Work/Digitalization | Reduced demand for new physical spaces | ~30% US employees full-time remote in 2024; Telehealth >20% outpatient visits. |

| Non-Consumption/Project Delay | Client decision to not build or postpone | Higher interest rates in late 2023/2024 increased project financing costs. |

Entrants Threaten

Entering the commercial construction sector, particularly for the sophisticated projects DPR Construction specializes in, demands a considerable outlay of capital. This includes securing essential equipment, establishing robust bonding capacity, managing working capital efficiently, and obtaining comprehensive insurance coverage.

These substantial financial hurdles act as a significant deterrent for many aspiring new companies looking to break into the market. For instance, in 2024, the average bonding capacity required for a large commercial construction project can easily run into tens of millions of dollars, a figure that immediately filters out less capitalized competitors.

Clients in high-stakes sectors such as advanced technology and healthcare place a premium on proven experience and a solid reputation for successful project execution, unwavering quality, and stringent safety standards. New entrants often struggle to demonstrate this essential track record, significantly hindering their ability to win major contracts against established players like DPR Construction.

The time and consistent performance required to build trust and credibility within these demanding industries are substantial, often spanning many years. For instance, a new construction firm would find it challenging to compete for a multi-million dollar semiconductor fabrication plant project without a portfolio of similar successful completions, a hurdle DPR Construction has overcome through decades of operation.

DPR Construction's reliance on technically complex projects means they need a workforce with specialized skills, from engineers to project managers. New companies find it tough to match DPR's established recruiting networks and existing talent pools, making it harder for them to break in.

The challenge of attracting and keeping this specialized talent acts as a significant barrier to entry. For instance, in 2024, the construction industry faced a notable shortage of skilled labor, with reports indicating millions of unfilled positions, making it even more difficult for new entrants to assemble a capable team.

Complex Regulatory and Licensing Requirements

The construction sector faces significant barriers to entry due to intricate regulatory and licensing demands. Navigating a labyrinth of permits, licenses, stringent safety protocols, and environmental regulations demands substantial specialized knowledge and financial backing. For instance, in 2024, the average time to obtain all necessary construction permits in major U.S. cities could range from several weeks to over six months, representing a considerable upfront investment of time and resources for any new player. This complex compliance landscape acts as a powerful deterrent for potential new entrants, protecting established firms like DPR Construction.

These regulatory hurdles translate into tangible costs and operational complexities.

- Permitting Fees: Costs for various permits can add up, with some large projects incurring tens of thousands of dollars in fees alone.

- Compliance Training: Ensuring all staff are up-to-date on safety and environmental regulations requires ongoing investment.

- Legal and Consulting Fees: Engaging experts to navigate the regulatory maze is often a necessity for new firms.

- Bonding and Insurance: Meeting the bonding and insurance requirements mandated by many jurisdictions can be a significant capital outlay.

Strong Client Relationships and Supply Chain Networks

The threat of new entrants for DPR Construction is significantly mitigated by its deeply entrenched client relationships and sophisticated supply chain networks. Established firms like DPR have spent years building trust and rapport with key stakeholders, including clients, architects, engineers, and subcontractors. These enduring partnerships are not easily replicated.

Newcomers would face the considerable challenge of establishing similar credibility and access. For instance, in the competitive US construction market, where DPR operates, securing major project bids often hinges on a proven track record and established relationships. In 2023, the construction industry saw continued consolidation, with larger, established players like DPR benefiting from their existing networks.

- Client Loyalty: DPR's long-standing client relationships create a barrier, as clients often prefer to work with trusted, experienced partners.

- Supply Chain Integration: Efficient and reliable supply chains, developed over time, are crucial for project delivery and cost management, making it hard for new entrants to compete on operational efficiency.

- Relationship Building Time: Cultivating the necessary network of architects, engineers, and subcontractors takes years of consistent performance and trust-building, a significant hurdle for new firms.

The threat of new entrants for DPR Construction is generally low, primarily due to the substantial capital requirements and the need for specialized expertise. Building a reputation and securing the necessary bonding capacity for large-scale, technically demanding projects, like those DPR undertakes, presents significant financial barriers. For example, in 2024, securing performance bonds for major infrastructure projects often necessitates a strong credit history and substantial liquid assets, making it difficult for new firms to compete.

Furthermore, the construction industry, particularly in specialized sectors, demands a proven track record of successful project delivery and stringent safety compliance. New companies struggle to demonstrate the experience and credibility that clients, especially in fields like advanced manufacturing or healthcare, require. This lack of established trust and a portfolio of complex projects acts as a formidable barrier, as clients prioritize reliability and expertise over novelty.

The intricate web of regulations, licensing, and permitting further complicates entry. Navigating these requirements demands significant time, resources, and specialized knowledge, often involving substantial upfront costs. For instance, in 2024, the average time to secure all necessary permits for a large commercial development in a major metropolitan area could extend for months, representing a considerable investment for any new entrant aiming to compete with established players like DPR Construction.

The industry also faces a persistent shortage of skilled labor, making it challenging for new firms to assemble a competent workforce capable of handling complex projects. DPR Construction's established recruitment channels and experienced personnel provide a significant advantage. In 2023, industry reports highlighted millions of unfilled construction jobs, underscoring the difficulty new entrants face in attracting and retaining top talent.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment for equipment, bonding, and insurance. | Significant financial hurdle. | Bonding capacity for large projects can reach tens of millions USD. |

| Reputation and Experience | Need for proven track record and client trust. | Difficult to win contracts without established credibility. | Clients in specialized sectors prioritize demonstrated success in similar projects. |

| Skilled Labor Shortage | Difficulty in attracting and retaining specialized talent. | Challenges in assembling a capable project team. | Millions of unfilled skilled positions reported in the construction sector. |

| Regulatory Compliance | Complex licensing, permits, and safety standards. | Time-consuming and costly to navigate. | Permit acquisition can take months, incurring significant upfront costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for DPR Construction is built upon a foundation of industry-specific market research reports, financial filings from DPR Construction and its key competitors, and data from construction industry trade associations.