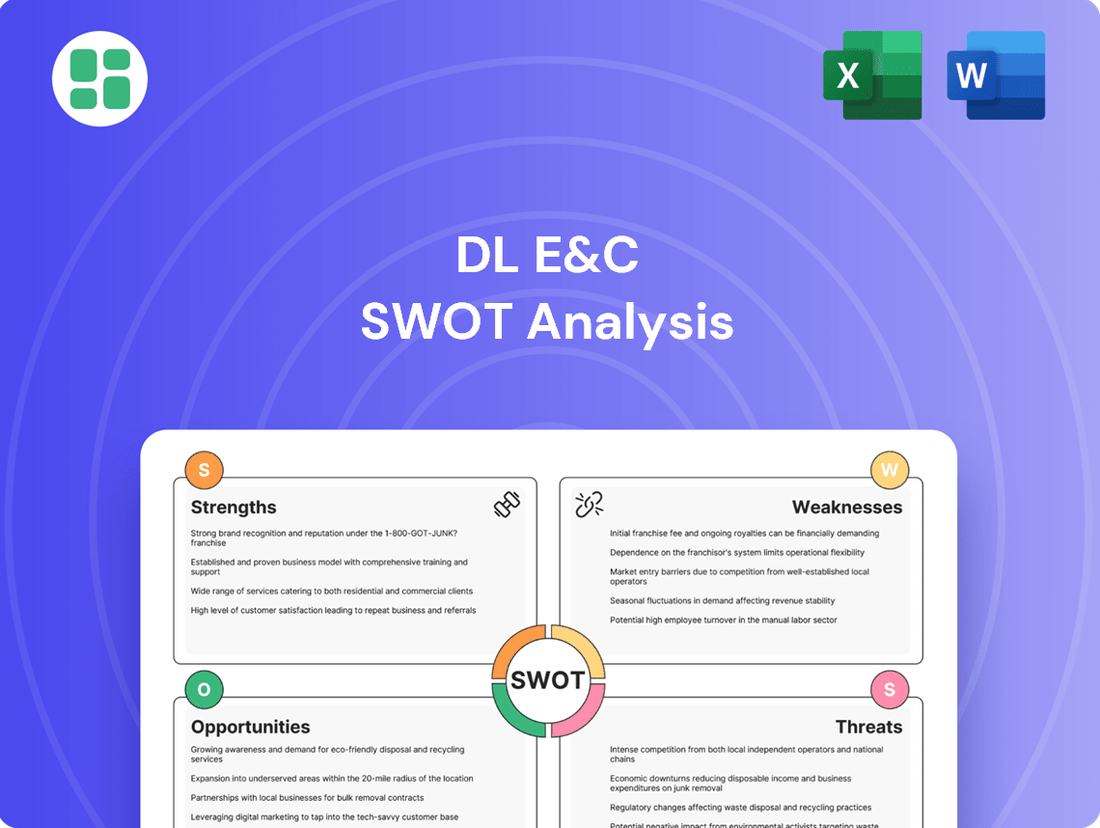

DL E&C SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DL E&C Bundle

DL E&C boasts significant strengths in its engineering capabilities and a strong backlog, but faces challenges from intense market competition and potential economic downturns. Understanding these dynamics is crucial for strategic planning.

Want the full story behind DL E&C's market position, identifying both their robust capabilities and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

DL E&C's strength lies in its highly diversified project portfolio, spanning civil engineering, building construction, and industrial plant development. This broad expertise allows the company to effectively manage risks by not being overly dependent on any single market segment. For instance, in 2023, DL E&C secured significant orders across various sectors, contributing to a robust order backlog that provides a stable foundation for future revenue.

DL E&C's comprehensive Engineering, Procurement, and Construction (EPC) capabilities offer clients a unified solution for project delivery. This end-to-end service model simplifies complex projects by providing a single point of accountability, which is crucial for large-scale developments. The company's ability to manage the entire lifecycle from design to construction significantly boosts project efficiency and can lead to improved cost and schedule adherence.

DL E&C's extensive global project execution experience is a significant strength. The company has a proven history of successfully managing complex construction projects across diverse international markets, demonstrating its capability to navigate varied regulatory landscapes and cultural differences. This global reach, evidenced by projects in regions like the Middle East and Southeast Asia, allows DL E&C to tap into new growth opportunities and diversify its revenue streams, thereby mitigating risks associated with reliance on a single domestic market.

Strong Technical Expertise and Innovation

DL E&C's deep involvement in constructing intricate industrial facilities, such as petrochemical plants and power generation sites, underscores its robust technical expertise and engineering capabilities. This proficiency allows the company to undertake projects demanding highly specialized knowledge and advanced construction techniques.

The company's dedication to innovation is evident in its likely investments in research and development, focusing on adopting cutting-edge construction technologies and methodologies. For instance, in 2023, DL E&C reported significant progress in developing and implementing smart construction technologies, aiming to boost productivity by an estimated 15-20% on complex projects.

This commitment to technical excellence is a cornerstone of DL E&C's ability to secure and successfully execute sophisticated projects requiring precise engineering and execution. Maintaining a technological advantage is paramount for staying competitive in the dynamic global construction landscape.

Key aspects of DL E&C's technical strengths include:

- Advanced Engineering Prowess: Demonstrated through successful completion of complex industrial projects.

- Investment in R&D: Focus on adopting new construction technologies for efficiency and quality.

- Specialized Project Execution: Capability to handle projects requiring sophisticated engineering solutions.

- Technological Leadership: Maintaining an edge in innovation to ensure market competitiveness.

Established Brand and Reputation

DL E&C benefits from a strong brand as a global construction leader, a reputation forged through consistent project success and high-quality delivery. This established credibility is crucial for attracting new clients and encouraging repeat business, offering a significant edge in securing lucrative contracts and strategic alliances.

The company's long-standing presence in the industry, underscored by its global reach, translates into deep-seated trust and reliability. This strong brand identity not only aids in winning new projects but also plays a vital role in attracting and retaining top talent, ensuring a skilled workforce.

DL E&C's established brand and reputation are reflected in its financial performance. For instance, in 2023, the company secured new orders totaling KRW 14.1 trillion, demonstrating market confidence. Furthermore, its backlog at the end of 2023 stood at KRW 37.1 trillion, indicating sustained demand driven by its reputable standing.

- Global Recognition: DL E&C is recognized worldwide for its extensive portfolio of complex engineering and construction projects.

- Client Trust: A history of successful project completion and adherence to stringent quality standards has cultivated significant client loyalty.

- Market Credibility: The company's brand equity allows it to command premium pricing and favorable terms in contract negotiations.

- Talent Magnet: Its reputable name attracts skilled professionals, enhancing its capacity for innovation and execution.

DL E&C's diversified project portfolio across civil engineering, building, and industrial sectors mitigates risk. In 2023, the company secured substantial orders, bolstering its backlog to KRW 37.1 trillion by year-end, ensuring revenue stability.

Its comprehensive EPC capabilities provide single-point accountability for complex projects, enhancing efficiency and schedule adherence. DL E&C's global experience, including successful projects in the Middle East and Southeast Asia, allows access to new markets and revenue diversification.

The company's technical expertise shines in intricate industrial facilities like petrochemical plants. DL E&C's 2023 R&D investment in smart construction technologies aims to boost productivity by an estimated 15-20% on complex projects.

DL E&C's strong global brand, built on consistent quality and project success, attracts clients and talent. This reputation is evidenced by KRW 14.1 trillion in new orders secured in 2023, reflecting market confidence.

| Strength Area | Key Aspect | 2023 Data/Impact |

|---|---|---|

| Project Diversification | Broad sector expertise (civil, building, industrial) | KRW 37.1 trillion order backlog end of 2023 |

| EPC Capabilities | End-to-end project management | Improved cost and schedule adherence on complex projects |

| Global Experience | Execution in diverse international markets | Access to new growth opportunities and revenue streams |

| Technical Expertise | Specialized industrial facility construction | Estimated 15-20% productivity boost from smart construction tech |

| Brand Reputation | Global recognition and client trust | KRW 14.1 trillion in new orders secured in 2023 |

What is included in the product

Analyzes DL E&C’s competitive position through key internal and external factors, including its strengths in technology and market presence, alongside opportunities in global infrastructure development and threats from economic volatility.

Simplifies complex strategic analysis into an actionable framework for DL E&C, reducing decision paralysis.

Weaknesses

The construction sector, including DL E&C, faces significant risks from fluctuating commodity prices. Steel, cement, and energy are foundational materials, and their price swings directly impact project costs. For instance, global steel prices saw considerable volatility in 2023 and early 2024, influenced by supply chain disruptions and geopolitical events, which can squeeze DL E&C's margins on long-term, fixed-price contracts.

Sudden increases in these material expenses can severely reduce profitability, especially when projects are locked into pre-determined pricing. This necessitates robust risk management, including advanced hedging techniques and adaptable contract structures. However, consistently applying these strategies across DL E&C's varied project portfolio presents an ongoing operational challenge.

DL E&C, like many in the construction sector, faces significant vulnerability to economic cycles. Demand for its building and infrastructure projects directly correlates with the overall health of the economy and government investment. For instance, a slowdown in global GDP growth, which saw a projected 2.6% in 2024 according to the IMF, can translate into fewer new projects and a shrinking order book for DL E&C.

Recessions or economic downturns can severely impact revenue generation. During such periods, both private and public sector investment in construction typically contracts. This cyclicality means DL E&C's financial performance is inherently sensitive to macroeconomic shifts, necessitating robust financial planning to weather periods of reduced demand.

While geographical diversification can help spread risk, it doesn't entirely shield the company from global economic headwinds. The inherent nature of the construction industry means that widespread economic contractions will inevitably affect project pipelines and profitability, regardless of geographic spread.

The global construction and engineering arena is a battlefield, crowded with seasoned giants all chasing the same lucrative, large-scale projects. This fierce rivalry often forces companies like DL E&C to sharpen their pencils on bids, squeezing profit margins and making it tougher to land new work. For instance, the global construction market was valued at approximately $14.7 trillion in 2023, a figure expected to grow, but this growth is shared among many players.

DL E&C needs to constantly innovate and prove its worth, not just on price but through cutting-edge technology and flawless execution, to stay ahead. The landscape is further complicated by a mix of strong domestic rivals and formidable international competitors, each vying for a slice of the market, making expansion and securing new contracts a persistent challenge.

Project-Specific Risks and Cost Overruns

Large-scale construction projects, like those undertaken by DL E&C, are inherently exposed to significant risks. These can range from unexpected subsurface conditions and evolving environmental regulations to labor unrest and complex technical hurdles. Such issues frequently result in schedule slippage, budget blowouts, and potential disagreements with clients, directly affecting financial performance and brand image. For instance, the global construction industry has seen increasing volatility; a 2024 report indicated that over 70% of major projects experienced cost overruns, with an average exceeding 15% of the initial budget.

Effective management of these multifaceted risks is crucial for DL E&C. This involves implementing stringent project management methodologies, developing comprehensive contingency plans, and deploying proactive risk mitigation tactics. Despite these efforts, a residual level of vulnerability to these project-specific challenges persists, impacting the company's operational stability and profitability projections.

- Project Delays: Unforeseen site conditions and regulatory shifts can push completion dates back, incurring additional costs.

- Cost Overruns: Fluctuations in material prices and labor availability, as seen in the 2024 market, can significantly exceed initial estimates.

- Reputational Damage: Failure to manage project risks effectively can lead to disputes and negatively impact DL E&C's standing with clients and stakeholders.

- Profitability Impact: Delays and overruns directly erode profit margins, potentially turning profitable projects into losses.

Reliance on Specific Regional Market Conditions

DL E&C's significant revenue concentration in its home market, South Korea, presents a notable weakness. For instance, in 2023, a substantial portion of its order backlog and new orders were secured within South Korea, making its financial performance heavily susceptible to domestic economic fluctuations and government infrastructure spending policies.

This reliance on specific regional market conditions, particularly in South Korea, limits DL E&C's ability to fully leverage global diversification. Economic downturns or geopolitical shifts within this primary market can disproportionately impact the company's overall financial health, potentially leading to volatility in earnings and project pipelines.

The company's exposure to localized market downturns or intensified competition in its key operating regions remains a significant concern. For example, increased competition from domestic players in South Korea's construction sector could pressure margins and market share, highlighting the need for broader geographic expansion to mitigate these risks.

To address this weakness, DL E&C must prioritize strategic expansion into new, stable international markets. This diversification is crucial to reduce its dependence on any single region and build a more resilient business model capable of weathering localized economic or political challenges.

DL E&C's reliance on a limited number of large-scale projects creates a vulnerability. A significant setback on one major contract, such as a major infrastructure development or a large petrochemical plant, could disproportionately impact the company's overall financial performance and profitability. For instance, if a flagship project in 2024 faced severe delays or cost overruns, it could significantly dent earnings, even if other smaller projects performed well.

This concentration means that the company's success is heavily tied to the performance and successful completion of a few key endeavors. Managing the complexities and risks associated with these mega-projects is paramount, as any failure can have amplified negative consequences that are difficult to offset.

The company's dependence on a concentrated project portfolio makes it susceptible to disruptions. For example, a major project delay or cancellation in 2024 due to unforeseen circumstances or client-side issues could lead to substantial revenue shortfalls and impact cash flow, even with a healthy overall order book.

DL E&C's operational efficiency can be hampered by its substantial fixed costs. High overheads related to skilled labor, specialized equipment, and extensive administrative structures mean that a downturn in project volume can quickly lead to reduced profitability. For example, if the company's utilization rate of its heavy machinery dropped significantly in early 2025 due to fewer new project awards, the fixed costs associated with that equipment would weigh more heavily on its bottom line.

| Weakness | Description | Impact | Example/Data Point |

| Project Concentration | Heavy reliance on a few large-scale projects. | Disproportionate impact of any single project's failure on overall financials. | A major project delay in 2024 could significantly impact DL E&C's earnings. |

| High Fixed Costs | Significant overheads including labor, equipment, and administration. | Reduced profitability during periods of lower project volume or utilization. | Lower machinery utilization in early 2025 due to fewer awards would increase cost burden. |

Same Document Delivered

DL E&C SWOT Analysis

This is the same DL E&C SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full DL E&C SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

This is a real excerpt from the complete DL E&C SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The global push for sustainability is creating significant opportunities in infrastructure. Governments worldwide are increasingly prioritizing green building and eco-friendly development, with initiatives like the EU Green Deal aiming for climate neutrality by 2050. DL E&C can leverage this by focusing on renewable energy projects and smart city solutions, tapping into a market segment that aligns with strong ESG investment trends.

Emerging markets are a significant growth avenue, driven by rapid urbanization and industrialization. For instance, Southeast Asia's infrastructure spending is projected to reach $1.5 trillion by 2030, creating substantial opportunities for construction firms like DL E&C. By leveraging its global expertise, DL E&C can tap into this burgeoning demand for residential, industrial, and infrastructure projects.

These regions often offer less intense competition compared to developed markets, presenting a chance for DL E&C to secure large-scale contracts and establish a strong foothold. While carefully navigating political and economic volatilities is crucial, the long-term growth potential is considerable. Collaborating with local partners can significantly ease market entry and enhance project success rates, as seen with successful joint ventures in other regions.

DL E&C can leverage the construction industry's digital transformation, which sees widespread adoption of Building Information Modeling (BIM), prefabrication, and AI. For instance, the global construction technology market was valued at approximately $11.4 billion in 2023 and is projected to reach $33.7 billion by 2028, showcasing significant growth potential.

Integrating these advanced technologies allows DL E&C to boost operational efficiency, cut costs, and elevate project quality. Companies that adopt BIM, for example, have reported cost savings of up to 10% and schedule reductions of up to 5%.

Embracing innovation offers a substantial competitive edge, enabling faster project delivery, safer work sites, and more accurate execution. This strategic move also aids in attracting and retaining a workforce skilled in modern technological applications.

Increasing Global Energy Transition Projects

The global drive towards decarbonization presents a significant opportunity for DL E&C. The company's expertise in plant construction is highly relevant for the burgeoning renewable energy sector, including solar, wind, and hydrogen power generation. For instance, the International Energy Agency (IEA) projects that renewable energy capacity additions will continue to accelerate, reaching an estimated 500 GW globally in 2024, a significant increase from previous years.

DL E&C can leverage this trend by focusing on building new renewable energy facilities and critical infrastructure like energy storage systems. Furthermore, there's a substantial market for upgrading existing industrial plants to improve efficiency and implement carbon capture technologies, a segment expected to see robust investment as companies strive to meet net-zero targets. The global market for carbon capture, utilization, and storage (CCUS) is anticipated to grow substantially, with project investments expected to reach hundreds of billions of dollars by 2030.

- Renewable Energy Infrastructure: Building new solar farms, wind power installations, and hydrogen production facilities.

- Energy Storage Solutions: Constructing battery storage systems and other energy storage technologies to support grid stability.

- Industrial Plant Modernization: Retrofitting existing plants for enhanced energy efficiency and the integration of carbon capture technologies.

- Global Sustainability Alignment: Positioning DL E&C as a key player in projects that directly contribute to international climate goals.

Public-Private Partnership (PPP) Model Growth

Governments globally are increasingly leveraging Public-Private Partnerships (PPPs) to bridge infrastructure funding gaps, a trend expected to accelerate. For instance, the global PPP market size was estimated to be around $1.2 trillion in 2023 and is projected to grow significantly. DL E&C can capitalize on this by actively seeking PPP projects, which offer the dual benefit of stable, long-term revenue streams and risk mitigation through collaboration with public entities.

PPPs present a more predictable project pipeline, shielding DL E&C from the volatility often associated with purely private sector-driven development. This model allows for shared responsibility in project execution and financial commitment. By 2024, many national infrastructure plans, such as those in North America and Europe, are heavily reliant on PPP frameworks to deliver critical projects like transportation networks and renewable energy facilities.

To effectively harness this opportunity, DL E&C must cultivate robust expertise in structuring and managing complex PPP agreements. This includes developing strong financial modeling capabilities for risk assessment and return optimization within these frameworks. The company's ability to navigate regulatory environments and build strong relationships with government bodies will be paramount to securing and successfully delivering PPP projects.

Key advantages for DL E&C in pursuing PPPs include:

- Access to a larger pool of projects: Governments often prioritize PPPs for large-scale public works.

- Enhanced financial stability: Long-term contracts provide predictable revenue streams.

- Risk sharing: Public sector involvement mitigates certain project risks.

- Strategic partnerships: Fosters stronger relationships with government agencies.

The global shift towards sustainability is a major opportunity, with governments worldwide pushing for green infrastructure. DL E&C can focus on renewable energy projects and smart city solutions, aligning with strong ESG investment trends. The International Energy Agency (IEA) projects accelerating renewable energy capacity additions, reaching an estimated 500 GW globally in 2024.

Emerging markets offer substantial growth, fueled by urbanization and industrialization. Southeast Asia's infrastructure spending is expected to hit $1.5 trillion by 2030, presenting a prime area for DL E&C to secure large-scale projects. These regions can offer less competition, allowing DL E&C to establish a stronger market presence.

The construction industry's digital transformation, marked by the adoption of BIM and AI, presents another key opportunity. The global construction technology market was valued around $11.4 billion in 2023 and is projected to reach $33.7 billion by 2028, indicating significant growth for tech-savvy firms. Companies using BIM have reported up to 10% cost savings.

Public-Private Partnerships (PPPs) are increasingly used to fund infrastructure, with the global PPP market estimated at $1.2 trillion in 2023. DL E&C can secure long-term revenue streams and mitigate risks by participating in these projects, particularly in transportation and renewable energy sectors.

| Opportunity Area | Key Drivers | Market Data/Projections | DL E&C Relevance |

| Sustainability & Green Infrastructure | Global decarbonization efforts, ESG investment | IEA: 500 GW renewable capacity in 2024 | Renewable energy plants, smart city solutions |

| Emerging Market Growth | Urbanization, industrialization | SEA infrastructure: $1.5T by 2030 | Residential, industrial, infrastructure projects |

| Digital Transformation in Construction | BIM, AI, prefabrication adoption | ConTech market: $11.4B (2023) to $33.7B (2028) | Efficiency gains, cost reduction, quality improvement |

| Public-Private Partnerships (PPPs) | Infrastructure funding gaps | Global PPP market: ~$1.2T (2023) | Stable revenue, risk sharing, project pipeline access |

Threats

The construction sector is under a microscope, with regulators worldwide tightening rules on environmental impact, fair labor, and safety. For DL E&C, this means that keeping up with these evolving standards, often driven by Environmental, Social, and Governance (ESG) mandates, can increase project costs and slow down approvals. For instance, in 2024, the global construction industry saw a notable rise in ESG-related investments, indicating a significant shift in operational expectations.

Non-compliance with these increasingly stringent regulations poses substantial risks, including hefty fines, project delays or outright cancellations, and significant damage to DL E&C's reputation. The potential for legal challenges also looms large. Meeting these complex requirements demands continuous adaptation and investment in new technologies and practices.

Geopolitical instability presents a significant threat to DL E&C, given its extensive global operations. For instance, ongoing trade tensions between major economies could lead to increased tariffs on imported materials, directly impacting project budgets and timelines. The company must remain vigilant, as disruptions in regions experiencing political unrest, such as those seen in parts of the Middle East or Africa in recent years, can halt construction and jeopardize worker safety.

Rising interest rates, a significant concern for DL E&C, directly impact borrowing costs. For instance, if benchmark rates like the Bank of Korea's policy rate increase by 0.25% in 2024, DL E&C's financing expenses could climb, potentially affecting project profitability and the attractiveness of new ventures for clients.

Higher financing costs can dampen the overall demand for new construction projects. This slowdown in project initiation directly translates to a potential reduction in DL E&C's order book, as fewer clients may be able to secure affordable funding for their development plans throughout 2024 and into 2025.

Existing projects that utilize variable-rate financing are also vulnerable. An increase in interest rates could lead to higher operational expenses for these ongoing projects, squeezing profit margins. This volatility underscores the critical need for DL E&C to manage its debt exposure and secure stable, affordable capital for its extensive operations.

Talent Shortages and Rising Labor Costs

The construction sector, including firms like DL E&C, grapples with persistent talent shortages, particularly for skilled engineers, project managers, and specialized trades. This scarcity directly impacts project timelines and budgets, as seen in the broader industry where labor costs have been a significant driver of inflation. For instance, in 2024, construction labor costs saw an average increase of 4.5% year-over-year in the US, a trend mirrored globally, impacting project profitability and the ability to undertake ambitious new ventures.

The demographic shift, with an aging workforce in key markets, intensifies this challenge. As experienced professionals retire, the pipeline of new talent struggles to keep pace, creating a widening skills gap. This situation forces companies to compete more aggressively for available workers, pushing wages higher and potentially compromising the quality of execution if less experienced individuals are brought in to fill critical roles.

To mitigate these threats, strategic investments in training and development are paramount for DL E&C and its peers.

- Skilled Labor Gap: A 2024 survey indicated that over 70% of construction firms reported difficulty finding skilled workers, a figure consistent with previous years.

- Wage Inflation: The average hourly wage for construction laborers in the US rose by approximately 5% in early 2024, contributing to increased project overhead.

- Demographic Challenge: The average age of a skilled tradesperson in many Western economies is nearing 50, signaling a critical need for new entrants.

- Project Impact: Delays attributed to labor shortages can cost projects millions, impacting client satisfaction and future bidding opportunities.

Disruptive Technologies and New Entrants

Disruptive technologies, such as advanced robotics and AI-powered project management, present a significant threat. Competitors who rapidly adopt these innovations could gain a substantial edge, potentially offering lower costs or faster project completion times. For instance, the global construction robotics market was valued at approximately $1.5 billion in 2023 and is projected to reach over $4 billion by 2030, indicating a rapid shift towards automation.

New entrants or existing rivals focusing on modular construction or prefabrication can also disrupt traditional building methods. These approaches often lead to increased efficiency and reduced waste. Companies like Katerra, despite facing challenges, demonstrated the potential for tech-driven modular construction to reshape the industry, highlighting the need for DL E&C to monitor and integrate similar advancements.

DL E&C must prioritize continuous innovation and the swift integration of new technologies to remain competitive. Failing to keep pace with more agile, tech-focused competitors could result in a loss of market share. The company's ability to adapt and leverage emerging technologies will be critical in navigating this evolving landscape and maintaining its market position.

- Disruptive Technologies: Robotics and AI in construction are rapidly advancing, impacting efficiency and cost.

- Modular Construction: Prefabrication and off-site construction offer competitive advantages in speed and waste reduction.

- Market Value: The global construction robotics market is expected to grow significantly, reaching over $4 billion by 2030.

- Competitive Pressure: Failure to adopt new technologies risks market share erosion against more innovative rivals.

Intensifying regulatory scrutiny, particularly around ESG compliance, presents a significant hurdle. DL E&C must navigate evolving environmental protection laws and labor standards, which can increase operational costs and project approval times. For example, in 2024, many global construction markets saw a notable uptick in ESG-related project requirements, impacting budget allocations.

Geopolitical instability and rising interest rates pose further threats, potentially disrupting supply chains, increasing financing costs, and dampening overall project demand. For instance, a 0.25% increase in the Bank of Korea's policy rate in 2024 could directly elevate DL E&C's borrowing expenses, affecting profitability. Additionally, persistent shortages of skilled labor, with average construction wages rising around 4.5% in the US in 2024, strain project timelines and budgets.

The rapid advancement of disruptive technologies, such as AI and robotics in construction, creates competitive pressure. Companies failing to adopt these innovations risk losing market share to more agile, tech-focused rivals. The global construction robotics market, valued at $1.5 billion in 2023, is projected to exceed $4 billion by 2030, highlighting this technological shift.

SWOT Analysis Data Sources

This DL E&C SWOT analysis is built upon a robust foundation of data, drawing from verified financial statements, comprehensive market intelligence, and authoritative industry publications to ensure an accurate and actionable strategic assessment.