Dishman Carbogen Amcis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dishman Carbogen Amcis Bundle

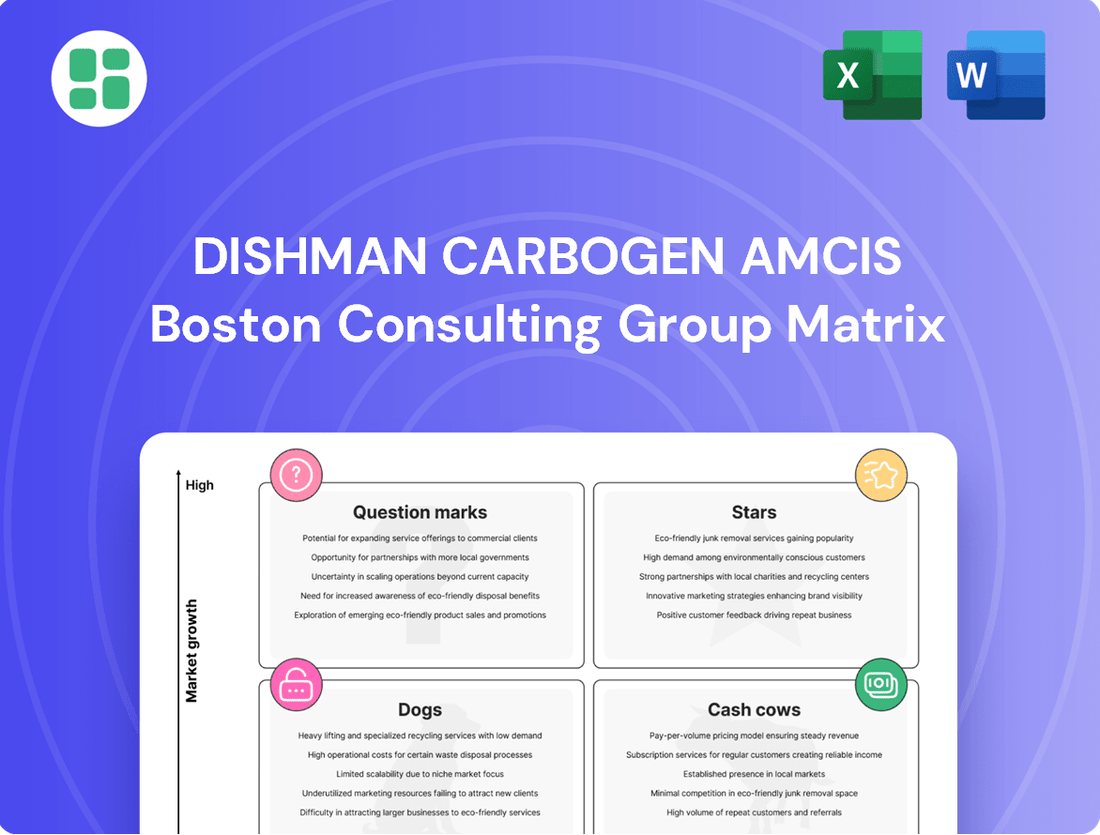

Curious about Dishman Carbogen Amcis's market performance? Our preliminary BCG Matrix analysis offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full strategic potential by purchasing the complete BCG Matrix report. Gain detailed quadrant placements, data-backed insights, and actionable recommendations to optimize your investment and product strategies for Dishman Carbogen Amcis.

Stars

Dishman Carbogen Amcis is making substantial investments in its Highly Potent API (HPAPI) and Antibody-Drug Conjugate (ADC) linker manufacturing capabilities, including securing co-investments. This strategic move targets a rapidly expanding segment of the pharmaceutical market, driven by the increasing demand for advanced oncology treatments and targeted therapies.

The company's focus on HPAPI and ADC linker production places it at the forefront of a high-growth niche. In 2024, the global ADC market alone was projected to reach approximately $11.5 billion, with significant growth expected in the coming years, underscoring the strategic importance of Dishman Carbogen Amcis's expansion.

The Contract Development and Manufacturing Organization (CDMO) sector is experiencing robust growth, particularly in biologics and advanced therapies such as gene and cell therapies. Dishman Carbogen Amcis (DCAL), historically a leader in small molecules, is strategically expanding its capabilities to meet this demand.

DCAL's investment in facilities like the new Saint-Beauzire site in France demonstrates a clear commitment to advanced therapies, including Antibody-Drug Conjugates (ADCs). This expansion is crucial for capturing market share in the rapidly evolving complex biological drug development and manufacturing space, aligning with market trends that saw the global biologics CDMO market valued at approximately $20.1 billion in 2023 and projected to grow significantly.

Dishman Carbogen Amcis's Contract Research and Manufacturing Services (CRAMS), specifically its Carbogen Amcis (CGAM) division, is a standout performer. Its success is built on consistently supplying commercial quantities of complex small molecules, a critical component for innovative pharmaceuticals.

This segment's strong growth, fueled by increased commercial molecule shipments, highlights its dominance in a niche but vital market. For instance, the company reported a significant increase in revenue from its CRAMS segment in the fiscal year ending March 31, 2024, indicating robust demand for their specialized services.

Global Regulatory Compliance & Quality

Dishman Carbogen Amcis (DCAL) excels in global regulatory compliance and quality, a cornerstone of its strong market position. The company consistently passes inspections from major regulatory bodies such as the USFDA, EDQM, PMDA Japan, and China's NMPA. This track record spans across its key manufacturing sites, including Bavla and Naroda in India, its Swiss facilities, and its Shanghai operation.

This robust compliance framework is a significant competitive advantage in the pharmaceutical sector. It assures clients of DCAL's adherence to the highest quality standards, making them a preferred partner for international pharmaceutical companies. This capability directly translates into securing a substantial market share, particularly in contracts where regulatory adherence is paramount.

- Consistent Regulatory Approvals: DCAL maintains a strong history of successful inspections and certifications from leading global regulatory authorities.

- Global Facility Compliance: The company's quality systems are validated across multiple international sites, including India, Switzerland, and China.

- Market Differentiation: Top-tier regulatory expertise allows DCAL to serve a wide international client base, solidifying its position in quality-sensitive markets.

- Client Trust and Reliability: Demonstrating unwavering compliance builds trust, enabling DCAL to secure high-value contracts with global pharmaceutical partners.

European Manufacturing Hubs (Switzerland & France)

Dishman Carbogen Amcis (DCAL) is significantly bolstering its European manufacturing capabilities, particularly in Switzerland and France, to capitalize on the expanding Contract Development and Manufacturing Organization (CDMO) market. These strategic moves underscore a commitment to high-value pharmaceutical services.

Recent substantial investments have been channeled into Swiss facilities, specifically targeting the burgeoning field of Antibody-Drug Conjugate (ADC) manufacturing. Simultaneously, DCAL has successfully established and certified a new facility in Saint-Beauzire, France. This dual-pronged approach strengthens DCAL's position within the lucrative European CDMO landscape.

These expansions are not merely about capacity; they are coupled with securing significant contracts. Notably, DCAL has landed a contract exceeding €1 million, demonstrating its competitive edge and ability to attract substantial business in key European regions for specialized pharmaceutical services.

- Swiss Investment Focus: Substantial capital deployed into Swiss sites for advanced ADC manufacturing.

- French Expansion: New facility in Saint-Beauzire, France, successfully established and certified.

- Contract Wins: Secured a contract valued at over €1 million, validating market strength.

- Market Position: Enhanced presence in the European CDMO market, indicating high growth potential.

Dishman Carbogen Amcis's Contract Research and Manufacturing Services (CRAMS) division, particularly Carbogen Amcis (CGAM), is a strong performer. It consistently delivers complex small molecules for commercial use, a vital aspect for new pharmaceuticals.

This segment is growing well due to increased shipments of commercial molecules, showing its leadership in a specialized, important market. For example, the company saw a notable revenue increase from its CRAMS segment in the fiscal year ending March 31, 2024.

The CRAMS segment, driven by strong commercial molecule shipments and a focus on complex small molecules, represents a significant "Star" in the BCG matrix for Dishman Carbogen Amcis. This segment's consistent growth and market leadership in a high-demand niche indicate its strong potential for future expansion and profitability.

| Segment | Market Growth | Company Strength | BCG Classification |

|---|---|---|---|

| CRAMS (Carbogen Amcis) | High | High | Star |

| HPAPI/ADC Manufacturing | Very High | Growing | Question Mark/Star |

| Other Services | Moderate | Established | Cash Cow |

What is included in the product

This BCG Matrix analysis provides a tailored view of Dishman Carbogen Amcis's product portfolio, highlighting strategic recommendations for investment and divestment.

The Dishman Carbogen Amcis BCG Matrix offers a clear, visual pain point reliever by strategically positioning business units for optimized resource allocation.

Cash Cows

Dishman Carbogen Amcis boasts extensive and adaptable cGMP reactor capacity for small molecule API manufacturing across various locations. This established segment, a cornerstone of the CDMO sector, provides a steady and substantial revenue stream, even if growth isn't rapid.

The company's deep experience in this area translates to secure, high-volume contracts and predictable cash generation. This reliable income requires minimal new capital investment for ongoing operations, solidifying its position as a cash cow.

Dishman Carbogen Amcis's custom synthesis for commercial-stage drugs, a key component of its Contract Research and Manufacturing Services (CRAMS) business, acts as a robust cash cow. This segment consistently delivers substantial revenue, driven by long-term agreements for established pharmaceutical products.

These contracts for commercial Active Pharmaceutical Ingredients (APIs) offer predictable, high-margin income due to the stable, ongoing demand. The company's established client relationships and validated manufacturing processes further solidify this segment's strong cash-generating capability.

Routine Analytical & Process Development Services are a cornerstone of Dishman Carbogen Amcis's (DCAL) offerings as an integrated CDMO. These services are critical throughout the entire drug development lifecycle, ensuring quality and efficacy.

Despite being mature offerings, these analytical and process development services maintain a consistent and high demand, securing a significant market share within the broader support services sector. For instance, the global pharmaceutical analytical testing market was valued at approximately $7.5 billion in 2023 and is projected to grow steadily, reflecting the ongoing need for such expertise.

These capabilities act as cash cows for DCAL, generating stable revenue streams. The mature nature of these services means they require minimal investment in aggressive market expansion, allowing the company to leverage its established strengths and consistently profit from these essential functions.

Vitamin D Analogues Production

The Vitamin D analogues sub-segment within Dishman Carbogen Amcis's marketable molecules business is a clear cash cow. This area has demonstrated consistent performance and notable growth in recent periods, making a significant positive contribution to overall revenue.

This strong market position for Vitamin D analogues translates into reliable cash flow generation. It signifies that these products are well-established and profitable, requiring minimal investment in new market development or aggressive expansion strategies to maintain their contribution.

- Stable Revenue Contributor: Vitamin D analogues consistently generate substantial revenue for Dishman Carbogen Amcis.

- Low Investment Needs: This segment requires minimal additional investment for growth, reflecting its mature market status.

- Profitability Driver: The established market presence ensures healthy profit margins, acting as a key source of funds for the company.

- 2024 Performance: While specific 2024 figures for this sub-segment are not yet fully detailed in public reports as of mid-2024, the trend from prior years indicates continued strong performance and contribution.

Specialty Chemicals & Disinfectants

Specialty Chemicals & Disinfectants are Dishman Carbogen Amcis's Cash Cows. These are established product lines that generate steady income. Despite a minor dip in the broader marketable molecules segment during FY24, these particular areas are expected to maintain a strong position within their specialized markets.

This strong market share translates into reliable revenue streams, reinforcing their status as cash cows for the company. The consistent demand for these products allows them to contribute significantly to Dishman Carbogen Amcis's overall cash generation.

- Market Share: High in niche segments for specialty chemicals and disinfectants.

- Revenue Generation: Consistent and stable, contributing to overall cash flow.

- Demand: Stable demand characteristics typical of mature product lines.

- FY24 Performance: While the broader marketable molecules segment saw a slight decline, these categories are anticipated to remain strong performers.

Dishman Carbogen Amcis's established cGMP reactor capacity for small molecule API manufacturing serves as a significant cash cow. This mature segment provides a steady, substantial revenue stream with minimal need for new capital investment, ensuring predictable cash generation from high-volume contracts.

The company's custom synthesis for commercial-stage drugs is another robust cash cow, generating substantial revenue through long-term agreements for established pharmaceutical products. These predictable, high-margin income streams are secured by validated processes and strong client relationships.

Routine Analytical & Process Development Services, despite being mature, act as consistent cash cows for DCAL. The global pharmaceutical analytical testing market, valued around $7.5 billion in 2023, highlights the ongoing demand for these essential, low-investment, high-demand services.

Vitamin D analogues and Specialty Chemicals & Disinfectants are also key cash cows. These segments demonstrate consistent performance and stable demand, contributing significantly to overall cash flow despite minor fluctuations in broader marketable molecules during FY24.

| Segment | BCG Category | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Small Molecule API Manufacturing | Cash Cow | Established cGMP capacity, steady revenue, low investment | Core, consistent contributor to revenue and cash flow. |

| Custom Synthesis (Commercial Drugs) | Cash Cow | Long-term contracts, predictable high margins, validated processes | Reliable, high-margin income source, reinforcing stable cash generation. |

| Analytical & Process Development | Cash Cow | Consistent demand, minimal expansion investment, essential services | Leverages established strengths for consistent profit; market valued at ~$7.5B in 2023. |

| Vitamin D Analogues | Cash Cow | Consistent performance, strong market position, minimal new development needs | Reliable cash flow generator, established profitability. |

| Specialty Chemicals & Disinfectants | Cash Cow | Stable niche market share, consistent revenue, mature product lines | Expected to maintain strong performance and cash contribution. |

What You See Is What You Get

Dishman Carbogen Amcis BCG Matrix

The Dishman Carbogen Amcis BCG Matrix preview you are viewing is the identical, final document you will receive upon purchase. This means no altered content, watermarks, or demo elements—just the complete, professionally formatted strategic tool ready for immediate application. You can be confident that the insights and structure presented here are precisely what you will download, enabling you to seamlessly integrate this analysis into your business planning and decision-making processes.

Dogs

Commoditized generic API synthesis represents a challenging segment within the pharmaceutical ingredients market. In these areas, competition is fierce, and distinguishing one product from another is difficult, which typically leads to slim profit margins and a struggle for any single company to capture a significant market share.

If Dishman Carbogen Amcis is involved in highly commoditized generic API production without any special process advantages or unique selling propositions, these operations would likely be categorized as Dogs in the BCG matrix. This is because such activities generally exhibit low market growth potential and offer limited profitability, making them less attractive strategic assets.

For instance, the global generic API market, while growing, faces intense price pressures. In 2024, the market is projected to reach approximately $230 billion, but the commoditized segments often see price erosion due to oversupply and the ease of entry for new manufacturers, impacting overall profitability for players without a strong competitive edge.

Dishman Carbogen Amcis's legacy/outdated technology services represent areas where older manufacturing processes or service offerings are less efficient than newer, more cost-effective industry methods. These segments may find it challenging to attract new clients and retain their market share, potentially becoming cash traps that yield minimal returns.

For instance, if a specific chemical synthesis process in their portfolio relies on technology that has been significantly surpassed in efficiency and cost by newer catalytic methods, it would fall into this category. Such operations, while perhaps still generating some revenue, might require substantial investment to modernize or could be phased out, impacting overall profitability.

Dishman Carbogen Amcis's Domestic CRAMS (Contract Research and Manufacturing Services) segment, specifically its DCAL India operations, faced significant headwinds in fiscal year 2024. Revenue from this area saw a substantial drop of 12.2% compared to the previous year.

This decline points to a challenging market position for the company within India's CRAMS landscape. With a shrinking revenue stream and likely a low market share in a non-expanding segment, this business unit aligns with the characteristics of a 'Dog' in the BCG Matrix.

The persistent underperformance necessitates a strategic review. Management must consider whether to invest in revitalizing this segment or explore options for divestiture to reallocate resources to more promising areas of the business.

Specific Quaternary Compounds Production

The marketable molecules segment of Dishman Carbogen Amcis (DCAL) experienced a revenue downturn in FY24, primarily due to reduced sales of specific quaternary compounds. This performance indicates these particular compounds may be positioned as Dogs within the BCG matrix. Their struggle suggests a combination of waning market demand and heightened competitive pressures, leading to a low market share and minimal growth for DCAL in these product categories.

The negative impact on revenue from these specific quaternary compounds highlights a potential strategic challenge for DCAL. Companies often categorize products with low growth and low market share as Dogs. This classification implies that these offerings may not be generating significant profits and could be consuming resources without substantial returns.

- FY24 Revenue Impact: Lower sales of certain quaternary compounds negatively affected the marketable molecules segment's revenue.

- Market Position: This performance suggests these compounds may hold a low market share and experience low growth, characteristic of a 'Dog' in the BCG matrix.

- Underlying Causes: Potential reasons include declining market demand or intense competition for these specific chemical products.

Services Tied to Declining Therapeutic Areas

Dishman Carbogen Amcis might face challenges if its services are heavily concentrated in therapeutic areas experiencing a downturn in pharmaceutical R&D. For instance, if the company has substantial capabilities in developing APIs for indications with declining patient populations or where generic competition has intensified significantly, these services could be categorized as Dogs.

Such a scenario would mean these offerings operate in low-growth markets, potentially seeing a reduction in demand for new drug development and manufacturing. This could lead to a shrinking market share for Dishman Carbogen Amcis in these specific segments.

For example, if the company's revenue from services tied to older antiviral treatments or certain cardiovascular drugs, which have seen significant patent expirations and increased generic availability, represents a large portion of its business, these would be considered Dogs.

- Declining R&D Investment: Therapeutic areas with reduced pharmaceutical R&D spending, such as some areas of infectious diseases or specific oncological targets that have proven difficult to treat, could represent Dog services.

- Patent Cliffs and Generic Erosion: Services supporting drugs that have recently faced or are about to face patent cliffs, leading to a surge in generic alternatives and a subsequent drop in demand for novel API development, would also fall into this category.

- Low Market Growth: Any service area characterized by a Compound Annual Growth Rate (CAGR) significantly below the industry average, indicating stagnant or declining market demand, would be classified as a Dog.

Dishman Carbogen Amcis's involvement in commoditized generic API synthesis without unique advantages places these operations in the 'Dog' category. These segments typically exhibit low growth and profitability, making them less attractive. For instance, the global generic API market, projected around $230 billion in 2024, faces intense price erosion in commoditized areas due to oversupply.

Legacy or outdated technology services also fall under 'Dogs' if they are less efficient than newer methods, struggling to attract clients and potentially becoming cash traps. An example would be a synthesis process reliant on older technology compared to more cost-effective catalytic methods, requiring investment or phase-out.

The company's DCAL India CRAMS segment, experiencing a 12.2% revenue drop in FY24, aligns with 'Dog' characteristics due to its challenging market position, shrinking revenue, and likely low market share in a non-expanding segment. This underperformance necessitates a strategic review, considering revitalization or divestiture.

Specific quaternary compounds within Dishman Carbogen Amcis's marketable molecules segment also appear to be 'Dogs', as indicated by reduced sales in FY24. This suggests waning demand and intense competition, leading to low market share and minimal growth for these products.

Question Marks

Dishman Carbogen Amcis's recent acquisition of a Drug Manufacturing License from China's NMPA for its Shanghai subsidiary marks a pivotal entry into a rapidly expanding pharmaceutical market. This achievement positions the company to capitalize on China's growing healthcare demands, which are projected to reach approximately $2.2 trillion by 2030, according to some industry forecasts.

Despite this significant regulatory milestone, Dishman Carbogen Amcis's current manufacturing market share within China is anticipated to be minimal. This low penetration, coupled with the substantial investment needed to scale operations and build brand recognition in such a competitive landscape, firmly places its Chinese manufacturing operations in the 'Question Mark' category of the BCG matrix.

AI-driven drug discovery is a rapidly expanding frontier within the CDMO sector. Companies like Dishman Carbogen Amcis (DCAL) are looking to leverage AI for faster, more efficient drug development processes. This includes areas like molecular modeling and predictive analytics, aiming to reduce the time and cost associated with bringing new therapies to market.

The integration of AI into CDMO services positions them as potential question marks in the BCG matrix. While the market for AI-driven drug discovery is experiencing significant growth, with projections indicating a substantial increase in AI adoption within the pharmaceutical R&D landscape, the current market share for specialized AI services from CDMOs may still be relatively low. For instance, the global AI in drug discovery market was valued at approximately $600 million in 2023 and is expected to grow at a CAGR of over 35% through 2030. This presents DCAL with an opportunity to invest heavily in developing these capabilities to capture a larger share of this burgeoning market and transform them into future stars.

As drug development increasingly focuses on complex biologics and advanced therapies, the need for specialized Contract Development and Manufacturing Organization (CDMO) services in Novel Drug Delivery Systems (NDDS) is surging. If Dishman Carbogen Amcis is investing in and expanding its capabilities beyond traditional Active Pharmaceutical Ingredient (API) and drug product manufacturing into these cutting-edge delivery methods, these nascent offerings would likely be positioned as a Question Mark on the BCG Matrix. This segment operates within a high-growth market, driven by the demand for improved therapeutic efficacy and patient compliance, but currently represents a smaller portion of the company's overall business, hence a low market share.

Continuous Manufacturing Implementation

Dishman Carbogen Amcis's investment in continuous manufacturing positions it as a potential leader in a rapidly evolving pharmaceutical production landscape. This advanced technology promises significant improvements in efficiency and cost reduction, making it attractive for clients seeking optimized drug development and manufacturing. As of early 2024, the pharmaceutical industry's adoption of continuous manufacturing is accelerating, with many companies dedicating substantial capital to this transition. For Dishman Carbogen Amcis, this means building a strong foundation in a high-growth segment, albeit one that demands significant upfront investment.

The implementation of continuous manufacturing requires substantial capital expenditure for new equipment, process development, and specialized training. For instance, some estimates suggest that transitioning a traditional batch manufacturing facility to a continuous flow system can involve investments ranging from tens of millions to over a hundred million dollars, depending on the scale and complexity. Dishman Carbogen Amcis's commitment to this area reflects a strategic bet on future market demand and technological leadership.

- High Growth Potential: Continuous manufacturing is a key trend in pharmaceutical production, offering enhanced speed and reduced waste.

- Investment Requirement: Implementing these advanced systems necessitates significant capital outlay for new technologies and process optimization.

- Market Share Building: Early adoption allows Dishman Carbogen Amcis to cultivate expertise and capture market share in this emerging field.

- Efficiency Gains: Continuous manufacturing can lead to substantial operational cost savings and improved product quality for clients.

Expansion into New Niche Bioconjugation beyond ADCs

Dishman Carbogen Amcis (DCAL) is exploring expansion into new niche bioconjugation areas beyond antibody-drug conjugates (ADCs). This strategic move targets a high-growth, specialized market segment for complex biologics. Currently, DCAL's market share in these broader bioconjugation services is likely low, classifying them as question marks within the BCG matrix.

These emerging bioconjugation services require significant strategic investment to develop capabilities and gain traction. The global bioconjugation market, excluding ADCs, is projected for substantial growth, driven by advancements in therapeutic modalities like antibody-drug conjugates (ADCs) and other targeted therapies. For instance, the broader bioconjugation market, which encompasses services beyond ADCs, was estimated to be valued at over USD 2.5 billion in 2023 and is anticipated to grow at a CAGR of approximately 10-12% through 2030. This presents a significant opportunity for DCAL to establish a strong foothold.

- High-Growth Potential: Targeting specialized bioconjugation for complex biologics beyond ADCs taps into an expanding therapeutic landscape.

- Low Initial Market Share: DCAL's current position in these newer niche areas is likely nascent, requiring focused development.

- Strategic Investment Needed: Significant capital and R&D investment will be crucial to build expertise and capture market share.

- Future Star Potential: Successful development could transform these niche services into future revenue drivers for DCAL.

Dishman Carbogen Amcis's foray into new niche bioconjugation areas beyond ADCs represents a strategic move into a high-growth, specialized market. While these emerging services hold significant future potential, the company's current market share in these specific segments is likely low, positioning them as question marks on the BCG matrix.

These nascent bioconjugation services require substantial investment to develop capabilities and establish market presence. The global bioconjugation market, excluding ADCs, was valued at over USD 2.5 billion in 2023 and is projected to grow at a CAGR of approximately 10-12% through 2030, indicating a fertile ground for DCAL to cultivate its offerings.

The company's expansion into China's pharmaceutical market, while a significant regulatory achievement, begins with a minimal current market share. The substantial investment required to scale operations and build brand recognition in this competitive landscape firmly places its Chinese manufacturing operations in the 'Question Mark' category.

Similarly, the integration of AI into CDMO services, though a high-growth area with the global AI in drug discovery market valued at approximately $600 million in 2023 and expected to grow at over 35% CAGR through 2030, may still represent a low current market share for specialized AI services from CDMOs, thus classifying them as question marks.

| BCG Category | Business Area | Market Growth | Current Market Share | Strategic Implication |

| Question Mark | China Pharmaceutical Market Entry | High | Minimal | Requires significant investment to gain share and become a Star. |

| Question Mark | AI-Driven Drug Discovery Services | Very High | Low | Strategic investment in AI capabilities needed to capture future market growth. |

| Question Mark | Niche Bioconjugation Services (Beyond ADCs) | High | Low | Focus on R&D and capability building to establish a strong market position. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.