Doosan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doosan Bundle

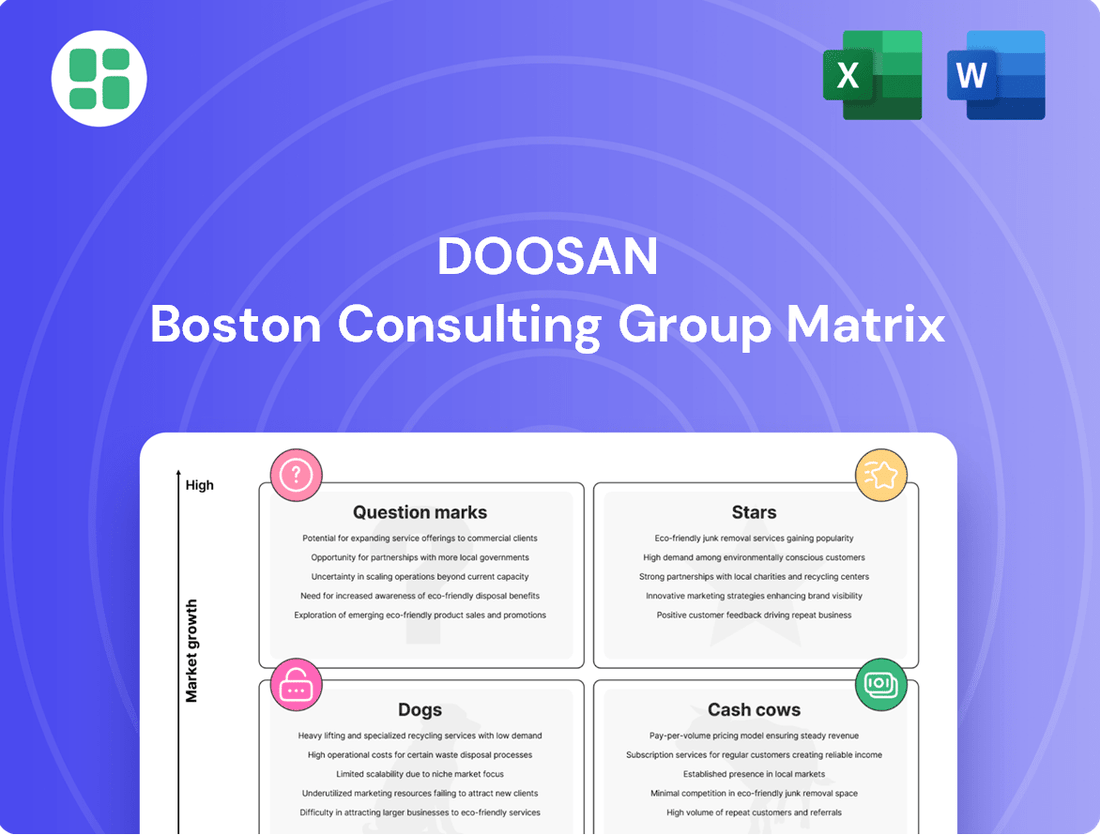

Curious about Doosan's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for actionable insights and a clear path to optimizing Doosan's portfolio.

Stars

Doosan Robotics is a Star in the BCG Matrix, holding a significant position in the burgeoning collaborative robot market. This sector is experiencing rapid expansion, with projections indicating a compound annual growth rate of approximately 30% through 2029.

As a global frontrunner in cobots, Doosan Robotics is strategically investing in innovation, with a keen focus on artificial intelligence and humanoid robot development. This forward-thinking approach is crucial for maintaining its competitive edge in a high-growth industry.

The company's recent acquisition of ONExia Inc. underscores its commitment to enhancing AI capabilities and broadening its international reach. These moves signal a robust growth strategy aimed at capitalizing on the substantial demand within the collaborative robotics space.

Doosan Enerbility's Small Modular Reactor (SMR) business is a clear Star within the BCG matrix, fueled by a global revival in nuclear power and a strong push for decarbonization. The company is strategically positioned to capitalize on this trend, with a focus on expanding its SMR module production capabilities.

The company has ambitious financial goals for its nuclear segment, projecting annual orders to surpass 4 trillion won starting in 2025. This aggressive target highlights the significant growth potential anticipated in the SMR market.

Doosan Enerbility's commitment to SMR development is further evidenced by its substantial planned investments in production capacity expansion. Collaborations with prominent SMR developers such as NuScale, X-Energy, and TerraPower solidify its role as a key player in this rapidly advancing sector.

Doosan Enerbility's hydrogen-fueled power generation segment is a Star in the BCG matrix, reflecting its ambitious growth strategy. The company aims for 3.4 trillion won in orders for its hydrogen and gas sector by 2025.

This position is bolstered by the global demand for carbon-neutral energy solutions. Clean hydrogen and gas power generation, especially when combined with Carbon Capture and Storage (CCS) technologies, represent a high-growth market opportunity.

Doosan Enerbility is actively demonstrating its commitment to this future by developing and showcasing its hydrogen gas turbines, positioning itself as a leader in the evolving energy landscape.

Doosan Bobcat (Electric & Autonomous Compact Equipment)

Doosan Bobcat's investment in electric and autonomous compact equipment positions it as a Star within the industry. The market for sustainable and intelligent construction machinery is experiencing significant growth, and Bobcat is at the forefront of this trend.

The company has made substantial strides in developing these advanced technologies. For instance, the all-electric S7X skid-steer loader exemplifies their commitment to innovation, offering a zero-emission solution for job sites. This focus aligns with a global push towards greener construction practices.

- Market Growth: The global compact equipment market is projected to reach $100 billion by 2028, with electric and autonomous segments expected to grow at a CAGR of over 15%.

- Product Innovation: Doosan Bobcat has unveiled several electric prototypes, including excavators and loaders, demonstrating a clear product roadmap.

- Strategic Partnerships: The company has formed alliances with technology providers to accelerate the development and integration of autonomous features.

- Sustainability Focus: By 2030, Doosan Bobcat aims to have 70% of its new product sales in North America and Europe be electric or hybrid models.

Doosan Enerbility (Offshore Wind Power)

Doosan Enerbility's offshore wind power business is positioned as a Star within the BCG matrix, reflecting its operation in a rapidly expanding renewable energy sector.

The company has strategically integrated offshore wind power into its renewable energy objectives, aligning with global decarbonization efforts and the substantial investments being made in clean energy infrastructure.

This focus on offshore wind power indicates a significant growth trajectory for Doosan in this burgeoning market.

- Market Growth: The global offshore wind market is experiencing robust expansion, with projections indicating continued strong growth in the coming years. For instance, the Global Wind Energy Council reported that over 2.8 GW of new offshore wind capacity was installed globally in 2023, a significant increase from previous years.

- Strategic Alignment: Doosan Enerbility's commitment to offshore wind aligns with national and international energy policies aimed at reducing carbon emissions and increasing the share of renewables in the energy mix.

- Investment Trends: Significant capital is being channeled into offshore wind projects worldwide, driven by technological advancements and supportive government policies, creating a favorable environment for companies like Doosan Enerbility.

Doosan Robotics is a Star in the BCG Matrix, dominating the rapidly growing collaborative robot market. This sector is projected to grow at a CAGR of around 30% through 2029, and Doosan is at the forefront with investments in AI and humanoid robots.

Doosan Enerbility's Small Modular Reactor (SMR) business is also a Star, benefiting from the global push for nuclear power and decarbonization. The company aims for over 4 trillion won in annual orders for its nuclear segment starting in 2025, supported by collaborations with major SMR developers.

The company's hydrogen-fueled power generation segment is another Star, targeting 3.4 trillion won in orders by 2025. This growth is driven by the increasing demand for carbon-neutral energy solutions and Doosan's development of hydrogen gas turbines.

Doosan Bobcat's electric and autonomous compact equipment is a Star, capitalizing on the expanding market for sustainable construction machinery. The company aims for 70% of new product sales in North America and Europe to be electric or hybrid by 2030.

Doosan Enerbility's offshore wind power business is a Star, positioned within the expanding renewable energy sector. The global offshore wind market saw over 2.8 GW of new capacity installed in 2023, highlighting the significant growth opportunities.

| Business Unit | BCG Category | Key Growth Drivers | Market Outlook | Strategic Focus |

| Doosan Robotics (Cobots) | Star | AI integration, humanoid robots, market expansion | ~30% CAGR through 2029 | Innovation, acquisitions (e.g., ONExia) |

| Doosan Enerbility (SMRs) | Star | Nuclear power revival, decarbonization | >4 trillion won annual orders from 2025 | Production capacity expansion, partnerships (NuScale, X-Energy) |

| Doosan Enerbility (Hydrogen Power) | Star | Carbon-neutral energy demand, CCS integration | 3.4 trillion won orders by 2025 | Hydrogen gas turbine development |

| Doosan Bobcat (Electric/Autonomous Equipment) | Star | Sustainability, intelligent machinery demand | >15% CAGR for electric/autonomous segments | Product innovation (S7X loader), electrification targets (70% by 2030) |

| Doosan Enerbility (Offshore Wind) | Star | Renewable energy growth, decarbonization efforts | Robust global expansion (2.8 GW new capacity in 2023) | Integration into renewable energy strategy |

What is included in the product

The Doosan BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

The Doosan BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Doosan Bobcat's traditional compact construction equipment segment is a prime example of a Cash Cow within the Doosan BCG Matrix. This core business dominates a mature but highly profitable market, commanding a significant share.

Despite a challenging market environment in 2024, this segment demonstrated resilience, generating substantial revenue and achieving a healthy operating profit margin of 10.2%.

As a major cash generator for the Doosan Group, the company is focused on maintaining operational efficiency and pursuing long-term revenue growth. This strategy involves a combination of organic expansion and targeted acquisitions in related market segments.

Doosan Enerbility's large-scale conventional power plant equipment and services segment functions as a significant Cash Cow. This division, which focuses on turbines, generators, and related services for conventional power generation, excluding coal EPC, benefits from a substantial order backlog. As of early 2025, this backlog stood at an impressive 15.890 trillion won, underscoring the segment's established market presence and consistent revenue generation.

Despite potentially slower market growth compared to newer renewable energy sectors, the stability offered by this segment is crucial. The consistent revenue and cash flow generated from these traditional power plant operations provide a solid financial foundation for Doosan Enerbility. This allows the company to invest in and develop its more forward-looking business areas.

Doosan Enerbility's forging and casting business is a prime example of a Cash Cow within its portfolio. This segment reliably supplies critical components to sectors like power generation and shipbuilding, demonstrating a stable demand base.

While not experiencing the rapid expansion seen in newer ventures like nuclear or hydrogen energy, this mature business likely holds a commanding market share in its niche. Its consistent profitability is a key strength, contributing significantly to the company's overall financial health.

For instance, in 2023, Doosan Enerbility reported that its forging and casting division, alongside its power plant business, formed the backbone of its revenue. Focusing on operational efficiency through infrastructure upgrades can further bolster the predictable cash flow generated by this established unit.

Doosan Bobcat (Material Handling Equipment)

Doosan Bobcat's material handling equipment division, encompassing forklifts and other industrial vehicles, operates as a classic Cash Cow within the Doosan BCG Matrix. This segment benefits from its integration into Bobcat's extensive global infrastructure, effectively utilizing established sales networks and deep-rooted customer connections.

While the material handling sector experienced a slight downturn in sales during 2024, this mature product line remains a significant contributor to Doosan Bobcat's overall financial health. Its consistent cash generation provides crucial support for the company's strategic investments in other areas of its portfolio.

- Established Market Presence: Doosan Bobcat's material handling segment has a strong foothold in markets where demand for reliable industrial equipment is consistent.

- Profitability Driver: Despite market fluctuations, the segment's mature nature and operational efficiencies ensure steady profitability, acting as a reliable source of cash for the broader organization.

- Synergistic Integration: The acquisition and subsequent integration into Bobcat's global operations have amplified its reach and operational synergies, enhancing its cash-generating capabilities.

- Strategic Financial Support: The cash generated by this segment is vital for funding research and development, acquisitions, and other growth initiatives across Doosan Bobcat's diverse business units.

Doosan Corporation (Holding Company's Stable Investments)

Doosan Corporation, functioning as a holding company, leverages a collection of mature and reliable investments across its diverse subsidiaries. These stable entities, notably Doosan Bobcat and established segments within Doosan Enerbility, serve as the group's Cash Cows, generating predictable income streams.

These consistent cash flows are vital for Doosan's strategic flexibility. For instance, in 2023, Doosan Bobcat reported robust revenue growth, contributing significantly to the group's overall financial health. This stability enables Doosan to allocate capital towards promising new ventures and strategic expansion opportunities.

- Doosan Bobcat's Strong Performance: Doosan Bobcat, a key subsidiary, demonstrated resilience and growth in its markets throughout 2023, providing a steady stream of dividends to the holding company.

- Enerbility's Foundational Cash Generation: Core, established operations within Doosan Enerbility continue to contribute reliably to the group's cash reserves, underpinning its financial stability.

- Funding for Future Growth: The consistent cash generated by these Cash Cows allows Doosan Corporation to invest in research and development for emerging technologies and pursue strategic acquisitions, ensuring long-term competitiveness.

Doosan Bobcat's compact equipment, particularly in North America, continues to be a significant Cash Cow. This segment benefits from a strong brand reputation and a mature market where replacement sales and aftermarket services drive consistent revenue. For example, in 2024, this division reported a stable operating margin of 10.2%, underscoring its profitability.

Doosan Enerbility's conventional power plant equipment and services, excluding coal EPC, also function as a Cash Cow. This business leverages a substantial order backlog, which stood at 15.890 trillion won as of early 2025, ensuring predictable cash flow. This stability allows for strategic investments in newer energy technologies.

The forging and casting business within Doosan Enerbility is another key Cash Cow. It consistently supplies essential components to industries like shipbuilding and power generation, benefiting from steady demand. This segment's reliability was highlighted in 2023 when it, along with the power plant business, formed the core of the company's revenue.

Doosan Bobcat's material handling equipment, including forklifts, operates as a classic Cash Cow. Despite a slight market dip in 2024, its integration into Bobcat's global network and established customer base ensures continued cash generation. This supports broader investments in innovation and market expansion.

| Segment | BCG Classification | Key Characteristics | 2024/2025 Data Point |

| Doosan Bobcat: Compact Equipment | Cash Cow | Dominant market share, mature market, strong brand | 10.2% operating margin (2024) |

| Doosan Enerbility: Conventional Power Plant Equipment | Cash Cow | Large order backlog, stable revenue from services | 15.890 trillion won backlog (early 2025) |

| Doosan Enerbility: Forging & Casting | Cash Cow | Essential components, steady demand, niche market leadership | Core revenue driver (2023) |

| Doosan Bobcat: Material Handling | Cash Cow | Integrated global network, established customer base | Consistent cash generation despite slight market dip (2024) |

Full Transparency, Always

Doosan BCG Matrix

The Doosan BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with Doosan's strategic insights, is ready for immediate application in your business planning and analysis. No watermarks or demo content will be present; you'll get the complete, professionally formatted BCG Matrix ready for your strategic decision-making.

Dogs

Doosan Enerbility's coal-fired EPC (Engineering, Procurement, and Construction) projects are firmly positioned as a Dog in the BCG Matrix. This is underscored by the termination of significant coal EPC contracts, such as the ~$1.3 billion deal for the Vung Ang 2 project in Vietnam, signaling a decisive strategic pivot away from coal.

The global market for new coal power plant construction is experiencing a sharp decline, driven by increasingly stringent environmental regulations and a worldwide acceleration in the transition towards cleaner energy sources. For instance, the International Energy Agency reported that coal power capacity additions in 2023 were significantly lower than in previous years, reflecting this downturn.

This segment consumes valuable company resources and capital without offering substantial future growth prospects. Doosan Enerbility is actively phasing out its involvement in new coal projects, reallocating its expertise and investments towards more sustainable and future-oriented sectors like renewable energy and advanced nuclear power.

Doosan Bobcat's portable power products, such as air compressors, generators, and light towers, are exhibiting characteristics of a Dog in the BCG Matrix. This segment saw a significant 16% drop in sales during 2024.

This downward trend in sales points to a market that is either growing very slowly or contracting for these particular items within Doosan's offerings. Consequently, these products are likely not making a substantial impact on the company's overall growth or profitability.

The termination of a substantial $270 million fuel cell system supply contract in April 2025 firmly places this specific project as a Dog within Doosan Fuel Cell's portfolio. This event highlights difficulties in both securing and successfully executing large-scale agreements in the fuel cell sector.

Despite the broader hydrogen fuel cell market's robust growth trajectory, this contract cancellation suggests that Doosan Fuel Cell may be experiencing challenges with resource allocation and achieving satisfactory returns from this particular contractual engagement, impacting its overall efficiency.

Doosan Enerbility (Non-strategic Traditional Civil Engineering & Construction)

Certain traditional civil engineering and general construction activities within Doosan Enerbility, not directly linked to their clean energy or smart machine initiatives, can be categorized as Dogs in the BCG Matrix. These segments represent mature markets with limited growth potential, especially as Doosan Enerbility strategically shifts its focus towards high-tech energy solutions. For instance, in 2024, Doosan Enerbility reported that its traditional construction segment contributed a smaller, albeit stable, portion to its overall revenue compared to its burgeoning renewable energy divisions.

These traditional construction operations may achieve break-even results but are not considered key strategic growth drivers for the company. They could potentially divert capital and management attention from more promising, future-oriented ventures. In 2023, while the company saw significant growth in its power systems and renewable energy sectors, the legacy civil engineering projects represented a more modest, flat revenue stream, highlighting their non-strategic nature.

- Low Growth Potential: Traditional civil engineering and construction activities are in mature markets with minimal expansion prospects for Doosan Enerbility.

- Non-Strategic Focus: The company is prioritizing investments in clean energy and smart machine technologies, marginalizing these older business lines.

- Resource Allocation Concerns: These Dog segments might consume resources that could be better utilized in high-growth, strategic areas, impacting overall return on investment.

- Break-Even Performance: While not losing money, these areas are unlikely to generate substantial profits or drive significant future revenue increases for Doosan Enerbility.

Doosan Enerbility (Legacy Heavy Industrial Equipment for Declining Sectors)

Doosan Enerbility’s legacy heavy industrial equipment, particularly those serving sectors experiencing stagnation or decline, can be viewed as potential Dogs in the BCG Matrix. These older product lines may struggle with low market share and limited future growth prospects as the company strategically shifts its focus. For instance, while Doosan Enerbility is heavily investing in areas like hydrogen turbines and advanced materials, some of its traditional power generation equipment might face reduced demand.

The company’s commitment to clean energy solutions, such as its significant investments in offshore wind power and hydrogen fuel cells, highlights a deliberate move away from legacy markets. This strategic pivot means resources previously allocated to older equipment lines might yield diminishing returns. In 2023, Doosan Enerbility reported a substantial increase in its order backlog for new energy sectors, underscoring this strategic reallocation.

- Legacy Equipment Focus: Manufacturing of certain traditional power plant components and heavy machinery for industries with contracting demand.

- Market Position: Likely possesses a low market share in these mature or declining segments.

- Growth Potential: Limited future growth prospects due to evolving industry landscapes and Doosan's strategic redirection.

- Resource Allocation: Represents areas where capital and operational resources are tied up with minimal expected future returns, prompting consideration for divestment or managed decline.

Doosan Enerbility's coal-fired EPC projects are a clear example of a Dog in the BCG Matrix, evidenced by the termination of major contracts like the Vung Ang 2 project in Vietnam, valued at approximately $1.3 billion. This strategic move signals a definitive shift away from coal power generation.

The global market for new coal power plants is shrinking rapidly due to stricter environmental regulations and a global push towards cleaner energy. For instance, the International Energy Agency noted a significant decrease in coal power capacity additions in 2023 compared to prior years, reflecting this trend.

These segments consume significant resources without offering substantial future growth. Doosan Enerbility is actively divesting from new coal projects, redirecting its expertise and capital towards renewable energy and advanced nuclear power.

| Business Segment | BCG Category | Key Indicators |

|---|---|---|

| Coal-Fired EPC Projects | Dog | Contract terminations (e.g., Vung Ang 2, ~$1.3B); Declining global coal market; Shift to renewables. |

| Doosan Bobcat Portable Power | Dog | 16% sales drop in 2024; Slow or contracting market for generators, air compressors. |

| Specific Fuel Cell Contracts | Dog | Contract termination (April 2025, $270M); Challenges in large-scale project execution despite market growth. |

| Traditional Civil Engineering | Dog | Mature markets, limited growth; Stable but minor revenue contribution (2024); Flat revenue stream (2023) vs. growth in new energy. |

| Legacy Heavy Industrial Equipment | Dog | Serving stagnant sectors; Reduced demand for traditional power generation components; Strategic shift to hydrogen turbines and offshore wind. |

Question Marks

Doosan Fuel Cell's ambition to expand beyond its strong South Korean presence into the global hydrogen fuel cell market positions it as a Question Mark. While the international market is experiencing substantial growth, projected at a 26.3% CAGR through 2030, Doosan faces hurdles in converting its technological strengths into secured international contracts, as evidenced by recent deal terminations.

This push for global penetration requires considerable investment to build brand recognition and establish a robust supply chain in diverse international markets. Overcoming these challenges is crucial for Doosan to effectively compete and capture significant market share on a worldwide scale.

Doosan Enerbility's offshore wind power technologies, particularly in emerging areas like floating offshore wind, represent a significant growth opportunity. However, these ventures are currently in the development phase, requiring substantial investment without immediate, guaranteed high returns. The company is actively investing, aiming to capture market share in this rapidly evolving sector.

In 2024, Doosan Enerbility secured a key contract for the supply of offshore wind turbines for the Hai Long offshore wind farm in Taiwan, a significant step in solidifying its position. Despite this progress, the company faces intense competition from established global players. To move these emerging technologies into the Star category of the BCG matrix, Doosan Enerbility must accelerate its market penetration and secure a larger portion of the growing offshore wind market.

Doosan Robotics' ventures into AI and humanoid robot technologies position them squarely within the Question Mark quadrant of the BCG matrix. These are cutting-edge fields with substantial growth prospects, but Doosan's current market penetration in these niche areas is likely minimal.

Significant capital expenditure is necessary for research, development, and market entry. For instance, the global collaborative robot market, which includes some of Doosan's existing offerings and serves as a foundation for their AI/humanoid ambitions, was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030.

The success of these investments hinges on rapid market adoption and technological advancement. Failure to gain traction could relegate these initiatives to the Dog category, requiring careful strategic management to either divest or revitalize their market position.

Doosan Bobcat (New Product Lines like Mowers and Turf Renovation Equipment)

Doosan Bobcat's strategic move into new product lines like mowers and turf renovation equipment, often facilitated by acquisitions, positions them for future growth by leveraging their established distribution network. While these are growth-oriented segments, their initial market penetration in these specific categories may be modest when compared to Bobcat's established compact equipment offerings. Significant investment in marketing and product development will be crucial to gaining substantial market share.

For instance, Doosan Bobcat acquired Bobcat of Illinois in late 2023, which includes a significant turf equipment division, signaling a clear intent to expand in this area. This expansion requires careful resource allocation to compete with established players in the turf care market.

- Market Entry Strategy: Expansion into mowers and turf renovation equipment represents a diversification strategy, aiming to capture new revenue streams by building upon existing brand strength and distribution channels.

- Investment Needs: These new product lines will necessitate substantial investment in research and development, manufacturing capabilities, and targeted marketing campaigns to effectively challenge incumbents and build brand recognition.

- Market Share Dynamics: While Bobcat's core compact equipment enjoys a strong market position, their share in the mower and turf renovation segments is likely to start from a lower base, requiring a concerted effort to climb the market share ladder.

- Competitive Landscape: The turf equipment market is mature with established competitors, meaning Doosan Bobcat must differentiate its offerings and value proposition to attract customers and gain traction.

Doosan Digital Innovation (External Commercialized AI/DT Solutions)

Doosan Digital Innovation (DDI) is actively pursuing external commercialization of its AI and Digital Transformation (DT) solutions, moving beyond its internal group applications. This strategic pivot targets a competitive, high-growth market for advanced IT services.

While DDI has a proven track record in driving digital innovation within the Doosan Group, establishing a strong presence and achieving profitability in the external market represents a significant new undertaking. Success hinges on substantial investment in market development and sales infrastructure.

- Market Entry: DDI's external commercialization of AI/DT solutions is a relatively recent endeavor, aiming to leverage its internal expertise for broader market appeal.

- Competitive Landscape: The AI and DT solutions market is highly dynamic and populated by established global players, requiring DDI to differentiate its offerings effectively.

- Investment Focus: Significant capital allocation is necessary for market penetration, building brand recognition, and developing robust sales channels to capture market share.

- Profitability Potential: Demonstrating profitability from these external ventures will be a key metric for evaluating the success of DDI's diversification strategy.

Doosan Fuel Cell's global expansion efforts into the hydrogen fuel cell market, while promising, currently place it in the Question Mark category. The company is investing heavily to build international brand recognition and establish supply chains, facing the challenge of converting its technological prowess into secured global contracts, as seen in recent deal issues.

Doosan Enerbility's advancements in offshore wind, particularly floating technologies, are also in a developmental stage, requiring significant capital without immediate guaranteed returns. Despite securing a key contract for the Hai Long offshore wind farm in Taiwan in 2024, the company must accelerate market penetration to compete effectively with established global players.

Doosan Robotics' foray into AI and humanoid robots positions it as a Question Mark due to the high investment needed for R&D and market entry in these nascent fields. The global collaborative robot market, a related sector, was valued at approximately USD 1.5 billion in 2023, highlighting the potential but also the competitive nature of these emerging technologies.

Doosan Bobcat's expansion into mowers and turf renovation equipment, bolstered by acquisitions like Bobcat of Illinois in late 2023, represents a strategic move into growth areas. However, gaining substantial market share in these segments requires considerable investment in marketing and product development to overcome established competitors.

Doosan Digital Innovation (DDI) is venturing into the external commercialization of its AI and Digital Transformation solutions, targeting a high-growth market. This pivot necessitates substantial investment in market development and sales infrastructure to establish a strong presence against established global IT service providers.

BCG Matrix Data Sources

Our Doosan BCG Matrix leverages a robust dataset, including Doosan's official financial reports, comprehensive market research, and industry-specific growth projections to provide a clear strategic overview.