DMG Mori Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMG Mori Bundle

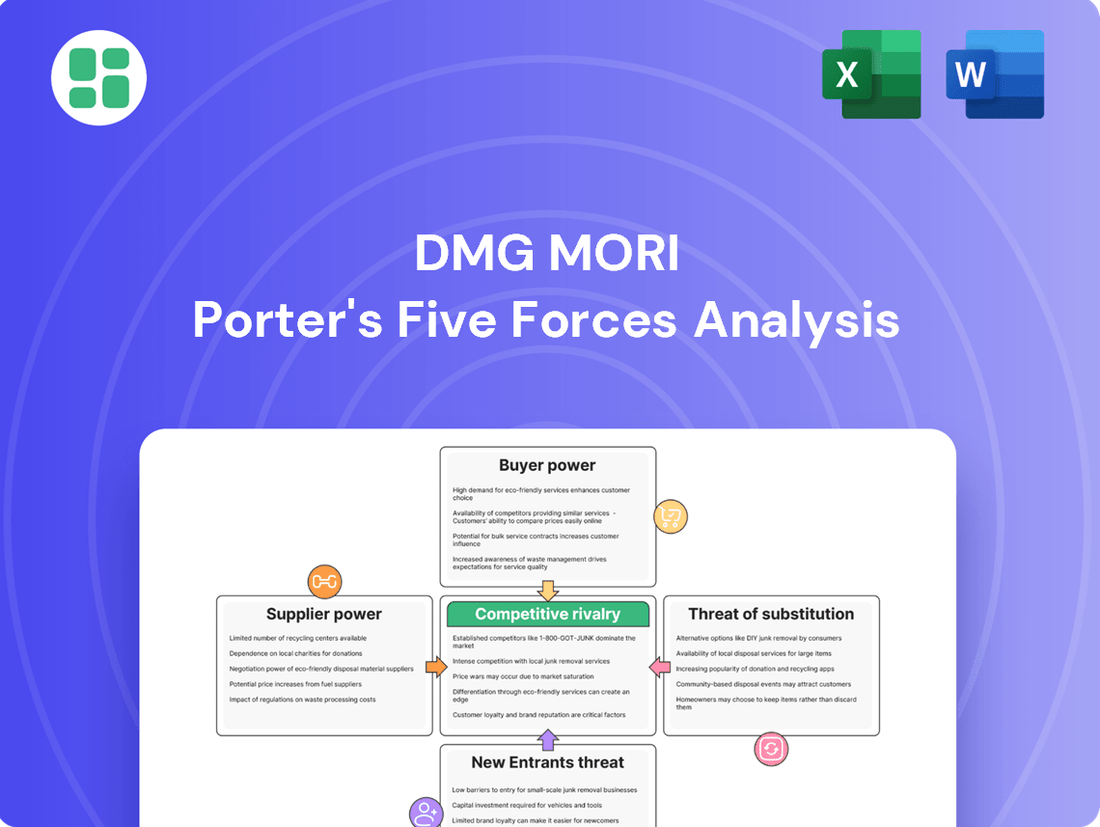

DMG Mori, a leader in machine tool manufacturing, faces a complex competitive landscape. Understanding the interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the pressure from substitutes is crucial for strategic success. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore DMG Mori’s competitive dynamics, market pressures, and strategic advantages in detail, gaining actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DMG Mori's reliance on a concentrated supplier base for critical components like high-precision mechanical parts, specialized electronics, and advanced CNC software significantly influences supplier bargaining power. For instance, if only a few companies provide patented control systems or unique tooling, these suppliers can command higher prices and dictate terms.

DMG Mori's reliance on highly specialized components, such as advanced control systems and precision-engineered parts for its complex machine tools, significantly influences supplier bargaining power. If these inputs are custom-made or proprietary, with few alternative suppliers available, DMG Mori faces greater pressure on pricing and contract terms.

DMG Mori faces significant switching costs when changing suppliers for specialized machine tool components. These costs can include the expense and time involved in retooling manufacturing processes, requalifying new parts to meet stringent quality standards, and potentially redesigning integrated systems to accommodate different supplier specifications. For instance, a shift in a critical control system supplier might necessitate extensive software and hardware modifications, impacting production timelines and incurring substantial engineering expenses.

Threat of Forward Integration by Suppliers

The possibility of key suppliers integrating forward into machine tool manufacturing poses a direct competitive threat to DMG Mori. This risk is amplified if these suppliers hold proprietary technologies or established brand loyalty, enabling a smoother market entry. For instance, a supplier of advanced control systems or specialized components could leverage their expertise to produce entire machine tools, thereby encroaching on DMG Mori's core business.

- Forward Integration Threat: Suppliers of critical components, such as high-precision spindle manufacturers or advanced control system developers, could potentially move into direct machine tool production.

- Enabling Factors: This threat is heightened if suppliers possess unique, patented technologies or strong brand recognition within the industrial sector, allowing them to capture market share more easily.

- Impact on DMG Mori: Such integration would increase competitive pressure, potentially driving down prices and margins for DMG Mori's existing product lines.

- Supplier Capabilities: For example, a supplier of sophisticated robotics integrated into CNC machines might consider offering complete automated manufacturing cells, directly competing with DMG Mori's automation solutions.

Importance of DMG Mori to Suppliers

DMG Mori's significance to its suppliers plays a crucial role in its bargaining power. If DMG Mori constitutes a substantial portion of a supplier's revenue, the supplier is more likely to be accommodating to DMG Mori's terms. Conversely, if DMG Mori is a minor customer for a supplier, that supplier holds greater leverage.

For instance, in 2024, DMG Mori's substantial order volumes for specialized machine components mean that many suppliers rely heavily on this business. This dependence can shift the power dynamic in DMG Mori's favor, allowing them to negotiate more favorable pricing and delivery schedules. Suppliers who cater to a niche within the machine tool industry, where DMG Mori is a dominant player, find themselves with less room to dictate terms.

- Supplier Dependence: Many suppliers to DMG Mori have a significant portion of their business tied to DMG Mori's operations, increasing DMG Mori's leverage.

- Market Position: DMG Mori's strong market position in machine tool manufacturing means suppliers often prioritize its business to maintain their own sales volumes.

- Niche Component Suppliers: Suppliers of highly specialized or proprietary components, where DMG Mori is a key customer, have less bargaining power.

DMG Mori's bargaining power with its suppliers is influenced by the concentration of its supplier base and the availability of alternatives. When suppliers provide unique, patented components or specialized services with limited substitutes, their leverage increases, allowing them to command higher prices and stricter terms. Conversely, DMG Mori's substantial purchasing volume can provide significant leverage, especially when suppliers depend heavily on its business.

In 2024, DMG Mori's strategic sourcing and long-term relationships with key component providers help mitigate some supplier power. However, the ongoing demand for highly integrated, technologically advanced machine tool systems means that suppliers of critical elements like advanced robotics and specialized software retain considerable influence. The company's ability to secure favorable terms often hinges on its own market share and the suppliers' dependence on its orders.

| Factor | Impact on DMG Mori | Example Scenario |

|---|---|---|

| Supplier Concentration | High if few suppliers offer critical components. | A single supplier for a proprietary CNC control system. |

| Switching Costs | High due to integration and requalification needs. | Changing a key electronic component supplier requires extensive testing. |

| Supplier Dependence on DMG Mori | Lowers supplier power if DMG Mori is a major customer. | Suppliers whose revenue is largely derived from DMG Mori orders. |

| Forward Integration Threat | Moderate to High for suppliers of key technologies. | A specialized robotics supplier entering the machine tool assembly market. |

What is included in the product

This analysis applies Porter's Five Forces to DMG Mori, examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within the machine tool industry.

Quickly identify and mitigate competitive threats with a visually intuitive breakdown of industry rivalry and buyer power.

Customers Bargaining Power

DMG Mori's customer base exhibits a degree of concentration, especially within the automotive sector, which traditionally represents a significant portion of machine tool demand. While specific customer revenue breakdowns are proprietary, the industry reliance on large automotive manufacturers means that a few key accounts could exert considerable influence over pricing and terms.

Switching costs for customers in the machine tool industry, particularly for complex integrated solutions like those offered by DMG Mori, are generally high. These costs encompass not only the purchase price of new machinery but also significant expenses related to retraining skilled operators and maintenance personnel, reconfiguring existing production layouts, and integrating new software systems with existing enterprise resource planning (ERP) or manufacturing execution systems (MES). For instance, a 2024 report indicated that for a typical automotive manufacturing line, the total cost of switching to a new machine tool supplier, including installation, programming, and training, could easily exceed 15-20% of the new equipment's value.

DMG Mori's highly precise, innovative, and integrated machine tool solutions are critical for manufacturers in industries like automotive and aerospace, where quality and efficiency are paramount. For example, in 2023, the aerospace sector, a key DMG Mori market, saw continued strong demand for advanced manufacturing technologies, with global aerospace MRO (Maintenance, Repair, and Overhaul) spending projected to reach over $100 billion.

The criticality of these advanced machines in ensuring product quality and optimizing production processes significantly reduces the bargaining power of customers. When a machine tool failure can halt an entire production line or compromise the integrity of high-value components, customers are less likely to switch suppliers based solely on price. DMG Mori's comprehensive lifecycle support, including maintenance, training, and digital services, further embeds them into the customer's operational workflow, diminishing price sensitivity.

Threat of Backward Integration by Customers

The threat of customers backward integrating into machine tool manufacturing for DMG Mori is generally considered low. The industry demands significant capital investment, specialized expertise, and advanced technological capabilities, making it difficult for most customers to replicate DMG Mori's core competencies. However, for simpler, standardized components or less complex machinery, some larger, technologically advanced customers might explore in-house production to gain greater control over supply chains or reduce costs.

For instance, a major automotive manufacturer, a significant customer segment for DMG Mori, might possess the engineering prowess and financial resources to consider producing certain basic tooling or fixtures internally. This is more likely for high-volume, less sophisticated parts rather than the advanced, multi-axis CNC machines that form DMG Mori's primary offering. The complexity and ongoing innovation in high-precision machine tools create a substantial barrier to entry for most customer firms.

The likelihood of backward integration is further mitigated by the specialized nature of machine tool development and manufacturing. DMG Mori invests heavily in research and development, maintaining proprietary technologies and manufacturing processes. Customers typically benefit more from outsourcing these complex requirements to specialists like DMG Mori, rather than undertaking the substantial investment and risk associated with building such capabilities themselves. In 2023, the global machine tool market was valued at approximately $100 billion, highlighting the scale and specialization required.

- Low Likelihood of Full Backward Integration: The high capital expenditure and technical expertise required for advanced machine tool production make it impractical for most DMG Mori customers to manufacture these complex machines internally.

- Potential for Component Integration: Larger, technologically advanced customers might consider producing simpler, standardized components or less complex tooling in-house to optimize their supply chains.

- Focus on Core Competencies: Most customers benefit from DMG Mori's specialization and innovation, choosing to focus on their own core manufacturing processes rather than investing in machine tool production.

- Market Complexity as a Barrier: The intricate nature of machine tool design, engineering, and continuous technological advancement presents a significant hurdle for potential customer integration.

Customer Price Sensitivity

Customer price sensitivity for DMG Mori's high-value machinery is influenced by several key factors. The significant capital expenditure involved means buyers carefully consider the total cost of ownership, including maintenance, energy consumption, and tooling over the machine's lifecycle. For instance, in 2023, the average price for advanced CNC machining centers can range from hundreds of thousands to millions of dollars, making upfront cost a critical consideration.

The direct impact of DMG Mori's machines on a customer's own product quality and manufacturing costs is another crucial determinant of price sensitivity. If a machine's precision and efficiency directly translate to higher output quality or lower production expenses for the customer, they may be willing to absorb a higher purchase price. For example, industries like aerospace and medical device manufacturing often prioritize absolute precision, where machine cost is secondary to performance reliability.

- Total Cost of Ownership: Buyers evaluate not just the initial purchase price but also ongoing operational and maintenance expenses.

- Impact on Customer's Product: The machine's contribution to product quality, production speed, and cost reduction significantly affects willingness to pay.

- Capital Expenditure Nature: The substantial upfront investment necessitates thorough financial analysis and justification by customers.

- Industry-Specific Needs: Sectors demanding extreme precision or specialized capabilities may exhibit lower price sensitivity.

DMG Mori faces moderate bargaining power from its customers, primarily due to the high switching costs associated with its advanced machinery and the critical role these machines play in customer operations. While customers may be price-sensitive, the need for precision and reliability often outweighs cost considerations. The threat of backward integration is low, as replicating DMG Mori's technological capabilities is prohibitively expensive and complex for most clients.

| Factor | Impact on Bargaining Power | DMG Mori Context |

|---|---|---|

| Customer Concentration | Moderate | Key sectors like automotive have large players, but DMG Mori's broad customer base mitigates this. |

| Switching Costs | Low Customer Power | High costs for integration, training, and reconfiguration limit customer ability to switch. |

| Product Differentiation | Low Customer Power | DMG Mori's advanced, precise solutions are critical for customer quality and efficiency. |

| Backward Integration Threat | Low | Significant capital and expertise required make it impractical for most customers. |

Same Document Delivered

DMG Mori Porter's Five Forces Analysis

The document you see here is the exact, professionally crafted Porter's Five Forces Analysis of DMG Mori. What you preview is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The CNC machine tool and advanced manufacturing technology market is characterized by a significant number of global and regional competitors. This intense competition stems from the presence of both large, diversified conglomerates and highly specialized niche players.

Key global players such as DMG Mori, Mazak, Okuma, and Makino compete fiercely on innovation, product quality, and service. Regional competitors also exert considerable pressure, particularly in emerging markets, further fragmenting the competitive landscape and driving down prices.

The global machine tools market is experiencing robust growth, projected to reach approximately $100 billion by 2027, with a compound annual growth rate (CAGR) of around 5.8%. This expansion, driven by automation, advanced manufacturing, and demand from sectors like automotive and aerospace, generally tempers intense rivalry as companies can capture market share through innovation and expansion rather than solely through aggressive price competition. However, periods of subdued demand for capital goods, which can occur even within a growing overall market, might still lead to intensified competition for available orders.

DMG Mori actively differentiates its offerings through advanced technology and comprehensive services, emphasizing its Machining Transformation (MX) strategy. This includes a strong focus on Process Integration, Automation, Digital Transformation (DX), and Green Transformation (GX), positioning innovation as a critical area of competition.

Competitors in the machine tool industry, such as Haas Automation and Mazak, also invest heavily in R&D to introduce new features and enhance product performance. For instance, Haas Automation is known for its user-friendly controls and robust designs, while Mazak often highlights its integrated automation solutions and multi-tasking capabilities.

The market for high-precision machine tools sees significant rivalry, with companies constantly seeking to gain an edge through technological advancements. DMG Mori reported a revenue of €2,729 million for the fiscal year 2023, underscoring the scale of investment and competition within this sector.

Exit Barriers

Exit barriers in the machine tool industry, particularly for a player like DMG Mori, are substantial. These include the high cost and specialized nature of manufacturing plants and equipment, meaning assets are not easily repurposed or sold. Significant capital is tied up in research and development, tooling, and global distribution networks, making a clean exit financially challenging.

These elevated exit barriers mean that even when market conditions become less favorable, companies like DMG Mori may continue to operate in certain segments. This prolonged competition can suppress profitability across the board, as excess capacity persists. For instance, the machine tool sector often sees companies holding onto older, less efficient machinery rather than incurring the costs associated with decommissioning.

Key exit barriers for DMG Mori and its competitors include:

- High Asset Specificity: Manufacturing facilities and specialized machinery are designed for producing machine tools, with limited alternative uses.

- Significant Capital Investment: The initial outlay for setting up production, R&D, and global service networks is immense.

- Specialized Labor Requirements: A skilled workforce with expertise in engineering, manufacturing, and servicing complex machinery is difficult to retrain or redeploy.

- Contractual Obligations: Long-term supply agreements and customer contracts can also impede a swift exit from specific markets or product lines.

Market Share and Strategic Stakes

The machine tool industry, including players like DMG Mori, is characterized by a fragmented market share distribution. While DMG Mori is a significant global player, its market share is challenged by numerous competitors, both large and small, across various regions. The strategic importance of this business is paramount for these companies, as machine tools are foundational to manufacturing across diverse sectors, influencing their overall competitiveness and technological advancement.

- Market Share Concentration: The global machine tool market is not dominated by a single entity. While DMG Mori holds a substantial position, other key players such as AMADA, Yamazaki Mazak, and TRUMPF also command significant market shares, particularly in their respective specializations and geographic strongholds.

- Strategic Importance: For companies like DMG Mori, the machine tool business is not merely a product line but a core competency. It directly impacts their ability to innovate in manufacturing processes, which is crucial for maintaining leadership in high-value industrial sectors.

- Competitive Intensity: Competitors with high strategic stakes in the machine tool sector often engage in aggressive strategies. This can manifest as intense price competition, substantial investments in research and development to introduce cutting-edge technologies, and strategic acquisitions to expand product portfolios or market reach. For instance, R&D spending as a percentage of revenue is a key indicator of this strategic commitment among leading firms.

Competitive rivalry within the machine tool industry is intense, with numerous global and regional players vying for market share. This competition is driven by innovation, product quality, and service offerings, as companies like DMG Mori, Mazak, and Okuma invest heavily in research and development. The market's robust growth, projected to reach around $100 billion by 2027, generally supports this rivalry by allowing companies to expand through innovation rather than solely aggressive pricing.

The machine tool sector is characterized by a fragmented market share, with no single dominant player. DMG Mori, a significant global entity, faces strong competition from companies like AMADA, Yamazaki Mazak, and TRUMPF, each holding substantial positions in specialized areas and regions. This high level of competition necessitates continuous investment in cutting-edge technologies and strategic market positioning to maintain leadership.

| Competitor | Approximate 2023 Revenue (EUR Millions) | Key Focus Areas |

|---|---|---|

| DMG Mori | 2,729 | Process Integration, Automation, Digital & Green Transformation |

| Mazak | N/A (Private Company) | Integrated Automation, Multi-tasking Capabilities |

| Haas Automation | N/A (Private Company) | User-friendly Controls, Robust Designs |

| Okuma | N/A (Part of Marubeni Corporation) | Automation, IoT Integration |

| Makino | N/A (Part of Park Ohio Holdings) | High-precision Machining, Advanced Software |

SSubstitutes Threaten

The threat of substitutes for DMG Mori's machine tools is moderate, primarily driven by the price-performance trade-off offered by alternative manufacturing processes. While traditional machining remains dominant for many applications, advancements in areas like additive manufacturing (3D printing) present a growing challenge. For instance, 3D printing can produce intricate parts with less material waste, potentially offering a more cost-effective solution for specific, low-volume, or highly complex components, thereby substituting some traditional machining needs.

For example, the global 3D printing market was valued at approximately $15.2 billion in 2023 and is projected to reach over $60 billion by 2030, indicating significant growth and increasing capability to address needs previously met by subtractive manufacturing. This expanding technological frontier means that customers can increasingly find viable alternatives that might offer a better price-performance ratio for certain production requirements, impacting demand for conventional machine tools.

Customer willingness to substitute DMG Mori's offerings is influenced by the perceived benefits and ease of adopting alternative technologies. For instance, the rise of additive manufacturing, or 3D printing, presents a potential substitute for certain traditional subtractive CNC machining processes. In 2024, the global additive manufacturing market was valued at approximately $20.5 billion, indicating a growing acceptance and adoption of these alternative technologies by various industries.

The manufacturing landscape is constantly shifting, and new technologies can emerge as significant substitutes for traditional methods. For instance, advancements in additive manufacturing, or 3D printing, are increasingly capable of producing complex components that were once exclusively made through subtractive processes like milling or turning. Companies that can leverage these new methods to offer similar or superior parts at a lower cost or with faster turnaround times present a direct threat to established players like DMG Mori, even if DMG Mori itself adopts some of these technologies.

Consider the rise of specialized robotic automation for tasks like welding or assembly. If these robots can perform certain functions more efficiently or with higher precision than a traditional CNC machine, they become a substitute for that part of the manufacturing process. In 2024, the global industrial robotics market was valued at approximately $50 billion, with significant growth driven by demand for automation across various sectors, highlighting the increasing viability of such substitutes.

Cost of Switching to Substitutes

The cost of switching from traditional DMG Mori machine tools to substitute technologies, like additive manufacturing or advanced automation, involves significant investment and disruption for customers. This includes the expense of new equipment, extensive employee retraining, and the complex integration of these new systems into existing production lines. For instance, a manufacturer adopting 3D printing for certain components might face initial capital outlays of tens of thousands to hundreds of thousands of dollars, alongside the need for specialized software and skilled personnel.

Even when substitutes offer potential benefits such as faster prototyping or reduced material waste, high retooling, training, and integration costs can act as a substantial deterrent. These upfront expenditures create a considerable barrier, making customers hesitant to abandon established, familiar processes. DMG Mori's customers, particularly those with deeply entrenched CNC machining workflows, often find the transition costs outweigh the immediate perceived advantages of alternatives.

Consider the impact on a mid-sized automotive parts supplier in 2024. Transitioning a significant portion of their production from traditional CNC milling to a hybrid additive-manufacturing approach could require an initial investment exceeding $500,000 for new machinery and software. Furthermore, retraining their existing machinists to operate and maintain this new technology could add another $50,000 to $100,000 in training expenses, making the switch a considerable financial undertaking.

- High Capital Outlay: Customers face substantial upfront costs for new machinery and software when adopting substitute technologies.

- Workforce Retraining: Significant investment is needed to train existing staff on new operational procedures and maintenance for alternative manufacturing methods.

- Integration Complexity: Seamlessly incorporating new technologies into existing production workflows requires time, expertise, and potential system overhauls, adding to the overall cost of switching.

Quality and Precision Capabilities of Substitutes

The threat of substitutes for DMG Mori's high-precision machine tools is generally low, particularly in industries demanding extreme accuracy and specialized material processing. For sectors like aerospace and medical, where components must meet stringent safety and performance standards, alternative technologies often fall short. For instance, while additive manufacturing (3D printing) has advanced significantly, it typically cannot match the sub-micron precision and surface finish achievable with advanced CNC machining for critical parts like turbine blades or orthopedic implants. In 2024, the global aerospace market, a key DMG Mori customer, was projected to reach over $900 billion, underscoring the demand for highly precise manufacturing capabilities that substitutes struggle to replicate.

The ability of substitutes to deliver the required quality and precision is a significant barrier. For example, in medical device manufacturing, tolerances are often measured in single-digit microns. While some advanced machining processes are evolving, they often involve higher costs or longer production times compared to established CNC methods for achieving such levels of accuracy. DMG Mori's commitment to innovation in areas like multi-axis machining and advanced grinding technologies ensures they maintain a competitive edge where substitute technologies are not yet mature enough to consistently deliver.

- High-Precision Requirements: Industries like aerospace and medical demand tolerances often in the single-digit micron range, a level difficult for many substitute technologies to consistently achieve.

- Surface Finish and Material Integrity: Achieving specific surface finishes and maintaining material integrity, crucial for fatigue life and biocompatibility, remains a strong point for advanced machining.

- Cost-Effectiveness of Precision: While substitutes like additive manufacturing are improving, the overall cost-effectiveness for achieving high-precision, low-volume production runs often favors traditional CNC machining.

- Technological Maturity: For many critical applications, the established precision and reliability of advanced machine tools represent a proven solution that substitutes have yet to fully supplant.

The threat of substitutes for DMG Mori's offerings is generally moderate, but this can vary significantly by industry segment. While innovative technologies like additive manufacturing (3D printing) and advanced automation are gaining traction, they often struggle to match the precision, surface finish, and material integrity required by high-demand sectors such as aerospace and medical device manufacturing. For instance, the global additive manufacturing market was valued at approximately $20.5 billion in 2024, a figure that highlights its growth but also its current scale relative to the established machine tool market.

The cost and complexity of switching to these substitute technologies also present a significant barrier for many customers. High capital outlays for new equipment, extensive workforce retraining, and the intricate integration of new systems into existing production lines can deter adoption. For example, a mid-sized automotive parts supplier might face initial investments exceeding $500,000 to transition to hybrid additive manufacturing, plus substantial costs for employee retraining, making established CNC machining processes a more practical choice for many.

However, for less demanding applications or for specific niche production needs, substitutes can pose a more direct threat. The increasing capability and cost-effectiveness of technologies like specialized robotics for assembly or 3D printing for prototyping and low-volume parts mean that customers have more choices than ever. The global industrial robotics market, valued at around $50 billion in 2024, demonstrates the growing viability of automation as a substitute for certain manufacturing tasks previously handled by traditional machinery.

| Substitute Technology | 2024 Market Value (Approx.) | Key Threat to DMG Mori | DMG Mori's Counter-Strength |

| Additive Manufacturing (3D Printing) | $20.5 billion | Cost-effective for complex, low-volume parts; reduced material waste. | High-precision, surface finish, material integrity in critical applications. |

| Industrial Robotics & Automation | $50 billion | Efficiency and precision in repetitive assembly/welding tasks. | Versatility and precision in complex machining operations. |

| Advanced Composites Manufacturing | (Integrated within broader materials market) | Lighter weight, higher strength-to-weight ratio for specific components. | Precision machining of complex geometries and tight tolerances. |

Entrants Threaten

The machine tool industry demands immense capital. Developing cutting-edge technology, like the advanced automation DMG Mori is known for, requires substantial research and development funding. For instance, companies investing in Industry 4.0 capabilities face significant upfront costs.

Establishing state-of-the-art manufacturing facilities and a robust global sales and service infrastructure also necessitates billions in investment. This high barrier to entry effectively deters many potential new competitors from even attempting to enter the market.

Existing players like DMG Mori leverage strong proprietary technology and patents in CNC, automation, and advanced machining, creating significant barriers to entry. DMG Mori's commitment to innovation, evidenced by numerous world premieres, further solidifies its technological advantage.

Economies of scale significantly deter new entrants in the machine tool industry. Established players like DMG Mori benefit from massive production volumes, leading to lower per-unit costs in manufacturing, procurement, and distribution. For instance, in 2023, DMG Mori reported a revenue of €3.1 billion, indicating substantial operational scale that new, smaller competitors cannot easily replicate.

The experience curve further reinforces this barrier. DMG Mori's decades of accumulated knowledge in designing, producing, and servicing sophisticated machinery translate into greater efficiency, higher quality, and reduced waste. This deep-seated expertise allows them to offer competitive pricing and superior product performance, making it incredibly challenging for newcomers to achieve comparable cost structures and product reliability.

Access to Distribution Channels and Customer Loyalty

New entrants face significant hurdles in establishing robust global distribution networks. Industrial customers, particularly in the machinery sector, often prioritize established relationships and reliable after-sales service, making it difficult for newcomers to gain traction. DMG Mori's extensive network of 124 sales and service locations worldwide exemplifies the established infrastructure that new competitors must overcome.

Customer loyalty is a key barrier, as existing relationships built on trust and consistent support are hard to displace. New entrants must not only offer competitive products but also invest heavily in building a comparable service and support ecosystem to attract and retain customers. This often involves significant upfront capital expenditure and a long-term commitment to customer satisfaction.

- Established Distribution Networks: New entrants struggle to replicate the extensive global sales and service infrastructure of incumbents like DMG Mori, which boasts 124 locations.

- Customer Loyalty and Trust: Industrial buyers tend to stick with established suppliers due to long-term relationships and the critical need for dependable after-sales support.

- High Switching Costs: The complexity and cost associated with changing machinery suppliers create a significant barrier for new market entrants.

- Brand Reputation: A strong brand reputation, built over years of reliable performance and service, acts as a powerful deterrent against new competition.

Government Policy and Regulations

Government policies and regulations can significantly deter new entrants. For instance, stringent environmental regulations, like those implemented in the European Union's Green Deal, can require substantial upfront investment in compliance technology, favoring established players with existing infrastructure. Trade tariffs and import quotas, such as those impacting the automotive sector in various regions, can also increase the cost of entry for foreign competitors.

Industry standards, particularly in sectors like aerospace or medical devices, often mandate rigorous quality and safety certifications. Achieving these certifications can be a lengthy and expensive process, acting as a substantial barrier. For example, obtaining FDA approval for medical devices can take years and millions of dollars, making it difficult for smaller, newer companies to compete with established manufacturers.

- Stricter environmental regulations increase capital expenditure for new market entrants.

- Trade barriers like tariffs can elevate the cost of importing components or finished goods.

- Industry-specific certifications (e.g., aerospace, medical) require significant time and financial investment.

- Compliance with safety standards can create a high hurdle for new businesses.

The threat of new entrants in the machine tool industry, particularly for a company like DMG Mori, is generally low due to substantial barriers. These include the massive capital required for R&D and manufacturing, the need for extensive global sales and service networks, and the significant advantage of established economies of scale and experience curves. Furthermore, customer loyalty, strong brand reputation, and the high cost of switching suppliers create a formidable challenge for newcomers.

Government regulations, industry standards, and the cost of certifications also act as significant deterrents. For instance, the substantial investment in advanced automation and digital manufacturing capabilities, like those pursued by DMG Mori, requires deep pockets that many potential entrants lack. In 2023, DMG Mori reported revenues of €3.1 billion, highlighting the immense scale of operations that new players must contend with.

| Barrier Type | Description | Example Impact on New Entrants | DMG Mori's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and infrastructure. | Requires billions in investment to compete. | Established financial resources and operational scale. |

| Distribution & Service | Need for a global sales and service network. | Difficult to replicate DMG Mori's 124 locations. | Extensive existing infrastructure and customer relationships. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants face higher production costs. | Significant cost advantages from large-scale operations. |

| Customer Loyalty | Preference for established suppliers due to trust and support. | Challenging to displace existing supplier relationships. | Strong brand reputation and long-term customer partnerships. |

Porter's Five Forces Analysis Data Sources

Our DMG Mori Porter's Five Forces analysis is built upon a foundation of comprehensive data, including DMG Mori's annual reports, investor presentations, and public financial statements. We also incorporate industry-specific market research reports from reputable firms and news from leading trade publications to capture competitive dynamics.