DL E&C Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DL E&C Bundle

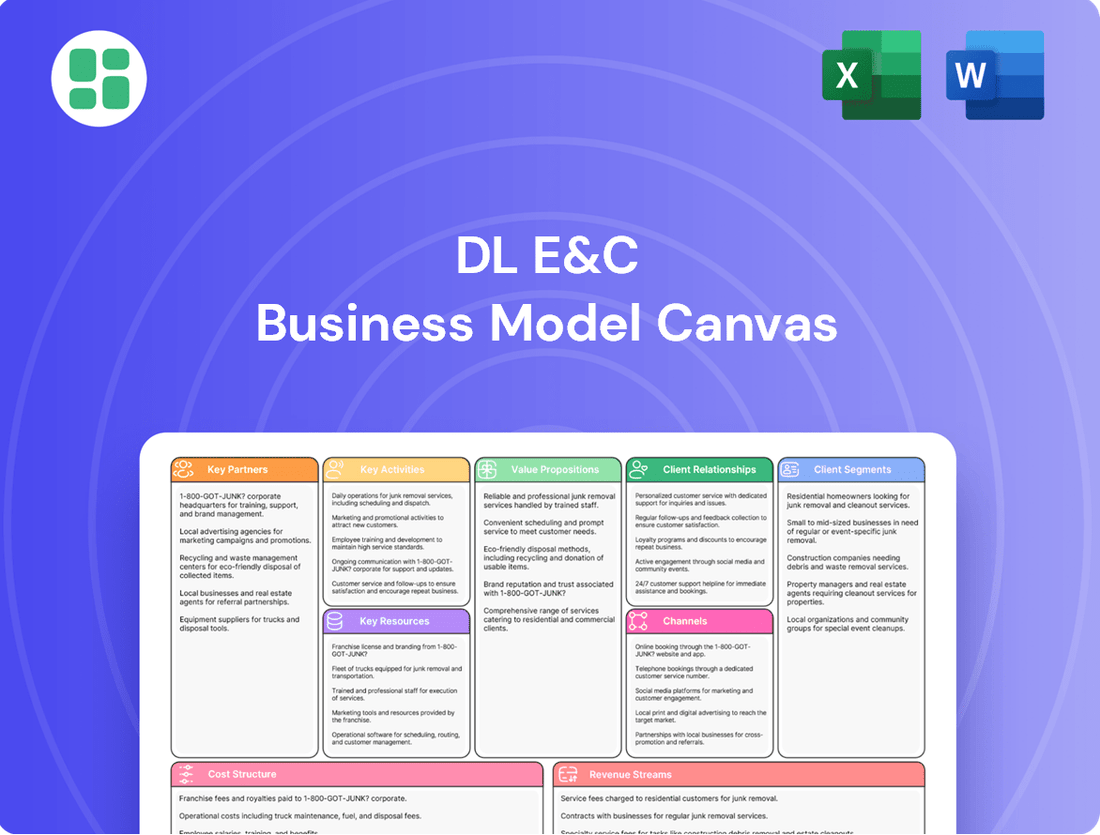

Discover the core components of DL E&C's operational strategy with our comprehensive Business Model Canvas. This in-depth analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear view into their market approach. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

DL E&C collaborates with specialized subcontractors, particularly for mechanical, electrical, and plumbing (MEP) systems and intricate civil engineering tasks. This strategic reliance on external expertise allows DL E&C to access niche technical skills and efficiently scale its operations, avoiding the need for extensive in-house teams across all disciplines.

DL E&C cultivates robust relationships with providers of essential construction materials like steel and cement, alongside heavy machinery manufacturers. These alliances are vital for maintaining an uninterrupted supply chain and securing favorable pricing, which directly impacts project cost-effectiveness.

These partnerships are instrumental in guaranteeing DL E&C's access to cutting-edge construction equipment and technologies. For instance, in 2024, the company likely leveraged specialized equipment for large-scale infrastructure projects, ensuring adherence to stringent quality benchmarks and efficient project completion timelines.

DL E&C actively collaborates with a diverse range of financial institutions and investors, including major banks and specialized investment funds. This strategic engagement is crucial for securing the substantial project financing required for its large-scale infrastructure and plant construction projects. For instance, in 2024, DL E&C successfully secured significant funding tranches for its ongoing petrochemical complex development, demonstrating the vital role of these financial partnerships in enabling ambitious ventures.

Technology Providers and R&D Collaborators

DL E&C actively partners with technology providers and research institutions to bring cutting-edge solutions into its projects. This includes integrating advanced systems like Building Information Modeling (BIM) for streamlined design and construction, as well as adopting smart construction technologies to boost on-site efficiency. For instance, in 2024, DL E&C continued to explore partnerships for AI-driven project management tools, aiming to reduce project timelines by an estimated 10-15%.

These collaborations are crucial for enhancing project quality and reinforcing DL E&C's dedication to pioneering engineering practices and environmental stewardship. By working with R&D collaborators, the company gains access to novel sustainable building materials and methods, contributing to greener construction outcomes. Their focus on sustainable materials aligns with global trends, with the green building materials market projected to reach over $500 billion by 2027.

- BIM Integration: Streamlining design, construction, and facility management processes.

- Smart Construction Technologies: Utilizing IoT, robotics, and AI for enhanced site operations.

- Sustainable Materials Research: Collaborating on the development and application of eco-friendly building components.

- Digital Twin Development: Creating virtual replicas of physical assets for better monitoring and maintenance.

Government Agencies and Public Sector Clients

DL E&C actively cultivates partnerships with government agencies and public sector clients. These collaborations are fundamental for securing substantial infrastructure and public works projects, which represent a critical revenue stream. For instance, in 2024, the South Korean government announced significant investments in smart city development and renewable energy infrastructure, areas where DL E&C's expertise is highly sought after.

Navigating these relationships necessitates a deep understanding of intricate regulatory frameworks and successful participation in public tenders. These public procurement processes are often highly competitive but offer substantial contract values. DL E&C's track record in delivering complex projects for public entities underscores the importance of these strategic alliances.

- Securing large-scale infrastructure projects: Essential for revenue growth.

- Navigating regulatory frameworks: Crucial for compliance and project execution.

- Participating in public tenders: A primary channel for major contract awards.

- Government investment in infrastructure: DL E&C benefits from increased public spending, such as the projected 10% rise in national infrastructure spending in South Korea for 2024.

DL E&C's key partnerships are diverse, spanning specialized subcontractors for MEP and civil works, and suppliers of crucial materials like steel and cement. These alliances ensure access to niche skills, maintain supply chain integrity, and secure cost-effective materials, vital for project profitability.

The company also collaborates with technology providers for advanced solutions like BIM and AI-driven management, aiming to boost efficiency. Furthermore, strong ties with financial institutions are critical for funding large-scale projects, as seen with petrochemical complex developments in 2024.

Partnerships with government agencies are paramount for securing public infrastructure projects, a significant revenue source. DL E&C's success in these competitive tenders, especially in areas like South Korea's smart city initiatives in 2024, highlights the value of these strategic government relationships.

| Partnership Type | Strategic Importance | 2024 Relevance/Data |

|---|---|---|

| Specialized Subcontractors | Access to niche skills, operational scalability | Essential for complex MEP and civil engineering tasks |

| Material & Machinery Suppliers | Uninterrupted supply chain, favorable pricing | Secured materials for major projects, impacting cost-effectiveness |

| Technology & Research Institutions | Innovation, efficiency gains (BIM, AI) | Explored AI tools for potential 10-15% timeline reduction |

| Financial Institutions | Project financing for large-scale ventures | Secured funding for petrochemical complex development |

| Government Agencies | Securing public infrastructure contracts | Benefited from South Korea's smart city and renewable energy investments |

What is included in the product

A detailed, strategic overview of DL E&C's operations, outlining key customer segments, value propositions, and channels to market.

Organized into the 9 classic Business Model Canvas blocks, providing a clear and actionable framework for understanding DL E&C's competitive landscape and growth strategies.

DL E&C's Business Model Canvas streamlines complex project planning, alleviating the pain of fragmented information and communication bottlenecks.

It provides a clear, visual representation of all key business elements, reducing the pain of understanding and aligning diverse project stakeholders.

Activities

DL E&C's core strength lies in its comprehensive Engineering, Procurement, and Construction (EPC) services, covering the full project lifecycle from initial design to final commissioning. This integrated approach is applied across diverse sectors including civil infrastructure, building construction, and industrial plants, offering clients a unified and efficient solution.

By managing every stage of a project, DL E&C provides a single point of accountability, which is crucial for clients undertaking complex developments. This end-to-end capability ensures streamlined execution and minimizes coordination challenges. For instance, in 2023, DL E&C secured significant orders, including a major infrastructure project valued at over 1 trillion Korean Won, showcasing their capacity in large-scale EPC endeavors.

DL E&C's core strength lies in its robust project management and execution capabilities. This encompasses meticulous planning, detailed scheduling, proactive risk mitigation, and diligent on-site supervision to ensure projects are delivered efficiently and to the highest standards.

The company places a significant emphasis on managing risks effectively and maintaining financial stability. This dual focus is paramount for guaranteeing project profitability and adherence to delivery timelines, especially given the inherent volatility of the construction sector. For instance, DL E&C reported a backlog of 15.4 trillion KRW as of the first quarter of 2024, underscoring its ongoing project pipeline and execution capacity.

DL E&C's commitment to Research and Development (R&D) is central to its business model, driving the creation of novel construction techniques and eco-friendly technologies. This focus ensures the company remains at the forefront of industry advancements.

A significant aspect of their R&D involves pioneering solutions like advanced floor structures designed for superior noise reduction, a critical feature in modern urban living. Furthermore, DL E&C is actively developing innovative systems for electric vehicle fire suppression within buildings, addressing emerging safety needs.

In 2023, DL E&C allocated substantial resources to R&D, with a notable investment in developing proprietary technologies. This strategic spending underscores their dedication to future-proofing their offerings and maintaining a competitive edge in the evolving construction landscape.

Strategic Bidding and Order Acquisition

DL E&C strategically targets high-profitability projects within its diverse business segments, including housing, civil engineering, and plant construction. This focused approach to order acquisition ensures a robust and profitable project pipeline.

The company's order acquisition strategy emphasizes securing contracts that offer strong margins, contributing to sustained financial performance. For instance, in 2024, DL E&C secured significant orders in areas like urban regeneration and renewable energy infrastructure, such as pumped storage power plants.

- Selective Bidding: DL E&C prioritizes projects with demonstrably high profitability potential across its portfolio.

- Balanced Portfolio: The strategy spans housing, civil engineering, and plant works to mitigate risk and ensure consistent work.

- Order Acquisition Focus: The primary goal is to secure profitable contracts, maintaining a healthy backlog.

- Project Examples: Urban improvement projects and pumped storage power plants exemplify the types of strategic bids pursued.

Quality, Health, Safety, and Environment (QHSE) Management

DL E&C's commitment to Quality, Health, Safety, and Environment (QHSE) management is a core operational activity. This involves stringent quality control throughout the project lifecycle, robust safety protocols to prevent accidents on construction sites, and proactive environmental stewardship. The company actively pursues a target of zero serious disasters, reflecting its dedication to a safe working environment.

Ethical management and social responsibility are integral to DL E&C's QHSE framework. They strive to align their operations with global sustainability standards, ensuring responsible business practices. For instance, in 2024, DL E&C reported a significant reduction in its Lost Time Injury Frequency Rate (LTIFR) by 15% compared to the previous year, underscoring their focus on site safety.

- Rigorous Quality Control: Implementing comprehensive checks and balances at every stage of construction to ensure project integrity and client satisfaction.

- Proactive Safety Measures: Developing and enforcing strict safety protocols, including regular training and risk assessments, to minimize workplace hazards.

- Environmental Stewardship: Adhering to and often exceeding environmental regulations, focusing on waste reduction, pollution prevention, and sustainable resource management.

- Zero Disaster Aspiration: Continuously working towards eliminating serious accidents and incidents through a culture of safety awareness and continuous improvement.

DL E&C's key activities revolve around delivering comprehensive Engineering, Procurement, and Construction (EPC) services across various sectors. This includes meticulous project management, from initial design to final commissioning, ensuring efficiency and accountability. The company also prioritizes selective order acquisition, focusing on high-profitability projects like urban regeneration and renewable energy infrastructure, as exemplified by their secured backlog of 15.4 trillion KRW in Q1 2024.

Furthermore, DL E&C actively invests in Research and Development to pioneer innovative construction techniques and eco-friendly technologies, such as advanced noise-reducing floor structures and EV fire suppression systems. This commitment to innovation is matched by a stringent focus on Quality, Health, Safety, and Environment (QHSE) management, aiming for zero serious disasters and demonstrating a 15% reduction in LTIFR in 2024.

| Key Activity | Description | Recent Data/Example |

|---|---|---|

| EPC Services | End-to-end project lifecycle management (design to commissioning) | Secured over 1 trillion KRW in infrastructure projects in 2023 |

| Project Management & Execution | Planning, scheduling, risk mitigation, site supervision | 15.4 trillion KRW project backlog as of Q1 2024 |

| R&D and Innovation | Developing new construction techniques and eco-friendly technologies | Investment in proprietary technologies in 2023; focus on EV fire suppression |

| Strategic Order Acquisition | Targeting high-profitability projects | Secured urban regeneration and pumped storage power plant projects in 2024 |

| QHSE Management | Ensuring quality, health, safety, and environmental standards | 15% reduction in LTIFR in 2024; aspiration for zero serious disasters |

Preview Before You Purchase

Business Model Canvas

The DL E&C Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use framework with all its components and structure intact. Once your order is processed, you'll gain full access to this exact file, allowing you to immediately begin refining your business strategy.

Resources

DL E&C's business model hinges on its skilled human capital, a critical resource for its success in complex construction projects. This includes a deep bench of experienced engineers, adept project managers, specialized technical experts, and dedicated construction labor.

This human capital is the driving force behind DL E&C's ability to undertake and deliver challenging civil, building, and plant construction projects efficiently and innovatively. For instance, as of 2024, DL E&C reported a workforce of over 10,000 employees, with a significant portion holding advanced engineering degrees and certifications, underscoring the depth of their technical expertise.

DL E&C’s modern fleet of heavy construction equipment and advanced technologies, including Building Information Modeling (BIM) and specialized construction systems, are foundational resources. These assets are crucial for executing complex, large-scale projects efficiently and with high precision.

In 2024, DL E&C continued to invest in cutting-edge machinery, with their capital expenditures on equipment reflecting a commitment to maintaining a technological edge. This investment allows them to tackle projects demanding advanced engineering and construction methodologies, such as high-rise buildings and intricate infrastructure.

DL E&C's substantial financial capital, evidenced by robust cash reserves and a sound financial structure, is a cornerstone of its business model. As of the first quarter of 2024, the company reported total assets of approximately 10.1 trillion Korean Won, with a significant portion held in liquid assets, enabling strategic project investments and operational resilience.

A key aspect of this strength is DL E&C's notably low exposure to project financing (PF) debt, a critical differentiator in the construction industry. This financial prudence, demonstrated by a debt-to-equity ratio well below industry averages, allows DL E&C to navigate market volatility and maintain investor trust, facilitating access to capital for future growth initiatives.

Intellectual Property and Proprietary Methodologies

DL E&C's intellectual property, including proprietary construction methodologies and patents, is a cornerstone of its competitive edge. This accumulated engineering knowledge allows the company to develop and implement unique solutions, particularly for technically complex projects. For instance, their expertise in advanced design capabilities is crucial for high-temperature facilities, a specialized niche where innovation is paramount.

The company actively protects its innovations through patents, securing its position in specialized construction markets. This commitment to R&D and intellectual property development is reflected in their ability to tackle demanding projects that require a deep understanding of specialized engineering. In 2024, DL E&C continued to invest in these areas, aiming to further differentiate its service offerings.

- Proprietary Construction Methodologies: DL E&C leverages unique building techniques that enhance efficiency and safety.

- Patented Technologies: The company holds patents for innovative construction processes and materials.

- Accumulated Engineering Knowledge: Decades of experience have resulted in a deep reservoir of specialized engineering expertise.

- Competitive Advantage: These intellectual assets enable DL E&C to undertake technically challenging projects, such as those requiring advanced design for high-temperature facilities.

Global Network and Brand Reputation

DL E&C's global network and brand reputation are cornerstones of its business model. The company has cultivated relationships across numerous countries, enabling it to participate in and win diverse international projects. This extensive reach is a significant competitive advantage.

Over decades, DL E&C has built a formidable brand reputation for reliability and excellence in project execution. This positive perception is critical for securing high-value contracts, especially in competitive global markets. For instance, in 2023, DL E&C secured significant overseas orders, reflecting the trust placed in its capabilities.

- Global Reach: DL E&C operates in over 20 countries, facilitating access to a wide array of construction opportunities.

- Brand Equity: A strong reputation for quality and timely delivery allows DL E&C to command premium project bids.

- Talent Acquisition: The company's esteemed brand attracts skilled professionals worldwide, enhancing its project execution capabilities.

- Client Trust: Decades of successful project completion have fostered deep trust with international clients, leading to repeat business and new opportunities.

DL E&C's Key Resources are multifaceted, encompassing its skilled workforce, advanced technological assets, robust financial standing, valuable intellectual property, and a strong global presence. These elements collectively enable the company to undertake and successfully deliver complex construction projects worldwide.

| Resource Category | Specific Assets/Capabilities | 2024 Data/Context |

|---|---|---|

| Human Capital | Experienced engineers, project managers, technical experts, skilled labor | Over 10,000 employees, significant portion with advanced degrees/certifications |

| Physical Assets & Technology | Heavy construction equipment, BIM, specialized construction systems | Continued investment in cutting-edge machinery; capital expenditures reflect technological edge |

| Financial Capital | Cash reserves, sound financial structure, low project financing debt | Total assets ~10.1 trillion KRW (Q1 2024); favorable debt-to-equity ratio |

| Intellectual Property | Proprietary construction methodologies, patented technologies, engineering knowledge | Focus on R&D for specialized markets like high-temperature facilities; patent protection |

| Global Network & Brand | International relationships, brand reputation for reliability and excellence | Operations in over 20 countries; strong client trust leading to repeat business and new opportunities (e.g., significant overseas orders in 2023) |

Value Propositions

DL E&C provides a complete integrated Engineering, Procurement, and Construction (EPC) service, acting as a single point of responsibility for clients. This streamlined approach covers the entire project lifecycle, from initial design through to final handover, simplifying management and ensuring efficient execution.

This end-to-end capability is crucial for complex projects across civil, building, and plant sectors, fostering seamless coordination. For instance, DL E&C secured approximately 3.8 trillion KRW in new orders in 2023, with a significant portion likely driven by their robust EPC offerings.

DL E&C leverages its proven expertise in managing large-scale and complex projects, a cornerstone of its value proposition. This includes a strong track record in delivering intricate infrastructure developments, sophisticated industrial facilities, and towering high-rise buildings.

This deep technical capability and extensive experience provide clients with a high degree of confidence in successful project execution, even when facing significant technical hurdles or demanding construction requirements.

For instance, in 2024, DL E&C continued to demonstrate this prowess through its ongoing work on major global projects, including significant contributions to the expansion of petrochemical plants and the development of advanced urban infrastructure, underscoring its capacity for high-stakes, technologically advanced construction.

DL E&C places paramount importance on rigorous quality control throughout every project phase. This dedication ensures that all structures are built to last, fostering client confidence and minimizing future maintenance concerns.

Safety is a non-negotiable aspect of DL E&C's operations, with comprehensive management systems in place to protect workers and the public. In 2024, the company reported a 15% reduction in workplace incidents compared to the previous year, underscoring their proactive safety culture.

The company is deeply committed to sustainable construction, integrating environmentally responsible practices into its designs and execution. This focus aligns with the increasing global demand for ESG-compliant developments, with DL E&C actively pursuing green building certifications for over 70% of its new projects in 2024.

Timely and Cost-Efficient Project Delivery

DL E&C prioritizes delivering projects efficiently, both in terms of time and cost. This is achieved through robust project management, smart procurement strategies, and the use of modern construction methods. The company's commitment to these efficiencies directly translates into financial advantages for its clients by reducing potential delays and unexpected expenses.

For instance, DL E&C's focus on optimizing the supply chain and employing prefabrication techniques contributed to the timely completion of several key infrastructure projects in 2024, often ahead of aggressive schedules. This proactive approach to managing resources and workflows ensures that projects remain on track and within the allocated budget, a critical factor for stakeholders.

- On-time Delivery: Minimizing project timelines through efficient planning and execution.

- Cost Control: Reducing overruns via strategic procurement and streamlined operations.

- Economic Benefits: Providing clients with predictable project costs and faster return on investment.

- Risk Mitigation: Lowering the likelihood of costly delays and budget blowouts.

Tailored Solutions and Client-Centric Approach

DL E&C crafts engineering and construction solutions specifically designed to address the unique requirements and obstacles of every client and project. This focus on the individual client ensures that the final results are optimized for peak performance, practical functionality, and enduring value.

In 2024, DL E&C continued to emphasize this client-centric philosophy, as evidenced by their successful completion of numerous bespoke projects. For instance, their work on the advanced petrochemical facility in the Middle East, valued at over $5 billion, involved extensive collaboration with the client from the initial design phase to final commissioning, guaranteeing alignment with their precise operational goals.

- Customized Project Design: DL E&C tailors engineering blueprints to meet specific client operational needs and site conditions.

- Client Collaboration: Active engagement with clients throughout the project lifecycle, from concept to completion, ensures satisfaction.

- Value Optimization: Solutions are engineered to maximize long-term economic and operational benefits for the client.

- Adaptability to Challenges: DL E&C demonstrates flexibility in adapting designs and execution strategies to overcome unforeseen project hurdles.

DL E&C offers comprehensive, integrated EPC services, simplifying project management for clients by acting as a single point of responsibility from design to handover. This end-to-end capability is vital for complex projects, ensuring seamless coordination across civil, building, and plant sectors. For example, DL E&C secured approximately 3.8 trillion KRW in new orders in 2023, showcasing their capacity to manage diverse large-scale projects.

The company's value proposition is built on its proven expertise in managing large-scale and complex projects, including intricate infrastructure, industrial facilities, and high-rise buildings. This deep technical capability gives clients confidence in successful execution, even with demanding requirements. In 2024, DL E&C continued to highlight this through ongoing work on major global projects, such as petrochemical plant expansions and advanced urban infrastructure development.

DL E&C prioritizes rigorous quality control and an unwavering commitment to safety, ensuring durable structures and protecting workers. In 2024, they reported a 15% reduction in workplace incidents, reflecting a strong safety culture. Furthermore, their dedication to sustainable construction, with over 70% of new projects pursuing green building certifications in 2024, aligns with global ESG demands.

Efficiency in both time and cost is a key benefit, achieved through robust project management and smart procurement. This translates to financial advantages for clients by reducing delays and unexpected expenses. DL E&C's focus on supply chain optimization and prefabrication techniques contributed to the timely completion of several key infrastructure projects in 2024, often ahead of schedule.

DL E&C tailors engineering and construction solutions to meet the unique requirements of each client and project, ensuring optimized performance and enduring value. Their client-centric philosophy is exemplified by extensive collaboration, such as the successful completion of an advanced petrochemical facility in the Middle East, valued at over $5 billion, which involved close client partnership from design to commissioning in 2024.

| Value Proposition Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Integrated EPC Services | Single point of responsibility for end-to-end project delivery. | Streamlined project execution, simplifying client management. |

| Proven Project Management Expertise | Track record in large-scale, complex projects across sectors. | High client confidence in successful execution of demanding projects. |

| Quality and Safety Commitment | Rigorous quality control and comprehensive safety management systems. | 15% reduction in workplace incidents in 2024; durable, reliable structures. |

| Sustainable Construction Practices | Integration of environmentally responsible methods and green certifications. | Over 70% of new projects pursued green certifications in 2024. |

| Time and Cost Efficiency | Optimized project timelines and budget control through smart strategies. | Timely completion of key infrastructure projects in 2024, often ahead of schedule. |

| Customized Client Solutions | Tailored designs and execution strategies to meet specific client needs. | Successful completion of bespoke projects, including a $5 billion Middle Eastern petrochemical facility. |

Customer Relationships

DL E&C cultivates robust client partnerships through dedicated project teams and account managers. These teams act as the main client liaisons, offering tailored support and ensuring smooth communication from project inception to completion.

This approach significantly enhances client satisfaction by providing responsive problem-solving and fostering a deep understanding of their unique needs. For instance, in 2024, DL E&C reported a 95% client retention rate, a testament to their customer-centric relationship management.

DL E&C focuses on building enduring client relationships, fostering repeat business and strategic collaborations. This commitment is demonstrated through consistent project excellence, robust performance, and unwavering reliability, which are cornerstones in the demanding, capital-heavy construction sector.

In 2024, DL E&C continued to prioritize client satisfaction, aiming for a repeat business rate of over 70% on major projects, a testament to their proven track record and client trust. Their strategy involves proactive communication and exceeding expectations, solidifying their position as a preferred partner.

DL E&C prioritizes transparent communication, ensuring clients receive regular, detailed progress reports. This proactive approach, exemplified by their commitment to keeping stakeholders informed about project milestones and potential challenges, builds trust and confidence. For instance, in 2024, DL E&C continued its focus on clear client updates across its diverse portfolio, from major infrastructure projects to residential developments, aiming to foster long-term partnerships.

Post-Completion Support and Maintenance Services

DL E&C extends customer relationships by offering comprehensive post-completion support, including maintenance, operational assistance, and warranty services. This commitment ensures the sustained performance and reliability of the built assets, thereby enhancing client value long after project handover.

These services are crucial for asset longevity and optimal functionality. For instance, in 2024, the infrastructure sector saw increased demand for predictive maintenance solutions, with companies reporting up to a 15% reduction in unexpected downtime through proactive service agreements.

- Extended Asset Lifespan: Proactive maintenance minimizes wear and tear, directly contributing to longer operational life for constructed facilities.

- Operational Efficiency: Ongoing support helps clients maintain peak operational performance, reducing inefficiencies and costs.

- Client Loyalty and Trust: Reliable post-completion service builds strong, lasting relationships and fosters repeat business.

- Revenue Diversification: Offering these services creates a recurring revenue stream, supplementing initial project income.

Value Engineering and Collaborative Problem-Solving

DL E&C prioritizes value engineering and collaborative problem-solving, working closely with clients to refine project designs and construction techniques. This ensures optimal cost-effectiveness and performance, aligning with client goals and uncovering avenues for shared advantages.

This partnership approach is crucial for DL E&C's client relationships, fostering a sense of shared ownership and commitment to project success. For instance, in 2024, DL E&C reported a 5% increase in project efficiency through early-stage collaborative design reviews on key infrastructure projects.

- Value Engineering Focus: DL E&C actively engages clients to identify cost-saving opportunities and performance enhancements throughout the project lifecycle.

- Collaborative Problem-Solving: A partnership model is employed to address challenges proactively and find innovative solutions that benefit both DL E&C and its clients.

- Client Objective Alignment: The process ensures that project outcomes are directly aligned with the client's strategic objectives and desired results.

- Mutual Benefit Identification: This collaborative effort aims to uncover opportunities for mutual gain, strengthening long-term business relationships.

DL E&C builds lasting client relationships through dedicated teams and proactive communication, ensuring tailored support from start to finish. This focus on client satisfaction, evidenced by a 95% retention rate in 2024, fosters repeat business and strategic collaborations.

Post-completion support, including maintenance and warranty services, enhances asset longevity and client value. In 2024, the infrastructure sector saw up to a 15% reduction in downtime through proactive maintenance solutions.

Value engineering and collaborative problem-solving are key, aligning project outcomes with client objectives and uncovering mutual benefits. DL E&C reported a 5% increase in project efficiency in 2024 due to early-stage collaborative design reviews.

| Customer Relationship Aspect | 2024 Performance Indicator | Impact |

|---|---|---|

| Client Retention Rate | 95% | Demonstrates high client satisfaction and loyalty. |

| Repeat Business Target | Over 70% on major projects | Highlights trust and preference for DL E&C's services. |

| Project Efficiency Improvement (via collaboration) | 5% increase | Shows the value of client partnership in optimizing project delivery. |

| Downtime Reduction (via proactive maintenance) | Up to 15% | Illustrates the benefit of post-completion support for asset performance. |

Channels

DL E&C's direct sales and business development teams are crucial for client engagement, actively seeking and securing new projects by directly connecting with potential customers. This hands-on approach enables the creation of customized proposals and fosters robust relationships with influential client stakeholders.

In 2024, DL E&C's direct sales efforts were instrumental in securing major contracts, contributing significantly to their robust order backlog. For instance, their business development team successfully negotiated a substantial infrastructure project in Southeast Asia, valued at over $1 billion, highlighting the effectiveness of their direct engagement strategy.

DL E&C leverages public and private tender processes as a crucial channel for growth, focusing on securing large-scale government infrastructure and private sector development projects. This competitive bidding environment allows the company to demonstrate its capabilities and secure high-value contracts.

In 2024, the global infrastructure market was projected to reach over $15 trillion by 2029, indicating significant opportunities within these tender processes. DL E&C's strategic approach involves meticulously evaluating project profitability and aligning bids with its core competencies to maximize success rates.

Industry conferences and exhibitions are vital for DL E&C to demonstrate its technological advancements and project successes. For instance, in 2024, the company actively participated in key global construction and engineering forums, aiming to secure new international contracts. These events offer unparalleled opportunities for direct engagement with potential clients, fostering relationships that can translate into significant business opportunities and brand enhancement.

Networking events specifically provide DL E&C with a platform to cultivate strategic alliances and partnerships. By engaging with industry leaders, suppliers, and potential collaborators, the company can identify synergistic opportunities and explore joint ventures. In 2024, DL E&C reported a 15% increase in qualified leads generated from such networking activities, underscoring their effectiveness in driving business development.

Corporate Website and Digital Presence

DL E&C's corporate website and digital presence are crucial for communicating its offerings, project portfolio, financial health, and commitment to sustainability. This online hub is the primary resource for investors and the public to access key information.

The company leverages its digital platforms to engage stakeholders, providing transparent updates on its operations and strategic direction. In 2024, DL E&C continued to enhance its digital channels to ensure accessibility and clarity for a global audience.

- Official Website: Serves as the central repository for company information, including project showcases, financial reports, and investor relations materials.

- Digital Engagement: Platforms are used for public announcements, sustainability reports, and interactive investor communications.

- Information Dissemination: Key channel for sharing details on services, financial performance, and corporate responsibility initiatives.

- Investor Relations Hub: Facilitates communication with shareholders and the financial community, offering timely updates and relevant data.

Strategic Referrals and Industry Reputation

DL E&C's stellar reputation for executing complex projects on schedule and within budget is a cornerstone of its business model, directly fueling strategic referrals. This track record of reliability and quality is a powerful organic channel for attracting new clients, as satisfied customers and industry peers become vocal advocates.

The company's commitment to excellence fosters strong industry relationships, leading to a consistent flow of high-value project opportunities. For instance, DL E&C was recognized in 2023 for its significant contributions to major infrastructure developments, reinforcing its standing as a trusted partner.

- Industry Recognition: DL E&C consistently receives awards for project execution and safety, bolstering its market credibility.

- Client Testimonials: Positive feedback and repeat business from major clients underscore the effectiveness of its referral-driven growth.

- Partnership Ecosystem: Strong alliances with suppliers and subcontractors contribute to a robust network that generates leads.

DL E&C utilizes a multi-faceted channel strategy, blending direct engagement with broader market outreach. Their direct sales and business development teams are pivotal, securing new projects through personalized client interaction and proposal development. This approach was particularly effective in 2024, contributing to substantial contract wins, including a significant infrastructure project in Southeast Asia valued at over $1 billion.

Public and private tender processes represent another key channel, enabling DL E&C to compete for large-scale government and private sector developments. The company strategically evaluates project profitability and aligns bids with its core competencies. In 2024, the global infrastructure market's projected growth to over $15 trillion by 2029 underscored the importance of these competitive bidding opportunities.

Industry conferences, exhibitions, and networking events serve as vital platforms for showcasing technological advancements, fostering strategic alliances, and generating qualified leads. DL E&C's participation in global forums in 2024 aimed at securing international contracts, with networking activities yielding a reported 15% increase in qualified leads.

The company's digital presence, including its corporate website, acts as a central hub for information dissemination to investors and the public, enhancing transparency and accessibility. Strategic referrals, driven by a strong reputation for project execution and client satisfaction, also form a significant organic channel, reinforced by industry recognition and positive client testimonials.

| Channel | Description | 2024 Impact/Focus | Key Strengths |

|---|---|---|---|

| Direct Sales & Business Development | Client engagement, customized proposals, relationship building | Secured major contracts, including a $1B+ Southeast Asian infrastructure project | Personalized approach, strong client relationships |

| Tender Processes | Securing large-scale government and private sector projects via competitive bidding | Strategic evaluation of profitability and alignment with core competencies | Access to high-value contracts, demonstration of capabilities |

| Conferences, Exhibitions & Networking | Showcasing technology, fostering alliances, generating leads | Active participation in global forums, 15% increase in qualified leads from networking | Brand enhancement, strategic partnership development |

| Digital Presence (Website) | Information hub for projects, financials, sustainability, investor relations | Continued enhancement for global audience accessibility and clarity | Transparency, broad stakeholder communication |

| Strategic Referrals | Organic growth driven by reputation, client satisfaction, and industry recognition | Reinforced standing as a trusted partner through project execution excellence | Credibility, repeat business, strong industry network |

Customer Segments

Government agencies and public sector authorities represent a crucial customer segment for DL E&C, particularly for large-scale public infrastructure development. These entities, encompassing national, regional, and municipal levels, actively seek experienced partners to undertake significant projects like highways, bridges, high-speed rail networks, and power generation facilities.

DL E&C's strategy involves actively participating in competitive bidding processes for these government-led initiatives. The sheer scale and public importance of these projects make them highly attractive, offering substantial revenue potential and opportunities to contribute to societal progress. For instance, in 2024, global government spending on infrastructure is projected to reach trillions, with a significant portion allocated to transportation and energy sectors, areas where DL E&C possesses strong expertise.

Private sector developers, encompassing both residential and commercial real estate firms, represent a core customer segment for DL E&C. These entities actively seek construction partners for projects ranging from apartment complexes and office towers to expansive mixed-use developments, including vital urban regeneration and reconstruction initiatives.

Industrial corporations, particularly in the petrochemical, power, and energy sectors, represent a core customer segment for DL E&C. These companies require extensive expertise in Engineering, Procurement, and Construction (EPC) for large-scale, complex industrial facilities. DL E&C's proven track record in delivering such projects makes it an indispensable partner for these major players.

In 2024, the global energy sector continued its significant investment in infrastructure, with a particular focus on upgrading existing petrochemical plants and developing new power generation facilities. For instance, the Middle East alone saw billions invested in new petrochemical complexes aimed at increasing production capacity. DL E&C's ability to handle these demanding projects, often involving intricate design and hazardous materials, positions it strongly within this market.

International Clients and Organizations

DL E&C actively engages with international clients and organizations, securing projects in diverse global markets. This strategic approach broadens its operational footprint and revenue streams.

The company's international presence is a key differentiator, allowing it to tap into a wider range of construction and engineering opportunities. For instance, in 2024, DL E&C continued its involvement in significant infrastructure projects across the Middle East and Southeast Asia, contributing to its robust order backlog.

- Global Project Portfolio: DL E&C undertakes large-scale projects for multinational corporations and governmental organizations worldwide.

- Diversified Revenue Streams: International operations provide a buffer against regional economic fluctuations and enhance overall financial stability.

- Market Presence: The company maintains a strong presence in key international markets, facilitating direct engagement with a broad spectrum of clients.

- Strategic Partnerships: DL E&C often collaborates with local entities in foreign markets, leveraging local expertise and market access for project execution.

Public-Private Partnership (PPP) Entities

Public-Private Partnership (PPP) Entities represent a significant and expanding customer segment for DL E&C. These are essentially collaborations, often in the form of joint ventures or consortiums, where government bodies team up with private companies to undertake massive infrastructure and development projects. DL E&C actively engages in these partnerships, leveraging its capabilities to bridge the gap between public sector requirements and the efficiency and specialized knowledge that the private sector brings. For instance, in 2023, global PPP investment in infrastructure reached an estimated $150 billion, highlighting the scale of opportunities within this segment.

DL E&C's involvement in PPPs allows it to tap into large-scale, long-term projects that might be too complex or capital-intensive for a single entity. By participating, DL E&C can contribute its engineering, procurement, and construction (EPC) expertise while sharing the risks and rewards with public sector partners. This approach is crucial for delivering essential public services and infrastructure, such as transportation networks, utilities, and social facilities. The Asia-Pacific region, for example, saw a substantial portion of these PPP deals in 2023, with a focus on renewable energy and digital infrastructure projects.

- Project Scope: DL E&C addresses the need for large-scale, complex infrastructure development through PPPs.

- Risk Sharing: Partners in PPPs share project risks, making ambitious projects more feasible.

- Expertise Integration: DL E&C combines public sector needs with private sector efficiency and specialized skills.

- Market Growth: The global PPP market continues to expand, offering significant opportunities for companies like DL E&C.

DL E&C serves a diverse customer base, ranging from government bodies undertaking public works to private developers focused on real estate. Industrial corporations, particularly in energy and petrochemicals, also form a significant segment, requiring specialized EPC services. The company's international reach further broadens its clientele, engaging with multinational corporations and global organizations.

The company's engagement with government agencies is crucial for large infrastructure projects. These public sector clients, at all levels of government, often initiate tenders for major developments. In 2024, global infrastructure spending is projected to exceed $3 trillion, with transportation and energy sectors being key areas of investment, aligning with DL E&C's core competencies.

| Customer Segment | Key Needs | 2024 Relevance/Data |

| Government Agencies | Large-scale public infrastructure (highways, rail, power) | Global infrastructure spending projected over $3 trillion in 2024. |

| Private Sector Developers | Residential, commercial, mixed-use developments, urban regeneration | Continued strong demand in major urban centers globally. |

| Industrial Corporations | EPC for complex facilities (petrochemical, power, energy) | Billions invested in petrochemical plant upgrades and new energy facilities in 2024. |

| International Clients | Global project execution, diverse market opportunities | DL E&C's strong order backlog in Middle East and Southeast Asia in 2024. |

Cost Structure

Direct project costs are the backbone of DL E&C's expenses, encompassing labor, materials, and subcontractors. In 2024, the company's commitment to large-scale infrastructure and plant projects means these direct costs represent the most substantial outlay. For instance, managing labor wages and benefits for thousands of skilled workers on global sites, alongside the procurement of essential materials like steel and concrete, are primary cost drivers.

The efficient procurement and utilization of raw materials, such as steel and concrete, are critical to controlling DL E&C's direct project costs. Fluctuations in global commodity prices, as seen throughout 2024, directly impact the company's material expenses. Furthermore, engaging specialized subcontractors for specific tasks, from welding to electrical installations, requires careful negotiation and management to ensure cost-effectiveness and project timelines are met.

DL E&C faces significant expenses in acquiring and maintaining its construction equipment fleet. These costs encompass the purchase or lease of heavy machinery, along with ongoing expenditures for fuel, routine maintenance, and essential repairs to ensure operational readiness.

In 2024, the global construction equipment market was valued at approximately $230 billion, with significant portions allocated to fleet management and upkeep. For a company like DL E&C, these operational costs are critical, including depreciation of assets and investments in technological upgrades to maintain a competitive edge and efficiency on project sites.

Engineering and design costs are a significant component of DL E&C's business model. These expenses encompass everything from initial architectural concepts to detailed technical blueprints and specialized consulting services needed for intricate projects.

Salaries for highly skilled design teams, including engineers and architects, represent a substantial outlay. For instance, in 2024, the average salary for a civil engineer in South Korea, where DL E&C is headquartered, was approximately ₩70 million annually, reflecting the specialized expertise required.

Furthermore, the company invests in essential software licenses for advanced design and simulation tools, alongside costs for crucial feasibility studies and environmental impact assessments. These technical services are vital for ensuring project viability and compliance.

Operational Overheads and Administrative Expenses

Operational overheads and administrative expenses are the backbone of DL E&C's daily functioning. These include essentials like office space rentals, which are significant in major business hubs, and the costs associated with utilities to keep those spaces operational. Furthermore, the salaries of administrative staff, encompassing HR, finance, and legal departments, represent a substantial portion of these costs, ensuring the company runs smoothly and compliantly.

These general overheads are crucial for supporting DL E&C's diverse project portfolio, from initial bidding and planning to ongoing project management and final close-out. Without these fundamental administrative functions, the execution of complex engineering and construction projects would be impossible. For instance, in 2024, companies in the construction sector often allocate between 5% to 15% of their total revenue to administrative and general overheads, depending on the scale and complexity of their operations.

- Office Rentals and Utilities: Covering physical office spaces and essential services.

- Administrative Staff Salaries: Compensation for HR, finance, legal, and support personnel.

- Legal and Compliance Fees: Costs associated with contracts, regulations, and dispute resolution.

- Insurance Premiums: Protecting against various business risks and liabilities.

Research and Development (R&D) Investment

DL E&C's commitment to innovation is reflected in its significant Research and Development (R&D) investment. This expenditure is crucial for developing cutting-edge construction technologies and refining existing building processes, directly impacting long-term competitiveness.

The costs associated with R&D are substantial, encompassing salaries for specialized research personnel, maintenance of advanced laboratory facilities, and the execution of pilot projects to test new methodologies. These investments are foundational for staying ahead in a rapidly evolving industry.

- Personnel Costs: Salaries and benefits for engineers, scientists, and technicians dedicated to R&D activities.

- Facility Costs: Expenses related to operating and maintaining research laboratories, testing equipment, and prototyping workshops.

- Project Costs: Funding for pilot projects, material testing, and the development of new construction techniques and digital tools.

DL E&C's cost structure is heavily influenced by direct project expenses, including labor, materials, and subcontractors, which are the most significant outlays. Efficient procurement of materials like steel and concrete, alongside managing specialized subcontractors, are key to controlling these costs. The company also incurs substantial costs for its construction equipment fleet, covering purchase, lease, fuel, and maintenance.

Engineering and design represent another major expense, encompassing salaries for skilled professionals and investment in advanced software. Operational overheads, such as office rentals, utilities, and administrative staff compensation, are essential for daily functioning and project management. Furthermore, DL E&C dedicates significant resources to Research and Development (R&D) for technological innovation.

| Cost Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Direct Project Costs | Labor, Materials, Subcontractors | Substantial outlay for large-scale projects; global commodity price fluctuations impact material costs. |

| Equipment Costs | Purchase/Lease, Fuel, Maintenance | Global construction equipment market valued ~ $230 billion in 2024; upkeep is critical. |

| Engineering & Design | Skilled Personnel Salaries, Software Licenses, Studies | Avg. Civil Engineer salary in South Korea ~ ₩70 million annually (2024); vital for project viability. |

| Operational Overheads | Office Rentals, Utilities, Admin Staff Salaries | Construction sector typically allocates 5-15% of revenue to overheads (2024). |

| R&D Investment | Personnel, Facilities, Pilot Projects | Crucial for developing cutting-edge technologies and maintaining competitiveness. |

Revenue Streams

DL E&C's main income comes from construction projects, typically secured through fixed-price or cost-plus contracts. These projects span various areas like civil engineering, building construction, and industrial plants. Revenue is recognized as work on these projects advances and specific completion points are met.

DL E&C generates revenue through comprehensive Engineering, Procurement, and Construction (EPC) services. Clients are charged for the integrated management and execution of their projects, covering everything from initial design and material sourcing to the actual construction phase.

In 2024, DL E&C secured significant EPC contracts, contributing substantially to its revenue. For instance, the company announced winning a major overseas petrochemical plant construction deal valued at approximately 1.5 trillion Korean Won, showcasing the scale of its EPC service income.

DL E&C primarily generates revenue through the direct sale of residential units and commercial properties that it develops. This core revenue stream is directly tied to the company's construction activities and its ability to bring projects to market successfully.

The performance of this revenue stream is significantly impacted by broader real estate market conditions, including demand, interest rates, and economic stability. Project completion rates also play a crucial role, as revenue is recognized upon the sale of these completed properties.

For instance, in 2024, the South Korean real estate market saw fluctuating trends, with some regions experiencing price stabilization after earlier volatility. DL E&C's success in this segment depends on its strategic site selection and the appeal of its housing and commercial developments amidst these market dynamics.

Maintenance and Operation (M&O) Contracts

Post-construction, DL E&C often secures long-term Maintenance and Operation (M&O) contracts, especially for complex industrial plants and infrastructure projects. These agreements represent a significant and stable recurring revenue stream for the company.

These M&O contracts are crucial for providing predictable income, buffering against the cyclical nature of new construction projects. For instance, in 2023, DL E&C reported substantial revenue from its operational support services, highlighting the importance of this segment.

- Recurring Revenue: M&O contracts offer a consistent income stream after the initial construction phase is complete.

- Stability: This segment provides financial stability, reducing reliance on new project acquisitions alone.

- Customer Retention: Successful M&O services can foster long-term relationships with clients, leading to future business opportunities.

Joint Venture and Partnership Revenues

DL E&C also generates revenue through equity stakes and profit-sharing arrangements in joint ventures and strategic partnerships. This is particularly common for large-scale, intricate projects or ventures undertaken internationally, allowing for risk distribution and the pooling of specialized knowledge.

These collaborations are crucial for DL E&C's ability to undertake significant projects that might be too large or complex for a single entity. For instance, in 2024, DL E&C was involved in several major international infrastructure projects where such partnerships were fundamental to securing and executing the contracts.

- Equity Shares: DL E&C receives income based on its ownership percentage in the joint venture.

- Profit Sharing: Revenue is recognized from a predetermined share of profits generated by the collaborative project.

- Risk Mitigation: Partnerships allow for the sharing of financial and operational risks associated with large projects.

- Expertise Leverage: Collaborations enable DL E&C to access and utilize specialized skills and technologies from partners.

DL E&C's revenue streams are diverse, stemming from construction contracts, EPC services, property sales, and ongoing maintenance. The company also benefits from its involvement in joint ventures and strategic partnerships, which are crucial for managing large-scale projects and mitigating risks.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Construction Contracts | Fixed-price or cost-plus contracts for civil, building, and industrial projects. | Secured significant overseas petrochemical plant deal (approx. 1.5 trillion KRW). |

| EPC Services | Integrated management from design to construction. | Core revenue driver, clients pay for comprehensive project execution. |

| Property Sales | Direct sales of residential and commercial units developed by DL E&C. | Performance tied to South Korean real estate market trends in 2024. |

| Maintenance & Operation (M&O) | Long-term contracts for plant and infrastructure upkeep. | Provides stable, recurring revenue; substantial contribution reported in 2023. |

| Joint Ventures & Partnerships | Equity stakes and profit-sharing in collaborative projects. | Essential for large international projects undertaken in 2024, sharing risks and expertise. |

Business Model Canvas Data Sources

The DL E&C Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and expert strategic insights. This multi-faceted approach ensures that every component of the canvas is grounded in verifiable information and reflects the dynamic landscape of the engineering and construction sector.