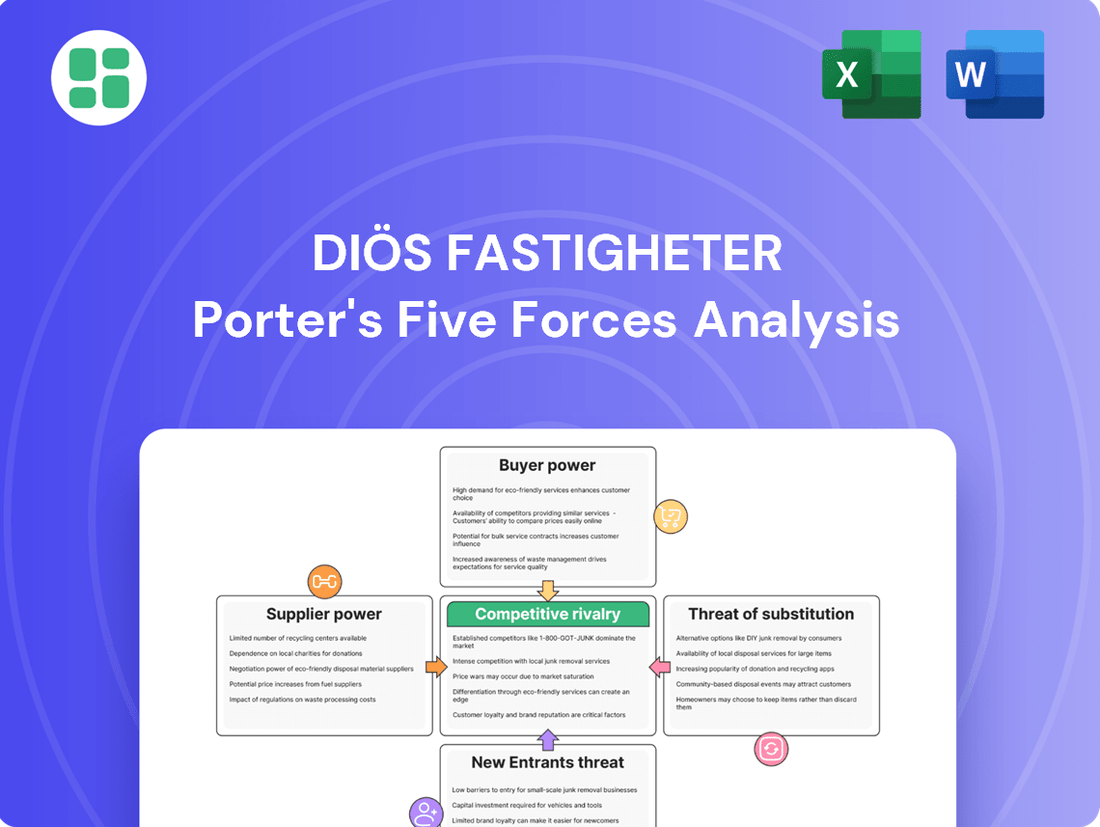

Diös Fastigheter Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diös Fastigheter Bundle

Diös Fastigheter operates within a dynamic real estate landscape, where understanding the interplay of competitive forces is crucial for strategic success. Our analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sector.

The complete report reveals the real forces shaping Diös Fastigheter’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of suitable land in Diös Fastigheter’s core growth cities in northern Sweden presents a significant factor in supplier bargaining power. Land supply is often constrained and controlled by municipalities or a limited number of major landowners, creating scarcity.

This scarcity can translate into considerable bargaining power for land sellers, directly impacting Diös' acquisition costs and the overall feasibility of development projects. For instance, in 2024, Diös reported SEK 1,248 million in property acquisitions, highlighting the importance of managing these land acquisition costs effectively.

Diös' strategic success hinges on its capacity to secure attractive development sites. The company's ability to negotiate favorable terms for land is therefore crucial for executing its long-term growth strategy and maintaining competitive advantage in the property development sector.

Suppliers of construction services and building materials exert a moderate level of influence, especially when demand is high or inflation is a factor. While a broad range of general suppliers exist, scarcity of specialized materials or skilled labor can drive up expenses. Diös Fastigheter's Q1 2025 report highlighted ongoing inflationary pressures, underscoring the potential impact from these suppliers on project costs.

Financing providers, such as banks and bond investors, are crucial suppliers for Diös Fastigheter. Their influence stems from their ability to provide capital, and their bargaining power is directly tied to prevailing interest rates and overall market liquidity. For instance, if interest rates rise significantly, the cost of borrowing for Diös will increase.

Diös Fastigheter has historically maintained a prudent financial strategy, evidenced by its diversified funding sources and a stable loan-to-value ratio, which was around 45% in late 2023. However, even with this conservative approach, any tightening of credit conditions or a sharp increase in interest rates, as seen in the upward trend of benchmark rates throughout 2023 and into early 2024, can elevate Diös's borrowing expenses and potentially affect its net operating income.

Maintenance and Service Providers

Diös Fastigheter depends on external companies for essential property upkeep, cleaning, and security. While many of these services are standard, a scarcity of specialized providers or a concentration of local service companies in northern Sweden could give these suppliers a stronger hand in negotiations. For instance, in 2024, the Swedish construction and maintenance sector faced ongoing labor shortages, potentially increasing costs for specialized skills.

The bargaining power of these maintenance and service providers can be influenced by several factors:

- Provider Concentration: A limited number of qualified providers in Diös's operating regions, particularly in less populated areas of northern Sweden, can increase supplier leverage.

- Service Specialization: Highly specialized maintenance or technical services, which require specific expertise or certifications, tend to have higher bargaining power than general services.

- Switching Costs: The effort and expense involved in changing service providers can influence how much power suppliers wield. Long-term contracts or integrated systems can raise these costs.

- Supplier Dependence: If Diös represents a significant portion of a supplier's revenue, the supplier's bargaining power might be reduced. Conversely, if Diös is a small client for a large provider, the supplier has more leverage.

Technology and Digital Solutions Providers

The increasing reliance on technology for smart building features, efficient energy management, and enhanced tenant experiences is elevating the influence of specialized technology providers. Diös Fastigheter's commitment to developing appealing and sustainable properties necessitates the adoption of advanced solutions, which in turn can amplify the bargaining power of suppliers offering integrated property technology.

For instance, the global smart building market was valued at approximately USD 80.2 billion in 2023 and is projected to grow significantly. This growth indicates a strong demand for innovative digital solutions. Diös' strategic investments in digital transformation, aiming to improve operational efficiency and tenant satisfaction, mean that providers of these critical technologies hold considerable sway.

- Increased Demand: The expanding smart building market, projected to reach substantial figures by 2030, underscores the growing importance of technology providers.

- Specialized Expertise: Providers offering unique, integrated property technology solutions possess niche knowledge that is difficult for real estate firms to replicate internally.

- Switching Costs: Implementing and integrating new technology systems can involve significant costs and operational disruptions, making it less feasible for Diös to switch providers frequently.

Land suppliers in Diös Fastigheter's core northern Swedish markets wield significant bargaining power due to scarcity, directly impacting acquisition costs. Diös' 2024 property acquisitions totaling SEK 1,248 million underscore the need for effective land cost management.

Suppliers of specialized construction materials and skilled labor can exert moderate influence, particularly during periods of high demand or inflation, as noted by Diös' Q1 2025 report on inflationary pressures.

Financing providers, like banks, hold considerable power, with their influence tied to interest rates. Diös' stable loan-to-value ratio of around 45% in late 2023 provides some buffer, but rising rates, seen throughout 2023-2024, increase borrowing expenses.

| Supplier Type | Bargaining Power Factor | Impact on Diös | Relevant Data/Context |

|---|---|---|---|

| Land Suppliers | Scarcity, Municipal control | Higher acquisition costs | SEK 1,248M property acquisitions in 2024 |

| Construction Materials/Labor | Demand, Inflation, Specialization | Increased project expenses | Q1 2025 inflationary pressures noted |

| Financing Providers | Interest rates, Market liquidity | Higher borrowing costs | Rates rose through 2023-2024; LTV ~45% (late 2023) |

What is included in the product

This analysis of Diös Fastigheter leverages Porter's Five Forces to dissect the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the Swedish real estate market.

Instantly identify and mitigate competitive threats with a visual breakdown of Diös's market landscape.

Customers Bargaining Power

Diös' substantial holdings in office and retail spaces naturally give its commercial tenants, especially larger entities, a degree of bargaining power. This leverage is amplified in markets experiencing higher vacancy rates or an oversupply of properties, as tenants can more readily negotiate favorable lease terms.

The evolving Swedish real estate landscape, marked by a growing demand for flexible office solutions and a trend toward lease renegotiations, further empowers tenants. In 2024, this translates into tenants actively seeking better rental rates, shorter lease commitments, or more adaptable space configurations to align with their changing operational needs.

Public sector tenants represent a significant portion of Diös Fastigheter's rental income, typically securing long-term leases that inherently limit their bargaining power. These entities prioritize stability and a consistent local presence, often foregoing aggressive price negotiations in favor of reliable, long-term partnerships. For instance, in 2024, Diös reported that a substantial percentage of its revenue was derived from these stable, public sector agreements, underscoring their importance in providing a predictable income stream.

In Diös Fastigheter's residential segment, tenant bargaining power is influenced by a dynamic interplay of factors. While strong demand for rentals in key northern Swedish growth cities generally limits tenant leverage, rising affordability concerns and a modest uptick in unemployment in some regions could provide tenants with a degree of negotiation strength.

Despite these potential shifts, a general housing shortage across many of Diös's operating areas continues to bolster the landlord's position, reinforcing their ability to set rental terms. For instance, in Q1 2024, Diös reported a vacancy rate of only 3.5% in its residential portfolio, indicating robust occupancy and a favorable market for property owners.

Tenant Mobility and Switching Costs

Tenant mobility for Diös Fastigheter is influenced by switching costs, which can encompass relocation expenses, potential business disruption, and the administrative burden of finding new commercial spaces. For instance, if a tenant needs to move, they might incur costs for fitting out a new space, moving services, and potential downtime in operations.

The power of customers, meaning Diös' tenants, is directly related to how easy or difficult it is for them to switch to a competitor. If there are many readily available and comparable properties in the same northern Swedish locations where Diös operates, tenants have more leverage. Conversely, a scarcity of suitable alternatives can significantly reduce their bargaining power.

Diös Fastigheter actively works to mitigate tenant power by fostering a strong local presence and offering customized property solutions. This approach aims to increase tenant loyalty and reduce the likelihood of them seeking alternative landlords, thereby minimizing churn and maintaining stable rental income.

- Tenant Switching Costs: Include relocation expenses, business interruption, and the effort of finding new premises.

- Impact of Alternatives: Lower switching costs and abundant alternatives increase tenant power.

- Diös' Mitigation Strategy: Local presence and tailored solutions aim to retain tenants and reduce their bargaining power.

- Market Context: In 2024, the commercial real estate market in northern Sweden may present varying levels of tenant mobility depending on local economic conditions and new supply.

Demand for Modern and Sustainable Premises

Tenants are increasingly prioritizing modern, efficient, and sustainable spaces, especially in the office market. This trend can empower tenants who seek specific green certifications or advanced amenities, allowing them to negotiate more favorable terms. Diös Fastigheter's proactive approach to developing environmentally friendly and certified buildings is therefore vital for retaining and attracting these discerning clients, thereby safeguarding its competitive standing.

In 2024, the demand for sustainable office spaces continued to rise, with a notable increase in inquiries for buildings holding certifications like LEED or BREEAM. For instance, reports from the Swedish Green Building Council indicated that properties with strong sustainability credentials often commanded higher rental rates and experienced lower vacancy periods. Diös' investment in upgrading its portfolio to meet these evolving tenant expectations, evidenced by their ongoing projects in cities like Östersund and Sundsvall, directly addresses this shift in bargaining power.

- Growing Tenant Preference: A significant portion of office leasing activity in 2024 focused on spaces that offered modern design, energy efficiency, and robust sustainability features.

- Certification as a Differentiator: Properties with recognized green building certifications, such as LEED Platinum or equivalent, provided tenants with a tangible benefit, influencing their location decisions.

- Diös' Strategic Response: Diös Fastigheter's commitment to developing and retrofitting properties to enhance their sustainability profile, including investments in renewable energy sources and improved insulation, directly counters tenant leverage by meeting these critical demands.

The bargaining power of Diös Fastigheter's customers, primarily its tenants, is a key consideration in its operational strategy. Factors such as the availability of alternative properties, the costs associated with switching, and the specific needs of tenants all influence their ability to negotiate lease terms. In 2024, the demand for flexible and sustainable office spaces meant that tenants with specific requirements could exert more influence.

While Diös's efforts to build strong local relationships and offer tailored solutions aim to reduce tenant bargaining power, market dynamics play a crucial role. The presence of numerous comparable properties in its operating regions can empower tenants, especially larger commercial entities, to seek more favorable lease agreements. Conversely, a tight market with limited alternatives strengthens Diös's position.

The public sector's significant tenancy provides a stable income base, as these entities typically prioritize long-term partnerships over aggressive price negotiations. In 2024, Diös continued to benefit from these predictable agreements, which contribute substantially to its revenue stream.

In the residential segment, while a general housing shortage in northern Sweden supports landlord power, rising affordability concerns in some areas in 2024 could offer tenants some negotiation leverage. However, Diös's low residential vacancy rate of 3.5% in Q1 2024 underscores a generally strong market position.

Preview Before You Purchase

Diös Fastigheter Porter's Five Forces Analysis

This preview showcases the complete Diös Fastigheter Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the real estate sector. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The Swedish real estate landscape, particularly in the northern regions where Diös Fastigheter operates, is quite diverse. It features a blend of substantial national real estate companies alongside specialized regional firms that deeply understand local dynamics.

Diös strategically positions itself as a frontrunner within its ten chosen growth cities across northern Sweden. This leadership is built upon its extensive local footprint and profound understanding of these specific markets, serving as a significant advantage over its competitors.

For instance, in 2023, Diös Fastigheter reported a property value of SEK 78,733 million, highlighting its substantial presence in these northern Swedish markets and its ability to compete effectively within this fragmented environment.

Competition for prime assets and new development projects within the Swedish real estate market is notably intense. This is particularly true as investment volumes have rebounded, with a notable recovery observed in 2024 and expectations for continued growth into 2025.

This heightened demand for attractive properties and development opportunities directly fuels increased acquisition costs and can lead to compressed yields for companies like Diös Fastigheter.

Competitors actively battle for tenants by adjusting rental prices, offering attractive incentives, and enhancing property quality. Diös Fastigheter, despite experiencing stable rental income, noted a slight dip in its economic occupancy rate during the first quarter of 2025. This suggests that competitive forces or shifts in market demand are at play.

Effectively managing vacancy rates and securing positive net lettings are therefore paramount for Diös to navigate this competitive landscape. In Q1 2025, Diös reported a net letting of SEK 58 million, a positive indicator, though ongoing market dynamics will influence future performance.

Diversified Portfolios and Strategies

Competitive rivalry within the real estate sector is intense, with major players like Fastighets AB Balder, AB Sagax, and Castellum boasting highly diversified portfolios. These competitors spread their investments across various property types and geographical regions, aiming to mitigate risk and capture broader market opportunities.

Diös Fastigheter, by contrast, has adopted a more focused strategy, concentrating its efforts on northern Sweden and a blend of commercial and residential properties. While this specialization allows Diös to cultivate deep expertise within its chosen niche, it also places it in direct competition with other firms operating within similar geographic and property segments.

The differing strategies highlight a key aspect of rivalry: breadth versus depth. Diversified players compete across a wider landscape, while focused players like Diös face concentrated competition within their specialized areas. For instance, in 2024, Diös reported a property portfolio valued at SEK 32.1 billion, with a significant portion concentrated in its core northern Swedish markets.

- Diversified Competitors: Companies like Balder, Sagax, and Castellum operate across multiple property sectors and regions.

- Diös' Focus: Diös concentrates on northern Sweden, balancing commercial and residential assets.

- Specialization vs. Breadth: Diös' focused strategy offers niche expertise but intensifies direct competition in its chosen markets.

- Market Value Context: Diös' property portfolio was valued at SEK 32.1 billion in 2024, underscoring the scale of operations within its specialized focus.

Focus on Sustainability and ESG

The increasing focus on Environmental, Social, and Governance (ESG) criteria is reshaping the competitive landscape for real estate firms like Diös Fastigheter. Companies that proactively integrate sustainability into their operations and property portfolios are gaining a distinct advantage.

This shift means that demonstrating strong ESG performance is no longer just a matter of corporate responsibility; it's a key driver of competitive differentiation. For instance, by 2024, a significant portion of institutional investors are expected to have ESG mandates, making sustainable properties more attractive for capital allocation.

- Tenant Attraction: Properties with green certifications, such as LEED or BREEAM, are increasingly sought after by tenants looking to align with their own sustainability goals. This can lead to higher occupancy rates and potentially premium rental income for Diös Fastigheter if they can offer such spaces.

- Investor Appeal: Investors are channeling more capital into ESG-compliant assets. Diös Fastigheter's ability to showcase robust sustainability metrics and transparent reporting on its environmental impact can attract a wider pool of capital and potentially lower its cost of financing.

- Regulatory & Market Pressures: Evolving regulations and growing public awareness around climate change are creating pressure for real estate companies to adopt greener practices. Those that lag behind may face reputational damage and market share erosion.

- Innovation in Green Building: The competition is also fostering innovation in sustainable building technologies and materials. Diös Fastigheter's success will partly depend on its capacity to adopt and implement these advancements to create more energy-efficient and environmentally friendly properties.

Competition among real estate firms in northern Sweden is robust, with Diös Fastigheter facing off against both large, diversified national players and smaller, regionally focused entities. This rivalry intensifies for prime properties and development opportunities, especially as investment activity picked up in 2024 and is expected to continue growing into 2025.

While companies like Fastighets AB Balder, AB Sagax, and Castellum leverage broad portfolios across various sectors and geographies, Diös maintains a concentrated strategy in northern Sweden. This specialization allows for deep market knowledge but means Diös competes directly with others targeting similar niches, leading to increased acquisition costs and pressure on yields.

The drive for sustainability is also a significant competitive factor. Properties with strong ESG credentials are increasingly attractive to both tenants and investors, potentially impacting occupancy and financing costs. Diös's Q1 2025 economic occupancy rate dip suggests that navigating these competitive pressures, including tenant attraction through property quality and sustainability, remains crucial.

| Competitor Type | Strategy Example | Diös Fastigheter's Position | 2024 Portfolio Value (SEK) | Q1 2025 Net Letting (SEK) |

|---|---|---|---|---|

| Diversified National | Broad portfolio across sectors/regions (e.g., Balder, Castellum) | Focused on northern Sweden | SEK 32.1 billion (Diös) | SEK 58 million (Diös) |

| Regional Specialists | Deep local market understanding | Frontrunner in 10 chosen growth cities | SEK 78,733 million (Diös property value 2023) |

SSubstitutes Threaten

The increasing prevalence of remote and hybrid work models presents a substantial threat of substitutes for traditional office spaces. This shift means companies may require less physical office space, impacting demand for Diös Fastigheter's core offerings.

For instance, a 2024 survey indicated that 60% of companies plan to maintain hybrid work arrangements, signaling a sustained reduction in the need for traditional, long-term office leases. This trend directly challenges the value proposition of fixed office premises.

Companies are increasingly exploring flexible leasing options and co-working spaces as viable alternatives. This can lead to lower occupancy rates and potentially reduced rental income for property owners like Diös, as businesses opt for agility over extensive office commitments.

For Diös Fastigheter's residential segment, alternative housing solutions present a key threat. These include co-living spaces and shared accommodations, which cater to changing lifestyle preferences and affordability concerns. For instance, the growing popularity of co-living in major Swedish cities could divert demand from traditional rental units.

Technological advancements pose a significant threat by enabling new ways to utilize or manage property, potentially replacing traditional real estate services. For example, the rise of virtual offices and the increasing efficiency of smaller physical spaces, facilitated by technology, could lessen the demand for extensive commercial real estate. In 2023, the global flexible workspace market was valued at approximately $65 billion, a figure expected to grow, indicating a shift that could impact traditional office leasing models.

Shifts in Retail Consumption Patterns

The persistent expansion of e-commerce and evolving consumer preferences present a significant substitute for traditional physical retail locations. This shift directly impacts the demand for brick-and-mortar stores, a segment within Diös Fastigheter's portfolio.

A notable trend is the increasing reliance on online platforms for purchases, which can diminish the foot traffic and sales potential of physical retail spaces. For instance, global e-commerce sales were projected to reach approximately $6.3 trillion in 2024, underscoring the scale of this substitution effect.

Diös Fastigheter, with its holdings in retail properties, must contend with this substitute threat. The company's strategy may need to incorporate adaptations such as enhancing in-store experiences or diversifying its retail asset base to mitigate the impact of reduced demand for traditional retail.

- E-commerce Growth: Global e-commerce sales are expected to reach approximately $6.3 trillion in 2024.

- Consumer Behavior: A growing preference for online shopping reduces the necessity for physical retail visits.

- Impact on Retail Assets: Diös Fastigheter's retail properties face potential decreased demand due to online alternatives.

- Strategic Adaptation: The company may need to diversify its retail offerings or enhance physical store appeal.

Build-to-Own vs. Build-to-Rent Models

In the residential real estate sector, the fundamental choice between developing properties for sale (build-to-own) and developing properties for rent (build-to-rent) creates a significant substitutive threat for companies like Diös Fastigheter. This means that potential residents or investors might opt for one model over the other depending on market conditions and personal preferences.

Diös, which primarily operates a build-to-rent model, must contend with developers focused on the build-to-own market. The attractiveness of build-to-own is heavily influenced by factors such as interest rates and the overall health of the housing market. For instance, rising interest rates can make purchasing a home less affordable, potentially increasing demand for rental properties, thus benefiting Diös. Conversely, a booming housing market with falling interest rates might draw more individuals towards ownership, presenting a challenge.

- Build-to-Own: Focuses on selling newly constructed homes directly to buyers.

- Build-to-Rent: Focuses on retaining ownership and generating income through rental payments.

- Interest Rate Sensitivity: Higher interest rates generally favor build-to-rent by making homeownership more expensive.

- Market Trends: Shifts in housing affordability and consumer preference for ownership versus renting directly impact the substitutive threat.

The threat of substitutes for Diös Fastigheter's properties is multifaceted, stemming from evolving work and living arrangements, alongside the digital economy. Remote work models and flexible office solutions directly substitute traditional office leases, impacting demand for commercial spaces. Similarly, the rise of co-living and alternative housing options presents a substitute for standard residential rentals.

Technological advancements also enable substitutes, such as virtual offices and more efficient use of smaller physical footprints, potentially reducing the need for extensive commercial real estate. The increasing shift towards e-commerce directly substitutes physical retail, diminishing the appeal of brick-and-mortar stores.

| Substitute Type | Description | 2024 Data/Trend | Impact on Diös |

|---|---|---|---|

| Remote/Hybrid Work | Reduced need for physical office space. | 60% of companies plan to maintain hybrid work. | Lower occupancy and rental income for office assets. |

| Flexible Office Solutions | Co-working spaces and agile leasing. | Global flexible workspace market valued at ~$65 billion in 2023, with growth expected. | Competition for traditional leases, potential for reduced long-term commitments. |

| Alternative Housing | Co-living, shared accommodations. | Growing popularity in major Swedish cities. | Diversion of demand from traditional rental units. |

| E-commerce | Online shopping replacing physical retail. | Global e-commerce sales projected to reach ~$6.3 trillion in 2024. | Decreased foot traffic and sales potential for retail properties. |

| Build-to-Own Housing | Preference for homeownership over renting. | Influenced by interest rates and housing market health. | Potential reduction in demand for rental properties if homeownership becomes more attractive. |

Entrants Threaten

Diös Fastigheter operates in a sector where high capital requirements act as a significant deterrent to new entrants. The real estate industry, particularly development and ownership, demands substantial financial outlays for acquiring land, covering construction costs, and managing properties. For example, in 2024, major commercial property developments often require hundreds of millions of Swedish Kronor, if not billions, making it difficult for smaller or less capitalized firms to compete.

Success in real estate, particularly in commercial property like that managed by Diös Fastigheter, hinges on deep experience in development, management, and nuanced market analysis. Newcomers often struggle to replicate the established operational efficiencies and market understanding that seasoned firms possess.

For instance, Diös Fastigheter's 2024 financial reports highlight their long-standing presence and expertise, with a portfolio valued in the billions of Swedish kronor. New entrants typically lack the critical mass of projects, established supplier relationships, and a proven ability to navigate complex regulatory environments, making it difficult to match the operational leverage and risk management capabilities of incumbents.

Diös Fastigheter's robust local market knowledge and established relationships in northern Swedish growth cities present a formidable barrier to new entrants. This deep understanding of regional dynamics, including local business needs and municipal partnerships, is not easily replicated.

For instance, Diös' long-standing presence allows them to navigate complex permitting processes and secure prime locations, advantages that newcomers would struggle to match. In 2024, their focus on these specific regions, evidenced by their portfolio concentration, underscores the value of this localized expertise.

Regulatory and Permitting Hurdles

The real estate sector, including companies like Diös Fastigheter, faces significant barriers to entry due to intricate regulatory frameworks. These include complex zoning laws, building codes, and environmental regulations that vary by municipality and region. For instance, in Sweden, obtaining building permits can be a lengthy process, often taking several months to over a year, depending on the project's scale and location. This complexity requires specialized legal and technical expertise, making it difficult and expensive for new players to enter the market and compete effectively.

Navigating these legal and bureaucratic challenges demands substantial investment in time and resources. New entrants must dedicate significant capital to understand and comply with all applicable laws, secure necessary permits, and potentially engage with local authorities. This can deter potential competitors who lack the established infrastructure and experience to manage these hurdles. In 2024, the average time for obtaining a major construction permit in many European cities remained a critical factor, with some projects experiencing delays impacting overall development timelines and costs.

- Regulatory Complexity: Real estate development is governed by a web of local, regional, and national regulations.

- Permitting Delays: Obtaining necessary permits can be a time-consuming and unpredictable process, often taking months or even years.

- Cost of Compliance: New entrants must invest heavily in legal counsel, consultants, and administrative processes to ensure compliance.

- Knowledge Gap: Understanding and navigating these intricate rules requires specialized expertise that new companies may not possess.

Brand Reputation and Tenant Base

Diös Fastigheter, like many established real estate firms, benefits significantly from its established brand reputation and a deeply entrenched tenant base. This existing loyalty acts as a substantial barrier to entry for newcomers. New entrants face the daunting task of not only establishing their own brand recognition but also of convincing potential tenants, particularly those in the commercial and public sectors, to switch from a known and trusted entity. This often necessitates considerable investment in marketing and a protracted period of building credibility, making it a slow and financially demanding undertaking.

For example, in 2024, attracting anchor tenants for prime commercial spaces typically involves lengthy negotiation periods and significant upfront incentives. New entrants must overcome the inertia associated with established relationships, where tenants may prioritize continuity and reliability over potentially lower, but unproven, offers. Diös's long-standing presence in its markets, often spanning decades, means it has cultivated deep relationships with local businesses and public authorities, providing a stable foundation that is difficult for new players to replicate quickly.

- Established Brand Loyalty: Diös benefits from a strong, recognized brand, making it easier to retain existing tenants and attract new ones.

- Tenant Trust and Relationships: Long-term relationships with commercial and public sector tenants create a significant hurdle for new entrants seeking to establish similar trust.

- High Initial Investment: New companies must spend heavily on marketing and building a reputation to compete with established players like Diös.

- Slow Customer Acquisition: The process of attracting and securing tenants, especially large clients, is inherently slow and costly for new market participants.

The threat of new entrants for Diös Fastigheter is considerably low due to substantial capital requirements and the need for extensive industry experience. New players face significant hurdles in acquiring properties and navigating complex development processes, demanding billions of Swedish Kronor for major projects in 2024. Furthermore, replicating Diös's established market knowledge, operational efficiencies, and strong local relationships, built over decades, presents a formidable challenge.

Regulatory complexities and permitting delays in the real estate sector also act as a strong deterrent. For instance, obtaining building permits in Sweden can take over a year, requiring significant investment in legal and technical expertise, which new entrants often lack. This intricate legal landscape, coupled with high compliance costs, makes market entry difficult and expensive for less experienced firms.

Diös Fastigheter's strong brand reputation and existing tenant base further minimize the threat of new entrants. Building tenant trust and loyalty is a lengthy and costly process, requiring substantial marketing investment and a proven track record. In 2024, attracting anchor tenants still involves lengthy negotiations and incentives, a barrier that new companies find difficult to overcome against established players.

Porter's Five Forces Analysis Data Sources

Our Diös Fastigheter Porter's Five Forces analysis is built upon a foundation of publicly available data, including the company's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable real estate industry publications and market research reports to provide a comprehensive view of the competitive landscape.