DPR Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

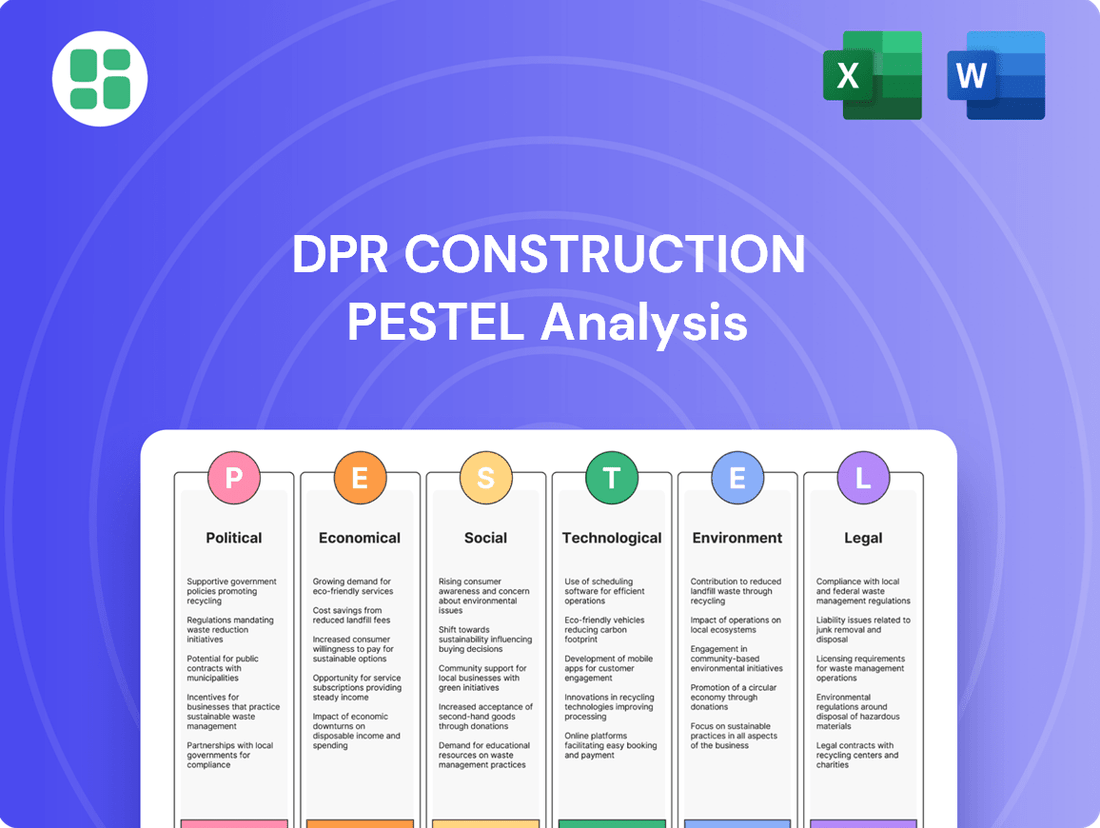

Navigate the complex external forces shaping DPR Construction's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations and strategic decisions. Gain a critical edge by leveraging these expert insights to refine your own market approach. Download the full version now for actionable intelligence.

Political factors

Government infrastructure spending remains a powerful driver for the construction sector. Acts like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) are injecting substantial capital into projects across manufacturing, energy, and transportation. For DPR Construction, known for its expertise in complex builds, this translates to a robust and sustained pipeline of work. Billions of dollars are still being deployed through 2026, ensuring continued opportunities.

Evolving building codes, especially those emphasizing energy efficiency and sustainability, directly shape how construction projects are managed. For example, California's 2025 Building Energy Efficiency Standards require the use of heat pumps and electric-ready infrastructure, steering contractors toward more environmentally sound methods. This regulatory shift is a key political factor influencing the construction industry.

Changes in trade policies and the imposition of tariffs on construction materials can significantly impact project costs and supply chain stability for companies like DPR Construction. For instance, the U.S. imposed tariffs on steel and aluminum imports in recent years, which directly increased material expenses for many construction projects.

While some forecasts for 2024 and 2025 anticipate a slowdown in overall construction spending due to persistent high interest rates, potential new tariffs or changes to existing ones could introduce actual or speculative cost increases. This uncertainty makes precise budgeting and material procurement more challenging.

Monitoring these evolving trade policies and tariff structures is therefore crucial for DPR Construction to effectively manage material procurement, negotiate pricing, and maintain supply chain resilience throughout 2024 and into 2025.

Labor Laws and Immigration Policies

The construction sector, including DPR Construction, faces significant labor and employment challenges. A persistently tight labor market, coupled with a notable increase in unionization efforts, presents ongoing legal and operational hurdles. For instance, the U.S. Bureau of Labor Statistics reported in April 2024 that the construction industry had 396,000 job openings, underscoring the demand for skilled workers.

Stricter enforcement of overtime and minimum wage laws, as well as potential shifts in immigration policies, directly impact labor availability and overall costs. These regulatory changes require DPR to maintain robust compliance strategies and actively work to attract and retain a qualified workforce to meet project demands.

Key considerations for DPR include:

- Navigating a tight labor market: The construction industry's unemployment rate hovered around 3.8% in early 2024, indicating a competitive environment for talent acquisition.

- Adapting to evolving wage and hour laws: Changes in federal and state minimum wage and overtime regulations can significantly alter labor budgets.

- Managing immigration policy impacts: Fluctuations in immigration policies can affect the supply of both skilled and unskilled labor crucial to construction projects.

- Responding to increased union activity: A rising trend in unionization requires careful management of labor relations and adherence to collective bargaining agreements.

Public-Private Partnership (PPP) Initiatives

Public-private partnerships (PPPs) are increasingly shaping the landscape for commercial contractors like DPR Construction. Governments worldwide are leveraging PPPs as a critical strategy to fund and deliver essential infrastructure, from transportation networks to healthcare facilities. This trend presents significant opportunities for firms with the technical expertise and project management capabilities to handle complex, large-scale developments.

For instance, the United States saw substantial investment in infrastructure through PPPs. In 2023, the U.S. Department of Transportation’s BUILD program (now MEGA grants) continued to support projects that often involve private sector participation, with billions allocated. Similarly, the Infrastructure Investment and Jobs Act of 2021 is expected to spur further PPP activity across various sectors, including transportation, energy, and broadband.

- Growing PPP Investment: Global spending on infrastructure through PPPs is projected to reach trillions of dollars over the next decade, with a significant portion directed towards projects requiring specialized construction expertise.

- Government Funding Models: Governments are actively seeking private capital and innovation to bridge infrastructure funding gaps, making PPPs a preferred procurement method for large, complex projects.

- DPR's Advantage: DPR Construction's proven track record in delivering technically demanding projects positions them well to capitalize on the increasing demand for their services within these public-private ventures.

Government infrastructure spending remains a powerful driver for the construction sector, with acts like the Infrastructure Investment and Jobs Act (IIJA) injecting substantial capital into projects. Billions are still being deployed through 2026, ensuring continued opportunities for companies like DPR Construction. Evolving building codes, especially those emphasizing energy efficiency, directly shape construction methods, steering contractors toward more environmentally sound practices.

Changes in trade policies and tariffs on construction materials can significantly impact project costs and supply chain stability. For instance, the U.S. imposed tariffs on steel and aluminum imports, directly increasing material expenses. While some forecasts for 2024 and 2025 anticipate a slowdown due to high interest rates, potential new tariffs could introduce cost increases and uncertainty.

The construction sector faces significant labor challenges, with a persistently tight labor market and increased unionization efforts. The U.S. Bureau of Labor Statistics reported 396,000 construction job openings in April 2024, underscoring the demand for skilled workers. Stricter enforcement of wage laws and potential shifts in immigration policies directly impact labor availability and costs.

Public-private partnerships (PPPs) are increasingly shaping the landscape for commercial contractors. Governments are leveraging PPPs to fund essential infrastructure, presenting significant opportunities for firms with expertise in large-scale developments. The U.S. Department of Transportation's BUILD program (now MEGA grants) continued to support projects with private sector participation in 2023, with billions allocated.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing DPR Construction across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by detailing how these forces create both threats and opportunities, enabling strategic decision-making for DPR Construction.

A concise, actionable summary of DPR Construction's PESTLE analysis, highlighting key external factors and their potential impact, serves as a pain point reliever by streamlining complex information for strategic decision-making.

Economic factors

Interest rate fluctuations significantly affect the cost of capital for construction projects. Developers and clients face higher borrowing expenses when rates rise, potentially delaying or scaling back investments. Conversely, falling rates, as anticipated for late 2024 and into 2025, are expected to reduce borrowing costs, making new projects more financially viable and potentially boosting demand.

The Federal Reserve's monetary policy plays a key role. After a series of rate hikes through 2023, the market anticipates potential rate cuts starting in mid-2024, with further reductions possible in 2025. For instance, the Federal Funds Rate target range, which was at 5.25%-5.50% in early 2024, is projected to move lower, stimulating economic activity and, by extension, the construction sector.

The commercial construction sector is projected for moderate growth, with particularly robust demand in sectors like data centers, manufacturing, life sciences, and healthcare. For instance, the U.S. Census Bureau reported that total construction spending reached an annualized rate of $2,094.3 billion in April 2024, a 0.1% increase from March. DPR Construction's strategic focus on these high-demand areas, such as the $100 billion projected investment in U.S. semiconductor manufacturing facilities by 2030, positions them to benefit from this specialized investment surge.

Persistent inflationary pressures and volatile material costs continue to challenge the construction sector, directly impacting project budgets and overall profitability for firms like DPR Construction. While inflation is anticipated to moderate, with projections suggesting a fall to 2.1% by the close of 2025, the need for vigilant cost management remains paramount.

Companies must prioritize efficient material estimation and actively seek out alternative, more cost-effective solutions to navigate these economic headwinds. This proactive approach is crucial for maintaining healthy profit margins in a dynamic market environment.

Labor Shortages and Wage Growth

The construction sector, including companies like DPR Construction, continues to grapple with a pronounced labor shortage, particularly impacting the availability of skilled tradespeople. This scarcity directly fuels upward pressure on wages as companies compete for a limited pool of qualified workers. For instance, average hourly earnings for construction laborers saw a notable increase, reflecting this tight labor market.

This ongoing challenge necessitates strategic investments in robust workforce development programs and comprehensive training initiatives to cultivate new talent and upskill existing employees. Furthermore, exploring and integrating technology, such as prefabrication or advanced robotics, can help mitigate reliance on traditional labor inputs. The demand for expertise in specialized areas like advanced building systems or sustainable construction practices remains exceptionally high, exacerbating the shortage in these critical niches.

- Skilled Labor Gap: The industry faces a persistent deficit in experienced construction professionals, impacting project timelines and costs.

- Wage Inflation: Competition for talent has driven significant wage growth, increasing operational expenses for construction firms.

- Training Investment: Companies are prioritizing internal training and apprenticeships to build a more resilient workforce.

- Technological Adoption: Automation and off-site construction methods are being explored to address labor constraints and improve efficiency.

Credit Availability and Financing Landscape

Economic conditions significantly impact how easily construction firms like DPR can access credit and the terms they receive. During periods of economic uncertainty, lenders tend to be more risk-averse, making it harder to secure financing and often leading to higher interest rates. This caution was evident in late 2023 and early 2024 as central banks maintained higher interest rates to combat inflation, increasing the cost of borrowing for projects.

Securing affordable financing remains a persistent hurdle, especially for smaller construction businesses that may not have DPR's established financial strength or extensive banking relationships. For instance, the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices in Q4 2023 indicated a tightening of credit standards for commercial and industrial loans, a trend that likely extended to construction financing.

DPR Construction's robust financial health and long-standing ties with financial institutions provide a distinct advantage in this challenging lending environment. This allows them to potentially negotiate more favorable terms and explore a wider array of financing avenues, including private placements or project-specific debt, which might be less accessible to smaller competitors.

- Interest Rate Environment: The Federal Reserve's target federal funds rate remained elevated through early 2024, influencing broader borrowing costs.

- Lender Caution: Surveys from late 2023 showed a notable percentage of banks reporting tighter lending standards for commercial real estate.

- Financing Accessibility: Smaller firms often face greater difficulty accessing capital compared to larger, well-capitalized companies like DPR.

- Alternative Financing: DPR's financial stability supports exploring options beyond traditional bank loans, such as bonds or private equity partnerships.

Economic factors significantly shape the construction landscape for DPR Construction. Interest rate movements directly impact project financing costs, with anticipated rate cuts in late 2024 and 2025 expected to lower borrowing expenses and stimulate investment. Inflationary pressures, though projected to moderate to around 2.1% by year-end 2025, continue to necessitate vigilant cost management and the exploration of cost-effective material solutions.

The labor market presents a persistent challenge, with a shortage of skilled trades driving wage inflation and demanding strategic investments in workforce development and technology adoption. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings in construction increased by 5.1% year-over-year as of April 2024, highlighting this trend.

Access to capital is also a key consideration. While DPR Construction's strong financial standing provides an advantage, tighter lending standards reported by banks in late 2023 for commercial real estate loans underscore the importance of robust financial health for all industry players. The Federal Reserve's Federal Funds Rate, which stood at 5.25%-5.50% in early 2024, influences these broader borrowing costs.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on DPR Construction |

|---|---|---|---|

| Interest Rates | Anticipated cuts starting mid-2024; Fed Funds Rate target 5.25%-5.50% (early 2024) | Further potential reductions, lowering borrowing costs | Reduced capital expenditure for projects, improved project profitability |

| Inflation | Moderating, projected to fall to ~2.1% by end of 2025 | Continued moderation | Pressure on material costs, need for efficient procurement |

| Labor Market | Skilled labor shortage, wage inflation (e.g., 5.1% avg. hourly earnings increase YoY April 2024) | Persistent shortage in specialized trades | Increased labor costs, focus on training and technology adoption |

| Credit Availability | Tightening standards reported by some lenders (late 2023) | Dependent on economic recovery and monetary policy | Advantage for financially strong firms; potential challenges for smaller competitors |

Full Version Awaits

DPR Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This DPR Construction PESTLE Analysis provides a comprehensive overview of the external factors impacting the company. It delves into Political, Economic, Social, Technological, Legal, and Environmental considerations, offering valuable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and professionally organized analysis.

Sociological factors

The construction industry faces a significant challenge with an aging workforce and a concurrent shortage of younger talent entering skilled trades. This demographic reality directly impacts labor availability for companies like DPR Construction. For instance, the Bureau of Labor Statistics projected a need for 439,100 additional construction laborers between 2022 and 2032, highlighting the urgency of this issue.

Addressing this labor gap requires a strategic focus on cultivating a more diverse workforce. This includes actively recruiting and supporting women and underrepresented minority groups within the construction sector. DPR Construction's commitment is evident in programs such as the 'Design & Build Camp by DPR and Girls Inc.', which aims to spark interest in construction careers among young people, particularly girls, thereby fostering future talent pipelines.

Societal expectations and regulatory bodies like OSHA continue to place a strong emphasis on worker well-being and safety within the construction industry. In 2024, construction remains one of the most dangerous industries, with the Bureau of Labor Statistics reporting 1,103 fatalities in 2023, a slight increase from the previous year.

Companies like DPR Construction must maintain stringent safety protocols and invest in training to mitigate risks and ensure compliance. This focus is crucial for both ethical reasons and to avoid costly legal penalties and reputational damage, especially as public scrutiny on corporate responsibility intensifies.

Clients and communities increasingly demand that construction firms go beyond simply completing projects. They expect tangible positive social impact, such as prioritizing local hiring, contributing to community development initiatives, and actively addressing the needs of neighborhoods where projects are located. This evolving expectation means construction companies must integrate social responsibility into their core operations.

DPR Construction's stated commitment to fostering a 'people-first' culture and cultivating 'raving fans' directly aligns with these growing social expectations. This focus on internal culture and external relationships suggests a strategic approach to meeting the demand for socially conscious business practices within the construction sector.

Demand for Sustainable and Healthy Buildings

There's a significant shift in what people expect from buildings. Public awareness around sustainability and health is growing, meaning clients are increasingly asking for spaces that are better for both the planet and the people inside them. This translates to a demand for improved indoor air quality, more natural light, and features that genuinely enhance occupant well-being. For instance, a 2024 survey indicated that over 70% of office workers would prefer to work in a building with certified green credentials, highlighting this trend.

DPR Construction is well-positioned to capitalize on this evolving market. Their established expertise in sustainable construction practices allows them to effectively meet these new client preferences. This includes integrating elements like biophilic design, which brings nature into the built environment, and implementing advanced energy-efficient systems. By focusing on these areas, DPR can deliver projects that not only meet regulatory requirements but also resonate with a public increasingly valuing healthier and more environmentally responsible spaces.

Key drivers behind this demand include:

- Increased occupant health awareness: Studies in 2024 have shown a direct correlation between building design and occupant productivity and satisfaction.

- Corporate Social Responsibility (CSR) goals: Many companies are setting ambitious sustainability targets, pushing for greener construction.

- Regulatory pressures: Stricter building codes and incentives for green construction are becoming more common globally.

- Employee attraction and retention: Companies recognize that healthy, sustainable workplaces are a significant draw for top talent.

Evolving Workplace Culture and Digital Skills

The construction sector is seeing a significant change in the skills needed, with a growing demand for digital literacy, data analytics, and cloud computing expertise. This evolution is driven by the increasing integration of technology on job sites and in project management. For example, a 2024 report indicated that over 60% of construction firms are investing in digital transformation initiatives, highlighting the need for these new competencies.

To stay competitive, companies like DPR Construction must cultivate a workplace culture that readily adopts new technologies and actively supports the upskilling of their current employees. This proactive approach ensures the workforce can adapt to an environment that is becoming more automated and reliant on data-driven decision-making. By 2025, it's projected that the demand for workers with advanced digital skills in construction will outpace supply by 20%.

- Digital Transformation Investment: Construction firms are increasing spending on technology, with an average of 15% of capital budgets allocated to digital solutions in 2024.

- Skill Gap Projection: By 2025, an estimated 70% of construction projects will require at least one specialized digital skill, such as BIM management or drone operation.

- Upskilling Initiatives: Companies are implementing training programs; a recent survey found that 85% of construction companies offer some form of digital skills training to their employees.

- Data Analytics Importance: The use of data analytics in construction is expected to grow by 25% annually through 2026, improving project efficiency and cost management.

Societal expectations are shifting, with a growing demand for construction firms to prioritize local hiring and community development. Clients and the public increasingly expect businesses to demonstrate social responsibility beyond project completion, influencing brand perception and project acquisition. This necessitates integrating community engagement and local economic contributions into core operational strategies.

Technological factors

Advancements in Building Information Modeling (BIM) are significantly reshaping the construction landscape. By 2025, BIM is expected to see widespread adoption of AI-driven insights for predictive analysis and enhanced interoperability across platforms, reducing design errors by an estimated 15-20% on complex projects.

DPR Construction leverages these evolving BIM capabilities to optimize collaboration and precision, particularly on technically demanding projects. The integration of BIM with IoT sensors on job sites further allows for real-time data capture, improving material tracking and progress monitoring, which can lead to an estimated 10% reduction in waste.

Artificial intelligence and machine learning are fundamentally reshaping the construction industry, particularly in areas like project management and design. These technologies allow for more precise forecasting of project timelines, costs, and potential risks, while also automating many of the more routine tasks. For instance, by mid-2024, AI adoption in construction project management was projected to increase by 25% year-over-year, leading to an estimated 15% reduction in project delays.

DPR Construction, with its strong technical foundation, is well-positioned to harness these advancements for improved decision-making and greater operational efficiency. By integrating AI-driven predictive analytics, DPR can gain deeper insights into project performance, enabling proactive problem-solving and resource allocation. This strategic adoption of AI is crucial for maintaining a competitive edge in a rapidly evolving market.

AI-powered robots are taking on crucial construction jobs like laying bricks, pouring concrete, and assembling steel, leading to better accuracy and lower labor expenses. For instance, in 2024, the global construction robotics market was valued at approximately $2.5 billion, with projections indicating substantial growth through 2030.

While the upfront cost of these robots can be considerable, they provide major advantages in precision and safety, especially in difficult work conditions. Companies like DPR Construction can look into adopting these automated systems for particular tasks to boost their output and operational efficiency.

Digital Twins and IoT Sensors

Digital twin technology, integrated with Internet of Things (IoT) sensors, is revolutionizing how construction projects are managed. These twins create virtual replicas of physical assets, allowing for real-time monitoring and simulation of building performance from design through operation. This means potential issues can be identified and addressed before they become costly problems.

The proliferation of IoT sensors on construction sites is a key enabler. These sensors collect vast amounts of data on everything from equipment status to environmental conditions. For DPR Construction, this translates into more efficient fleet management, enabling proactive maintenance schedules that reduce downtime. For instance, predictive maintenance, powered by sensor data analysis, can anticipate equipment failures, saving significant repair costs and project delays.

The impact on operational management and energy efficiency is substantial. DPR can leverage digital twins and IoT data to optimize construction processes and, critically, the energy performance of the buildings they construct. By simulating different scenarios, they can identify the most energy-efficient designs and operational strategies. The global IoT market in construction was valued at approximately $1.3 billion in 2023 and is projected to reach over $3.5 billion by 2028, highlighting the significant investment and adoption of these technologies.

- Real-time performance monitoring: Digital twins provide a live, virtual representation of a building, updated by IoT sensor data.

- Predictive maintenance: IoT sensors enable the forecasting of equipment failures, reducing unexpected breakdowns and associated costs.

- Enhanced energy efficiency: Simulation capabilities within digital twins help optimize building design and operational energy consumption.

- Market growth: The construction IoT market is experiencing robust growth, indicating increasing industry reliance on these advanced technological solutions.

Prefabrication, Modularization, and Offsite Construction

The construction industry is increasingly adopting prefabrication and modularization, driven by the need for faster project delivery and reduced waste. This trend is particularly strong in 2024 and projected to continue through 2025, with global modular construction market expected to reach $257.2 billion by 2030, growing at a CAGR of 6.7%. DPR Construction can leverage this by enhancing its offsite construction capabilities, which directly addresses the demand for efficiency and sustainability.

These methods allow for greater quality control and can significantly shorten on-site construction timelines, often by 30-50%. For instance, projects utilizing modular components can see completion times reduced, freeing up capital and resources sooner. This aligns perfectly with DPR's strategy to offer innovative and rapid building solutions, capitalizing on the growing demand for eco-friendly and cost-effective construction practices.

- Reduced Waste: Offsite construction can cut construction waste by up to 90% compared to traditional methods.

- Faster Timelines: Projects can be completed 20-50% faster due to parallel processing of design and fabrication.

- Improved Quality Control: Factory-controlled environments lead to higher precision and fewer defects.

- Sustainability Focus: Facilitates the integration of sustainable materials and energy-efficient designs.

Technological advancements are rapidly transforming construction, with AI and BIM leading the charge. By 2025, AI integration in project management is expected to cut project delays by an estimated 15%, while BIM adoption is projected to reduce design errors by up to 20% on complex projects.

DPR Construction is strategically adopting these technologies to enhance precision and efficiency, particularly with AI-powered predictive analytics and real-time data from IoT sensors for improved material tracking and waste reduction, potentially by 10%.

| Technology | 2024/2025 Impact/Projection | DPR Construction Relevance |

|---|---|---|

| BIM with AI | 15-20% reduction in design errors; AI for predictive analysis | Optimizing collaboration and precision on complex projects |

| AI in Project Management | 25% YoY increase in adoption (mid-2024); 15% reduction in project delays | Improving decision-making and operational efficiency |

| Robotics | Global market ~$2.5 billion (2024); substantial growth projected | Boosting output and efficiency for specific tasks |

| Digital Twins & IoT | IoT in construction market ~$1.3 billion (2023) to >$3.5 billion (2028) | Enabling real-time monitoring, predictive maintenance, and energy optimization |

| Prefabrication/Modularization | Global market ~$257.2 billion by 2030 (6.7% CAGR) | Enhancing offsite construction capabilities for faster, sustainable delivery |

Legal factors

The legal landscape for building safety is becoming increasingly stringent, particularly with new legislation and guidance emerging in the 2023-2024 period. Contractors like DPR Construction face growing pressure to adhere to these evolving standards to sidestep legal repercussions and protect their reputation.

Failure to comply with these updated regulations can result in significant fines and project delays, impacting profitability. For instance, the UK's Building Safety Act 2022, which came into full effect in stages, places greater responsibility on those involved in the design and construction of higher-risk buildings, with potential penalties for non-compliance.

DPR's dedication to delivering high-quality construction solutions must therefore include a robust strategy for ensuring rigorous adherence to these complex safety mandates. This involves continuous monitoring of legislative changes and proactive integration of new safety protocols into all project phases.

Governments worldwide are enacting more stringent environmental laws aimed at reducing carbon emissions, improving waste management, and protecting natural ecosystems, frequently mandating that construction projects achieve specific green building standards. For instance, the EU's Green Deal aims for climate neutrality by 2050, impacting construction materials and energy efficiency requirements across member states.

Environmental, Social, and Governance (ESG) reporting is transitioning from a voluntary best practice to a legal requirement in many jurisdictions, becoming a crucial factor for investor relations and operational compliance. Companies like DPR must develop sophisticated systems to accurately measure and report on their environmental impact, such as tracking Scope 1, 2, and 3 emissions, which saw a global average increase in reporting scope for large companies by 15% between 2022 and 2023.

DPR Construction needs to proactively adapt its accounting procedures and project management methodologies to align with these increasingly complex ESG mandates, ensuring transparency and accountability in its sustainability efforts. Failure to comply could result in penalties and a diminished competitive standing in a market where sustainable practices are highly valued.

The inherent complexity of construction projects, amplified by economic volatility and ongoing supply chain issues, significantly elevates the risk of contractual disputes, project delays, and claims. For instance, the Associated General Contractors of America reported in early 2024 that over 70% of construction firms experienced project delays due to material shortages.

To effectively manage these risks, DPR Construction must prioritize clear liability caps within its contracts, maintain rigorous documentation throughout project lifecycles, and implement efficient dispute resolution processes. This proactive approach is essential for mitigating financial exposure and ensuring project continuity.

Robust contract terms, including well-defined scopes of work and clear payment schedules, coupled with consistent, proactive legal review, are paramount for DPR to successfully navigate the challenging legal landscape of modern construction.

Data Protection and Cybersecurity Laws

The increasing reliance on digital tools like Building Information Modeling (BIM), the Internet of Things (IoT), and cloud platforms for collaboration exposes construction firms, including DPR Construction, to significant cybersecurity and data protection risks. As of 2024, the global cybersecurity market is projected to reach over $230 billion, highlighting the critical need for robust defenses.

Compliance with a patchwork of evolving data privacy regulations, such as GDPR and CCPA, is paramount. These laws mandate strict handling of sensitive project blueprints, intellectual property, and client personal data, with potential fines for non-compliance reaching millions of dollars. For instance, a data breach could lead to reputational damage and significant financial penalties.

DPR Construction must therefore prioritize substantial investments in advanced cybersecurity infrastructure, including encryption, access controls, and regular vulnerability assessments. Furthermore, clearly defined contractual clauses are essential to allocate responsibility and mitigate risks associated with data breaches and unauthorized access in all project phases.

- Cybersecurity spending in the construction sector is expected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2027.

- GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial imperative for compliance.

- IoT devices in construction, while enhancing efficiency, can introduce new attack vectors if not properly secured, with reports in 2024 indicating a rise in attacks targeting connected devices.

- Data breaches in the construction industry can result in an average cost of $4.35 million per incident, according to IBM's 2023 Cost of a Data Breach Report.

Labor and Employment Law Updates

Ongoing shifts in labor legislation, particularly concerning minimum wage hikes and worker classification, demand continuous employer attention. For instance, by the end of 2024, several states are expected to see increases in their minimum wage rates, impacting payroll costs. DPR Construction must remain adaptable to these evolving requirements.

The risk of substantial financial penalties and legal battles is significant for businesses that misclassify employees or fail to adhere to workplace safety standards like those set by OSHA. In 2023, OSHA reported issuing millions of dollars in penalties for various violations, underscoring the importance of compliance.

To mitigate these risks, DPR Construction should proactively update its employment agreements and internal HR policies. This ensures alignment with the most current federal and state labor regulations, preventing potential legal entanglements and associated costs.

- Minimum Wage Adjustments: Several states are slated to increase their minimum wage in 2024 and 2025, impacting labor costs for construction firms.

- Worker Classification Scrutiny: Increased regulatory focus on distinguishing between employees and independent contractors can lead to back-pay and benefit claims if misclassified.

- OSHA Compliance Costs: Non-compliance with Occupational Safety and Health Administration standards can result in substantial fines, with penalties often reaching tens of thousands of dollars per violation.

- Unionization Trends: A rise in unionization efforts across various sectors, including construction, may necessitate adjustments in negotiation strategies and employee relations practices.

The legal environment for construction is increasingly complex, with new building safety regulations and environmental protection laws demanding strict adherence. For instance, the UK's Building Safety Act 2022, fully implemented in stages, places greater responsibility on contractors for higher-risk buildings, with significant penalties for non-compliance.

DPR Construction must navigate evolving data privacy laws like GDPR, which impose substantial fines, potentially up to 4% of global annual revenue, for breaches involving sensitive project data. This necessitates robust cybersecurity measures and clear contractual clauses to manage risks, especially as IoT devices in construction offer new attack vectors.

Labor laws are also a critical legal factor, with minimum wage increases expected in numerous states through 2024 and 2025, directly impacting payroll. Furthermore, increased scrutiny on worker classification and OSHA compliance can lead to hefty fines, with OSHA penalties often reaching tens of thousands of dollars per violation.

Contractual disputes and delays, exacerbated by supply chain issues, remain a significant legal risk, with over 70% of construction firms reporting delays in early 2024 due to material shortages. DPR must prioritize clear liability limits and meticulous documentation to mitigate financial exposure.

Environmental factors

The construction industry, including DPR Construction, is seeing a significant shift towards eco-friendly building materials. Think recycled metals, reclaimed wood, and innovative bio-based options like mass timber, all aimed at cutting down embodied carbon. This trend is projected to gain even more traction by 2025.

The circular economy is a major driver, prioritizing waste reduction and material reuse. This model is shaping how projects are conceived and executed, with DPR actively investigating and incorporating these sustainable material choices into its projects.

For instance, the market for mass timber construction is expected to grow substantially, with some projections indicating a doubling in size by 2027. This reflects a broader industry commitment to materials that offer lower environmental impact.

The push for energy-efficient buildings is accelerating, with new designs increasingly featuring passive heating, superior airtightness, and on-site renewable energy generation, such as solar panels. In 2024, the global renewable energy market saw significant growth, with solar power capacity additions projected to reach record levels, reflecting this trend.

Government regulations are a major catalyst, mandating net-zero energy targets and encouraging the widespread adoption of technologies like heat pumps. For instance, many regions in 2024 introduced stricter building codes requiring higher energy performance standards for new constructions.

DPR Construction, with its established commitment to sustainable building practices, is well-positioned to capitalize on this shift. The company can further solidify its leadership by focusing on the integration of high-performance HVAC systems and innovative renewable energy solutions into its projects, aligning with market demands and regulatory advancements.

Sustainable construction practices are increasingly focused on efficient waste management, with a goal to divert materials from landfills. This is often achieved through advanced sorting and recycling technologies on project sites. For example, in 2023, the construction and demolition waste recycling rate in the US reached approximately 50%, a figure that is expected to grow with stricter regulations.

Regulations are becoming more stringent, often mandating that a certain percentage of construction debris be recycled. Many states and municipalities now have specific targets, such as California's goal of diverting 75% of C&D waste from landfills by 2020, with ongoing efforts to increase this. DPR Construction can significantly enhance its environmental footprint by prioritizing waste reduction strategies and actively embracing circular economy principles across its projects.

Water Conservation and Management

Water efficiency is a cornerstone of sustainable commercial building design, with DPR Construction implementing strategies such as low-flow fixtures and rainwater harvesting systems. These measures not only reduce operational costs but also align with growing environmental consciousness. For instance, a 2024 report indicated that buildings incorporating advanced water conservation technologies can see a reduction in water consumption by up to 30% compared to conventional designs.

As environmental regulations continue to tighten globally, robust water management plans are becoming indispensable for construction projects. Many regions are introducing or strengthening mandates for water-efficient landscaping and greywater recycling, directly impacting project planning and execution. DPR's commitment to integrating these conservation measures into its designs and operations is crucial for minimizing water usage and ensuring compliance, particularly as water scarcity becomes a more pressing issue in many of its operating regions.

DPR Construction's proactive approach to water conservation offers significant advantages:

- Reduced Operational Costs: Lower water bills for building owners.

- Enhanced Brand Reputation: Demonstrates commitment to sustainability.

- Regulatory Compliance: Meets and exceeds evolving environmental standards.

- Resource Efficiency: Minimizes strain on local water resources.

Climate Resilience and Adaptation in Design

The construction industry, including firms like DPR Construction, is increasingly focused on climate resilience and adaptation in building design. This means creating structures that can better withstand extreme weather events, a growing concern given recent climate trends. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling over $150 billion in damages, according to NOAA. This necessitates designing for flood resilience, mitigating the urban heat island effect through materials and green spaces, and ensuring overall climate adaptability.

DPR Construction's proven track record in technically complex projects positions them well to address these environmental factors. Their expertise can be leveraged to develop robust and adaptable structures that meet future environmental challenges. This includes incorporating advanced materials and construction techniques that enhance durability against severe weather and changing climate conditions. For example, in 2024, there's a growing emphasis on using permeable paving materials to manage stormwater runoff, a key aspect of flood resilience.

- Flood Resilience: Incorporating elevated building designs, waterproof materials, and advanced drainage systems to protect against rising sea levels and increased precipitation events.

- Heat Island Effect Mitigation: Utilizing cool roofing materials, green roofs, and strategic landscaping to reduce ambient temperatures in urban environments.

- Overall Climate Adaptability: Designing buildings with flexible systems and materials that can adjust to future climate shifts, such as increased temperature extremes or altered weather patterns.

The construction industry, including DPR Construction, is increasingly prioritizing sustainable and eco-friendly materials, with a notable rise in the use of mass timber and recycled components. This trend is driven by a growing awareness of embodied carbon and a push towards a circular economy, aiming to minimize waste and maximize material reuse.

Energy efficiency in buildings is paramount, with new designs incorporating passive heating, superior insulation, and on-site renewable energy generation like solar panels. Government regulations are a significant catalyst, mandating net-zero energy targets and promoting technologies such as heat pumps, with many regions in 2024 introducing stricter building codes for energy performance.

Water conservation strategies, including low-flow fixtures and rainwater harvesting, are becoming standard in commercial building design, offering reduced operational costs and enhanced brand reputation. As environmental regulations tighten, robust water management plans are essential for compliance, especially as water scarcity becomes a more pressing issue.

Climate resilience is a growing concern, necessitating designs that can withstand extreme weather events. DPR Construction's expertise in complex projects positions them to develop adaptable structures, incorporating features like permeable paving to manage stormwater and cool roofing materials to mitigate the urban heat island effect.

PESTLE Analysis Data Sources

Our PESTLE Analysis for DPR Construction is informed by a comprehensive review of publicly available data, including government reports, industry publications, and economic forecasts. We analyze regulatory changes, market trends, and technological advancements from reputable sources to provide actionable insights.