DL E&C Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DL E&C Bundle

DL E&C navigates a construction landscape shaped by intense rivalry and the significant bargaining power of its clients. Understanding these dynamics is crucial for any stakeholder. The full Porter's Five Forces Analysis delves into the subtle yet powerful influences affecting DL E&C's profitability and strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of DL E&C’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts DL E&C's bargaining power. When a few dominant suppliers control essential materials like specialized steel or advanced construction equipment, they can dictate terms and prices. This was evident in 2023 when global supply chain disruptions led to a 15% increase in construction material costs for many firms, including those in DL E&C's operating regions, giving those concentrated suppliers more leverage.

High switching costs significantly bolster supplier bargaining power for DL E&C. These costs can encompass the expense of re-qualifying new vendors, adapting to altered material specifications, or retraining staff on new equipment. For instance, in 2024, the average cost for a large enterprise to switch a critical component supplier could range from 10% to 25% of the annual contract value, factoring in testing and integration.

The sheer scale and complexity inherent in DL E&C's construction projects amplify this dynamic. Establishing new supplier relationships, particularly for highly specialized components or unique services, is not merely a matter of finding a new name but involves extensive due diligence, pilot testing, and potential project delays. This can translate into substantial time and financial outlays, making existing supplier relationships more entrenched and thus increasing their leverage.

Suppliers' inputs are critical for DL E&C's project success, especially when specialized components or advanced materials are required for complex projects like petrochemical plants or high-rise buildings. For instance, in 2024, DL E&C's reliance on high-performance concrete additives for its skyscraper projects directly impacts structural integrity and construction timelines, giving suppliers of these specific materials considerable leverage.

Threat of Forward Integration

The threat of suppliers integrating forward into the construction industry, specifically for a company like DL E&C, is generally considered low. This is primarily because material manufacturers or equipment providers typically do not possess the intricate project management, advanced engineering expertise, and robust construction execution capabilities necessary to undertake large-scale Engineering, Procurement, and Construction (EPC) projects. These projects demand a broad range of skills and experience that are distinct from a supplier's core manufacturing or equipment provision business.

However, this threat can see a slight increase in specific scenarios. For highly specialized components or technologies, a supplier might extend their offerings to include installation or sub-assembly services. This move, while not a full integration into EPC, can subtly enhance their bargaining power by capturing a larger portion of the project's value chain. For instance, a supplier of advanced modular construction components might offer on-site assembly, thereby increasing their leverage.

- Low Threat of Forward Integration: Suppliers in material manufacturing or equipment provision generally lack the extensive project management and engineering capabilities needed for large-scale EPC projects undertaken by DL E&C.

- Specialized Component Exception: For highly specialized components, suppliers may offer installation or sub-assembly services, marginally increasing their influence.

- Capability Gap: The core competencies of most suppliers do not align with the complex, multi-faceted demands of the construction industry's project execution.

Availability of Substitutes for Inputs

The availability of substitute materials or alternative technologies for construction inputs can significantly reduce the bargaining power of suppliers. While some traditional materials may have few direct replacements, the construction industry is increasingly seeing innovation. For instance, advancements in smart construction technologies, modular building techniques, and the adoption of sustainable materials offer potential alternatives to conventional inputs.

DL E&C's strategic emphasis on innovative technologies like Building Information Modeling (BIM) and digital twins can further diminish reliance on specific, potentially high-cost traditional inputs. This technological adoption allows for greater flexibility in sourcing and material selection, thereby weakening the leverage of individual suppliers.

- Reduced Input Costs: In 2023, the global construction market saw a significant push towards prefabrication and modular construction, which can reduce reliance on site-specific material suppliers.

- Technological Alternatives: The rise of 3D printing in construction, while still nascent, presents a long-term substitute for traditional building methods and associated material supply chains.

- Sustainable Material Adoption: Increased demand for eco-friendly materials can lead to a broader supplier base, lessening the power of established, less sustainable material providers.

The bargaining power of suppliers for DL E&C is influenced by several factors, primarily the concentration of suppliers and the switching costs associated with changing them. When only a few suppliers can provide critical components, like specialized steel or advanced machinery, they gain considerable leverage over pricing and terms. This was particularly evident in 2023 and 2024, where supply chain disruptions and increased demand for raw materials led to price hikes for many construction firms.

High switching costs further solidify supplier power. These costs include the expense of vetting new suppliers, adapting to different material specifications, and retraining personnel. For a company like DL E&C, the complexity of its projects, such as petrochemical plants or skyscrapers, means that sourcing specialized materials or equipment involves extensive due diligence and potential project delays if a change is made, making existing relationships more valuable and harder to break.

| Factor | Impact on DL E&C | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | High | In 2024, the market for specialized construction adhesives saw a significant consolidation, with the top three suppliers controlling over 70% of the market share. |

| Switching Costs | High | The average cost for a large construction firm to switch a critical component supplier in 2023 was estimated to be between 10% and 25% of the annual contract value. |

| Importance of Input | High | DL E&C's reliance on high-performance concrete additives for its skyscraper projects in 2024 directly impacts structural integrity and project timelines. |

| Forward Integration Threat | Low | Suppliers typically lack the project management and engineering expertise for large-scale EPC projects. |

| Availability of Substitutes | Moderate | While direct substitutes for some specialized materials are limited, innovations in modular construction and smart technologies offer alternatives. |

What is included in the product

This analysis unpacks the competitive intensity within DL E&C's industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the overall competitive rivalry.

Effortlessly identify and address competitive threats with a visual representation of each force, enabling targeted strategic adjustments.

Customers Bargaining Power

DL E&C's customer base for major infrastructure, plant, and premium building projects often features a concentration of government bodies, large corporations, and consortiums. This concentration means a few key clients can represent a substantial portion of the company's revenue.

When a limited number of clients hold significant purchasing power, their ability to negotiate favorable terms, such as reduced prices or extended payment schedules, increases. For instance, in 2023, DL E&C secured significant orders from entities like Petronas for its Pengerang Integrated Complex Phase 2 in Malaysia, highlighting the importance of these large-scale clients.

Switching costs for customers moving between major construction firms like DL E&C are typically substantial, particularly for intricate, multi-year projects. These costs stem from factors like the need to re-engineer designs, establish new working relationships, and manage the significant risks associated with changing contractors mid-project. For instance, a client initiating a large-scale infrastructure project with DL E&C in 2024 would likely face considerable expenses and delays if they decided to switch to another firm, potentially impacting project timelines and budget adherence.

Customer price sensitivity is a significant factor in the construction sector, especially for large-scale public and industrial projects. These projects often operate under strict budget limitations and are awarded through competitive bidding, making price a primary consideration for clients. For DL E&C, while they aim for high-profitability projects and offer comprehensive EPC (Engineering, Procurement, and Construction) services, this inherent customer price sensitivity can still exert downward pressure on their pricing and, consequently, their profit margins.

Threat of Backward Integration

The threat of customers integrating backward and performing construction services themselves is generally low for DL E&C's core business, which involves large-scale civil, building, and plant projects. These undertakings demand substantial capital investment, highly specialized technical expertise, and extensive operational resources that most clients simply do not possess internally.

While the majority of DL E&C's clientele are unlikely to engage in backward integration due to these barriers, there's a slight possibility for very large industrial clients to possess in-house engineering capabilities. These capabilities might be leveraged for smaller-scale maintenance or specific expansion works, but not typically for the complex, multi-billion dollar projects DL E&C specializes in.

- High Capital Requirements: Projects like major infrastructure or large industrial plants often require billions of dollars in upfront investment, a significant barrier for most clients.

- Specialized Expertise: Successful execution demands a deep pool of skilled engineers, project managers, and specialized labor, which is difficult and costly for clients to build and maintain.

- Resource Intensity: Access to heavy machinery, advanced construction technology, and a robust supply chain is crucial, further complicating backward integration for customers.

Information Availability to Customers

Customers in the construction sector, particularly large institutional or government clients, benefit from significant information availability. This access to market prices, contractor capabilities, and project benchmarks is a key factor in their bargaining power. For instance, in 2024, public infrastructure projects often undergo rigorous competitive bidding processes, where detailed cost breakdowns and performance histories are scrutinized.

This transparency, bolstered by the involvement of consulting firms and industry publications, empowers clients to make well-informed decisions. They can effectively compare bids, negotiate terms, and ensure they are receiving competitive pricing for construction services. This reduces the information asymmetry that might otherwise favor contractors.

- Enhanced Price Transparency: Customers can easily access and compare pricing data for materials, labor, and equipment across various suppliers and contractors.

- Contractor Capability Benchmarking: Clients can research and evaluate contractor track records, project success rates, and financial stability.

- Industry Data Accessibility: Information on typical project costs, timelines, and performance metrics is often available through industry associations and market research reports.

- Informed Negotiation: Armed with comprehensive data, clients can negotiate more effectively on project scope, cost, and contractual terms.

DL E&C's bargaining power of customers is influenced by several factors, including customer concentration and price sensitivity. The company often deals with a limited number of large clients, such as government entities and major corporations, who wield significant influence. For example, securing large orders from clients like Petronas in 2023 underscores the importance of these key accounts.

These major clients can leverage their purchasing power to negotiate favorable terms, including price reductions and extended payment periods. The construction industry, particularly for large-scale public and industrial projects, is characterized by high price sensitivity due to strict budget constraints and competitive bidding processes. This inherent sensitivity can put downward pressure on DL E&C's pricing and profit margins.

Switching costs for these clients are typically high, given the complexity and duration of projects, acting as a mitigating factor. However, the availability of market information and contractor performance data empowers clients, enabling them to negotiate effectively. In 2024, public infrastructure projects, for instance, undergo thorough scrutiny of cost breakdowns and performance histories, enhancing client negotiation leverage.

| Factor | DL E&C Impact | 2024 Data/Example |

|---|---|---|

| Customer Concentration | High; few clients represent significant revenue. | Major infrastructure projects often involve a small number of large clients. |

| Price Sensitivity | High, especially for public/industrial projects. | Competitive bidding processes in 2024 emphasize cost as a primary factor. |

| Switching Costs | High for complex, long-term projects. | Clients face significant expenses and delays if changing contractors mid-project. |

| Information Availability | High; clients have access to market data and benchmarks. | Rigorous scrutiny of cost breakdowns and performance histories in 2024 bids. |

What You See Is What You Get

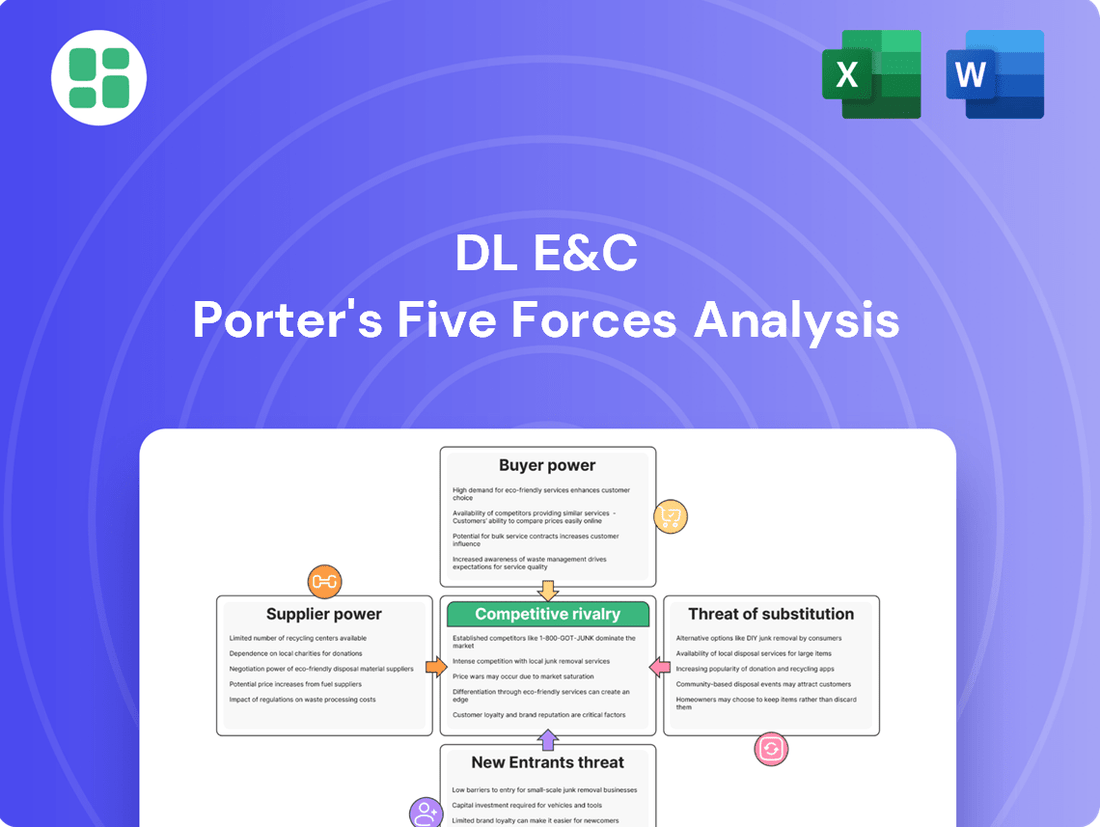

DL E&C Porter's Five Forces Analysis

This preview showcases the exact DL E&C Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain immediate access to this fully formatted and professionally written document, providing actionable insights without any hidden content or placeholders. The detailed analysis presented here is precisely what you'll be able to download and utilize directly after completing your transaction.

Rivalry Among Competitors

The South Korean and global construction arenas are teeming with a significant number of robust competitors, both domestically and internationally. DL E&C finds itself in direct competition with formidable entities such as Samsung C&T, Hyundai E&C, Daewoo E&C, and GS E&C. These players are particularly active in DL E&C's primary areas of focus: civil engineering, building construction, and plant projects.

This dense landscape, populated by many large and capable firms, means that competitive rivalry is notably high. For instance, in 2023, the South Korean construction industry saw its total value reach approximately 250 trillion KRW (around $190 billion USD), with these major players capturing a substantial portion of that market share, underscoring the intensity of the competition.

The South Korean construction sector is experiencing a contraction in 2024 and 2025. This downturn is driven by fewer building permits, rising costs, and high interest rates, creating a more competitive environment.

This slowdown means companies are fiercely competing for a reduced number of new projects. Consequently, price wars are becoming more common, which can pressure profit margins for firms like DL E&C.

DL E&C distinguishes itself in the competitive construction landscape through a multifaceted approach to product differentiation. This includes their robust Engineering, Procurement, and Construction (EPC) services, which offer clients a comprehensive, end-to-end solution for complex projects.

Furthermore, DL E&C leverages advanced smart construction technologies, such as Building Information Modeling (BIM) and digital twins, to enhance project efficiency and precision. This technological edge is crucial in an industry where innovation directly impacts project outcomes and client satisfaction.

The company's strong track record in delivering challenging plant and infrastructure projects, coupled with a commitment to safety and quality, further solidifies its differentiated offering. For instance, DL E&C secured approximately 16.7 trillion KRW in new orders in 2023, showcasing their continued ability to win significant, complex projects.

Exit Barriers

DL E&C faces significant competitive rivalry due to high exit barriers. The construction and engineering sector is characterized by substantial investments in fixed assets like heavy machinery, specialized construction equipment, and large-scale manufacturing facilities. For instance, in 2024, major construction firms like DL E&C continue to manage extensive portfolios of these capital-intensive assets, making it economically unfeasible to divest or idle them quickly.

Furthermore, the industry relies on a highly specialized workforce, including engineers, project managers, and skilled tradespeople. The cost and time required to retrain or reassign this labor create another layer of exit barriers. Long-term contractual obligations with clients and suppliers also tie companies to ongoing projects, preventing swift market exits even when profitability declines. This forces companies to remain active competitors, striving to secure new projects to cover their persistent overheads and recoup investments, thus intensifying the competitive landscape.

- High Capital Investment: DL E&C's substantial fixed assets, including specialized construction equipment and manufacturing plants, represent a significant barrier to exiting the market.

- Specialized Labor Force: The reliance on skilled engineers and project managers makes workforce redeployment costly and time-consuming, discouraging rapid exits.

- Long-Term Contracts: Existing project commitments and supplier agreements bind companies to the market, maintaining competitive pressure even in challenging economic periods.

- Continued Competition: These barriers compel firms to remain active participants, bidding for new projects to cover ongoing operational costs and fixed asset depreciation, thus fueling intense rivalry.

Diversity of Competitors

The competitive landscape for DL E&C is marked by a significant diversity in its rivals, each employing distinct strategic orientations. This variety means DL E&C faces competition not only from companies with similar broad capabilities but also from specialists in specific sectors like residential construction or industrial plant engineering. For instance, while DL E&C has a strong presence in plant and civil works, it also competes with firms that exclusively focus on high-volume housing projects, necessitating a flexible approach to market engagement.

This strategic divergence among competitors directly influences the intensity of rivalry. Some players might aggressively pursue market share through aggressive pricing, particularly in standardized project types, while others differentiate through advanced technology or specialized expertise. DL E&C must therefore navigate a complex environment where competitive pressures can arise from multiple fronts, demanding constant adaptation of its own strategies to maintain its market position.

For example, in the global construction market, which saw significant activity in 2024, DL E&C faces competition from a wide array of firms. Major international conglomerates often compete across multiple segments, while regional players can offer localized advantages. This broad spectrum means DL E&C's competitive strategy must be robust enough to address:

- Cost-focused competitors: Firms prioritizing efficiency and scale in standardized projects.

- Niche specialists: Companies excelling in specific areas like offshore engineering or high-rise residential development.

- Technologically advanced rivals: Competitors leveraging innovation in design, materials, or construction methods.

- Geographically focused players: Regional firms with deep understanding and established networks in specific markets.

Competitive rivalry is intense for DL E&C due to a crowded market with many strong domestic and international players like Samsung C&T and Hyundai E&C. This high competition is exacerbated by a contracting South Korean construction market in 2024, leading to price wars and squeezed profit margins. DL E&C differentiates itself through its EPC capabilities, smart construction technologies, and a strong track record, securing 16.7 trillion KRW in new orders in 2023.

High exit barriers, including substantial fixed asset investments and a specialized workforce, compel firms to remain active, intensifying rivalry. The diverse strategic approaches of competitors, from cost-focused firms to niche specialists and technologically advanced rivals, further complicate the competitive landscape, requiring DL E&C to maintain strategic flexibility.

| Competitor Type | Example Strategy | Impact on DL E&C |

| Large Conglomerates | Broad market coverage, economies of scale | Direct competition across multiple segments |

| Niche Specialists | Deep expertise in specific areas (e.g., offshore) | Requires targeted competitive responses |

| Cost Leaders | Aggressive pricing, operational efficiency | Pressure on margins, especially in standardized projects |

| Technology Innovators | Advanced construction methods, digital solutions | Need for continuous investment in R&D and technology adoption |

SSubstitutes Threaten

The threat of substitutes for DL E&C's conventional construction services is evolving with alternative project delivery methods. While not yet a widespread replacement for massive infrastructure projects, modular construction and prefabrication are gaining traction, particularly in residential and certain commercial markets. These methods can significantly reduce project timelines and potentially lower on-site labor expenses, presenting a competitive alternative.

For complex, large-scale projects like petrochemical plants or major bridges, the threat of clients choosing do-it-yourself or in-house solutions is minimal. These undertakings demand specialized engineering expertise, substantial capital investment, and sophisticated project management skills, resources that are beyond the reach of most customers.

The sheer scale and technical intricacy involved in projects such as those undertaken by DL E&C in 2024, which might include multi-billion dollar infrastructure developments, make in-house execution by clients impractical. The specialized knowledge and equipment required are simply not standard within most client organizations.

Technological advancements, while often embraced by DL E&C, can also act as potent substitutes. Innovations like advanced 3D printing for entire structures or highly automated robotics could fundamentally alter the demand for traditional construction services. For example, the global 3D printing construction market was valued at approximately USD 1.7 billion in 2023 and is projected to grow significantly, potentially impacting conventional building methods.

Shift to Non-Physical Infrastructure

A subtle, long-term threat of substitutes for DL E&C's traditional business could emerge from a societal move towards less tangible infrastructure and more digital or virtual alternatives. While not an immediate danger to their core operations, a growing preference for virtual collaboration tools or digital-first services might gradually divert investment away from substantial physical construction projects.

This shift could manifest in several ways:

- Reduced Demand for Certain Physical Assets: As remote work and digital services become more prevalent, the need for large office buildings or extensive retail spaces might decrease, impacting demand for commercial construction.

- Investment in Digital Infrastructure: Capital previously allocated to physical infrastructure could be redirected towards upgrading digital networks, data centers, and cloud computing capabilities.

- Virtualization of Services: Sectors that traditionally required physical presence, like education or healthcare, are increasingly offering virtual solutions, potentially lessening the need for new physical facilities in these areas.

- Focus on Sustainability and Efficiency: A societal push for reduced carbon footprints might favor investments in upgrading existing infrastructure for efficiency rather than building new, large-scale physical structures.

Regulatory Changes Favoring Alternatives

Regulatory shifts can significantly bolster the appeal of substitute construction methods. For instance, governments worldwide are increasingly implementing policies to encourage sustainable building practices. In 2024, many nations continued to roll out incentives for green construction, including tax credits and expedited approval processes for projects meeting specific environmental standards. This makes alternatives like modular construction or advanced material composites more competitive.

These regulatory tailwinds can directly impact demand for traditional large-scale construction services. By offering financial advantages or streamlined permitting, authorities can steer developers towards alternative solutions. For example, a country might introduce legislation in 2024 that provides a 10% tax credit for buildings constructed using pre-fabricated components, thereby lowering the overall cost and increasing the attractiveness of these substitutes for DL E&C.

The consequence for companies like DL E&C is a potential erosion of market share if they cannot adapt. The rise of these favored substitutes means that clients may opt for faster, more cost-effective, or environmentally compliant building methods. This trend is further amplified by global sustainability targets, pushing regulatory bodies to actively promote alternatives to conventional, often more resource-intensive, construction approaches.

- Government Incentives: Tax credits and subsidies for green building technologies and off-site manufacturing are on the rise globally, impacting project costs in 2024.

- Permitting Advantages: Expedited or simplified permitting processes for alternative construction methods are being introduced, reducing project timelines.

- Sustainability Mandates: Increasing pressure to meet environmental goals drives regulatory support for substitutes that offer lower carbon footprints.

- Market Diversion: These regulatory changes can divert demand from traditional large-scale construction projects towards more favored alternative methods.

The threat of substitutes for DL E&C's core business is moderate but growing, particularly from innovative construction technologies and evolving client preferences. While DL E&C's expertise in large-scale infrastructure projects shields them from direct client insourcing, advancements like 3D printing and modular construction present viable alternatives in specific market segments. The global 3D printing construction market, valued at roughly USD 1.7 billion in 2023, exemplifies this trend, with significant projected growth that could reshape demand for traditional methods.

Regulatory tailwinds in 2024 are further bolstering these substitutes, with governments worldwide offering incentives like tax credits for green building and expedited permitting for off-site manufacturing. For instance, a 10% tax credit for pre-fabricated components could make these alternatives significantly more cost-effective. This regulatory push, driven by sustainability mandates, risks diverting market share from conventional construction services if companies like DL E&C do not adapt to these evolving industry dynamics.

| Substitute Type | Impact on DL E&C | Market Trend (2023-2024) | Key Driver |

|---|---|---|---|

| Modular Construction | Moderate Threat (Residential/Commercial) | Growing adoption, cost-efficiency gains | Faster project timelines, reduced labor costs |

| 3D Printing Construction | Emerging Threat (Niche Applications) | Market valued at USD 1.7 billion (2023), high growth potential | Innovation, potential for reduced material waste |

| In-house Client Execution | Minimal Threat (Large-scale projects) | Limited by expertise and capital needs | Specialized engineering and project management requirements |

| Digital/Virtual Alternatives | Long-term, Subtle Threat | Increasing investment in digital infrastructure | Shift towards remote work and digital services |

Entrants Threaten

The construction sector, especially for major projects akin to DL E&C's endeavors, demands immense capital. Newcomers must secure vast sums for machinery, property, operational funds, and skilled labor, presenting a formidable entry hurdle.

Established players like DL E&C leverage substantial economies of scale in areas such as bulk material procurement and efficient project execution, which are critical in the construction industry. For instance, DL E&C's extensive project pipeline in 2024 likely allowed for more favorable terms with suppliers compared to a new entrant. This scale translates directly into cost advantages that are difficult for newcomers to replicate quickly.

Furthermore, decades of accumulated experience in handling complex engineering challenges and managing large-scale projects provide a significant barrier. DL E&C's proven track record and deep understanding of operational intricacies mean they can anticipate and mitigate risks more effectively than a less experienced competitor. This expertise is not easily acquired and represents a substantial hurdle for potential new entrants aiming to compete on both cost and capability in 2024.

New construction firms face significant hurdles in accessing established distribution channels and cultivating strong customer relationships, which are vital for securing major projects. DL E&C, for instance, has cultivated deep, long-standing partnerships with key stakeholders, including government agencies and major real estate developers, a testament to their consistent performance and reliability. These existing ties represent a substantial barrier, making it difficult for emerging competitors to penetrate the market and secure lucrative contracts, especially when considering that in 2024, the construction industry saw a significant portion of its new projects awarded through established, pre-qualified bidder lists.

Government Policy and Regulations

The construction sector, and by extension DL E&C, faces significant barriers to entry due to stringent government policies and regulations. New companies must contend with extensive licensing, rigorous safety protocols, and demanding environmental compliance standards. Navigating these complex permitting processes and meeting numerous industry-specific standards can be both time-consuming and financially burdensome, effectively deterring potential new entrants.

In 2024, the global construction market continues to be shaped by evolving regulatory landscapes. For instance, in many developed nations, new environmental regulations concerning carbon emissions and sustainable building practices are being implemented. These often require substantial upfront investment in new technologies or processes, which can be prohibitive for smaller, less capitalized new entrants. Furthermore, government initiatives often favor established players who have a proven track record of compliance and existing relationships with regulatory bodies.

- Regulatory Hurdles: New entrants must overcome licensing, safety, and environmental compliance requirements, which are often complex and costly.

- Permitting Processes: Navigating government permitting can be a lengthy and expensive undertaking, posing a significant barrier to market entry.

- Government Support for Incumbents: Existing large-scale projects often receive government backing, creating an uneven playing field for new companies.

- Compliance Costs: Adhering to a multitude of standards and regulations requires significant investment, impacting the profitability and feasibility for new entrants.

Brand Identity and Reputation

DL E&C benefits from a deeply ingrained brand identity and a robust reputation built over decades of successful project execution, including significant contributions to South Korea's infrastructure development. This established credibility is a formidable barrier for newcomers. For instance, DL E&C's involvement in major urban regeneration projects and its consistent delivery of high-quality construction have solidified its standing. In 2023, the company secured notable contracts, underscoring its market position.

New entrants often struggle to replicate this level of trust and proven performance, which is paramount in securing large-scale, high-value contracts. The construction industry, particularly for major infrastructure and complex building projects, heavily weighs past performance and client confidence. Without a track record of successful, high-profile deliveries, new firms find it challenging to compete against established players like DL E&C.

- Established Brand Recognition: DL E&C's long history and involvement in landmark projects create strong brand recall and trust among clients and stakeholders.

- Reputation for Quality and Reliability: Decades of successful project completion have cemented DL E&C's reputation as a dependable and high-quality builder.

- Barrier to Entry: New companies lack the established credibility necessary to win bids for prestigious or high-value projects, a key differentiator for DL E&C.

- Client Trust: In an industry where trust is paramount, DL E&C's proven track record significantly reduces perceived risk for clients awarding major contracts.

The threat of new entrants for DL E&C is significantly mitigated by the immense capital requirements in major construction projects. New companies must secure substantial funding for equipment, land, operations, and skilled labor, creating a high financial barrier. For instance, a large-scale infrastructure project in 2024 could easily require hundreds of millions of dollars in upfront investment, a sum many new firms cannot readily access.

Porter's Five Forces Analysis Data Sources

Our DL E&C Porter's Five Forces analysis is built on a foundation of robust data, drawing from company annual reports, industry-specific market research, and regulatory filings to capture the nuances of competitive dynamics.