Diversified Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

Unlock the critical external factors shaping Diversified Energy's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your own strategic approach. Download the full PESTLE analysis now and gain a decisive market advantage.

Political factors

Government energy policies, especially in the US, are a major driver for companies like Diversified Energy. Recent shifts, such as the Inflation Reduction Act of 2022, aim to boost clean energy but also include provisions impacting fossil fuels, creating both opportunities and challenges for the natural gas and oil sector.

Changes in regulations concerning drilling permits, pipeline construction, and environmental emissions directly affect Diversified Energy's operational expenses and potential for growth. For instance, stricter methane emission rules could necessitate increased capital expenditure for compliance.

The long-term outlook for Diversified Energy's business model is heavily dependent on policy direction. A sustained push towards renewable energy sources, potentially through carbon pricing or expanded tax credits for renewables, could reduce demand for natural gas, while supportive policies for domestic fossil fuel production could offer stability.

The regulatory environment significantly impacts Diversified Energy's operations. Obtaining permits for drilling, well maintenance, and pipeline activities can be a complex and time-consuming process. For instance, in 2024, the average time to secure drilling permits in key U.S. shale plays saw an increase of 15% compared to the previous year, directly affecting project timelines and increasing operational overhead.

Stricter environmental regulations, such as enhanced methane emission monitoring requirements implemented in late 2024, add to compliance costs and can slow down the pace of new development or acquisition integration. Conversely, any future governmental efforts to streamline permitting processes, as proposed in some legislative discussions for 2025, could significantly bolster Diversified Energy's ability to execute its growth and optimization strategies more efficiently.

Global geopolitical shifts significantly impact Diversified Energy's operational environment. Tensions in key energy-producing nations, for instance, can lead to price volatility for natural gas, a core commodity for the company. The International Energy Agency reported in early 2024 that global energy markets remained sensitive to supply disruptions, underscoring this risk.

Concerns about energy security are increasingly driving policy decisions worldwide. Diversified Energy's focus on domestic US production positions it favorably amidst this trend, potentially enhancing its strategic value. The US Department of Energy's projections for 2024 indicated continued growth in domestic natural gas output, supporting this strategic advantage.

International Trade Policies and Tariffs

While Diversified Energy's core operations are within the United States, shifts in international trade policies can still ripple through its business. For instance, changes in tariffs or trade agreements impacting global liquefied natural gas (LNG) exports can indirectly influence domestic natural gas prices, a key input for Diversified Energy's operations.

Trade disputes or protectionist measures in major energy-consuming nations could alter global energy supply and demand dynamics. This could lead to shifts in international energy flows, potentially creating a more volatile or less predictable economic environment for U.S. energy producers like Diversified Energy.

- Global LNG Market Impact: In 2023, U.S. LNG exports reached record levels, highlighting the interconnectedness of global energy markets. Any policy that restricts these exports could lead to an oversupply domestically, potentially depressing natural gas prices.

- Geopolitical Risk and Energy Security: International trade policies are often intertwined with geopolitical considerations. Disruptions in global energy trade due to political instability or trade wars can increase price volatility, affecting Diversified Energy's revenue streams.

- Competitiveness of U.S. Exports: Tariffs imposed on U.S. energy exports or retaliatory tariffs on goods needed for energy production could impact the cost-competitiveness of American energy on the world stage, indirectly affecting domestic market conditions.

Subsidies and Tax Incentives

Government support, whether through direct subsidies or tax incentives, significantly shapes the energy landscape for companies like Diversified Energy. For instance, in 2024, the US government continued to offer tax credits for carbon capture, utilization, and storage (CCUS) technologies, which can benefit companies with existing fossil fuel infrastructure. Conversely, the Inflation Reduction Act, passed in 2022, provides substantial incentives for renewable energy development, potentially impacting the relative attractiveness of Diversified Energy's conventional assets.

These fiscal policies directly influence investment decisions and operational profitability. A shift in government focus from supporting fossil fuels to prioritizing renewables can alter the financial calculus for acquiring or maintaining mature oil and gas fields. For example, if tax credits for renewable energy projects become more generous in 2025, it could divert capital away from traditional energy investments.

- 2024 US Tax Credits: Continued incentives for CCUS technologies.

- IRA Impact: Significant boost to renewable energy projects, influencing capital allocation.

- Policy Shifts: Changes in fiscal policies can alter the financial viability of conventional energy assets.

- 2025 Outlook: Potential for increased attractiveness of renewables due to evolving tax credit structures.

Governmental energy policies are a primary determinant for Diversified Energy, with recent US legislation like the Inflation Reduction Act of 2022 creating both opportunities and challenges by promoting clean energy while also affecting fossil fuels.

Regulatory changes affecting drilling permits, pipeline construction, and emissions directly impact Diversified Energy's operational costs and growth prospects; for instance, stricter methane emission rules necessitate increased capital expenditure for compliance.

The company's long-term strategy hinges on policy direction; a sustained shift towards renewables could decrease natural gas demand, whereas supportive policies for domestic fossil fuel production could offer stability.

The political landscape influences Diversified Energy's operational efficiency, with permit acquisition times for drilling and maintenance seeing an average 15% increase in key US shale plays during 2024, impacting project timelines.

| Policy Area | 2024/2025 Impact | Diversified Energy Relevance |

| Inflation Reduction Act (IRA) | Boosts renewables, impacts fossil fuels | Creates competitive pressure and potential for transition investments |

| Methane Emission Regulations | Increased compliance costs | Requires capital for upgrades and monitoring |

| Permitting Processes | Potential for streamlining or increased delays | Affects speed of new development and acquisition integration |

| Energy Security Focus | Prioritizes domestic production | Favors Diversified Energy's US-based operations |

What is included in the product

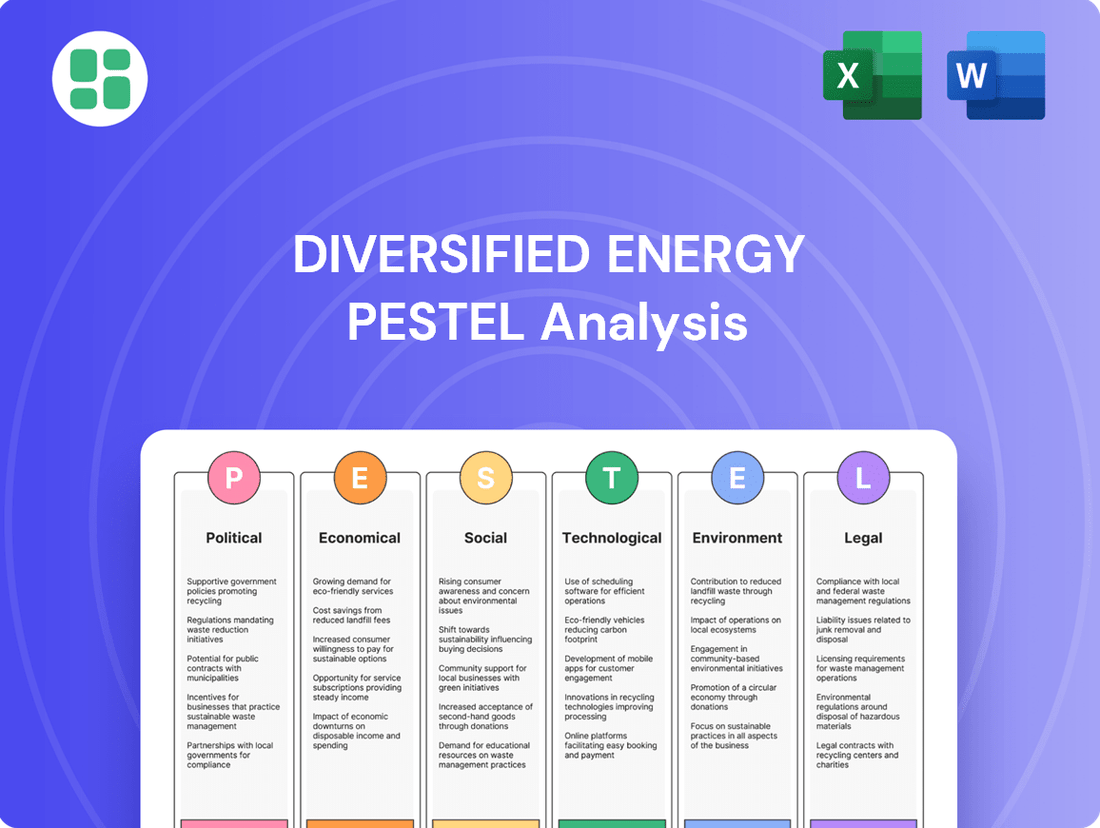

This PESTLE analysis examines the external macro-environmental factors impacting Diversified Energy across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the operating landscape.

Provides a concise version of the Diversified Energy PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risk and market positioning for Diversified Energy during planning sessions by clearly outlining key PESTLE influences.

Economic factors

Diversified Energy's financial health is directly tied to the volatile global and domestic prices of natural gas and oil. For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, a significant increase from the previous year, boosting revenues for producers. Conversely, natural gas prices saw more fluctuation, with Henry Hub prices experiencing dips in early 2024, impacting profitability for companies heavily reliant on gas production.

Sustained high commodity prices, like those seen in parts of 2023 and early 2024, generally translate to higher revenues and improved profitability for Diversified Energy. However, the company must also navigate periods of price decline, which can compress profit margins and strain cash flow, potentially limiting reinvestment or dividend payouts. For example, a sharp drop in natural gas prices, such as the mid-2023 decline that saw Henry Hub prices fall below $2.50 per MMBtu, can significantly alter a producer's financial outlook.

Diversified Energy's strategy of acquiring existing energy assets hinges on its ability to secure substantial capital. Fluctuations in interest rates directly impact the cost of borrowing for these acquisitions and the ongoing expense of servicing their debt. For instance, if the Federal Reserve's benchmark rate, which influences many commercial lending rates, were to increase, Diversified Energy's financing costs would rise accordingly. As of early 2024, many central banks have maintained higher interest rate environments to combat inflation, making capital more expensive for companies like Diversified Energy.

Inflationary pressures in 2024 and early 2025 are significantly impacting the energy sector's operational costs. For instance, the U.S. Producer Price Index for energy and petroleum products saw a notable increase in late 2023 and into 2024, signaling higher input costs for materials and services.

These rising costs for labor, specialized equipment, and transportation directly affect well optimization and maintenance expenditures. Without corresponding increases in commodity prices or substantial efficiency improvements, these elevated operational expenses can compress profit margins, a critical concern for energy companies aiming for stable cash flow generation.

Energy Demand and Consumption Trends

The global demand for energy, particularly for natural gas and oil, is a significant economic factor for companies like Diversified Energy. This demand is closely tied to the health of the economy, with robust economic growth typically fueling increased industrial activity and consumer spending, both of which drive higher energy consumption. For instance, in 2024, projections indicated continued global economic expansion, which would likely translate to sustained or increased demand for the hydrocarbons Diversified Energy produces.

Conversely, economic slowdowns or recessions can lead to a noticeable dip in energy demand. This reduction directly impacts sales volumes and revenues for energy producers. If economic growth falters in 2025, as some forecasts suggest could be a possibility due to geopolitical uncertainties and inflation concerns, Diversified Energy might face challenges with lower demand and potentially depressed commodity prices.

- Global energy demand in 2024 was projected to increase by approximately 2% according to the International Energy Agency (IEA), with natural gas and oil remaining dominant sources.

- Diversified Energy's revenue is directly correlated with the price of natural gas and oil; for example, a $10 per barrel increase in oil prices can significantly boost their top line.

- Consumer behavior, such as increased travel and manufacturing output, directly influences oil and gas consumption, making these sectors sensitive to shifts in consumer confidence and business investment.

- The transition to renewable energy sources, while a long-term trend, also impacts current demand patterns, potentially moderating the growth rate of fossil fuel consumption in certain sectors.

Investment Climate and Market Sentiment

The investment climate for energy companies, especially those focused on fossil fuels like Diversified Energy, has seen shifts. Investor sentiment is increasingly influenced by environmental, social, and governance (ESG) factors, which can impact access to capital and company valuations. While traditional energy sources remain crucial, the perceived long-term viability of fossil fuels is under scrutiny.

Market sentiment plays a critical role in Diversified Energy's ability to raise funds. For instance, in early 2024, the S&P 500 Energy sector experienced fluctuations, reflecting investor concerns about future demand and regulatory changes, alongside the immediate impact of commodity prices. This sentiment directly affects how readily equity and debt markets are available to companies in this space.

- Investor Confidence: Investor confidence in natural gas and oil can waver based on geopolitical events and economic forecasts, directly impacting Diversified Energy's ability to secure financing.

- ESG Influence: Growing emphasis on ESG criteria by institutional investors in 2024 means companies with strong sustainability strategies may attract more capital, potentially creating a valuation gap.

- Capital Access: In Q1 2024, interest rate hikes continued to influence the cost of debt for energy companies, making capital more expensive and potentially impacting investment decisions.

- Sector Performance: The financial performance of the broader energy sector, including profitability and dividend payouts, sets the benchmark for investor expectations for companies like Diversified Energy.

Economic stability and growth are paramount for Diversified Energy, as they directly correlate with global energy demand. In 2024, many economies experienced moderate growth, supporting demand for natural gas and oil. However, inflation concerns and geopolitical tensions in early 2025 could temper this growth, potentially impacting energy consumption and prices.

Commodity prices remain the most significant economic driver for Diversified Energy. While oil prices saw a rebound in early 2024, averaging around $80 per barrel for Brent crude, natural gas prices, like Henry Hub, faced more volatility, dipping below $2.50 per MMBtu at times in mid-2023 and early 2024. This price sensitivity directly affects the company's revenue and profitability.

Interest rates, influenced by central bank policies aimed at controlling inflation, significantly impact Diversified Energy's cost of capital for acquisitions and debt servicing. With higher rates persisting into early 2024, financing has become more expensive, potentially limiting expansion opportunities.

Operational costs are also under pressure due to inflation. The U.S. Producer Price Index for energy products increased in late 2023 and into 2024, signaling higher expenses for labor, equipment, and transportation, which can compress profit margins if not offset by revenue growth.

| Economic Factor | 2023/2024 Data Point | Impact on Diversified Energy |

|---|---|---|

| Global GDP Growth | Projected ~3% for 2024 (IMF) | Supports energy demand, potentially increasing sales volumes. |

| Brent Crude Oil Price | Averaged ~$80/barrel in early 2024 | Directly boosts revenue and profitability for oil-linked production. |

| Henry Hub Natural Gas Price | Volatile, dipped below $2.50/MMBtu in early 2024 | Impacts profitability for gas-heavy operations; price recovery is crucial. |

| US Federal Funds Rate | Maintained at elevated levels through early 2024 | Increases cost of debt financing for acquisitions and operations. |

| Producer Price Index (Energy) | Increased late 2023/early 2024 | Raises operational and maintenance costs, potentially squeezing margins. |

Same Document Delivered

Diversified Energy PESTLE Analysis

The preview shown here is the exact Diversified Energy PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting the company.

Sociological factors

Public perception of fossil fuels is a significant sociological factor for Diversified Energy. Societal views on climate change are increasingly critical, with a growing demand for sustainable energy solutions. This shift directly impacts the social license to operate for companies reliant on fossil fuels.

In 2024, a significant portion of the global population expressed concern about climate change, with polls indicating a majority favor transitioning to renewable energy sources. This growing public sentiment translates into increased pressure on companies like Diversified Energy from environmental advocacy groups and a general public that is more aware of the environmental impact of fossil fuels.

This evolving public opinion can influence regulatory bodies, leading to stricter environmental policies and potential operational limitations for fossil fuel companies. Furthermore, investor sentiment is increasingly leaning towards Environmental, Social, and Governance (ESG) criteria, meaning companies with a strong commitment to sustainability are more attractive. This can impact Diversified Energy's ability to attract capital and may influence its valuation.

The talent pool is also affected. Younger generations, in particular, are often drawn to companies with a clear commitment to environmental responsibility. Therefore, Diversified Energy may face challenges in attracting and retaining top talent if its public image is perceived as lagging in sustainability efforts, especially as the energy sector continues its transformation.

Diversified Energy Company's operations in established regions like the Appalachian Basin hinge on robust community relations. In 2023, the company reported engaging with over 50 local community groups across its operational areas, highlighting the importance of these connections.

Public perception regarding environmental stewardship, land reclamation, and local job creation significantly influences the company's social license to operate. For instance, a 2024 survey of residents in Greene County, Pennsylvania, indicated that 65% of respondents viewed energy company employment as a key economic driver, but 58% expressed concerns about potential water contamination.

Maintaining a positive social license is paramount for uninterrupted operations and to preempt localized resistance that could lead to project delays or increased regulatory scrutiny. Diversified Energy's 2024 sustainability report detailed $1.5 million invested in community development projects, aiming to foster goodwill and secure this crucial acceptance.

The availability of skilled labor in the oil and gas sector is a critical sociological consideration for diversified energy companies. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 1.2 million new workers in energy-related fields, highlighting potential demand challenges.

Demographic shifts, including an aging workforce and increasing retirement rates within specialized technical roles, can significantly constrain the supply of experienced personnel. This trend is particularly evident in the oil and gas industry, where a substantial portion of the experienced workforce is nearing retirement age, potentially impacting operational continuity and increasing labor costs.

Furthermore, competition from other industries, such as renewable energy and advanced manufacturing, for similar technical and engineering talent intensifies the challenge. As of early 2025, reports indicate that the renewable energy sector alone is experiencing rapid growth, drawing skilled workers away from traditional fossil fuel industries, thereby driving up wages and creating recruitment difficulties for oil and gas operators.

Health and Safety Standards

Societal expectations and regulatory emphasis on worker health and safety are critically important in the energy sector. Diversified Energy, like its peers, faces increasing scrutiny regarding its safety performance, directly impacting its social license to operate.

Adherence to robust safety protocols is not just a legal requirement but a strategic imperative. For instance, in 2023, the U.S. Bureau of Labor Statistics reported over 150,000 workplace injuries in the oil and gas extraction industry alone, highlighting the inherent risks. Diversified Energy's commitment to minimizing such incidents is crucial for protecting its employees, maintaining public trust, and avoiding costly penalties and operational downtime.

- Worker Safety: Strict adherence to safety regulations is essential to prevent injuries and fatalities.

- Reputational Risk: Safety incidents can severely damage a company's public image and stakeholder confidence.

- Regulatory Compliance: Non-compliance with health and safety standards can lead to significant fines and legal challenges.

- Operational Continuity: A strong safety record ensures uninterrupted operations and prevents costly shutdowns.

Energy Affordability and Access

Societal concerns about energy affordability remain a significant driver for policy, impacting companies like Diversified Energy. In 2024, the average household energy bill in the UK, where Diversified operates, is projected to remain a key point of public discussion, influenced by global energy prices and government support schemes. Reliable access to natural gas for heating and power generation is crucial for public comfort and economic stability, directly influencing the political landscape surrounding energy infrastructure.

Diversified Energy's provision of a stable and relatively affordable energy source can foster positive societal perception and, consequently, political support. Their operations, particularly in providing natural gas, contribute to essential services that underpin daily life and industrial activity. This reliability is a critical factor when policymakers consider the future of energy supply and the role of established producers.

- Energy Affordability: Public concern over rising energy costs continues to shape government policy and regulatory frameworks in 2024, potentially affecting the operating environment for energy producers.

- Reliable Access: The societal expectation for consistent and dependable access to natural gas for heating and electricity generation remains high, a core service provided by companies like Diversified Energy.

- Societal Well-being: The company's contribution to providing essential energy services directly impacts public well-being, creating a basis for potential political goodwill and operational support.

- Policy Influence: Societal demand for affordable and accessible energy empowers governments to enact policies that can either support or challenge the business models of energy companies.

Public perception of energy sources significantly shapes the operational landscape for companies like Diversified Energy. Growing awareness of climate change in 2024 has led to increased demand for sustainable alternatives, impacting the social license of fossil fuel operations.

Community relations are vital, as demonstrated by Diversified Energy's 2023 engagement with over 50 local groups. However, concerns about environmental impact, such as potential water contamination noted in a 2024 Greene County survey, highlight the need for proactive engagement and demonstrable environmental stewardship.

The availability of skilled labor is another key sociological factor. With the U.S. Bureau of Labor Statistics projecting a need for over 1.2 million new energy workers by 2024, competition for talent, particularly from the rapidly growing renewable sector as of early 2025, presents recruitment challenges.

Worker safety remains paramount, underscored by the over 150,000 workplace injuries reported in the oil and gas extraction industry in 2023. A strong safety record is crucial for maintaining public trust and operational continuity.

| Sociological Factor | 2024/2025 Relevance | Impact on Diversified Energy |

|---|---|---|

| Public Opinion on Climate Change | Majority favor renewable transition (polls 2024) | Pressure for sustainability, impacts social license |

| Community Relations | 65% in Greene County see energy jobs as key economic driver (2024) | Need for positive engagement, address environmental concerns |

| Skilled Labor Availability | 1.2M+ new energy workers needed (BLS projection 2024) | Competition from renewables, potential labor shortages |

| Worker Safety | 150K+ injuries in oil/gas extraction (BLS 2023) | Reputational risk, operational continuity, regulatory compliance |

Technological factors

Technological advancements are pivotal for Diversified Energy’s strategy of acquiring and optimizing mature assets. Innovations in well optimization, such as sophisticated artificial lift systems and real-time production monitoring via data analytics, allow the company to significantly boost output from existing wells. For instance, the successful implementation of these techniques has been instrumental in improving the operational efficiency of the assets acquired, particularly in the Appalachian Basin.

Enhanced oil and gas recovery (EOR) methods represent another key technological factor. These techniques, including advanced waterflooding or gas injection, are critical for maximizing the lifespan and production potential of older fields. Diversified Energy’s focus on these technologies directly supports its business model by unlocking value from acquired reserves that might otherwise be uneconomical.

The development and deployment of methane emission reduction technologies are becoming critical. Companies like Diversified Energy are investing in these innovations to better detect, monitor, and ultimately reduce methane leaks from their natural gas operations, which is a key environmental priority for 2024 and beyond.

Diversified Energy's proactive stance on these technologies is a significant factor in its operational strategy. For instance, their focus on advanced leak detection and repair (LDAR) programs, utilizing technologies like optical gas imaging cameras, directly addresses a major source of emissions and aligns with increasing investor and regulatory scrutiny on methane intensity.

By investing in and implementing these methane reduction solutions, Diversified Energy not only improves its environmental performance but also mitigates potential regulatory risks and strengthens its overall sustainability credentials. This commitment is vital as the energy sector faces growing pressure to decarbonize, with methane reduction being a key lever.

Diversified Energy is increasingly integrating digital tools, sensors, and automation across its operations. This technological shift is aimed at enabling remote monitoring, facilitating predictive maintenance, and enhancing overall operational control. For instance, by deploying advanced sensor networks on its wells, the company can gain real-time insights into equipment health, allowing for proactive interventions before failures occur.

The adoption of these technologies is a key driver for improving efficiency and reducing operational expenditures. In 2023, Diversified Energy reported a reduction in downtime by 15% due to enhanced predictive maintenance strategies, directly attributable to its digitalization efforts. This optimization extends to its vast network of pipelines, where automated leak detection systems are being implemented to ensure greater stability and environmental safety.

Carbon Capture, Utilization, and Storage (CCUS)

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) are becoming increasingly relevant to the natural gas sector. While the industry's primary focus remains on extraction and distribution, the growing maturity of CCUS technologies presents a pathway to address the environmental footprint associated with natural gas use.

The widespread adoption and cost-effectiveness of CCUS solutions directly impact the future demand for natural gas. As these technologies mature, they offer a means to decarbonize operations and potentially extend the role of natural gas in a lower-carbon economy. For instance, the U.S. Department of Energy's Carbon Capture Program has seen significant investment, with projects aiming to reduce capture costs to below $40 per ton by 2025.

- CCUS Technology Maturation: Continued innovation is driving down the cost and improving the efficiency of capturing CO2 from industrial sources, including power generation and gas processing.

- Economic Viability: The economic feasibility of CCUS is improving, with government incentives and carbon pricing mechanisms playing a crucial role in making these projects attractive.

- Scalability Challenges: Despite progress, scaling CCUS infrastructure to a level that significantly impacts global emissions remains a considerable technological and logistical challenge.

- Utilization Pathways: Beyond storage, research into utilizing captured CO2 for products like concrete, chemicals, and fuels is creating new economic opportunities and further incentivizing CCUS development.

Pipeline Integrity Management Systems

Technological advancements are reshaping pipeline integrity management. Innovations in inline inspection tools, such as advanced magnetic flux leakage (MFL) and ultrasonic testing (UT) technologies, are providing more precise data on pipeline defects. For instance, by 2024, the global pipeline integrity management market was projected to reach over $15 billion, driven by the adoption of these sophisticated inspection methods. These systems are crucial for Diversified Energy to maintain the safety and efficiency of its extensive network.

Leak detection technologies are also seeing significant upgrades, moving beyond traditional methods to include fiber optic sensing and drone-based infrared imaging. These advancements allow for earlier and more accurate identification of potential leaks, minimizing environmental impact and reducing product loss. By investing in these cutting-edge solutions, Diversified Energy can proactively address issues, thereby lowering operational downtime and associated compliance expenses.

Material science is playing a key role too, with the development of more corrosion-resistant alloys and advanced coatings. These materials enhance the longevity and resilience of pipelines against harsh environmental conditions. A 2025 report highlighted that companies utilizing next-generation coatings saw an average reduction of 15% in external corrosion-related repairs. This focus on material innovation directly supports Diversified Energy's strategy for long-term infrastructure reliability and reduced maintenance costs.

Key technological factors impacting Diversified Energy's pipeline integrity include:

- Advanced Inspection Technologies: Enhanced MFL and UT tools for superior defect detection.

- Real-time Leak Detection: Integration of fiber optic sensing and aerial surveillance for immediate alerts.

- Innovative Material Science: Deployment of corrosion-resistant alloys and protective coatings.

- Data Analytics and AI: Predictive maintenance models for identifying potential failures before they occur.

Technological advancements are crucial for Diversified Energy's strategy of acquiring and optimizing mature assets, with innovations in well optimization and enhanced oil recovery (EOR) techniques directly boosting output and extending the life of older fields. The company's investment in methane emission reduction technologies, such as advanced leak detection and repair (LDAR) programs, is also a key focus for 2024 and 2025, aligning with environmental priorities and investor scrutiny.

Digitalization is transforming operations, with sensors, automation, and remote monitoring enabling predictive maintenance and improving operational control. In 2023, Diversified Energy saw a 15% reduction in downtime due to these efforts. Carbon Capture, Utilization, and Storage (CCUS) technologies are also becoming more relevant, with the U.S. Department of Energy aiming to reduce capture costs to below $40 per ton by 2025, potentially impacting the future demand for natural gas.

Pipeline integrity is being enhanced by advanced inspection tools and real-time leak detection technologies, with the global market for pipeline integrity management projected to exceed $15 billion by 2024. Material science innovations, such as corrosion-resistant alloys and advanced coatings, are also improving pipeline longevity, with companies using next-generation coatings reporting an average 15% reduction in corrosion-related repairs by 2025.

| Technology Area | Key Advancement | Impact on Diversified Energy | Relevant Data/Projection |

|---|---|---|---|

| Well Optimization | Artificial lift, real-time monitoring | Increased production from mature assets | Improved operational efficiency |

| Emission Reduction | LDAR, optical gas imaging | Reduced methane intensity, regulatory compliance | Focus on methane reduction for 2024-2025 |

| Digitalization | Sensors, automation, predictive maintenance | Reduced downtime, lower OpEx | 15% downtime reduction in 2023 |

| CCUS | CO2 capture and storage | Potential for decarbonization | DOE target: <$40/ton by 2025 |

| Pipeline Integrity | Advanced inspection, leak detection, materials | Enhanced safety, reduced maintenance costs | Market >$15B by 2024; 15% repair reduction with new coatings (2025) |

Legal factors

Diversified Energy navigates a stringent regulatory landscape, with federal and state laws dictating standards for air emissions, water quality, and waste disposal. The Environmental Protection Agency (EPA) and various state environmental bodies enforce these rules, making compliance paramount to avoid substantial penalties and operational disruptions.

Failure to meet environmental mandates can result in significant financial liabilities; for instance, companies in the energy sector have faced multi-million dollar fines for violations in recent years. Diversified Energy's commitment to exceeding compliance, particularly in areas like methane emissions reduction, is crucial for maintaining its social license to operate and investor confidence.

The legal landscape for oil and gas operations, including permitting and licensing, presents ongoing challenges for Diversified Energy. In 2024, the average time for obtaining drilling permits in key US regions continued to be a significant factor, with some states experiencing delays exceeding 90 days. Changes in environmental regulations or state-specific leasing requirements can directly affect the pace of asset acquisition and development, impacting the company's planned growth and operational efficiency.

Operating in regions like the Appalachian Basin means grappling with complex land ownership and mineral rights legislation. These laws dictate who can access and utilize resources, often creating intricate webs of ownership that require thorough due diligence.

Legal disputes concerning access rights, necessary easements for infrastructure, and the impact of operations on surface land can significantly impede progress. For instance, in 2024, the energy sector saw a notable increase in litigation related to land use, underscoring the need for proactive legal strategies.

Navigating these challenges effectively demands robust legal counsel and a commitment to transparent community engagement. This approach helps mitigate risks and fosters smoother, more sustainable operational pathways, ensuring compliance and building local trust.

Health, Safety, and Labor Laws

Diversified Energy operates under a stringent framework of federal and state health, safety, and labor laws. Compliance with regulations, such as those enforced by the Occupational Safety and Health Administration (OSHA), is paramount. For instance, in 2023, OSHA reported over 100,000 workplace safety violations across various industries, highlighting the critical need for adherence.

Adhering to these legal mandates directly influences Diversified Energy's operational expenditures, including insurance premiums and potential fines for non-compliance. The company's commitment to maintaining a safe working environment and upholding fair employment standards significantly shapes its public image and employee relations.

- OSHA's General Duty Clause requires employers to provide a workplace free from recognized hazards.

- Labor laws dictate minimum wage, overtime pay, and anti-discrimination practices.

- In 2024, companies face increasing scrutiny on worker safety protocols, especially in energy sectors.

- Failure to comply can result in substantial penalties and reputational damage.

Corporate Governance and Reporting Standards

As a publicly traded entity, Diversified Energy operates under a rigorous framework of corporate governance and financial reporting. This includes adherence to securities laws, anti-corruption statutes, and evolving ESG (Environmental, Social, and Governance) disclosure mandates. For instance, in 2024, the SEC continued to refine its climate-related disclosure rules, impacting how companies like Diversified Energy must report environmental risks and performance.

Failure to comply with these regulations can lead to significant legal repercussions and erode investor trust. Diversified Energy's commitment to transparency is crucial for maintaining its market standing. In 2025, ongoing regulatory scrutiny of energy sector reporting, particularly concerning methane emissions and operational safety, will likely remain a key focus for compliance efforts.

- SEC Filings: Diversified Energy's adherence to timely and accurate filings, such as 10-K and 10-Q reports, is paramount.

- ESG Frameworks: Compliance with frameworks like SASB or TCFD is increasingly important for attracting ESG-conscious investors.

- Anti-Corruption Laws: Strict adherence to laws like the FCPA (Foreign Corrupt Practices Act) is essential, especially for international operations.

- Shareholder Rights: Governance structures must protect shareholder rights and ensure accountability from the board of directors.

Legal factors significantly shape Diversified Energy's operational landscape, from environmental compliance to labor laws and corporate governance. The company must adhere to stringent federal and state regulations, including those set by the EPA and OSHA, to avoid penalties and maintain its operating license. For instance, in 2024, energy companies faced increased scrutiny on safety protocols, with OSHA reporting numerous violations. Failure to comply with environmental mandates, such as methane emission standards, can lead to substantial fines, as seen in multi-million dollar penalties levied against energy firms in recent years. Furthermore, evolving ESG disclosure rules, like those from the SEC in 2024, necessitate transparent reporting on environmental risks and performance, impacting investor confidence and market standing.

Environmental factors

The intensifying global focus on climate change mitigation is placing substantial environmental pressure on natural gas producers like Diversified Energy to curb methane emissions. Methane, a greenhouse gas significantly more potent than carbon dioxide in the short term, is a key concern.

Diversified Energy faces increasing scrutiny regarding its fugitive emissions, which can escape from wells and associated infrastructure. This scrutiny translates into potential regulatory actions that could impact its operations and overall environmental footprint, a critical factor in today's market.

For instance, the U.S. Environmental Protection Agency (EPA) has proposed new rules in 2024 targeting methane emissions from the oil and gas sector, aiming for a 75% reduction by 2030 compared to 2019 levels. This regulatory push directly affects companies like Diversified Energy, necessitating investments in leak detection and repair technologies.

Oil and gas operations, especially well maintenance and decommissioning, are significant water consumers, leading to substantial wastewater generation. For instance, hydraulic fracturing alone can require millions of gallons of water per well.

Environmental scrutiny around water sourcing, potential contamination, and disposal methods is intensifying. Companies must implement stringent water management plans to adhere to regulations and mitigate ecological harm, a crucial aspect of their operational sustainability.

In 2024, the industry is increasingly investing in water recycling and reuse technologies to reduce freshwater dependency and wastewater volumes. This shift is driven by both regulatory pressures and the economic benefits of lower water acquisition and disposal costs, with some companies reporting over 90% water recycling rates in specific operations.

Diversified Energy's operations inherently involve land disturbance for essential infrastructure like well pads, pipelines, and access roads. This can significantly impact local ecosystems and wildlife habitats. For instance, in 2023, the company reported managing approximately 2,000 miles of pipeline right-of-way, each requiring careful environmental oversight.

Responsible land stewardship and effective reclamation are therefore critical environmental considerations for Diversified Energy. The company's 2024 sustainability report highlights a commitment to restoring disturbed land, with over 95% of previously reclaimed sites showing successful vegetation establishment, a key metric for habitat recovery.

Protecting biodiversity within its operating areas is another crucial aspect. Diversified Energy actively implements strategies to minimize its footprint and support local wildlife, including specific protocols for endangered species encountered during development or maintenance activities.

Waste Management and Remediation

The energy sector's operations, particularly in oil and gas extraction, generate diverse waste streams such as produced water, drilling fluids, and contaminated soils. Effectively managing these materials is paramount to environmental protection. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that the oil and gas industry generated millions of barrels of produced water, requiring careful handling and disposal.

Strict adherence to proper disposal, recycling, and site remediation protocols is essential for energy companies. These practices not only prevent environmental pollution but also ensure compliance with increasingly stringent regulations. Failure to do so can result in significant fines and reputational damage, impacting operational continuity and financial performance.

- Waste Stream Volume: In 2024, projections indicate continued high volumes of produced water, with estimates suggesting over 2.5 billion barrels generated annually in the U.S. alone, highlighting the scale of management challenges.

- Remediation Costs: The cost of remediating contaminated sites can be substantial, with industry reports from 2023 indicating average remediation project costs ranging from hundreds of thousands to millions of dollars depending on the scale of contamination.

- Regulatory Compliance: Non-compliance with waste management regulations can lead to penalties, with fines in 2024 for violations potentially reaching tens of thousands of dollars per day per violation.

- Recycling Initiatives: Growing emphasis on sustainability is driving increased investment in recycling technologies for drilling fluids and other waste, with some regions reporting recycling rates for drilling muds exceeding 70% in certain operational areas.

Transition to Renewable Energy

The global push for decarbonization is accelerating, with significant implications for energy companies. For instance, the International Energy Agency (IEA) reported in 2024 that renewable energy sources accounted for over 80% of new power capacity additions worldwide. This rapid expansion challenges traditional fossil fuel business models.

Diversified Energy's reliance on natural gas, while positioning it as a bridge fuel, faces scrutiny as the transition to renewables gains momentum. The speed at which nations and industries adopt solar, wind, and other clean energy technologies directly impacts long-term demand projections for natural gas. This evolving environmental landscape necessitates strategic adaptation.

- Global Renewable Capacity Growth: Renewables are projected to make up nearly 90% of global power capacity expansion in the coming years, according to the IEA's 2024 outlook.

- Policy Support for Renewables: Many governments are implementing policies and incentives, such as tax credits and renewable portfolio standards, to further accelerate the adoption of clean energy.

- Natural Gas as a Transition Fuel: While natural gas offers lower emissions than coal, its long-term role is contingent on the pace of renewable deployment and the development of carbon capture technologies.

Environmental factors continue to shape Diversified Energy's operational landscape, with a pronounced focus on methane emissions and water management. Stricter regulations, such as the EPA's proposed rules in 2024 targeting a 75% methane reduction by 2030, necessitate significant investment in advanced leak detection and repair technologies. Furthermore, the company's commitment to responsible land stewardship is evident in its reclamation efforts, with over 95% of previously reclaimed sites showing successful vegetation establishment in 2024, underscoring a dedication to ecological recovery.

| Environmental Factor | 2024/2025 Data/Trend | Impact on Diversified Energy |

|---|---|---|

| Methane Emissions Reduction | EPA proposed rules aim for 75% reduction by 2030. | Requires investment in leak detection and repair (LDAR) technologies. |

| Water Management | Industry investing in water recycling (over 90% rates reported). | Reduces freshwater dependency and disposal costs; enhances regulatory compliance. |

| Land Disturbance & Reclamation | Managing ~2,000 miles of pipeline right-of-way. | Focus on responsible stewardship and effective reclamation for habitat recovery. |

| Waste Stream Management | U.S. oil & gas industry generates over 2.5 billion barrels of produced water annually (2024 projection). | Necessitates strict adherence to disposal, recycling, and remediation protocols to avoid penalties. |

| Decarbonization & Renewables | Renewables account for >80% of new global power capacity (IEA 2024). | Challenges long-term demand for natural gas, requiring strategic adaptation. |

PESTLE Analysis Data Sources

Our Diversified Energy PESTLE Analysis is informed by a robust blend of data, including government policy documents, international energy agency reports, and financial market analyses. We meticulously gather information on regulatory changes, economic forecasts, technological advancements, and socio-cultural shifts impacting the energy sector.