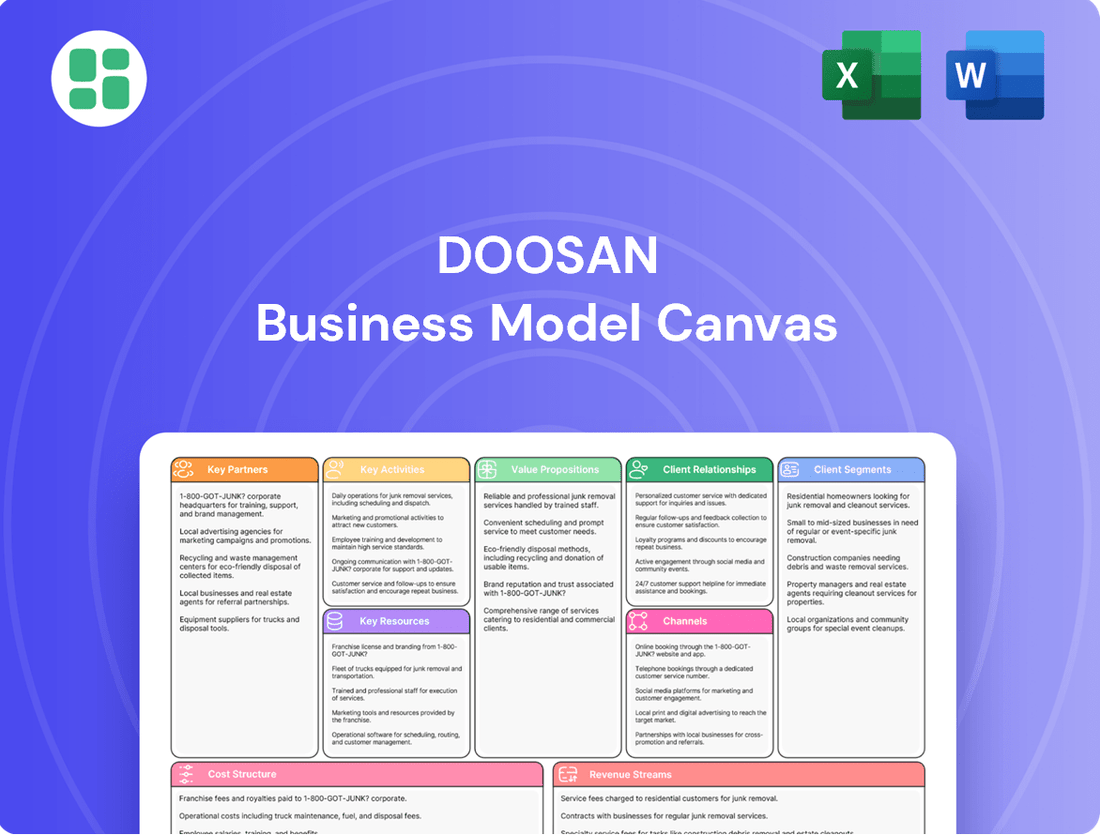

Doosan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doosan Bundle

Unlock the strategic DNA of Doosan's success with our comprehensive Business Model Canvas. Discover how they masterfully segment customers, forge key partnerships, and drive revenue streams in the competitive industrial landscape. This detailed breakdown is your key to understanding their operational excellence and market dominance.

Partnerships

Doosan actively cultivates strategic alliances and joint ventures with global leaders to enhance its technological capabilities and market penetration. For instance, partnerships with NuScale and X-energy are pivotal for advancing Small Modular Reactor (SMR) development, positioning Doosan at the forefront of next-generation nuclear energy solutions.

These collaborations are instrumental in accelerating the deployment of innovative energy technologies and unlocking access to new, lucrative markets. Doosan’s commitment to sustainable energy is further exemplified by its work with entities like Korea Western Power (KOWEPO) on hydrogen-fueled turbines and the Electricity Generating Authority of Thailand (EGAT) for carbon-free energy initiatives.

Doosan's extensive supplier network is crucial, providing essential components and raw materials for its wide-ranging industrial activities. This network underpins Doosan Enerbility's commitment to shared growth, actively collaborating with partners, including small and medium-sized enterprises, to build a robust ecosystem.

In 2023, Doosan Group reported a total revenue of approximately KRW 19.9 trillion. The strength of its supply chain is paramount, guaranteeing the consistent, high-quality delivery of inputs vital for Doosan's manufacturing operations, thereby supporting its operational efficiency and product quality.

Doosan's distribution and dealer partnerships are crucial for its global reach, especially for construction equipment via Doosan Bobcat. These alliances are vital for accessing diverse customer segments and ensuring effective sales and localized after-sales support. For instance, Doosan Bobcat reported strong performance in 2024, with its dealer network playing a key role in achieving significant market share gains in North America and Europe.

Technology and Innovation Collaborations

Doosan actively cultivates key partnerships focused on technology and innovation. These collaborations are crucial for driving advancements across its diverse business units, from robotics to construction equipment.

- AI Robotics Advancement: Doosan Robotics' acquisition of ONExia in 2024 exemplifies a strategic partnership aimed at bolstering AI capabilities in robotics, enhancing automation solutions.

- Product Development Networks: Doosan Bobcat leverages its extensive dealer and customer networks, fostering collaborative environments for new product ideation and testing, ensuring market relevance.

- Academic Research and Talent: Partnerships with institutions like the University of North Carolina at Charlotte for STEM initiatives help Doosan tap into cutting-edge research and cultivate a pipeline of future engineering talent.

- Cross-Segment Synergies: These alliances facilitate the sharing of technological insights and best practices across Doosan's various segments, accelerating the adoption of new technologies and fostering innovation.

Government and Public Sector Collaborations

Doosan actively collaborates with government entities and state-owned enterprises on significant infrastructure and energy initiatives. For instance, their partnership with the Electricity Generating Authority of Thailand (EGAT) focuses on developing carbon-free energy solutions, highlighting a commitment to sustainable development. These strategic alliances are vital for Doosan to secure large-scale contracts and ensure their projects align with national development objectives, fostering long-term commitments and supportive policy environments for technological advancements.

- Infrastructure Development: Doosan's involvement in government-led infrastructure projects, such as power plants and transportation networks, leverages public sector funding and strategic planning.

- Energy Transition: Collaborations on renewable energy and carbon-free solutions, like those with EGAT, are critical for Doosan to participate in global energy transitions and meet evolving regulatory demands.

- Policy Alignment: These partnerships ensure Doosan's business strategies are aligned with national economic and environmental policies, often leading to preferential treatment or incentives for their technologies.

Doosan's key partnerships are strategically designed to enhance technological capabilities, expand market reach, and foster innovation across its diverse business segments. These collaborations are crucial for staying competitive and driving growth in rapidly evolving industries.

The company actively engages with technology providers and research institutions to accelerate the development of cutting-edge solutions, particularly in areas like advanced robotics and sustainable energy. For example, Doosan Robotics' acquisition of ONExia in 2024 significantly bolstered its AI capabilities.

Furthermore, Doosan leverages its extensive dealer and supplier networks to ensure product quality and market penetration. Doosan Bobcat's strong performance in 2024 was partly attributed to its robust dealer network, which facilitated market share gains in key regions.

Strategic alliances with government entities and state-owned enterprises are also vital, particularly for large-scale infrastructure and energy projects, ensuring alignment with national development goals and policy environments.

| Partnership Type | Example Partner | Strategic Focus | Impact/Benefit |

| Technology & Innovation | ONExia (acquired by Doosan Robotics) | AI capabilities in robotics | Enhanced automation solutions, advanced robotics |

| Energy Solutions | NuScale, X-energy | Small Modular Reactor (SMR) development | Advancing next-generation nuclear energy |

| Sustainable Energy | Korea Western Power (KOWEPO), EGAT | Hydrogen turbines, carbon-free energy | Accelerating deployment of innovative energy technologies |

| Distribution & Sales | Doosan Bobcat Dealer Network | Global reach, market access | Significant market share gains in North America and Europe (2024) |

| Supply Chain | Various SMEs and global suppliers | Component provision, raw materials | Ensuring operational efficiency and product quality |

What is included in the product

A detailed Doosan Business Model Canvas that outlines their core operations, customer relationships, and revenue streams within the heavy industry sector.

The Doosan Business Model Canvas offers a structured approach to identify and address operational inefficiencies, acting as a pain point reliever by clarifying value propositions and customer segments.

By visually mapping out key resources and activities, the Doosan Business Model Canvas helps pinpoint and resolve bottlenecks, thus alleviating common business pain points.

Activities

Doosan's advanced manufacturing and production activities are the backbone of its operations, encompassing the creation of heavy machinery, power generation equipment, construction vehicles, and cutting-edge materials across its global network. This commitment to production is evidenced by strategic expansions, such as Doosan Bobcat's new facility in Mexico, which aims to enhance its North American manufacturing capabilities and address growing market needs.

Further demonstrating this focus, Doosan has also invested in expanding its factory in Chennai, India. This expansion is crucial for meeting the escalating global demand for its diverse product portfolio, reinforcing its position as a key player in various industrial sectors and ensuring efficient delivery of high-quality goods to a worldwide customer base.

Doosan's commitment to Research and Development (R&D) is a cornerstone of its strategy, with substantial investments directed towards pioneering future growth sectors. A key focus area includes the development of Small Modular Reactors (SMRs), advanced hydrogen turbines, and intelligent AI robotics, aiming to shape the energy and industrial landscapes of tomorrow.

Doosan Enerbility, a major subsidiary, is a prime example of this dedication, channeling significant resources into eco-friendly innovations. This includes advancements in metal additive manufacturing, often referred to as 3D printing for metals, and the development of cutting-edge carbon capture technologies, crucial for environmental sustainability.

This relentless pursuit of innovation ensures Doosan consistently maintains a leading position in its core industries. For instance, in 2023, Doosan Enerbility reported R&D expenses of approximately 340 billion Korean Won (around $250 million USD), underscoring the scale of their commitment to technological advancement and future market leadership.

Doosan's global sales, marketing, and distribution strategy is a cornerstone of its business model, ensuring its construction equipment, industrial vehicles, and other offerings are accessible to customers across continents. This involves a multifaceted approach, leveraging a robust network of direct sales forces, authorized dealers, and strategic distribution partners to penetrate diverse markets effectively. For instance, in 2024, Doosan continued to expand its dealer network in emerging markets, aiming to capture a larger share of regional infrastructure development projects.

Effective market penetration relies on tailored marketing campaigns that resonate with local needs and preferences, coupled with efficient distribution channels to ensure timely product delivery and after-sales support. Doosan's commitment to brand promotion is evident in its participation in major international trade shows and its investment in digital marketing initiatives to enhance customer engagement and brand visibility. This global reach is crucial for maintaining its competitive edge and driving revenue growth in a dynamic marketplace.

Engineering, Procurement, and Construction (EPC)

Doosan's Engineering, Procurement, and Construction (EPC) segment is crucial for its large-scale project delivery, especially in power generation and infrastructure. This integrated approach covers everything from initial design and detailed engineering to sourcing all necessary materials and overseeing the actual construction of complex industrial facilities. These comprehensive services are essential for providing clients with complete, ready-to-operate solutions.

For instance, in 2023, Doosan Heavy Industries & Construction (now Doosan Enerbility) secured significant EPC contracts. One notable project involved the construction of a new power plant in Southeast Asia, valued at over $1 billion. This demonstrates the substantial scale and financial impact of their EPC capabilities.

- Design and Engineering: Developing detailed blueprints and technical specifications for power plants and industrial facilities.

- Procurement: Sourcing and managing the acquisition of all required materials, equipment, and components globally.

- Construction: Executing the physical building and assembly of the project, ensuring quality and timely completion.

- Project Management: Overseeing the entire EPC lifecycle, from inception to handover, managing risks and stakeholders.

After-sales Service and Maintenance

Doosan's commitment to after-sales service and maintenance is a cornerstone of its business model, ensuring the continued optimal performance of its heavy machinery and infrastructure solutions. This involves a robust global network for parts supply, expert technical support, and comprehensive service agreements, particularly for high-value assets like gas turbines.

For instance, Doosan Heavy Industries & Construction, a major segment, focuses on providing long-term maintenance contracts for power plants, which are critical for revenue generation and customer retention. In 2024, Doosan continued to invest in digital service platforms to enhance remote diagnostics and predictive maintenance capabilities, aiming to reduce downtime for its clients.

- Parts Supply Chain: Maintaining an efficient and readily available supply of genuine spare parts globally to minimize equipment downtime.

- Technical Support and Expertise: Offering expert technical assistance, troubleshooting, and on-site repair services by highly trained engineers.

- Long-Term Service Agreements: Providing customized service contracts for critical machinery, ensuring ongoing maintenance, performance monitoring, and operational continuity.

- Digital Service Enhancement: Leveraging digital technologies for remote monitoring, diagnostics, and predictive maintenance to proactively address potential issues.

Doosan's manufacturing excellence drives its core operations, producing a wide array of heavy machinery and industrial equipment. This is supported by significant investments in production capacity, such as the ongoing expansion of its facilities in India and Mexico, to meet global demand. The company's commitment to quality and efficiency in production is paramount to its market position.

What You See Is What You Get

Business Model Canvas

The Doosan Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This comprehensive overview provides a clear, actionable framework for understanding Doosan's strategic approach. You'll gain full access to this same detailed analysis, ready for your own strategic planning and insights.

Resources

Doosan's advanced technology and intellectual property are cornerstones of its business model, particularly in high-growth sectors. The company holds a substantial portfolio of patents covering innovations in small modular reactors (SMRs), advanced gas turbines, hydrogen fuel cells, and sophisticated robotics. This deep well of proprietary knowledge fuels the creation of next-generation products and solutions, giving Doosan a distinct competitive advantage.

Ongoing investment in research and development is crucial for maintaining this edge. For instance, Doosan Electro-Materials, a key subsidiary, has been actively developing advanced materials for electric vehicle batteries and semiconductor components, areas expected to see significant growth through 2025 and beyond. These R&D efforts ensure Doosan remains at the forefront of technological advancement, ready to capitalize on emerging market trends.

Doosan's global manufacturing and production facilities are a cornerstone of its business model, representing a vast network of physical assets. These strategically positioned plants, found in key regions like Korea, the USA, Czech Republic, France, Germany, India, China, and Mexico, are crucial for efficient global supply chains and localized production capabilities.

The company actively invests in expanding this critical resource. For instance, the recent inauguration of a new Bobcat plant in Mexico underscores Doosan's dedication to scaling up operations to meet escalating global demand for its products, particularly in the construction equipment sector.

Doosan's workforce is a cornerstone, featuring a deep bench of skilled engineers, researchers, technicians, and management professionals. This human capital is directly responsible for driving innovation, ensuring operational excellence, and successfully managing complex projects across Doosan's varied business sectors.

In 2024, Doosan continued to invest heavily in its people. For example, Doosan Heavy Industries & Construction reported significant spending on employee training programs aimed at upskilling its workforce in areas like advanced manufacturing and digital transformation, crucial for maintaining a competitive edge.

Financial Capital and Investment Capacity

Doosan's financial capital and investment capacity are foundational to its ambitious growth agenda. This includes pursuing strategic mergers and acquisitions, investing heavily in research and development to foster innovation, and expanding its manufacturing and operational facilities.

The company's robust financial health allows for significant capital deployment. For instance, Doosan Electro-Materials reported a notable increase in its operating profit for the first quarter of 2024, reaching ₩150 billion, demonstrating strong performance that underpins its investment capabilities.

- Financial Strength for Strategic Moves: Doosan leverages its strong balance sheet to fund key initiatives like acquiring new technologies or entering new geographic markets.

- R&D Investment Focus: The company is committed to allocating substantial resources to R&D, aiming to stay at the forefront of its industries, particularly in areas like renewable energy solutions and advanced materials.

- Capital Allocation for Expansion: Doosan's investment capacity directly fuels its ability to build new plants and upgrade existing infrastructure, enhancing production efficiency and capacity to meet growing global demand.

Established Brand Portfolio and Reputation

Doosan's established brand portfolio and reputation are cornerstones of its business model, acting as significant intangible assets. Global recognition for brands like Bobcat, Doosan Enerbility, and Doosan Robotics fosters immediate customer trust and eases market penetration.

This strong reputation, built on a legacy of quality and innovation, directly translates into competitive advantages. For instance, Bobcat's brand equity in compact equipment is unparalleled, allowing for premium pricing and customer loyalty.

The diversified portfolio, encompassing sectors from construction machinery to advanced energy solutions and robotics, broadens Doosan's market appeal and resilience. In 2024, Doosan Enerbility secured key contracts for offshore wind power projects, underscoring the market's confidence in its established capabilities.

- Global Brand Strength: Doosan's subsidiaries, including Bobcat, Doosan Enerbility, Doosan Fuel Cell, Doosan Robotics, and Doosan Tesna, command significant worldwide brand recognition.

- Customer Trust and Market Entry: The reputation for quality, reliability, and innovation built by these brands facilitates customer trust and smoother market entry.

- Market Appeal: The diversified portfolio across various industries enhances Doosan's broad market appeal and reduces reliance on any single sector.

- 2024 Performance Indicator: Doosan Enerbility's successful bid for major offshore wind power projects in 2024 highlights the market's ongoing trust in its established brand and technological prowess.

Doosan's key resources are its technological prowess, global manufacturing footprint, skilled workforce, financial strength, and robust brand portfolio. These elements collectively enable the company to innovate, produce efficiently, and maintain a strong market position across diverse sectors.

The company's commitment to R&D is evident in its patent portfolio and investments in emerging technologies. Its global network of production facilities, supported by strategic expansions like the new Bobcat plant in Mexico, ensures efficient supply chains. Doosan's workforce, continuously upskilled through training programs, drives operational excellence. Financially, strong performance, such as Doosan Electro-Materials' Q1 2024 profit of ₩150 billion, fuels further investment and strategic moves. The established brands, like Bobcat and Doosan Enerbility, foster customer trust and market penetration, as demonstrated by Doosan Enerbility's 2024 offshore wind project wins.

| Key Resource | Description | 2024 Data/Example |

|---|---|---|

| Technology & IP | Patents in SMRs, gas turbines, fuel cells, robotics | Ongoing development of advanced materials for EV batteries by Doosan Electro-Materials. |

| Manufacturing Facilities | Global network in Korea, USA, Europe, Asia, Mexico | Inauguration of new Bobcat plant in Mexico to meet demand. |

| Human Capital | Skilled engineers, researchers, technicians, management | Significant investment in employee training for advanced manufacturing and digital transformation. |

| Financial Capital | Investment capacity for R&D, M&A, expansion | Doosan Electro-Materials' Q1 2024 operating profit of ₩150 billion. |

| Brand Portfolio | Bobcat, Doosan Enerbility, Doosan Robotics, etc. | Doosan Enerbility securing key offshore wind power projects. |

Value Propositions

Doosan's value proposition centers on providing comprehensive industrial solutions, encompassing everything from heavy industry and machinery to power generation, infrastructure, and construction equipment. This integrated approach simplifies procurement for clients.

By offering a wide spectrum of products and services, Doosan acts as a single, reliable source for diverse industrial needs. This allows customers to streamline their supply chains and manage fewer vendor relationships.

Doosan's capabilities span the entire industrial lifecycle, from initial power plant development to the provision of construction vehicles. This end-to-end offering underscores their commitment to delivering complete industrial solutions.

Pioneering Technological Innovation is a core value proposition for Doosan, demonstrated through their relentless pursuit of advancements in areas like Small Modular Reactors (SMRs) and hydrogen-fueled turbines. This dedication to research and development ensures the creation of highly efficient, advanced, and sustainable products designed to tackle significant industrial hurdles.

Doosan's commitment to innovation is further exemplified by their work in AI robotics and the development of groundbreaking equipment, such as the world's first all-electric compact loaders. These cutting-edge solutions showcase Doosan's ability to deliver tangible benefits and address evolving market needs with forward-thinking technology.

Customers consistently choose Doosan for its unwavering commitment to reliability and exceptional performance. This reputation is built on a foundation of delivering equipment that consistently meets and exceeds expectations, even in the most challenging operational settings.

Doosan places a significant emphasis on quality, adhering to stringent global standards. This focus ensures that their machinery is not only durable but also highly efficient, minimizing operational disruptions for clients.

For instance, in 2023, Doosan Bobcat reported a significant increase in sales for its compact equipment, a testament to the market's trust in their product quality and performance. This translates directly into tangible long-term value and reduced downtime for businesses relying on Doosan solutions.

Global Reach with Localized Support

Doosan's global reach, supported by localized manufacturing and distribution, is a cornerstone of its value proposition. This setup allows for efficient service and timely delivery across diverse markets, ensuring customers receive what they need, when they need it.

This extensive network fosters strong customer relationships by enabling responsive after-sales support and the development of solutions tailored to specific local requirements. For instance, in 2024, Doosan continued to invest in regional hubs to enhance this localized support.

- Global Network: Doosan operates manufacturing facilities and distribution centers in key regions worldwide, facilitating efficient logistics.

- Localized Solutions: The company adapts its products and services to meet the unique demands and regulations of different local markets.

- Customer Proximity: This approach allows for closer collaboration with customers, leading to better understanding of their needs and faster problem resolution.

- Timely Delivery & Support: Doosan's infrastructure is designed to ensure prompt delivery of equipment and readily available after-sales service globally.

Commitment to Sustainability and Clean Energy

Doosan is a frontrunner in delivering sustainable energy solutions, championing eco-friendly and carbon-free technologies. This commitment includes significant investments and advancements in hydrogen fuel cells, offshore wind power generation, and carbon capture systems. For instance, by 2024, Doosan Fuel Cell had already secured substantial orders, demonstrating tangible market traction for its hydrogen solutions.

This dedication to sustainability provides customers with pathways to meet their environmental objectives and comply with increasingly stringent regulations. Doosan’s offerings directly address the growing global demand for cleaner energy sources, making it a strategic partner for businesses and governments aiming for a reduced carbon footprint.

Doosan’s focus on clean energy positions it as a key enabler of a greener future. The company’s portfolio actively supports the transition away from fossil fuels, aligning with international climate agreements and national energy transition strategies. By 2024, Doosan Heavy Industries & Construction (now Doosan Enerbility) was actively involved in multiple large-scale offshore wind projects, contributing to renewable energy capacity expansion.

- Leading in Hydrogen Fuel Cells: Doosan is a major player in the hydrogen economy, developing and deploying advanced fuel cell technology.

- Offshore Wind Power Expertise: The company is a significant contributor to the offshore wind sector, providing essential components and services for wind farm development.

- Carbon Capture Solutions: Doosan offers innovative carbon capture technologies, helping industries reduce their greenhouse gas emissions.

- Alignment with Environmental Goals: Doosan's sustainable solutions empower customers to achieve their sustainability targets and navigate evolving environmental regulations.

Doosan offers integrated industrial solutions, simplifying procurement by acting as a single, reliable source for diverse needs. Their end-to-end capabilities, from power plant development to construction vehicles, ensure complete project fulfillment.

Pioneering technological innovation is central, with advancements in Small Modular Reactors (SMRs) and hydrogen turbines. This focus on R&D yields efficient, sustainable products addressing major industrial challenges.

Reliability and exceptional performance are hallmarks, with equipment designed to exceed expectations even in demanding environments. Doosan’s commitment to quality, adhering to stringent global standards, ensures durability and efficiency.

Doosan's global network, with localized manufacturing and distribution, ensures efficient service and timely delivery. This proximity fosters strong customer relationships and tailored solutions, with continued investment in regional hubs for enhanced support.

The company leads in sustainable energy, investing in hydrogen fuel cells, offshore wind, and carbon capture. Doosan Fuel Cell secured substantial orders by 2024, demonstrating market traction for its hydrogen solutions.

These clean energy offerings help customers meet environmental goals and comply with regulations. Doosan's portfolio supports the transition from fossil fuels, aligning with climate agreements.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Integrated Industrial Solutions | Providing a comprehensive range of products and services, simplifying procurement and supply chain management for clients. | Doosan Bobcat sales increased significantly in 2023, indicating strong customer trust in their diverse equipment offerings. |

| Technological Innovation | Developing cutting-edge, efficient, and sustainable technologies to solve complex industrial problems. | World's first all-electric compact loaders developed; significant advancements in Small Modular Reactors (SMRs) and hydrogen turbines. |

| Reliability and Performance | Delivering durable, high-performing equipment that consistently meets and exceeds expectations in challenging conditions. | Adherence to stringent global quality standards ensures machinery durability and efficiency, minimizing operational disruptions. |

| Global Network & Localized Support | Leveraging an extensive global presence with localized manufacturing and distribution for efficient service and timely delivery. | Continued investment in regional hubs in 2024 to enhance localized customer support and responsiveness. |

| Sustainable Energy Solutions | Championing eco-friendly technologies like hydrogen fuel cells, offshore wind, and carbon capture to support environmental objectives. | By 2024, Doosan Fuel Cell had secured substantial orders for its hydrogen solutions; Doosan Enerbility actively involved in large-scale offshore wind projects. |

Customer Relationships

Doosan fosters long-term strategic partnerships, particularly with clients involved in substantial projects such as power plant construction and global infrastructure development. These relationships are solidified through a track record of successful project execution and continuous collaborative efforts, building a foundation of trust.

The company's commitment to sustained engagement is evident in its focus on client retention and repeat business, aiming for enduring client satisfaction. For instance, Doosan's involvement in significant infrastructure projects, like the expansion of the Suez Canal or major energy initiatives in the Middle East, often spans many years, underscoring the depth of these strategic alliances.

Doosan distinguishes its customer relationships through dedicated sales and technical support teams. These specialists guide clients through intricate product choices, installations, and ongoing operational hurdles. This hands-on approach ensures customers receive expert advice and solutions precisely tailored to their industrial requirements.

This personalized support is a cornerstone of building lasting client loyalty. For instance, Doosan's commitment to direct engagement means that in 2024, customers seeking complex equipment like excavators or construction machinery had access to highly trained personnel who understood the nuances of their specific projects, fostering trust and repeat business.

Post-sale, Doosan nurtures robust customer connections via comprehensive service and maintenance agreements. These contracts cover essential parts, expert repairs, and performance enhancements for their diverse machinery and systems, ensuring extended product life and peak operational efficiency for clients.

This dedication to ongoing support is a cornerstone of Doosan's customer relationship strategy. For instance, in 2024, Doosan reported a significant portion of its revenue derived from service contracts, highlighting the financial importance of this ongoing engagement. This consistent support builds deep customer trust and loyalty.

Dealer and Distributor Engagement

Doosan places significant emphasis on cultivating robust relationships with its worldwide network of dealers and distributors, especially for its machinery divisions like Doosan Bobcat. This partnership is crucial for market penetration and customer support.

To foster these connections, Doosan actively provides its partners with comprehensive training programs, dedicated marketing assistance, and essential technical resources. This strategic approach ensures that local markets are effectively served and customers receive timely, expert assistance.

- Global Reach: Doosan's indirect sales model, leveraging dealers and distributors, allows for extensive market coverage across diverse geographical regions.

- Partner Support: In 2023, Doosan Bobcat invested significantly in dealer training, with over 10,000 hours delivered globally, enhancing their technical and sales capabilities.

- Customer Proximity: This network ensures that end-users have access to localized sales, service, and parts, improving overall customer satisfaction and operational uptime for machinery.

Community Involvement and Corporate Social Responsibility (CSR)

Doosan actively cultivates strong ties with its operating communities through dedicated Corporate Social Responsibility (CSR) programs and encourages employee volunteerism. This dedication to social impact, often detailed in their sustainability disclosures, cultivates positive public perception and bolsters the company's brand image.

These community engagements underscore Doosan's commitment extending beyond its core business operations, building trust and mutual respect. For instance, Doosan Heavy Industries & Construction's efforts in South Korea often focus on environmental conservation and local economic development, reflecting a deep-seated commitment.

- Community Engagement: Doosan's CSR initiatives aim to create shared value with local stakeholders.

- Reputation Enhancement: Active participation in community development strengthens Doosan's brand and social license to operate.

- Employee Volunteerism: Encouraging employees to volunteer fosters a sense of social responsibility and connection.

- Sustainability Reporting: Transparency in sustainability reports details Doosan's commitment to social and environmental well-being.

Doosan prioritizes deep, long-term partnerships, especially with clients on large-scale projects like power plants and global infrastructure, built on a history of successful execution and collaboration.

This focus on client retention is evident in their multi-year involvement in projects such as the Suez Canal expansion, demonstrating enduring client satisfaction and repeat business.

Dedicated sales and technical teams offer tailored guidance, from product selection to ongoing operations, ensuring clients receive expert, project-specific solutions.

Doosan also nurtures relationships through comprehensive service and maintenance agreements, securing extended product life and peak efficiency, which in 2024 contributed significantly to their service revenue.

Channels

For substantial and intricate projects like power plants, infrastructure, and defense, Doosan leverages its direct sales teams and participates in competitive bidding. This approach facilitates direct negotiation and tailored solutions, fostering close client relationships.

This direct channel is especially suited for high-value, long-term sales cycles. For instance, in 2024, Doosan Heavy Industries & Construction secured a significant contract for a power plant project, demonstrating the effectiveness of this direct engagement model in securing large-scale infrastructure deals.

Doosan's construction and compact machinery, notably under the Doosan Bobcat banner, relies heavily on a vast global network of dealers and distributors. These partners are crucial for reaching customers worldwide, offering essential sales, service, and parts support directly in local markets.

This extensive channel strategy is key to Doosan's market penetration, ensuring that end-users have accessible and localized support for their equipment needs. In 2023, Doosan Bobcat reported strong performance, with net sales reaching $10.9 billion, reflecting the effectiveness of its distribution channels in driving global sales and customer satisfaction.

Doosan maintains a global network of service centers and parts distribution centers to support its extensive installed base of equipment. These facilities are vital for providing customers with timely maintenance, expert repairs, and access to genuine spare parts, all of which are critical for minimizing operational downtime.

In 2024, Doosan continued to invest in optimizing its parts distribution logistics. For instance, the company's focus on efficient inventory management and strategic placement of distribution hubs aims to reduce delivery times for essential components, directly impacting customer satisfaction and operational continuity.

Online Platforms and Digital Presence

Doosan utilizes its extensive online presence, including corporate and subsidiary websites, to communicate vital information to investors and stakeholders. These platforms are central to their investor relations efforts and provide detailed insights into sustainability initiatives and product offerings. For instance, Doosan Heavy Industries & Construction (now Doosan Enerbility) actively uses its website to share annual reports and ESG performance data, enhancing transparency.

While not always direct sales channels, these digital touchpoints are critical for building trust and providing accessibility to information about Doosan's diverse business portfolio. The company's digital strategy focuses on creating a seamless experience for users seeking information, thereby supporting overall stakeholder engagement and corporate reputation. In 2024, Doosan continued to invest in enhancing its digital platforms to ensure up-to-date and easily navigable content for all audiences.

Key aspects of Doosan's digital presence include:

- Investor Relations Hub: Dedicated sections on corporate websites offering financial reports, stock information, and investor event schedules.

- Sustainability Reporting: Digital dissemination of Environmental, Social, and Governance (ESG) reports, showcasing commitment to responsible business practices.

- Product Information Portals: Detailed specifications, case studies, and brochures for Doosan's wide range of industrial equipment and solutions.

- Stakeholder Engagement: Platforms designed for feedback, inquiries, and building relationships with customers, partners, and the broader community.

Industry Trade Shows, Exhibitions, and Conferences

Doosan actively participates in key global and regional industry trade shows, exhibitions, and conferences. These events are crucial for unveiling new products and technologies, fostering relationships, and demonstrating innovations directly to potential customers and partners.

These platforms are instrumental for enhancing market visibility and generating qualified leads. For instance, in 2024, Doosan showcased its latest heavy construction equipment at major events like Bauma, the world's leading trade fair for construction machinery, which typically draws over 600,000 visitors and thousands of exhibitors.

- Product Showcase: Demonstrating new excavators, wheel loaders, and compact equipment.

- Relationship Building: Engaging with existing clients, distributors, and potential business partners.

- Market Intelligence: Gathering insights on competitor activities and emerging industry trends.

- Lead Generation: Capturing contact information from interested attendees for future sales follow-up.

Doosan employs a multi-faceted channel strategy to reach its diverse customer base. For large-scale projects, direct sales teams and competitive bidding are utilized, enabling tailored solutions and strong client relationships, particularly for high-value, long-term contracts. Doosan Bobcat, on the other hand, relies on an extensive global dealer and distributor network for its construction and compact machinery, ensuring localized sales and support.

These channels are supported by a robust network of service and parts distribution centers, critical for minimizing customer downtime and ensuring operational continuity. Doosan also leverages its digital presence, including corporate websites, for investor relations and information dissemination, with a focus on transparency and stakeholder engagement.

Furthermore, participation in industry trade shows and exhibitions serves as a vital platform for product launches, lead generation, and market intelligence gathering, reinforcing Doosan's market visibility and engagement with industry professionals. In 2023, Doosan Bobcat's net sales reached $10.9 billion, underscoring the effectiveness of its broad channel approach.

Customer Segments

Governmental and public sector agencies, encompassing national and local administrations, alongside state-owned enterprises and public utilities, represent a key customer segment for Doosan. These entities frequently procure Doosan's offerings for critical infrastructure development, power generation projects, and the supply of heavy machinery essential for public works and defense initiatives.

A significant driver for this segment is the demand for robust, large-scale, and enduring solutions. For instance, in 2024, governments worldwide continued to invest heavily in renewable energy infrastructure, a sector where Doosan's power generation technologies are highly relevant. Public spending on infrastructure projects, such as transportation networks and water management systems, also fuels demand for Doosan's heavy equipment, with many nations allocating substantial budgets towards modernization efforts.

Large industrial and commercial enterprises, including major players in construction, mining, manufacturing, and general industry, form a core customer segment for Doosan. These businesses depend on Doosan for essential heavy equipment, comprehensive industrial solutions, and high-performance components that drive their core operations.

Customers in this segment prioritize robust, highly efficient, and technologically sophisticated machinery designed to optimize their demanding operational environments. For instance, Doosan's excavator sales in 2023 saw significant demand from these sectors, reflecting their ongoing investment in infrastructure and resource extraction projects.

Doosan addresses the unique needs of these large enterprises by offering tailored solutions, ensuring their equipment meets specific operational requirements and performance benchmarks. This focus on customization and reliability is crucial for sectors where downtime can result in substantial financial losses.

Power Generation and Energy Companies are a cornerstone customer segment for Doosan. This group encompasses traditional utilities and independent power producers (IPPs) who require robust solutions for electricity generation across diverse technologies, including nuclear, gas turbines, and increasingly, renewable sources like wind and solar, as well as emerging hydrogen power plants.

Doosan supports these clients by supplying critical equipment, offering comprehensive Engineering, Procurement, and Construction (EPC) services for complex energy projects, and providing ongoing maintenance to ensure operational efficiency and longevity. For example, in 2024, Doosan Electro-Materials saw significant growth driven by demand from the renewable energy sector, supplying advanced components for wind turbine manufacturing.

A key trend within this segment is the accelerating shift towards clean and sustainable energy sources. Companies are actively investing in decarbonization strategies, driving demand for Doosan's solutions in areas such as advanced gas turbines capable of running on hydrogen blends and components for offshore wind farms. The global renewable energy market is projected to reach trillions by the late 2020s, underscoring the strategic importance of this transition for Doosan's energy clients.

Construction and Agricultural Contractors

Construction and agricultural contractors, from small landscaping outfits to large-scale building firms, represent a core customer base for Doosan. These businesses rely heavily on the durability, efficiency, and versatility of Doosan's equipment, including excavators, loaders, and tractors, to get their demanding jobs done. Doosan Bobcat, in particular, focuses on meeting the specific needs of this diverse segment.

In 2024, the construction equipment market continued to see robust demand, with global sales of construction machinery projected to reach over $200 billion. This growth is fueled by infrastructure development and housing projects worldwide, directly benefiting companies like Doosan that supply essential machinery to contractors.

- Equipment Needs: Contractors require reliable excavators, wheel loaders, skid-steer loaders, and compact track loaders for a wide range of tasks, from site preparation to material handling.

- Value Proposition: Key purchasing drivers include machine uptime, fuel efficiency, operator comfort, and the availability of specialized attachments to enhance versatility.

- Market Trends: The adoption of telematics and digital solutions for fleet management is increasing, allowing contractors to monitor equipment performance and optimize operations.

- Doosan Bobcat Focus: This division specifically caters to these segments with a comprehensive lineup of compact equipment designed for productivity and ease of use in various jobsite conditions.

Semiconductor and Advanced Materials Manufacturers

Doosan's customer segment of Semiconductor and Advanced Materials Manufacturers is crucial, driven by the increasing demand for sophisticated electronic components. Through subsidiaries like Doosan Tesna, the company offers essential wafer testing services and specialized electronic materials, vital for the production of semiconductors. This sector demands unparalleled precision and consistently high quality, areas where Doosan focuses its specialized solutions.

The strategic emphasis on advanced materials aligns with the dynamic nature of the semiconductor market. For instance, the global semiconductor market was valued at approximately $600 billion in 2023 and is projected to see continued growth, underscoring the importance of suppliers like Doosan who can meet these evolving needs. The performance of this segment is directly tied to the innovation cycles within the electronics industry.

- Key Offerings: Wafer testing services and specialized electronic materials.

- Industry Demands: Precision, high quality, and specialized solutions.

- Market Relevance: Catering to the rapidly evolving high-tech semiconductor industry.

- Strategic Focus: Investment in advanced materials to meet future market needs.

Doosan serves a broad array of customers, from governmental bodies and large industrial enterprises to power generation companies and construction/agricultural contractors. Additionally, the semiconductor and advanced materials sector represents a key, high-tech customer base.

These diverse segments rely on Doosan for heavy machinery, critical infrastructure components, and specialized materials, with purchase decisions often driven by efficiency, reliability, technological sophistication, and tailored solutions.

The global demand for infrastructure development, renewable energy, and advanced electronics continues to fuel growth across these customer segments, with significant market values and projected expansion in the coming years.

| Customer Segment | Key Needs | 2023/2024 Relevance | Doosan's Role |

| Government & Public Sector | Infrastructure, Power Generation, Defense | Continued investment in renewables and modernization (2024) | Supplying heavy machinery, power tech |

| Industrial & Commercial Enterprises | Heavy Equipment, Industrial Solutions | Strong demand in construction, mining (e.g., excavator sales 2023) | Providing efficient, technologically advanced machinery |

| Power Generation & Energy Companies | Electricity Generation Solutions, EPC Services | Growth in renewables, hydrogen power (Doosan Electro-Materials 2024) | Supplying critical equipment, EPC, maintenance |

| Construction & Agricultural Contractors | Durable, Efficient Equipment | Robust construction market (>$200B global sales projected 2024) | Offering excavators, loaders, tractors (Doosan Bobcat) |

| Semiconductor & Advanced Materials Manufacturers | Wafer Testing, Specialized Materials | Semiconductor market valued ~$600B (2023), high-tech demands | Providing wafer testing (Doosan Tesna), advanced materials |

Cost Structure

Manufacturing and production expenses represent a substantial cost driver for Doosan, encompassing the acquisition of raw materials, direct labor, and factory overheads. For instance, in 2023, Doosan Heavy Industries & Construction reported significant expenditures in its production facilities, reflecting the capital-intensive nature of heavy equipment manufacturing.

Energy consumption for operating its global manufacturing plants is another critical component of this cost structure. The company's commitment to energy efficiency initiatives aims to mitigate these rising energy costs, which are particularly impactful in energy-intensive production processes.

Doosan dedicates significant resources to Research and Development, a cornerstone for its innovation across clean energy, smart machinery, and advanced materials. These ongoing investments are vital for staying ahead in competitive markets and cultivating future revenue streams.

For instance, in 2023, Doosan Group's R&D spending was reported to be around 1.4 trillion Korean Won (approximately $1.05 billion USD), underscoring the long-term strategic nature of these expenditures aimed at technological advancement and market leadership.

Doosan's sales, marketing, and distribution costs are substantial, reflecting the global reach of its heavy equipment and industrial products. These expenses cover maintaining a worldwide sales force, running extensive marketing campaigns to build brand recognition, managing complex logistics for product delivery, and supporting a network of dealers and service centers. For instance, in 2023, Doosan Bobcat reported significant investments in marketing and sales initiatives to drive growth in key markets.

Capital Expenditures (CapEx)

Doosan's cost structure heavily relies on significant capital expenditures (CapEx) to maintain and grow its operations. These investments are essential for expanding and upgrading manufacturing facilities, acquiring advanced equipment, and developing crucial infrastructure. For instance, the company committed 400 billion won towards establishing a new plant in Mexico, a clear indicator of their commitment to increasing production capacity and enhancing technological capabilities. Such large-scale outlays are fundamental to staying competitive in the global market.

These capital expenditures directly impact Doosan's financial health and operational capacity. The company's strategic investments are designed to bolster its manufacturing prowess and technological edge, ensuring it can meet growing market demands.

- Manufacturing Facility Upgrades: Ongoing investment in modernizing production lines and expanding plant capacity.

- Equipment Acquisition: Procurement of cutting-edge machinery and technology to improve efficiency and product quality.

- Infrastructure Development: Investment in logistics, R&D centers, and other support infrastructure.

- Strategic Expansion Projects: Such as the 400 billion won investment in a new Mexican plant to boost global manufacturing footprint.

Personnel and Labor Costs

Personnel and labor costs are a significant expense for Doosan, reflecting its extensive global workforce. This includes compensation and benefits for skilled engineers, technicians, and management across its diverse industrial sectors. For instance, Doosan Heavy Industries & Construction, a key subsidiary, employs thousands of individuals worldwide, necessitating substantial investment in human capital.

Managing this international workforce involves considerable human resource expenditure. These costs encompass not only salaries and wages but also comprehensive benefits packages and ongoing training programs to maintain a high level of expertise. In 2023, Doosan Group's total employee-related expenses represented a substantial portion of its overall operating costs, underscoring the importance of efficient workforce management.

- Global Workforce Size: Doosan operates with a workforce numbering in the tens of thousands across its various international operations.

- Key Cost Components: Wages, salaries, health insurance, retirement contributions, and professional development programs are major drivers of personnel expenses.

- Impact of Skilled Labor: The need for specialized engineering and technical talent in sectors like construction, energy, and machinery directly influences labor cost intensity.

- HR Investment: Significant resources are allocated to recruitment, retention, and training to manage a diverse and geographically dispersed employee base effectively.

Doosan's cost structure is dominated by manufacturing and production expenses, including raw materials and factory overheads. Energy consumption for its global plants is another significant cost, with initiatives focused on efficiency. R&D is a major investment, evidenced by approximately 1.4 trillion Korean Won spent in 2023 by Doosan Group to drive innovation.

Sales, marketing, and distribution costs are substantial due to Doosan's global reach, covering sales forces, marketing campaigns, and logistics. Capital expenditures are also critical for maintaining and expanding operations, such as the 400 billion won investment in a new Mexican plant. Personnel and labor costs, encompassing a large global workforce, represent a considerable expense, including wages, benefits, and training.

| Cost Category | Key Components | 2023 Data/Examples |

|---|---|---|

| Manufacturing & Production | Raw materials, direct labor, factory overhead | Significant expenditures reported by Doosan Heavy Industries & Construction |

| Energy Consumption | Electricity, fuel for plant operations | Impactful in energy-intensive processes; focus on efficiency |

| Research & Development (R&D) | Innovation in clean energy, smart machinery | Approx. 1.4 trillion KRW ( ~$1.05B USD) by Doosan Group in 2023 |

| Sales, Marketing & Distribution | Global sales force, marketing campaigns, logistics | Investments by Doosan Bobcat to drive market growth |

| Capital Expenditures (CapEx) | Facility upgrades, equipment acquisition, infrastructure | 400 billion KRW for new plant in Mexico |

| Personnel & Labor | Wages, benefits, training for global workforce | Substantial portion of operating costs for Doosan Group |

Revenue Streams

Doosan's primary revenue comes from selling heavy equipment like excavators, loaders, and forklifts, a significant contributor, especially through its Doosan Bobcat brand. In 2024, the construction equipment market saw robust activity, with global sales expected to grow, driven by infrastructure development and urbanization trends.

Revenue streams for power plant and infrastructure projects are primarily derived from large-scale Engineering, Procurement, and Construction (EPC) contracts. These contracts cover a wide range of projects, including nuclear, gas, combined cycle, and renewable energy power plants, as well as significant infrastructure developments. Doosan Enerbility plays a crucial role in this segment, contributing substantially to the company's project-based income.

These EPC contracts are typically characterized by their high value and long-term nature, offering a consistent and substantial income flow. For instance, as of the first quarter of 2024, Doosan Enerbility secured new orders worth approximately 2.1 trillion Korean Won (around $1.5 billion USD), with a significant portion attributed to these large-scale projects, demonstrating the ongoing demand and revenue generation potential in this sector.

Doosan generates a predictable income through its after-sales services, spare parts sales, and maintenance agreements. This revenue stream is crucial as it supports the extensive installed base of construction equipment and power generation solutions. For instance, in 2023, Doosan Bobcat reported a significant portion of its revenue coming from parts and services, highlighting the stability these offerings provide.

Advanced Components and Materials Sales

Revenue flows from the sale of specialized components and advanced materials, a significant area for Doosan, particularly within the semiconductor and electronics sectors. Subsidiaries like Doosan Tesna are key players here, supplying high-value products to technology-driven markets. This revenue stream highlights Doosan's strategic expansion into advanced technology areas.

This diversification is evident in Doosan Tesna's performance. For instance, in 2023, Doosan Tesna reported a revenue of approximately KRW 1.1 trillion, showcasing the substantial contribution of these advanced materials and components to the group's overall financial health. This segment is crucial for capturing growth in cutting-edge industries.

- Specialized Components: High-margin sales of critical parts for advanced manufacturing processes.

- Advanced Materials: Revenue from proprietary materials used in electronics and semiconductors.

- Subsidiary Contribution: Doosan Tesna's significant role in generating revenue from these niche markets.

- Market Focus: Targeting high-growth, technology-intensive sectors for premium pricing.

Emerging Clean Energy Solutions

Doosan is actively diversifying its revenue through advanced clean energy technologies. This includes significant investments and early revenue generation from hydrogen fuel cells, which are gaining traction in various industrial and transportation sectors. The company is also making strides in Small Modular Reactors (SMRs), positioning itself for future growth in the nuclear energy market.

Furthermore, Doosan is developing and commercializing Carbon Capture, Utilization, and Storage (CCUS) solutions, tapping into the growing demand for emissions reduction technologies. These emerging clean energy streams are strategically aligned with global sustainability mandates and the ongoing energy transition, indicating substantial future revenue potential.

- Hydrogen Fuel Cells: Doosan Fuel Cell saw its order backlog reach approximately 1.7 trillion Korean won by the end of 2023, demonstrating strong market demand.

- Small Modular Reactors (SMRs): Doosan Enerbility secured a key contract in early 2024 for the development of SMR components, signaling progress in this high-growth area.

- CCUS Technologies: The company is actively pursuing pilot projects and partnerships for CCUS, aiming to capture and repurpose CO2 emissions from industrial sites.

- Market Alignment: These solutions directly address the global push towards decarbonization, with the clean energy market projected for substantial expansion in the coming decade.

Doosan's revenue streams are diverse, encompassing heavy equipment sales, large-scale EPC contracts for power and infrastructure, aftermarket services, specialized components for technology sectors, and emerging clean energy solutions.

The company's construction equipment division, notably Doosan Bobcat, generates significant income from sales of excavators, loaders, and other machinery, benefiting from global infrastructure investments. In 2024, the construction equipment market is experiencing robust growth, driven by urbanization and infrastructure development projects worldwide.

Doosan Enerbility is a key contributor through its EPC contracts for power plants and infrastructure, securing substantial new orders. For example, in Q1 2024, Doosan Enerbility's new orders reached approximately KRW 2.1 trillion, underscoring the revenue generated from these long-term, high-value projects.

After-sales services, spare parts, and maintenance agreements provide a stable income, supporting Doosan's extensive installed base. Doosan Bobcat, in 2023, saw a considerable portion of its revenue derived from these service-related offerings, demonstrating their consistent contribution.

The sale of specialized components and advanced materials, particularly for the semiconductor and electronics industries through Doosan Tesna, represents another vital revenue stream. Doosan Tesna's 2023 revenue of approximately KRW 1.1 trillion highlights the financial significance of these high-tech market contributions.

Emerging clean energy technologies, including hydrogen fuel cells and Small Modular Reactors (SMRs), are increasingly contributing to Doosan's revenue and future growth prospects. Doosan Fuel Cell's order backlog reached around KRW 1.7 trillion by the end of 2023, indicating strong market acceptance for these sustainable solutions.

| Revenue Stream | Key Activities/Products | 2023/2024 Data Points |

|---|---|---|

| Heavy Equipment | Excavators, loaders, forklifts (Doosan Bobcat) | Global construction equipment market robust in 2024. |

| EPC Contracts | Power plants, infrastructure projects (Doosan Enerbility) | Q1 2024 new orders for Doosan Enerbility: ~KRW 2.1 trillion. |

| After-Sales & Services | Spare parts, maintenance agreements | Significant portion of Doosan Bobcat revenue in 2023. |

| Specialized Components & Materials | Semiconductor/electronics components (Doosan Tesna) | Doosan Tesna 2023 revenue: ~KRW 1.1 trillion. |

| Clean Energy Technologies | Hydrogen fuel cells, SMRs, CCUS | Doosan Fuel Cell order backlog end of 2023: ~KRW 1.7 trillion. |

Business Model Canvas Data Sources

The Doosan Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and operational performance metrics. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.