DMG Mori SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMG Mori Bundle

DMG Mori, a leader in machine tool manufacturing, boasts strong brand recognition and a robust innovation pipeline, but faces challenges from intense global competition and evolving technological demands. Understanding these dynamics is crucial for any serious market player.

Want the full story behind DMG Mori's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DMG Mori stands as a titan in the global machine tool sector, boasting an impressive array of CNC turning and milling machines, complemented by cutting-edge ultrasonic and laser texturing technologies. This broad product offering, encompassing roughly 200 distinct machine models, enables the company to cater to a wide spectrum of industrial demands, solidifying its robust market standing.

The company's global footprint is substantial, with 116 sales and service centers and 17 production facilities strategically located across 43 countries. This extensive network underscores DMG Mori's commitment to international reach and customer support, reinforcing its position as a market leader.

DMG Mori's dedication to technological innovation is a significant strength, evident in their continuous stream of new products and manufacturing advancements. In 2024 alone, the company showcased 34 innovations, with 20 being world premieres, highlighting their focus on 5-axis machining, integrated processes, and additive manufacturing.

This deep expertise in high-precision technologies solidifies DMG Mori's position as a frontrunner, capable of providing sophisticated solutions for even the most demanding production challenges.

DMG Mori's integrated service and automation ecosystem is a significant strength, offering customers a complete package that goes beyond just machinery. This includes automation solutions, advanced software, and a full spectrum of lifecycle services, creating a seamless experience for clients.

The company's Machining Transformation (MX) strategy is central to this, focusing on integrating processes, boosting automation, and driving both digital and green transformations. This holistic approach aims to deliver substantial value to customers.

This integrated model not only deepens customer relationships but also builds reliable, recurring revenue streams. These come from essential services like maintenance, specialized training, and ongoing digital solutions, solidifying DMG Mori's market position.

Strong Brand Reputation and Quality Focus

DMG Mori boasts a formidable brand reputation, deeply rooted in decades of innovation, unwavering quality, and exceptional precision in the global machine tool sector. This commitment to excellence is further validated by significant accolades; for instance, their Iga Campus was awarded the esteemed Deming Prize for Total Quality Management in October 2024. This recognition highlights the company's dedication to superior operational standards and manufacturing integrity.

The strength of DMG Mori's brand translates directly into tangible market advantages. Customers consistently associate the brand with reliability and cutting-edge technology, fostering strong loyalty and trust in a highly competitive landscape. This powerful brand equity allows DMG Mori to command premium pricing and secure a significant market share, as evidenced by their consistent performance in key global markets throughout 2024.

Key aspects contributing to this strength include:

- Long-standing Industry Presence: Decades of experience build credibility and customer familiarity.

- Innovation and Precision: A core focus on advanced technology and accuracy differentiates their offerings.

- Deming Prize Recognition: The October 2024 award for Total Quality Management at the Iga Campus underscores a commitment to world-class standards.

- Customer Trust and Loyalty: A strong brand reputation cultivates enduring relationships and repeat business.

Commitment to Digitalization and Sustainability (MX & GX)

DMG Mori's commitment to digitalization, evident in its Machining Transformation (MX) strategy, is a significant strength. This strategy integrates digital transformation (DX) with green transformation (GX), focusing on smart, connected machines and AI-driven solutions. For instance, in 2023, the company reported a substantial increase in digital service offerings, contributing to a growing revenue stream from software and digital solutions.

The company's proactive approach to sustainability (GX) is also a key advantage. DMG Mori is actively developing energy-efficient machines and promoting sustainable manufacturing practices. This focus aligns with the increasing global demand for environmentally responsible industrial solutions, positioning them favorably in a market prioritizing ESG criteria.

- Digitalization (MX): Integrating AI and connected technologies into machine tools.

- Sustainability (GX): Developing energy-efficient machinery and processes.

- Industry Alignment: Meeting global trends towards smart and green manufacturing.

- Market Positioning: Seen as a forward-thinking leader in advanced and responsible manufacturing.

DMG Mori's extensive product portfolio, featuring around 200 distinct machine models, allows it to serve diverse industrial needs effectively. This breadth of offering, from CNC turning and milling machines to advanced ultrasonic and laser technologies, solidifies its strong market presence.

The company's global reach is a significant asset, supported by 116 sales and service centers and 17 production facilities across 43 countries, ensuring robust customer support worldwide.

DMG Mori's commitment to innovation is demonstrated by its continuous introduction of new products and manufacturing advancements. In 2024, they unveiled 34 innovations, including 20 world premieres, emphasizing their focus on 5-axis machining, integrated processes, and additive manufacturing.

Their integrated service and automation ecosystem, driven by the Machining Transformation (MX) strategy, provides customers with a complete solution including automation, software, and lifecycle services, fostering strong customer relationships and recurring revenue.

The brand's reputation for quality and precision is a key strength, underscored by the Deming Prize for Total Quality Management awarded to their Iga Campus in October 2024, reinforcing customer trust and loyalty.

DMG Mori's focus on digitalization and sustainability through its MX and GX strategies positions it as a leader in smart and green manufacturing, aligning with growing global market demands.

| Strength Area | Key Aspect | Supporting Fact/Data (2024/2025) |

|---|---|---|

| Product Breadth | Diverse Machine Portfolio | Approx. 200 distinct machine models catering to various industrial demands. |

| Global Presence | Extensive Sales & Service Network | 116 sales and service centers and 17 production facilities in 43 countries. |

| Technological Innovation | New Product Development | Showcased 34 innovations in 2024, with 20 world premieres. |

| Integrated Solutions | MX Strategy & Automation | Focus on digital and green transformation, offering comprehensive automation and services. |

| Brand Reputation | Quality & Precision | Deming Prize for Total Quality Management (October 2024) at Iga Campus. |

What is included in the product

Analyzes DMG Mori’s competitive position through key internal and external factors, detailing its strengths in innovation and market presence, weaknesses in certain product lines, opportunities in emerging markets and digitalization, and threats from global competition and economic volatility.

Offers a clear, actionable framework to identify and address DMG Mori's strategic challenges and opportunities.

Weaknesses

DMG Mori's position as a capital goods manufacturer makes it particularly susceptible to fluctuations in the global economy and industrial investment patterns. Downturns in economic activity directly impact customer willingness to invest in new machinery.

The company's Q1 2025 financial report underscored this vulnerability, revealing a notable drop in both sales revenue and new orders. This decline was largely attributed to ongoing geopolitical tensions, trade disputes, and a general cooling of capital expenditure by businesses worldwide.

These external economic and political factors represent a significant weakness, as they can rapidly erode demand for DMG Mori's high-value products, impacting profitability and growth prospects.

DMG Mori's sophisticated, high-precision machine tools command a substantial initial capital outlay for clients. This significant investment acts as a barrier, restricting access for smaller enterprises or those facing budget limitations, particularly during economic downturns. For instance, in 2023, the average price for a new high-end CNC machining center could range from $200,000 to over $1 million, a considerable sum for many potential buyers.

Consequently, sales cycles for DMG Mori can be protracted, heavily influenced by a customer's optimism regarding future economic conditions and their ability to secure financing. This reliance on customer confidence means that market penetration can be slower in uncertain economic climates, impacting revenue growth projections.

DMG Mori operates in a fiercely competitive global machine tool market, facing pressure from both established international manufacturers and agile regional players. This intense rivalry often translates into significant price pressures, which can directly impact the company's profit margins. For instance, the global machine tool market was valued at approximately $105 billion in 2023 and is projected to grow, but this growth is shared among many participants, intensifying the need for competitive pricing strategies.

Dependency on Key Industrial Sectors

DMG Mori's reliance on foundational sectors like automotive, aerospace, and general machinery presents a significant vulnerability. For instance, the automotive sector, a major consumer of machine tools, is undergoing a substantial transformation with the shift towards electric vehicles. This transition could lead to reduced demand for certain types of machinery that DMG Mori currently supplies.

The company's order intake and overall sales performance are therefore susceptible to the economic health and strategic decisions within these critical industries. A downturn in automotive production, or a slowdown in aerospace manufacturing, could have a more pronounced negative impact on DMG Mori than on a more diversified industrial conglomerate.

- Sectoral Concentration: A large percentage of DMG Mori's revenue is tied to the automotive, aerospace, and general machinery sectors.

- Automotive Transition Impact: The ongoing shift to electric vehicles in the automotive industry may reduce demand for traditional machining equipment.

- Economic Sensitivity: Fluctuations and slowdowns in these key industrial sectors can disproportionately affect DMG Mori's financial results.

Impact of Supply Chain Disruptions and Export Controls

DMG Mori faces significant challenges from ongoing supply chain disruptions and increasingly complex export controls. In 2024, the company reported delays in machine deliveries stemming from extended processing times for export licenses, highlighting a growing regulatory burden. This volatility in global supply chains and the imposition of export restrictions directly impede production efficiency, inflate operational costs, and compromise DMG Mori's capacity to adhere to crucial delivery timelines. Consequently, these factors negatively impact customer satisfaction and can lead to a reduction in overall revenue.

The impact of these weaknesses is multifaceted:

- Extended Lead Times: Delays in obtaining export licenses and sourcing components are stretching delivery schedules, potentially frustrating customers and leading to lost sales opportunities.

- Increased Costs: Navigating complex regulatory environments and dealing with supply chain bottlenecks often results in higher manufacturing and logistics expenses, squeezing profit margins.

- Reduced Competitiveness: Inability to meet delivery commitments or offer competitive pricing due to these disruptions can erode market share against rivals with more resilient supply chains.

- Reputational Risk: Consistent delivery failures can damage DMG Mori's reputation for reliability, impacting future customer acquisition and retention efforts.

DMG Mori's reliance on a few key industrial sectors, particularly automotive and aerospace, presents a significant vulnerability. For example, the automotive sector's ongoing transition to electric vehicles could decrease demand for traditional machining equipment, impacting DMG Mori's sales. Economic slowdowns or strategic shifts within these core industries can disproportionately affect the company's financial performance.

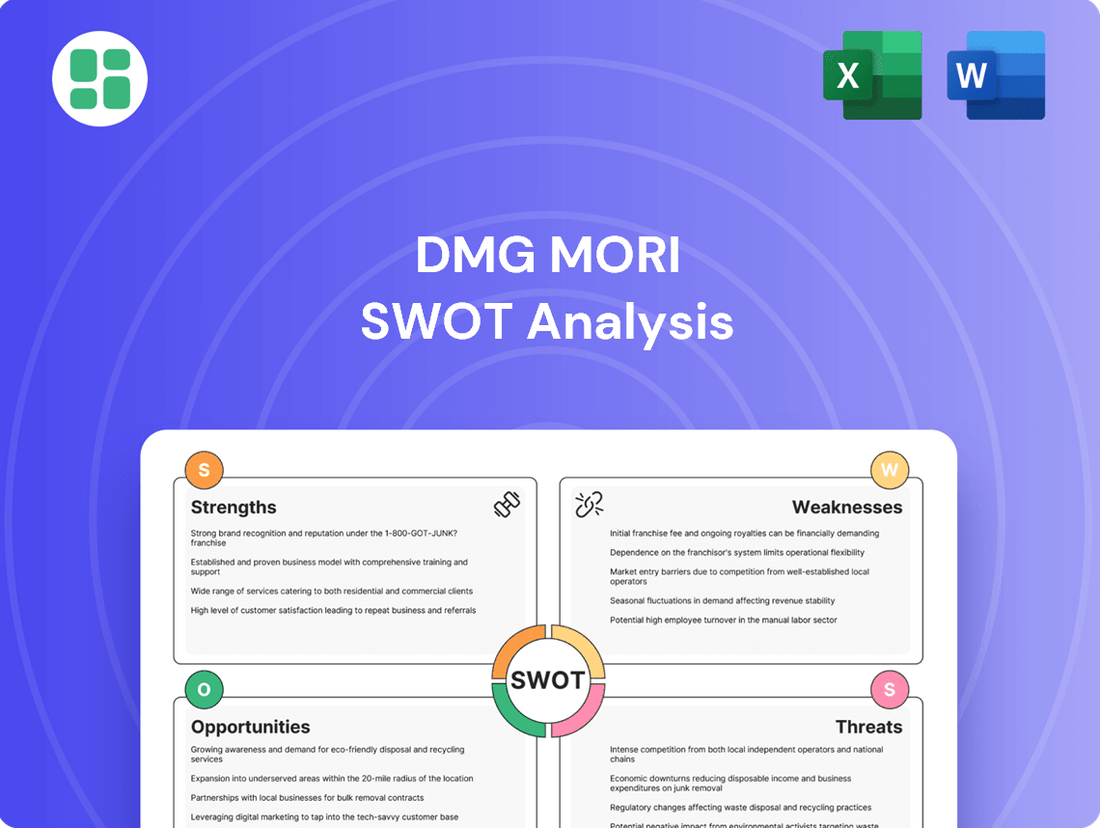

Preview Before You Purchase

DMG Mori SWOT Analysis

This is the actual DMG Mori SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full DMG Mori SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real DMG Mori SWOT analysis document—professional, structured, and ready to use.

Opportunities

The global manufacturing sector's accelerating embrace of automation and Industry 4.0 principles offers a substantial growth avenue for DMG Mori. This trend is fueled by a desire for increased efficiency, precision, and reduced labor costs, creating a robust market for advanced machining solutions.

DMG Mori is well-positioned to capitalize on this by expanding its portfolio of integrated solutions, including robotics and interconnected machinery. The company's focus on digital ecosystems like CELOS X, which leverages AI and IoT for predictive maintenance and real-time operational monitoring, directly addresses the evolving needs of modern factories.

The market for industrial automation is projected to reach $332.3 billion by 2027, growing at a compound annual growth rate of 8.6%, according to Mordor Intelligence. This indicates a strong and sustained demand for the types of advanced technologies DMG Mori provides.

Emerging markets, especially in Asia-Pacific, are experiencing rapid industrialization, with significant investments in manufacturing. This trend creates substantial growth opportunities for DMG Mori as these economies increasingly demand advanced machine tools to upgrade their production capabilities.

Government-backed industrialization programs worldwide are further stimulating the need for modern machinery. For instance, initiatives like India's 'Make in India' are projected to drive substantial growth in the machine tool sector, presenting DMG Mori with a prime opportunity to expand its footprint and capture a larger market share in these developing regions.

The growing global commitment to sustainability and climate action is a significant tailwind for DMG Mori. This trend directly fuels demand for machinery that prioritizes energy efficiency and supports greener manufacturing practices. Customers are increasingly seeking solutions that reduce their environmental footprint, making sustainable offerings a key differentiator.

DMG Mori's strategic initiatives, such as their Green Transformation (GX) strategy and GREENMODE technology, are well-aligned with this market shift. These programs are designed to achieve substantial energy savings, with some machines offering over 30% reduction in energy consumption. This positions DMG Mori favorably to capture market share from environmentally conscious clients seeking to optimize their operational sustainability.

Leveraging Additive Manufacturing and Hybrid Technologies

The integration of additive manufacturing with traditional subtractive processes presents a significant growth avenue for DMG Mori. Their hybrid machines, such as the LASERTEC DED series, merge these capabilities, enabling the creation of intricate components and offering solutions for part repair, thereby accessing new markets and applications.

This technological convergence allows DMG Mori to cater to emerging demands in industries like aerospace and medical, where complex geometries and material efficiency are paramount. For instance, the global additive manufacturing market was valued at approximately $15.7 billion in 2023 and is projected to reach $64.9 billion by 2030, indicating substantial growth potential for companies at the forefront of this innovation.

- Expanding Service Offerings: Hybrid technologies enable DMG Mori to offer advanced repair services for high-value components, extending product lifecycles and creating a recurring revenue stream.

- New Market Penetration: The ability to produce complex, customized parts opens doors to industries previously underserved by traditional machining, such as specialized tooling and advanced prototyping.

- Enhanced Product Value: By combining additive and subtractive capabilities on a single platform, DMG Mori provides customers with a more efficient and versatile manufacturing solution, reducing lead times and costs.

Demand for High-Precision and Specialized Machining

The increasing demand for high-precision and specialized machining is a significant opportunity for DMG Mori. Industries such as aerospace, medical technology, and semiconductor manufacturing are consistently pushing the boundaries of component complexity, requiring advanced machining solutions. DMG Mori's established expertise in technologies like 5-axis machining and its ability to offer customized solutions directly address this need for intricate, high-value parts.

This trend is supported by market data indicating robust growth in these sectors. For instance, the global aerospace market is projected to reach over $1 trillion by 2030, with a significant portion driven by the need for advanced materials and precision manufacturing. Similarly, the medical device market, valued at over $500 billion in 2023, relies heavily on precision machining for implants and surgical instruments. DMG Mori's strategic focus on these areas allows it to capitalize on these expanding markets.

DMG Mori is well-positioned to benefit from this opportunity through:

- Development of advanced machining centers capable of handling complex geometries and tight tolerances.

- Tailored solutions and application expertise for specific industry challenges in aerospace, medical, and semiconductors.

- Investment in R&D to stay ahead of technological advancements in precision machining.

DMG Mori can leverage the global shift towards automation and Industry 4.0, as the market for industrial automation is expected to reach $332.3 billion by 2027. Furthermore, emerging markets, particularly in Asia-Pacific, are investing heavily in manufacturing, with government initiatives like India's 'Make in India' driving demand for advanced machinery. The company's focus on sustainable manufacturing, with technologies like GREENMODE offering over 30% energy savings, aligns with growing environmental concerns.

The integration of additive and subtractive manufacturing presents a significant growth area, with the additive manufacturing market projected to reach $64.9 billion by 2030. This allows DMG Mori to cater to high-precision demands in sectors like aerospace and medical technology, which are experiencing substantial growth, with the aerospace market alone expected to exceed $1 trillion by 2030.

| Opportunity Area | Market Projection/Growth Driver | DMG Mori's Strategic Alignment |

| Industry 4.0 & Automation | Industrial Automation Market: $332.3B by 2027 (Mordor Intelligence) | CELOS X, integrated solutions, robotics |

| Emerging Markets | Rapid industrialization in Asia-Pacific, government initiatives (e.g., 'Make in India') | Expanding footprint, tailored solutions for developing economies |

| Sustainability | Demand for energy-efficient machinery, GREENMODE offering >30% energy savings | GX strategy, GREENMODE technology |

| Additive & Subtractive Integration | Additive Manufacturing Market: $64.9B by 2030 | Hybrid machines (LASERTEC DED), catering to aerospace/medical |

| High-Precision Machining | Aerospace Market: >$1T by 2030; Medical Device Market: >$500B in 2023 | 5-axis machining, customized solutions, R&D investment |

Threats

Ongoing geopolitical uncertainties and trade conflicts continue to create a volatile global economic landscape. This instability heightens the risk of economic slowdowns and potential recessions, directly impacting demand for capital goods such as machine tools. For DMG Mori, this translates to a significant threat to their order intake and overall sales performance.

The lingering effects of recent economic restraint and weakened capital spending have already begun to affect the industry. For instance, a slowdown in manufacturing output in key markets, coupled with inflation concerns, could further dampen investment in new machinery. DMG Mori's financial reports for the fiscal year ending December 2023, for example, showed a noticeable impact on new orders due to these macroeconomic headwinds.

Heightened geopolitical instability and rising protectionist trade policies pose a significant threat by disrupting global supply chains and potentially increasing operational expenses. These factors can also restrict DMG Mori's access to key international markets, impacting sales volumes and revenue streams.

The recent deconsolidation of DMG Mori's Russian subsidiary serves as a concrete example of how geopolitical events directly affect the company. This move, coupled with extended processing times for export licenses, underscores the tangible challenges faced in maintaining seamless global operations and achieving consistent financial performance in the current climate.

The relentless pace of technological advancement, particularly in areas like additive manufacturing and advanced automation, presents a significant threat. Competitors introducing disruptive innovations could quickly erode DMG Mori's market share if the company cannot match their speed or adapt to entirely new manufacturing paradigms. For instance, the growing adoption of AI-driven predictive maintenance in machinery, a field where DMG Mori invests heavily, could be leapfrogged by rivals offering more integrated and cost-effective solutions.

Supply Chain Fragility and Raw Material Price Fluctuations

DMG Mori faces significant threats from supply chain disruptions. Global events, like geopolitical tensions or natural disasters, can lead to component shortages and extended lead times, directly impacting production timelines and the ability to meet customer delivery commitments. For instance, the semiconductor shortage experienced globally in 2021-2022 significantly affected manufacturing across various industries, a risk DMG Mori must continually monitor.

Furthermore, the volatility of raw material and energy prices poses a substantial challenge. Fluctuations in the cost of steel, aluminum, and energy directly impact DMG Mori's cost of goods sold. These price swings can compress profit margins if not effectively managed through hedging strategies or price adjustments, thereby affecting overall financial stability.

- Component Shortages: Ongoing global supply chain vulnerabilities can lead to delays in critical machine parts.

- Increased Lead Times: Extended delivery schedules for components can disrupt production planning.

- Raw Material Cost Volatility: Significant price swings in metals and energy impact manufacturing expenses.

- Energy Price Fluctuations: Rising energy costs directly affect operational expenses and profitability.

Workforce Skill Gaps and Labor Costs

A significant challenge for DMG Mori, as with much of the manufacturing sector, is the persistent shortage of skilled labor. This scarcity, particularly in areas requiring expertise in advanced manufacturing technologies, can hinder production efficiency and innovation. For instance, in 2024, Germany, a key market for DMG Mori, continued to face a shortage of skilled workers, with the Ifo Institute reporting that over half of manufacturing firms struggled to find qualified personnel.

Furthermore, the potential for rising personnel costs presents a direct threat to profitability. As demand for skilled labor increases, wages are likely to follow, impacting the company's operating expenses. While DMG Mori heavily invests in automation to reduce reliance on human capital, the effective operation and maintenance of these sophisticated machines still necessitate a highly skilled workforce. A growing personnel ratio, driven by either increased hiring or higher wages, could therefore compress profit margins.

- Skilled Labor Shortage: Ongoing difficulty in finding qualified technicians and engineers for advanced machinery.

- Rising Labor Costs: Projections indicate continued upward pressure on wages for skilled manufacturing roles in 2024-2025.

- Automation Dependency: While automation reduces labor needs, it increases the demand for specialized maintenance and operational skills.

- Profitability Impact: An increasing personnel ratio, even with automation, could negatively affect DMG Mori's bottom line if not managed effectively.

Intensifying competition from both established players and emerging market manufacturers presents a significant threat. These competitors often leverage lower cost structures or specialized technological niches, potentially eroding DMG Mori's market share. For example, reports from early 2024 indicate a growing presence of Asian machine tool manufacturers in European markets, offering competitive pricing on standard machinery.

The increasing adoption of digital manufacturing technologies, such as Industry 4.0 solutions and smart factory integration, requires continuous and substantial investment. Failure to keep pace with these advancements could render DMG Mori's product offerings less attractive and competitive. The company's commitment to digital transformation is crucial, as seen in their ongoing investments in areas like digital twins and IoT connectivity for their machines, a trend that will only accelerate through 2025.

Regulatory changes and evolving environmental standards pose a threat by potentially increasing compliance costs and requiring product redesign. For instance, stricter emissions regulations or mandates for energy efficiency in manufacturing equipment could necessitate significant R&D expenditure and impact production processes. DMG Mori's proactive approach to sustainability is therefore critical to mitigate these risks.

Economic downturns in key markets, such as China or the United States, could lead to a sharp decrease in capital expenditure by manufacturers, directly impacting DMG Mori's sales. The IMF's 2024 economic outlook, for instance, highlighted potential slowdowns in several major economies, which could translate to reduced demand for high-value capital goods like machine tools.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2024/2025 focus) |

|---|---|---|---|

| Competition | Emerging Market Competitors | Market share erosion, price pressure | Increased penetration of Asian manufacturers in European markets (early 2024 reports). |

| Technological Disruption | Failure to adopt Industry 4.0 | Reduced product competitiveness, obsolescence | Ongoing investment in digital twins and IoT is critical to stay relevant through 2025. |

| Regulatory Environment | Stricter Environmental Standards | Increased compliance costs, R&D investment | Potential impact of evolving emissions regulations on machinery design and production. |

| Economic Factors | Downturns in Key Markets | Decreased order intake, reduced sales | IMF's 2024 outlook signaling potential slowdowns in major economies impacting capital goods demand. |

SWOT Analysis Data Sources

This DMG Mori SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert analyses from industry professionals.