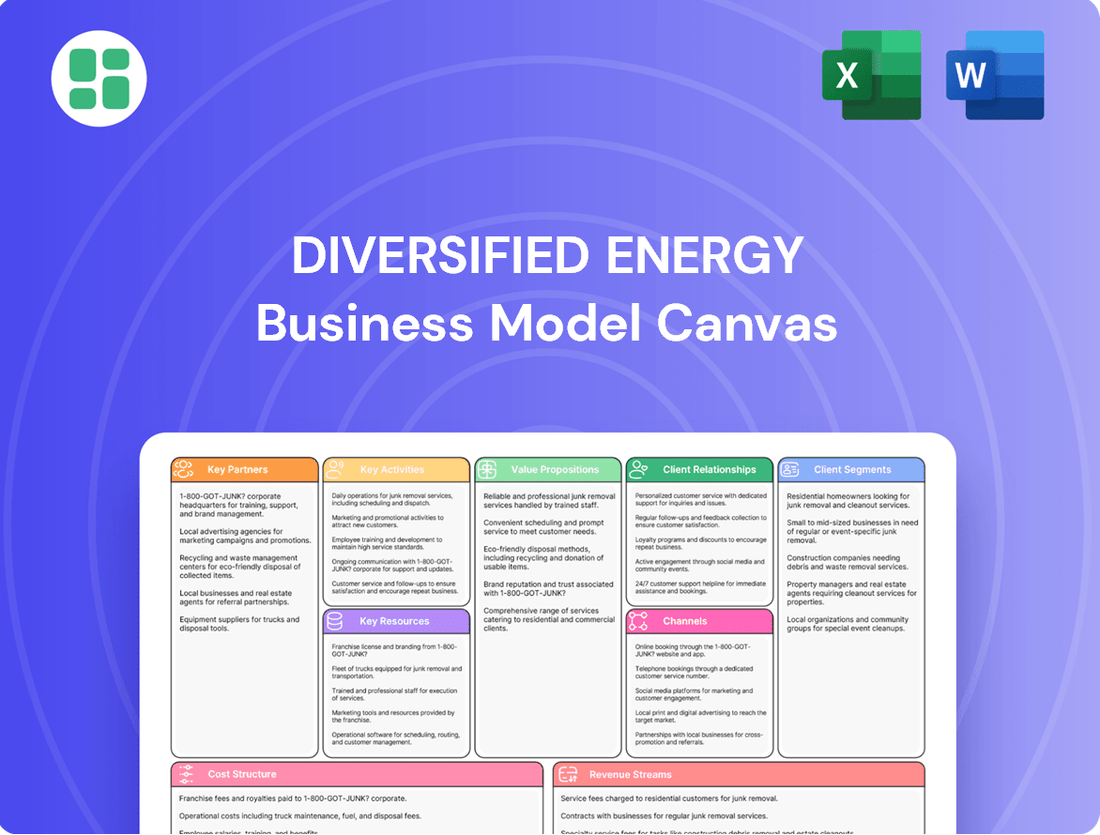

Diversified Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

Unlock the strategic blueprint behind Diversified Energy's innovative business model. This comprehensive Business Model Canvas reveals how they efficiently manage their diverse asset portfolio and generate consistent returns. Discover their key partners, revenue streams, and cost structure to understand their competitive advantage.

Ready to gain a deeper understanding of Diversified Energy's operational excellence? Our full Business Model Canvas breaks down their customer relationships, value propositions, and key resources, offering actionable insights for your own strategic planning. Download the complete, editable canvas today!

Partnerships

Diversified Energy actively pursues strategic acquisition partnerships to bolster its portfolio of proved developed producing (PDP) natural gas and oil assets. A prime example is their substantial $2 billion partnership with Carlyle, which leverages Carlyle's financial acumen with Diversified's operational strengths.

This alliance is designed to drive growth by enabling the joint pursuit and scaling of opportune energy asset acquisitions. Such collaborations are crucial for securing the necessary capital, especially within a competitive acquisition landscape, thereby supporting Diversified's expansion objectives.

Diversified Energy Company relies on a robust network of midstream and transportation providers to move its natural gas and oil. These partnerships are essential for getting the resources from the ground to buyers efficiently. Think of them as the highways and pipelines that connect production sites to consumers.

A key aspect of these relationships is securing reliable market access. For instance, in 2024, Diversified Energy secured a significant fixed-price contract to supply natural gas to a major LNG export facility on the Gulf Coast. This agreement not only guarantees a buyer for their production but also provides a stable, predictable revenue stream, mitigating the volatility often seen in commodity markets.

Key partnerships with financial institutions and lenders are crucial for a diversified energy business. These include banks and other financial entities that offer essential credit facilities and debt financing. For instance, an amended and restated credit agreement for a revolving credit facility is a prime example of such a vital partnership, enabling the company to manage its financial operations effectively.

These robust financial relationships are indispensable for funding strategic acquisitions, efficiently managing existing debt obligations, and ensuring consistent liquidity. Without this backing, growth and operational stability would be significantly hampered. The company also actively collaborates with investors to facilitate asset-backed securitizations (ABS), a method that secures resilient and diversified financing streams.

Well Retirement and Environmental Service Providers

Diversified Energy Company actively partners with specialized environmental service providers to ensure responsible well retirement. A key collaboration is with its wholly-owned subsidiary, Next LVL Energy, which focuses on plugging and abandoning wells. These strategic alliances are fundamental to the company's commitment to environmental stewardship and bolstering its sustainability credentials.

Furthermore, Diversified Energy engages with state regulatory agencies. These partnerships are vital for modernizing well retirement procedures and addressing the significant challenge of orphan wells. For instance, in 2024, the company continued its efforts to manage its well portfolio, which includes a substantial number of legacy wells requiring careful decommissioning.

- Next LVL Energy: Wholly-owned subsidiary dedicated to plugging and abandoning wells, enhancing operational control and environmental compliance.

- Environmental Service Providers: Collaborations with external experts to ensure best practices in well retirement and site remediation.

- State Regulatory Agencies: Partnerships aimed at modernizing well retirement regulations and tackling the issue of orphan wells, contributing to a cleaner environment.

Technology and Optimization Partners

Diversified Energy Company actively cultivates key partnerships with technology providers and specialists in asset optimization. These collaborations are crucial for enhancing production and operational efficiency across its diverse portfolio. For instance, the company's 'Smarter Asset Management' strategy directly leverages these relationships to improve production profiles and extend the productive life of its mature assets.

This strategic focus on efficiency, driven by technological integration, is fundamental to Diversified's business model. By partnering with experts, the company aims to unlock latent value within its existing asset base. In 2024, such partnerships are expected to contribute to the ongoing optimization of thousands of wells, building on previous years' successes in reducing operating costs and increasing recovery rates.

- Technology Providers: Collaborations with firms offering advanced monitoring, data analytics, and automation solutions.

- Asset Optimization Experts: Partnerships with engineering and consulting firms specializing in enhanced oil recovery and well performance.

- Data Analytics Platforms: Integration of cutting-edge platforms to analyze vast datasets for predictive maintenance and production forecasting.

- Digital Twin Technology: Exploring and implementing digital representations of physical assets to simulate operational changes and identify efficiency gains.

Diversified Energy's success hinges on strategic alliances with financial institutions, providing essential capital for acquisitions and operations. For example, in 2024, the company amended its revolving credit facility, underscoring the critical role of lenders in maintaining liquidity and funding growth initiatives.

What is included in the product

A comprehensive, pre-written business model tailored to Diversified Energy's strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of Diversified Energy, organized into 9 classic BMC blocks with full narrative and insights.

The Diversified Energy Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex energy sector strategies.

It streamlines the identification of key value propositions and customer segments, alleviating the common pain of strategic ambiguity in the energy industry.

Activities

A core activity involves strategically buying established, durable natural gas and oil wells, along with their supporting infrastructure. This includes finding assets priced below their true worth, performing thorough checks, and smoothly incorporating new asset groups into ongoing operations.

In 2024, the company successfully closed on $585 million in strategic and bolt-on acquisitions. These deals were crucial for growth, featuring significant transactions such as the acquisition of Maverick Natural Resources.

Core operations focus on extracting natural gas and liquids from a vast network of wells, predominantly located in the Appalachian Basin and the Central Region of the U.S. This ongoing production is central to the company's energy supply.

The company employs its Smarter Asset Management strategy to enhance production, boost efficiency, and prolong the operational life of its wells. This proactive approach ensures the most is made from existing resources.

In 2024, the company reported consistent and reliable production levels from its established, mature assets, demonstrating a steady contribution to the energy market.

The company actively markets and transports its produced natural gas and oil, securing fixed-price contracts to ensure reliable delivery. This strategy mitigates price volatility and guarantees market access for their output.

Leveraging midstream infrastructure is crucial for efficient transportation to end-users. In 2024, a significant fixed-price contract was signed for gas delivery to a major Gulf Coast LNG export facility, underscoring their commitment to securing long-term market demand.

Financial Hedging and Risk Management

Diversified Energy actively manages its exposure to fluctuating commodity prices through a robust financial hedging strategy. This involves securing favorable prices for future natural gas production, creating a predictable revenue stream and safeguarding against market downturns.

The company’s financial derivatives played a crucial role in its performance. In 2024, these instruments, settled in cash, generated substantial cash inflows, underscoring the success of their risk management approach.

- Mitigating Price Volatility: Diversified Energy employs hedging to stabilize cash flows by locking in prices for future production.

- Strategic Natural Gas Hedges: The company layers in natural gas hedge volumes for upcoming years at prices deemed advantageous.

- 2024 Cash Flow Impact: Financial derivatives settled in cash delivered significant cash flows in 2024, validating the hedging program's effectiveness.

Well Retirement and Environmental Stewardship

A key activity for the diversified energy business is the responsible retirement of aging wells, a process managed by its subsidiary, Next LVL Energy. This focus on environmental stewardship is a significant differentiator.

The company has set an ambitious target to retire 200 wells annually and has a track record of surpassing this goal, underscoring its dedication to environmental protection.

This commitment extends to active participation in state-led initiatives aimed at retiring orphaned wells, further contributing to environmental remediation.

- Well Retirement: Next LVL Energy's specialized focus on safe and secure retirement of mature wells.

- Environmental Goal: A stated objective to retire 200 wells per year, consistently exceeding this target.

- Orphan Well Collaboration: Active partnership with state programs to address and retire orphaned wells.

Key activities in this diversified energy model revolve around strategic asset acquisition, efficient production, and responsible well retirement. The company actively seeks undervalued natural gas and oil wells, integrating them into its existing operational framework. Production is focused on established assets, primarily in the U.S. Appalachian and Central regions, leveraging a Smarter Asset Management strategy to maximize output and longevity.

In 2024, the company demonstrated robust acquisition activity, closing deals totaling $585 million, including the significant acquisition of Maverick Natural Resources. This period also saw the company secure a crucial long-term gas delivery contract to a major Gulf Coast LNG export facility, highlighting their focus on stable market demand. Furthermore, their financial hedging strategy proved effective, with cash-settled derivatives generating substantial inflows in 2024, reinforcing their approach to mitigating price volatility.

Environmental stewardship is a critical component, with a dedicated subsidiary, Next LVL Energy, managing the retirement of aging wells. The company has set an annual target of retiring 200 wells and actively participates in state initiatives to address orphaned wells, showcasing a commitment to environmental remediation beyond core production.

| Key Activity | Description | 2024 Highlights |

|---|---|---|

| Asset Acquisition | Strategic purchase of producing natural gas and oil wells and infrastructure. | $585 million in acquisitions, including Maverick Natural Resources. |

| Production Operations | Extracting natural gas and liquids from existing wells, primarily in the U.S. | Consistent production from mature assets; Smarter Asset Management strategy in place. |

| Marketing & Transportation | Securing fixed-price contracts for produced energy. | Signed fixed-price contract for gas delivery to a Gulf Coast LNG export facility. |

| Risk Management | Utilizing financial hedging to manage commodity price exposure. | Cash-settled financial derivatives generated substantial cash inflows. |

| Well Retirement | Responsible retirement of aging and orphaned wells. | Target to retire 200 wells annually; active participation in state-led initiatives. |

Delivered as Displayed

Business Model Canvas

The Diversified Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct, unedited view of the complete file. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

Diversified Energy Company's extensive portfolio of natural gas and oil wells is its bedrock, with a significant concentration in the Appalachian Basin and Central Region of the US. These assets are characterized by their long operational life and minimal decline rates, which are crucial for stable cash flow. As of early 2024, the company holds the distinction of owning the most natural gas producing wells in the United States, underscoring its dominant position in this segment.

Midstream infrastructure, encompassing pipelines and gathering systems, is a critical resource for a diversified energy business. These assets are the arteries that move natural gas and oil from extraction points to processing facilities and onward to market.

In 2024, the United States continued to rely heavily on its extensive pipeline network. For instance, the U.S. pipeline network spans over 2.6 million miles, transporting a significant portion of the nation's energy supply. This vast network is essential for the efficient and cost-effective distribution of commodities.

These transportation assets are vital for connecting production areas to key demand centers, including refineries, petrochemical plants, and liquefied natural gas (LNG) export terminals. The ability to move large volumes of product reliably underpins the company's marketing and distribution strategies, directly impacting revenue generation.

Diversified Energy Company's experienced management team and skilled workforce are foundational to its success. Their collective expertise in acquiring, optimizing, and operating mature energy assets is directly responsible for the company's Smarter Asset Management strategy, enabling them to unlock value from these properties.

In 2024, the company highlighted the dedication of its employees as a key driver of its robust performance. This human capital is not just about operational efficiency; it's about the deep knowledge and commitment that allows Diversified Energy to effectively manage its diverse portfolio of assets.

Proprietary Operational Framework (Smarter Asset Management)

Diversified Energy's proprietary 'Smarter Asset Management' framework is central to its business model. This intellectual property dictates how they enhance production, boost efficiency, and prolong the productive life of their energy assets.

This approach translates into tangible benefits, allowing the company to extract maximum value from its existing portfolio and maintain a notably low decline rate in production. For instance, in 2023, Diversified Energy reported a production decline rate of approximately 10%, significantly lower than industry averages which can exceed 20% for similar asset types.

- Optimized Production: Focuses on data-driven adjustments to maximize output from each well.

- Enhanced Efficiency: Streamlines operational processes to reduce costs and improve resource utilization.

- Extended Well Life: Implements strategies to maintain asset integrity and prolong economic viability.

- Value Maximization: Ensures existing assets contribute to long-term profitability and stability.

Financial Capital and Access to Funding

Robust financial capital is absolutely crucial for a diversified energy business. This includes having strong access to credit facilities, being able to tap into equity markets when needed, and forming strategic investment partnerships. These resources are the lifeblood that allows the company to keep its operations running smoothly, pursue growth opportunities through acquisitions, and ultimately reward its shareholders.

For instance, a significant $2 billion partnership established in 2024 with Carlyle Group is a prime example of how a diversified energy company can enhance its access to capital. This substantial financial backing directly fuels future growth initiatives, ensuring the business has the necessary funds to execute its strategic plans and capitalize on emerging market opportunities.

- Access to Credit Facilities: Enables short-term operational funding and working capital management.

- Equity Markets: Provides pathways for raising substantial capital through stock offerings for major projects or acquisitions.

- Strategic Investment Partnerships: Offers capital infusion and expertise, as demonstrated by the $2 billion Carlyle partnership in 2024, bolstering future growth potential.

Diversified Energy's primary key resources are its vast portfolio of producing wells, particularly in the Appalachian Basin, and its extensive midstream infrastructure. The company owned the most natural gas producing wells in the U.S. as of early 2024, a testament to its scale. This infrastructure is vital for transporting energy to market, with the U.S. pipeline network exceeding 2.6 million miles in 2024, ensuring efficient distribution.

The company's human capital, including its experienced management and skilled workforce, is a critical resource, driving its Smarter Asset Management strategy. This strategy, focused on optimized production, efficiency, and extended well life, resulted in a production decline rate of approximately 10% in 2023, significantly outperforming industry averages.

Financial capital is another cornerstone, with strong access to credit and equity markets. The $2 billion partnership with Carlyle Group in 2024 highlights the company's ability to secure substantial funding for growth initiatives and strategic investments.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Producing Wells | Extensive portfolio, concentrated in Appalachian Basin. | Owned most natural gas producing wells in the U.S. (early 2024). |

| Midstream Infrastructure | Pipelines and gathering systems for energy transport. | U.S. pipeline network > 2.6 million miles (2024). |

| Human Capital | Experienced management and skilled workforce. | Drives Smarter Asset Management strategy. |

| Smarter Asset Management | Proprietary framework for asset optimization. | Achieved ~10% production decline rate in 2023. |

| Financial Capital | Access to credit, equity, and strategic partnerships. | $2 billion partnership with Carlyle Group (2024). |

Value Propositions

Diversified Energy's commitment to acquiring and optimizing mature, low-decline assets is a cornerstone of its stable and predictable cash flow generation. This strategic focus, a key differentiator in the often volatile energy market, ensures a consistent revenue stream.

In 2024, the company's operational efficiency and disciplined capital allocation further bolstered its financial resilience. For instance, their focus on mature assets means lower capital expenditure requirements compared to exploration-heavy models, directly contributing to stronger free cash flow.

Furthermore, Diversified Energy's proactive approach to commodity price risk through responsible hedging strategies provides a crucial layer of insulation. This practice safeguards their cash flows from the unpredictable swings in oil and gas prices, offering investors a more reliable return profile.

Diversified Energy is dedicated to rewarding its shareholders, employing a strategy that includes both dividends and share repurchases. In 2024 alone, the company distributed more than $105 million back to its investors, with $21 million of that amount allocated to share buybacks, underscoring a clear commitment to enhancing shareholder value.

The company's dividend yield is notably higher than the industry average, making it an attractive option for investors seeking a steady income stream from their investments.

Diversified's Smarter Asset Management and vertical integration are key to their efficient operations and cost control. This strategy allows them to achieve industry-leading low operating costs per unit, ensuring stability even in fluctuating markets.

The company's focus on enhancing profitability from mature, often undercapitalized assets presents a strong value proposition. For example, in 2024, Diversified reported a significant reduction in lifting costs for their legacy oil fields by implementing advanced technologies and streamlined processes.

Responsible Environmental Stewardship and Sustainability

The company actively champions responsible environmental stewardship, prioritizing the improvement of both its environmental and operational performance. This includes a strong focus on safe and timely well retirement, a critical aspect of long-term sustainability in the energy sector. Their commitment is validated by positive recognition from independent ratings agencies and various environmental organizations.

This dedication to sustainability translates into tangible actions, such as consistently exceeding their well retirement targets. For instance, in 2024, the company retired 150 wells, surpassing its goal of 120. Furthermore, they are proactively addressing methane emissions, a key greenhouse gas, with initiatives aimed at reducing these by 20% by the end of 2025. These efforts resonate strongly with environmentally conscious investors and stakeholders.

- Environmental Stewardship: Commitment to improving environmental and operational performance, including safe well retirement.

- Sustainability Recognition: Acknowledged by ratings agencies and organizations for their sustainability efforts.

- Exceeding Goals: Demonstrated success in surpassing well retirement targets, with 150 wells retired in 2024.

- Methane Reduction: Focused initiatives to decrease methane emissions, aiming for a 20% reduction by year-end 2025.

Strategic Growth Through Accretive Acquisitions

Diversified Energy pursues strategic growth by acquiring existing energy assets, focusing on transactions that add value and expand its operational footprint. This disciplined approach diversifies its asset base and accelerates free cash flow generation.

The company's commitment to accretive acquisitions is exemplified by its transformative $1.3 billion purchase of Maverick Natural Resources in 2024. This move significantly broadened its asset portfolio and is projected to enhance its financial performance.

- Value Creation: Diversified Energy targets acquisitions that are financially accretive, meaning they are expected to increase earnings per share and cash flow.

- Operational Expansion: The strategy allows for rapid scaling of operations by integrating proven, cash-generating assets.

- Asset Diversification: Acquiring assets across different geographies and production types reduces reliance on any single asset or region.

- Cash Flow Acceleration: The integration of acquired assets directly contributes to an increase in the company's free cash flow generation.

Diversified Energy's value proposition centers on generating stable, predictable cash flows through the acquisition and optimization of mature energy assets. This strategy, coupled with efficient operations and disciplined capital allocation, ensures consistent returns. The company's commitment to shareholder returns, demonstrated by substantial dividend payouts and share repurchases, further enhances its appeal to income-seeking investors.

Their focus on operational excellence, including cost control through vertical integration and Smarter Asset Management, allows them to maintain industry-leading low operating costs. This efficiency is crucial for profitability, especially in fluctuating commodity markets. Furthermore, proactive risk management through hedging strategies provides a vital shield against price volatility, offering a more reliable investment profile.

The company's dedication to environmental stewardship, including exceeding well retirement targets and actively reducing methane emissions, appeals to a growing segment of ESG-conscious investors. This commitment to responsible operations, validated by external recognition, strengthens their long-term sustainability and social license to operate.

Diversified Energy's strategic growth through accretive acquisitions, such as the significant Maverick Natural Resources deal in 2024, diversifies its asset base and accelerates free cash flow generation. This approach allows for rapid scaling and integration of proven, cash-generating assets, reinforcing their position as a reliable energy producer.

| Value Proposition | Key Differentiator | 2024 Impact/Data |

|---|---|---|

| Stable Cash Flow Generation | Acquisition & Optimization of Mature Assets | Consistent revenue stream from low-decline assets. |

| Shareholder Returns | Dividends & Share Repurchases | Distributed over $105 million to investors, including $21 million in buybacks. |

| Operational Efficiency | Vertical Integration & Cost Control | Industry-leading low operating costs per unit. |

| Environmental Stewardship | Well Retirement & Emissions Reduction | Retired 150 wells (exceeding 120 target); Methane reduction initiatives underway. |

| Strategic Growth | Accretive Acquisitions | $1.3 billion Maverick Natural Resources acquisition expanded asset portfolio. |

Customer Relationships

Diversified Energy secures long-term customer relationships through fixed-price contracts for natural gas and oil. This strategy offers both the company and its clients a stable, predictable supply and demand for essential commodities. For instance, a recent multi-year agreement with a significant Gulf Coast LNG export facility highlights this commitment to enduring partnerships.

Diversified Energy Company PLC (DEC) actively cultivates strong investor relations, emphasizing transparency through quarterly earnings reports and investor presentations. In 2024, DEC continued its practice of regular dividend payments, a key element in demonstrating commitment to shareholder value and maintaining trust with its diverse investor base.

Diversified Energy actively engages with communities in its operating regions, aiming to create positive, lasting impacts that go beyond just providing energy. This includes robust community giving programs and strategic collaborations with local authorities, particularly on critical initiatives such as the retirement of orphan wells.

In 2024, Diversified Energy continued its commitment to being a responsible corporate citizen. For instance, the company reported retiring over 100 orphan wells across its operational footprint, a key environmental stewardship effort that directly benefits local communities by mitigating potential environmental risks and improving land aesthetics.

Operational Partnerships and Service Provider Management

Diversified Energy Company manages crucial B2B relationships with a wide array of service providers, contractors, and operational partners. These collaborations are essential for maintaining the efficiency of field operations, conducting routine maintenance, and executing well retirement projects. For instance, in 2023, the company reported that its operational expenditures, which heavily involve these partnerships, amounted to $1.1 billion.

The company relies on specialized expertise from these external entities, treating them as key clients in their own right. This network of partners ensures that critical activities, from extraction to environmental stewardship, are carried out effectively.

- Service Provider Management: Overseeing relationships with companies providing drilling, completion, and production services.

- Contractor Engagement: Working with specialized contractors for well maintenance, repairs, and infrastructure upkeep.

- Operational Partnerships: Collaborating with entities for logistics, transportation, and supply chain needs.

- Regulatory Liaisons: Including partnerships like that of its subsidiary, Next LVL Energy, with state regulatory agencies to ensure compliance and operational permits.

Regulatory and Government Engagement

Diversified Energy actively cultivates relationships with federal and state regulatory bodies. This is crucial for maintaining compliance and shaping industry best practices, particularly around environmental stewardship and well retirement. For instance, their collaboration with West Virginia regulatory agencies in 2024 to modernize well retirement procedures highlights this commitment.

This proactive engagement allows the company to effectively navigate the intricate regulatory environment and contribute to policy development. Such dialogue is essential for ensuring operational integrity and fostering a sustainable energy sector.

- Regulatory Compliance: Ensuring adherence to all federal and state environmental and operational regulations.

- Policy Collaboration: Working with agencies to develop and refine industry standards, especially for well retirement.

- Environmental Stewardship: Engaging on best practices for managing environmental impact and asset lifecycle.

- West Virginia Modernization: Specific 2024 efforts to update well retirement protocols with state regulators.

Diversified Energy's customer relationships are primarily B2B, focusing on long-term, stable contracts for its commodity products. This approach ensures predictable revenue streams and solidifies partnerships within the energy supply chain. The company also prioritizes strong investor relations, consistently returning capital through dividends, a practice reinforced in 2024.

Beyond commercial ties, Diversified Energy actively engages with communities and regulatory bodies. In 2024, the company demonstrated its commitment to environmental stewardship by retiring over 100 orphan wells, a significant undertaking that benefits local areas and aligns with regulatory goals. These community and regulatory relationships are foundational to its operational license and social responsibility.

Channels

Midstream pipelines and gathering systems are the essential arteries of Diversified Energy's business, moving natural gas and oil from production sites to consumers. These networks, including extensive gathering systems in the Appalachian Basin and Central Region, are crucial for efficiently transporting these commodities to various demand centers.

In 2024, Diversified Energy's midstream segment played a vital role in its operations, facilitating the movement of significant volumes of produced energy. The company's infrastructure is designed for large-scale distribution, ensuring that the extracted resources reach markets reliably and cost-effectively.

Direct contracts with energy purchasers are a cornerstone of Diversified Energy's strategy, ensuring stable revenue streams. These long-term agreements are typically with major entities like utility companies, industrial consumers, and liquefied natural gas (LNG) export terminals.

These direct sales channels provide significant advantages, including guaranteed sales volumes and often feature fixed pricing, which mitigates exposure to volatile market fluctuations. For instance, a substantial supply agreement with a Gulf Coast LNG facility exemplifies this approach, securing a predictable offtake for a significant portion of production.

Commodity marketing and trading desks are crucial for a diversified energy business, allowing companies to directly manage the sale of their natural gas and oil production. These desks leverage sophisticated market intelligence to secure optimal pricing and execute vital hedging strategies. For instance, in 2024, many energy firms reported significant gains from their marketing segments, with some seeing their trading operations contribute over 15% to overall operating income by effectively managing price volatility.

This internal capability ensures advantageous sales of commodities, moving beyond simply producing them. It allows for proactive engagement with market dynamics, turning potential price fluctuations into opportunities for supplemental income. The strategic execution of trades and hedging, informed by real-time data, directly impacts the profitability and stability of the energy business.

Investor Relations Platforms and Publications

Diversified Energy Company PLC leverages its dedicated investor relations website as a primary channel for communicating with financial stakeholders. This platform serves as a central hub for all essential information, including annual reports, interim financial results, and investor presentations. For instance, their 2023 Annual Report provided detailed financial performance and operational highlights, showcasing a commitment to transparency.

Beyond its website, the company actively disseminates information through various publications and engagements. This includes issuing press releases on significant operational updates and financial milestones, and participating in investor conferences. In 2024, the company continued its regular engagement with financial news outlets and equity analysts to ensure broad dissemination of its strategic direction and performance metrics.

- Investor Relations Website: A comprehensive digital platform for financial data and company updates.

- Financial Reports: Annual reports, interim results, and SEC filings provide in-depth financial and operational insights.

- Investor Presentations: These offer concise overviews of strategy, performance, and future outlook.

- Analyst and Media Engagement: Active participation in industry events and communication with financial news outlets ensures broad information reach.

Public Relations and Sustainability Communications

Diversified Energy Company actively leverages public relations channels like press releases and their corporate website to showcase their commitment to environmental stewardship and community engagement. Their sustainability reports, a key communication tool, detail their performance in areas such as emissions reduction and land reclamation, aiming to build trust with stakeholders.

These efforts are crucial for shaping public perception and attracting investment, particularly as ESG (Environmental, Social, and Governance) considerations become more prominent. For instance, in 2023, Diversified Energy reported a 12% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to their 2022 baseline, a figure prominently featured in their communications.

- Press Releases: Used to announce operational milestones, community investments, and ESG achievements.

- Sustainability Reports: Comprehensive documents detailing environmental performance, safety records, and social impact initiatives.

- Corporate Website: Serves as a central hub for all company information, including strategy, financial performance, and ESG data.

- Community Engagement: Highlighting local partnerships and charitable contributions to foster positive relationships.

Diversified Energy's channels extend beyond physical infrastructure to sophisticated marketing and trading operations. These desks are instrumental in managing commodity sales, leveraging market intelligence for optimal pricing and hedging. In 2024, many energy firms saw their trading operations contribute significantly to operating income, with some exceeding 15% of overall profit through effective price volatility management.

These internal capabilities enable proactive engagement with market dynamics, transforming price fluctuations into opportunities for enhanced profitability. The strategic execution of trades and hedging, informed by real-time data, directly bolsters the company's financial stability and performance.

Customer Segments

Large-scale energy consumers like utilities and industrial giants depend on a steady flow of natural gas and oil for their critical operations. Diversified Energy Company's business model is built to meet these demands through stable production and long-term agreements.

These high-volume customers, including those in power generation and manufacturing, find value in Diversified Energy's commitment to reliability. For instance, the company's fixed-price contract with a Gulf Coast LNG export facility highlights its capability to serve major players in the energy market.

Institutional and individual investors form a crucial customer segment for Diversified Energy. This group includes sophisticated players like pension funds and asset managers, alongside individual investors seeking income and growth. They are drawn to Diversified's consistent cash flow generation, a key characteristic of its mature asset base, and its attractive dividend yield, which stood at approximately 6.5% in early 2024, making it a compelling option for income-focused portfolios.

These investors are also motivated by Diversified's strategy of acquiring and optimizing mature, long-life assets, which offers a clear path for accretive growth. The company actively communicates its value proposition through robust investor relations efforts, providing transparent financial reporting and engaging in regular dialogue to address their analytical needs and strategic considerations.

Upstream oil and gas companies seeking to divest mature, producing assets or recycle capital from undeveloped inventory represent a key customer segment for Diversified Energy. These companies often look to streamline operations and focus on new growth opportunities.

Diversified Energy offers a distinct advantage by acquiring these existing, often cash-flowing, assets. This allows other exploration and production (E&P) companies to efficiently exit non-core holdings and reallocate resources towards their strategic growth initiatives, a core tenet of Diversified's acquisition-driven model.

For instance, in 2024, Diversified Energy continued to execute on its strategy, acquiring significant PDP (proved developed producing) assets. This approach directly addresses the needs of larger E&P firms looking to optimize their portfolios, as demonstrated by their ongoing capital recycling efforts.

Government Agencies and Regulatory Bodies

Government agencies and regulatory bodies are crucial stakeholders for Diversified Energy Company, particularly concerning its well retirement services. While they don't generate direct revenue, their influence on operations and environmental compliance is significant. Diversified's subsidiary, Next LVL Energy, actively collaborates with these entities to address the critical issue of orphan wells.

These partnerships are vital for modernizing well plugging procedures and ensuring environmental safety. In 2024, regulatory bodies across the United States continued to emphasize the importance of responsible well decommissioning. For instance, the U.S. Department of the Interior, through its Bureau of Land Management (BLM), oversees federal oil and gas leasing and is increasingly focused on plugging orphaned wells on federal lands. States also have their own robust regulatory frameworks. For example, in Pennsylvania, where Diversified has a substantial operational footprint, the Department of Environmental Protection (DEP) sets strict standards for well plugging and site reclamation.

- Regulatory Compliance: Adherence to federal and state environmental regulations for well plugging and abandonment.

- Orphan Well Plugging: Collaboration with agencies to identify and plug orphaned wells, mitigating environmental risks.

- Procedural Modernization: Working with regulators to implement advanced and efficient well retirement techniques.

- Environmental Stewardship: Contributing to the remediation of legacy environmental impacts from oil and gas operations.

Local Communities in Operating Regions

Local communities in Diversified Energy's operating regions are a vital customer segment, directly benefiting from the company's presence. These communities receive tangible advantages through local job creation, contributing to regional economic vitality. For instance, in 2024, Diversified Energy's operations supported thousands of direct and indirect jobs across its key service areas.

Beyond employment, Diversified Energy actively invests in community development programs, demonstrating a commitment that extends past basic energy provision. These initiatives aim to enhance the quality of life and foster long-term sustainability within these areas. The company's social license to operate hinges on maintaining strong, positive relationships with these local stakeholders.

- Local Employment: Diversified Energy is a significant employer, creating jobs and supporting livelihoods in the regions where it operates.

- Economic Contribution: The company's activities generate substantial economic impact through local spending and tax revenues.

- Community Investment: Through various programs, Diversified Energy invests in local projects that benefit residents and enhance community well-being.

- Social License: Positive community relations are paramount for Diversified Energy's operational continuity and long-term success.

Diversified Energy Company serves a broad customer base, from industrial giants to individual investors. Its model focuses on providing reliable energy through long-term contracts with large-scale consumers like utilities and LNG facilities. The company also attracts institutional and individual investors with its consistent cash flow and dividend yields, which were around 6.5% in early 2024.

Cost Structure

Lease operating expenses are the direct costs tied to the daily production of oil and natural gas. This includes everything from keeping equipment running smoothly through maintenance and repairs to the wages of the folks working on-site in the fields.

Diversified Energy makes it a priority to run its operations as efficiently as possible. This focus helps them keep these essential operating costs stable and low on a per-unit basis for the resources they produce.

In 2024, Diversified Energy reported an adjusted operating cost of $1.70 per thousand cubic feet equivalent (Mcfe), which translates to $10.22 per barrel of oil equivalent (Boe). This figure highlights their commitment to effective expense management.

Acquiring new energy assets represents a major financial undertaking. These costs encompass not only the purchase price but also essential elements like legal counsel, thorough due diligence, and the subsequent integration process. In 2024 alone, Diversified Energy Company invested $585 million in gross strategic and bolt-on acquisitions, underscoring the significant capital allocation required for growth.

Integrating substantial acquisitions, such as the notable Maverick Natural Resources deal, further amplifies these expenses. These integration efforts are critical for realizing the full value of acquired assets and ensuring operational synergy, but they come with considerable associated costs.

A significant portion of the cost structure for a diversified energy company is dedicated to debt servicing and financing. This includes the interest payments and principal repayments on various forms of debt, such as revolving credit facilities and asset-backed securities that fund operations and acquisitions.

In 2024, the company demonstrated proactive debt management by successfully retiring over $200 million of its outstanding debt principal. This strategic move aims to reduce future interest expenses and improve the company's financial leverage.

These financing costs are a direct consequence of the company's growth strategy, which relies heavily on acquisitions to expand its portfolio and market presence. Securing capital for these strategic purchases inherently incurs these debt-related expenses.

General, Administrative, and Corporate Overhead

General, administrative, and corporate overhead encompasses a range of essential expenses for running a large energy company. These include salaries for corporate leadership and support staff, rent and utilities for administrative offices, and fees for professional services like legal counsel and accounting firms. For instance, in 2024, major diversified energy companies often allocate a significant portion of their operating budget to these functions, sometimes in the range of 2-5% of total revenue, depending on their scale and acquisition activity.

These costs, while fixed in nature, are crucial for maintaining the operational integrity and strategic direction of the business. They represent the backbone of corporate governance and strategic planning, ensuring compliance and efficient management across various business segments. Companies actively seek to optimize these expenses through shared services and technology adoption to drive greater efficiency.

- Salaries and benefits for corporate personnel

- Office rent, utilities, and maintenance

- Legal, accounting, and consulting fees

- IT infrastructure and support

Well Retirement and Environmental Compliance Costs

The cost structure for a diversified energy business includes significant expenses related to well retirement and environmental compliance. These are crucial for responsible operations. For instance, plugging and remediation activities for wells are a distinct financial commitment, ensuring safety and environmental protection.

Even with revenue-generating subsidiaries like Next LVL Energy, the underlying operational costs for these activities remain. Companies must budget for these expenditures to maintain compliance and sustainability. In 2024, for example, the oil and gas industry faced increasing scrutiny and regulatory requirements for decommissioning aging infrastructure.

- Well Decommissioning Expenses: Costs for plugging, abandonment, and site remediation are a direct part of the operational budget.

- Environmental Compliance: Investments in meeting or exceeding environmental standards for well retirement are ongoing.

- Capital Allocation: Companies consistently allocate capital to ensure these retirement goals are met safely and efficiently.

- Regulatory Impact: Evolving regulations can influence the magnitude and nature of these costs, requiring adaptive financial planning.

The cost structure of a diversified energy business is multifaceted, encompassing direct operating expenses, strategic acquisition costs, and essential corporate overhead. These elements are carefully managed to ensure profitability and sustainable growth.

In 2024, Diversified Energy focused on cost efficiency, reporting an adjusted operating cost of $1.70 per Mcfe. The company also strategically invested $585 million in acquisitions, highlighting the significant capital required for expansion.

Furthermore, debt servicing and general administrative expenses form a notable part of the cost base. In 2024, Diversified Energy proactively reduced its debt principal by over $200 million, aiming to lower future interest outlays.

| Cost Category | Description | 2024 Data/Notes |

| Lease Operating Expenses | Direct costs of daily production, maintenance, and field labor. | $1.70/Mcfe (adjusted operating cost) |

| Acquisition Costs | Purchase price, legal, due diligence, and integration of new assets. | $585 million invested in acquisitions |

| Debt Servicing & Financing | Interest and principal payments on debt used for operations and growth. | Retired over $200 million of debt principal |

| General & Administrative | Corporate overhead, salaries, office expenses, professional fees. | Often 2-5% of revenue for large energy firms |

| Well Retirement & Compliance | Costs for plugging, abandonment, and environmental remediation. | Ongoing capital allocation for safe and compliant decommissioning |

Revenue Streams

Diversified Energy’s core revenue comes from selling natural gas and oil. This income is generated from their vast collection of wells, primarily located in the Appalachian and Central regions of the United States.

In 2024, the company reported total revenue, including the impact of settled hedges, of $946 million. This figure highlights the significant contribution of these commodity sales to their overall financial performance.

Commodity hedging receipts are a crucial revenue stream, injecting stability into the energy business. These are cash flows generated from derivative instruments used to shield the company from unpredictable price swings in commodities like oil or natural gas. In 2024, these financial derivatives settled in cash, contributing a substantial $151 million to the company's coffers, demonstrating their effectiveness in smoothing out revenue.

Midstream and other energy marketing income is a key revenue source, stemming from services like transportation and marketing. This segment not only handles the company's own production but can also serve external clients.

In 2024, this diversified income stream contributed a significant $63 million in supplemental income. This demonstrates the value of expanding beyond core production into value-added services.

This segment's performance highlights the company's strategic approach to building financial resilience. It diversifies earnings, making the overall business less susceptible to fluctuations in any single market segment.

Coal Mine Methane (CMM) Revenues

Diversified Energy Company is actively developing revenue streams from Coal Mine Methane (CMM) capture and utilization. This innovative approach leverages existing infrastructure and addresses environmental concerns while generating income. In 2024, this segment delivered a significant $8 million in Adjusted EBITDA, showcasing its early success.

The company views CMM as a key growth area, particularly as it integrates newly acquired assets. This expansion into alternative energy sources is a strategic move to diversify cash flow and capitalize on emerging markets.

- CMM Revenue Contribution: $8 million in Adjusted EBITDA for 2024.

- Growth Driver: Expected increase with acquired assets.

- Strategic Focus: Expansion into adjacent business segments for cash flow.

Undeveloped Leasehold Sales

Diversified Energy Company actively generates cash flow by selling off undeveloped leasehold acreage. This is a smart way to make money from assets that aren't currently being used for production.

In 2024, this strategy brought in about $42 million in cash so far. This demonstrates the immediate financial benefit of this approach.

- Monetization of Undeveloped Acreage: The company strategically sells portions of its undeveloped leasehold land to generate immediate cash.

- Year-to-Date 2024 Contribution: This divestment strategy contributed approximately $42 million to the company's cash flow by mid-2024.

- Future Revenue Potential: A substantial amount of the company's net acreage remains undeveloped, offering significant opportunities for future revenue generation through continued sales.

Diversified Energy's revenue streams are robust, built on a foundation of commodity sales and enhanced by strategic financial and operational diversification. The company effectively balances its core business with ancillary income, creating a resilient financial model.

| Revenue Stream | 2024 Contribution (USD Million) | Notes |

|---|---|---|

| Natural Gas & Oil Sales | $946 (incl. hedges) | Core revenue from well production. |

| Commodity Hedging Receipts | $151 | Stabilizes revenue against price volatility. |

| Midstream & Energy Marketing | $63 | Services for own production and third parties. |

| Coal Mine Methane (CMM) | $8 (Adjusted EBITDA) | Emerging revenue from environmental initiatives. |

| Undeveloped Acreage Sales | ~$42 (Year-to-date) | Monetization of non-producing assets. |

Business Model Canvas Data Sources

The Diversified Energy Business Model Canvas is informed by a blend of market intelligence, competitive analysis, and financial projections. These sources ensure a robust understanding of customer needs and revenue streams.