Diversified Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

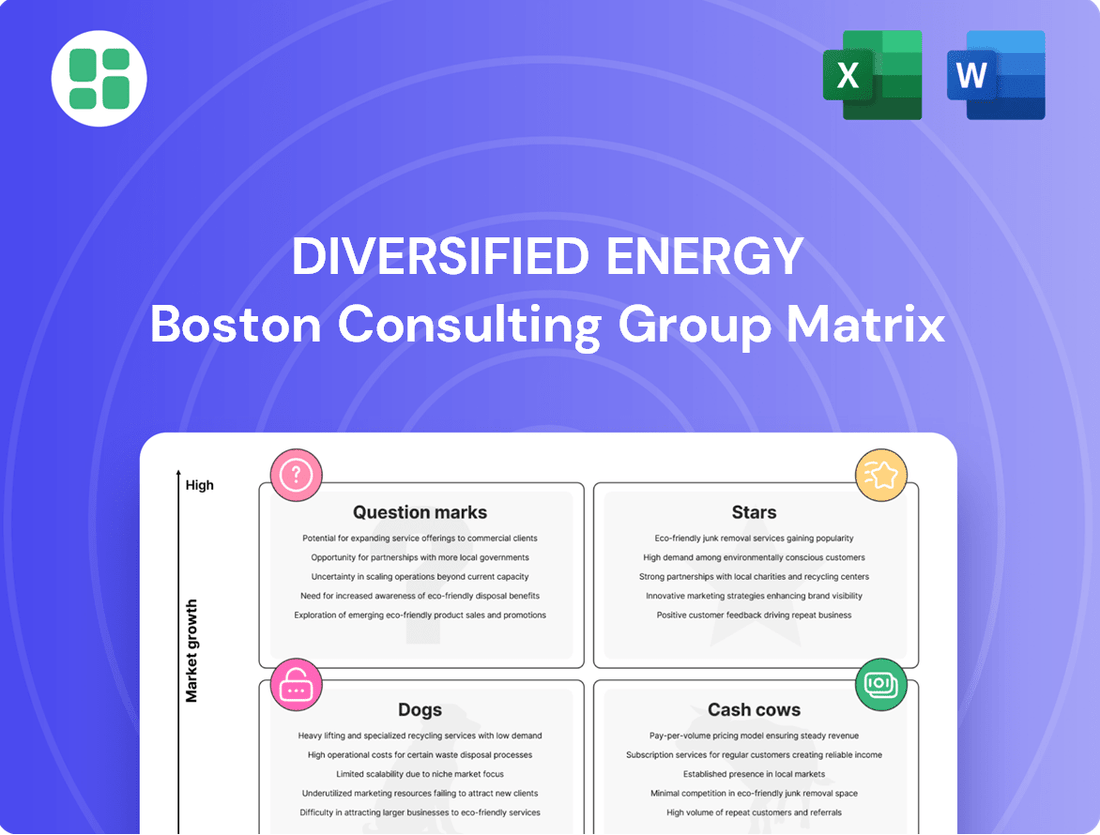

Unlock the strategic potential of Diversified Energy's portfolio by understanding its position within the BCG Matrix. This preview offers a glimpse into how their assets might be categorized as Stars, Cash Cows, Dogs, or Question Marks, guiding your initial assessment of their market standing.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The acquisition of Maverick Natural Resources for roughly $1.3 billion was a game-changer for Diversified Energy. This move nearly doubled their revenue and boosted EBITDA by 68% in 2024, solidifying their position as the top producer in the Western Anadarko Basin.

This strategic acquisition brought significant commodity diversification, balancing their production mix across oil, NGLs, and gas. It's a major growth engine for the company, setting them up for continued expansion.

With anticipated annual synergies exceeding $50 million, the integration of Maverick Natural Resources is expected to significantly enhance free cash flow and accelerate growth into 2025.

Diversified Energy Company's strategic bolt-on acquisition of assets from Summit Natural Resources for around $45 million in early 2025 exemplifies a focused growth strategy within the Appalachian Basin. This move is designed to bolster operational efficiencies by integrating new assets into their established infrastructure, thereby enhancing synergies and improving profit margins through better asset utilization.

The acquisition is particularly noteworthy for its potential to unlock additional revenue streams, especially from coal mine methane (CMM) capture. By expanding their footprint in a core operating region, Diversified is leveraging existing expertise and infrastructure to drive growth, a classic indicator of a strong position within its market niche.

Diversified Energy is strategically expanding its Coal Mine Methane (CMM) revenue, a move that generates valuable environmental credits and consistent cash flow. This segment is positioned for significant growth, driven by the increasing global demand for cleaner energy alternatives and the market for carbon reduction credits.

The acquisition of Summit Natural Resources in 2023, for instance, was a key move specifically designed to unlock further CMM production and extend revenue streams into the future. This demonstrates a clear commitment to capitalizing on the CMM opportunity.

While CMM may represent a smaller slice of Diversified Energy's total revenue pie currently, its high-growth potential is undeniable. For example, CMM capture and utilization projects are becoming increasingly attractive as regulatory frameworks and market incentives for decarbonization strengthen, bolstering the financial viability of this segment.

Smarter Asset Management (SAM) Program

Diversified's Smarter Asset Management (SAM) program is a key driver for optimizing its diverse energy portfolio. This initiative focuses on maximizing production from existing wells and improving operational efficiency.

SAM's proprietary technology and operational framework are designed to unlock value from mature assets, thereby increasing Diversified's market presence in established basins. The program's continuous optimization efforts directly translate into more consistent production levels and improved profit margins, serving as a significant internal growth catalyst.

- Enhanced Production: SAM has been instrumental in boosting production from existing wells, contributing to Diversified's overall output.

- Efficiency Gains: The program drives operational efficiencies, reducing costs and improving the profitability of each asset.

- Well Life Extension: SAM's strategies are aimed at extending the productive life of wells, maximizing the return on investment over time.

- Internal Growth Engine: By continuously optimizing performance, SAM acts as a powerful internal engine for growth within Diversified's asset base.

Partnerships for Data Center Power Solutions

Diversified Energy is actively forging strategic partnerships, notably with Carlyle, to pioneer net-zero power solutions for data centers. This collaboration aims to harness the company's existing natural gas assets to meet the escalating energy demands of the digital infrastructure sector.

The data center industry's energy consumption is a rapidly expanding market, with global data center electricity demand projected to reach approximately 1,000 terawatt-hours (TWh) annually by 2026, up from around 300 TWh in 2022. This presents a substantial high-growth avenue for Diversified Energy, potentially bolstering its energy marketing and utilization segments.

- Market Growth: Data center energy demand is a rapidly expanding sector, with significant growth expected in the coming years.

- Strategic Partnerships: Collaborations like the one with Carlyle are crucial for developing innovative, sustainable energy solutions.

- Asset Utilization: Leveraging existing natural gas assets provides a foundation for these new energy ventures.

- Future Potential: Successful execution could establish a new, high-market share segment for Diversified in the energy solutions space.

Stars in the BCG Matrix represent business units with high market share in a high-growth market. For Diversified Energy, their expanding Coal Mine Methane (CMM) segment and their strategic push into net-zero power solutions for data centers, particularly through partnerships like the one with Carlyle, are emerging as potential Stars. These ventures tap into rapidly growing markets driven by decarbonization efforts and the increasing energy demands of digital infrastructure.

The CMM segment, while currently a smaller revenue contributor, exhibits strong growth potential due to increasing demand for cleaner energy and carbon credits. Similarly, the data center energy market is experiencing exponential growth, with projected annual electricity demand reaching approximately 1,000 TWh by 2026. Diversified's ability to leverage existing assets and form strategic alliances positions these areas for significant expansion and market leadership.

| Segment | Market Growth | Diversified's Position | Key Drivers |

|---|---|---|---|

| Coal Mine Methane (CMM) | High (driven by decarbonization & carbon credits) | Growing Market Share | Environmental regulations, carbon credit markets |

| Data Center Power Solutions | Very High (driven by digital infrastructure demand) | Emerging Leader (via partnerships) | Data center energy consumption, net-zero initiatives |

What is included in the product

The Diversified Energy BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Diversified Energy BCG Matrix offers a clear, visual roadmap to identify underperforming assets, alleviating the pain of resource misallocation.

Cash Cows

Diversified Energy's extensive asset base in the Appalachian and Central regions forms the backbone of its cash cow strategy. These mature, low-decline natural gas and oil wells consistently generate robust and stable cash flows, a key indicator of a cash cow business. The company's focus on acquiring and optimizing these long-life assets solidifies its market position in these established, albeit low-growth, regions.

The company's consistent free cash flow generation is a hallmark of its cash cow status. In 2024, it reported adjusted free cash flow in the range of $210 million to $215 million.

Looking ahead, the company has provided guidance for approximately $420 million in free cash flow for 2025, largely driven by the strategic Maverick acquisition. This substantial and growing cash flow provides significant financial flexibility.

This robust cash generation enables the company to effectively return capital to shareholders, reduce its outstanding debt, and strategically invest in new growth opportunities. Crucially, this financial strength means core operations are not dependent on external funding, solidifying its position in a mature market.

Diversified Energy demonstrates a robust dedication to shareholder returns through its reliable dividend payments. In 2024 alone, the company distributed over $105 million to its shareholders, encompassing both dividends and share repurchases.

This consistent capital return is further underscored by the declared quarterly dividend of $0.29 per share for the fourth quarter of 2024, scheduled for payment in June 2025. This payout reflects the company's ability to generate substantial excess cash, even when operating within a low-growth market scenario.

Vertically Integrated Midstream and Marketing Operations

Vertically integrated midstream and marketing operations offer a significant competitive edge. By managing its own midstream network, the company can direct produced volumes to the most lucrative markets, thereby boosting cash margins. This self-sufficiency minimizes dependence on external providers, leading to optimized costs and more consistent, higher prices for natural gas and liquids.

These integrated operations are crucial for the sustained profitability of the company's established production assets. For instance, in 2024, Diversified Energy Company reported that its midstream segment generated substantial adjusted EBITDA, demonstrating the cash-generating power of this segment. This segment's ability to secure favorable pricing and manage transportation efficiently directly contributes to the overall financial health of the company.

- Competitive Advantage: In-house midstream and marketing capabilities enable routing to premium sales points and enhanced cash margins.

- Cost Optimization: Reduced reliance on third parties lowers operational costs and ensures more stable, higher realized prices.

- Profitability Driver: These operations significantly contribute to the consistent profitability of mature production assets.

- 2024 Performance: The midstream segment was a key contributor to adjusted EBITDA, highlighting its financial strength.

Low Corporate Production Decline Rate

Diversified Energy's exceptionally low corporate production decline rate, around 10% annually, is a cornerstone of its cash cow status. This contrasts sharply with the higher decline rates common in many shale plays, meaning the company needs to spend less to keep production steady. This stability is crucial for generating predictable cash flow.

This low decline rate directly translates to lower capital intensity for Diversified Energy. Instead of constantly drilling new wells to replace rapidly declining output, the company can rely on its existing, mature assets to generate substantial cash. For example, in 2024, the company's focus on low-decline assets allowed for significant free cash flow generation, with capital expenditures primarily directed towards maintenance rather than aggressive growth. This efficiency underpins its ability to consistently return capital to shareholders.

- Low Decline Rate Advantage: Diversified Energy's ~10% annual production decline rate minimizes the need for extensive reinvestment, unlike high-decline shale assets.

- Capital Efficiency: This low decline rate significantly reduces capital intensity, allowing for more free cash flow generation.

- Asset Longevity: The stability of its mature assets ensures predictable revenue streams and a longer cash-generating lifespan.

- 2024 Performance: The company's strategy of focusing on low-decline assets in 2024 facilitated strong free cash flow, with capital allocation prioritizing maintenance and shareholder returns.

Diversified Energy's cash cow strategy is anchored by its mature, low-decline asset base, primarily in the Appalachian and Central regions. These assets consistently produce stable cash flows, a key characteristic of cash cows. The company's focus on optimizing these long-life wells solidifies its position in established, low-growth markets.

The company's financial performance in 2024 underscored its cash cow status, with reported adjusted free cash flow between $210 million and $215 million. This robust generation of cash is further bolstered by the company's commitment to shareholder returns, having distributed over $105 million in 2024 through dividends and share repurchases.

Diversified Energy's vertically integrated midstream and marketing operations provide a significant competitive advantage, allowing for optimized routing to lucrative markets and enhanced cash margins. This self-sufficiency minimizes reliance on third parties, leading to more consistent and higher realized prices for its produced volumes.

| Metric | 2024 (Actual/Guidance) | 2025 (Guidance) |

| Adjusted Free Cash Flow | $210M - $215M | ~$420M |

| Shareholder Distributions | >$105M | N/A |

| Production Decline Rate | ~10% | N/A |

Preview = Final Product

Diversified Energy BCG Matrix

The preview you are examining is the identical Diversified Energy BCG Matrix document you will receive upon purchase, ensuring you know precisely what you're acquiring. This comprehensive analysis, detailing stars, cash cows, question marks, and dogs within the energy sector, is fully formatted and ready for immediate strategic application. You can confidently proceed with your purchase, knowing this preview represents the complete, unedited report designed to enhance your business planning and decision-making processes.

Dogs

Within Diversified Energy's extensive portfolio, certain wells or small groups of wells might be considered marginal or high-cost. This happens when their oil or gas output drops significantly, or when the cost to keep them running is more than the money they bring in. For instance, in 2023, Diversified Energy reported that a portion of its wells had higher operating expenses per barrel of oil equivalent than the average, though the company actively works to reduce these costs through efficiency measures.

While the company's strategy involves optimizing production across its assets, some older wells that are no longer very productive can end up in this category. These assets might use up cash without generating substantial profits. In the first quarter of 2024, the company continued its program of retiring uneconomic wells, a key part of managing its operational costs and focusing capital on more productive assets.

Such underperforming assets, especially if they consistently fail to deliver value or offer no future strategic benefit, are typically candidates for sale or early closure. Diversified Energy's approach to asset management includes regularly evaluating its well base to identify and address these situations, aiming to improve overall portfolio economics.

In 2024, Diversified Energy strategically divested some of its Appalachia assets, selling them to a Special Purpose Vehicle for around $200 million while keeping a minority stake. This move was aimed at cutting debt and boosting cash availability.

These divested assets, while cash-generating, were likely viewed as having lower growth potential or being less critical to the company's core strategy compared to its main holdings. Such actions are common when managing 'dog' assets to free up capital for more profitable ventures.

Diversified Energy Company's focus on optimizing existing assets means some older midstream or well infrastructure might demand substantial repair outlays, potentially draining resources if not managed carefully. For instance, in 2023, the company reported capital expenditures of $732 million, with a significant portion allocated to maintaining and enhancing its existing asset base to ensure long-term viability and efficiency.

These older segments, if they become cash traps due to escalating maintenance needs without corresponding revenue generation, could hinder overall profitability. Diversified's stated commitment to asset integrity, however, is designed to proactively address these challenges, aiming to prevent such situations and ensure the continued operational health of its extensive portfolio.

Wells with Limited Remaining Reserve Life

Even with a strategy centered on long-lasting assets, Diversified Energy Company (DEC) occasionally acquires older wells with very short economic lifespans. These wells, often nearing the end of their productive capacity, might be candidates for early decommissioning. In 2023, DEC reported that approximately 3% of its acquired wells had remaining reserve lives of less than one year, highlighting the reality of managing a diverse portfolio.

These wells, if they don't generate significant cash flow and instead incur ongoing operational or regulatory expenses, can be categorized as "cash cows" in a divestment context. They are essentially being maximized for their remaining value before being retired from service. For instance, wells with minimal production, perhaps producing less than 5 barrels of oil equivalent per day, often fall into this category, especially if lifting costs exceed revenue.

- Limited Economic Life: Some acquired wells, particularly older ones, have a very short remaining economic life, making them candidates for early retirement.

- "Milking Dry" Operations: If these wells do not contribute meaningfully to cash flow and incur ongoing operational or regulatory costs, they are essentially being 'milked dry' before retirement.

- Cost-Benefit Analysis: The decision to continue operating such wells hinges on a careful cost-benefit analysis, weighing minimal production revenue against operational and regulatory expenditures.

- Portfolio Management: Managing these wells is a crucial aspect of portfolio optimization, ensuring that capital is not tied up in assets with diminishing returns.

Non-strategic or Geographically Isolated Assets

Assets that are geographically isolated from Diversified's main operational hubs, such as the Appalachian Basin and Central Region, and don't offer significant synergistic advantages can become inefficient to manage. For instance, if these remote assets also exhibit low production volumes and limited growth potential, they might be classified as Dogs.

This classification stems from their inherently higher relative operating costs, often due to increased transportation and logistical expenses, coupled with a lack of strategic alignment with the core business. In 2024, companies like Diversified Energy have been actively evaluating such peripheral assets, with reports indicating a focus on divesting non-core holdings to streamline operations and improve overall capital allocation efficiency.

- Geographic Isolation: Assets located far from primary operational centers increase management and logistical overhead.

- Low Production & Growth: Limited output and subdued market growth prospects diminish the asset's value contribution.

- High Operating Costs: Remote locations often translate to higher per-unit production costs.

- Limited Strategic Alignment: These assets may not fit into the company's long-term strategic vision or offer significant operational synergies.

Within Diversified Energy's portfolio, certain wells or asset groups can be classified as Dogs if their production declines significantly or if the cost to maintain them outweighs the revenue generated. For example, in the first quarter of 2024, Diversified continued its program of retiring uneconomic wells, a strategy to manage costs and focus capital on more productive assets.

These underperforming assets, especially those with no future strategic benefit, are prime candidates for divestment or early closure. Diversified Energy's asset management approach involves continuous evaluation to identify and address such situations, aiming to enhance overall portfolio economics.

In 2024, Diversified Energy strategically divested certain Appalachia assets for approximately $200 million, a move designed to reduce debt and improve cash availability, indicating a focus on shedding lower-growth or non-core holdings.

Assets that are geographically isolated and offer limited synergistic advantages can become inefficient to manage, particularly if they also have low production volumes and minimal growth potential. Such assets often incur higher relative operating costs due to increased logistics, making them candidates for divestment to streamline operations and improve capital allocation efficiency.

| Asset Type | Key Characteristics | Potential Actions | Financial Impact | Example Data Point (Q1 2024) |

| Marginal Wells | Low production, high lifting costs | Retirement, divestment | Cash drain, reduced profitability | Continued retirement of uneconomic wells |

| Older Infrastructure | High maintenance needs, low revenue | Repair, upgrade, or retirement | Potential cash trap, operational inefficiency | Capital expenditures of $732 million in 2023 for asset maintenance |

| Short-Life Acquired Wells | Nearing end of productive capacity | Early decommissioning, "milking dry" | Minimal cash flow, ongoing expenses | Approx. 3% of acquired wells in 2023 had remaining reserve lives of less than one year |

| Geographically Isolated Assets | Remote from core operations, low synergy | Divestment, sale | Increased operating costs, inefficient capital allocation | Focus on divesting non-core holdings in 2024 |

Question Marks

Diversified Energy's commitment to reducing methane intensity, exemplified by their 2023 goal to lower it to 1.5%, hints at future explorations into early-stage carbon capture and storage (CCS) initiatives. While not a current revenue driver, these technologies represent a nascent but rapidly expanding sector within the energy transition.

For Diversified, CCS would initially fall into the "Question Mark" category of the BCG Matrix. This means it would likely have a low market share in a high-growth market, demanding substantial capital investment to develop and scale. For instance, the global CCS market is projected to reach $60 billion by 2030, indicating significant growth potential but also the substantial investment required to gain traction.

Diversified Energy is strategically eyeing expansion beyond its core Appalachian and Central regions. These new ventures would represent smaller, exploratory entries into basins exhibiting higher growth potential, even though the company's current presence is minimal. This positions these new ventures as classic Question Marks within the BCG matrix, characterized by low market share but significant growth prospects.

For instance, a potential move into the Delaware Basin, known for its robust oil and gas production growth, would fit this profile. While Diversified's current market share there is negligible, the basin's projected 2024 production growth rate of around 10-15% offers a compelling high-growth environment. This aligns perfectly with the 'Question Mark' designation, requiring careful investment decisions to determine if they can become Stars.

Diversified Energy is likely exploring pilot projects in emerging energy technologies, such as advanced geothermal systems or innovative methane capture and utilization. These initiatives represent high-growth potential but currently occupy nascent markets, demanding significant research and capital to establish commercial viability.

In 2024, the global renewable energy sector saw substantial investment, with the International Energy Agency reporting over $500 billion directed towards clean energy technologies. Pilot projects in areas like enhanced geothermal systems (EGS) are crucial for unlocking vast, untapped energy reserves, with some EGS projects aiming for outputs comparable to conventional power plants, albeit at higher initial costs.

For instance, advanced methane utilization technologies, which convert captured methane into higher-value products like hydrogen or methanol, are gaining traction. Companies are investing in pilot plants to demonstrate the economic feasibility of these processes, aiming to reduce greenhouse gas emissions while creating new revenue streams from a previously wasted resource.

Smaller, Recent Bolt-on Acquisitions with Untapped Potential

Beyond major strategic moves like the Maverick acquisition, Diversified Energy Company (DEC) might pursue smaller, recent bolt-on acquisitions. These targets could be in niche markets or geographical areas showing less immediate but substantial long-term growth potential.

These smaller acquisitions often feature assets with low current production relative to their untapped reserves. This necessitates further capital investment in enhanced oil recovery (EOR) techniques or operational optimization to unlock their full economic value and expand DEC's market share.

- Potential for Growth: Assets with low initial production but significant underlying reserves offer a pathway to future expansion.

- Investment Requirement: Realizing the full value of these bolt-ons requires dedicated capital for development and optimization.

- Risk Factor: The success of these smaller acquisitions is inherently uncertain, placing them in a position of higher risk but also potentially higher reward.

- Market Share Expansion: Successfully integrating these assets can incrementally increase DEC's footprint and competitive standing in targeted regions.

Enhanced Oil Recovery (EOR) Pilot Programs

Diversified Energy Company could strategically deploy Enhanced Oil Recovery (EOR) pilot programs on select mature assets. This approach aligns with their core competency of optimizing existing wells, potentially unlocking significant incremental production from fields that have passed their primary recovery phase. For instance, if a field has a typical recovery factor of 30%, EOR could boost this to 50% or more, representing substantial growth for that specific asset.

Implementing EOR pilot programs would position Diversified in a new, albeit niche, market segment within the oil and gas sector, thus representing a low-market-share venture. The company would need to invest in specialized technology and expertise, as EOR methods like CO2 injection or chemical flooding require different operational approaches than conventional extraction. For example, the global EOR market was valued at approximately $30 billion in 2023 and is projected to grow, indicating a viable, albeit competitive, future market.

- Potential for increased recovery factors in mature fields.

- Entry into a new, specialized market segment.

- Requirement for significant upfront investment in technology and expertise.

- Opportunity to leverage existing infrastructure for new production streams.

Diversified Energy's exploration into emerging technologies like carbon capture and storage (CCS) and advanced geothermal systems places them in the Question Mark quadrant of the BCG Matrix. These ventures likely have low current market share but operate within high-growth potential markets, demanding significant capital investment and strategic focus to determine their future viability.

New geographical ventures, such as potential entries into basins like the Delaware Basin, also fit the Question Mark profile. While Diversified's current presence is minimal, these regions exhibit strong projected growth, around 10-15% for the Delaware Basin in 2024. This necessitates careful evaluation to see if these can evolve into Stars.

Pilot projects in advanced methane utilization and smaller bolt-on acquisitions in niche markets also represent Question Marks. These initiatives require substantial investment to prove economic feasibility and unlock untapped reserves, with the potential for significant future returns if successful.

Enhanced Oil Recovery (EOR) pilot programs on mature assets are another example. While leveraging existing infrastructure, EOR requires specialized technology and expertise, positioning it as a low-market-share, high-investment segment with a projected global market value of approximately $30 billion in 2023.

BCG Matrix Data Sources

Our BCG Matrix is built upon a foundation of comprehensive market data, encompassing financial disclosures, industry growth rates, and competitive landscape analysis to provide strategic direction.