Dignity PLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dignity PLC Bundle

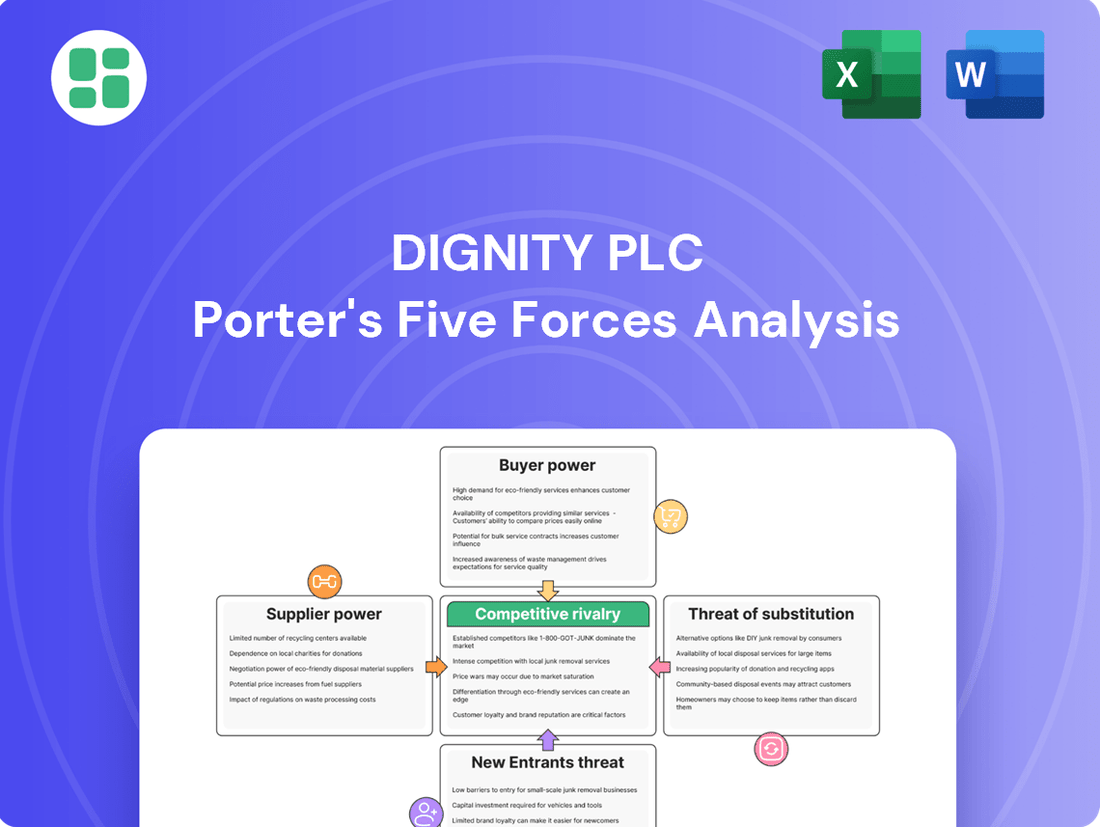

Dignity PLC operates within a landscape shaped by powerful external forces, from intense rivalry among funeral providers to the significant bargaining power of grieving families. Understanding these dynamics is crucial for navigating the complexities of the bereavement services market.

The full Porter's Five Forces Analysis provides a comprehensive, force-by-force breakdown of Dignity PLC's competitive environment, revealing the true extent of market pressures and strategic opportunities. Unlock actionable insights to drive smarter decision-making and gain a competitive edge.

Suppliers Bargaining Power

Concentrated niche suppliers, particularly for specialized equipment like cremator technology or bespoke funeral vehicles, can wield significant bargaining power over Dignity PLC. While common inputs might have numerous providers, reliance on a few manufacturers for critical, high-cost machinery means these suppliers can dictate terms and pricing. For example, if a particular cremator requires proprietary parts or specialized servicing only available from the original manufacturer, Dignity's ability to negotiate on price is diminished.

The bargaining power of suppliers for Dignity PLC is significantly influenced by the availability of substitutes for the inputs they provide. For example, while coffins are a fundamental requirement, Dignity has a broad spectrum of choices, ranging from traditional wooden caskets to more contemporary and eco-conscious alternatives. This variety in materials and designs empowers Dignity by offering multiple sourcing options, thereby diminishing the leverage any single coffin manufacturer might hold.

However, the situation shifts when considering highly specialized inputs. For instance, certain embalming chemicals or specific pieces of mortuary equipment may possess fewer readily available substitutes in the market. In such cases, suppliers of these niche products can exert greater bargaining power due to Dignity’s limited alternatives.

The cost and complexity for Dignity PLC to switch suppliers significantly bolster supplier bargaining power. Dignity's reliance on specialized equipment, like crematoria machinery, and bespoke vehicle fleets means that changing suppliers involves not just the price of new goods but also the expense of retraining staff and integrating new systems. This investment in specific infrastructure and expertise creates a high barrier to switching, making it more advantageous for Dignity to maintain existing relationships, thereby empowering their suppliers.

Supplier's Threat of Forward Integration

The threat of suppliers integrating forward into funeral services themselves is generally low for most of Dignity PLC's suppliers. This is due to the substantial capital investment, complex regulatory landscape, and the need for established brand recognition required to enter the funeral care industry.

However, for suppliers providing specialized services like pre-paid funeral plan administration or advanced digital platforms, the barrier to expanding their offerings might be less imposing. This could subtly enhance their bargaining power.

For instance, a 2024 report indicated that while the funeral services sector saw a slight increase in operational costs, the capital expenditure for new entrants remains a significant deterrent. This suggests that the integration threat from traditional suppliers, such as coffin manufacturers or florists, is minimal.

- Low Threat from Traditional Suppliers: Suppliers of raw materials or standard funeral accoutrements face high barriers to forward integration into Dignity's core business.

- Moderate Threat from Niche Service Providers: Companies offering administrative or digital solutions for pre-paid plans could potentially expand their service scope, increasing their leverage.

- Industry Capital Requirements: The substantial capital needed to establish and operate funeral homes, including property acquisition and licensing, deters most suppliers.

- Regulatory Hurdles: Navigating the specific regulations governing funeral directing and crematoria services presents a significant challenge for non-industry players.

Importance of Supplier's Input to Dignity's Business

The bargaining power of suppliers is a crucial element in Dignity PLC's operational landscape. The criticality of a supplier's input to Dignity's core operations directly impacts their bargaining power. Essential services, such as the provision of land for crematoria or the supply of key funeral products, are indispensable to Dignity's business model, thereby granting these suppliers a more influential position in negotiations.

Disruptions or quality issues stemming from these critical suppliers could significantly impede Dignity's ability to function effectively. This reliance on dependable, high-quality inputs inherently strengthens the leverage of those suppliers who can consistently meet Dignity's stringent operational requirements. For instance, in 2024, Dignity's procurement of specific embalming fluids and cremation urns from a limited number of specialized manufacturers highlights this dependency.

- Critical Inputs: Land for crematoria and specialized funeral supplies are vital for Dignity's service delivery.

- Supplier Leverage: Indispensable services give suppliers a stronger negotiating position.

- Operational Impact: Disruptions or quality failures from key suppliers can severely affect Dignity's operations.

- Supplier Reliability: The need for consistent, high-quality inputs empowers reliable suppliers.

Suppliers of specialized equipment and niche services hold considerable sway over Dignity PLC due to limited alternatives and high switching costs. While common inputs like coffins offer Dignity ample choice, critical components such as cremator technology, requiring proprietary parts and specialized servicing, concentrate power in the hands of a few manufacturers. This reliance, coupled with the significant investment needed to change suppliers, strengthens their negotiating position, as demonstrated by Dignity's 2024 procurement of specific embalming fluids and cremation urns from a limited number of specialized providers.

| Factor | Impact on Dignity PLC | Example |

|---|---|---|

| Supplier Concentration | High for specialized equipment | Cremator technology manufacturers |

| Availability of Substitutes | Low for niche inputs | Specific embalming chemicals |

| Switching Costs | High for integrated systems | Bespoke funeral vehicle fleets |

| Criticality of Input | High for essential services | Land for crematoria operations |

What is included in the product

This analysis unpacks the competitive forces impacting Dignity PLC, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the funeral services industry.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, allowing for rapid identification of strategic threats and opportunities.

Customers Bargaining Power

Customers are increasingly mindful of funeral costs, a trend amplified by the rising cost of living. The average funeral expense in the UK saw an increase, reaching approximately £4,285 in 2025, up from £4,141 in 2023. This financial pressure naturally leads consumers to actively seek out more economical choices.

The increasing popularity of direct cremations, priced significantly lower than traditional funerals, is a major factor boosting customer bargaining power. These services, often starting between £975 and £1,500, offer a cost-effective alternative that resonates with a growing segment of the population.

By 2024, direct cremation plans represented over 60% of all plan sales, demonstrating a clear consumer preference for these simpler, more affordable options. This trend directly pressures funeral providers like Dignity PLC to adapt their offerings and pricing to remain competitive in the face of this powerful customer demand.

Customers increasingly have access to a wider range of funeral choices beyond traditional full-service packages. Options like family-led services, humanist ceremonies, and eco-friendly burials are becoming more common, allowing individuals to tailor funerals to their specific needs and financial comfort levels.

This growing diversity means customers are less dependent on any single provider, significantly boosting their bargaining power. For instance, the rise of direct cremation services, which can cost a fraction of a traditional funeral, provides a clear benchmark for pricing and service expectations.

In 2024, the funeral industry continued to see a shift towards more personalized and cost-conscious options. Data from industry surveys indicated that a notable percentage of consumers were actively exploring or utilizing alternative funeral arrangements, demonstrating a clear trend that empowers them to negotiate more effectively with established providers like Dignity PLC.

Enhanced Consumer Protections in Pre-paid Plans

The Financial Conduct Authority's (FCA) regulation of the pre-paid funeral plan market, effective since July 2022, has significantly bolstered consumer protections. This oversight ensures greater security for customers' investments in pre-paid plans, offering more transparency and clearer terms. For instance, by July 2024, the FCA reported that over 2.9 million pre-paid funeral plans were in force, with a total value exceeding £4.4 billion, highlighting the scale of consumer engagement and the importance of this regulatory framework.

This enhanced regulatory environment empowers customers by increasing their confidence in the security of their arrangements. Such protections can lead to a more discerning customer base, more willing to compare providers and plan options, thereby increasing the bargaining power of customers within the Dignity PLC market. For example, the FCA's rules mandate that providers must hold sufficient assets to cover future liabilities, a crucial safeguard that was not always present before regulation.

The increased transparency and security provided by FCA regulation mean customers are better equipped to understand the value and terms of pre-paid funeral plans. This can lead to:

- Greater price sensitivity among consumers.

- Increased demand for clearly defined service inclusions.

- A willingness to switch providers if better value or terms are found.

- A stronger emphasis on provider reputation and financial stability.

Emotional and Time Constraints on Decision-Making

While the emotional distress and time sensitivity inherent in funeral arrangements might traditionally curb customer bargaining power, Dignity PLC, like many in the sector, faces evolving consumer behaviors. The increasing availability and promotion of pre-planned funeral options empower individuals to make decisions outside of immediate grief, thereby reducing the leverage funeral directors could previously exert due to urgency.

This shift means families can research and compare services more effectively, potentially negotiating better terms. For instance, the Financial Conduct Authority (FCA) in the UK has been tightening regulations around funeral plan sales, aiming to increase transparency and consumer protection, which indirectly bolsters customer awareness and bargaining potential. As of early 2024, the market continues to see a rise in consumers seeking personalized and transparent funeral services, a trend that supports greater customer agency.

- Pre-planning mitigates emotional leverage: Customers making arrangements in advance are less susceptible to emotional pressure.

- Increased market transparency: Regulatory oversight, like that from the FCA, enhances customer knowledge and bargaining power.

- Consumer demand for choice: A growing preference for diverse and accessible funeral options encourages comparison and negotiation.

Customers are increasingly price-sensitive, driven by rising funeral costs which averaged £4,285 in the UK in 2025. The growing popularity of direct cremations, priced between £975 and £1,500, offers a significant cost-saving alternative, with these plans making up over 60% of sales by 2024.

Enhanced consumer protection through FCA regulation of pre-paid funeral plans, with over 2.9 million plans in force by July 2024, increases customer confidence and willingness to compare providers. This regulatory environment, coupled with a demand for diverse and transparent funeral options, empowers customers to negotiate more effectively.

| Factor | Impact on Bargaining Power | Supporting Data (2024/2025) |

|---|---|---|

| Price Sensitivity | High | Average funeral cost: £4,285 (2025) |

| Availability of Alternatives | High | Direct cremation plans: >60% of sales (2024) |

| Regulatory Oversight (FCA) | Moderate | Pre-paid plans in force: >2.9 million (July 2024) |

Preview Before You Purchase

Dignity PLC Porter's Five Forces Analysis

This preview showcases the complete Dignity PLC Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate utility. You can trust that this professionally formatted analysis is ready for your strategic planning needs without any alterations or missing sections.

Rivalry Among Competitors

The UK funeral industry is quite fragmented, meaning Dignity PLC faces a lot of competition. It's not just the big names like Co-op Funeralcare; there's also a growing number of independent funeral directors actively serving the market.

This competition is intensifying, as evidenced by the significant rise in the number of funeral directors across the UK. In 2024, this number reached 5,125, marking a substantial 28% increase over the last decade. This surge directly fuels rivalry as more players compete to capture market share.

The increasing popularity of direct cremation services has significantly ramped up competition. This surge in demand has attracted both established funeral providers and new, smaller entrants, all vying for market share in this growing segment.

Co-op's strategic move into direct cremation in early 2024, supported by substantial marketing efforts and its strong brand recognition, has particularly heightened the competitive pressure on existing players like Dignity and Pure Cremation, challenging their established market positions.

The increasing cost of living, with inflation reaching 2.3% in the UK as of May 2024, is significantly impacting consumers' disposable income. This economic pressure is directly translating into heightened price sensitivity when it comes to funeral services, a sector historically less prone to aggressive price wars.

Average funeral costs in the UK saw a notable increase, with the average cost reaching £4,125 in 2023 according to SunLife’s latest report. This upward trend, coupled with the economic squeeze, is compelling customers to actively seek out more affordable funeral arrangements, thereby intensifying competition among providers like Dignity PLC.

Consequently, Dignity PLC faces mounting pressure to scrutinize its operational costs and implement competitive pricing strategies. This dynamic not only challenges profit margins but also fuels a more aggressive rivalry within the funeral care industry as providers vie for cost-conscious customers.

High Exit Barriers

Dignity PLC, like many in the funeral services sector, faces significant competitive rivalry stemming from high exit barriers. These barriers are largely due to the specialized nature of assets within the industry. For instance, crematoria and funeral home properties represent substantial, often illiquid investments that are difficult to repurpose or sell quickly, locking companies into their existing operational footprint.

Furthermore, long-term commitments, such as pre-paid funeral plans, create a sticky customer base but also a liability that complicates exiting the market. Companies are compelled to continue operations to honor these plans, even if profitability dwindles. This situation can intensify rivalry as firms strive to maintain market share and client relationships rather than risk the financial implications of withdrawal.

- Specialized Assets: Crematoria and funeral homes are difficult to repurpose, representing significant sunk costs for companies like Dignity PLC.

- Pre-paid Funeral Plans: These long-term commitments bind companies to service delivery, discouraging early exit.

- Intensified Rivalry: High fixed costs and specialized assets force firms to remain operational, leading to a more competitive market environment as companies fight for survival and market share.

Brand Reputation and Local Presence

Dignity PLC, despite its extensive national network, faces intense competition from independent funeral directors who often leverage deep-rooted local reputations and strong community ties. This dynamic means that while Dignity benefits from scale, it must actively nurture localized service offerings and community engagement to counter the loyalty smaller, community-focused businesses command. For instance, in 2024, the UK funeral market saw continued activity from numerous independent providers, many of whom have served families for generations, creating a significant barrier to entry and market share consolidation for larger players.

The competitive rivalry is further shaped by the fact that trust and personal relationships are paramount in funeral care. Local funeral homes often benefit from word-of-mouth referrals and a long-standing presence, which can be more influential than national advertising. This is evident as many smaller firms continue to operate successfully, catering to specific community needs and traditions, which can be difficult for a national brand to replicate perfectly across all regions.

- Local Loyalty: Independent funeral directors often possess strong, long-standing relationships within their communities, fostering significant customer loyalty.

- Community Ties: A deep understanding of local customs and traditions allows independent providers to offer highly personalized services, which resonate strongly with grieving families.

- Brand vs. Personal Touch: Dignity PLC must balance its national brand strength with the ability to deliver a localized, personal touch to remain competitive against smaller, community-centric rivals.

- Market Fragmentation: The UK funeral services market remains somewhat fragmented, with a substantial number of independent operators continuing to thrive alongside larger national companies.

The competitive landscape for Dignity PLC is characterized by a fragmented market with a growing number of independent funeral directors, alongside established players like Co-op Funeralcare. This rivalry intensified significantly in 2024, with the number of UK funeral directors rising to 5,125, a 28% increase over the past decade. The increasing adoption of direct cremation services has further fueled competition, attracting both new and existing providers into this growing segment.

Economic pressures, such as the 2.3% inflation rate in May 2024, are making consumers more price-sensitive, pushing them towards more affordable funeral options. This trend is particularly challenging for Dignity PLC, as average funeral costs reached £4,125 in 2023. Consequently, companies are compelled to focus on cost management and competitive pricing to attract and retain customers in this increasingly aggressive market.

| Metric | Value (2023/2024) | Implication for Rivalry |

|---|---|---|

| Number of UK Funeral Directors | 5,125 (2024) | Increased market fragmentation and competition. |

| UK Inflation Rate | 2.3% (May 2024) | Heightened price sensitivity among consumers. |

| Average UK Funeral Cost | £4,125 (2023) | Drives demand for more affordable services, intensifying price competition. |

SSubstitutes Threaten

The rise of direct cremation presents a significant threat of substitutes for Dignity PLC. This service, offering a simpler, unattended farewell, is considerably more affordable, typically costing between £975 and £1,500. Its growing popularity is evident, with direct cremation plans making up more than 60% of all pre-paid funeral plan sales in 2024, directly challenging the market share of Dignity's traditional, more elaborate offerings.

The increasing consumer demand for eco-friendly and natural burial options, such as woodland burials, poses a significant threat of substitution for Dignity PLC. These alternatives, which often use biodegradable materials and eschew embalming, directly compete with traditional funeral services. For instance, the UK's Natural Death Centre reported a notable increase in inquiries for natural burials in recent years, indicating a shift in consumer preference.

The rise of DIY and family-led funerals presents a significant threat of substitutes for traditional funeral service providers like Dignity PLC. These alternatives empower families with greater control and cost savings, directly challenging the necessity of comprehensive funeral director packages. For instance, in 2024, the trend towards personalized ceremonies saw an estimated 15% increase in families opting for at-home viewings or simplified arrangements, bypassing many traditional services.

Emergence of New Technologies like Water Cremation

Emerging technologies like alkaline hydrolysis, often referred to as water cremation or resomation, present a nascent but growing threat of substitutes for Dignity PLC. This process uses an alkaline solution to dissolve the body, leaving behind bone fragments and a sterile liquid, with proponents highlighting its lower carbon footprint compared to flame cremation. While the market penetration remains low, with only a handful of facilities offering this service globally, continued technological advancement and increasing consumer interest in eco-friendly options could shift preferences.

The environmental appeal of water cremation is a key driver. For instance, resomation systems are reported to use significantly less energy than traditional cremation, potentially appealing to a growing segment of environmentally conscious consumers. As of early 2024, the number of providers offering this service is still limited, but this could change rapidly as the technology matures and regulatory hurdles are overcome.

- Emerging Technologies: Water cremation (alkaline hydrolysis) offers an alternative to traditional flame cremation.

- Environmental Benefits: Proponents claim a lower carbon footprint and reduced energy consumption compared to flame cremation.

- Market Penetration: Currently, the number of providers is limited, but this is expected to grow as the technology develops and gains acceptance.

- Potential Future Threat: Wider adoption could divert customers from traditional services, impacting market share for companies like Dignity PLC.

Non-Religious and Celebration of Life Ceremonies

The rise of non-religious and 'celebration of life' ceremonies presents a significant threat of substitutes for traditional funeral services. These alternatives often focus on personal tributes and memories rather than religious doctrine, appealing to a growing segment of the population seeking more secular or personalized farewells.

These ceremonies can be less formal and may utilize a broader range of venues, potentially reducing the reliance on traditional funeral homes and their associated services. This shift can limit the scope of offerings for companies like Dignity PLC, as these ceremonies might require fewer of the core services traditionally provided by funeral directors.

- Growing Trend: In the UK, the proportion of deaths registered with non-religious or mixed beliefs has been steadily increasing. For instance, ONS data indicated a notable rise in non-religious registrations in recent years, suggesting a sustained shift away from exclusively religious ceremonies.

- Venue Flexibility: Celebration of life events can be held in community centers, private residences, or outdoor spaces, offering a more flexible and potentially cost-effective alternative to traditional crematoriums or churches.

- Reduced Service Needs: These ceremonies may require less involvement from funeral directors in terms of religious rites, embalming, or specific ceremonial arrangements, impacting the revenue streams for traditional providers.

- Cost Considerations: While not always cheaper, the perceived flexibility and personalization of non-religious ceremonies can make them an attractive substitute for individuals and families seeking to control costs and tailor the event to their specific preferences.

The increasing popularity of direct cremation, a simpler and more affordable funeral option, presents a significant threat of substitutes for Dignity PLC. This trend is underscored by the fact that direct cremation plans constituted over 60% of all pre-paid funeral plan sales in 2024, directly impacting Dignity's traditional market share.

Eco-friendly alternatives like woodland burials are gaining traction, offering a stark contrast to conventional funeral services. The Natural Death Centre in the UK has observed a marked increase in inquiries for these natural burial options, reflecting a clear shift in consumer preferences towards more environmentally conscious choices.

The rise of DIY and family-led funerals empowers individuals with greater control and cost savings, challenging the necessity of comprehensive funeral director packages. In 2024, an estimated 15% increase in families opting for at-home viewings or simplified arrangements highlights this growing trend away from traditional services.

Emerging technologies like water cremation (alkaline hydrolysis) offer a lower-carbon footprint alternative to traditional flame cremation. While still a niche market, with limited providers as of early 2024, continued technological advancement and growing consumer interest in sustainable options could significantly impact the funeral services landscape.

| Substitute Type | Key Characteristic | 2024 Market Trend/Data | Impact on Dignity PLC |

|---|---|---|---|

| Direct Cremation | Affordable, unattended farewell | Over 60% of pre-paid funeral plan sales | Directly challenges traditional, elaborate offerings |

| Natural Burials | Eco-friendly, biodegradable materials | Increasing consumer inquiries (Natural Death Centre) | Competes with traditional burial services |

| DIY/Family-Led Funerals | Cost-saving, personalized control | Estimated 15% increase in simplified arrangements | Reduces reliance on comprehensive funeral director packages |

| Water Cremation | Lower carbon footprint, reduced energy | Limited providers, but growing interest | Potential future diversion of customers from traditional cremation |

Entrants Threaten

The threat of new entrants in the funeral director market is notably high due to a significant lack of statutory regulation in the UK. This means virtually anyone can establish themselves as a funeral director, creating a low barrier to entry.

This regulatory gap has fueled market expansion, with the number of funeral directors increasing by a substantial 28% between 2014 and 2024. Such growth indicates a market ripe for new competition, potentially impacting established players like Dignity PLC.

The threat of new entrants for Dignity PLC is heightened by the relatively low initial investment needed for smaller funeral director operations. Reportedly, setting up a small funeral home can cost as little as £20,000 to £30,000, particularly if vehicles are leased rather than purchased outright. This accessibility allows independent businesses to enter the market more readily, increasing competition for established players like Dignity.

While the financial investment to start a funeral service might not be sky-high, the real hurdle for new entrants is building a strong local reputation. Dignity PLC benefits from decades of trust within communities, a significant intangible asset.

Gaining consumer confidence in a deeply personal service like funeral care is a slow process. New competitors must invest heavily in community engagement and demonstrate consistent quality to even begin chipping away at established brands, a task that can take years.

FCA Regulation for Funeral Plan Providers as a Barrier

While the traditional funeral director business might seem accessible, the landscape for pre-paid funeral plans has significantly changed. Since January 2022, the Financial Conduct Authority (FCA) has been regulating this sector. This means companies offering pre-paid funeral plans must meet stringent operational and financial standards.

This new regulatory framework acts as a substantial barrier to entry for new players specifically targeting the pre-paid funeral plan market. The FCA's oversight necessitates compliance with capital requirements, conduct of business rules, and consumer protection measures, which can be costly and complex to implement. Consequently, existing larger firms that are already regulated or can more easily adapt to these requirements are better positioned, shifting sales distribution power and creating a more consolidated market.

- FCA Regulation: The introduction of FCA regulation in 2022 for pre-paid funeral plans significantly raises the barrier to entry.

- Increased Costs: Compliance with FCA rules involves substantial costs related to capital, governance, and consumer protection, deterring smaller or new entrants.

- Market Consolidation: The regulatory shift favors established, larger firms, potentially leading to a more concentrated market for pre-paid funeral plans.

- Shift in Distribution: Sales channels and distribution power are increasingly moving towards regulated entities, making it harder for new, unregulated companies to gain traction.

Capital Intensity for Crematoria and Large Networks

For new entrants looking to challenge Dignity PLC by establishing crematoria or extensive funeral home networks, the initial capital outlay is a major hurdle. Building a single crematorium can cost millions, and creating a national network requires immense financial backing, effectively deterring many potential competitors.

This high capital intensity serves as a robust barrier, safeguarding Dignity's established infrastructure and the cost advantages it enjoys from its scale. For instance, Dignity PLC reported capital expenditure of £101.5 million in 2023, underscoring the significant investment needed to maintain and expand its physical assets.

- Significant upfront investment: Establishing crematoria and funeral homes demands substantial capital for land acquisition, construction, and equipment.

- Economies of scale: Existing large players like Dignity benefit from operational efficiencies and purchasing power that new entrants struggle to match initially.

- Regulatory compliance: Meeting stringent health, safety, and environmental regulations adds to the complexity and cost of setting up new facilities.

The threat of new entrants in the funeral director market is moderated by the significant capital required for physical infrastructure like crematoria and extensive funeral home networks. Dignity PLC's 2023 capital expenditure of £101.5 million highlights the substantial investment needed to compete on this scale, acting as a strong deterrent for smaller players.

While the FCA's 2022 regulation of pre-paid funeral plans creates a higher barrier for that specific segment, the broader market still sees new entrants, albeit often smaller, independent operations. The 28% growth in funeral directors between 2014 and 2024 indicates ongoing market entry, though these new businesses may not immediately challenge Dignity's scale.

| Barrier Type | Description | Impact on New Entrants | Example for Dignity PLC |

|---|---|---|---|

| Capital Requirements | High cost for crematoria and funeral homes. | Deters large-scale entry, favors established players. | £101.5 million capital expenditure in 2023. |

| Brand Reputation & Trust | Building consumer confidence takes time. | New entrants need to invest in community engagement. | Decades of established trust within communities. |

| Regulatory Compliance (Pre-paid Plans) | FCA oversight since 2022. | Increases costs and complexity for plan providers. | Stringent capital and conduct requirements. |

Porter's Five Forces Analysis Data Sources

Our Dignity PLC Porter's Five Forces analysis is built upon a foundation of robust data, including Dignity's official annual reports and investor presentations. We supplement this with industry-specific market research reports and publicly available competitor financial statements to provide a comprehensive view.