Dishman Carbogen Amcis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dishman Carbogen Amcis Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Dishman Carbogen Amcis's trajectory. Our comprehensive PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and refine your strategic approach. Don't get left behind; download the full version now for actionable insights.

Political factors

Government healthcare policies significantly shape the pharmaceutical landscape, directly impacting demand for services like those offered by Dishman Carbogen Amcis. Healthcare reforms and public health initiatives can either boost or curb the need for contract development and manufacturing (CDMO) services and active pharmaceutical ingredient (API) production. For instance, increased government spending on healthcare, a trend observed in many developed nations, often translates to higher demand for outsourced manufacturing and development capabilities as pharmaceutical companies seek efficient ways to bring new drugs to market.

In 2024, global healthcare spending is projected to continue its upward trajectory, with significant investments expected in areas like biologics and specialized therapies, which are core to Dishman Carbogen Amcis's offerings. European Union countries, for example, have been prioritizing increased access to medicines and investing in digital health solutions, potentially creating opportunities for CDMOs that can support these goals. Similarly, the United States’ ongoing debates around drug pricing and healthcare accessibility could lead to policy shifts that influence R&D pipelines and manufacturing strategies, indirectly affecting demand for API production.

Government priorities in promoting specific therapeutic areas, such as oncology or rare diseases, can create substantial demand for specialized CDMO services. Dishman Carbogen Amcis's focus on complex chemistries and high-potency APIs positions them to capitalize on these government-driven market trends. For example, if a government allocates substantial funding to combat a particular disease, it can accelerate clinical trials and subsequent commercial manufacturing needs, benefiting companies with the necessary expertise.

Global trade relations significantly impact Dishman Carbogen Amcis, a CDMO with operations spanning India, Switzerland, France, the UK, China, and the Netherlands. Changes in international trade agreements and tariffs directly affect the cost of importing pharmaceutical raw materials and intermediates, as well as exporting finished products. For instance, a new bilateral agreement could streamline customs procedures, reducing lead times and costs for their Indian manufacturing facilities supplying European clients. Conversely, increased tariffs on active pharmaceutical ingredients (APIs) from China could raise their operational expenses.

The pharmaceutical sector is particularly sensitive to trade policies, with disruptions potentially impacting supply chain stability. For a company like Dishman Carbogen Amcis, navigating these evolving trade landscapes is crucial for maintaining competitive pricing and market access. For example, the ongoing trade tensions between major economies in 2024 and 2025 could lead to unexpected cost increases or necessitate the re-evaluation of sourcing strategies to mitigate risks. Any new trade agreements or the imposition of new tariffs will directly influence their operational efficiency and overall profitability.

Geopolitical stability in key markets directly impacts Dishman Carbogen Amcis's operations. For instance, ongoing regional tensions in parts of Asia, where the company has significant manufacturing presence, could disrupt supply chains for critical raw materials. The company's reliance on global sourcing means that political instability in any major supplier region, such as India or China, necessitates robust contingency planning to maintain production continuity.

Drug Pricing Regulations

Governmental regulations on drug pricing and reimbursement significantly shape the pharmaceutical industry's profitability and, consequently, their decisions regarding outsourcing to Contract Development and Manufacturing Organizations (CDMOs). Stricter price controls in key markets, such as potential changes in Medicare drug pricing negotiations anticipated in 2025 following the Inflation Reduction Act's provisions, could push pharmaceutical clients to seek more cost-efficient manufacturing partners. This scenario might boost demand for CDMO services as companies aim to reduce overheads, but it could also intensify pricing pressure on CDMOs like Dishman Carbogen Amcis.

The evolving landscape of drug pricing regulations, particularly in the United States and Europe, directly impacts the revenue streams of pharmaceutical companies. For instance, ongoing discussions around value-based pricing and potential reforms to reimbursement models in 2024-2025 could necessitate greater cost optimization throughout the drug development and manufacturing lifecycle. This creates a dynamic where CDMOs offering competitive pricing and efficient processes may see increased interest, while those unable to adapt to cost pressures might face challenges.

- Increased scrutiny on drug pricing in major markets like the US and EU.

- Potential for lower profit margins for pharmaceutical companies due to price controls.

- Demand for cost-effective manufacturing solutions from pharmaceutical clients.

- Pressure on CDMOs to offer competitive pricing and demonstrate value.

Government Support for Pharmaceutical Innovation

Government support for pharmaceutical innovation is a significant driver for companies like Dishman Carbogen Amcis. Initiatives such as tax credits for R&D, direct grants for novel drug development, and streamlined regulatory pathways for breakthrough therapies can substantially boost the pharmaceutical sector's growth. For instance, the U.S. government's commitment to advancing treatments for diseases like Alzheimer's and cancer through programs like the National Institutes of Health (NIH) funding, which saw over $47 billion allocated in fiscal year 2024, directly fuels demand for specialized CDMO services.

These policies are designed to accelerate the drug discovery and development pipeline. By encouraging pharmaceutical and biopharmaceutical companies to invest in cutting-edge research, governments indirectly create more opportunities for contract development and manufacturing organizations (CDMOs). This increased R&D activity translates into a higher demand for early-stage development, process optimization, and the manufacturing of clinical trial materials, areas where Dishman Carbogen Amcis excels.

Policies that specifically target unmet medical needs, such as rare diseases or emerging infectious diseases, can be particularly beneficial. For example, the Orphan Drug Act in the United States provides incentives that have led to a significant increase in the development of treatments for rare conditions. Such focused support can lead to new partnerships for Dishman Carbogen Amcis, enabling them to leverage their expertise in complex molecule synthesis and manufacturing for these specialized therapeutic areas.

- Increased R&D Spending: Government incentives often correlate with higher R&D expenditures by pharmaceutical firms, creating a larger market for CDMO services.

- Focus on Novel Therapies: Support for innovative treatments, including gene and cell therapies, requires specialized manufacturing capabilities that CDMOs can provide.

- Partnership Opportunities: Government-backed research programs and grants can foster collaborations between academic institutions, biotech startups, and established pharmaceutical companies, opening doors for CDMO involvement.

- Market Access and Reimbursement: Policies that facilitate market access and favorable reimbursement for innovative drugs indirectly boost demand for manufacturing services.

Government healthcare policies significantly influence the demand for CDMO services, with reforms and public health initiatives directly impacting the need for API production and outsourced manufacturing. Increased global healthcare spending, projected to continue its upward trend in 2024 and beyond, particularly in biologics and specialized therapies, presents opportunities for companies like Dishman Carbogen Amcis.

Government priorities in specific therapeutic areas, such as oncology or rare diseases, create demand for specialized CDMO services, aligning with Dishman Carbogen Amcis's expertise in complex chemistries and high-potency APIs. For example, substantial government funding for disease-specific research accelerates clinical trials and subsequent commercial manufacturing needs.

Trade relations and tariffs directly affect the cost of raw materials and finished products for global CDMOs. Geopolitical stability in key markets is also crucial, as regional tensions can disrupt supply chains for critical raw materials, necessitating robust contingency planning for companies with international operations.

Drug pricing regulations, especially in the US and EU, influence pharmaceutical clients' decisions to outsource manufacturing. Potential price controls could drive demand for cost-effective CDMO solutions, while also intensifying pricing pressure on service providers. Government support for pharmaceutical innovation through tax credits and grants further fuels the sector's growth and creates opportunities for CDMOs.

What is included in the product

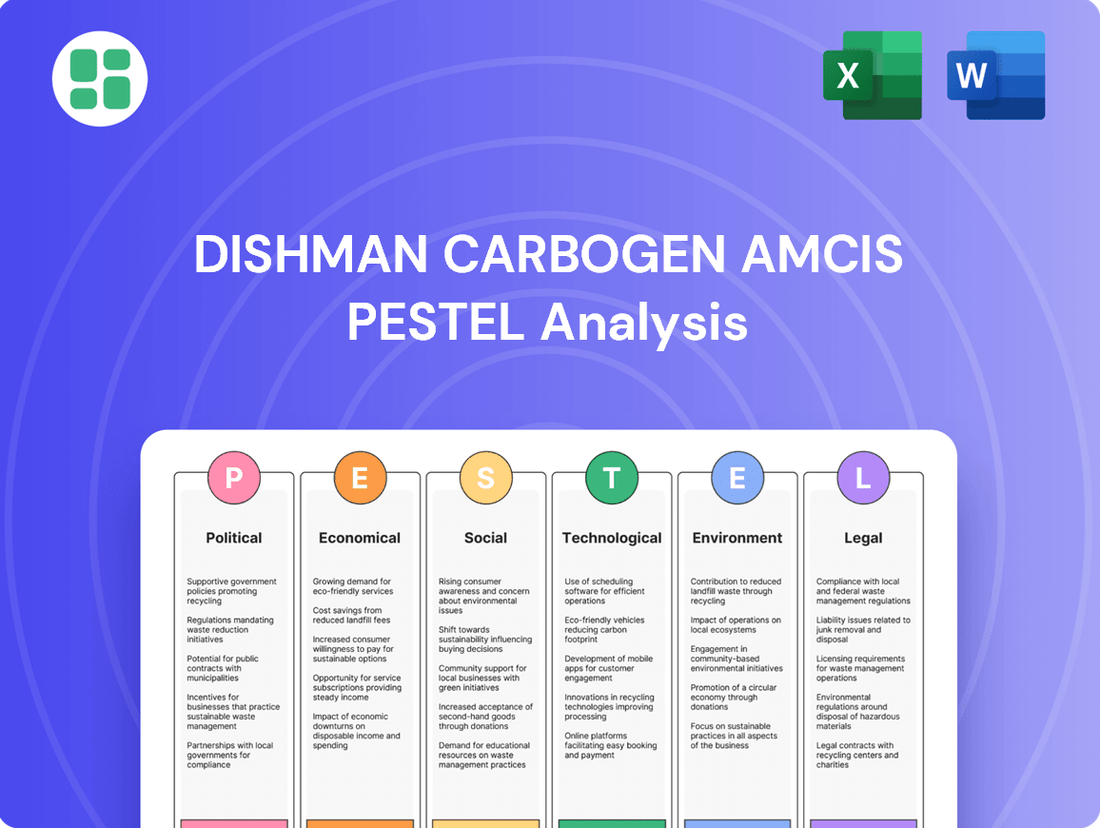

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Dishman Carbogen Amcis, offering a comprehensive view of its operating landscape.

This PESTLE analysis for Dishman Carbogen Amcis offers a clean, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic meetings and presentations.

Economic factors

The global economic landscape significantly shapes investment in the pharmaceutical sector, directly impacting companies like Dishman Carbogen Amcis. Robust economic growth generally translates to higher healthcare expenditure and increased R&D funding, which benefits contract development and manufacturing organizations (CDMOs) through greater demand for their services. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight increase from 3.0% in 2023, indicating a generally supportive environment for pharmaceutical outsourcing.

However, the specter of recessionary pressures poses a considerable risk. Economic slowdowns can trigger budget constraints within pharmaceutical firms, leading to reduced outsourcing of R&D and manufacturing. This can directly impact Dishman Carbogen Amcis's revenue streams and order pipelines. Emerging market economies, while offering growth potential, can also be more susceptible to global economic volatility, presenting a dual-edged sword for the company's international operations.

Dishman Carbogen Amcis, operating globally, faces significant risks from currency exchange rate fluctuations. For instance, a strengthening US Dollar against the Indian Rupee could reduce the rupee value of dollar-denominated revenues, impacting profitability. In 2024, the Indian Rupee saw fluctuations against major currencies, with the USD/INR trading around 83.50, and the EUR/INR near 90.00, highlighting the potential for significant impact on reported earnings.

Unfavorable movements, such as a weaker Euro against the Swiss Franc, could increase the cost of raw materials sourced from Europe for their Swiss operations, thereby squeezing profit margins. Similarly, if the Swiss Franc strengthens considerably against the Euro, this could make their European-sourced inputs more expensive, affecting their cost structure and overall competitiveness in the European market.

Rising inflation, a persistent economic challenge through 2024 and into 2025, directly impacts Dishman Carbogen Amcis by increasing the cost of essential inputs. For instance, global inflation saw the Producer Price Index (PPI) for chemicals and allied products in the US reach 10.5% in early 2024, a significant jump from previous years, indicating higher raw material and manufacturing expenses.

The pharmaceutical sector's intricate supply chains are particularly vulnerable. Higher energy costs, a key driver of inflation, directly translate to increased operational expenses for chemical synthesis and manufacturing processes. This can compress profit margins if the company cannot fully pass these elevated costs onto its clients, who themselves are facing budget constraints.

Dishman Carbogen Amcis, like many in the contract development and manufacturing organization (CDMO) space, navigates a delicate balance. While raw material price hikes, such as a reported 15% increase in the cost of key solvents and reagents in late 2024, necessitate pricing reviews, client contracts and competitive pressures limit immediate full cost pass-through, impacting profitability.

Access to Capital and Interest Rates

The cost and availability of capital are paramount for Dishman Carbogen Amcis, directly impacting its capacity for expansion, technological advancement, and research and development. Fluctuations in interest rates and broader financial market conditions significantly shape these factors. For instance, in early 2024, many central banks maintained higher interest rates to combat persistent inflation, which would have increased borrowing costs for companies like Dishman Carbogen Amcis. This environment directly affects the financial viability of new projects and the management of existing debt obligations, potentially slowing strategic growth initiatives.

Higher interest rates can make it more expensive for Dishman Carbogen Amcis to finance new ventures or refinance existing debt. This increased cost of capital can reduce the net present value of future projects, making them less attractive. For example, if the Reserve Bank of India's policy repo rate, a key benchmark for lending rates in India, remains elevated, it directly translates to higher interest expenses for Indian companies, including Dishman Carbogen Amcis, which has significant operations in India.

- Increased Borrowing Costs: Higher interest rates directly inflate the cost of debt for Dishman Carbogen Amcis, impacting profitability and cash flow.

- Investment Feasibility: Elevated borrowing costs can render expansion projects and R&D initiatives less financially viable, potentially delaying or cancelling strategic investments.

- Debt Management: Companies with substantial debt may face increased interest payments, affecting their ability to service existing obligations and potentially impacting credit ratings.

- Impact on Valuation: Higher discount rates, driven by increased interest rates, can negatively affect the valuation of companies like Dishman Carbogen Amcis in discounted cash flow (DCF) analyses.

R&D Investment Trends in the Pharmaceutical Sector

Research and development (R&D) investment is a critical driver for contract development and manufacturing organizations (CDMOs) like Dishman Carbogen Amcis. Increased R&D spending by pharmaceutical and biopharmaceutical firms directly translates to a higher demand for specialized services such as custom synthesis and process development. For instance, global pharmaceutical R&D spending was projected to reach over $240 billion in 2024, with a significant portion allocated to novel drug discovery and development.

Shifts in R&D focus areas significantly influence the project pipeline for CDMOs. The growing emphasis on biologics, gene therapies, and oncology treatments requires specialized expertise and manufacturing capabilities. In 2024, oncology continued to be a leading therapeutic area for R&D investment, accounting for approximately 30% of all new drug approvals. This trend benefits CDMOs equipped to handle complex biologics and advanced therapies.

Outsourcing trends within the pharmaceutical industry also play a crucial role in Dishman Carbogen Amcis's growth. As companies increasingly focus on core competencies and seek cost efficiencies, they are outsourcing more R&D and manufacturing activities. The global CDMO market was valued at over $150 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 7-8% through 2025. This expansion indicates a strong market for CDMO services.

- Projected Global Pharmaceutical R&D Spending (2024): Over $240 billion.

- Oncology's Share of R&D Investment (2024): Approximately 30% of new drug approvals.

- Global CDMO Market Value (2023): Exceeded $150 billion.

- Projected CDMO Market CAGR (through 2025): 7-8%.

Economic growth is a key driver for the pharmaceutical sector, influencing demand for contract development and manufacturing organizations (CDMOs) like Dishman Carbogen Amcis. The IMF projected 3.2% global growth for 2024, suggesting a generally favorable environment for outsourcing, though recessionary fears could dampen this. Currency fluctuations, particularly for companies with global operations, present a significant risk, impacting revenue translation and input costs.

Inflation, especially in raw materials and energy, directly increases operational expenses for CDMOs. For example, the US Producer Price Index for chemicals saw a notable increase in early 2024. This pressure on costs can squeeze profit margins if higher expenses cannot be fully passed on to clients. The cost of capital, influenced by interest rates, also affects investment feasibility and debt management for companies like Dishman Carbogen Amcis.

Pharmaceutical R&D spending, projected to exceed $240 billion in 2024, fuels demand for CDMO services. Shifts in R&D focus, such as the increasing emphasis on oncology (around 30% of approvals in 2024), require specialized capabilities. The overall CDMO market, valued over $150 billion in 2023, is expected to grow at a CAGR of 7-8% through 2025, underscoring the sector's expansion.

What You See Is What You Get

Dishman Carbogen Amcis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Dishman Carbogen Amcis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping its strategic landscape.

Sociological factors

The world's population is getting older. By 2050, it's projected that one in six people globally will be 65 or older, a significant jump from one in eleven in 2020. This demographic shift directly fuels a greater need for healthcare, particularly for chronic diseases and age-related conditions. For companies like Dishman Carbogen Amcis, which provides crucial drug development and manufacturing services, this trend translates into a steady and growing demand for their expertise, especially in areas like oncology, cardiovascular health, and neurological disorders.

Growing public awareness of health and wellness is a significant sociological driver. Globally, there's an increasing demand for preventive medicines and treatments that support healthier lifestyles. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to grow, indicating a strong consumer focus on well-being.

Evolving lifestyle choices, such as increased physical activity and healthier diets, also shape pharmaceutical demand. This trend can shift focus towards generics and specialized treatments for lifestyle-related conditions, requiring Contract Development and Manufacturing Organizations (CDMOs) like Dishman Carbogen Amcis to adapt their service offerings to support these emerging areas of drug development.

Public trust in the pharmaceutical sector significantly impacts companies like Dishman Carbogen Amcis. For instance, in 2024, surveys indicated that while many acknowledge the industry's role in innovation, concerns about drug affordability and pricing practices, particularly highlighted by events in late 2023 and early 2024, continue to erode public confidence. This can translate into heightened regulatory pressure and demands for greater transparency, influencing operational costs and strategic decisions for contract development and manufacturing organizations (CDMOs).

Workforce Availability and Skill Sets

The availability of highly skilled labor, especially scientists, engineers, and manufacturing experts proficient in intricate chemical processes and pharmaceutical manufacturing, is paramount for Dishman Carbogen Amcis. A deficit in specialized skills or a scarcity of available talent in critical operational areas can directly constrain production capabilities and escalate labor expenses.

These skill gaps can also impede the company's ability to scale operations, integrate novel technologies, or pursue strategic growth initiatives effectively. For instance, in 2024, the global pharmaceutical industry faced ongoing challenges in recruiting specialized talent, with reports indicating a shortage of experienced process chemists and biopharmaceutical manufacturing technicians in key markets.

- Skilled Workforce Demand: High demand for scientists and engineers in complex chemical synthesis and pharmaceutical production.

- Impact of Shortages: Labor deficits can limit operational capacity and increase labor costs.

- Technology Adoption: Lack of specialized skills may hinder the implementation of advanced manufacturing technologies.

- Regional Variations: Skill availability can differ significantly across geographical operating regions.

Demand for Personalized Medicine

The increasing demand for personalized medicine, encompassing advanced treatments like gene and cell therapies, necessitates specialized manufacturing and development expertise. This trend requires Contract Development and Manufacturing Organizations (CDMOs) to invest in novel technologies and processes to support the creation and production of highly targeted, small-batch therapies.

This shift presents a significant growth avenue for companies like Dishman Carbogen Amcis, as the global personalized medicine market was projected to reach USD 650 billion by 2024, with a compound annual growth rate of over 10% in the preceding years.

- Specialized Manufacturing Needs: Advanced therapies require sterile, controlled environments and complex processing techniques, demanding significant capital investment in facilities and equipment.

- Expertise in Complex Modalities: The development and production of gene and cell therapies require highly skilled personnel with expertise in molecular biology, virology, and aseptic processing.

- Growth Opportunity in Niche Markets: Catering to the personalized medicine segment allows CDMOs to tap into high-value, lower-volume markets with substantial profit potential.

- Regulatory Landscape Evolution: Navigating the evolving regulatory pathways for novel therapies is crucial, requiring CDMOs to maintain robust quality systems and regulatory affairs capabilities.

Societal attitudes towards health and wellness continue to evolve, driving demand for preventive care and treatments supporting active lifestyles. This trend directly influences the pharmaceutical industry, requiring companies like Dishman Carbogen Amcis to align their services with emerging health priorities.

The increasing prevalence of chronic diseases, often linked to aging populations and lifestyle factors, presents a sustained demand for pharmaceutical solutions. By 2024, the global burden of non-communicable diseases accounted for a significant portion of healthcare expenditure, underscoring the ongoing need for effective drug development and manufacturing.

Public perception of the pharmaceutical sector, particularly concerning drug pricing and accessibility, remains a critical sociological factor. Concerns raised in late 2023 and early 2024 regarding affordability can lead to increased scrutiny and regulatory pressures, impacting operational strategies for CDMOs.

Technological factors

Continuous innovation in drug discovery, like high-throughput screening and computational chemistry, directly influences the molecules Dishman Carbogen Amcis is tasked with synthesizing. These advancements, including the rise of mRNA and gene therapies, are reshaping the demand for specialized manufacturing capabilities.

Staying ahead of these technological shifts is crucial for Dishman Carbogen Amcis to provide leading-edge custom synthesis and process development. For instance, the increasing complexity of biologics and targeted therapies requires CDMOs to invest in new platforms and expertise, a trend expected to continue through 2025.

The pharmaceutical manufacturing sector is seeing a significant surge in automation and AI adoption. This trend is driven by the potential to boost efficiency, cut operational expenses, and elevate product quality. For instance, by 2024, the global market for AI in manufacturing was projected to reach $10.4 billion, with pharmaceuticals being a key segment.

Dishman Carbogen Amcis can gain a substantial competitive edge by integrating these advanced technologies into its operations. This could translate to faster production cycles and more robust quality assurance. However, realizing these benefits necessitates considerable capital outlay for new equipment and the development of a highly skilled workforce capable of managing and maintaining these sophisticated systems.

The pharmaceutical industry is undergoing a significant shift, driven by rapid advancements in biotechnology. This includes the burgeoning fields of biologics, gene therapies, and cell therapies, which are fundamentally changing how medicines are developed and manufactured.

These complex biological molecules demand specialized manufacturing processes that differ greatly from the production of traditional small molecule Active Pharmaceutical Ingredients (APIs). Companies must invest in new technologies and expertise to handle these intricate products.

Dishman Carbogen Amcis has proactively responded to this trend by making strategic investments in critical areas such as Antibody-Drug Conjugate (ADC) manufacturing. This focus on ADCs, a rapidly growing segment within biopharmaceuticals, demonstrates the company's commitment to adapting and capitalizing on these high-growth therapeutic areas. The global ADC market, for instance, was valued at approximately $10.7 billion in 2023 and is projected to grow substantially in the coming years, highlighting the strategic importance of such investments.

Digital Transformation in Supply Chain

The digitalization of supply chain management is fundamentally reshaping how companies operate. For a global Contract Development and Manufacturing Organization (CDMO) like Dishman Carbogen Amcis, embracing technologies such as real-time tracking, predictive analytics, and blockchain offers significant advantages. These digital tools can dramatically improve transparency, boost operational efficiency, and build greater resilience within complex global networks.

By optimizing logistics and reducing lead times, Dishman Carbogen Amcis can ensure the timely and secure delivery of sensitive pharmaceutical materials. This enhanced supply chain security is paramount in the pharmaceutical industry, where disruptions can have severe consequences for patient care and regulatory compliance. In 2024, the global supply chain management market was valued at over $30 billion, with digital solutions representing a significant growth driver, indicating strong industry adoption of these advancements.

- Real-time tracking provides immediate visibility into inventory and shipments, crucial for high-value pharmaceutical components.

- Predictive analytics can forecast potential disruptions, allowing for proactive mitigation strategies, thereby reducing delays.

- Blockchain technology enhances traceability and security, ensuring the integrity of the pharmaceutical supply chain from raw materials to finished products.

Data Security and Cybersecurity Threats

The increasing digitization of research and development, manufacturing processes, and client data management for companies like Dishman Carbogen Amcis elevates the importance of data security and protection against cyber threats. Safeguarding proprietary intellectual property and sensitive client information is absolutely critical for maintaining trust and adhering to strict data privacy regulations. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the significant financial and reputational risks involved.

Dishman Carbogen Amcis must prioritize investment in advanced cybersecurity measures to effectively mitigate these evolving risks. This includes implementing multi-layered security protocols, regular vulnerability assessments, and comprehensive employee training programs. Failure to do so could lead to data breaches, intellectual property theft, and substantial regulatory fines, impacting operational continuity and market standing.

- Data Security Investment: Cybersecurity spending globally is expected to exceed $300 billion in 2024, highlighting the industry's focus on protection.

- Intellectual Property Protection: Pharmaceutical and chemical sectors are prime targets for IP theft, making robust digital defenses a strategic imperative.

- Regulatory Compliance: Adherence to regulations like GDPR and CCPA necessitates strong data protection frameworks to avoid penalties.

The company must stay abreast of technological advancements in drug discovery, such as AI-driven molecule design and high-throughput screening, which directly impact the complexity of compounds it synthesizes. The increasing demand for specialized manufacturing capabilities for biologics and gene therapies, a trend projected to continue through 2025, necessitates ongoing investment in new platforms and expertise.

Legal factors

Strong intellectual property (IP) protection laws are vital in pharmaceuticals, encouraging innovation and shielding exclusive drug formulas and production methods. Dishman Carbogen Amcis prioritizes client IP safeguarding to build trust and secure contract manufacturing deals, a cornerstone of their business model.

In 2024, the global pharmaceutical patent landscape saw continued focus on biologics and complex generics, with regulatory bodies like the FDA and EMA reinforcing data exclusivity periods. Any shifts in patent enforceability or duration, such as potential changes in patent linkage regulations in key markets, could significantly influence drug development timelines and the competitive dynamics within the Contract Development and Manufacturing Organization (CDMO) sector.

Compliance with rigorous drug approval processes and oversight from global regulatory bodies like the US Food and Drug Administration (USFDA), European Medicines Agency (EMA), China's National Medical Products Administration (NMPA), and Japan's Pharmaceuticals and Medical Devices Agency (PMDA) is paramount for Dishman Carbogen Amcis. These agencies dictate the standards for drug development, manufacturing, and quality control, directly impacting market access and operational viability.

The company's commitment to meeting these stringent requirements is demonstrated through regular inspections and the attainment of critical certifications. For instance, securing and maintaining accreditations such as USFDA approval, EDQM certification, EUDRA GMP, and PMDA compliance are essential. These certifications validate that Dishman Carbogen Amcis's facilities and manufacturing processes adhere to the highest international standards for safety and quality, fostering client trust and enabling entry into key global pharmaceutical markets.

Environmental, Health, and Safety (EHS) regulations are a critical legal factor for Dishman Carbogen Amcis. These stringent rules cover everything from how pharmaceutical manufacturing waste is handled and emissions are controlled to ensuring a safe working environment for employees. For instance, in 2024, the European Union continued to tighten its directives on chemical safety and waste disposal, impacting operations in France.

Adherence to these global EHS standards is non-negotiable for Dishman Carbogen Amcis across all its operational bases, including Switzerland, France, and India. Failure to comply not only jeopardizes employee well-being and the environment but also carries the risk of substantial fines and operational shutdowns. In 2024, the pharmaceutical industry faced an average of $1.5 million in fines for EHS violations in Europe.

Meeting these demanding legal requirements often necessitates considerable financial commitment. Companies like Dishman Carbogen Amcis must invest in advanced infrastructure, such as state-of-the-art waste treatment facilities and emission control systems, alongside comprehensive employee training programs. These investments are crucial for maintaining operational integrity and avoiding costly penalties.

Product Liability Laws

Product liability laws hold companies like Dishman Carbogen Amcis accountable for any harm caused by their manufactured products, particularly the active pharmaceutical ingredients (APIs) and finished drug products. This necessitates rigorous quality control and strict adherence to global Good Manufacturing Practices (GMP) to ensure safety and efficacy. Failure to meet these standards can lead to significant legal repercussions and damage to client relationships. For instance, in 2024, regulatory bodies worldwide continue to emphasize stringent oversight of pharmaceutical manufacturing, with recalls due to quality defects remaining a concern across the industry.

To effectively manage product liability, CDMOs must implement comprehensive quality assurance systems. This includes meticulous testing at every stage of production, from raw material sourcing to final product release. Maintaining detailed batch records and traceability is crucial for demonstrating compliance and addressing any potential issues promptly. The global pharmaceutical market, valued at over $1.5 trillion in early 2025, underscores the immense responsibility and potential liability associated with API and drug manufacturing.

- API Quality Assurance: Ensuring all manufactured APIs meet stringent purity, potency, and safety specifications is paramount.

- GMP Compliance: Adherence to current Good Manufacturing Practices (cGMP) is non-negotiable for pharmaceutical production.

- Traceability: Maintaining complete traceability of all materials and processes is vital for recall management and investigations.

- Regulatory Scrutiny: Increased regulatory inspections and enforcement actions in 2024-2025 highlight the importance of proactive compliance.

Anti-trust and Competition Laws

Anti-trust and competition laws are crucial for maintaining a level playing field in the pharmaceutical contract development and manufacturing organization (CDMO) sector. These regulations aim to prevent monopolistic practices and ensure fair competition, impacting how companies like Dishman Carbogen Amcis operate. For instance, in 2024, regulatory bodies globally, including the European Commission and the US Federal Trade Commission, continued to scrutinize large-scale mergers and acquisitions within the life sciences industry, potentially affecting consolidation opportunities for CDMOs.

Dishman Carbogen Amcis must navigate a complex web of these laws across its operating regions. This includes ensuring that its pricing strategies, supply agreements, and any potential joint ventures or collaborations do not stifle competition or create unfair advantages. For example, a CDMO found to be engaging in price-fixing or market allocation could face significant fines and reputational damage, as seen in past cases within the broader pharmaceutical supply chain.

Compliance is not just about avoiding penalties; it's integral to sustainable business growth. By adhering to competition laws, Dishman Carbogen Amcis can foster trust with clients and partners, and secure its long-term market position. The ongoing enforcement actions and evolving regulatory landscape in 2024 and projected into 2025 underscore the importance of proactive legal counsel and robust internal compliance programs for CDMOs.

- Regulatory Scrutiny: Increased focus by global competition authorities on mergers and acquisitions within the pharmaceutical sector in 2024.

- Compliance Requirements: Ensuring pricing, supply agreements, and collaborations adhere to anti-trust regulations in all operating jurisdictions.

- Risk Mitigation: Avoiding penalties and reputational damage through strict adherence to competition laws, crucial for sustainable growth.

- Market Integrity: Upholding fair competition principles to maintain trust and a stable market environment for CDMO services.

Navigating the intricate legal landscape is fundamental for Dishman Carbogen Amcis, particularly concerning intellectual property (IP) protection and regulatory compliance. In 2024, the global pharmaceutical industry saw a continued emphasis on safeguarding biologics and complex generics, with regulatory bodies reinforcing data exclusivity periods.

The company's adherence to rigorous drug approval processes, overseen by entities like the USFDA and EMA, is crucial for market access. Maintaining certifications such as USFDA approval and EUDRA GMP validates their commitment to international quality standards. Furthermore, stringent Environmental, Health, and Safety (EHS) regulations, which saw tightened directives in the EU in 2024, necessitate significant investment in advanced infrastructure and training to avoid substantial fines and operational disruptions.

Product liability laws also demand meticulous quality assurance and adherence to Good Manufacturing Practices (GMP) to ensure product safety and efficacy. Increased regulatory scrutiny in 2024-2025 highlights the importance of proactive compliance in this area. Finally, anti-trust and competition laws require careful navigation of pricing strategies and agreements to prevent monopolistic practices and maintain fair competition within the CDMO sector, with global authorities actively scrutinizing mergers and acquisitions in 2024.

| Legal Factor | 2024/2025 Focus | Impact on Dishman Carbogen Amcis |

|---|---|---|

| Intellectual Property (IP) Protection | Safeguarding biologics and complex generics; reinforced data exclusivity. | Essential for securing contract manufacturing deals and building client trust. |

| Regulatory Compliance (FDA, EMA, etc.) | Stringent oversight of drug approval, manufacturing, and quality control. | Directly impacts market access and operational viability; requires certifications (e.g., USFDA, EUDRA GMP). |

| Environmental, Health, and Safety (EHS) | Tightened directives on chemical safety and waste disposal (e.g., EU). | Necessitates investment in advanced infrastructure and training; non-compliance risks fines and shutdowns. |

| Product Liability | Emphasis on stringent quality control and GMP adherence; ongoing recalls due to quality defects. | Requires comprehensive quality assurance systems and meticulous traceability to mitigate legal repercussions. |

| Anti-trust and Competition Laws | Scrutiny of mergers and acquisitions; focus on fair competition. | Requires adherence to laws in pricing, supply agreements, and collaborations to avoid penalties and maintain market integrity. |

Environmental factors

The pharmaceutical sector, including companies like Dishman Carbogen Amcis, is under growing scrutiny to embrace sustainable manufacturing. This involves actively reducing waste and ensuring responsible disposal of chemical by-products, a trend amplified in 2024 and projected to intensify. For instance, the global pharmaceutical waste management market was valued at approximately $11.5 billion in 2023 and is expected to grow, reflecting this industry-wide focus.

Dishman Carbogen Amcis's commitment to green chemistry and process optimization directly addresses these environmental pressures. By minimizing by-products and enhancing the efficiency of chemical waste treatment, the company not only bolsters its environmental credentials but also potentially achieves significant operational cost savings. A 2024 report highlighted that pharmaceutical companies investing in sustainable processes saw an average reduction of 15% in waste disposal costs.

Global efforts to combat climate change are intensifying, prompting companies like Dishman Carbogen Amcis to set ambitious carbon footprint reduction goals. This is particularly relevant for their European sites, which are often subject to stricter environmental regulations and greater client demand for sustainability.

The company may need to invest in renewable energy sources, such as solar or wind power, to decrease reliance on fossil fuels. Enhancing energy efficiency across manufacturing processes and exploring innovative carbon capture technologies will also be crucial to meet international environmental targets and satisfy the growing expectation for sustainable supply chains from their customers.

The availability and cost of vital resources like water and energy are paramount for pharmaceutical manufacturing operations. For Dishman Carbogen Amcis, increasing scarcity or escalating prices of these resources directly affects production expenses and the company's ability to operate sustainably.

In 2024, global energy prices saw volatility, with crude oil averaging around $80 per barrel for much of the year, impacting manufacturing overheads. Similarly, water scarcity in key industrial regions can lead to higher operational costs and potential production disruptions, a factor Dishman Carbogen Amcis must actively manage.

To ensure long-term viability, Dishman Carbogen Amcis must focus on implementing robust strategies for efficient resource utilization. This includes investing in water recycling technologies and exploring energy-efficient manufacturing processes, alongside investigating alternative energy sources to mitigate the risks associated with traditional supplies.

Climate Change Impact on Supply Chains

Climate change poses significant threats to global supply chains, with extreme weather events increasingly disrupting the sourcing of raw materials and the delivery of finished goods. For a Contract Development and Manufacturing Organization (CDMO) like Dishman Carbogen Amcis, which operates a global network, understanding and addressing these climate-related vulnerabilities is paramount for maintaining operational continuity.

The company's reliance on a complex web of suppliers and logistics partners means that disruptions in one region can have cascading effects across its entire value chain. For instance, the increasing frequency of floods, droughts, and storms, as observed in various reports throughout 2024, can damage manufacturing facilities, halt transportation, and impact agricultural output, which is often a source of key chemical precursors.

- Supplier Diversification: Proactively identifying and onboarding alternative suppliers in geographically diverse regions to mitigate risks associated with localized climate events.

- Logistics Route Optimization: Developing contingency plans for transportation, including exploring alternative shipping routes and modes that are less susceptible to weather-related disruptions.

- Inventory Management: Strategically increasing buffer stocks for critical raw materials to absorb short-term supply shocks.

- Climate Risk Assessment: Integrating climate risk assessments into supplier selection and ongoing due diligence processes to ensure partners have robust resilience strategies.

Compliance with Environmental Regulations

Dishman Carbogen Amcis faces a dynamic landscape of environmental regulations, with standards for emissions, water discharge, and chemical handling continually shifting across its global operations. For instance, in 2024, the European Union continued to tighten its grip on industrial emissions through initiatives like the Industrial Emissions Directive, impacting manufacturing processes. Failure to adhere to these evolving rules can result in significant financial penalties and legal repercussions, underscoring the critical need for unwavering compliance.

Maintaining rigorous compliance is paramount to safeguarding Dishman Carbogen Amcis's reputation and avoiding operational disruptions. The company's proactive investments in advanced environmental management systems are therefore not just a matter of regulatory adherence but a strategic imperative. By consistently meeting or exceeding these stringent standards, the company mitigates risks and demonstrates its commitment to sustainable practices, a factor increasingly valued by investors and stakeholders.

The company's commitment to environmental stewardship is reflected in its ongoing efforts to upgrade facilities and processes. For example, a 2024 report highlighted investments in wastewater treatment technologies at several key sites, aiming to reduce chemical discharge by an estimated 15% by the end of 2025. Such initiatives are crucial for navigating the complex web of international environmental laws.

- Evolving Regulations: Environmental standards for emissions, water, and chemicals are in constant flux globally.

- Risk Mitigation: Non-compliance can lead to fines, legal action, and severe reputational damage.

- Strategic Investment: Proactive investment in environmental management systems is essential for meeting and exceeding compliance targets.

- Sustainability Focus: Demonstrating strong environmental performance enhances corporate reputation and stakeholder confidence.

The pharmaceutical industry, including Dishman Carbogen Amcis, is facing increasing pressure to adopt sustainable manufacturing practices. This involves minimizing waste and responsibly managing chemical by-products, a trend that gained momentum in 2024 and is expected to intensify. The global pharmaceutical waste management market was valued at approximately $11.5 billion in 2023, underscoring this industry-wide focus on environmental responsibility.

Dishman Carbogen Amcis's adoption of green chemistry principles and process optimization directly addresses these environmental challenges. By reducing by-products and improving chemical waste treatment, the company not only enhances its environmental standing but also has the potential to realize substantial operational cost savings. A 2024 report indicated that pharmaceutical firms investing in sustainable processes experienced an average 15% decrease in waste disposal costs.

Global efforts to combat climate change are escalating, compelling companies like Dishman Carbogen Amcis to set ambitious targets for reducing their carbon footprint. This is particularly relevant for their European facilities, which are often subject to more stringent environmental regulations and higher client expectations for sustainability.

The company may need to invest in renewable energy sources, such as solar or wind power, to lessen its dependence on fossil fuels. Improving energy efficiency across manufacturing operations and exploring innovative carbon capture technologies will also be vital for meeting international environmental goals and satisfying the growing demand for sustainable supply chains from customers.

The availability and cost of essential resources like water and energy are critical for pharmaceutical manufacturing. For Dishman Carbogen Amcis, increasing scarcity or rising prices of these resources directly impact production expenses and the company's ability to operate sustainably.

In 2024, global energy prices experienced volatility, with crude oil averaging around $80 per barrel for much of the year, affecting manufacturing overheads. Similarly, water scarcity in key industrial regions can lead to higher operational costs and potential production disruptions, a factor Dishman Carbogen Amcis must actively manage.

To ensure long-term viability, Dishman Carbogen Amcis must focus on implementing robust strategies for efficient resource utilization. This includes investing in water recycling technologies and exploring energy-efficient manufacturing processes, alongside investigating alternative energy sources to mitigate the risks associated with traditional supplies.

Climate change presents significant threats to global supply chains, with extreme weather events increasingly disrupting the sourcing of raw materials and the delivery of finished goods. For a Contract Development and Manufacturing Organization (CDMO) like Dishman Carbogen Amcis, which operates a global network, understanding and addressing these climate-related vulnerabilities is paramount for maintaining operational continuity.

The company's reliance on a complex web of suppliers and logistics partners means that disruptions in one region can have cascading effects across its entire value chain. For instance, the increasing frequency of floods, droughts, and storms, as observed in various reports throughout 2024, can damage manufacturing facilities, halt transportation, and impact agricultural output, which is often a source of key chemical precursors.

| Environmental Factor | Impact on Dishman Carbogen Amcis | Key Considerations/Actions (2024-2025) |

| Climate Change & Extreme Weather | Disruptions to supply chains, raw material sourcing, and logistics. Potential damage to facilities. | Supplier diversification, logistics route optimization, enhanced inventory management, climate risk assessment in supplier selection. |

| Resource Availability & Cost (Water, Energy) | Increased operational costs, potential production disruptions due to scarcity or price hikes. | Investment in water recycling, energy-efficient processes, exploration of alternative energy sources. |

| Environmental Regulations & Compliance | Need for continuous adherence to evolving standards for emissions, water discharge, and chemical handling across global operations. | Proactive investment in advanced environmental management systems, upgrading facilities and processes, ensuring robust wastewater treatment technologies. |

| Waste Management & Green Chemistry | Growing scrutiny on sustainable manufacturing, waste reduction, and responsible chemical by-product disposal. | Commitment to green chemistry, process optimization to minimize by-products, enhancing chemical waste treatment efficiency. |

PESTLE Analysis Data Sources

Our Dishman Carbogen Amcis PESTLE Analysis is grounded in a comprehensive review of public and proprietary data. This includes regulatory filings, industry-specific market research, and economic indicators to ensure a holistic understanding of the macro-environment.