Doosan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doosan Bundle

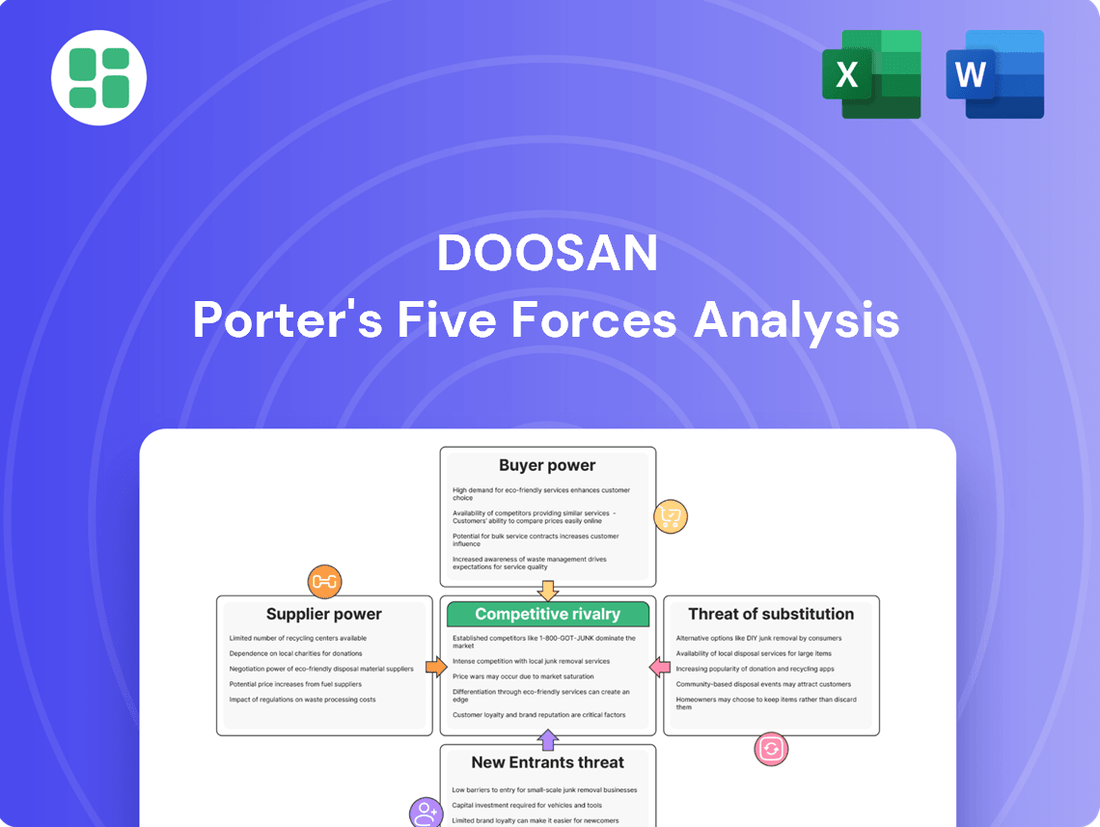

Doosan's competitive landscape is shaped by powerful forces, from the bargaining power of its numerous buyers to the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for any stakeholder seeking to navigate this industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Doosan’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Doosan's extensive operations, especially in power generation and heavy machinery, create a strong reliance on specialized components and advanced materials. For instance, suppliers of critical parts for gas turbines and advanced robotics hold considerable power because these items are unique and not easily sourced elsewhere.

This dependency means Doosan can face increased input costs and potential supply chain disruptions if it cannot find readily available alternatives for these specialized parts. In 2023, the global industrial machinery sector saw average raw material costs rise by approximately 7%, directly impacting companies like Doosan that depend on specialized inputs.

Raw material volatility significantly impacts Doosan's bargaining power of suppliers. The heavy industry relies on commodities like steel and copper, whose prices can swing wildly. For instance, in early 2024, global steel prices saw an upward trend due to increased demand from infrastructure projects and supply chain constraints, directly affecting Doosan's input costs.

Suppliers gain leverage when markets are tight or when geopolitical events disrupt supply chains, as seen with disruptions affecting rare earth element availability in 2023. This can lead to higher prices and reduced availability for Doosan. To counter this, Doosan employs strategies like securing long-term contracts and diversifying its supplier base to stabilize costs and ensure consistent material flow.

Suppliers who possess unique or patented technologies, vital for Doosan's advanced offerings, wield significant influence. For instance, a supplier of specialized materials for Doosan's construction machinery or proprietary software for its energy solutions can command higher prices if alternatives are scarce.

Doosan's reliance on these innovations means that disruptions or price hikes from such suppliers can directly impact its product development cycles and market competitiveness. In 2024, the semiconductor shortage, for example, highlighted how critical component suppliers can hold immense power, affecting production across various industries, including heavy equipment manufacturing.

To mitigate this, Doosan likely invests in strong partnerships and explores internal research and development to reduce dependence on single-source, high-value technology providers.

Limited Supplier Base

In specialized segments of its operations, Doosan may encounter a limited pool of suppliers possessing the necessary technical expertise and quality certifications. This scarcity directly amplifies the leverage these suppliers hold, as Doosan faces substantial costs and operational disruptions when attempting to switch providers. For instance, in advanced materials or critical component manufacturing, reliance on a few key suppliers can create significant dependencies.

The bargaining power of these limited suppliers stems from their ability to dictate terms, pricing, and delivery schedules, especially when Doosan's production lines depend on their specialized inputs. This concentration risk is a critical consideration for Doosan's procurement strategy. For example, if a key supplier for Doosan's construction equipment engines has limited production capacity, they can command higher prices.

- Limited Supplier Base: In highly specialized sectors, Doosan's access to qualified suppliers for critical components or advanced materials can be restricted.

- Increased Supplier Leverage: A concentrated supply market empowers existing suppliers to negotiate more favorable terms, potentially increasing Doosan's input costs.

- Switching Costs and Delays: Identifying and onboarding new suppliers for specialized needs can involve significant time, expense, and potential production interruptions for Doosan.

- Mitigation Strategy: Proactive supply chain diversification and building strong relationships with a broader range of qualified vendors are crucial for Doosan to reduce supplier dependency.

Forward Integration Threat

While not a frequent occurrence, the threat of forward integration by suppliers, particularly those with advanced technology, could see them moving into producing sub-assemblies or even directly competing with Doosan on certain components. For instance, a major hydraulics supplier might develop its own compact excavation units, directly challenging Doosan's market share in that segment.

This potential for suppliers to become competitors underscores the importance of Doosan cultivating robust, collaborative relationships. Maintaining open communication and understanding supplier roadmaps can provide early warnings of such integration efforts. Doosan's strategy might involve investing in joint ventures or strategic alliances with critical suppliers, thereby aligning interests and mitigating the risk of direct competition.

Consider the implications for Doosan's supply chain resilience. In 2024, Doosan Heavy Industries & Construction reported significant investments in R&D, aiming to enhance its own technological capabilities. This internal focus can reduce reliance on suppliers who might otherwise be tempted to integrate forward. For example, if Doosan develops proprietary engine technology, it lessens the leverage of external engine manufacturers who could potentially enter Doosan's core markets.

- Forward Integration by Suppliers: Large, technologically advanced suppliers may integrate forward into manufacturing sub-assemblies or compete directly with Doosan.

- Strategic Alliances: Doosan should foster strong collaborative relationships, potentially through joint ventures or strategic alliances, with key suppliers.

- Doosan's R&D Investment: Doosan's commitment to research and development, such as its 2024 R&D spending, can bolster its own capabilities and reduce supplier leverage.

Doosan faces significant supplier bargaining power due to its reliance on specialized components and advanced materials, particularly in sectors like power generation and heavy machinery. Suppliers of unique or patented technologies, essential for Doosan's product innovation, can command higher prices and dictate terms, especially when alternatives are scarce. For instance, the semiconductor shortage in 2024 demonstrated how critical component suppliers can wield immense power, impacting production across industries, including heavy equipment.

The limited availability of qualified suppliers in highly specialized areas further amplifies their leverage. This concentration risk means Doosan can experience increased input costs and potential production delays if key suppliers face capacity constraints or supply chain disruptions. In 2023, rising raw material costs by approximately 7% in the industrial machinery sector underscored this vulnerability.

To counter this, Doosan focuses on diversifying its supplier base and securing long-term contracts. Investing in research and development to enhance internal capabilities, as seen in Doosan Heavy Industries & Construction's 2024 R&D investments, also plays a crucial role in reducing dependence on external providers and mitigating the risk of suppliers integrating forward into Doosan's markets.

| Factor | Impact on Doosan | Mitigation Strategy |

|---|---|---|

| Specialized Components | High supplier leverage due to unique nature | Supplier diversification, long-term contracts |

| Advanced Technologies | Supplier control over pricing and terms | Strategic alliances, internal R&D investment |

| Limited Supplier Pool | Increased input costs, supply chain risks | Building strong supplier relationships, proactive sourcing |

| Forward Integration Threat | Potential for direct competition | Open communication with suppliers, joint ventures |

What is included in the product

This analysis unpacks the competitive forces shaping Doosan's industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly visualize competitive pressures with a dynamic, interactive dashboard that pinpoints areas needing strategic attention.

Customers Bargaining Power

Doosan's core clientele in power generation and infrastructure includes major utilities, government bodies, and large industrial conglomerates. These entities frequently undertake massive, multi-year procurement cycles for projects valued in the billions, affording them considerable leverage through the sheer scale and strategic significance of their acquisitions.

These substantial customers typically require bespoke solutions, aggressive pricing strategies, and advantageous contractual conditions. For instance, a single large power plant project can represent a significant portion of Doosan's annual revenue, making the customer's negotiation position particularly strong.

Doosan Bobcat's customer base in construction equipment is remarkably diverse, ranging from massive construction conglomerates to individual contractors. Large fleet purchasers, by virtue of their substantial order volumes, wield considerable bargaining power. For instance, in 2023, major rental companies often negotiate bulk discounts, impacting Doosan's per-unit pricing.

However, the collective demand of smaller, independent contractors represents a significant market force. While their individual impact is limited, their aggregated purchasing decisions heavily influence overall market trends and product development priorities for Doosan. This segment often prioritizes reliability and serviceability, shaping Doosan's support strategies.

Doosan's extensive global sales network and a broad product portfolio are key strategies to effectively serve these varied customer segments. This allows them to tailor offerings and support to meet the distinct needs and purchasing power of each group, thereby managing overall customer bargaining power.

In commodity markets where Doosan's products are standardized, customer price sensitivity is heightened. This means buyers readily switch suppliers based on minor price differences, putting pressure on Doosan to align its pricing with competitors. For instance, in the market for smaller steam turbines, under 50 MW, where differentiation is minimal, this price competition is particularly intense.

Switching Costs and Long-Term Relationships

While Doosan's heavy equipment, like excavators and loaders, represents a significant initial capital investment with long operational lifespans, which naturally fosters some customer loyalty, the landscape for switching costs is evolving. The increasing availability of third-party maintenance, parts, and service providers can erode this initial stickiness, giving customers more options to service their existing equipment without relying solely on Doosan. This means Doosan must actively work to retain its customer base beyond the initial sale.

Doosan's strategy to counter this involves a strong emphasis on cultivating enduring customer relationships and delivering robust after-sales support. By offering comprehensive service packages, readily available genuine parts, and responsive technical assistance, Doosan aims to make the total cost of ownership more attractive and to build trust, thereby diminishing the customer's inclination to explore alternative service providers or equipment manufacturers. This focus is crucial as the industry sees a greater fragmentation in the aftermarket service sector.

- Customer Retention Focus: Doosan prioritizes building long-term relationships to mitigate the impact of potential third-party service competition.

- After-Sales Service Value: The company invests in comprehensive after-sales services and parts availability to enhance customer loyalty.

- Switching Cost Mitigation: By offering superior service and support, Doosan aims to make switching to competitors less appealing despite the availability of alternative maintenance options.

Customer Knowledge and Information

Customers within Doosan's diverse industrial sectors, such as heavy machinery and construction equipment, are increasingly well-informed. They readily access detailed product specifications, compare market pricing, and thoroughly research competitor alternatives. This heightened awareness significantly strengthens their ability to negotiate favorable terms.

The widespread availability of information, including industry benchmarks and performance data, equips customers with the leverage to demand better value. For instance, in the global construction equipment market, where Doosan operates, price transparency has increased, allowing buyers to easily identify cost differences between manufacturers. In 2024, the average price for a new mid-size excavator saw a 3% increase year-over-year, making informed comparisons crucial for buyers.

To counter this, Doosan must consistently highlight its unique selling propositions. This involves showcasing technological advancements, superior product quality, and exceptional after-sales service. Maintaining customer loyalty hinges on demonstrating tangible value that transcends mere price, ensuring Doosan remains the preferred choice in a competitive landscape.

- Informed Buyers: Customers in Doosan's markets possess deep knowledge of product features and pricing.

- Information Accessibility: Online resources and industry reports empower customers to negotiate effectively.

- Value Proposition: Doosan must continuously prove its superiority in technology, quality, and service to retain customers.

- Market Dynamics: In 2024, the construction equipment sector saw price adjustments, amplifying the need for customer information and competitive differentiation.

Doosan's customers, particularly large utilities and government bodies in the power sector, wield significant bargaining power due to the immense scale and strategic importance of their projects. These buyers often procure billions worth of equipment, allowing them to demand customized solutions and aggressive pricing. For example, a single large power plant contract can represent a substantial portion of Doosan's annual revenue, amplifying the customer's negotiation leverage.

In the construction equipment segment, large fleet purchasers also exert considerable influence through bulk orders, securing discounts. While individual contractors have less sway, their collective purchasing power shapes market trends. Doosan Bobcat experienced this in 2023 when major rental companies negotiated significant volume discounts. The company's strategy to manage this involves tailored offerings and robust after-sales support, aiming to build loyalty beyond initial price points.

The increasing transparency in pricing and product information, especially in the construction equipment market, further empowers Doosan's customers. Buyers in 2024 are well-equipped to compare specifications and costs, as evidenced by a 3% year-over-year increase in mid-size excavator prices, making informed comparisons critical. Doosan counters this by emphasizing technological innovation, product quality, and superior after-sales service to justify its value proposition.

Preview the Actual Deliverable

Doosan Porter's Five Forces Analysis

This preview showcases the comprehensive Doosan Porter's Five Forces Analysis you will receive immediately after purchase, offering an in-depth examination of the competitive landscape. You're looking at the actual document, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Doosan's industry. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic planning.

Rivalry Among Competitors

Doosan operates in global markets for heavy equipment and power solutions that are quite concentrated, meaning a few big companies dominate. This leads to really tough competition from well-known players.

In the construction equipment sector, Doosan goes head-to-head with giants like Caterpillar, Komatsu, SANY, Volvo Construction Equipment, and Hitachi Construction Machinery. These companies often have vast product lines and extensive dealer networks, making it challenging to gain market share.

For power generation, Doosan faces formidable rivals such as Siemens AG, General Electric, and Mitsubishi Heavy Industries. These competitors are known for their advanced technology and large-scale project capabilities, particularly in the evolving energy landscape of 2024.

Competitive rivalry in this sector is fierce, driven by an ongoing race for technological supremacy. Companies are pouring significant resources into research and development to create solutions that are not only advanced and efficient but also environmentally sustainable. This push is evident in the rapid adoption of electrification, hydrogen power, automation, and AI within construction and heavy machinery.

Doosan, for instance, demonstrates this commitment through its investments in Small Modular Reactors (SMRs), advanced gas turbines, and wind power technologies, highlighting the industry-wide effort to lead in next-generation solutions. This intense innovation cycle means that staying ahead requires constant adaptation and substantial capital expenditure on new technologies.

In mature segments of Doosan's business, like some construction equipment and traditional power components, intense competition leads to significant pricing pressure. Competitors actively battle for market share, which can squeeze profit margins and highlight the need for greater operational efficiency. For example, Doosan Enerbility's revenue has been affected by the winding down of large coal engineering, procurement, and construction (EPC) projects.

Diversified Portfolio Competition

Doosan's diversified conglomerate structure means it faces a wide array of competitors across its many business segments. This broad competitive exposure necessitates navigating distinct market dynamics, from the highly fragmented compact equipment sector where Doosan Bobcat competes, to the capital-intensive and technologically advanced energy solutions market occupied by Doosan Enerbility. For instance, in the construction equipment arena, Doosan Bobcat contends with giants like Caterpillar and John Deere, while Doosan Enerbility faces established players in the nuclear and renewable energy sectors.

This diversification, while a strategic advantage for risk management, presents a significant challenge in terms of competitive rivalry. Doosan must effectively manage and respond to different competitive pressures simultaneously. The company's ability to maintain market share and profitability hinges on its capacity to adapt strategies tailored to each specific industry's competitive intensity and structure.

In 2024, the construction equipment market, where Doosan Bobcat operates, saw continued robust demand, particularly in North America and Europe, driven by infrastructure spending and residential construction. However, this segment also experiences intense price competition and a constant need for product innovation to meet evolving environmental regulations and customer preferences. Doosan Bobcat's performance is directly impacted by its ability to compete effectively against rivals who also invest heavily in R&D and global distribution networks.

Meanwhile, Doosan Enerbility operates in sectors with higher barriers to entry but also faces competition from both traditional energy providers and emerging renewable energy technology companies. The global energy transition is intensifying competition, with companies vying for contracts in nuclear power plant construction and maintenance, as well as in the rapidly growing offshore wind and hydrogen energy markets. Doosan Enerbility’s competitive standing is influenced by its technological capabilities, project execution track record, and its ability to secure large-scale, long-term contracts amidst evolving energy policies and technological advancements.

- Doosan Bobcat competes in the construction equipment market against major players like Caterpillar and John Deere, facing intense price competition and a need for continuous innovation.

- Doosan Enerbility operates in capital-intensive energy sectors, competing with established firms and new entrants in nuclear, renewable energy, and emerging technologies like hydrogen.

- The company's diversified nature requires managing multiple, distinct competitive landscapes, demanding tailored strategies for each business unit to maintain market position.

- In 2024, infrastructure spending supported the construction equipment market, while the energy sector saw increased competition driven by the global energy transition.

Regional and Strategic Alliances

Competitive rivalry extends beyond direct product competition to encompass strategic alliances and regional market strengths. Companies often form partnerships to enhance market access, share the costs and risks of significant projects, or speed up the development and adoption of new technologies. These collaborations can create formidable barriers to entry for outsiders and solidify the market position of allied firms.

Doosan actively participates in such strategic collaborations. For instance, Doosan Enerbility is part of the 'Team Korea Consortium for Gas Turbine Exports,' a strategic alliance specifically targeting the North American market. This consortium aims to leverage collective expertise and resources to secure a substantial share of the growing demand for gas turbines in the region.

These alliances can significantly impact market dynamics:

- Market Access: Alliances can provide immediate entry into new geographic regions or customer segments that would be difficult to penetrate independently.

- Resource Pooling: Competitors may join forces to bid on and execute large-scale projects requiring substantial capital, technology, and human resources, such as major infrastructure developments or advanced manufacturing initiatives.

- Technology Acceleration: Partnerships can foster joint research and development, leading to faster innovation cycles and the creation of proprietary technologies that give allied firms a competitive edge.

Doosan faces intense competition across its diverse business segments, from construction equipment to power solutions. Major global players like Caterpillar, Komatsu, Siemens, and General Electric are constant rivals, pushing for innovation and market share. This rivalry is particularly acute in 2024, with companies heavily investing in advanced technologies like electrification and hydrogen power to meet sustainability demands and gain a competitive edge.

The construction equipment market, where Doosan Bobcat operates, is characterized by fierce price competition and the need for continuous product development to meet evolving environmental standards. In the energy sector, Doosan Enerbility competes with established giants and emerging renewable energy firms, especially in the rapidly expanding markets for nuclear, offshore wind, and hydrogen technologies.

| Company | Primary Sector | Key Competitors | 2024 Market Focus |

|---|---|---|---|

| Doosan Bobcat | Construction Equipment | Caterpillar, John Deere, Komatsu | Infrastructure spending, compact equipment innovation |

| Doosan Enerbility | Power Solutions | Siemens, GE, Mitsubishi Heavy Industries | Renewable energy, gas turbines, SMRs |

SSubstitutes Threaten

The rise of electric and hydrogen construction equipment presents a significant threat of substitution for Doosan's traditional diesel offerings. As of early 2024, global investment in green construction technology is rapidly increasing, with major players like Volvo CE and Caterpillar investing heavily in battery-electric and hydrogen fuel cell prototypes. This shift is driven by stricter emissions standards and a growing demand for sustainable building practices.

The rise of renewable energy technologies presents a substantial threat of substitution for Doosan Enerbility, a company historically focused on conventional power generation. As solar and wind power become increasingly cost-competitive, they offer viable alternatives to traditional fossil fuel-based plants. For instance, in 2023, the global levelized cost of electricity for onshore wind was approximately $29 per megawatt-hour, and for solar PV, it was around $34 per megawatt-hour, making them increasingly attractive options compared to new fossil fuel plants.

This shift means that new power plant construction projects are more likely to favor renewables, directly impacting Doosan Enerbility's core business. The declining costs and improving efficiency of these green technologies are accelerating their adoption worldwide. By mid-2024, renewable energy sources are projected to account for a significant portion of new power capacity additions globally, further intensifying this substitution pressure.

Large-scale, centralized power generation, a core business for Doosan, is increasingly facing substitution from distributed energy generation (DEG) solutions. These include onsite solar installations, battery storage systems, and fuel cells, all of which allow energy to be produced closer to where it's consumed.

These localized DEG systems offer enhanced resilience, meaning they can continue to provide power even if the main grid experiences disruptions. Furthermore, they can respond to energy demand more rapidly than traditional, large-scale power plants, thereby diminishing the need for extensive grid infrastructure.

The market for distributed energy resources is growing significantly. For instance, the global distributed generation market was valued at approximately $230 billion in 2023 and is projected to reach over $400 billion by 2030, indicating a strong trend towards these alternative energy sources.

Advanced Nuclear and Hydrogen as Alternatives

Doosan's strategic investments in advanced nuclear (Small Modular Reactors - SMRs) and hydrogen power position them to capitalize on the global energy transition. However, these very technologies represent significant substitutes for Doosan's existing offerings in conventional nuclear and fossil fuel power generation.

The escalating drive towards decarbonization means that continuous innovation in these cleaner energy alternatives is paramount. For instance, by mid-2024, the global hydrogen market was valued at approximately $183 billion, with projections indicating substantial growth driven by government incentives and industrial demand for cleaner fuels. Similarly, SMR development is gaining momentum, with several countries, including the United States and the United Kingdom, actively pursuing deployment strategies, aiming to provide reliable, low-carbon electricity.

This dynamic environment necessitates that Doosan not only develops these advanced technologies but also ensures they are competitive and scalable. The success of these substitutes directly impacts the long-term viability of older, higher-emission energy infrastructure, underscoring the need for Doosan to stay ahead of the curve in providing viable, clean energy solutions.

- Hydrogen Market Growth: The global hydrogen market was valued at around $183 billion by mid-2024, showcasing a rapidly expanding sector.

- SMR Deployment Focus: Nations like the US and UK are actively planning SMR deployments, signaling a strong market push for advanced nuclear.

- Competitive Innovation: Continuous technological advancement in SMRs and hydrogen is crucial for Doosan to remain competitive against emerging clean energy substitutes.

New Construction Methods and Materials

Innovations like 3D printing and prefabrication are transforming the construction landscape, potentially reducing the need for traditional heavy machinery used by companies like Doosan. For example, the global 3D printing construction market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly. This shift towards more efficient, automated building processes can be seen as a substitute for conventional construction methods that heavily rely on Doosan's equipment.

The adoption of advanced materials, such as self-healing concrete and aerogels, also contributes to this threat. These materials can lead to faster construction times and reduced maintenance needs, indirectly decreasing the demand for certain types of construction equipment. By 2024, the market for advanced construction materials is expected to continue its upward trajectory, further solidifying the impact of these substitutes.

- 3D Printing in Construction: Valued at $1.5 billion in 2023, offering faster build times.

- Prefabrication Growth: Increasing adoption for efficiency, reducing on-site machinery needs.

- Advanced Materials: Innovations like self-healing concrete lessen reliance on traditional repair equipment.

The threat of substitutes for Doosan's offerings is multifaceted, spanning both its construction equipment and energy divisions. In construction, advancements like 3D printing and prefabrication are streamlining building processes, potentially lessening the reliance on traditional heavy machinery. For Doosan Enerbility, the rapidly growing renewable energy sector, particularly solar and wind, presents a strong alternative to conventional power generation, driven by decreasing costs and increasing efficiency.

| Substitute Area | Key Substitute Technologies | Market Data (2023/2024 Estimates) | Impact on Doosan |

| Construction Equipment | 3D Printing, Prefabrication | 3D Printing Construction Market: ~$1.5 billion (2023) | Reduced demand for traditional heavy machinery. |

| Power Generation | Solar PV, Onshore Wind | Onshore Wind LCOE: ~$29/MWh; Solar PV LCOE: ~$34/MWh (2023) | Decreased demand for fossil fuel power plants. |

| Energy Systems | Distributed Energy Generation (DEG) | Global DEG Market: ~$230 billion (2023) | Challenges traditional large-scale power infrastructure. |

Entrants Threaten

Entering industries where Doosan operates, such as heavy machinery or power generation, demands substantial upfront capital. For instance, establishing a new, large-scale manufacturing plant for construction equipment can easily cost hundreds of millions of dollars, not to mention the R&D and supply chain setup. This high capital requirement acts as a significant barrier, discouraging potential competitors from entering the market.

Doosan's established brand reputation and deep-rooted customer loyalty pose a significant barrier to new entrants. With a history spanning decades and a global footprint, Doosan has cultivated trust and a proven track record in delivering complex projects, such as power plants and critical infrastructure. This makes it exceptionally difficult for newcomers to replicate the credibility and assurance that Doosan offers, particularly in sectors where reliability is non-negotiable.

Doosan and its key rivals hold significant advantages through proprietary technologies and patents in fields such as gas turbines and advanced robotics. For instance, Doosan Enerbility's commitment to R&D, which represented a substantial portion of its revenue in 2023, fuels the development of these critical assets.

The sheer depth of engineering expertise and the extensive patent portfolios held by established players make it incredibly difficult and expensive for newcomers to replicate this level of innovation. Building comparable intellectual property from the ground up is a lengthy and resource-intensive undertaking, effectively deterring potential entrants.

Regulatory Hurdles and Compliance Costs

The threat of new entrants in sectors like power generation and heavy equipment is significantly dampened by substantial regulatory hurdles. Industries worldwide impose rigorous environmental, safety, and operational standards. For instance, obtaining approvals for new nuclear power facilities can take many years and involve extensive compliance procedures.

New players must invest heavily in meeting these complex requirements, including securing licenses and navigating intricate approval processes. These compliance costs can act as a formidable barrier, making it difficult for smaller or less capitalized companies to enter the market. As of 2024, the global average cost for obtaining environmental permits for large industrial projects can range from hundreds of thousands to millions of dollars, depending on the jurisdiction and project scope.

- High Compliance Costs: Significant financial outlay required to meet environmental, safety, and operational regulations.

- Lengthy Approval Processes: Navigating licensing and regulatory approvals can be a time-consuming and complex undertaking.

- Industry-Specific Regulations: Sectors like power generation face particularly stringent rules, especially for advanced technologies like nuclear energy.

- Capital Intensity of Compliance: The need for substantial upfront investment in regulatory adherence deters potential new entrants.

Supply Chain and Distribution Network Access

Establishing a sophisticated global supply chain and an extensive distribution and service network is a significant hurdle for any new player entering the heavy equipment market. Doosan's existing infrastructure, built over decades, provides a substantial competitive advantage.

New entrants would face immense challenges in replicating Doosan's established global manufacturing footprint and its comprehensive sales and service network. For example, as of 2024, Doosan Bobcat reported a robust presence with over 1,700 dealer locations worldwide, a testament to the scale of investment required to match their reach.

- Global Reach: Doosan's established network spans numerous countries, offering localized support and efficient product delivery.

- Logistical Complexity: Replicating the intricate logistics of sourcing components globally and distributing heavy machinery is a capital-intensive and time-consuming endeavor.

- Service Infrastructure: Building a reliable after-sales service and parts network to support complex machinery requires significant investment in training and infrastructure, a barrier new entrants must overcome.

The threat of new entrants for Doosan is generally low due to several formidable barriers. High capital requirements for manufacturing and R&D, coupled with established brand loyalty and deep customer relationships, make market entry exceedingly difficult. Furthermore, Doosan's proprietary technologies and extensive patent portfolios, a result of significant R&D investment, create a substantial technological moat.

Regulatory hurdles, especially in sectors like power generation, add another layer of complexity and cost for potential new players. The need to comply with stringent environmental and safety standards, which can cost millions in permits as of 2024, deters many. Finally, replicating Doosan's vast global supply chain, distribution, and service networks, exemplified by Doosan Bobcat's over 1,700 dealer locations worldwide in 2024, requires immense capital and time.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (2024) |

| Capital Requirements | High upfront investment for manufacturing, R&D, and infrastructure. | Significant deterrent due to scale of investment needed. | Hundreds of millions for a new heavy machinery plant. |

| Brand Loyalty & Reputation | Established trust and proven track record in complex projects. | Difficult for newcomers to match credibility and assurance. | Decades of global operation and project delivery. |

| Technology & Patents | Proprietary innovations and extensive patent portfolios. | Requires substantial R&D to replicate technological edge. | Doosan Enerbility's R&D investment as a significant portion of revenue in 2023. |

| Regulatory Hurdles | Strict environmental, safety, and operational standards. | Adds significant cost and time for compliance and approvals. | Millions of dollars for environmental permits for large industrial projects. |

| Distribution & Service Networks | Extensive global supply chain, sales, and service infrastructure. | Replication is capital-intensive and time-consuming. | Doosan Bobcat's over 1,700 global dealer locations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Doosan draws from a comprehensive mix of data, including Doosan's official annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry analysis firms and market research reports that track the heavy equipment and construction sectors.