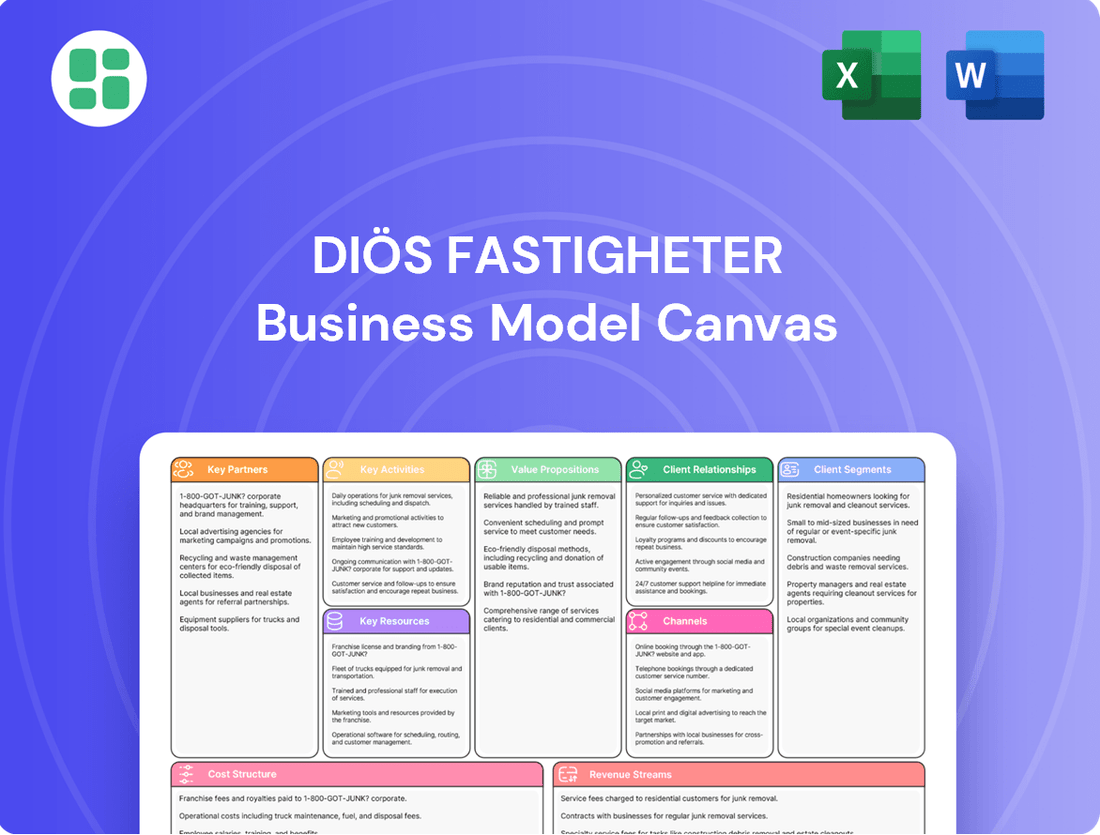

Diös Fastigheter Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diös Fastigheter Bundle

Unlock the strategic blueprint behind Diös Fastigheter's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they create and deliver value in the dynamic real estate market. Discover their key partners, revenue streams, and cost structure to gain actionable insights for your own business.

Partnerships

Diös Fastigheter's partnerships with municipalities in northern Sweden are fundamental to their urban development strategy and property acquisition. These collaborations are vital for navigating permit processes, aligning with local zoning regulations, and integrating with regional growth initiatives, particularly in areas attracting substantial investment.

Working with public sector entities as tenants offers Diös a reliable and stable revenue stream, a significant factor in their portfolio's financial resilience. For instance, in 2024, the public sector represented a substantial portion of their rental income, underscoring the value of these key relationships.

Diös Fastigheter actively collaborates with construction and development companies for both new construction and significant renovation projects. These partnerships are crucial for Diös to effectively expand and update its real estate holdings, ensuring projects are completed efficiently and to high-quality standards.

In 2024, Diös continued to leverage these relationships to deliver modern, sustainable properties that align with market needs. For instance, their ongoing development in Sundsvall, involving extensive modernization of existing office spaces, relies heavily on the expertise of specialized construction partners to meet stringent energy efficiency targets.

Diös Fastigheter's relationships with financial institutions and lenders are fundamental to its business model, enabling the company to fund property acquisitions, development initiatives, and ongoing operations. These partnerships are crucial for securing the necessary capital to grow and maintain its real estate portfolio.

Maintaining favorable financing conditions, such as competitive interest rates and optimal loan-to-value ratios, is a core component of Diös's financial management strategy. This focus ensures the company can operate efficiently and profitably in the property market.

In 2024, Diös Fastigheter continued to emphasize a flexible and cost-effective financing structure. This includes a strategic focus on sustainability-linked loans, reflecting a commitment to both financial prudence and environmental responsibility. As of the first quarter of 2024, the company reported a solid financial position, with a loan-to-value ratio of 46.6%, demonstrating prudent leverage management.

Service Providers and Facility Management Companies

Diös Fastigheter relies on a network of service providers and facility management companies to ensure its properties are consistently well-maintained and operational. These partnerships are crucial for delivering high-quality services to tenants, covering everything from routine maintenance to specialized facility management. This strategic outsourcing allows Diös to concentrate on its core competencies in property ownership and strategic growth.

For instance, in 2024, Diös continued to collaborate with numerous local and regional service providers across its portfolio. These collaborations are essential for upholding property standards and tenant satisfaction. By leveraging external expertise, Diös maintains operational efficiency and ensures that its properties remain attractive and functional assets.

- Property Maintenance: Partnering with specialized firms for upkeep, repairs, and renovations.

- Facility Services: Engaging companies for cleaning, security, and technical building management.

- Tenant Support: Collaborating with providers to offer responsive service and address tenant needs efficiently.

- Operational Efficiency: Outsourcing non-core functions to specialized providers to streamline operations and reduce costs.

Energy and Sustainability Partners

Diös Fastigheter's focus on sustainable environments necessitates strong alliances with energy providers and sustainability consultants. These partnerships are crucial for implementing advanced energy-saving technologies and achieving ambitious environmental goals, such as reducing CO2 emissions. For instance, in 2024, Diös continued its efforts to enhance energy efficiency across its portfolio, aiming to further decrease its carbon footprint. These collaborations directly support their strategy of creating long-term value by integrating sustainable practices into property development and management.

These collaborations are instrumental in achieving key sustainability targets and certifications.

- Energy Efficiency Improvements: Partnerships facilitate the adoption of innovative solutions to reduce energy consumption in Diös's properties, contributing to lower operational costs and environmental impact.

- Environmental Certifications: Collaborations with sustainability experts help Diös obtain and maintain certifications like BREEAM, validating their commitment to green building standards.

- CO2 Emission Reduction: Working with energy companies and consultants enables Diös to implement strategies specifically designed to cut CO2 emissions, aligning with broader climate objectives.

- Long-Term Value Creation: By fostering these partnerships, Diös strengthens its position as a responsible real estate owner, enhancing the attractiveness and value of its sustainable property portfolio.

Diös Fastigheter strategically partners with various entities to enhance its property portfolio and operational efficiency. These key partnerships are essential for securing capital, executing development projects, and maintaining high property standards.

Collaborations with municipalities are vital for navigating urban planning and regional growth, while strong relationships with construction firms ensure quality development. Financial institutions provide the necessary funding, and service providers guarantee operational excellence. Furthermore, alliances with energy companies and sustainability consultants drive Diös's commitment to environmentally responsible property management.

| Partner Type | Role in Business Model | Example of 2024 Impact |

|---|---|---|

| Municipalities | Urban development, permits, zoning | Facilitated new property acquisitions in growth areas |

| Construction Companies | New builds, renovations, quality assurance | Completed modernization of office spaces in Sundsvall |

| Financial Institutions | Funding for acquisitions and development | Maintained a loan-to-value ratio of 46.6% in Q1 2024 |

| Service Providers | Property maintenance, facility management | Ensured high tenant satisfaction through efficient operations |

| Energy/Sustainability Consultants | Energy efficiency, CO2 reduction | Supported implementation of advanced energy-saving technologies |

What is included in the product

Diös Fastigheter's business model focuses on creating attractive city districts by developing and managing commercial and residential properties in growth regions. It emphasizes long-term tenant relationships and sustainable urban development.

Diös Fastigheter's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core components, streamlining complex real estate operations for efficient decision-making.

Activities

Diös Fastigheter actively pursues strategic acquisitions of commercial and residential properties within its prioritized growth cities, including Umeå and Sundsvall, to bolster its portfolio. For instance, in 2023, the company completed acquisitions totaling SEK 450 million, enhancing its presence in key regional hubs.

Concurrently, Diös engages in the divestment of non-core assets to refine its property holdings and bolster its financial position. This strategic pruning allows for optimized capital allocation and a more focused portfolio. In 2023, property divestments amounted to SEK 300 million, contributing to improved capital efficiency.

Diös Fastigheter's active property management is the engine driving their portfolio's performance. This includes the crucial tasks of leasing vacant spaces, nurturing strong tenant relationships, and diligently working to keep occupancy rates high. For instance, in the first quarter of 2024, Diös reported a strong occupancy rate of 94.9%, highlighting their success in this area.

The core objective of this hands-on approach is to boost rental income and streamline operations. This focus is evident in their consistent operating surplus and their commitment to minimizing tenant churn, which is vital for long-term stability. Their strategy centers on offering appealing commercial spaces in well-chosen locations that meet tenant needs.

Diös Fastigheter actively engages in property development and redevelopment to align its portfolio with current market demands and boost property value. This strategic focus encompasses both new construction projects and the conversion of existing buildings, such as repurposing office spaces into residential units, thereby fostering vibrant and sustainable urban areas.

In 2024, Diös continued its commitment to these activities, with a particular emphasis on creating modern and functional spaces. For instance, the company has been involved in projects aimed at increasing the residential offering in key growth regions, responding to a persistent demand for housing. These initiatives are fundamental to Diös's strategy for sustained value generation and ensuring its properties remain attractive to tenants.

Leasing and Tenant Relationship Management

Securing new leases and nurturing relationships with current tenants are central to Diös's operations. This involves not only lease renegotiations but also a proactive approach to tenant satisfaction, aiming to create thriving business environments.

Diös focuses on achieving positive net lettings and maintaining high occupancy rates, which are direct results of their effective tenant management strategies. Their commitment to fostering strong, long-term tenant relationships is underpinned by a strong local presence and direct engagement.

- Lease Acquisition and Retention: Diös actively works to attract new tenants and retain existing ones through responsive service and tailored solutions.

- Tenant Satisfaction: A key activity is ensuring tenants are satisfied with their premises and the services provided, which is crucial for long-term success.

- Local Presence: Diös leverages its local teams to build personal connections and understand tenant needs, facilitating smoother operations and stronger partnerships.

- Net Lettings Performance: In 2024, Diös reported continued positive net lettings, demonstrating the effectiveness of their leasing and tenant relationship management efforts in a competitive market.

Financial Management and Optimization

Financial management and optimization are central to Diös Fastigheter's operations, focusing on maintaining a robust financial structure. This involves carefully managing debt levels, interest rate exposure, and the strategic allocation of capital across the portfolio. The company prioritizes a stable cash flow and a well-balanced financial risk profile.

Diös actively seeks cost-effective financing solutions, employing financial instruments like interest rate derivatives to enhance flexibility and manage market volatility. For instance, as of the first quarter of 2024, Diös reported a loan-to-value ratio of 47.2%, indicating a prudent approach to leverage.

- Debt Management: Diös aims for a cost-effective financing structure, managing its debt portfolio to secure favorable terms and interest rates.

- Interest Rate Hedging: The company utilizes interest rate derivatives to mitigate risks associated with fluctuating interest rates, ensuring greater predictability in financing costs.

- Capital Allocation: Strategic deployment of capital is crucial for profitable growth, ensuring investments align with the company's overall financial objectives and risk appetite.

- Cash Flow Stability: Maintaining a predictable and stable cash flow is a key objective, underpinning the company's ability to meet its financial obligations and pursue growth opportunities.

Diös Fastigheter's key activities revolve around strategic property acquisitions and disposals to optimize its portfolio. They also focus on active property management, including leasing and tenant relations, to maximize rental income and occupancy. Furthermore, property development and redevelopment are crucial for adapting to market demands and enhancing property value.

| Key Activity | Description | Recent Data/Example |

|---|---|---|

| Acquisitions & Disposals | Strategic buying of properties in growth cities and selling non-core assets. | 2023 acquisitions: SEK 450 million; 2023 divestments: SEK 300 million. |

| Property Management | Leasing, tenant relations, and maintaining high occupancy. | Q1 2024 occupancy rate: 94.9%. |

| Development & Redevelopment | New construction and repurposing of existing buildings. | Focus on increasing residential offerings in growth regions. |

| Lease Management | Securing new leases and retaining existing tenants. | Reported positive net lettings in 2024. |

What You See Is What You Get

Business Model Canvas

The Diös Fastigheter Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this exact same structured and detailed analysis, ensuring no surprises and immediate usability for your strategic planning.

Resources

Diös's extensive property portfolio is its bedrock, encompassing approximately SEK 31.4 billion in value. This vast collection of commercial and residential properties is strategically situated in northern Sweden's growth cities.

The portfolio spans 1.58 million square meters of lettable area, forming a solid foundation for consistent rental income. These strategically positioned assets are poised for future value appreciation, driven by regional growth trends.

Diös Fastigheter's financial capital is a cornerstone of its business model, enabling significant investments and strategic growth. In 2024, the company's robust financial position, bolstered by equity, bank loans, and access to capital markets via bonds and commercial papers, underpins its ability to undertake major development projects and strategic acquisitions.

The company's capacity to secure financing on favorable terms is a distinct competitive advantage, allowing for efficient capital allocation. This strong financial footing directly supports Diös's ongoing development pipeline and its commitment to delivering value to shareholders through dividends and share buybacks.

Diös Fastigheter’s human capital is a cornerstone, featuring property managers, development specialists, and financial experts who possess intimate knowledge of northern Swedish markets. This deep local expertise is crucial for navigating regional nuances and fostering strong tenant relationships.

The company emphasizes its local presence and the dedication of its employees as significant strengths. This allows for highly effective property management and strategic decision-making that is precisely tailored to the unique needs of each community they serve.

This specialized human capital provides Diös with a distinct competitive advantage. For instance, in 2024, their focus on local market understanding contributed to a stable occupancy rate of 93.1% across their portfolio, demonstrating the tangible benefits of this expertise.

Brand Reputation and Market Leadership

Diös Fastigheter's brand reputation as one of Sweden's largest real estate companies and a leader in its chosen cities is a cornerstone of its business model. This strong standing attracts a desirable tenant base and fosters crucial partnerships, essential for growth and stability.

This market leadership translates into tangible benefits. For instance, Diös's commitment to urban development, aiming to create inspiring cities, not only shapes their brand but also builds trust with investors who see a long-term vision and commitment to sustainable growth. In 2024, this reputation is vital for securing favorable financing terms and attracting high-quality tenants in a competitive market.

- Tenant Attraction: A strong brand reputation makes Diös a preferred landlord, leading to higher occupancy rates and potentially better rental terms.

- Partnership Facilitation: Market leadership encourages collaborations with municipalities, developers, and other stakeholders, driving innovation and new project opportunities.

- Investor Confidence: A well-regarded brand signals stability and a clear strategy, making Diös a more attractive investment, especially in uncertain economic climates.

- Visionary Development: The focus on creating inspiring cities reinforces the brand's commitment to quality of life and sustainable urban living, appealing to a broad range of stakeholders.

Technological Infrastructure and Digital Platforms

Diös Fastigheter leverages modern technological infrastructure, including advanced property management software and digital communication tools, to ensure efficient operations and superior tenant experiences. These platforms are crucial for streamlining workflows, enabling data-informed decisions, and fostering better communication channels, all of which contribute to overall operational excellence and tenant satisfaction.

The company's investment in digital platforms supports its strategic goals by enhancing internal efficiency and external tenant engagement. For instance, in 2024, Diös Fastigheter continued to invest in upgrading its digital systems, aiming to provide tenants with seamless access to services and information. This focus on technology is a key enabler for their business model, ensuring they remain competitive in the evolving real estate market.

- Property Management Software: Facilitates efficient handling of leases, maintenance requests, and financial reporting.

- Digital Communication Platforms: Enhance interaction with tenants, providing quick access to information and support.

- Smart Building Technologies: Increasingly integrated to optimize energy usage and improve tenant comfort, contributing to sustainability goals.

Diös Fastigheter's key resources include its substantial property portfolio, valued at approximately SEK 31.4 billion, comprising 1.58 million square meters of lettable area strategically located in northern Sweden. This physical asset base is complemented by strong financial capital, enabling significant investments and strategic growth, supported by equity, loans, and capital markets access. The company also relies on its specialized human capital, with property managers and development specialists possessing deep local market knowledge, contributing to a 93.1% occupancy rate in 2024. Furthermore, a robust brand reputation as a leader in its niche and advanced technological infrastructure, including property management software, are vital for tenant attraction and operational efficiency.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Property Portfolio | Commercial and residential properties in northern Sweden | SEK 31.4 billion value, 1.58 million sqm lettable area |

| Financial Capital | Equity, bank loans, capital markets access | Underpins investments, development, and acquisitions |

| Human Capital | Local market expertise, property management specialists | Contributed to 93.1% occupancy rate |

| Brand Reputation | Market leadership and commitment to urban development | Attracts tenants and investors, secures favorable financing |

| Technological Infrastructure | Property management software, digital communication tools | Enhances operational efficiency and tenant experience |

Value Propositions

Diös Fastigheter is dedicated to creating appealing and sustainable commercial and residential properties that foster lively urban settings throughout northern Sweden. This commitment is evident in their proactive pursuit of environmental certifications and energy efficiency measures, making their spaces attractive to tenants who prioritize modern and responsible living and working environments.

In 2024, Diös continued to invest in upgrading its portfolio, with a significant portion of their capital expenditure focused on enhancing energy performance and achieving higher environmental standards across their properties. For instance, their ongoing efforts in sustainable development aim to reduce the carbon footprint of their buildings, aligning with growing tenant demand for eco-conscious spaces.

Diös Fastigheter strategically places its properties in key growth cities across northern Sweden, capitalizing on burgeoning regional economies. These prime locations are selected for their direct correlation with economic development and heightened commercial activity, ensuring tenants benefit from increased foot traffic and business opportunities. For instance, in 2024, Diös continued to focus on cities like Umeå and Gävle, areas experiencing significant investment and population growth, thereby enhancing the value proposition for its lessees.

Diös Fastigheter champions active and responsive property management, a cornerstone of their business. This means they don't just maintain buildings; they actively ensure tenant needs are met promptly and efficiently. Their core values of Simple, Close, and Active truly shine here, promoting straightforward communication, genuine connection, and a proactive stance on responsibility.

This commitment translates into tangible benefits for tenants, fostering environments where businesses can thrive. For instance, in 2023, Diös reported a high tenant satisfaction score of 8.4 out of 10, underscoring the success of their hands-on approach to property care and tenant relations.

Long-Term Value Creation for Stakeholders

Diös Fastigheter is committed to creating enduring value for all its stakeholders. This extends beyond just shareholders to encompass tenants, employees, and the local communities where Diös operates. For instance, in 2024, Diös continued its focus on sustainable development, with a significant portion of its portfolio featuring environmentally certified properties, contributing to community well-being and long-term asset appreciation.

The company achieves this multifaceted value creation through a strategy of smart investments and diligent property management. By actively enhancing its properties and ensuring they meet evolving tenant needs, Diös fosters stable rental income and growth. This approach is reflected in their financial performance, where they aim for consistent positive cash flow and a robust balance sheet, supporting ongoing development and shareholder returns.

- Shareholder Value: Diös targets sustainable profit growth and dividends, aiming to deliver attractive returns on investment.

- Tenant Value: Providing modern, well-maintained, and functional spaces that support tenant business success and satisfaction.

- Community Value: Investing in local development and sustainable practices that benefit the environment and social fabric of their operating regions.

- Employee Value: Fostering a positive work environment and offering opportunities for professional growth and development.

Diverse Property Offerings

Diös Fastigheter offers a wide array of property types, encompassing offices, retail spaces, industrial and warehouse facilities, as well as healthcare, education, and residential units. This broad spectrum of offerings is designed to reduce risk and effectively serve a diverse customer base with varied needs.

This diversification strategy allows Diös to cater to numerous business types and individual residential preferences, ensuring a robust and adaptable portfolio. For instance, in 2024, their portfolio continued to balance these segments, with a significant portion dedicated to commercial properties that house a variety of businesses.

- Office Spaces: Catering to businesses seeking modern and functional workspaces.

- Retail Units: Providing prime locations for shops and consumer-facing businesses.

- Industrial/Warehouse: Supporting logistics, manufacturing, and storage needs.

- Residential: Offering homes for diverse living preferences.

Diös Fastigheter's value proposition centers on providing attractive, sustainable, and strategically located properties that foster thriving urban environments in northern Sweden. They actively enhance their portfolio through upgrades, focusing on energy efficiency and environmental certifications to meet tenant demand for modern, responsible spaces. Their commitment to active property management ensures tenant satisfaction and business success.

The company's strategic placement of properties in growing northern Swedish cities, such as Umeå and Gävle, capitalizes on economic development and increased commercial activity, directly benefiting tenants with enhanced business opportunities and foot traffic. This focus on prime locations, coupled with their hands-on management approach, cultivates environments where businesses can flourish.

Diös Fastigheter is dedicated to creating enduring value for all stakeholders. This includes generating sustainable profit growth and dividends for shareholders, providing functional and well-maintained spaces for tenants, and investing in local development and sustainable practices that benefit communities and the environment. In 2024, their portfolio continued to reflect a commitment to sustainability, with a significant portion featuring environmentally certified properties.

Their diverse property portfolio, encompassing offices, retail, industrial, and residential units, mitigates risk and caters to a broad customer base. This adaptability ensures they can serve varied business types and individual living preferences, maintaining a robust and resilient portfolio. In 2024, commercial properties continued to represent a substantial part of their offerings, supporting a wide range of businesses.

| Value Proposition Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Sustainable & Appealing Properties | Creating modern, eco-friendly spaces that attract tenants prioritizing responsibility. | Continued investment in energy performance upgrades and environmental certifications across the portfolio. |

| Strategic Location | Leveraging growth cities in northern Sweden for economic advantage and tenant opportunity. | Focus on cities like Umeå and Gävle, experiencing significant investment and population growth. |

| Active Property Management | Promptly addressing tenant needs and fostering positive relationships for business success. | High tenant satisfaction scores, with a reported 8.4 out of 10 in 2023, reflecting their responsive approach. |

| Stakeholder Value Creation | Delivering returns for shareholders, supporting tenant businesses, and benefiting communities. | Emphasis on sustainable development and environmentally certified properties contributing to community well-being. |

| Portfolio Diversification | Offering a wide range of property types to serve diverse needs and reduce risk. | A balanced portfolio including offices, retail, industrial, and residential units, with commercial properties forming a significant segment. |

Customer Relationships

Diös cultivates robust customer relationships by assigning dedicated property management teams, ensuring each tenant receives personalized attention. This direct approach fosters trust and allows for swift resolution of any issues that may arise.

With a strong local presence in its core operating cities, Diös employees are deeply embedded in the communities they serve. This proximity enables a nuanced understanding of local market trends and tenant needs, as evidenced by their commitment to being accessible and responsive.

In 2024, Diös continued to emphasize this local connection, with a significant portion of their workforce residing and working within the same cities where they manage properties. This personal investment translates into a genuine commitment to their tenants' well-being and business success, strengthening the overall customer relationship.

Diös Fastigheter actively cultivates strong tenant relationships through consistent, proactive dialogue. This includes regular check-ins and robust feedback channels designed to capture evolving tenant needs and ensure ongoing satisfaction. For instance, in 2024, Diös reported a high tenant satisfaction score of 8.5 out of 10, reflecting the success of these engagement strategies.

This commitment to understanding and responding to tenant requirements allows Diös to adapt its property portfolio and service offerings effectively. This adaptability is a key driver for their strong tenant retention rates, which stood at 95% in the first half of 2024, and contributes significantly to positive net lettings, demonstrating a business model where tenant-centricity fuels growth.

Diös Fastigheter actively cultivates enduring connections with both its commercial and residential tenants, seeing them as vital collaborators in developing vibrant urban settings. This commitment to ongoing cooperation transcends mere transactional exchanges, striving for shared prosperity and value generation.

In 2023, Diös reported a stable occupancy rate of 93.6%, underscoring the success of their long-term partnership approach in retaining tenants and ensuring consistent demand for their properties.

These stable, long-term tenant relationships are instrumental in providing Diös with predictable and reliable revenue streams, a cornerstone of their financial stability and strategic planning.

Community Engagement and Urban Development Initiatives

Diös Fastigheter extends its customer relationships beyond direct tenant interactions by actively participating in community engagement and urban development. This proactive approach involves creating vibrant and secure urban spaces, which in turn elevates the overall appeal and value for both its commercial and residential tenants.

These urban development efforts are not just about beautification; they are strategic investments. For instance, in 2024, Diös continued its focus on revitalizing city centers. Their projects often include improving public spaces, supporting local businesses, and enhancing infrastructure, directly contributing to a better quality of life for residents and a more attractive environment for businesses operating within their properties. This holistic strategy fosters goodwill and strengthens the company's social license to operate.

The benefits of this community-centric model are widespread. By investing in the well-being and attractiveness of the cities where they operate, Diös cultivates stronger, more resilient communities. This can translate into higher occupancy rates, increased tenant loyalty, and a more stable long-term investment for all stakeholders involved.

- Community Investment: Diös Fastigheter's commitment to urban development in 2024 saw continued investment in public spaces and local infrastructure, enhancing the living and working environments for its tenants.

- Tenant Value Enhancement: By fostering attractive and safe city environments, Diös indirectly boosts the value proposition for its tenants, leading to greater satisfaction and retention.

- Stakeholder Benefit: These initiatives create a positive ripple effect, benefiting not only tenants but also local residents, businesses, and the municipality, solidifying Diös's role as a responsible corporate citizen.

Digital Communication and Service Platforms

Diös Fastigheter balances personal tenant relationships with robust digital communication and service platforms. These digital tools, including a tenant portal and app, streamline service requests and information sharing, making interactions more efficient and accessible. This dual approach ensures tenants receive comprehensive support, blending the human touch with digital convenience.

In 2024, Diös continued to invest in its digital infrastructure to enhance tenant experience. For instance, the company reported a significant increase in the usage of its digital service channels for handling maintenance requests and lease inquiries. This digital focus complements their established strategy of maintaining direct, personal contact with their clients.

- Digital Accessibility: Diös’s platforms provide 24/7 access to services and information, improving convenience for tenants.

- Service Efficiency: Digital channels facilitate quicker processing of requests, reducing response times and enhancing overall satisfaction.

- Information Dissemination: Key updates, building information, and community news are readily shared through these digital touchpoints.

- Complementary to Personal Contact: Digital tools act as an extension of personal relationships, not a replacement, ensuring a well-rounded customer experience.

Diös Fastigheter prioritizes building strong, lasting relationships with its tenants, viewing them as partners in urban development. This is achieved through dedicated property management teams, proactive communication, and a deep understanding of local needs, fostering high tenant satisfaction and retention.

Their strategy blends personal interaction with efficient digital platforms, offering tenants convenience and accessibility. By investing in community engagement and urban revitalization, Diös enhances the value proposition for its tenants, creating attractive living and working environments.

This tenant-centric approach, evidenced by high satisfaction scores and occupancy rates, underpins Diös's stable revenue streams and long-term financial health.

| Metric | 2023 | H1 2024 |

|---|---|---|

| Tenant Satisfaction Score | N/A | 8.5/10 |

| Tenant Retention Rate | N/A | 95% |

| Occupancy Rate | 93.6% | N/A |

Channels

Diös Fastigheter heavily relies on its dedicated in-house sales and leasing teams to connect directly with both prospective and current tenants for their commercial and residential portfolios. This direct engagement is crucial for building relationships and understanding tenant needs.

These teams are instrumental in providing personalized experiences, including detailed property viewings and direct negotiations, ensuring a tailored approach to leasing. Their local expertise in each operating city further enhances the effectiveness of this direct sales channel.

In 2023, Diös reported that their direct leasing efforts contributed significantly to their occupancy rates, which remained robust across their portfolio. This hands-on approach allows for quicker lease-up periods and stronger tenant retention.

The Diös Fastigheter company website is a crucial digital storefront, presenting available properties, detailed company profiles, and essential investor relations materials. It's where potential tenants and investors find comprehensive information, including financial reports, reinforcing transparency.

Online portals extend this reach, streamlining tenant interactions for inquiries and service requests. These platforms offer easy access to property specifics, broadening Diös Fastigheter's engagement with its customer base and stakeholders.

Diös Fastigheter may partner with external real estate brokers and commercial agents, especially for significant commercial leases or unique property offerings. This collaboration broadens their access to potential tenants and utilizes the agents' deep market knowledge, complementing their internal leasing initiatives.

Industry Events and Networking

Diös Fastigheter actively participates in key industry events and real estate fairs, such as Fastighetsdagen and regional business expos, to foster connections. These gatherings are crucial for engaging with potential commercial tenants seeking office or retail spaces and for attracting new investors interested in their urban development projects. In 2024, Diös reported increased engagement at these events, noting a rise in qualified leads generated from networking opportunities.

These events serve as vital platforms for Diös to not only showcase its diverse property portfolio but also to actively discuss ongoing and future urban development initiatives. By presenting their vision and progress, Diös aims to solidify its reputation and strengthen its market presence within the regions they operate. For instance, their presence at the 2024 Norrland Property Fair highlighted their commitment to revitalizing city centers.

Furthermore, involvement in local business networking groups allows Diös to build and maintain relationships with a broad spectrum of stakeholders. This includes connecting with local authorities, potential business partners for joint ventures, and service providers. Such engagement in 2024 helped Diös secure several new tenant agreements through direct referrals from these networks.

- Industry Event Participation: Diös actively attends major real estate expos and local business gatherings to expand its network.

- Tenant and Investor Engagement: These events provide direct access to potential commercial tenants and investors, facilitating crucial business development.

- Showcasing Portfolio and Projects: Diös uses these platforms to present its property offerings and discuss urban development plans, enhancing market visibility.

- Strengthening Market Presence: Participation in 2024 events, like Fastighetsdagen, resulted in a notable increase in qualified leads and partnership opportunities.

Local Presence and Physical Offices

Diös Fastigheter leverages its local presence and physical offices as a key channel, reinforcing its commitment to being close to its customers and communities. This strategy allows for direct engagement, fostering trust and immediate responsiveness to the unique needs of each market in northern Sweden.

Having a physical footprint in their target cities enables Diös to build strong relationships and maintain high visibility. For instance, as of the first quarter of 2024, Diös reported a property portfolio valued at SEK 32,518 million, with a significant portion of this value tied to their presence in these specific local markets.

- Local Offices: Diös maintains physical offices in key cities across northern Sweden, serving as hubs for customer interaction and property management.

- Community Engagement: These offices facilitate direct dialogue with tenants and local stakeholders, crucial for understanding and addressing market demands.

- Brand Visibility: The physical presence enhances brand recognition and reinforces Diös's commitment to the regions where it operates.

- Operational Efficiency: Localized operations allow for quicker decision-making and more efficient property management, contributing to their stated core value of being 'Close'.

Diös Fastigheter utilizes a multi-channel approach, blending direct engagement with digital platforms and strategic partnerships. Their in-house sales teams are pivotal, fostering tenant relationships through personalized service and local market expertise. The company website acts as a primary digital hub, complemented by online portals that streamline inquiries and service requests, ensuring broad accessibility for tenants and investors alike.

External brokers are engaged for specialized leasing needs, expanding market reach. Participation in industry events and local networking groups in 2024, such as Fastighetsdagen, proved effective in generating qualified leads and fostering new partnerships, directly contributing to increased tenant engagement and business development opportunities.

Diös Fastigheter's physical presence through local offices in northern Sweden is a cornerstone of its channel strategy. These offices facilitate direct interaction, building trust and ensuring responsiveness to tenant needs within their operational regions. This localized approach supports efficient property management and strengthens brand visibility, aligning with their core value of being 'Close' to their customers and communities.

| Channel | Description | Key Activities | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales & Leasing Teams | In-house teams for commercial and residential properties. | Property viewings, direct negotiations, tenant relationship management. | Contributed to robust occupancy rates; enhanced tenant retention. |

| Company Website & Online Portals | Digital storefront for property listings, company info, and investor relations. | Property showcasing, inquiry handling, service requests, information dissemination. | Streamlined tenant interactions; broadened customer base engagement. |

| Real Estate Brokers & Agents | External partners for significant or unique property leases. | Leveraging market knowledge, accessing wider tenant pools. | Complemented internal leasing efforts for specialized deals. |

| Industry Events & Networking | Participation in real estate expos and local business gatherings. | Networking, showcasing portfolio, discussing urban development, lead generation. | Increased qualified leads and partnership opportunities; highlighted commitment to city center revitalization. |

| Local Physical Offices | Physical presence in key northern Swedish cities. | Customer interaction, property management, community engagement, brand visibility. | Facilitated direct dialogue and responsive property management; supported operational efficiency. |

Customer Segments

Commercial tenants seeking office spaces represent a core customer segment for Diös Fastigheter, contributing over half of their rental income. These businesses, from startups to established corporations, prioritize modern, well-located, and flexible office solutions within Sweden's growth cities.

The demand for adaptable workspaces is high, with tenants often looking for environments that can support evolving work models. In 2024, Diös continued to focus on providing these contemporary office environments, understanding that tenant needs are shifting towards more collaborative and technologically integrated spaces.

A stable sub-segment within this group comprises public sector organizations. Their consistent need for office facilities provides a reliable revenue stream, underpinning Diös's strategy to offer diverse and dependable office solutions across their portfolio.

Commercial tenants, encompassing a wide array of retail stores, restaurants, and essential urban service providers, form a core segment for Diös Fastigheter. These businesses are drawn to Diös's portfolio for its strategic placement in bustling city centers and key commercial districts, offering them direct access to significant foot traffic and a vibrant customer base.

Diös actively cultivates these relationships by offering attractive, well-maintained commercial spaces designed to foster tenant success. For instance, in 2024, Diös reported a strong occupancy rate across its commercial properties, with a particular emphasis on retail and service tenants in Sweden's growth regions, demonstrating the segment's vital contribution to the company's revenue and the revitalization of urban environments.

Diös Fastigheter focuses on providing homes for individuals and families in the vibrant cities of northern Sweden. They manage and maintain residential properties, ensuring tenants have appealing living spaces with easy access to city conveniences.

In 2024, Diös continued its strategy of transforming vacant commercial spaces into desirable residential units, directly addressing the housing needs of this customer segment. The company's commitment to well-kept properties and attractive living environments is a key draw for those seeking a home in these growing urban centers.

Public Sector Tenants

Public sector tenants represent a cornerstone of Diös Fastigheter's business, accounting for a substantial one-third of their total rental income. This reliance on government agencies, municipalities, and educational institutions underscores the stability and predictability inherent in this customer segment.

These agreements are typically characterized by their long-term nature, providing Diös with a reliable revenue stream that bolsters its overall financial resilience. For instance, in 2024, Diös continued to see consistent demand from these entities for specialized properties.

- Tenant Profile Tax-funded entities including government agencies, municipalities, and educational institutions.

- Revenue Contribution Approximately one-third of Diös's total rental income.

- Key Characteristics Long-term rental agreements, contributing to financial stability.

- Property Requirements Often necessitate specific facility types and strategic locations.

Local Businesses and Entrepreneurs

Diös Fastigheter focuses on local businesses and entrepreneurs seeking prime locations in northern Sweden's urban centers. They actively support these ventures, aiming to foster their growth and contribute to the region's economic vitality.

The company acts as a partner, providing not just space but also a conducive environment for businesses to thrive. This approach is crucial for diversifying local economies.

In 2024, Diös continued its strategy of investing in and developing properties that cater to the evolving needs of these local enterprises. Their portfolio is designed to attract and retain a diverse range of businesses.

- Targeting: Local businesses and entrepreneurs in northern Swedish cities.

- Value Proposition: Providing suitable premises for establishment and expansion.

- Role: Supportive landlord fostering local economic growth and diversification.

- 2024 Focus: Continued investment in properties tailored for local business needs.

Diös Fastigheter serves a diverse clientele, with commercial tenants, including retail and service providers, forming a significant segment drawn to prime urban locations for high foot traffic. Public sector entities, such as government agencies and educational institutions, represent another crucial customer base, contributing about one-third of rental income through stable, long-term agreements. Additionally, individuals and families seeking residential spaces in northern Sweden's growing cities are a key focus, with Diös actively converting commercial properties to meet housing demands.

| Customer Segment | Description | 2024 Focus/Contribution |

|---|---|---|

| Commercial Tenants (Retail, Service) | Businesses seeking well-located spaces with high foot traffic in city centers. | Strong occupancy in retail and service spaces, vital for urban revitalization. |

| Public Sector Tenants | Government agencies, municipalities, and educational institutions requiring specialized properties. | Consistent demand, contributing approximately one-third of total rental income with long-term agreements. |

| Residential Tenants | Individuals and families looking for appealing living spaces in northern Swedish cities. | Strategy to convert commercial spaces to residential units to meet housing needs. |

| Local Businesses & Entrepreneurs | Startups and established local enterprises needing suitable premises for growth. | Investment in properties tailored to local business needs, fostering economic diversification. |

Cost Structure

Diös Fastigheter's property acquisition costs are a significant driver of their business model, encompassing purchase prices, transaction fees, and extensive legal and due diligence. In 2024, the company continued its strategic expansion, with property acquisitions forming a cornerstone of its growth. These investments are particularly substantial when Diös pursues larger portfolio acquisitions, reflecting their commitment to expanding their footprint in strategically chosen growth regions.

Property operation and maintenance costs are the ongoing expenses Diös incurs to keep its portfolio running smoothly. These include essential services like heating, electricity, regular repairs, cleaning, and security, as well as administrative overhead. For instance, in 2023, Diös reported that its property management expenses amounted to SEK 497 million, reflecting the significant commitment to maintaining its assets.

Diös prioritizes efficient management of these recurring costs. A key strategy is energy price hedging, which helps to stabilize expenses related to utilities, even with fluctuating market prices. This proactive approach is crucial for preserving a healthy operating surplus, which is a measure of profitability before interest and taxes.

Financing and interest costs are a significant component of Diös Fastigheter's expenses due to their substantial reliance on external funding. In 2024, the company's interest expenses on loans and bonds represent a major outflow, directly impacting their bottom line.

Diös actively manages its interest rate exposure by employing various financial instruments and strategies to optimize its financing structure. This proactive approach aims to minimize borrowing costs and enhance profitability in a fluctuating interest rate environment.

Property Development and Renovation Costs

Diös Fastigheter’s cost structure is significantly influenced by property development and renovation. Investing in new construction, redevelopments, and substantial renovations involves considerable expenses. These include the price of building materials, skilled labor, necessary permits, and project management fees. These outlays are essential for boosting property worth and responding to market needs, aiming to create contemporary and eco-friendly environments.

In 2024, Diös continued its strategic focus on value-enhancing projects. For instance, their ongoing development in Östersund, a key project involving modernizing existing structures and adding new commercial spaces, is a prime example of these significant capital expenditures. Such initiatives are vital for maintaining a competitive edge and ensuring properties align with current sustainability standards and tenant expectations.

- Construction Materials: Fluctuations in global commodity prices directly impact the cost of steel, concrete, and timber, key components in Diös' development projects.

- Labor Costs: The availability and cost of skilled construction labor in Sweden are critical factors in project budgeting and timelines.

- Permits and Fees: Obtaining necessary building permits and navigating regulatory approvals represent a fixed cost component for all new developments and major renovations.

- Project Management: Efficient project management is crucial for controlling costs and ensuring projects are delivered on time and within budget, reflecting Diös' commitment to operational excellence.

Personnel and Administrative Costs

Personnel and administrative costs are fundamental to Diös Fastigheter's operations, encompassing salaries, benefits, and general overhead for essential functions like management, leasing, finance, and support. This includes the expenses associated with maintaining a local presence and dedicated teams across its operational areas.

In 2024, Diös Fastigheter's personnel and administrative expenses are a significant component of its cost structure. These costs are directly tied to the company's ability to manage its property portfolio effectively and engage with its tenants and stakeholders. The emphasis on a local presence necessitates investment in regional teams.

- Personnel Costs: Salaries and benefits for management, leasing agents, finance staff, and administrative support.

- Administrative Overhead: Costs related to office space, utilities, IT, and general operational expenses.

- Local Presence: Expenses incurred from maintaining regional offices and dedicated local teams to manage properties and tenant relationships.

- 2023 Financials: While specific 2024 figures are still being finalized, personnel and administrative costs represented a notable portion of Diös's total operating expenses in 2023, reflecting the company's operational scale and commitment to local expertise.

Diös Fastigheter's cost structure is heavily influenced by property acquisition, ongoing operations, and strategic development. The company incurs substantial costs in purchasing new properties, managing existing ones through maintenance and utilities, and investing in renovations and new builds to enhance value and meet market demands.

Financing and interest expenses are a significant outflow due to the company's reliance on debt. Personnel and administrative costs, including salaries and maintaining a local presence, are also fundamental to their operations. In 2024, these elements collectively shape Diös's financial outlay.

| Cost Category | Key Components | 2023/2024 Impact |

|---|---|---|

| Property Acquisition | Purchase prices, transaction fees, legal costs | Significant investment in strategic growth areas in 2024 |

| Property Operation & Maintenance | Heating, electricity, repairs, cleaning, security, administration | SEK 497 million in property management expenses in 2023; energy hedging for stability |

| Development & Renovation | Materials, labor, permits, project management | Ongoing value-enhancing projects in 2024, e.g., Östersund development |

| Financing & Interest Costs | Loans, bonds | Major outflow impacting profitability; active management of interest rate exposure |

| Personnel & Administrative | Salaries, benefits, overhead, local presence | Significant component of operating expenses in 2023; supports effective portfolio management and tenant engagement |

Revenue Streams

Diös Fastigheter's core revenue engine is the rental income derived from its substantial collection of commercial properties. This includes a mix of office buildings, retail outlets, and industrial facilities strategically located across Sweden.

A key strength of this revenue stream is its diversification across a wide range of tenants. Notably, a significant portion of Diös's rental income comes from public sector entities, which lends a considerable degree of stability and predictability to their earnings, especially when compared to private sector tenants.

For the full year 2024, Diös Fastigheter reported a rental income of SEK 2,663 million. This figure demonstrates the substantial scale of their operations and the consistent cash flow generated from their property holdings.

Diös Fastigheter generates revenue by renting out residential units within its extensive property portfolio. This stream, while secondary to commercial rentals, plays a crucial role in diversifying the company's income sources and meeting housing demands in its key growth cities.

In 2024, Diös continued to focus on its strategic growth cities, where the demand for housing remains strong. This residential segment contributes to a more stable and predictable revenue flow, complementing the performance of its commercial properties.

Diös Fastigheter generates revenue through the strategic sale of properties, often divesting non-core assets or those where value can be realized. This approach contributes to capital gains and frees up capital for strategic acquisitions or new development projects. In 2023, Diös reported net sales from property divestments amounting to SEK 350 million, demonstrating active portfolio management.

Development Profits

Diös Fastigheter realizes profits from its property development and redevelopment initiatives. This involves enhancing property value through new construction or substantial renovations, creating opportunities to either generate ongoing rental income or achieve capital gains through sales. These completed projects directly contribute to the company's operating surplus.

In 2024, Diös Fastigheter continued to focus on value-creation through development. For instance, their project in Sundsvall, involving the development of approximately 20,000 square meters of modern office and retail space, is expected to significantly boost rental income and property values upon completion. The company's strategic focus on urban development and modernization of existing portfolios underpins this revenue stream.

- Property Value Appreciation: Profits are generated by increasing the market value of assets through development.

- Rental Income Enhancement: Redeveloped properties often command higher rents, boosting recurring revenue.

- Sales Profitability: The sale of developed or redeveloped properties can yield substantial one-time profits.

- Contribution to Operating Surplus: Successful development projects directly increase the company's overall financial performance.

Service and Management Fees (if applicable)

Diös Fastigheter, like many real estate entities, likely supplements its core rental income with service and management fees, even if not extensively detailed. These fees can arise from providing specific services to tenants or managing properties for third parties. For instance, in 2023, the Swedish real estate sector saw a continued focus on operational efficiency, with companies exploring ancillary revenue streams to bolster profitability.

These fees might encompass charges for managing utilities, offering additional services like cleaning or maintenance beyond standard lease agreements, or even administrative charges for specific tenant requests. While Diös Fastigheter's primary revenue comes from property rentals, these smaller, often recurring fees contribute to overall financial health.

Examples of such revenue streams in the broader real estate market include:

- Property Management Fees: Charges for overseeing and operating properties, often a percentage of rental income or a fixed fee.

- Ancillary Service Charges: Fees for services like concierge, security, or specialized maintenance provided to tenants.

- Utility Management Fees: Markups or administrative fees associated with managing and billing for shared utility costs.

- Leasing and Brokerage Fees: Income generated from securing new tenants or managing lease renewals.

Diös Fastigheter's revenue streams are primarily driven by rental income from its diverse property portfolio, which includes commercial and residential spaces. In 2024, rental income reached SEK 2,663 million, highlighting the stability of this core revenue source, particularly with a significant portion derived from public sector tenants.

The company also generates income through property divestments, actively managing its portfolio to realize capital gains and reinvest in growth opportunities. In 2023, property divestments contributed SEK 350 million to their revenue.

Furthermore, Diös benefits from property development and redevelopment projects, which enhance asset values and can lead to both increased rental income and capital appreciation upon sale. Their ongoing development in Sundsvall, for example, aims to boost future rental income and property valuations.

| Revenue Stream | Description | 2023/2024 Data |

|---|---|---|

| Rental Income | Income from leasing commercial and residential properties. | SEK 2,663 million (2024) |

| Property Divestments | Revenue from selling properties. | SEK 350 million (2023) |

| Property Development | Profits from enhancing property value through new construction or renovations. | Ongoing projects contributing to future income and value. |

Business Model Canvas Data Sources

The Diös Fastigheter Business Model Canvas is informed by their annual reports, investor presentations, and market analysis of the Swedish real estate sector. These sources provide crucial insights into their property portfolio, customer base, and competitive landscape.