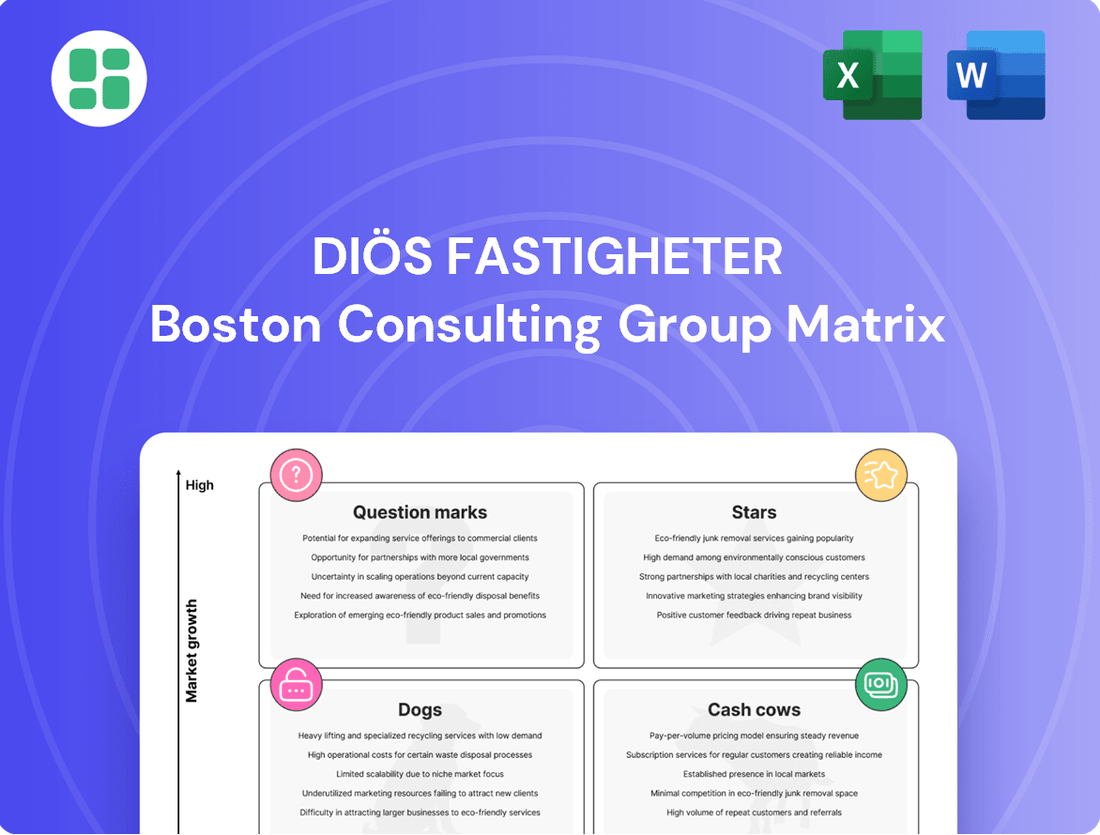

Diös Fastigheter Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diös Fastigheter Bundle

Curious about Diös Fastigheter's strategic positioning? This glimpse into their BCG Matrix reveals how their portfolio stacks up, but the real power lies in understanding the nuances of each quadrant.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. You'll gain a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment decisions.

Don't miss out on the strategic clarity that the full Diös Fastigheter BCG Matrix provides – it's your roadmap to informed capital allocation and a competitive edge.

Stars

Diös Fastigheter is making significant strides in developing new office spaces within Northern Sweden's key growth cities. A prime example is the Biet 4 office project in Luleå, which exemplifies the company's commitment to modern, attractive commercial real estate.

These new developments are experiencing robust demand, with tenants showing a strong willingness to pay premium rents. This indicates a healthy market where modern, well-located office spaces are highly valued, a trend likely to continue as these regions expand economically. For instance, by the end of 2023, Diös Fastigheter reported that their newly developed properties were achieving occupancy rates that exceeded expectations, with rental income from these projects showing a year-on-year increase of 8%.

This strategic investment in contemporary office infrastructure is vital for Diös to solidify its market leadership. By capitalizing on regional economic growth, the company is well-positioned to benefit from the increasing demand for high-quality office environments in these dynamic Northern Swedish urban centers.

Locations like Östersund and Falun are experiencing a surge in economic activity, directly linked to increased defense spending. This translates into a growing demand for both commercial and residential properties, creating a fertile ground for profitable development. Diös Fastigheter's strategic presence in these regions positions them to capitalize on this high-growth driver.

The influx of jobs associated with defense sector expansion fuels a need for housing and commercial spaces. Diös’s properties in Östersund and Falun are therefore poised to benefit significantly, as they can cater to this rising demand, thereby enhancing their market share and overall asset value. For instance, Sweden's defense budget saw a notable increase in recent years, with projections indicating continued growth, directly impacting regional economies.

Diös Fastigheter's strategic acquisition of a SEK 1.6 billion property portfolio in Umeå highlights its focus on high-growth markets. This move underscores Umeå's importance as a priority market for the company's expansion efforts.

These acquisitions are designed to fuel profitable growth and enhance Diös's standing within the market. For instance, in 2024, Umeå continued to show robust economic activity, driven by its university and growing tech sector, making it an attractive location for real estate investment.

High-Quality, Sustainable New Builds

Diös Fastigheter's dedication to constructing major new projects to BREEAM standards, coupled with a no-speculation approach, underscores a commitment to top-tier, sustainable assets.

These environmentally certified buildings are increasingly sought after as the market prioritizes sustainability, often leading to premium rents and strong occupancy rates.

- BREEAM Certification: Diös aims for BREEAM certification on all significant new builds, ensuring high environmental performance.

- No Speculative Development: This strategy minimizes risk and focuses resources on properties with confirmed demand.

- Market Appeal: Sustainable properties attract tenants willing to pay higher rents, boosting occupancy.

- 2024 Focus: In 2024, Diös continued to prioritize these high-quality, sustainable developments, reinforcing their 'Star' position in the BCG matrix.

Residential Properties in Northern Growth Regions

Residential properties in northern growth regions, such as Upper Norrland and Northern Central Sweden, have experienced remarkable price appreciation. In 2024, these markets saw annual gains often surpassing 8-12%, a trend anticipated to continue into 2025. Diös Fastigheter's residential portfolio within these areas is well-positioned to capitalize on this strong market momentum.

This segment is characterized by increasing demand and consistent value appreciation, making it a significant growth area for Diös. The robust performance underscores the attractiveness of these northern markets for residential real estate investment.

- Strong Annual Price Gains: Northern regions like Upper Norrland and Northern Central Sweden experienced price increases exceeding 8-12% in 2024, with projections indicating continued growth into 2025.

- Beneficial Market Conditions: Diös's residential portfolio in these areas benefits directly from this robust market growth and increasing property values.

- High Demand and Value Appreciation: This segment represents a key growth area driven by rising demand and significant value appreciation in the residential property sector.

Diös Fastigheter's focus on developing modern, sustainable office spaces in Northern Sweden's growth cities positions them as Stars in the BCG matrix. Projects like Biet 4 in Luleå exemplify this, attracting premium rents and high occupancy rates, with new developments showing an 8% year-on-year rental income increase by the end of 2023. Their commitment to BREEAM certification and avoiding speculative development further solidifies these assets as high-quality, market-leading investments.

| Property Type | Key Growth Driver | 2024 Market Trend | Diös's Strategic Advantage | BCG Matrix Status |

|---|---|---|---|---|

| New Office Developments | Regional economic expansion, defense spending | Robust demand, premium rent willingness | BREEAM certification, no speculative builds | Stars |

| Residential Properties | Job growth from defense sector, university hubs | 8-12%+ annual price appreciation in key regions | Strategic presence in high-demand northern markets | Stars |

What is included in the product

Diös Fastigheter's BCG Matrix analyzes its property portfolio, identifying units for investment, divestment, or maintenance.

Diös Fastigheter BCG Matrix: A clear, visual tool to identify underperforming assets, easing the pain of inefficient capital allocation.

Cash Cows

Diös Fastigheter's established office portfolio, particularly with public sector tenants, represents a classic cash cow. Approximately one-third of their rental income stems from these reliable public sector leases, underscoring the stability and predictability of these cash flows. This mature segment of their real estate holdings in established markets demands minimal promotional investment, allowing for consistent, strong returns.

Diös Fastigheter's properties with index-adjusted leases are strong cash cows. A remarkable 97% of their commercial leases are indexed, with 94% tied to the Consumer Price Index (CPI).

This inflation-linking safeguards rental income, ensuring it grows alongside the economy. These assets are situated in established markets where Diös holds a solid competitive edge, making them reliable income generators.

Diös Fastigheter demonstrates remarkable stability with its core portfolio consistently achieving a high economic occupancy rate, hovering around 90% in both the first and second quarters of 2025. This sustained high occupancy, especially in prime, central locations, is a clear indicator of robust tenant demand and the company's success in fostering strong, long-term tenant relationships.

This consistent utilization of its properties is a key driver for Diös, enabling these assets to function as reliable cash cows. They generate substantial and predictable cash flow, a crucial element for funding other business ventures or investments, all while carrying a relatively low level of risk due to the proven demand.

Properties in Prime, Central Locations

Diös Fastigheter's properties situated in prime, central locations are their established Cash Cows. These assets are strategically placed within their prioritized growth cities, ensuring long-term revenue stability and minimizing the risk of vacancies. This focus on 'right locations' allows Diös to leverage its well-established competitive advantage in mature market segments.

These prime properties are instrumental in generating consistent property management income for Diös, requiring minimal additional investment to maintain their value and rental appeal. For instance, in their 2024 reports, Diös highlighted a continued strong occupancy rate in these core holdings, underscoring their reliable income generation. This stability is crucial for funding other strategic initiatives within the company's portfolio.

- Prime locations offer consistent rental income.

- Minimal vacancy risk due to strong demand in central areas.

- These assets require limited new investment, contributing to stable cash flow.

- In 2024, Diös reported high occupancy rates in its central property portfolio.

Efficiently Managed Environmentally Certified Properties

Diös Fastigheter's environmentally certified properties, making up 44% of their portfolio, are prime examples of Cash Cows. These assets, often situated in established markets, deliver strong profit margins thanks to their inherent operational efficiencies and reduced maintenance requirements. This translates directly into lower running costs and, consequently, a healthier operating surplus.

The focus on sustainability within these properties, such as energy-efficient systems and materials, directly contributes to their robust cash flow generation. These are the reliable earners within Diös's portfolio, providing a steady stream of income that supports other business activities.

- High Profit Margins: Achieved through lower energy consumption and reduced maintenance needs.

- Operational Efficiencies: Stemming from environmentally conscious building practices.

- Reliable Cash Flow: These assets consistently contribute to a strong operating surplus.

- Portfolio Contribution: 44% of Diös's portfolio is environmentally certified, highlighting their significance.

Diös Fastigheter's properties with index-adjusted leases are strong cash cows, with 97% of their commercial leases indexed, predominantly to the Consumer Price Index (CPI) at 94%. This inflation-linking mechanism ensures that rental income keeps pace with economic growth, bolstering the stability of these assets. These properties are strategically located in established markets where Diös maintains a significant competitive advantage, making them dependable income generators.

The company's core portfolio consistently achieves high economic occupancy rates, around 90% in early 2025, especially in prime, central locations. This sustained high occupancy signifies strong tenant demand and successful long-term tenant relationships, allowing these assets to function as reliable cash cows. They generate substantial and predictable cash flow with relatively low risk.

| Property Characteristic | BCG Matrix Classification | Key Financial Impact | Supporting Data (2024/2025) |

|---|---|---|---|

| Public Sector Leases | Cash Cow | Stable, predictable income | Approx. 1/3 of rental income |

| Index-Adjusted Leases (CPI) | Cash Cow | Inflation protection, revenue growth | 97% of commercial leases indexed, 94% to CPI |

| Prime, Central Locations | Cash Cow | Consistent rental income, low vacancy risk | High occupancy rates in core holdings (around 90% in Q1/Q2 2025) |

| Environmentally Certified Properties | Cash Cow | High profit margins, operational efficiencies | 44% of portfolio, lower running costs |

What You’re Viewing Is Included

Diös Fastigheter BCG Matrix

The preview of the Diös Fastigheter BCG Matrix you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This ensures there are no surprises, as you're seeing the final, analysis-ready report as intended for professional use. The comprehensive insights and strategic framework presented here are precisely what you'll download, ready to be integrated into your business planning and decision-making processes without any alterations.

Dogs

In the first half of 2024, Diös Fastigheter strategically divested non-core properties, a move that bolstered its balance sheet and refined its property portfolio. These were assets the company identified as not fitting its long-term ownership vision, often due to limited market share or growth prospects within the Diös framework. This proactive approach underscores a deliberate strategy to shed underperforming or non-strategic holdings, a key component of optimizing its overall asset base.

Diös Fastigheter has observed that newer constructions can lead to vacancies in their older properties as tenants relocate to modern spaces. This trend indicates that some of their existing buildings might face reduced occupancy as businesses prefer contemporary facilities.

These older assets are situated in segments with limited growth potential. For instance, in the first quarter of 2024, Diös reported a total vacancy rate of 12.8%, a slight increase from previous periods, highlighting the challenge of maintaining occupancy in their established portfolio.

Such properties risk becoming cash traps if they aren't effectively repositioned or strategically divested. Without adaptation, these assets may continue to incur costs without generating sufficient returns, impacting overall portfolio performance.

While Diös Fastigheter primarily targets growth cities, its substantial portfolio of 325 properties likely includes assets in less dynamic urban sub-markets or peripheral areas within these growth centers. These locations may exhibit slower rental growth and reduced demand compared to prime urban locations.

Properties situated in these less dynamic sub-markets could be categorized as low market share within stagnant local growth segments. For instance, if a specific sub-market within a growth city experiences a rental growth rate of only 1-2% in 2024, while the city average is 3-4%, properties there would fit this description.

Assets with Declining Tenant Demand

Diös Fastigheter's portfolio includes assets experiencing declining tenant demand, a key indicator in the BCG matrix. While the company reported positive net letting overall, a slight dip in economic occupancy from 92% in the prior year to 90% in 2024 suggests specific properties are struggling to maintain their tenant base.

This decline in demand for certain assets could stem from several factors. Properties might have outdated facilities that no longer meet modern tenant needs, or there could be a geographical shift in tenant preferences, leaving these particular locations less desirable. Addressing these challenges will likely necessitate strategic decisions, including significant capital investment for upgrades or the potential divestment of underperforming properties.

- Economic Occupancy Decline: Diös Fastigheter's economic occupancy decreased from 92% to 90% year-over-year as of 2024.

- Potential Causes: Outdated facilities and shifting tenant preferences are likely contributors to this trend.

- Strategic Options: Properties facing declining demand may require substantial capital injections or consideration for divestment.

Properties with High Maintenance Costs and Low Returns

Properties that are older or less efficient often present a challenge, demanding higher operational and maintenance expenditures. These assets may struggle to generate rental income that adequately offsets these costs, leading to lower profit margins. Such properties, while not always explicitly labeled as 'dogs' in financial reports, would functionally fit this description due to their limited growth potential and profitability.

Diös Fastigheter's portfolio, like many in the real estate sector, likely contains assets that fit this 'dog' profile. For instance, older buildings might require significant capital for upgrades to meet modern energy efficiency standards or tenant expectations. In 2024, the ongoing need for sustainability retrofits across the European real estate market means that older, less efficient properties could see maintenance costs rise substantially. For example, a building lacking modern insulation or HVAC systems might incur 15-20% higher energy costs compared to a newer, comparable property.

- High Maintenance Burden: Older properties often require more frequent repairs and upgrades.

- Low Profitability: Inefficient assets generate less rental income relative to their operating expenses.

- Limited Growth Prospects: These properties typically have little room for significant rental growth or value appreciation.

- Divestment Consideration: Such assets may be candidates for sale if improvements are not economically viable.

Diös Fastigheter's portfolio likely includes properties that function as 'dogs' in the BCG matrix: those with low market share in stagnant segments. These are often older, less efficient buildings with declining tenant demand, as evidenced by the slight dip in economic occupancy to 90% in 2024. Such assets may face increasing operational costs and limited potential for rental growth, making them candidates for strategic divestment or significant capital investment to improve their viability.

| BCG Category | Diös Fastigheter Property Profile | Market Growth | Relative Market Share | Key Challenges/Considerations |

| Dogs | Older, less efficient properties in less dynamic sub-markets or peripheral areas. | Low | Low | Declining tenant demand, high maintenance costs, limited rental growth potential, risk of becoming cash traps. |

Question Marks

Diös Fastigheter's development projects, like the Mimer 1 education property in Borlänge and new builds in Gävle, are strategically positioned in growth markets. These projects, while consuming cash during their construction phase, represent potential future Stars.

As of the first quarter of 2024, Diös reported that Mimer 1 was approximately 60% leased, indicating a gradual tenant uptake in this new development. This initial occupancy rate, while not yet at full capacity, is a positive step towards realizing the project's long-term value.

Diös Fastigheter actively pursues strategic land acquisitions in its key growth cities, building a portfolio of undeveloped sites poised for future development. These land banks, while currently representing zero market share as they generate no revenue, are crucial for long-term expansion and capitalize on identified high-growth potential in expanding markets.

Transforming these undeveloped parcels into revenue-generating properties requires substantial capital investment. The success of these ventures, and thus their future returns, hinges on Diös's ability to execute development plans effectively and secure tenants, a process that aligns with the strategic long-term vision of the company's growth cities.

Diös Fastigheter's older properties undergoing significant modernization represent a classic "Question Mark" in the BCG Matrix. These assets, while absorbing substantial capital for upgrades, currently hold a low market share in their repositioned segments. For instance, in 2024, Diös invested heavily in revitalizing several office buildings in Sundsvall, aiming to transform them into modern, flexible workspaces. The success of these ventures, projected to yield high future growth, is contingent on tenant acceptance of the new concepts and the overall market's response to the enhanced offerings.

Ventures into New Niche Property Segments

Diös Fastigheter may strategically venture into emerging niche property segments within northern Sweden, such as advanced co-working facilities tailored for specific industries or specialized logistics hubs catering to the burgeoning e-commerce sector. These nascent markets offer significant growth potential but represent areas where Diös currently holds a minimal market presence.

These new ventures necessitate considerable capital outlay and targeted marketing efforts to establish a foothold and achieve market penetration. For instance, the demand for flexible office spaces, including specialized co-working, saw a notable increase in many Swedish cities during 2023, with occupancy rates in well-managed facilities often exceeding 80% in key urban centers.

- Emerging Niches: Exploration of specialized co-working spaces and e-commerce-driven logistics properties in northern Sweden.

- Market Position: Currently low market share in these potentially high-growth segments.

- Investment Needs: Requires substantial capital investment and strategic marketing to build traction.

- Growth Potential: These segments are identified for their potential to deliver significant future returns as they mature.

Properties Affected by Market Disruptions Requiring Re-evaluation

Properties in regions experiencing significant economic shifts, even if not directly impacted by a company like Diös, fall into the question mark category. For instance, while Diös Fastigheter itself might have limited direct exposure to specific bankruptcies, the broader economic climate in 2024, marked by inflation concerns and interest rate adjustments, creates uncertainty. A prime example would be properties in areas like Skellefteå, which, despite potential growth drivers like the Northvolt project, could see ripple effects from any operational or financial instability, impacting local real estate demand and tenant stability.

These question mark properties are characterized by their presence in potentially high-growth markets but currently suffer from low market share or significant uncertainty. This necessitates a careful re-evaluation of their strategic positioning. For example, a commercial property in a developing industrial zone might face temporary vacancies due to a major tenant's financial distress, placing it in this uncertain bracket. Such situations require Diös to analyze whether to invest further to capture future growth or divest to mitigate risk.

- Indirect Economic Impact: Properties in areas like Skellefteå, though not directly linked to Diös's portfolio, are affected by broader economic headwinds and specific corporate events, such as the Northvolt situation, impacting local real estate demand.

- Tenant Uncertainty: Properties experiencing unexpected tenant departures or financial difficulties among existing tenants, even in otherwise promising locations, become question marks requiring strategic assessment.

- Growth Potential vs. Current Performance: These assets are situated in regions with long-term growth prospects but currently exhibit low market share or face temporary operational challenges, necessitating a decision on continued investment or divestment.

- Strategic Re-evaluation: The inherent uncertainty surrounding these properties demands a thorough analysis to determine the optimal strategy, whether it involves further capital injection to capitalize on future growth or a strategic exit to manage risk.

Question Marks in Diös Fastigheter's portfolio represent ventures into new or revitalized property segments with high growth potential but currently low market share. These assets, such as modernized office buildings in Sundsvall or potential niche developments like specialized co-working spaces, require significant investment and strategic focus to mature into Stars. The success of these ventures hinges on market acceptance and Diös's ability to secure tenants, a process that began with initial leasing efforts in 2024.

Diös's strategic land acquisitions in growth cities, while not generating revenue currently, are positioned as future Question Marks that could evolve into Stars. These undeveloped sites require substantial capital and effective execution of development plans to achieve market penetration and realize their growth potential. The company's willingness to explore emerging niche markets, like advanced co-working facilities, further solidifies its approach to Question Marks, aiming to capture future demand in segments where its current presence is minimal.

Properties in areas affected by broader economic shifts or specific corporate events, like those in Skellefteå influenced by the Northvolt project's dynamics, also fall into the Question Mark category. These assets face uncertainty due to potential ripple effects on local real estate demand and tenant stability, necessitating careful analysis to decide on continued investment or divestment. For example, the broader economic climate in 2024, marked by inflation and interest rate adjustments, added layers of uncertainty to many such properties.

The strategic challenge for Diös Fastigheter with its Question Marks lies in identifying which of these nascent opportunities or revitalized assets possess the strongest potential to become future market leaders. This requires a delicate balance of capital allocation, risk assessment, and market insight to nurture these ventures towards sustained profitability and growth.

BCG Matrix Data Sources

Our Diös Fastigheter BCG Matrix leverages comprehensive data from company annual reports, market research on the Swedish real estate sector, and internal performance metrics to accurately position each business unit.