Dignity PLC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dignity PLC Bundle

Dignity PLC, a prominent player in the funeral care sector, presents a compelling case for strategic analysis. While its established brand and extensive network are clear strengths, understanding the nuances of its market position and potential challenges is crucial for informed decision-making.

Want the full story behind Dignity PLC’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dignity PLC boasts an extensive UK network, operating between 725 and 820 funeral homes and 45 to 46 crematoria. This broad geographical presence ensures significant market coverage and easy accessibility for customers nationwide.

The company leverages a strong brand identity, combining its overarching Dignity name with numerous well-established local funeral home brands. This dual approach fosters trust and recognition across diverse communities, reinforcing its market position.

Dignity PLC's comprehensive service offering is a significant strength, encompassing everything from full funeral arrangements and cremation to the sale of related products like urns, memorials, and floral tributes. This broad portfolio allows them to meet diverse customer needs and preferences, providing a complete end-of-life solution.

Furthermore, Dignity's inclusion of pre-paid funeral plans adds a crucial financial planning element, offering clients peace of mind and securing future revenue streams. In 2023, the company reported a substantial portion of its revenue derived from funeral services, underscoring the importance of this integrated approach.

Dignity PLC achieved a notable return to profitability in its 2024 financial year, reporting a pre-tax profit of US$9.7 million. This marks a substantial recovery from prior periods of significant losses, underscoring the effectiveness of its strategic repositioning and stringent cost control measures.

The company's board highlighted "significant strategic progress" throughout 2024, a testament to strong leadership and successful navigation of a challenging market landscape. This financial turnaround reflects a robust operational performance and a clear path forward for the business.

Strong Cost Management and Debt Reduction

Dignity PLC showcased impressive financial discipline in 2024 through robust cost management initiatives. The company strategically reduced its workforce and streamlined operations by closing 90 underperforming branch locations, directly impacting operational expenses.

Further strengthening its financial position, Dignity successfully repaid over US$185 million in debt. This significant debt reduction, coupled with the generation of free cash from the sale of surplus properties, has notably enhanced the company's financial health and operational efficiency.

- Workforce Reduction: Implemented to streamline operations and reduce overhead.

- Branch Network Optimization: Closure of 90 underperforming locations.

- Debt Repayment: Over US$185 million in debt settled in 2024.

- Property Sales for Cash Generation: Monetized unused assets to bolster free cash flow.

Leading Position in Pre-paid Funeral Plans

Dignity holds a commanding position in the UK's pre-paid funeral plan market, a sector it helped pioneer with the launch of the first national plan in 1985. This leadership is underscored by its track record of assisting over 700,000 individuals in pre-arranging their funerals. This established presence translates into a predictable and resilient revenue stream, offering significant financial stability for the company.

The pre-paid funeral plan segment provides a crucial service by easing the financial and emotional strain on grieving families. This value proposition resonates strongly, particularly given the increasing awareness and planning for later life needs. For instance, in 2023, Dignity reported a substantial number of new pre-paid funeral plan sales, reflecting continued consumer demand for such services.

- Market Pioneer: Launched the first nationally available pre-paid funeral plan in the UK in 1985.

- Customer Base: Assisted over 700,000 individuals in planning their funerals in advance.

- Revenue Stability: Generates a consistent and predictable revenue stream, enhancing financial resilience.

- Societal Value: Alleviates financial and emotional burdens for families during bereavement.

Dignity PLC's extensive UK network, comprising between 725 and 820 funeral homes and 45 to 46 crematoria, ensures broad market coverage and accessibility. This established infrastructure is a significant competitive advantage, allowing for efficient service delivery across the country.

The company's strong brand identity, a blend of the Dignity name and numerous local funeral home brands, fosters trust and recognition. This dual branding strategy effectively appeals to diverse customer segments and reinforces its market position.

Dignity's comprehensive service offering, from funeral arrangements and cremations to related products like urns and memorials, caters to a wide range of customer needs. This integrated approach provides a complete end-of-life solution.

The company's pioneering role in the pre-paid funeral plan market, dating back to 1985, has secured a substantial and stable revenue stream. Having assisted over 700,000 individuals with pre-arrangements highlights its deep market penetration and customer trust.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| Funeral Homes | 725-820 | 725-820 |

| Crematoria | 45-46 | 45-46 |

| Pre-paid Plans Assisted | >700,000 | >700,000 |

| Pre-tax Profit | N/A (Loss reported) | US$9.7 million |

| Debt Repaid | N/A | >US$185 million |

What is included in the product

Delivers a strategic overview of Dignity PLC’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Highlights key competitive advantages and potential threats, enabling proactive risk mitigation.

Weaknesses

Dignity PLC faced a significant challenge in 2024 with a 10.1% drop in funeral volumes, bringing their case volume down to 69,400. This downturn was largely a consequence of a 3.5% decrease in the national death rate compared to the previous year.

The reduced number of funerals directly translates to lower revenue from Dignity's primary funeral services, impacting their overall financial performance.

Dignity PLC has a history of financial instability, marked by a substantial pre-tax loss of over US$422 million in 2022. This past performance highlights a vulnerability to market shifts and operational disruptions.

The company’s significant net debt, reported at £500 million in 2024, presents a considerable weakness. While debt repayment is a focus, this high leverage can limit future investment and strategic flexibility.

The substantial debt burden, even with ongoing repayment efforts, could constrain Dignity's ability to pursue aggressive growth strategies or react to unforeseen market challenges in the near term.

Dignity PLC's decision to shutter 90 branch locations in 2024, a move necessitated by failure to meet financial targets, highlights a significant weakness stemming from past operational inefficiencies. This action points to a prior overextension within its network, suggesting that strategic planning and asset utilization were not optimally managed. While these closures are a step towards improving profitability, they underscore a historical challenge in ensuring all parts of the business were financially viable and efficiently run.

Impact of Pricing Strategy and Market Competition

Dignity PLC has historically faced challenges stemming from its pricing strategy and a highly competitive market. Past adjustments to pricing, combined with a growing consumer inclination towards more affordable alternatives, previously impacted revenue and profitability negatively. This trend persists, with ongoing pressure on prices, particularly due to the emergence of direct cremation services.

The competitive landscape is intensifying, with new entrants and established players vying for market share. This environment necessitates careful consideration of pricing to remain competitive while maintaining profitability. For instance, the rise of direct cremation providers, offering services at a lower cost point, presents a significant challenge to traditional funeral care models.

- Price Sensitivity: Consumers are increasingly price-sensitive, seeking value for money in funeral services.

- Competitive Pressure: The market is characterized by intense competition, with new, lower-cost providers entering the space.

- Direct Cremation Growth: The increasing popularity of direct cremation services erodes market share from traditional providers.

- Margin Erosion: Downward price pressure threatens to erode profit margins for established players like Dignity PLC.

Regulatory Scrutiny and Compliance Costs

The UK funeral market has faced significant regulatory attention, with the Competition and Markets Authority (CMA) conducting investigations. These probes have resulted in mandated changes aimed at improving price and information transparency for consumers. For Dignity PLC, this means a continued focus on adhering to these new rules, which can add to operational expenses and potentially constrain how they price their services.

Compliance with these evolving regulations, including those implemented following the CMA's market investigation, represents an ongoing challenge. Dignity PLC has stated it welcomed the clarity provided by the CMA's final recommendations in 2023, but the practical implementation of these remedies, such as standardized pricing information and potential service area reviews, requires investment in systems and processes. This can lead to increased compliance costs and may limit pricing flexibility in certain areas.

- Increased Operational Costs: Implementing new transparency measures and compliance protocols, as mandated by the CMA, necessitates investment in IT systems, staff training, and updated marketing materials.

- Reduced Pricing Flexibility: Regulatory interventions, particularly around price caps or standardized pricing structures, can limit Dignity PLC's ability to adjust prices based on market conditions or service variations.

- Potential for Future Interventions: Ongoing monitoring by the CMA and potential for further regulatory changes mean that Dignity PLC must remain agile and prepared for additional compliance burdens.

- Impact on Profit Margins: The combined effect of higher compliance costs and reduced pricing flexibility could put pressure on Dignity PLC's profit margins, especially if revenue growth does not keep pace.

Dignity PLC's operational performance in 2024 was hampered by a 10.1% decline in funeral volumes, reaching 69,400 cases, largely due to a 3.5% decrease in the national death rate. This reduction directly impacts revenue from their core funeral services, highlighting a vulnerability to demographic shifts.

The company's substantial net debt of £500 million as of 2024 limits its financial flexibility and capacity for strategic investments or navigating market downturns. This high leverage remains a significant concern despite ongoing repayment efforts.

Dignity's past operational inefficiencies led to the closure of 90 branches in 2024, indicating issues with strategic planning and asset management. The intense competition, especially from lower-cost direct cremation providers, continues to exert downward pressure on pricing and profit margins.

Regulatory scrutiny from the CMA has introduced increased operational costs and reduced pricing flexibility for Dignity PLC. Adhering to new transparency mandates and potential future interventions presents an ongoing challenge to profitability.

What You See Is What You Get

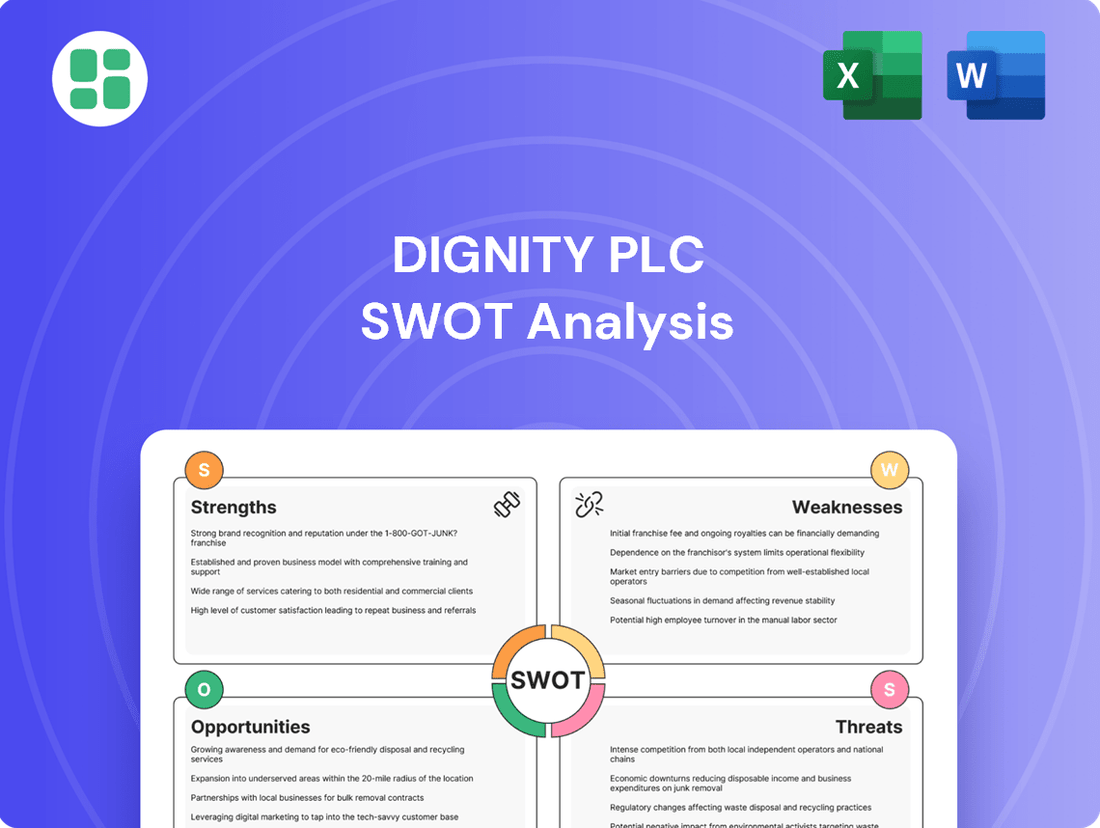

Dignity PLC SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This comprehensive report provides a detailed examination of Dignity PLC's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

Opportunities

The UK's demographic shift towards an older population is a significant tailwind for Dignity. With a growing number of individuals entering the age groups that typically require funeral and end-of-life care, demand for these essential services is inherently increasing. This trend, projected to continue, offers a stable and expanding customer base.

In 2024, the Office for National Statistics (ONS) data indicated that individuals aged 65 and over represented over 20% of the UK population, a figure expected to rise. This expanding demographic segment directly translates to a sustained and growing market for Dignity's core offerings, ensuring long-term revenue potential.

The growing demand for direct cremation, which represented 62% of funeral plan sales in 2024, presents a significant opportunity for Dignity PLC. This trend is fueled by its affordability and straightforward nature, appealing to a broad consumer base.

Concurrently, heightened environmental consciousness is boosting the market for eco-friendly funerals and natural burial sites. Dignity can leverage this by expanding its service portfolio to include more sustainable options, aligning with evolving consumer values.

Dignity's strategic acquisition of Farewill, an online platform for end-of-life services, positions the company well to capitalize on these shifts. This move allows Dignity to integrate and offer a wider range of direct cremation and eco-conscious funeral solutions.

The growing trend of digital engagement in funeral arrangements, from online planning to live-streamed services, offers a substantial avenue for Dignity PLC. This shift reflects a clear customer preference for convenience and accessibility, particularly for those unable to attend in person.

Dignity's existing investments in digital infrastructure position it well to capitalize on this opportunity. By further enhancing its online platforms, the company can streamline the customer journey, offer more comprehensive digital services, and attract a wider demographic, potentially boosting customer acquisition and satisfaction.

Personalization and 'Celebration of Life' Offerings

There's a significant societal evolution towards viewing funerals as celebrations of life, with a notable 68% of individuals expressing this sentiment. This presents a prime opportunity for Dignity PLC to expand its personalized service offerings. By focusing on bespoke arrangements, unique venues, and tailored themes, Dignity can cater to diverse individual preferences.

This shift allows for the development of higher-value services that resonate more deeply with clients. Imagine incorporating specific hobbies, musical tastes, or even digital tributes that truly reflect the deceased's personality. Such personalized approaches could differentiate Dignity in a competitive market.

- Growing Trend: 68% of people prefer funerals as a 'celebration of life'.

- Service Expansion: Opportunity to offer more personalized and bespoke funeral services.

- Revenue Potential: Catering to individual preferences can drive higher value per service.

- Market Differentiation: Unique venues, themes, and elements can set Dignity apart.

Growth in the Pre-paid Funeral Plan Market

The prepaid funeral plan market in the UK is showing consistent expansion. By the first half of 2024, 18.4% of all funerals were financed through these plans, a notable increase that highlights growing consumer preference for pre-arrangement. This trend presents a significant opportunity for Dignity PLC.

This market growth allows Dignity to lock in future revenue streams and improve its cash flow predictability. By securing business in advance, the company can better manage its operational capacity and financial planning, reducing its dependence on the more volatile at-need funeral services market.

- Securing Future Revenue: The increasing adoption of prepaid plans directly translates into guaranteed future income for Dignity.

- Improved Cash Flow: Advance payments for funeral plans provide a stable and predictable cash flow, aiding financial management.

- Client Relationship Building: Engaging with clients early through prepaid plans fosters long-term relationships and trust.

- Reduced Reliance on At-Need Services: A stronger prepaid market share diminishes the company's vulnerability to fluctuations in immediate funeral demand.

The aging UK population, with over 20% of individuals aged 65+ in 2024, presents a continuously growing customer base for Dignity's core services. Furthermore, the increasing popularity of direct cremation, accounting for 62% of funeral plan sales in 2024, and a societal shift towards viewing funerals as celebrations of life (68% preference) offer avenues for service diversification and higher-value offerings.

| Opportunity Area | Supporting Data (2024/2025) | Implication for Dignity |

|---|---|---|

| Demographic Shift | Over 20% of UK population aged 65+ | Stable and expanding demand for end-of-life services. |

| Direct Cremation Popularity | 62% of funeral plan sales | Opportunity to capitalize on a cost-effective and in-demand service. |

| Celebration of Life Funerals | 68% prefer funerals as a 'celebration of life' | Potential to expand personalized and premium service offerings. |

| Prepaid Funeral Plans | 18.4% of funerals financed via plans (H1 2024) | Secures future revenue and improves cash flow predictability. |

Threats

A significant threat to Dignity PLC's performance stems from fluctuations in national death rates, directly impacting funeral volumes and revenue. For instance, in 2024, a notable 3.5% decrease in the national death rate led to a substantial 10.1% drop in Dignity's funeral volumes.

Such unpredictable demographic shifts or advancements in public health could result in persistently lower death rates, posing a sustained challenge to Dignity's core business operations and financial projections.

The UK funeral market's fragmentation, with over 3,000 independent operators, fuels intense competition. This is further exacerbated by the rise of direct cremation services and innovative business models, creating a challenging environment for established players like Dignity PLC.

Consumers are increasingly price-sensitive, actively seeking more affordable funeral arrangements. This trend directly impacts pricing strategies, putting considerable downward pressure on profit margins across the industry.

Consumer preferences are shifting significantly, with a notable move away from traditional, full-service funerals toward simpler, more cost-effective options such as direct cremation. This trend is particularly evident as younger generations seek more personalized and often non-religious ceremonies, demanding greater flexibility in service design and pricing structures.

This evolving landscape presents a substantial threat of market disruption for established providers like Dignity PLC. Failure to adapt service portfolios and pricing models to meet these changing demands could lead to a loss of market share to more agile competitors offering tailored, value-driven solutions.

Economic Pressures on Consumer Spending

Economic pressures, such as stagnant wage growth, can significantly impact consumer spending on discretionary services like funerals. This could lead individuals to choose more basic or cost-effective options, potentially reducing Dignity PLC's average revenue per funeral.

For instance, if inflation outpaces wage increases, consumers may postpone or scale back on more elaborate funeral arrangements, directly affecting Dignity's higher-margin offerings. The UK's Consumer Price Index (CPI) saw a notable increase in recent periods, and if this trend continues without corresponding wage growth, it directly translates to reduced disposable income for households, making them more price-sensitive regarding funeral services.

- Reduced Demand for Premium Services: Consumers facing economic hardship may forgo higher-value funeral packages.

- Shift to Lower-Cost Options: A move towards more basic or direct cremation services could become prevalent.

- Impact on Average Revenue: Lower average spend per funeral directly affects Dignity PLC's top-line performance.

Potential for Further Regulatory Intervention

While the Competition and Markets Authority's (CMA) initial investigation into the UK funeral sector concluded in 2023 with a set of remedies, the possibility of further regulatory intervention for companies like Dignity PLC remains a significant threat. This ongoing scrutiny could translate into increased compliance costs and operational adjustments.

Future regulatory actions might include more stringent pricing controls, potentially impacting Dignity's revenue streams. For instance, if the CMA were to impose further caps on specific funeral services, it could directly affect profitability. The company's strategic flexibility could also be curtailed by mandates for enhanced transparency regarding pricing and service offerings.

The UK government has also shown a willingness to legislate in this sector, as evidenced by the Funeral Planning Regulations introduced in 2022. This precedent suggests that further legislative changes impacting funeral plan providers and operators are a distinct possibility, potentially adding new layers of compliance and operational requirements for Dignity.

- Increased Compliance Burden: Future regulations could necessitate investments in new systems or personnel to meet stricter reporting and operational standards.

- Pricing Controls: The CMA or government may introduce further measures to limit price increases or mandate lower prices for certain services, impacting revenue.

- Enhanced Transparency Requirements: Dignity might be required to disclose more detailed information about its pricing structures and service provisions, potentially affecting its competitive positioning.

The potential for declining national death rates, driven by improved public health and longer life expectancies, poses a significant threat to Dignity PLC. A 3.5% drop in the UK's national death rate in 2024 already resulted in a 10.1% decrease in Dignity's funeral volumes, highlighting the direct impact of demographic shifts on its core business.

Intense competition from over 3,000 independent funeral directors and the growing popularity of direct cremation services are pressuring Dignity's market share. Consumer preference for simpler, more affordable funeral options, influenced by economic pressures like inflation outpacing wage growth, further erodes potential revenue from premium services.

Ongoing regulatory scrutiny from bodies like the Competition and Markets Authority (CMA) and potential future government legislation present a substantial threat. These could lead to increased compliance costs, stricter pricing controls, and mandated transparency, all of which could constrain Dignity's operational flexibility and profitability.

SWOT Analysis Data Sources

This Dignity PLC SWOT analysis is built upon a foundation of robust data, drawing from official company financial reports, comprehensive market research, and expert industry analysis. These sources provide a well-rounded view of the company's internal capabilities and external environment.