Diös Fastigheter PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diös Fastigheter Bundle

Navigate the evolving landscape of the Swedish real estate market with our comprehensive PESTLE analysis of Diös Fastigheter. Understand how political shifts, economic fluctuations, and technological advancements are shaping their operations and future growth. Gain a strategic advantage by uncovering critical social and environmental factors that influence investment decisions. Download the full analysis now to unlock actionable insights and strengthen your market strategy.

Political factors

Government regional development policies, particularly those focused on northern Sweden, are a key political factor influencing Diös Fastigheter. Initiatives like the Swedish government's commitment to fostering growth in Norrland, often supported by significant public funding, directly impact the company's operating environment. For instance, the 2024 budget allocated substantial funds towards infrastructure projects and business incentives in these areas, aiming to stimulate economic activity and job creation.

These policies translate into tangible opportunities for Diös Fastigheter by increasing demand for commercial and residential real estate. Investments in transportation networks, such as high-speed rail or improved road infrastructure, make regions more attractive for businesses and residents alike. Furthermore, tax incentives or grants for companies relocating or expanding in northern Sweden can boost occupancy rates and rental income for Diös's property portfolio.

Local and regional political decisions on urban planning and zoning are critical for Diös Fastigheter, dictating where new developments can occur and existing properties can be redeveloped. For instance, in 2024, several Swedish municipalities where Diös operates, such as Sundsvall and Östersund, have been actively revising their master plans, often prioritizing sustainable urban growth and mixed-use developments. These shifts can present both opportunities and challenges, influencing project timelines and potential returns on investment.

The stringency or flexibility of zoning laws, covering aspects like land use, building height restrictions, and density allowances, directly impacts Diös Fastigheter's ability to execute its expansion strategies. For example, a region might introduce new regulations in 2025 that favor taller buildings to increase housing density, potentially benefiting Diös's portfolio. Conversely, tighter controls on commercial development could limit future growth prospects in certain areas.

Navigating this complex regulatory environment is a core operational consideration for Diös Fastigheter. The company's success in securing permits and approvals for its projects in 2024 and projected for 2025 hinges on its understanding and adaptation to evolving political landscapes and planning frameworks across its key markets in Sweden.

Sweden's historically stable political landscape offers a predictable environment crucial for Diös Fastigheter's long-term real estate investment strategy. This stability underpins confidence in the business climate, facilitating consistent planning and execution of capital-intensive projects. For instance, the Swedish government's commitment to economic growth, as evidenced by its fiscal policies, generally supports sectors like real estate.

However, potential shifts in government or policy priorities could introduce uncertainty. Changes to property taxation, environmental regulations impacting construction, or alterations in subsidies for sustainable development could directly affect Diös' operational costs and investment returns. The current political climate, with a focus on energy security and green transitions, suggests continued emphasis on sustainability, which Diös is already aligning with through its portfolio strategy.

Public Sector Investment in Infrastructure

Government decisions regarding infrastructure investments in northern Sweden are a significant political factor for Diös Fastigheter. Increased public sector spending on transportation networks, utilities, and public services directly boosts the appeal and accessibility of Diös's property portfolio. For instance, the Swedish government's commitment to developing the Norrbotniabanan railway, a project with substantial investment, will significantly improve connectivity in the region where Diös has a strong presence. This enhanced infrastructure is crucial for supporting Diös's strategy of focusing on 'growth cities' by attracting businesses and residents.

These infrastructure upgrades translate into tangible benefits for Diös Fastigheter. Improved accessibility and better public services can lead to higher property valuations and a stronger demand for commercial and residential spaces. The Swedish government's national infrastructure plan for 2022-2033 allocates significant funds to regional development and transportation, directly impacting areas where Diös operates. This public investment acts as a catalyst for private sector growth, making Diös's locations more attractive for tenants and investors alike.

- Increased Accessibility: Government investments in transportation, such as new roads or rail lines, make Diös's properties more accessible to customers and employees.

- Property Value Enhancement: Improved infrastructure is directly linked to increased property values in the surrounding areas.

- Attracting Talent and Business: Better infrastructure supports economic growth, drawing businesses and a skilled workforce to Diös's operational regions.

- Support for Growth Cities: Public investment aligns with and reinforces Diös's strategic focus on developing and capitalizing on growth potential in key Swedish cities.

Real Estate Taxation Policies

Changes to Swedish real estate taxation policies, including property taxes and corporate levies, directly influence Diös Fastigheter's financial performance and investment viability. For instance, a potential increase in the property tax rate could reduce net operating income for properties held by Diös. The government's stance on wealth distribution and fair taxation often centers on real estate, creating a dynamic environment for policy adjustments.

Monitoring these evolving tax landscapes is crucial for Diös Fastigheter's strategic financial planning and forecasting. For example, discussions in the Swedish Riksdag regarding potential adjustments to capital gains tax on property sales could impact Diös's future divestment strategies. The company must remain agile to adapt to any new real estate-related fiscal measures introduced by the government.

Key considerations for Diös Fastigheter include:

- Potential increases in property transfer taxes impacting acquisition costs.

- Changes to corporate income tax rates affecting overall profitability.

- Government incentives or disincentives for specific types of real estate development or ownership.

- The impact of any proposed wealth taxes on real estate holdings.

Government policies promoting regional development in northern Sweden, such as infrastructure investments and business incentives, directly benefit Diös Fastigheter by increasing property demand and value. For example, the Swedish government's continued focus on developing growth cities in Norrland, supported by public funding, aligns with Diös's strategic expansion. The national infrastructure plan, with significant allocations for regional development through 2033, is expected to enhance connectivity and attractiveness in Diös's key markets.

Changes in real estate taxation, including property and corporate taxes, can significantly impact Diös Fastigheter's profitability and investment strategies. For instance, adjustments to capital gains tax or property transfer taxes, as debated in the Swedish Riksdag, require careful monitoring for financial planning. The company must remain adaptable to evolving fiscal measures that could affect its operational costs and investment returns.

The stability of Sweden's political environment provides a predictable framework for Diös Fastigheter's long-term real estate investments, fostering confidence in the business climate. However, potential policy shifts concerning environmental regulations or development subsidies could alter operational costs and investment returns. Diös's proactive alignment with sustainability trends, driven by the current political emphasis on green transitions, positions it favorably.

Local planning and zoning decisions are critical for Diös Fastigheter's development projects, influencing where and how new properties can be built or redeveloped. Municipalities like Sundsvall and Östersund are updating master plans in 2024, often favoring sustainable, mixed-use developments. Diös's ability to navigate these evolving regulatory landscapes and secure necessary permits is key to its project execution and investment success.

| Political Factor | Impact on Diös Fastigheter | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Regional Development Policies | Increased property demand and value in northern Sweden | Swedish government's continued investment in Norrland's growth cities; National infrastructure plan (2022-2033) |

| Real Estate Taxation | Affects profitability and investment viability | Potential adjustments to property transfer taxes or capital gains tax debated in Riksdag |

| Political Stability | Provides predictable investment environment | Stable fiscal policies supporting real estate sector |

| Urban Planning & Zoning | Dictates development opportunities and timelines | Municipal master plan revisions in Sundsvall and Östersund favoring sustainable development |

What is included in the product

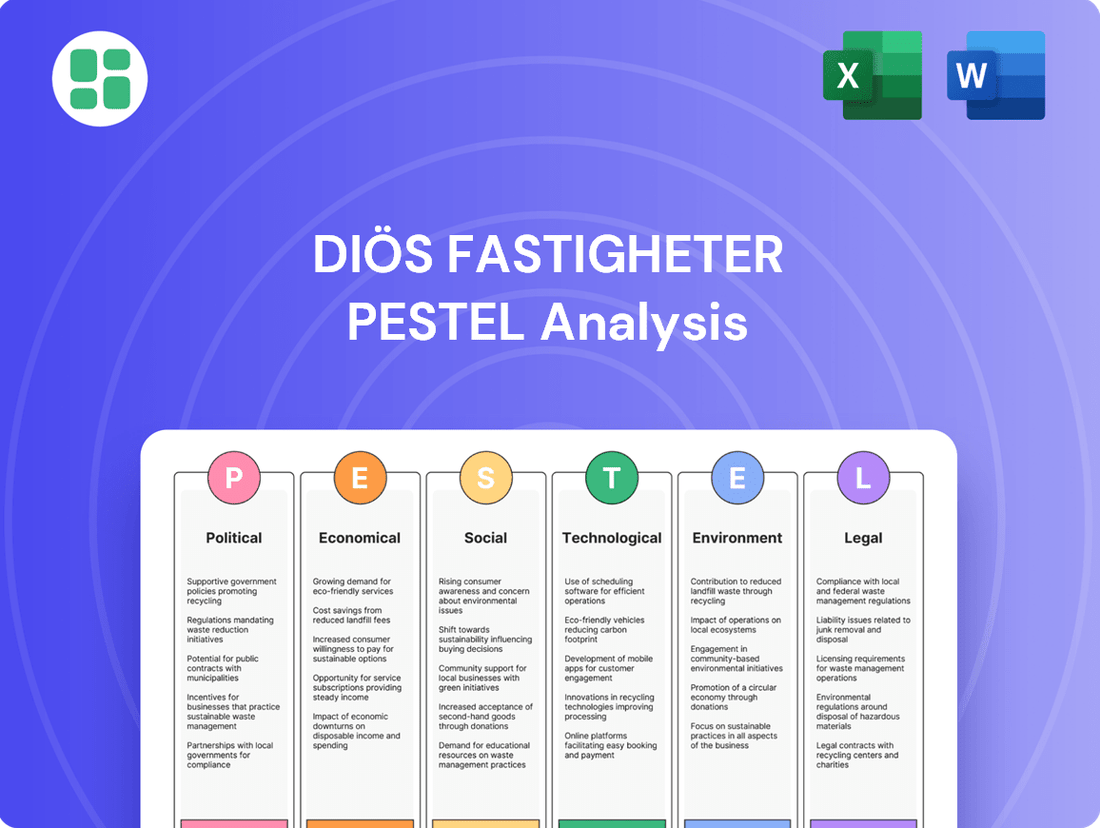

This PESTLE analysis for Diös Fastigheter delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, offering a comprehensive view of the external landscape.

It provides actionable insights by highlighting specific opportunities and threats derived from current market trends and regulatory shifts relevant to Diös Fastigheter's business environment.

The Diös Fastigheter PESTLE analysis provides a structured framework to identify and mitigate external risks, acting as a pain point reliever by highlighting potential challenges and opportunities for proactive strategic planning.

Economic factors

Interest rate fluctuations significantly impact Diös Fastigheter. The Riksbank's monetary policy directly affects borrowing costs, influencing the company's expenses for property acquisitions and development projects. For instance, if the Riksbank were to raise its key policy rate, Diös would likely face higher interest payments on its existing and new debt.

Higher interest rates can also put downward pressure on property valuations. This is because investors often use discount rates that are tied to prevailing interest rates when valuing real estate. A higher discount rate leads to a lower present value of future rental income, potentially reducing the overall worth of Diös's portfolio. Furthermore, increased borrowing costs for potential tenants could dampen demand for commercial or residential spaces.

Managing debt exposure and adapting financing strategies are therefore crucial for Diös Fastigheter, especially in periods of interest rate volatility. As of the latest available data in mid-2024, Sweden's inflation rate has shown signs of moderating, leading to discussions about potential shifts in the Riksbank's stance, though the exact timing and magnitude of any rate changes remain uncertain.

The economic health of northern Sweden, particularly in cities like Luleå, Umeå, and Östersund where Diös Fastigheter has a significant presence, is a critical driver of its performance. Strong growth in these regions directly boosts demand for commercial and residential properties.

For instance, the ongoing green industrial revolution in northern Sweden, with major investments in battery factories and steel production, is expected to fuel substantial economic expansion. Luleå, a key hub, is anticipating significant job creation and population growth, directly benefiting real estate demand.

In 2024, Sweden's GDP is projected to grow by 1.5%, with northern regions often exhibiting even more dynamic growth due to targeted industrial development. This upward economic trajectory translates into higher occupancy rates and increased rental income for Diös Fastigheter, as businesses expand and new residents seek housing.

Persistent high inflation in 2024 and projected into 2025 directly impacts Diös Fastigheter by escalating construction costs. Expect significant increases in prices for key materials like steel and concrete, alongside rising labor wages and energy expenses, which are crucial for any new development or renovation projects.

While rental income for Diös Fastigheter might eventually be adjusted to keep pace with inflation, this typically occurs with a time lag. This gap between rising expenses and delayed rental income adjustments can put considerable pressure on profit margins for ongoing and future developments throughout 2024 and 2025.

To mitigate these inflationary pressures, Diös Fastigheter must prioritize robust cost management and implement proactive procurement strategies. Securing material prices in advance and exploring alternative, cost-effective building solutions will be vital to maintaining project profitability in the current economic climate.

Rental Market Dynamics and Vacancy Rates

The balance between available rental properties and the demand from tenants is a key driver for Diös Fastigheter. This dynamic directly influences rental income and the overall value of their property portfolio. For instance, a tight market with low vacancy rates typically allows for rent increases, boosting revenue.

Conversely, high vacancy rates can put downward pressure on rents. In Q1 2024, Sweden's overall rental vacancy rate for commercial properties hovered around 8-10%, with regional variations. For Diös Fastigheter, this means actively managing their properties to keep occupancy high.

Monitoring local economic conditions and understanding evolving tenant preferences are therefore critical. Diös Fastigheter's strategy likely involves adapting to these shifts to ensure sustained demand for their spaces.

- Swedish commercial property vacancy rates in Q1 2024 were approximately 8-10%.

- High vacancy can lead to rent reductions, impacting Diös Fastigheter's income.

- Tenant needs and local market trends are crucial for maintaining occupancy.

- Diös Fastigheter must adapt to market shifts to ensure consistent rental demand.

Availability of Financing and Investor Sentiment

The availability of financing and investor sentiment significantly shape Diös Fastigheter's operational capacity. A robust financial market that is eager to lend, coupled with positive investor sentiment towards the real estate sector, directly translates into Diös Fastigheter's ability to secure capital for development and acquisitions. For instance, in early 2024, the Swedish real estate market experienced a cautious approach from lenders due to rising interest rates, potentially increasing Diös's cost of capital.

Investor sentiment, often reflected in stock market performance and capital flows, directly impacts property valuations and the ease with which companies like Diös can raise funds. A general downturn in investor confidence, as seen in certain periods of 2023, can lead to reduced investment opportunities and higher hurdles for securing new financing. Conversely, a more optimistic outlook, perhaps driven by anticipated economic recovery in late 2024 or early 2025, could lower Diös's cost of capital and boost property values.

Diös Fastigheter's strategic advantage lies in its access to diverse financing sources, which mitigates the risk associated with over-reliance on a single funding channel. This diversification is crucial in navigating periods of fluctuating market liquidity and investor appetite.

- Financing Availability: A tightening credit market in Sweden during late 2023 and early 2024 made securing new loans more challenging and expensive for real estate firms.

- Investor Sentiment: Investor confidence in the Swedish real estate sector showed signs of gradual improvement by mid-2024, following a period of correction in 2023.

- Cost of Capital: Higher interest rates in 2023 and 2024 directly increased the cost of debt financing for companies like Diös.

- Property Valuations: Investor caution in 2023 led to downward pressure on property valuations across the sector.

Economic factors significantly shape Diös Fastigheter's performance, with interest rate policy being a primary concern. The Riksbank's decisions directly influence borrowing costs, impacting Diös's expenses for acquisitions and development. Higher rates can also depress property valuations by increasing discount rates used in appraisals.

The economic vitality of northern Sweden, where Diös has a strong presence, is crucial. Investments in green industries are driving growth and population increases in cities like Luleå and Umeå, boosting demand for properties. Sweden's GDP growth, projected at 1.5% for 2024, supports this trend, leading to higher occupancy and rental income.

Inflation in 2024 and 2025 presents a challenge by increasing construction costs for materials, labor, and energy. While rents may eventually adjust, a lag can squeeze profit margins. Diös must focus on cost management and strategic procurement to maintain profitability.

Market balance between supply and demand for rental properties directly affects Diös's income and portfolio value. Low vacancy rates, around 8-10% for commercial properties in Q1 2024, allow for rent increases, but high vacancy can force rent reductions. Adapting to tenant needs and local market trends is key to maintaining high occupancy.

Financing availability and investor sentiment are critical. A tighter credit market in early 2024 increased the cost of capital for real estate firms like Diös. While investor confidence showed signs of recovery by mid-2024, market fluctuations can impact property valuations and funding accessibility.

| Economic Factor | Impact on Diös Fastigheter | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Affects borrowing costs and property valuations. | Riksbank policy shifts debated; rates remain a key consideration. |

| Regional Economic Growth | Drives property demand and rental income. | Green industrial investments boosting northern Sweden's economy. |

| Inflation | Increases construction costs, potentially squeezing margins. | Persistent inflation in 2024 impacting material and labor costs. |

| Market Vacancy Rates | Influences rental income and property values. | Commercial vacancy around 8-10% in Q1 2024; regional variations exist. |

| Financing & Investor Sentiment | Impacts capital access and cost of debt. | Cautious lending in early 2024; gradual improvement in sentiment by mid-2024. |

Full Version Awaits

Diös Fastigheter PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Diös Fastigheter PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

Sociological factors

Northern Sweden's growth cities are experiencing significant population increases, with a net migration of approximately 15,000 people in 2023 alone, according to Statistics Sweden. This demographic trend directly fuels demand for Diös Fastigheter's portfolio, as more residents require housing and commercial spaces to support local economies. Diös is strategically positioned to benefit from this sustained growth.

The surge in remote and hybrid work arrangements is fundamentally reshaping the commercial real estate landscape. For instance, reports indicate that by the end of 2024, approximately 30% of the global workforce is expected to be working remotely at least part-time, a significant increase from pre-pandemic levels. This shift directly impacts the demand for traditional office spaces, pushing companies to re-evaluate their footprint and seek more flexible, collaborative environments. Diös Fastigheter needs to consider how to adapt its portfolio to cater to these evolving needs, perhaps by incorporating more flexible office solutions or developing mixed-use properties that blend residential, retail, and workspace components.

Lifestyle changes are also playing a crucial role in property demand. As people spend more time in their local communities, there's a growing preference for accessible retail and service offerings. The convenience of having amenities nearby is becoming a key factor for consumers, influencing the success of retail and service-oriented properties. Diös Fastigheter should analyze these lifestyle shifts to ensure its retail and service properties align with current consumer preferences, potentially focusing on neighborhood-centric retail or essential services that complement residential areas.

There's a clear societal shift towards wanting homes and offices that are not just functional but also good for the planet and equipped with the latest conveniences. This means properties need to be energy-efficient and offer modern amenities to appeal to today's tenants.

Diös Fastigheter must actively invest in upgrading its existing portfolio and developing new properties to meet these rising expectations. For instance, focusing on green building certifications and smart home technology can attract environmentally conscious and tech-savvy renters.

In 2024, surveys indicated that over 70% of potential renters consider energy efficiency a key factor in their decision-making process, highlighting the critical need for Diös to prioritize sustainable features to remain competitive and desirable in the market.

Urbanization and City Development

Urbanization is a significant driver for Diös Fastigheter, as the company strategically targets growth cities. This trend, where populations and economic activities increasingly cluster in urban areas, directly aligns with Diös's portfolio of properties located in these expanding centers. For instance, Sweden's urban population has been steadily increasing, with a notable concentration in mid-sized cities where Diös has a strong presence.

Diös Fastigheter actively contributes to shaping these urban landscapes by developing modern, functional properties. These developments aim to enhance city centers and create appealing neighborhoods, fostering vibrant urban living and commercial spaces. Their involvement often includes close collaboration with municipal planning authorities to ensure developments meet city growth objectives.

- Urban Population Growth: Sweden's urban population is projected to continue its upward trajectory, with a significant portion of this growth occurring in the mid-sized cities where Diös Fastigheter operates.

- Property Development: Diös focuses on creating properties that not only meet current market demands but also contribute to the long-term attractiveness and functionality of urban areas.

- Municipal Partnerships: The company frequently engages in partnerships with local municipalities, a crucial aspect of urban development that ensures new projects integrate seamlessly with existing city plans and infrastructure.

Community Engagement and Social Responsibility

Societal expectations are pushing companies like Diös Fastigheter to actively contribute to the well-being of the communities where they operate. This means going beyond just providing real estate and focusing on creating positive social impact.

Diös Fastigheter's commitment to sustainable development and active engagement with local residents and businesses is crucial for building trust and maintaining its social license to operate. For instance, in 2023, the company reported a strong focus on community development projects across its portfolio, contributing to local initiatives that enhance quality of life.

- Community Investment: Diös Fastigheter's initiatives in 2023 supported local events and infrastructure improvements, fostering a sense of belonging and shared progress.

- Tenant Relations: By actively listening to and addressing tenant needs, Diös strengthens its relationships, leading to higher occupancy rates and tenant satisfaction, which was reflected in their 2023 annual report showing a high tenant retention rate.

- Local Authority Collaboration: Partnerships with local municipalities are vital for navigating urban development and ensuring projects align with community goals, a strategy that has proven effective in their recent urban regeneration projects.

- Reputation Enhancement: Demonstrating social responsibility not only bolsters Diös's public image but also attracts socially conscious investors and talent.

The increasing demand for sustainable and tech-enabled living spaces is a significant sociological trend. By the end of 2024, over 70% of potential renters prioritize energy efficiency, making it a key decision factor. Diös Fastigheter's investment in green building certifications and smart home technology directly addresses this, attracting environmentally conscious tenants and ensuring portfolio competitiveness.

Shifting work patterns, with an estimated 30% of the global workforce working remotely part-time by the end of 2024, are reshaping commercial real estate needs. Diös must adapt by offering flexible office solutions and mixed-use developments that cater to these evolving demands for collaborative and adaptable workspaces.

There's a societal push for companies to actively contribute to community well-being, a factor Diös Fastigheter addresses through its 2023 community development projects. This focus on social impact, alongside strong tenant relations and municipal partnerships, enhances reputation and fosters stronger community ties.

Technological factors

Diös Fastigheter's integration of smart building technologies, like IoT sensors for energy optimization and predictive maintenance, is crucial for boosting operational efficiency. These advancements can lead to substantial cost reductions and a more appealing environment for tenants.

The market for smart building technology is expanding rapidly. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a strong trend towards adoption.

Implementing smart access controls and advanced energy management systems not only enhances property value but also directly contributes to a better tenant experience, a key differentiator in the competitive real estate sector.

Diös Fastigheter is increasingly leveraging digital platforms to streamline property management. This includes using online portals for tenant communication, digital systems for maintenance requests, and automated administrative processes. These digital tools are designed to enhance operational efficiency across their entire property portfolio.

By adopting these digital solutions, Diös Fastigheter aims to improve responsiveness to tenant needs and reduce the administrative workload on its staff. For instance, a digital maintenance request system can expedite repairs, leading to higher tenant satisfaction. Such platforms also generate valuable data insights, enabling more informed decision-making regarding property operations and investments.

In 2024, the real estate sector saw continued investment in proptech, with companies reporting significant efficiency gains. For example, some property management firms using integrated digital platforms saw a reduction in operational costs by as much as 15% in the past year. Diös Fastigheter's focus on digitalization aligns with this industry trend, positioning them for greater efficiency and data-driven strategies in the coming years.

Advances in sustainable construction materials, like low-carbon concrete and advanced timber construction, present significant opportunities for Diös Fastigheter. For instance, the global green building materials market was valued at approximately USD 253.6 billion in 2023 and is projected to reach USD 478.9 billion by 2030, growing at a CAGR of 9.6%.

Adopting modular building techniques can also streamline construction processes, potentially reducing project timelines and associated costs. Diös Fastigheter's commitment to sustainability, demonstrated by its 2023 sustainability report highlighting reduced energy consumption, can be further bolstered by these material innovations.

Embracing these forward-thinking construction methods not only helps Diös Fastigheter meet its environmental targets but also positions its properties as attractive and modern in a market increasingly prioritizing eco-friendly solutions.

Proptech Adoption for Valuation and Investment

The integration of property technology, or Proptech, is revolutionizing how companies like Diös Fastigheter approach data analytics, market analysis, and property valuation. This adoption offers a pathway to more insightful strategic investments and refined portfolio management by leveraging advanced digital tools.

AI-powered solutions are increasingly capable of pinpointing nascent market trends, fine-tuning property pricing strategies, and conducting more precise risk assessments. For instance, a 2024 report indicated that Proptech startups secured over $10 billion in funding globally, highlighting the sector's rapid growth and the increasing reliance on these technologies by established real estate firms.

- Data-Driven Insights: Proptech enables Diös Fastigheter to process vast datasets, leading to a more granular understanding of market dynamics and tenant behavior.

- Enhanced Valuation Accuracy: AI and machine learning algorithms can provide more objective and up-to-date property valuations, reducing reliance on traditional, potentially slower methods.

- Risk Mitigation: Advanced analytics can identify potential risks in property investments earlier, allowing for proactive mitigation strategies and improved capital allocation.

- Operational Efficiency: Automation of tasks like lease management and property maintenance through Proptech can significantly boost operational efficiency and reduce costs.

Impact of Connectivity and Digital Infrastructure

The availability of robust digital infrastructure, including high-speed internet and 5G connectivity, is increasingly vital for both commercial and residential tenants. Diös Fastigheter must ensure its properties are equipped with modern digital infrastructure to meet the evolving demands of businesses and residents alike, particularly with the ongoing surge in remote work and digital services.

This focus on connectivity directly impacts tenant attraction and retention. For instance, in 2024, reports indicated that over 70% of businesses consider reliable internet a top priority when selecting office space. Diös Fastigheter's investment in digital infrastructure, therefore, becomes a key differentiator in the competitive property market.

- Enhanced Tenant Experience: High-speed internet and 5G enable seamless operations for businesses and convenient digital living for residents.

- Attracting Future-Ready Businesses: Properties with advanced digital capabilities are more appealing to companies embracing remote work and digital transformation.

- Increased Property Value: Modern digital infrastructure contributes to higher rental yields and overall property valuation.

- Support for Smart Building Technologies: Robust connectivity is essential for implementing and managing smart building solutions, improving efficiency and sustainability.

The increasing adoption of Proptech is fundamentally reshaping real estate operations, offering Diös Fastigheter enhanced data analytics for market insights and property valuations. AI-driven tools are becoming instrumental in identifying market trends and refining pricing, with Proptech startups attracting over $10 billion in global funding in 2024, underscoring the sector's rapid growth and reliance by established firms.

Technological advancements in smart building solutions, such as IoT sensors for energy management and predictive maintenance, are crucial for Diös Fastigheter's operational efficiency and tenant appeal. The global smart building market, valued at around $80 billion in 2023, is expected to exceed $200 billion by 2030, highlighting a significant trend towards technological integration.

Diös Fastigheter's strategic focus on digitalization streamlines property management through online portals and digital maintenance systems, enhancing tenant responsiveness and reducing administrative burdens. Companies utilizing integrated digital platforms saw operational cost reductions of up to 15% in 2023, a trend Diös Fastigheter is aligning with for greater efficiency and data-driven strategies.

The integration of advanced sustainable construction materials, like low-carbon concrete, presents a significant opportunity for Diös Fastigheter. The green building materials market was valued at approximately $253.6 billion in 2023 and is projected to reach $478.9 billion by 2030, growing at a 9.6% CAGR, supporting Diös Fastigheter's sustainability goals and enhancing property attractiveness.

Legal factors

Diös Fastigheter operates under stringent Swedish building codes and safety regulations, crucial for all construction, renovation, and maintenance. These mandates, covering structural integrity, fire prevention, and accessibility, are fundamental to occupant safety and mitigating company liability. For example, BBR 21 (Boverkets byggregler) dictates detailed requirements for energy efficiency and fire safety in new constructions and renovations, impacting material choices and design.

Swedish environmental legislation, focusing on energy efficiency, waste management, and emissions, directly shapes Diös Fastigheter's operational framework. For instance, the EU's Energy Performance of Buildings Directive, implemented in Sweden, mandates stringent energy performance standards for new and existing buildings, influencing renovation and development costs for Diös.

Compliance necessitates obtaining specific permits and certifications, such as those related to energy labeling and waste sorting, integrating sustainable practices into property development and management. Failure to adhere to these regulations, like exceeding emission limits or improper waste disposal, can result in significant fines and reputational damage, impacting Diös's financial health and market standing.

Tenant and landlord legislation in Sweden, including the Residential Tenancies Act and the Swedish Land Code, sets strict rules for rental agreements, rent adjustments, and eviction processes. Diös Fastigheter must navigate these laws carefully to ensure compliance, particularly concerning rent control mechanisms which can impact revenue predictability. For instance, the Hyresgästföreningen (Tenants' Association) plays a significant role in rent negotiations, influencing the pace of rent increases that Diös can implement.

The company's operational framework must align with regulations on property maintenance and tenant safety, as specified by Swedish housing laws. Failure to comply with these legal obligations can lead to disputes, fines, and damage to Diös Fastigheter's reputation. In 2024, an estimated 1.5 million households in Sweden were renting, highlighting the substantial number of tenants whose rights are protected by this legislation.

Planning and Zoning Laws

Planning and zoning laws are fundamental to Diös Fastigheter's operations, dictating where and how the company can develop properties. These regulations, established at local and regional levels, directly influence land acquisition and project feasibility. For instance, changes in zoning ordinances can either unlock new development opportunities or impose restrictions on existing or planned projects.

Navigating these legal frameworks is paramount for Diös Fastigheter's growth strategy. Securing necessary permits and approvals often involves a detailed understanding of urban planning policies, which can vary significantly across Sweden's municipalities. The company's ability to adapt to evolving zoning regulations and efficiently manage the permitting process is key to expanding its property portfolio and undertaking new construction or renovation projects.

- Impact on Development: Zoning laws define permissible land uses, building heights, and density, directly shaping the types of properties Diös Fastigheter can develop or acquire.

- Permitting Process: Obtaining development permits requires adherence to specific planning regulations, which can be time-consuming and complex, influencing project timelines.

- Strategic Land Use: Diös Fastigheter must align its land acquisition and development plans with current and anticipated planning and zoning frameworks to ensure long-term viability.

Data Privacy and Consumer Protection Laws

Diös Fastigheter, like all businesses handling personal information, must navigate a complex web of data privacy and consumer protection laws. Regulations like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, mandate strict rules for collecting, processing, and storing tenant data. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is greater. This is particularly relevant as Diös Fastigheter increasingly relies on digital property management systems to interact with tenants.

Ensuring robust data security, maintaining transparent privacy policies, and implementing clear consent mechanisms are paramount for Diös Fastigheter. These practices not only build tenant trust but also serve as a critical defense against potential legal challenges and reputational damage. For example, in 2023, the European Data Protection Board reported a steady increase in data breach notifications across various sectors, highlighting the ongoing need for vigilance.

- GDPR Compliance: Diös Fastigheter must adhere to GDPR principles, ensuring lawful, fair, and transparent processing of tenant data.

- Consumer Protection: Adherence to consumer protection laws safeguards tenant rights regarding data handling and service provision.

- Digital Systems Vulnerability: Increased reliance on digital platforms necessitates enhanced cybersecurity measures to prevent data breaches.

- Reputational Risk: Non-compliance can lead to substantial fines and damage to Diös Fastigheter's reputation, impacting tenant acquisition and retention.

Diös Fastigheter's operations are significantly shaped by Swedish and EU legislation governing property development and management. These laws cover everything from building safety standards, such as BBR 21, to environmental regulations that push for greater energy efficiency, directly impacting renovation and construction costs. For instance, the EU's Energy Performance of Buildings Directive necessitates upgrades that can add to project expenses.

Tenant and landlord laws, including the Residential Tenancies Act, dictate rental agreements and rent adjustments, with bodies like the Hyresgästföreningen influencing rent increases. Diös Fastigheter must navigate these to ensure compliance and predictable revenue, especially given that in 2024, approximately 1.5 million Swedish households were renters protected by these statutes.

Planning and zoning laws at local and regional levels are critical for land acquisition and project feasibility, with changes potentially opening or closing development avenues. Diös Fastigheter's strategic land use and development plans must align with these evolving frameworks to ensure long-term viability and successful project execution.

Data privacy regulations, particularly GDPR, impose strict rules on handling tenant data, with potential fines up to 4% of global turnover for non-compliance. As Diös Fastigheter increasingly uses digital property management, robust cybersecurity and transparent data policies are essential to maintain tenant trust and avoid legal repercussions, especially with the ongoing rise in reported data breaches.

Environmental factors

Diös Fastigheter's portfolio, concentrated in northern Sweden, faces growing risks from evolving climate patterns. Increased precipitation, more frequent extreme weather events, and fluctuating temperatures could impact property infrastructure and operational costs.

The company must proactively assess and integrate climate adaptation strategies to ensure its properties remain resilient. This includes evaluating building materials, energy systems, and site planning to mitigate potential damage and maintain long-term asset value in the face of environmental shifts.

Diös Fastigheter faces growing demands for energy efficiency, spurred by Sweden's and the EU's climate targets. For instance, the EU aims to cut emissions by at least 55% by 2030 compared to 1990 levels, a goal that directly impacts building regulations.

To comply and thrive, Diös must invest in energy-saving solutions and seek certifications like Miljöbyggnad or BREEAM. Achieving these standards not only lowers operating expenses but also boosts property appeal, aligning with sustainable development principles crucial in today's market.

The environmental impact of construction materials and waste generation is a significant concern for real estate companies like Diös Fastigheter. In 2024, the construction industry globally continues to grapple with its substantial carbon footprint, with materials like concrete and steel being major contributors.

Diös Fastigheter is expected to prioritize the sustainable sourcing of materials with lower carbon footprints, such as certified timber or recycled aggregates. For instance, the EU's Circular Economy Action Plan, updated in 2024, emphasizes reducing construction and demolition waste, which accounted for over 35% of total waste in the EU in recent years. Implementing robust waste management strategies during construction and demolition is crucial for Diös to reduce its environmental impact and align with these circular economy principles, aiming to divert a significant portion of waste from landfills.

Biodiversity and Green Infrastructure

Integrating biodiversity into urban development, like preserving green spaces and implementing green roofs, is a growing environmental consideration. Diös Fastigheter can boost property appeal and meet environmental planning mandates by contributing to urban biodiversity and ecosystem services.

For instance, in 2024, Sweden's national biodiversity strategy aims to halt biodiversity loss by 2030, influencing property development regulations. Diös Fastigheter's commitment to green infrastructure can align with these goals.

- Green Roofs: Studies show green roofs can reduce stormwater runoff by up to 70% and improve local air quality.

- Native Vegetation: Planting native species supports local insect populations, with some studies indicating a tenfold increase in insect diversity compared to non-native plants.

- Urban Green Spaces: Access to urban green spaces has been linked to improved mental well-being, with properties offering such amenities often commanding higher rental yields.

- Ecosystem Services: The value of ecosystem services provided by urban green infrastructure, such as carbon sequestration and temperature regulation, is increasingly being quantified, potentially adding economic value to Diös Fastigheter's portfolio.

Water Management and Resource Efficiency

Diös Fastigheter faces increasing scrutiny regarding water management and resource efficiency within its property portfolio. Implementing advanced water-saving technologies, such as low-flow fixtures and smart irrigation systems, can significantly reduce consumption. For example, by 2024, many Swedish municipalities are setting stricter targets for water usage per capita, influencing building codes and operational expectations for property owners like Diös. This focus on efficiency not only minimizes wastewater discharge but also directly lowers operational costs, contributing to Diös's broader environmental sustainability objectives.

The company can further enhance resource efficiency through proactive measures:

- Water-saving technologies: Installation of aerators, dual-flush toilets, and water-efficient appliances.

- Leak detection and repair: Implementing regular monitoring to promptly identify and fix water leaks across all properties.

- Tenant engagement: Educating tenants on water conservation practices to foster a shared responsibility.

- Rainwater harvesting: Exploring opportunities for rainwater collection and reuse for non-potable purposes like landscape irrigation.

Diös Fastigheter must navigate evolving climate patterns that pose risks to its property infrastructure and operational costs, especially given its concentration in northern Sweden. The company is increasingly pressured to adopt energy-efficient solutions to meet Sweden's and the EU's stringent climate targets, such as the EU's goal for a 55% emissions reduction by 2030.

Sustainable material sourcing and waste reduction are critical, as the construction sector's carbon footprint remains a concern; the EU's Circular Economy Action Plan, updated in 2024, highlights reducing construction and demolition waste, which historically represents over 35% of total EU waste.

Integrating biodiversity through green spaces and roofs enhances property appeal and aligns with national strategies, like Sweden's 2030 biodiversity goals, while efficient water management, supported by municipal targets in 2024, reduces operational costs and environmental impact.

| Environmental Factor | Impact on Diös Fastigheter | Key Data/Targets (2024/2025) |

| Climate Change & Extreme Weather | Property damage risk, increased operational costs | Growing frequency of extreme weather events globally. |

| Energy Efficiency & Emissions | Need for investment in sustainable solutions, regulatory compliance | EU target: 55% emissions reduction by 2030. Swedish national targets. |

| Construction Materials & Waste | Demand for sustainable sourcing, waste management strategies | EU C&D waste >35% of total EU waste. Focus on circular economy principles. |

| Biodiversity & Green Infrastructure | Enhanced property appeal, meeting planning mandates | Sweden's national biodiversity strategy aims to halt loss by 2030. |

| Water Management & Resource Efficiency | Need for water-saving technologies, compliance with municipal targets | Stricter municipal water usage targets in Sweden influencing building codes. |

PESTLE Analysis Data Sources

Our Diös Fastigheter PESTLE Analysis is built on a robust foundation of data from official Swedish government agencies, reputable economic research institutions, and leading industry publications. This ensures comprehensive insights into political, economic, social, technological, legal, and environmental factors impacting the Swedish real estate market.