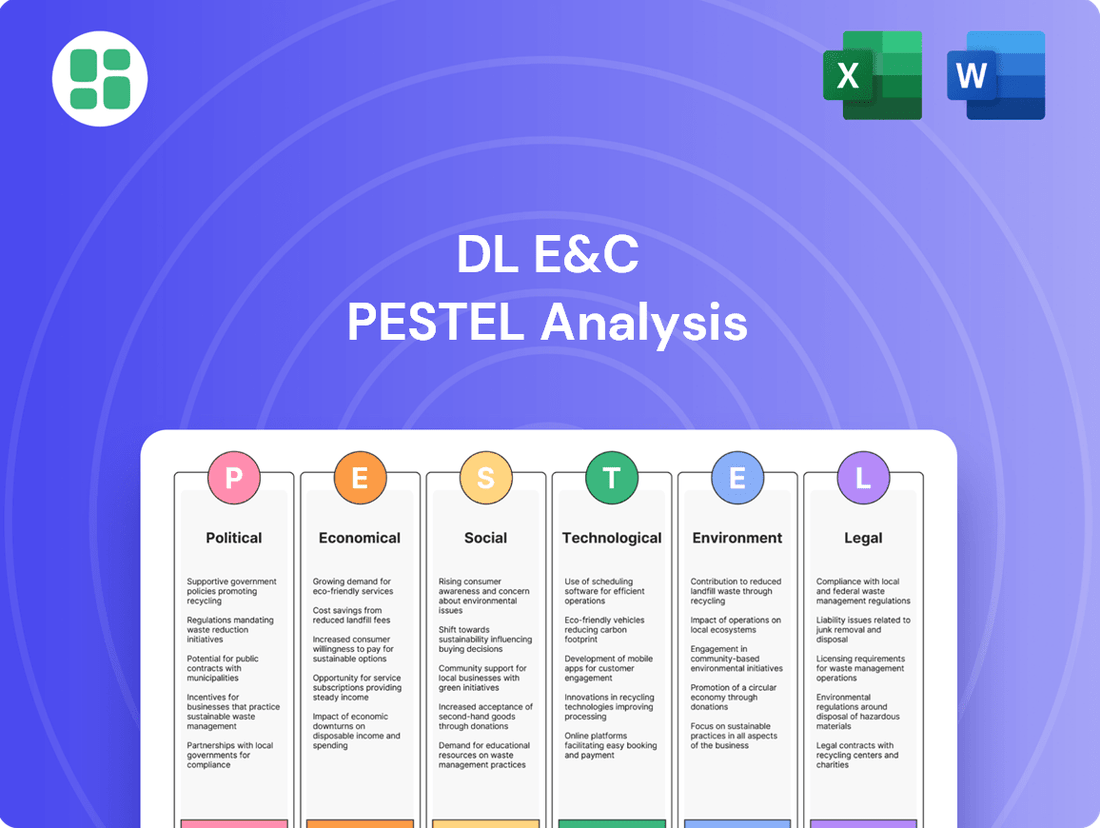

DL E&C PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DL E&C Bundle

Navigate the complex external forces shaping DL E&C's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing the company's operations and future growth. Gain a critical edge in your strategic planning and investment decisions.

Unlock actionable intelligence on DL E&C's market landscape. Our PESTLE analysis provides expert insights into the external drivers impacting the company, empowering you to anticipate challenges and identify opportunities. Download the full version now for a strategic advantage.

Political factors

Government investment in large-scale infrastructure projects, such as roads, railways, and power plants, directly impacts DL E&C's civil engineering and plant divisions. Increased government allocation, like the USD 28 billion for infrastructure in South Korea's 2025 budget, creates significant opportunities for the company.

This focus on public infrastructure, including renewable energy projects and smart transportation, provides a stable pipeline of projects for DL E&C. The emphasis on green infrastructure and digital transformation within these government plans aligns well with the company's capabilities and strategic direction.

The stability and clarity of South Korea's government policies, including building codes, urban planning regulations, and foreign investment rules, are paramount for DL E&C. A predictable regulatory environment significantly reduces operational risks and fosters confidence for long-term investments. This stability is a key factor in the company's ability to plan and execute projects effectively.

South Korea's commitment to improving energy efficiency and sustainability in public buildings, a policy initiative beginning in 2024, directly benefits DL E&C. This governmental focus aligns perfectly with the company's expertise in eco-friendly construction and smart building technologies. Such policies can drive demand for DL E&C's specialized services and innovative solutions.

DL E&C's global project execution is significantly shaped by the political stability and foreign relations of its operating countries. Unforeseen geopolitical events or sudden changes in trade agreements can directly impact project feasibility and the security of investments, as seen in the fluctuating global construction landscape.

For instance, the company's strategic move into emerging markets, such as its participation in the Canadian blue ammonia sector, hinges on the presence of supportive international relations and stable governance. Global political shifts can create both opportunities and risks, influencing supply chain reliability and the overall cost of doing business.

Government Support for Key Industries

Government initiatives aimed at bolstering specific industries, such as semiconductors or renewable energy, can significantly stimulate construction demand. South Korea's proactive support for its semiconductor sector, including substantial investment commitments, directly translates into opportunities for industrial construction. Furthermore, the nation's dedication to expanding renewable energy sources, particularly offshore wind farms, creates a robust pipeline for DL E&C's energy plant construction business.

These government-backed programs are not just abstract policies; they are translating into tangible projects. For instance, South Korea's Semiconductor Supply Chain Enhancement Package, announced in 2023, earmarks billions of dollars for R&D and infrastructure development, directly benefiting companies like DL E&C involved in building advanced manufacturing facilities. The government's renewable energy targets, aiming for a significant increase in offshore wind capacity by 2030, are also driving substantial investment in port facilities and specialized construction services.

- Semiconductor Industry Support: South Korea's commitment to making the nation a global semiconductor hub fuels demand for advanced manufacturing plant construction.

- Renewable Energy Push: Government targets for offshore wind power generation are creating a strong market for specialized marine and energy infrastructure projects.

- Infrastructure Investment: National plans for upgrading industrial complexes and energy grids provide ongoing opportunities for large-scale construction contracts.

- Economic Diversification: Policies encouraging growth in new and emerging industries often involve significant infrastructure development, benefiting construction firms.

Public-Private Partnerships (PPPs)

The South Korean government is actively promoting public-private partnerships (PPPs) to accelerate infrastructure development, creating significant opportunities for companies like DL E&C. This policy shift encourages private sector participation in key sectors, potentially leading to new project acquisitions and innovative financing structures.

PPPs are seen as a way to boost efficiency and leverage private capital, a trend particularly evident in South Korea's transportation and energy sectors. For instance, the Ministry of Economy and Finance reported that as of early 2024, the total value of infrastructure projects utilizing PPP models exceeded 100 trillion KRW (approximately $75 billion USD), with a notable increase in the pipeline for renewable energy and smart city initiatives.

- Increased PPP Funding: The government allocated an additional 5 trillion KRW (around $3.75 billion USD) in the 2024 budget specifically for PPP-driven infrastructure projects.

- Project Pipeline Growth: South Korea's PPP project pipeline saw a 15% year-on-year increase in new project announcements in late 2023, focusing on areas like high-speed rail and next-generation energy grids.

- Private Sector Investment: Private investment in PPP projects reached a record high in 2023, accounting for over 60% of total project financing in the transportation sector.

Government policies in South Korea, particularly the substantial USD 28 billion allocated for infrastructure in the 2025 budget, directly fuel DL E&C's growth. This includes a strong emphasis on green infrastructure and digital transformation, aligning with the company's expertise.

The government's commitment to energy efficiency and sustainability, evident in initiatives starting in 2024, benefits DL E&C through increased demand for eco-friendly construction and smart building technologies. Furthermore, active promotion of public-private partnerships (PPPs) is creating a robust pipeline of projects, with private investment in PPPs reaching record highs in 2023.

Government support for key industries like semiconductors and renewable energy, including billions for advanced manufacturing facilities and offshore wind expansion, translates into significant construction opportunities. For instance, the Semiconductor Supply Chain Enhancement Package and renewable energy targets are driving substantial investment.

| Policy Area | Impact on DL E&C | Relevant Data/Initiative |

| Infrastructure Investment | Increased project pipeline for civil engineering and plant divisions. | USD 28 billion allocated in South Korea's 2025 infrastructure budget. |

| Green Initiatives | Demand for eco-friendly construction and smart building solutions. | Government focus on energy efficiency in public buildings (from 2024). |

| Industry Support (Semiconductors & Renewables) | Opportunities in advanced manufacturing and energy plant construction. | South Korea's Semiconductor Supply Chain Enhancement Package; offshore wind capacity targets by 2030. |

| Public-Private Partnerships (PPPs) | New project acquisitions and innovative financing structures. | Over 100 trillion KRW (approx. $75 billion USD) in PPP infrastructure projects as of early 2024; 15% year-on-year increase in PPP project announcements (late 2023). |

What is included in the product

This DL E&C PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and data-driven perspectives to inform strategic decision-making, identify opportunities, and mitigate risks for DL E&C.

DL E&C's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during crucial meetings and strategic planning.

Economic factors

The overall health of the global and South Korean economies significantly influences DL E&C's demand for construction services. A robust economic climate generally translates to increased investment in infrastructure, housing, and commercial projects, directly benefiting construction firms.

South Korea's construction market is anticipated to reach USD 343.37 billion by 2025, signaling a positive and expanding landscape for companies like DL E&C. This growth projection suggests a strong underlying demand for new construction and development across various sectors.

Strong economic expansion is a key driver for construction activity. When economies grow, both businesses and individuals have greater confidence and capital to invest in new residential developments, commercial spaces, and industrial facilities, all of which are core areas for DL E&C.

Interest rate fluctuations directly impact DL E&C's project financing costs and those of its clients, influencing the viability of new developments. For instance, if benchmark rates like the US Federal Funds Rate, which saw increases throughout 2023 and into early 2024, remain elevated, borrowing becomes more expensive, potentially delaying or scaling back investment decisions.

The availability of credit and favorable lending conditions are paramount for DL E&C to undertake large-scale projects. In 2024, while some central banks began signaling potential rate cuts, overall credit conditions remained tighter than in previous years, requiring careful management of debt and liquidity.

Access to capital also underpins DL E&C's capacity for strategic investments in emerging technologies and operational expansion. A robust capital market, supported by stable economic outlooks and investor confidence, is crucial for funding research and development or acquiring new capabilities to maintain a competitive edge.

The cost of essential construction materials like steel and cement directly influences DL E&C's project profitability. For instance, global steel prices saw fluctuations throughout 2024, with some reports indicating a 5-10% increase in the first half of the year compared to 2023 averages, impacting project budgets significantly.

Labor costs are another critical factor. In 2024, many regions experienced a shortage of skilled construction labor, leading to wage pressures. This scarcity, coupled with the need for specialized expertise in complex projects, could drive up labor expenses for DL E&C by an estimated 3-7% in key markets by 2025.

Unpredictable supply chains further exacerbate these cost challenges. Disruptions caused by geopolitical events or natural disasters can lead to material shortages and price spikes, creating uncertainty for DL E&C's project planning and cost management strategies as they navigate the 2024-2025 period.

Real Estate Market Dynamics

The demand for both residential and commercial properties, including significant redevelopment initiatives, directly influences DL E&C's performance in its building and housing sectors. A robust real estate market translates to more opportunities for the company's core operations.

The Ulsan real estate market has shown promising signs of recovery. In the first quarter of 2024, housing prices in Ulsan saw an increase of 2.5%, while the number of unsold homes decreased by 15% compared to the same period in 2023. This trend suggests a favorable environment for initiating new residential development projects.

- Residential demand: Strong buyer interest in new housing units in key urban centers.

- Commercial leasing: Increased activity in office and retail spaces, particularly in revitalized business districts.

- Redevelopment potential: Government incentives and urban planning initiatives are driving demand for large-scale redevelopment projects.

- Market recovery indicators: Falling vacancy rates and rising property values in specific regions like Ulsan signal growth opportunities.

Currency Exchange Rates

For a global entity like DL E&C, currency exchange rate volatility directly affects the expenses associated with international projects, the procurement of imported materials, and the process of bringing profits back from foreign operations. Favorable currency movements can significantly boost the financial success of overseas ventures.

The Korean Won's performance against major currencies in 2024 and early 2025 is a key consideration. For instance, a stronger Won would make DL E&C's overseas projects more expensive when denominated in foreign currency, while a weaker Won would have the opposite effect. This dynamic impacts the cost of raw materials sourced internationally as well.

- Impact on Project Costs: Fluctuations in the KRW against currencies like the USD or EUR directly alter the cost of construction projects undertaken abroad.

- Material Sourcing: A weaker KRW increases the Won-denominated cost of imported steel, equipment, and other essential materials.

- Profit Repatriation: When profits earned in foreign currencies are converted back to KRW, their value is influenced by the prevailing exchange rates.

- Competitive Advantage: Favorable exchange rates can make DL E&C's bids for international projects more competitive.

Economic growth in South Korea and globally directly fuels demand for DL E&C's construction services, with the South Korean construction market projected to reach USD 343.37 billion by 2025. Elevated interest rates, as seen through 2023 and into early 2024, increase financing costs for both DL E&C and its clients, potentially slowing project initiation. Material costs, such as a potential 5-10% increase in global steel prices in early 2024, and skilled labor shortages, with wage pressures potentially rising 3-7% by 2025, significantly impact project profitability.

| Economic Factor | 2024/2025 Data Point | Impact on DL E&C |

|---|---|---|

| South Korean Construction Market Growth | Projected to reach USD 343.37 billion by 2025 | Increased demand for services |

| Interest Rate Trend (example: US Federal Funds Rate) | Elevated through 2023, potential for cuts in 2024/2025 | Higher financing costs, potential project delays |

| Global Steel Price Trend | Reported 5-10% increase in H1 2024 vs. 2023 average | Increased material costs, reduced profitability |

| Skilled Labor Cost Trend | Potential 3-7% increase in key markets by 2025 due to shortages | Higher labor expenses |

Preview Before You Purchase

DL E&C PESTLE Analysis

The preview shown here is the exact DL E&C PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same DL E&C PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

South Korea's continued urbanization, with a significant portion of its population concentrated in metropolitan areas like Seoul, fuels ongoing demand for construction and infrastructure projects. This trend is expected to persist, driving the need for new residential complexes, commercial spaces, and upgrades to urban infrastructure. For instance, by the end of 2024, urban populations are projected to account for over 92% of South Korea's total population, a testament to this ongoing shift.

DL E&C's strategic focus on smart city initiatives and urban mobility solutions directly addresses these demographic shifts. The company's participation in projects aimed at enhancing urban living environments, such as intelligent transportation systems and sustainable building developments, positions it to capitalize on the sustained demand for modernized urban infrastructure. This alignment with societal trends is crucial for long-term growth.

The construction sector, including companies like DL E&C, is grappling with an aging workforce, with many experienced professionals nearing retirement. This demographic shift exacerbates a pre-existing shortage of skilled labor, particularly in emerging fields such as sustainable building practices and the installation of green construction technologies.

This skills gap directly impacts project timelines and costs. For instance, a 2023 survey by the Associated General Contractors of America found that 78% of construction firms reported a shortage of skilled workers, leading to delays and increased labor expenses. DL E&C must therefore prioritize investments in robust training programs and explore advanced solutions like automation and modular construction to bridge these critical gaps and maintain competitiveness.

Consumer preferences are shifting, with a growing emphasis on sustainable living, smart home technology, and the efficiency of modular housing. This evolution directly impacts how residential properties are designed and what features are prioritized in new construction.

The demand for modular homes is particularly strong, fueled by government initiatives aimed at alleviating housing shortages. For companies like DL E&C, this trend creates significant opportunities in the construction sector.

DL E&C's 'C2 House' residential platform exemplifies this adaptation, focusing on space efficiency and practical design to meet contemporary homeowner needs. This platform is well-positioned to capitalize on the changing lifestyle and housing preferences observed in the market.

Health and Safety Standards

Societal expectations and government regulations are increasingly prioritizing worker health and safety in the construction sector, directly influencing DL E&C's operational methods and overall expenses. This heightened focus means companies like DL E&C are under greater pressure to ensure safe work environments, particularly in preventing fatalities.

DL E&C is responding by integrating advanced IT solutions for robust quality and safety management. For instance, in 2023, the company reported a significant reduction in safety incidents through the implementation of AI-powered monitoring systems and digital safety training platforms.

- Increased regulatory scrutiny on construction site safety, particularly concerning fatal accidents.

- DL E&C's investment in advanced IT for quality and safety management, aiming to mitigate risks.

- Societal demand for improved worker well-being driving adoption of new safety technologies.

- The company's proactive approach to safety management is crucial for maintaining its reputation and operational continuity.

Corporate Social Responsibility (CSR) Expectations

Public and investor scrutiny regarding corporate social responsibility is intensifying, pushing companies like DL E&C to integrate ethical management, fair partner dealings, and community engagement into their core strategies. These factors significantly shape brand perception and operational decisions.

DL E&C's adherence to the UN Global Compact principles, covering human rights, labor standards, and anti-corruption, underscores its commitment to responsible business practices. The company's focus on transparent Environmental, Social, and Governance (ESG) disclosure further solidifies this dedication.

- Growing ESG Investment: Global sustainable investment assets reached $37.8 trillion in early 2024, highlighting investor demand for socially responsible companies.

- CSR Impact on Brand: A 2024 survey indicated that 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Community Engagement Metrics: DL E&C's community contribution programs, detailed in their latest sustainability report, aim to foster shared growth and positive local impact.

Societal expectations are increasingly focused on worker well-being and safety, particularly in the construction industry. This heightened awareness directly influences operational standards and costs for firms like DL E&C, pushing for safer work environments and a reduction in fatalities.

DL E&C is actively addressing these concerns by integrating advanced IT solutions for enhanced quality and safety management, as evidenced by a reported reduction in safety incidents in 2023 through AI monitoring and digital training.

Furthermore, public and investor demand for corporate social responsibility is growing, compelling companies to embed ethical practices, fair dealings, and community engagement into their strategies. DL E&C's commitment to UN Global Compact principles and transparent ESG disclosures reflects this trend, aligning with the $37.8 trillion in global sustainable investment assets reported in early 2024.

Consumer preferences are also evolving, with a strong inclination towards sustainable living, smart home technologies, and the efficiency of modular housing, creating new market opportunities for adaptable construction solutions.

| Sociological Factor | Impact on DL E&C | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Worker Safety & Well-being | Increased operational costs, adoption of new safety tech | 78% of construction firms reported skilled labor shortages (AGC, 2023); DL E&C reduced incidents via AI monitoring (2023) |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation, investor attraction | $37.8 trillion in global sustainable investment assets (early 2024); 70% consumers consider social/environmental impact (2024 survey) |

| Consumer Preferences (Housing) | Demand for smart homes, modular construction | Growing demand for modular homes driven by housing shortages |

Technological factors

The widespread adoption of Building Information Modeling (BIM) is fundamentally reshaping how construction projects are designed, managed, and executed. This digital approach fosters enhanced collaboration, significantly reducing design errors, project delays, and improving overall resource efficiency. DL E&C has been recognized with innovation awards for its advanced BIM-driven solutions in civil and pile smart construction management, underscoring its commitment to technological leadership in the sector.

The construction industry, including major players like DL E&C, is increasingly leveraging automation, robotics, and Artificial Intelligence (AI) to tackle persistent labor shortages and enhance operational safety and efficiency. These technologies are transforming how projects are managed and executed, moving towards a more digitized and precise future. For instance, the global construction robotics market was valued at approximately $1.8 billion in 2023 and is projected to reach $3.9 billion by 2028, showcasing significant adoption growth.

AI's role extends to optimizing critical project aspects like scheduling, resource allocation, and risk management, leading to more predictable outcomes. Simultaneously, robotics are boosting productivity and the quality of work, from prefabrication to on-site assembly. DL E&C, for example, is actively investigating AI for autonomous error identification on construction sites, aiming to preemptively catch defects and improve overall project integrity.

DL E&C is leveraging digital twin technology, integrated with drone capabilities, to create virtual replicas of its construction sites. This allows for precise, real-time monitoring, significantly enhancing accuracy and cost control. For instance, by mid-2024, DL E&C reported a notable reduction in project delays attributed to improved site visibility and proactive issue identification through this integrated system.

The company's proactive adoption of a drone platform for digital twin integration across its residential projects is a key technological advancement. This approach not only boosts operational efficiency but also elevates safety standards by enabling remote inspection of hazardous areas, minimizing on-site personnel exposure.

Modular and Prefabricated Construction

Modular and prefabricated construction methods are revolutionizing the building industry by enabling faster project completion, lower costs, and enhanced quality control through off-site assembly of components. This approach is particularly gaining traction in South Korea, with government backing and a growing need for efficient housing solutions fueling its adoption.

The South Korean government has been actively promoting modular construction, recognizing its potential to address housing shortages and improve construction efficiency. For instance, the Ministry of Land, Infrastructure and Transport has set targets to increase the adoption of prefabricated housing. In 2023, the market for modular construction in South Korea was estimated to be around 1 trillion KRW (approximately $750 million USD), with projections indicating significant growth in the coming years.

- Speed: Projects can be completed up to 50% faster compared to traditional methods.

- Cost Reduction: Savings of 10-20% on overall project costs are achievable due to reduced labor and waste.

- Quality: Off-site manufacturing in controlled environments leads to higher and more consistent quality.

- Sustainability: Reduced material waste and improved energy efficiency in production contribute to greener building practices.

Development of Advanced Materials and Green Technologies

Technological advancements in sustainable materials and green technologies are rapidly reshaping the construction industry. DL E&C recognizes this shift, actively seeking innovations in areas like energy-efficient designs and carbon-neutral building solutions to align with evolving environmental regulations and growing consumer preference for eco-friendly structures. For instance, the global green building materials market was valued at approximately $244.1 billion in 2023 and is projected to reach $536.1 billion by 2030, showcasing significant growth potential.

DL E&C's commitment to this trend is evident in its participation in open innovation competitions. These initiatives are designed to identify promising startups and cutting-edge technologies in carbon-neutral and eco-friendly energy solutions. This proactive approach allows the company to integrate novel approaches into its projects, potentially reducing its environmental footprint and enhancing its competitive edge in the market. The company's focus on these areas is critical as global efforts to combat climate change intensify, driving demand for sustainable construction practices.

- Innovation in sustainable materials: DL E&C is exploring advanced materials that offer lower embodied carbon and improved lifecycle performance.

- Energy-efficient designs: The company is investing in technologies and methodologies that reduce the operational energy consumption of buildings.

- Carbon-neutral technologies: DL E&C is actively seeking partnerships and investments in startups developing solutions for achieving net-zero emissions in construction and building operations.

- Market demand for green buildings: Growing investor and consumer interest in sustainability is creating a strong market pull for eco-conscious construction projects.

DL E&C is actively integrating advanced technologies like Building Information Modeling (BIM) and AI to enhance project efficiency and reduce errors, with BIM-driven solutions earning innovation awards. The company is also exploring automation and robotics to combat labor shortages and improve safety, mirroring a global trend where the construction robotics market is projected to reach $3.9 billion by 2028.

Digital twin technology, combined with drones, allows DL E&C for real-time site monitoring, improving accuracy and cost control, leading to a reported reduction in project delays by mid-2024. Furthermore, the adoption of modular and prefabricated construction methods, supported by the South Korean government, offers significant speed and cost advantages, with the local market valued at approximately $750 million USD in 2023.

The company is also focusing on sustainable materials and green technologies, aligning with a global green building materials market expected to reach $536.1 billion by 2030. DL E&C's engagement with startups in carbon-neutral solutions highlights its commitment to eco-friendly practices and meeting growing market demand for sustainable structures.

| Technology | Application by DL E&C | Market/Growth Data (2023-2028/2030) |

|---|---|---|

| BIM | Design, management, collaboration, smart construction | Innovation awards received |

| AI & Robotics | Automation, scheduling, risk management, error identification | Construction robotics market to reach $3.9B by 2028 |

| Digital Twins & Drones | Real-time site monitoring, accuracy, cost control | Reported reduction in project delays (mid-2024) |

| Modular Construction | Faster completion, cost reduction, quality control | South Korean market ~$750M USD (2023) |

| Sustainable Materials | Energy efficiency, carbon-neutral solutions | Green building materials market to reach $536.1B by 2030 |

Legal factors

DL E&C must meticulously adhere to a complex web of national and local building codes, safety standards, and construction regulations. Compliance is non-negotiable for maintaining operational licenses and avoiding penalties, directly influencing project timelines and budgets. For instance, the stringent enforcement of South Korea's Serious Accident Punishment Act, which came into full effect in 2022, places significant legal liability on companies for workplace safety failures, impacting how DL E&C plans and executes its construction projects.

DL E&C's construction projects must strictly adhere to environmental regulations concerning emissions, waste disposal, water consumption, and land preservation. These laws are fundamental to responsible project execution and stakeholder trust.

The increasing stringency of environmental legislation and the market's demand for green building practices mean DL E&C must invest in and implement sustainable construction methods. For instance, in 2024, South Korea's Ministry of Environment continued to push for reduced construction waste, with targets aiming for a 10% increase in recycling rates for specific materials by the end of the year.

DL E&C's published environmental policy and management systems underscore a proactive approach to meeting these legal obligations. Their commitment is demonstrated through initiatives like the development of low-carbon concrete technologies, which saw pilot projects in late 2024 showing promising results in reducing the carbon footprint of major infrastructure builds.

DL E&C must strictly adhere to labor laws governing wages, working hours, and worker rights. This includes careful management of sub-contractors to ensure their compliance as well. Failure to comply can lead to significant legal penalties and operational disruptions.

The construction industry, including companies like DL E&C, faces scrutiny over workplace safety. Fatal accidents, such as those reported for DL E&C, underscore the severe legal and reputational consequences of safety regulation breaches. For instance, in South Korea, workplace safety violations can result in substantial fines and even criminal charges against company executives.

Contract Law and Dispute Resolution

The legal framework for construction contracts, encompassing terms, conditions, and dispute resolution, directly influences project risks and financial results for DL E&C. The enforceability of contract clauses, adherence to building codes, and the efficiency of arbitration or litigation processes are critical considerations. For instance, a study by the Royal Institution of Chartered Surveyors in 2024 highlighted that disputes in construction projects can add an average of 10% to project costs and extend timelines by up to 20%.

International projects necessitate navigating a complex web of diverse legal systems, demanding DL E&C to possess robust in-house legal expertise or strong partnerships with international legal firms. Understanding and complying with foreign contract laws, intellectual property rights, and labor regulations are paramount to avoiding costly legal entanglements. In 2024, global construction projects faced an average of 15% increase in legal compliance costs due to evolving international regulations.

- Contractual Clarity: Ensuring all project contracts are meticulously drafted and legally sound to minimize ambiguity and potential disputes.

- Dispute Resolution: Establishing efficient and cost-effective mechanisms for resolving contractual disagreements, whether through negotiation, mediation, arbitration, or litigation.

- International Legal Compliance: Maintaining up-to-date knowledge of and adherence to the legal frameworks of all countries in which DL E&C operates.

- Regulatory Adherence: Strictly following all relevant building codes, environmental laws, and safety regulations in each jurisdiction.

Corporate Governance and Anti-Corruption Laws

DL E&C's commitment to robust corporate governance and stringent anti-corruption laws is paramount. Adherence to these regulations not only bolsters investor trust but also serves as a critical shield against potential legal repercussions. The company actively promotes ethical leadership and operational transparency, mirroring the principles of the UN Global Compact and striving for thorough Environmental, Social, and Governance (ESG) disclosures. This focus is essential in navigating the complex legal landscape of the construction and engineering sectors.

Recent events underscore the significance of regulatory compliance. For instance, a tax dispute involving DL E&C highlighted the necessity of meticulous adherence to corporate tax regulations. Such situations can impact financial performance and brand reputation.

- Corporate Governance: DL E&C prioritizes ethical decision-making and transparent operations to maintain stakeholder confidence.

- Anti-Corruption Laws: Strict adherence to anti-corruption legislation is a cornerstone of the company's operational framework, mitigating legal and reputational risks.

- ESG Disclosure: The company aims for comprehensive ESG reporting, aligning with global standards and investor expectations for sustainability.

- Tax Compliance: Proactive management of tax obligations, as demonstrated by responses to recent tax disputes, is crucial for financial stability and legal standing.

DL E&C must navigate a complex regulatory environment, from building codes to environmental laws, ensuring every project adheres to national and international standards. Failure to comply can lead to significant penalties, operational halts, and reputational damage, impacting project budgets and timelines. For example, the South Korean Serious Accident Punishment Act, fully enacted in 2022, imposes substantial liability for workplace safety lapses, directly influencing DL E&C's project planning and execution strategies.

The company's commitment to legal compliance extends to environmental stewardship, with a focus on reducing construction waste and promoting sustainable practices. In 2024, South Korea's Ministry of Environment set targets to increase recycling rates for specific construction materials by 10% by year-end, a directive DL E&C actively addresses through initiatives like low-carbon concrete development, which showed promising results in pilot projects by late 2024.

DL E&C also faces legal scrutiny regarding labor practices and workplace safety, with strict adherence to labor laws and robust safety protocols being essential. The consequences of non-compliance, including substantial fines and potential criminal charges, underscore the critical importance of maintaining high safety standards. For instance, workplace safety violations in South Korea can lead to severe legal repercussions for companies and their executives.

Contractual clarity and efficient dispute resolution are vital for managing project risks and financial outcomes. In 2024, construction disputes were found to add an average of 10% to project costs and extend timelines by up to 20%, highlighting the need for meticulous contract drafting and effective conflict resolution mechanisms.

| Legal Aspect | Impact on DL E&C | 2024/2025 Data/Trend |

|---|---|---|

| Building Codes & Safety Standards | Operational licenses, project timelines, budgets | Stringent enforcement of South Korea's Serious Accident Punishment Act (since 2022) |

| Environmental Regulations | Responsible execution, stakeholder trust, investment in sustainable methods | South Korea targeting 10% increase in construction waste recycling for specific materials by end of 2024 |

| Labor Laws & Worker Rights | Avoiding penalties, operational disruptions | Focus on sub-contractor compliance critical |

| Contract Law & Dispute Resolution | Project risks, financial results | Disputes can add ~10% to costs and 20% to timelines (RICS study, 2024) |

| International Legal Compliance | Avoiding costly legal entanglements | Global projects saw average 15% increase in legal compliance costs in 2024 due to evolving regulations |

Environmental factors

Stricter climate change regulations are reshaping the construction industry, pushing companies like DL E&C to adopt more sustainable practices. These new rules, focused on reducing greenhouse gas emissions and boosting energy efficiency, directly influence how projects are planned and executed.

DL E&C is proactively addressing these environmental shifts by committing to achieve net-zero scope 1 and 2 emissions by 2050. This commitment is supported by the company's increasing involvement in renewable energy projects, such as offshore wind farms and solar power installations, which are crucial for meeting these ambitious climate targets.

The construction sector significantly contributes to waste generation, with landfilling remaining a dominant disposal method. However, there's a growing global push towards circular economy principles, emphasizing waste reduction, material reuse, and recycling. For instance, in 2023, the European Union reported that construction and demolition waste accounted for approximately 37% of all waste generated in the bloc, highlighting the scale of the challenge and the opportunity for improvement.

DL E&C's approach to waste management and circular economy principles is crucial for its long-term sustainability and operational efficiency. This likely involves adopting innovative construction techniques that minimize material offcuts and waste at the source. Furthermore, the company is probably investing in strategies for the effective segregation, recycling, and reuse of construction materials, aligning with regulatory requirements and growing market demand for eco-friendly building practices.

The demand for eco-friendly and sustainably sourced materials is reshaping the construction industry, pushing companies like DL E&C to innovate. This trend is particularly strong in South Korea, where there's a growing focus on green building certifications and energy-efficient designs. For instance, the South Korean government has set ambitious targets for green building, aiming to increase the number of certified green buildings significantly by 2030, which directly impacts material choices and construction methods.

Biodiversity Protection and Land Use Impact

DL E&C, like other major construction firms, faces scrutiny over its impact on local ecosystems. Large-scale development projects inherently alter land use, potentially affecting biodiversity. For instance, in 2023, South Korea, where DL E&C operates extensively, saw continued emphasis on green infrastructure development, with government initiatives promoting ecological restoration alongside urban planning.

Navigating these environmental concerns requires DL E&C to conduct rigorous environmental impact assessments (EIAs) and implement effective mitigation strategies. Public awareness and regulatory frameworks are increasingly pushing for developers to minimize their ecological footprint. This means incorporating biodiversity protection measures from the initial design phase through project completion.

DL E&C's commitment to sustainability is likely reflected in its reporting. Companies in this sector often detail their efforts in areas such as:

- Minimizing habitat disruption: Implementing construction practices that reduce direct impact on sensitive habitats.

- Restoration and offsetting: Engaging in projects to restore degraded areas or create new habitats to compensate for unavoidable impacts.

- Sustainable material sourcing: Prioritizing materials that have a lower environmental impact and are sourced responsibly.

Water Resource Management

DL E&C faces growing scrutiny regarding water resource management, particularly concerning efficient usage and discharge during construction. This is driven by heightened environmental awareness and stricter regulations, especially for large-scale projects and those located in water-stressed areas. For instance, the global construction industry's water consumption is substantial, with estimates suggesting it accounts for a significant portion of total freshwater withdrawal in many regions.

Effective water management strategies are crucial for compliance and operational sustainability. This involves minimizing water consumption through innovative techniques and ensuring responsible discharge practices that adhere to environmental standards. The increasing focus on the circular economy also encourages water recycling and reuse within construction processes.

- Water Scarcity Impact: Regions experiencing water stress, such as parts of the Middle East and Asia where DL E&C operates, mandate more rigorous water management plans, potentially increasing project costs.

- Regulatory Compliance: Adherence to discharge limits and water quality standards is non-negotiable, with potential fines for non-compliance.

- Technological Adoption: Investments in water-efficient technologies, like advanced filtration systems for reuse, are becoming a competitive advantage.

- ESG Reporting: Transparent reporting on water usage and conservation efforts is increasingly expected by investors and stakeholders, impacting DL E&C's Environmental, Social, and Governance (ESG) ratings.

DL E&C must navigate increasingly stringent environmental regulations, particularly concerning carbon emissions and waste management. The company's commitment to net-zero scope 1 and 2 emissions by 2050, alongside its involvement in renewable energy projects, demonstrates a proactive approach to these challenges. The global push for circular economy principles is also driving innovation in waste reduction and material reuse within the construction sector.

The demand for sustainable and eco-friendly materials is a significant market driver, influencing DL E&C's material sourcing and design choices. Companies are also under pressure to minimize their ecological footprint, necessitating rigorous environmental impact assessments and biodiversity protection measures, especially in regions like South Korea where green building initiatives are expanding.

Water resource management is another critical environmental factor, with a focus on efficient usage and responsible discharge. DL E&C's operational efficiency and compliance hinge on adopting water-saving technologies and adhering to strict discharge standards, which is particularly relevant in water-stressed regions.

| Environmental Factor | Impact on DL E&C | Key Trends/Data (2023-2025) |

|---|---|---|

| Climate Change & Emissions | Need for decarbonization strategies, investment in renewables | Global push for net-zero targets; increased focus on Scope 3 emissions reporting. South Korea's carbon neutrality goals by 2050. |

| Waste Management & Circular Economy | Opportunities for waste reduction, material reuse, and recycling innovation | EU construction waste ~37% of total waste (2023); growing adoption of circular economy principles in construction. |

| Sustainable Materials | Shift towards eco-friendly, responsibly sourced materials | Increased demand for green building certifications; South Korea's target to significantly increase certified green buildings by 2030. |

| Biodiversity & Land Use | Requirement for ecological impact assessments and mitigation strategies | Emphasis on green infrastructure and ecological restoration in urban planning (e.g., South Korea 2023 initiatives). |

| Water Resource Management | Focus on water efficiency, responsible discharge, and reuse | Growing water scarcity concerns globally; stricter regulations on water usage and discharge in construction. |

PESTLE Analysis Data Sources

Our PESTLE analysis for the Engineering & Construction sector is meticulously constructed using data from reputable sources including government regulatory bodies, international financial institutions, and leading industry associations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the industry.