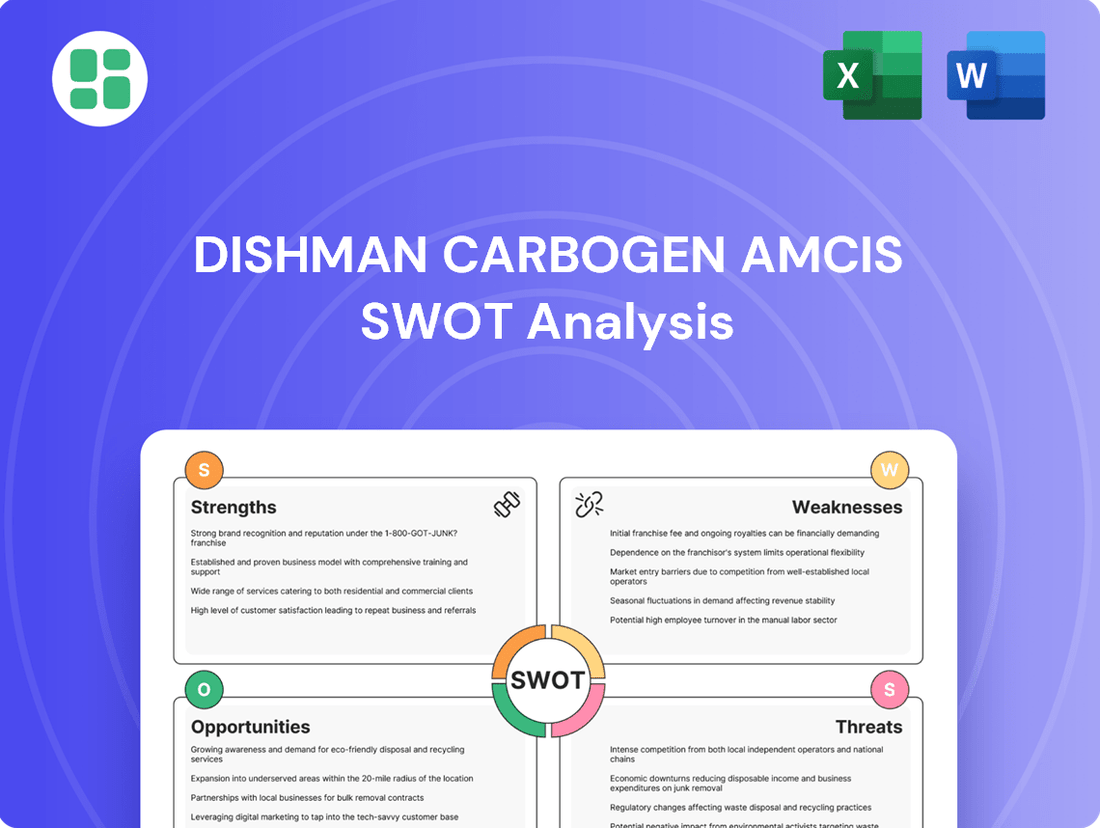

Dishman Carbogen Amcis SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dishman Carbogen Amcis Bundle

Dishman Carbogen Amcis boasts strong R&D capabilities and a diversified service portfolio, positioning it well in the pharmaceutical contract manufacturing sector. However, it faces challenges from intense competition and potential regulatory hurdles.

Want the full story behind Dishman Carbogen Amcis’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dishman Carbogen Amcis Limited (DCAL) boasts a robust global integrated CDMO service model, with facilities strategically located across India, Switzerland, the UK, France, the Netherlands, and China. This expansive network facilitates a seamless, end-to-end offering for pharmaceutical clients, covering the entire lifecycle from early-stage R&D to commercial manufacturing of APIs and drug products.

The company's integrated approach allows it to manage complex projects efficiently across diverse geographical regions, catering to a wide spectrum of client requirements. For instance, in fiscal year 2023-24, DCAL's revenue from its CDMO segment demonstrated continued growth, reflecting the strong demand for its comprehensive development and manufacturing solutions.

Dishman Carbogen Amcis, through its subsidiary Dishman Carbogen Amcis Limited (DCAL), exhibits exceptional strength in regulatory compliance and quality assurance, a vital asset in the pharmaceutical sector. The company’s Naroda facility received a clean report from the USFDA in June 2025, with no observations noted. This follows a similar successful inspection of its Bavla facility by the USFDA in March 2024.

Further underscoring its commitment to global standards, DCAL has obtained approvals from significant regulatory bodies including Japan's PMDA and the EDQM. These consistent affirmations from international authorities solidify DCAL's reputation as a reliable partner for pharmaceutical companies worldwide, directly contributing to its competitive advantage.

Dishman Carbogen Amcis boasts deep technical know-how in intricate chemical reactions and the production of high-potency active pharmaceutical ingredients (HiPo APIs). These are vital for cutting-edge treatments, especially in oncology.

Their Bavla facility in India stands out as Asia's largest HiPo API manufacturing site, giving them a substantial edge over competitors.

This specialized skill set positions DCAL to cater to a specialized, high-value segment of the pharmaceutical industry, drawing in clients with complex and demanding manufacturing needs.

Strategic Capacity Expansion and Customer Co-investments

Dishman Carbogen Amcis is demonstrating a robust strategic capacity expansion, notably with the recent opening of a new sterile liquid drug product manufacturing facility in France. This investment is directly aimed at meeting escalating market demand and broadening its service capabilities.

Further solidifying its growth trajectory, the company is engaging in strategic co-investments with key clients. A prime example is the CHF 25 million partnership with a Japanese customer to boost Antibody-Drug Conjugate (ADC) drug linker production in Switzerland. These collaborations not only augment manufacturing capacity but also foster deeper client alliances and secure future revenue by catering to precise market requirements.

- Manufacturing Infrastructure: Actively investing in expanding facilities to meet growing market demand.

- New Facility: Opened a state-of-the-art sterile liquid drug product manufacturing facility in France.

- Customer Co-investments: CHF 25 million partnership with a Japanese client for ADC drug linker production in Switzerland.

- Strategic Alignment: Expansions deepen client relationships and secure future revenue by meeting specific market needs.

Diversified Revenue Streams and Stable Credit Rating

Dishman Carbogen Amcis (DCAL) benefits significantly from its diversified revenue streams. The company’s core Contract Research and Manufacturing Services (CRAMS) segment is complemented by contributions from Vitamin-D, Bulk Drugs, Quats, and Specialty Chemicals, reducing dependence on any single market or product.

This strategic diversification bolsters the company's resilience against market fluctuations. For instance, in the fiscal year ending March 2025, the CRAMS segment continued to be the primary revenue driver, while the specialty chemicals division showed consistent growth, contributing to overall stability.

Further solidifying its financial health, DCAL maintained an IND A+/Stable credit rating from India Ratings in March and April 2025. This rating signifies a strong capacity to meet its financial obligations, indicating a low credit risk profile for investors and lenders.

- Diversified Revenue: CRAMS, Vitamin-D, Bulk Drugs, Quats, Specialty Chemicals.

- Risk Mitigation: Reduced reliance on single products or markets.

- Credit Rating: IND A+/Stable from India Ratings (March/April 2025).

- Financial Stability: Adequacy in servicing financial obligations, low credit risk.

Dishman Carbogen Amcis (DCAL) possesses a strong global integrated Contract Development and Manufacturing Organization (CDMO) service model, supported by facilities across India, Switzerland, the UK, France, the Netherlands, and China. This extensive network enables seamless, end-to-end solutions for pharmaceutical clients, covering the entire drug lifecycle from early-stage research to commercial API and drug product manufacturing.

The company's expertise in complex chemical reactions and high-potency API (HiPo API) production, particularly for oncology treatments, is a significant strength. Its Bavla facility in India is notably Asia's largest HiPo API manufacturing site, providing a distinct competitive advantage.

DCAL demonstrates robust strategic capacity expansion, including a new sterile liquid drug product facility in France and a CHF 25 million co-investment with a Japanese client for Antibody-Drug Conjugate (ADC) drug linker production in Switzerland. These moves enhance manufacturing capabilities and foster deeper client relationships.

The company also benefits from diversified revenue streams, including CRAMS, Vitamin-D, Bulk Drugs, Quats, and Specialty Chemicals, which mitigates market risk. Financial stability is further supported by a strong credit rating, such as IND A+/Stable from India Ratings in March/April 2025.

| Strength Area | Key Aspect | Supporting Fact/Data |

|---|---|---|

| Global Integrated CDMO Model | End-to-end services | Facilities in India, Switzerland, UK, France, Netherlands, China |

| Technical Expertise | HiPo API & Complex Chemistry | Bavla facility: Asia's largest HiPo API site |

| Strategic Expansion | Capacity & Client Partnerships | New France facility; CHF 25M ADC linker co-investment (Switzerland) |

| Revenue Diversification | Multiple Business Segments | CRAMS, Vitamin-D, Bulk Drugs, Quats, Specialty Chemicals |

| Financial Health | Creditworthiness | IND A+/Stable rating (India Ratings, March/April 2025) |

What is included in the product

This SWOT analysis provides a comprehensive examination of Dishman Carbogen Amcis's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Dishman Carbogen Amcis's strategic challenges and leverage its competitive advantages.

Weaknesses

Dishman Carbogen Amcis has struggled with consistent profitability, reporting consolidated net losses in both Q4 FY24 and Q1 FY25. This trend highlights difficulties in translating revenue into sustained profits, suggesting potential issues with cost management or market conditions.

The company’s financial performance for the full FY24 underscored these challenges, with a significant consolidated net loss of ₹153 crore reported, marking an increase from the prior fiscal year. This pattern of losses indicates underlying pressures that hinder the company's ability to achieve consistent net earnings.

Dishman Carbogen Amcis has faced headwinds from rising interest expenses, with a significant quarter-on-quarter increase observed in December 2024. This surge in borrowing costs directly impacts profitability and cash flow available for other strategic initiatives.

The company’s financial structure shows a growing reliance on debt, evidenced by the deterioration of its consolidated adjusted net leverage in FY24. Furthermore, the debt-to-equity ratio has steadily climbed over the last three years, reaching 0.4x by September 2024.

While these leverage metrics remain within manageable levels, the upward trend indicates a potential constraint on financial flexibility. This could present challenges in efficiently managing its debt obligations and securing favorable terms for future financing, potentially hindering strategic growth opportunities.

Dishman Carbogen Amcis has seen its operating profit margins shrink, reaching 9.9% in FY24 compared to 11.8% in FY23. This decline is further underscored by a 9.2% year-on-year drop in operating profit for FY24. Such a trend suggests that the company might be facing challenges such as rising operational expenses, intense market competition, or a strategic shift towards products that generate lower profits.

The situation appears to be ongoing, as Q1 FY25 also reported a negative operating profit. This persistent pressure on core operational profitability is a significant weakness, potentially impacting the company's ability to reinvest in growth or maintain its financial health.

Challenges in Specific Business Segments

While the Contract Research and Manufacturing Services (CRAMS) segment was a growth driver, certain business areas within Dishman Carbogen Amcis experienced notable challenges. The Marketable Molecules segment saw its revenue dip, primarily attributed to reduced sales of quaternary compounds and generic products. This indicates a specific market contraction affecting these particular product lines.

Further compounding these issues, the CRAMS DCAL India business, historically a high-margin contributor, also reported a year-on-year revenue decline. This suggests that the difficulties were not uniform across all CRAMS operations but rather concentrated in specific geographical or operational segments.

- Marketable Molecules Decline: Revenue decreased due to lower sales of quaternary compounds and generics.

- CRAMS DCAL India Performance: This segment, known for high margins, experienced a year-on-year revenue drop.

- Segment-Specific Headwinds: The company faced localized or segment-specific performance issues impacting overall results.

High Capital Expenditure Requirements

Dishman Carbogen Amcis has committed significant capital to expanding its manufacturing capacity, with substantial investments in facility upgrades and new projects. For instance, in fiscal year 2024, the company reported capital expenditures of approximately INR 2.04 billion, primarily directed towards enhancing its API and drug product capabilities.

These considerable capital outlays, while essential for future growth and maintaining a competitive edge in the pharmaceutical services sector, can exert pressure on the company's financial flexibility and cash flow in the near to medium term. Effectively managing these large-scale investments is critical to avoid potential liquidity constraints.

- Significant Capital Commitments: The company has a history of substantial capital expenditure, evidenced by INR 2.04 billion invested in FY24 for facility expansion and upgrades.

- Strain on Financial Resources: Large-scale investments can temporarily impact cash flow and financial liquidity.

- Management of Investments: Efficiently handling these expenditures is vital for maintaining financial stability.

Dishman Carbogen Amcis has grappled with persistent losses, reporting consolidated net losses in Q4 FY24 and Q1 FY25, indicating challenges in converting revenue to profit. This trend continued through FY24, with a net loss of ₹153 crore, an increase from the previous year.

Rising interest expenses, notably a significant quarter-on-quarter increase in December 2024, are directly impacting profitability and available cash flow. The company's financial structure shows increasing reliance on debt, with the debt-to-equity ratio climbing to 0.4x by September 2024, though still within manageable limits, the upward trend poses a potential constraint on financial flexibility.

Operating profit margins have shrunk to 9.9% in FY24 from 11.8% in FY23, accompanied by a 9.2% year-on-year drop in operating profit for FY24. This decline, further evidenced by a negative operating profit in Q1 FY25, suggests pressures from rising costs or intense competition.

Specific business segments have also underperformed. The Marketable Molecules segment saw revenue dips due to lower sales of quaternary compounds and generics, while the CRAMS DCAL India business experienced a year-on-year revenue decline, impacting historically high-margin contributions.

| Metric | FY23 | FY24 | Q1 FY25 |

|---|---|---|---|

| Consolidated Net Loss (₹ crore) | N/A | 153 | N/A |

| Operating Profit Margin (%) | 11.8 | 9.9 | Negative |

| Debt-to-Equity Ratio | N/A | 0.4x (Sep 2024) | N/A |

Full Version Awaits

Dishman Carbogen Amcis SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Dishman Carbogen Amcis SWOT analysis, providing a clear overview of its strategic position. The full, detailed report is unlocked upon purchase.

Opportunities

The global Contract Development and Manufacturing Organization (CDMO) market is poised for substantial growth, with forecasts suggesting a compound annual growth rate (CAGR) between 6.9% and 7.2% from 2024 through 2030 and potentially extending to 2034. This upward trajectory is fueled by pharmaceutical and biotechnology firms increasingly relying on external partners for their research and development and manufacturing needs.

This expanding market landscape offers a significant opportunity for Dishman Carbogen Amcis (DCAL) to enhance its market position, secure new client relationships, and leverage the escalating demand for outsourced pharmaceutical services.

The pharmaceutical landscape is increasingly dominated by complex molecules like biologics, cell and gene therapies, and ADCs, all demanding specialized manufacturing. This trend fuels a robust outsourcing market for these intricate processes.

Dishman Carbogen Amcis, through its subsidiary Dishman Carbogen Amcis Limited (DCAL), is well-positioned to capitalize on this growth. DCAL's existing expertise in high-potency APIs and complex chemistry, augmented by strategic investments in ADC drug linker production, allows it to capture a significant portion of this high-value sector.

The global biologics market alone was valued at approximately $490 billion in 2023 and is projected to grow substantially. Similarly, the cell and gene therapy market is experiencing rapid expansion, with numerous therapies gaining regulatory approval and entering commercialization, creating immense demand for specialized manufacturing services.

The pharmaceutical industry's growing reliance on outsourcing for cost savings, advanced technology access, and faster drug development presents a significant opportunity. This trend, particularly for comprehensive services from early research to large-scale manufacturing, directly benefits integrated Contract Development and Manufacturing Organizations (CDMOs) like Dishman Carbogen Amcis.

In 2024, the global CDMO market was valued at approximately $20 billion and is projected to grow substantially, driven by this outsourcing imperative. Dishman Carbogen Amcis is well-positioned to capitalize on this expansion, especially in areas like complex API manufacturing and sterile injectables, which are increasingly outsourced.

Geographic Expansion and Emerging Market Potential

The Asia-Pacific region, particularly China and India, is a burgeoning center for pharmaceutical R&D outsourcing, attracting global companies with its cost-effectiveness and growing specialized talent pool. Dishman Carbogen Amcis (DCAL) is well-positioned to capitalize on this trend, with its established operations in these key markets. The company's strategic exploration of new territories, including Russia and the Commonwealth of Independent States (CIS), further enhances its potential for geographic diversification and reaching a broader client base.

DCAL's expansion into emerging markets offers substantial growth prospects. For instance, the global pharmaceutical contract development and manufacturing organization (CDMO) market, which includes R&D outsourcing, was valued at approximately $16.3 billion in 2023 and is projected to grow significantly. By leveraging its existing infrastructure and expertise in APAC, DCAL can tap into this expanding demand.

- Asia-Pacific R&D Outsourcing Growth: The APAC region is a key driver of growth in pharmaceutical R&D outsourcing, attracting significant investment due to competitive pricing and skilled workforces.

- DCAL's Existing Footprint: The company's presence in China and India provides a strong foundation for expanding its services to meet the increasing demand for outsourced R&D.

- New Market Exploration: Investigating opportunities in regions like Russia and CIS offers potential for diversifying DCAL's revenue streams and client portfolio.

- Market Size and Projections: The global CDMO market, a proxy for R&D outsourcing, is expected to see robust growth, with projections indicating continued expansion in the coming years.

Leveraging Advanced Technologies and Digitalization

The pharmaceutical outsourcing sector is rapidly embracing digitalization, with AI, automation, and data analytics becoming key drivers for improved efficiency and smarter decision-making. Dishman Carbogen Amcis (DCAL) can capitalize on this trend by integrating these advanced technologies. This integration is crucial for streamlining manufacturing, enhancing quality assurance, and delivering novel solutions to clients, ultimately strengthening DCAL's market position.

By investing in digital transformation, DCAL can unlock significant operational advantages. For instance, AI-powered predictive maintenance can reduce downtime, while automation in quality control can minimize human error. The pharmaceutical contract development and manufacturing organization (CDMO) market is projected to reach approximately $130 billion by 2027, highlighting the growth potential for companies that adopt cutting-edge technologies.

DCAL's strategic adoption of advanced technologies presents several key opportunities:

- Enhanced Process Efficiency: Implementing automation and AI in manufacturing can lead to faster turnaround times and reduced operational costs.

- Improved Quality and Compliance: Advanced data analytics and AI can provide real-time monitoring and predictive insights for better quality control and regulatory adherence.

- Innovation in Service Offerings: Leveraging digital tools allows DCAL to offer more sophisticated and data-driven solutions to its pharmaceutical partners.

- Competitive Differentiation: Early and effective adoption of these technologies can set DCAL apart from competitors in the increasingly technology-dependent CDMO landscape.

The expanding global CDMO market, projected to grow significantly with a CAGR between 6.9% and 7.2% from 2024 to 2030, presents a prime opportunity for Dishman Carbogen Amcis (DCAL). This growth is driven by pharmaceutical companies increasingly outsourcing complex manufacturing, particularly for biologics and cell/gene therapies, markets valued in the hundreds of billions. DCAL's expertise in high-potency APIs and strategic investments in areas like ADCs position it to capture a substantial share of this high-value sector.

DCAL can leverage the burgeoning Asia-Pacific R&D outsourcing market, fueled by cost-effectiveness and skilled talent, by capitalizing on its existing footprint in China and India. Exploring new territories like Russia and CIS further enhances geographic diversification. The company's embrace of digitalization, including AI and automation, offers a pathway to improved efficiency, enhanced quality control, and innovative service offerings, creating a competitive edge in the technology-driven CDMO landscape.

| Opportunity Area | Market Context (2024/2025 Projections) | DCAL's Advantage |

|---|---|---|

| Global CDMO Market Growth | Projected CAGR of 6.9%-7.2% (2024-2030); Market valued around $20 billion in 2024. | Leveraging increasing outsourcing demand for complex molecules. |

| Biologics & Advanced Therapies | Biologics market ~$490 billion (2023); Cell & Gene Therapy market experiencing rapid expansion. | Specialized manufacturing expertise in high-potency APIs and ADCs. |

| Asia-Pacific R&D Outsourcing | APAC region is a key growth driver for pharmaceutical R&D outsourcing. | Established operations in China and India provide a strong foundation. |

| Digitalization & AI Adoption | CDMO market projected to reach ~$130 billion by 2027, driven by technology. | Potential for enhanced efficiency, quality, and innovative service offerings. |

Threats

The global Contract Development and Manufacturing Organization (CDMO) market, where Dishman Carbogen Amcis operates, is a crowded space. Numerous large, established companies and smaller, specialized firms vie for market share, creating a highly competitive environment.

This intense competition directly translates into significant pricing pressures. To win contracts, CDMOs are often compelled to reduce their service fees, which can squeeze profit margins considerably. For instance, reports from 2024 indicated that the average contract value in certain specialized CDMO segments saw a slight decline due to this competitive bidding.

To counteract these pressures, companies like Dishman Carbogen Amcis must constantly innovate and enhance their service offerings. Investing in advanced technologies, improving operational efficiency, and focusing on niche capabilities are crucial for maintaining a competitive edge and ensuring profitability in this challenging market.

The pharmaceutical sector faces a constantly shifting regulatory environment globally. New mandates like the EU's Health Technology Assessment (HTA) regulation, alongside ongoing oversight from agencies such as the USFDA and EDQM, demand persistent investment in compliance infrastructure. For instance, the increasing complexity of data integrity requirements can add significant overhead to quality control processes.

Dishman Carbogen Amcis's reliance on pharmaceutical R&D spending makes it vulnerable to shifts in client investment. A slowdown in drug development, perhaps due to economic pressures or regulatory changes, directly translates to reduced demand for CDMO services, creating revenue instability for the company.

The Inflation Reduction Act (IRA) of 2022, for instance, is expected to put significant pricing pressure on certain high-cost drugs, potentially impacting the profitability of pharmaceutical companies and their willingness to allocate substantial funds to R&D. This could lead to a contraction in the market for contract development and manufacturing organizations (CDMOs) like Dishman Carbogen Amcis, as clients may scale back on outsourcing non-core activities.

Economic Downturns and Biotech Funding Constraints

Broader economic downturns pose a significant threat by potentially reducing overall market demand for outsourced pharmaceutical services. As of late 2024 and into 2025, global economic forecasts indicate a period of slower growth and persistent inflation in many key markets, which can directly impact R&D budgets.

Constrained funding for smaller biotech and emerging pharmaceutical companies is a critical concern. Many of these smaller entities rely on venture capital and private equity, which have tightened their lending and investment criteria in response to economic uncertainty. This can lead to fewer new projects and a slowdown in the pipeline of outsourced work.

- Reduced R&D Spending: Global pharmaceutical R&D spending growth, while generally robust, can decelerate during economic contractions, impacting demand for CDMO services.

- Client Insolvency Risk: Smaller, less capitalized biotech firms face a higher risk of financial distress or insolvency during economic downturns, potentially impacting their ability to pay for services.

- Investment Climate: The overall investment climate for life sciences, particularly for early-stage companies, is sensitive to macroeconomic conditions, directly affecting the flow of capital into drug development.

Supply Chain Disruptions and Geopolitical Instability

Dishman Carbogen Amcis, operating as a global Contract Development and Manufacturing Organization (CDMO) with facilities and supply networks across various continents, faces considerable risks from worldwide supply chain interruptions, fluctuating raw material prices, and geopolitical uncertainties. Events like trade disputes, health crises, or localized conflicts can impede the movement of critical components, escalate operating expenses, and delay product shipments, ultimately impacting the company's operational stability and financial performance.

For instance, the ongoing geopolitical tensions in Eastern Europe and potential trade policy shifts in major economies in 2024-2025 could directly affect the cost and availability of key chemical intermediates and active pharmaceutical ingredients (APIs). The company's reliance on a diverse global supplier base, while a strength, also exposes it to a wider range of potential disruptions. For example, a significant port closure or a sudden imposition of tariffs could add weeks to transit times and substantially increase logistics costs for essential materials needed in their manufacturing processes.

- Supply Chain Vulnerability: Global CDMOs like Dishman Carbogen Amcis are inherently susceptible to disruptions affecting the sourcing of raw materials and intermediates, impacting production schedules.

- Geopolitical Impact: Trade wars, regional conflicts, and political instability can lead to increased operational costs, logistical challenges, and unpredictable market access for products.

- Raw Material Volatility: Fluctuations in the prices of essential chemicals and components, often driven by global supply and demand dynamics and geopolitical events, directly affect manufacturing costs and profitability.

- Operational Continuity Risk: The interconnected nature of global supply chains means that localized disruptions can have cascading effects, threatening the timely delivery of finished products to clients and impacting revenue streams.

Intense competition within the CDMO market, with numerous players vying for contracts, leads to significant pricing pressures. This was evident in 2024, where average contract values saw a slight dip in specialized segments due to aggressive bidding strategies from competitors.

The pharmaceutical industry's reliance on R&D spending makes CDMOs like Dishman Carbogen Amcis vulnerable to economic downturns and shifts in client investment. For instance, the Inflation Reduction Act of 2022 is expected to curb drug prices, potentially impacting R&D budgets and outsourcing demand through 2025.

Global supply chain disruptions, geopolitical uncertainties, and raw material price volatility pose significant threats. Events in 2024-2025, such as regional conflicts, have already impacted the cost and availability of key pharmaceutical intermediates, directly affecting manufacturing costs.

| Threat Category | Specific Threat | Impact on Dishman Carbogen Amcis | 2024-2025 Relevance |

|---|---|---|---|

| Market Competition | Intense Pricing Pressure | Reduced profit margins, need for service differentiation | Continued from 2024, with ongoing bidding wars for contracts. |

| Economic Factors | Reduced R&D Budgets | Lower demand for CDMO services, revenue instability | Economic slowdown and inflation forecasts for 2025 impacting client spending. |

| Supply Chain & Geopolitics | Raw Material Cost Volatility | Increased operational expenses, potential production delays | Geopolitical tensions in 2024-2025 affecting key intermediate availability and pricing. |

SWOT Analysis Data Sources

This Dishman Carbogen Amcis SWOT analysis is built upon a foundation of reliable data, including the company's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure a robust and accurate assessment.