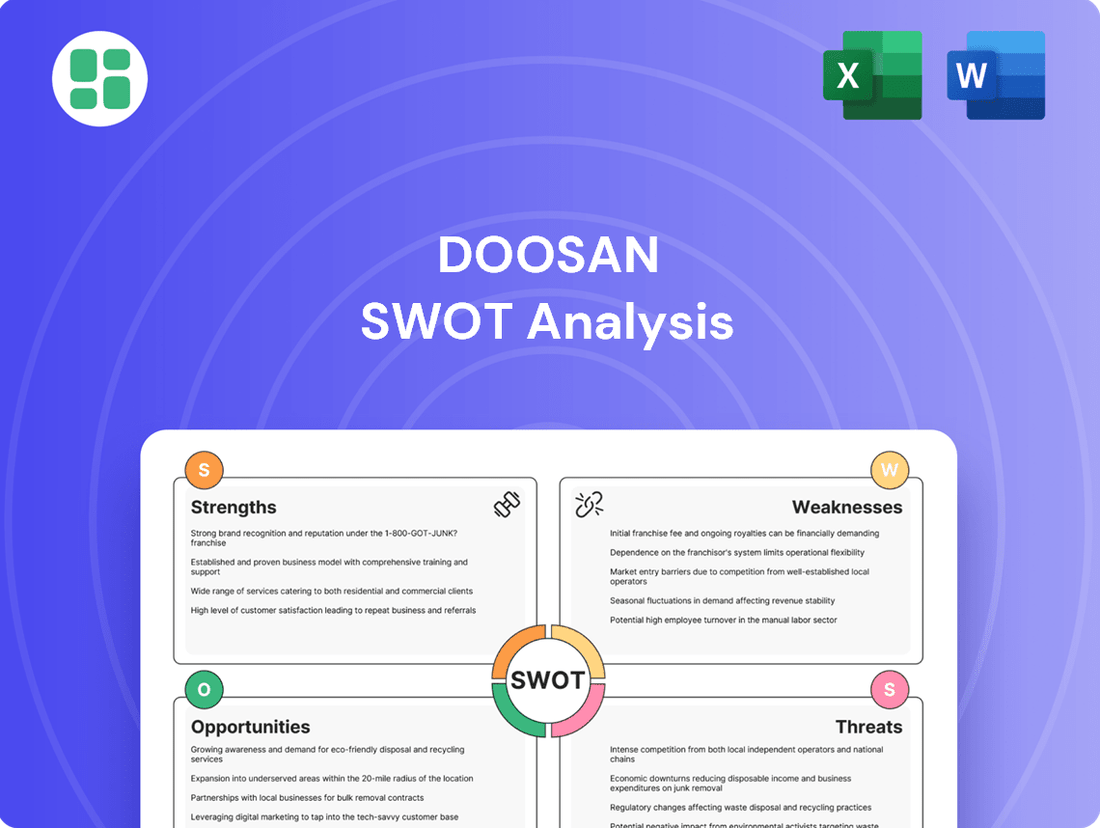

Doosan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doosan Bundle

Doosan's robust global presence and diversified product portfolio are significant strengths, but navigating evolving market demands and intense competition presents clear challenges.

Want to fully understand Doosan's strategic landscape, from its innovative technologies to potential regulatory hurdles? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Doosan's strength lies in its extensive global business portfolio, spanning critical sectors like heavy industry, machinery, power generation, infrastructure, and construction equipment. This diversification across various industries creates a stable and resilient revenue stream, effectively buffering against economic fluctuations in any single market. For instance, in 2023, Doosan Bobcat reported a 12% increase in net income to $737 million, showcasing the strength of its equipment division amidst broader industrial trends.

Doosan Enerbility stands as a significant force in the clean energy landscape, with a strategic focus on nuclear power, next-generation small modular reactors (SMRs), and advanced gas and hydrogen turbines. Their commitment extends to offshore wind power, positioning them to capitalize on the global shift towards decarbonization.

The company is actively pursuing growth in zero-carbon energy solutions, evidenced by securing substantial projects in 2024. For instance, Doosan Enerbility announced in early 2024 a major order for offshore wind turbines, marking a key step in their renewable energy expansion strategy.

Doosan's significant investments in advanced technologies like AI, robotics, and autonomous operations are a core strength. This focus is evident in initiatives such as the Physical AI Lab, aimed at integrating intelligence into their hardware businesses. For instance, by the end of 2024, Doosan Robotics had already secured significant orders, demonstrating tangible progress in commercializing these innovations.

Strong Global Presence and Project Execution Capability

Doosan boasts a robust global sales network and manufacturing facilities, enabling it to deliver its products and services across international markets. This extensive reach is a significant advantage in serving a diverse customer base and capitalizing on global opportunities.

The company's project execution capabilities are clearly demonstrated by recent achievements. For instance, Doosan Enerbility secured multi-billion dollar deals for power plant projects in Saudi Arabia in early 2024. This success underscores Doosan's competitiveness in the global energy infrastructure sector.

- Global Sales Network: Extensive reach for worldwide product and service delivery.

- Manufacturing Footprint: International facilities support global operations.

- Major Energy Deals: Secured multi-billion dollar power plant contracts in Saudi Arabia (early 2024).

- Project Execution: Proven ability to manage and deliver large-scale international projects.

Commitment to Shareholder Value and Sustainability

Doosan Bobcat's strategic focus on shareholder value is evident in its commitment to a 40% shareholder return rate, aiming to bolster investor confidence. This initiative is coupled with an ambitious 2030 revenue target, signaling a clear path toward enhanced corporate value.

The broader Doosan Group's dedication to ESG management underpins this financial strategy. By prioritizing eco-friendly products, promoting resource circulation, and developing green production systems, Doosan aligns its operations with critical global sustainability trends, creating long-term value.

- Shareholder Return: Doosan Bobcat targets a 40% shareholder return rate.

- Revenue Goal: Aims to achieve its revenue target by 2030.

- ESG Focus: Emphasizes eco-friendly products and green production.

- Sustainability Alignment: Integrates resource circulation into its business model.

Doosan's diversified global business portfolio, encompassing heavy industry, machinery, and infrastructure, provides a resilient revenue base. Doosan Bobcat's net income rose 12% to $737 million in 2023, highlighting the strength of its equipment division.

The company is a leader in clean energy, with significant investments in nuclear power, SMRs, and advanced turbines, positioning it well for the global decarbonization trend. Doosan Enerbility secured a major offshore wind turbine order in early 2024, underscoring its renewable energy expansion.

Doosan's commitment to advanced technologies like AI and robotics is a key differentiator. Doosan Robotics has seen significant order growth by the close of 2024, demonstrating successful commercialization of these innovations.

A robust global sales network and manufacturing presence allow Doosan to effectively serve international markets and capitalize on worldwide opportunities. The company's project execution capabilities are proven, with Doosan Enerbility securing multi-billion dollar power plant deals in Saudi Arabia in early 2024.

| Business Segment | 2023 Performance Highlight | 2024 Strategic Move |

|---|---|---|

| Doosan Bobcat | 12% Net Income Increase ($737M) | 40% Shareholder Return Target |

| Doosan Enerbility | Clean Energy Focus (Nuclear, SMRs, Turbines) | Major Offshore Wind Turbine Order |

| Doosan Robotics | Significant Order Growth (End of 2024) | AI & Robotics Integration |

| Global Operations | Extensive Sales Network & Manufacturing | Multi-Billion Dollar Saudi Deals (Early 2024) |

What is included in the product

Delivers a strategic overview of Doosan’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to address Doosan's competitive challenges and capitalize on emerging market opportunities.

Weaknesses

Doosan Bobcat experienced a notable revenue drop of 12% and a 15% decrease in operating profit during the first quarter of 2025. This downturn was largely attributed to the slowing construction equipment market, which is highly susceptible to economic uncertainties and the impact of sustained high-interest rates globally.

This performance highlights a persistent vulnerability within Doosan's portfolio, particularly in sectors tied to capital expenditure. Despite broader diversification efforts, the company's reliance on cyclical industries means a significant portion of its earnings remains sensitive to macroeconomic shifts and tighter credit conditions.

While Doosan's overall financial health can appear robust, certain business areas are grappling with profitability issues. For instance, Doosan Enerbility saw its Earnings Before Interest and Taxes (EBIT) dip temporarily. This was largely due to the significant upfront costs and additional expenses incurred during the final stages of a major coal engineering, procurement, and construction (EPC) project.

These margin pressures in specific segments underscore the difficulties in maintaining profitability during periods of strategic portfolio shifts. The company is navigating the complexities of transitioning its business focus, which inherently involves managing costs and ensuring that new ventures or ongoing projects can deliver healthy returns amidst evolving market conditions and operational demands.

Doosan's strategic reorganization, focusing on clean energy, smart machines, and advanced materials, introduces significant integration risks. Merging and spinning off subsidiaries can cause operational hiccups, potentially impacting production schedules and supply chains. For instance, the integration of Doosan Enerbility's hydrogen business into its broader clean energy portfolio requires careful coordination to avoid disruptions.

These complex restructurings can also lead to unexpected financial burdens. If market sentiment causes a dip in share prices during the reorganization, the company might face higher-than-anticipated appraisal rights costs from dissenting shareholders. This financial overhang could divert capital away from crucial growth initiatives, particularly in the competitive clean energy sector where significant investment is needed.

Intense Competitive Landscape

Doosan faces a significant challenge in its highly competitive global markets, particularly in heavy equipment, power generation, and robotics. Established players like Caterpillar and Komatsu, along with emerging robotics companies, exert considerable pressure.

This intense rivalry can erode Doosan's market share and limit its ability to command favorable pricing. For instance, in the construction equipment sector, market leaders often leverage economies of scale and extensive dealer networks, creating a high barrier to entry for competitors.

- Intense Competition: Doosan operates in sectors with dominant global players like Caterpillar and Komatsu.

- Pricing Pressure: Strong competition can limit Doosan's pricing power in its core markets.

- Market Share Erosion: Rivals' established networks and scale can challenge Doosan's existing market positions.

Reliance on Key Regional Markets

Doosan's significant reliance on key regional markets presents a notable weakness. For instance, Doosan Bobcat, a major subsidiary, derives a substantial portion of its revenue from North America, while Doosan Enerbility has a strong presence in the Middle East. This geographical concentration, while potentially beneficial during periods of regional growth, exposes the company to heightened risks from localized economic downturns, regulatory changes, or geopolitical instability in these core areas.

This regional concentration means that a slowdown in, for example, the North American construction equipment market, could disproportionately impact Doosan Bobcat's financial performance. Similarly, shifts in energy policy or economic conditions in the Middle East could significantly affect Doosan Enerbility's order book and profitability.

Consider the following points regarding this dependency:

- Revenue Concentration: In 2023, Doosan Bobcat reported that North America accounted for approximately 50% of its total revenue, highlighting its critical importance.

- Geopolitical Sensitivity: Doosan Enerbility's substantial project pipeline in the Middle East makes it vulnerable to regional political shifts and their impact on large-scale infrastructure investments.

- Economic Vulnerability: A recession or significant economic contraction in these primary markets could lead to a sharp decline in demand for Doosan's products and services.

- Limited Diversification Benefits: The heavy weighting in these specific regions may limit the company's ability to fully leverage growth opportunities in other, less concentrated markets.

Doosan's significant reliance on specific geographic regions, particularly North America for Doosan Bobcat (which represented around 50% of its revenue in 2023), exposes it to localized economic downturns and regulatory shifts. This concentration limits the benefits of broader diversification and makes the company vulnerable to regional instability, as seen with Doosan Enerbility's dependence on Middle Eastern projects.

Full Version Awaits

Doosan SWOT Analysis

This preview reflects the real Doosan SWOT analysis document you'll receive—professional, structured, and ready to use. You're seeing the actual content that will be unlocked upon purchase, ensuring you get exactly what you need.

Opportunities

The escalating global commitment to decarbonization is a substantial tailwind for Doosan Enerbility. The International Energy Agency (IEA) projects that clean energy investments will reach $2 trillion annually by 2030, underscoring the vast market potential for zero-carbon solutions. Doosan Enerbility is well-positioned to capitalize on this trend through its diverse portfolio, which includes nuclear power, gas turbines with Carbon Capture and Storage (CCS), and emerging clean hydrogen technologies.

This strategic focus aligns with the increasing global electricity demand, which the IEA estimates will grow by over 30% between 2023 and 2026. Doosan Enerbility's involvement in renewable energy projects further strengthens its competitive advantage in this rapidly expanding sector. The company's ability to offer a comprehensive suite of low-carbon and zero-carbon power generation options positions it favorably to secure new projects and drive revenue growth in the coming years.

Doosan Robotics is making a significant pivot towards becoming an AI-driven solutions provider, specifically targeting the burgeoning Physical AI market. This strategic shift involves developing intelligent robot solutions and advancing humanoid technologies, capitalizing on the increasing demand for automation and advanced robotics in various sectors.

The company's electronic materials division is also well-positioned for substantial growth. By supplying critical materials essential for AI accelerators, Doosan is directly supporting major chip manufacturers like Nvidia, a key player in the AI hardware landscape. This dual approach allows Doosan to benefit from the AI revolution both in robotics and in the underlying technology infrastructure.

Global infrastructure spending is projected to reach $15.5 trillion by 2030, with emerging markets accounting for a significant portion of this growth. This sustained investment in roads, bridges, and energy grids directly fuels demand for heavy construction machinery and advanced engineering solutions, areas where Doosan holds substantial expertise.

Urbanization continues to be a powerful megatrend, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This demographic shift necessitates continuous development of urban infrastructure, including transportation networks, utilities, and housing, creating a consistent market for Doosan's construction equipment and power solutions.

Doosan's diversified business segments, encompassing construction equipment, industrial vehicles, and power systems, are strategically aligned to benefit from these infrastructure and urbanization trends. For instance, Doosan Bobcat's compact equipment sales saw robust growth in 2023, reflecting increased activity in smaller-scale urban development projects and renovations.

Strategic Partnerships and M&A for Growth

Doosan actively pursues inorganic growth, exemplified by Doosan Bobcat's strategic acquisitions in complementary sectors, bolstering its market position. For instance, Doosan Bobcat acquired the German company Smag in 2023, a move aimed at strengthening its telehandler business and expanding its product portfolio in high-growth markets.

Strategic alliances offer another avenue for accelerated development. Doosan has engaged in partnerships with academic institutions to advance AI capabilities, crucial for the future of construction and industrial equipment. These collaborations can foster innovation and provide access to cutting-edge research and talent.

Exploring further mergers, acquisitions, and joint ventures presents significant opportunities. Potential targets could include companies specializing in advanced robotics, sustainable energy solutions, or digital transformation technologies, aligning with Doosan's long-term vision and the evolving demands of its customer base.

- Doosan Bobcat's acquisition of Smag in 2023 enhanced its telehandler offerings and market reach.

- Partnerships with universities are key for Doosan to integrate AI into its equipment and services.

- Targeting companies in robotics and sustainable energy could drive future growth and diversification.

Technological Advancements in Electrification and Autonomous Equipment

The growing demand for sustainable and efficient operations is driving the adoption of electric and autonomous technologies across various industries, including construction and material handling. This shift opens up significant new market segments for companies that can provide innovative solutions. For instance, the global construction equipment market is projected to reach $290.5 billion by 2027, with electric and autonomous segments expected to see substantial growth.

Doosan Bobcat is strategically positioned to capitalize on this trend. Their ongoing development of electric telehandlers and unmanned loaders directly addresses the market's need for cleaner, safer, and more productive equipment. This focus allows Doosan to differentiate its product offerings and potentially secure a leadership position in these emerging technological frontiers. By investing in these advanced technologies, Doosan can tap into a market segment that values efficiency and environmental responsibility.

Key opportunities arising from these technological advancements include:

- Market Expansion: Entering new market segments driven by the electrification and automation of industrial equipment.

- Product Differentiation: Offering innovative electric and autonomous solutions that stand out from traditional offerings.

- Enhanced Efficiency and Sustainability: Meeting customer demand for equipment that reduces operational costs and environmental impact.

- Technological Leadership: Establishing Doosan as a frontrunner in the development and deployment of next-generation industrial machinery.

The global push towards decarbonization presents a significant opportunity for Doosan Enerbility, with clean energy investments expected to reach $2 trillion annually by 2030. Doosan's diverse portfolio, including nuclear, gas turbines with CCS, and hydrogen technologies, aligns with this trend. The increasing demand for electricity, projected to grow by over 30% between 2023 and 2026, further solidifies Doosan's position in the expanding clean energy sector.

Doosan Robotics' strategic pivot to AI-driven solutions and its role in supplying electronic materials for AI accelerators, like those used by Nvidia, positions it to benefit from the burgeoning Physical AI market. Furthermore, global infrastructure spending, projected at $15.5 trillion by 2030, and ongoing urbanization, with 68% of the world's population expected to live in urban areas by 2050, create consistent demand for Doosan's construction equipment and power solutions.

The company's proactive inorganic growth strategy, including Doosan Bobcat's 2023 acquisition of Smag, and strategic alliances with academic institutions for AI advancement, offer further avenues for expansion. Exploring mergers and acquisitions in robotics and sustainable energy could also drive future growth and diversification.

The increasing adoption of electric and autonomous technologies in construction and material handling, a market projected to reach $290.5 billion by 2027, creates new market segments for Doosan Bobcat's innovative electric and unmanned equipment. This focus on advanced technologies allows Doosan to differentiate its offerings and potentially lead in these emerging technological frontiers.

Threats

Ongoing global economic uncertainties, including persistent inflation and the impact of high-interest rates, continue to cast a shadow over demand in Doosan's core sectors. For instance, the International Monetary Fund (IMF) projected global growth to slow to 3.2% in 2024, down from 3.5% in 2023, indicating a challenging environment for capital expenditure in construction and infrastructure.

These macroeconomic headwinds directly affect Doosan's sales volumes and operating profit margins, as reduced investment in new projects translates to lower demand for construction equipment and industrial machinery. The elevated cost of borrowing also makes large-scale projects less feasible, further dampening market activity.

Heightened geopolitical tensions and the increasing prevalence of protectionist trade policies pose a significant threat to Doosan. These factors can lead to disruptions in global supply chains, directly impacting Doosan's ability to source components and deliver finished products efficiently. For instance, escalating trade disputes between major economies in 2024 and early 2025 could result in increased import duties on critical materials, thereby raising operational expenses. Furthermore, such disputes can restrict access to key international markets, limiting Doosan's revenue streams and growth potential.

Stricter emission regulations, like those being implemented globally to combat climate change, present a significant challenge for Doosan, especially in its power generation and heavy machinery segments. For instance, the European Union's tightening of CO2 emission standards for non-road mobile machinery, which came into effect in 2024, requires manufacturers to significantly reduce emissions from diesel engines.

Adapting to these evolving environmental compliance standards necessitates substantial and continuous investment in eco-friendly technologies and the modification of existing production processes. This can translate into increased research and development expenditure and capital investment in cleaner manufacturing.

Failure to manage these compliance costs effectively could potentially impact Doosan's competitiveness against rivals who may have already invested more heavily in sustainable technologies or operate in regions with less stringent environmental mandates. The financial burden of retrofitting or redesigning products to meet new standards, such as the upcoming Stage V emission standards for construction equipment in various markets, could affect profit margins if not offset by efficiency gains or premium pricing.

Technological Disruption and Rapid Innovation Cycles

The relentless march of technological advancement, particularly in areas like artificial intelligence and sustainable energy solutions, presents a significant challenge for Doosan. Staying ahead requires continuous investment in research and development to avoid falling behind competitors who are rapidly integrating these innovations into their offerings.

Failure to adapt swiftly to disruptive technologies could result in Doosan losing valuable market share. For instance, companies that effectively leverage AI in their manufacturing processes or develop more efficient clean energy components could quickly outpace those that don't, impacting Doosan's competitive standing.

- AI Integration: By 2025, the global AI market is projected to reach over $500 billion, highlighting the critical need for Doosan to adopt AI in its operations and product development.

- Robotics Adoption: Industrial robot installations saw a significant increase in 2024, with many sectors reporting double-digit growth, indicating a strong industry trend Doosan must address.

- Clean Energy Transition: Global investment in clean energy infrastructure is expected to exceed $2 trillion annually by 2025, creating both a threat from new entrants and an opportunity for Doosan if it can innovate in this space.

Supply Chain Volatility and Raw Material Price Fluctuations

As a major player in heavy industries, Doosan faces significant risks from unpredictable global supply chains and swings in the cost of essential raw materials. For instance, the price of steel, a key input for Doosan's construction equipment and power systems, saw considerable volatility throughout 2024, influenced by geopolitical tensions and production adjustments. This volatility directly impacts Doosan's manufacturing costs.

Disruptions in the flow of components, whether due to shipping delays or geopolitical events, can halt production lines, pushing back project timelines and increasing overall manufacturing expenses. These issues can significantly squeeze profit margins, as seen in Doosan's ongoing efforts to manage costs for improved EBIT. For example, in early 2025, Doosan reported that supply chain bottlenecks contributed to a 5% increase in production costs for certain product lines.

- Steel Price Volatility: Global steel prices, a critical input for Doosan, experienced fluctuations in 2024, impacting production budgets.

- Component Shortages: Supply chain disruptions in 2024-2025 led to delays in component delivery, affecting manufacturing schedules.

- Increased Manufacturing Expenses: These supply chain and material cost issues directly contributed to higher production costs for Doosan.

- Margin Compression: The combined effect of these threats can lead to reduced profitability if not effectively managed.

Intensifying competition from both established players and emerging market manufacturers poses a significant threat to Doosan's market share and pricing power. For instance, by 2025, several Asian manufacturers are expected to increase their global presence in the construction equipment sector, potentially offering lower-cost alternatives.

The increasing adoption of advanced technologies by competitors, such as AI-driven predictive maintenance and fully electric heavy machinery, necessitates continuous and substantial investment from Doosan to remain competitive. Failure to innovate at a similar pace could lead to a loss of market leadership and reduced profitability. For example, reports from early 2025 indicate that competitors are heavily investing in R&D for autonomous construction vehicles, an area where Doosan needs to accelerate its development.

Doosan's reliance on global economic stability makes it vulnerable to downturns and localized recessions. For example, a projected slowdown in key emerging markets in 2024-2025 could significantly impact demand for Doosan's infrastructure and energy solutions.

| Threat Category | Specific Threat | Potential Impact on Doosan | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Economic Headwinds | Global economic slowdown | Reduced demand for construction and industrial equipment | IMF projected global growth at 3.2% for 2024, down from 3.5% in 2023. |

| Geopolitical Instability | Protectionist trade policies | Supply chain disruptions, increased costs, market access limitations | Escalating trade disputes in major economies impacting import duties and market access. |

| Regulatory Changes | Stricter emission standards | Increased R&D and capital investment in eco-friendly technologies | EU's tightening CO2 emission standards for non-road mobile machinery from 2024. |

| Technological Disruption | Rapid AI and clean energy advancements | Risk of losing market share to faster-innovating competitors | Global AI market projected to exceed $500 billion by 2025; clean energy investment over $2 trillion annually by 2025. |

| Supply Chain Volatility | Raw material price fluctuations and component shortages | Higher manufacturing costs, production delays, margin compression | Steel price volatility in 2024; component shortages impacting manufacturing schedules in 2024-2025. |

| Competitive Landscape | Increased competition from emerging players | Pressure on market share and pricing power | Growing presence of Asian manufacturers in construction equipment sector by 2025. |

SWOT Analysis Data Sources

This Doosan SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial reports, comprehensive market research, and expert industry analyses to provide a thorough and insightful assessment.