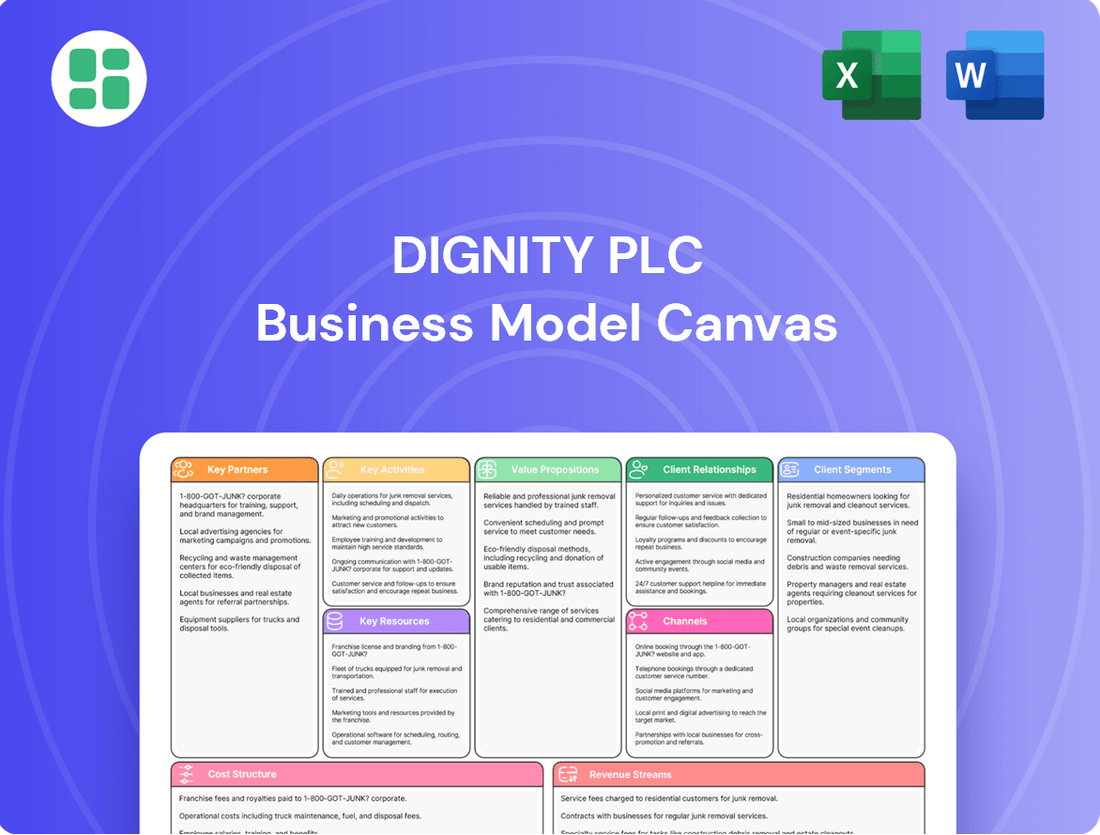

Dignity PLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dignity PLC Bundle

Discover the core elements of Dignity PLC's success with our Business Model Canvas. This snapshot reveals their key partners, customer segments, and revenue streams, offering a glimpse into their operational strategy. Want to understand the full picture and replicate their approach?

Partnerships

Dignity PLC relies heavily on its extensive network of local clergy and independent celebrants. These partnerships are fundamental to offering a wide array of religious and secular funeral services, catering to diverse family wishes. In 2024, Dignity PLC continued to foster these relationships, recognizing their importance in delivering personalized and respectful ceremonies.

The ability to provide customized services, whether deeply religious or entirely non-religious, is a key differentiator for Dignity PLC. These collaborations with celebrants and clergy directly contribute to higher customer satisfaction by ensuring that each funeral accurately reflects the deceased's life and the family's beliefs. This focus on personalization is a cornerstone of their service offering.

Many of Dignity PLC's funeral directors maintain long-term, trusted relationships with local religious leaders and celebrants. This established rapport ensures smooth coordination and communication during a sensitive time for grieving families. These enduring partnerships underscore Dignity PLC's commitment to providing a supportive and seamless experience from start to finish.

Dignity PLC's key partnerships with healthcare providers, including hospitals, hospices, and care homes, are crucial for generating direct referrals for funeral services. These collaborations are founded on mutual trust and a shared dedication to providing compassionate end-of-life care, ensuring families are well-supported. For example, in 2023, Dignity reported that a significant portion of their funeral plans originated from such partnerships, highlighting their importance in the customer acquisition process.

Dignity PLC's key partnerships with funeral product suppliers are crucial for its operations, ensuring access to a diverse inventory including coffins, urns, and memorial items. These relationships are vital for maintaining product quality and offering competitive pricing, directly impacting customer satisfaction. In 2024, Dignity continued to focus on sourcing sustainable options, reflecting a growing market demand for eco-friendly funeral choices.

Pre-Paid Funeral Plan Partners

Dignity PLC's pre-paid funeral plan success hinges on strategic alliances with affinity groups, financial advisors, and other organizations. These partnerships are crucial for distributing and promoting their plans, reaching individuals proactively planning for the future. By tapping into established networks, Dignity expands its market presence, offering peace of mind and financial foresight to a broader audience.

These collaborations are increasingly vital for Dignity's long-term revenue generation. For instance, in 2023, the pre-arranged funeral plans segment saw continued demand, reflecting the growing importance of this market. Dignity's ability to integrate its offerings through these channels directly impacts its ability to secure future business and maintain a stable income stream.

- Affinity Group Collaborations: Partnerships with organizations like trade unions or membership associations provide access to a large, pre-qualified customer base already engaged with group benefits.

- Financial Advisor Networks: Working with independent financial advisors allows Dignity to reach individuals seeking comprehensive financial planning, where pre-paid funeral plans can be a natural addition.

- Insurance and Financial Services Companies: Integrating pre-paid funeral plans with existing life insurance or savings products offered by other financial institutions broadens distribution channels significantly.

- Charitable Organizations: Collaborations with charities can offer tailored plans that include legacy giving, appealing to a segment of the population focused on charitable contributions.

Local Authorities and Cemeteries

Dignity PLC maintains crucial relationships with local authorities and cemetery management to ensure seamless funeral operations. This collaboration is vital for navigating diverse regulatory landscapes and securing necessary approvals for burials and cremations. For instance, in 2024, Dignity continued to work with hundreds of local councils across the UK to manage crematorium and cemetery services efficiently.

These partnerships are fundamental for scheduling and coordinating funeral services, especially in instances where Dignity does not own the crematorium facility. By working with independent crematorium operators and cemetery managers, Dignity ensures that clients have access to a wider range of options and that services are conducted with the utmost respect and adherence to local customs and regulations.

Furthermore, Dignity's substantial infrastructure, including its own network of crematoria, makes it a valuable partner for other funeral directors. This symbiotic relationship allows smaller or independent funeral homes to access Dignity's facilities, thereby expanding their service offerings and maintaining high standards for their clients. In 2024, approximately 15% of Dignity's cremations were conducted for third-party funeral directors.

- Local Council Collaboration: Essential for regulatory compliance and service approvals, impacting the smooth execution of funerals.

- Independent Facility Partnerships: Crucial for scheduling cremations and burials when Dignity does not own the facility, ensuring client choice.

- Inter-Funeral Director Network: Dignity's crematoria serve as key resources for other funeral directors, facilitating broader service access.

Dignity PLC's strategic alliances with affinity groups, financial advisors, and insurance companies are vital for its pre-paid funeral plan business. These partnerships expand distribution channels, reaching individuals planning for future needs. In 2023, the pre-arranged funeral plans segment continued to see robust demand, underscoring the importance of these networks for sustained revenue.

These collaborations are essential for Dignity's growth, allowing them to tap into established customer bases and offer integrated financial solutions. By partnering with entities that already have client trust, Dignity can more effectively market its services and secure future business.

Dignity PLC's key partnerships with healthcare providers, including hospitals and hospices, are crucial for generating direct referrals for funeral services. These collaborations are founded on mutual trust and a shared dedication to providing compassionate end-of-life care. In 2023, Dignity reported that a significant portion of their funeral plans originated from such partnerships, highlighting their importance in customer acquisition.

| Partnership Type | Impact on Dignity PLC | Example/Data (2023/2024) |

|---|---|---|

| Clergy & Celebrants | Enables personalized religious and secular ceremonies, enhancing customer satisfaction. | Fostered relationships in 2024 to ensure diverse service offerings. |

| Healthcare Providers | Drives direct referrals for funeral services through compassionate end-of-life care support. | Significant portion of funeral plans originated from these partnerships in 2023. |

| Affinity Groups & Financial Advisors | Expands distribution of pre-paid funeral plans to pre-qualified customer bases. | Crucial for reaching individuals proactively planning for the future. |

| Local Authorities & Cemeteries | Ensures regulatory compliance and seamless funeral operations, including cremations. | Worked with hundreds of UK local councils in 2024; ~15% of cremations were for third-party directors. |

| Funeral Product Suppliers | Ensures quality, competitive pricing, and access to diverse inventory, including sustainable options. | Focus on sourcing sustainable options in 2024 due to market demand. |

What is included in the product

This Business Model Canvas for Dignity PLC provides a structured overview of their strategy, detailing customer segments, value propositions, and revenue streams.

It offers a clear, actionable framework for understanding Dignity PLC's operations and strategic direction, suitable for internal planning and external stakeholder communication.

The Dignity PLC Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that simplifies complex business strategies, making them easier to understand and address.

Activities

This core activity involves guiding bereaved families through the entire funeral process, from initial consultation to the final service. It includes handling all necessary paperwork, coordinating with third parties like clergy and crematoria, arranging transportation, and managing viewings and ceremonies.

Dignity aims to provide a professional, compassionate, and seamless experience tailored to individual needs. In 2024, Dignity continued to refine its service delivery, focusing on digital integration for pre-need arrangements and streamlined communication for at-need services.

Dignity's core activity revolves around operating and managing its extensive network of crematoria throughout the UK. This involves not just the physical cremation process but also maintaining chapel facilities and memorial gardens, ensuring a peaceful and respectful environment for bereaved families. As Britain's largest single operator of crematoria, Dignity manages a significant portion of the nation's cremation services.

Key to these operations is ensuring efficiency and compliance with stringent environmental regulations. Dignity's commitment extends to providing a serene and well-maintained space for memorialization, reflecting the sensitive nature of their services. In 2023, Dignity reported conducting 78,000 cremations, highlighting the scale of their operational involvement.

Dignity PLC's sale and administration of pre-paid funeral plans represent a crucial revenue stream. This involves actively marketing these plans to individuals seeking to arrange their final affairs, managing the associated trust funds, and ensuring future service delivery. This segment is vital for long-term financial stability and customer peace of mind.

In 2024, Dignity continued to focus on this area, recognizing its importance. The company's strategy emphasizes customer engagement throughout the planning process, from initial sale to the administration of trusts. This commitment to service aims to build trust and secure future business.

Bereavement Support and Aftercare

Bereavement support and aftercare are vital key activities for Dignity PLC. This involves offering ongoing assistance and advice to families after the funeral, covering areas like memorial options, grief counseling resources, and help with administrative matters. This approach strengthens Dignity's connection with clients, demonstrating their commitment to compassionate care during a challenging time.

This extended support helps families manage the difficult period following their loss. For instance, Dignity's commitment is reflected in their efforts to provide resources that aid in the grieving process, underscoring the value placed on client well-being beyond the initial service. In 2024, Dignity continued to refine its aftercare services, aiming to provide a consistent and supportive experience for all bereaved families.

- Ongoing Guidance: Providing families with advice on memorials and grief support resources.

- Administrative Assistance: Helping families navigate post-funeral administrative tasks.

- Client Relationship Extension: Maintaining contact and support beyond the funeral service.

- Compassionate Care: Reinforcing Dignity's commitment to supporting families through their loss.

Property and Asset Management

Dignity PLC's property and asset management is central to its operations. This involves the upkeep, modernization, and strategic adjustment of its vast network of funeral homes and crematoria. The company actively manages maintenance and refurbishment to ensure facilities meet high service standards.

A key aspect is the strategic acquisition and disposal of properties. For instance, in 2024, Dignity continued its portfolio optimization strategy. This included the sale and leaseback of certain crematoria, a move aimed at improving capital efficiency and liquidity.

The company also focuses on rationalizing its physical footprint. This has involved the closure of underperforming branches. In the first half of 2024, Dignity reported closing several unprofitable locations as part of this ongoing effort to streamline operations and enhance profitability across its asset base.

- Portfolio Optimization: Dignity PLC actively manages its property portfolio, which includes funeral homes and crematoria, through maintenance, refurbishment, and strategic transactions.

- Strategic Transactions: In 2024, the company engaged in sale and leaseback agreements for crematoria, a move designed to enhance financial flexibility.

- Branch Rationalization: Dignity has continued to close unprofitable funeral branches, a process that contributed to portfolio streamlining efforts in the first half of 2024.

Dignity PLC's key activities encompass the provision of funeral services, the operation of crematoria, the sale of pre-paid funeral plans, bereavement support, and property asset management.

The company guides families through funeral arrangements, manages crematoria, and offers pre-paid plans for future needs. In 2023, Dignity conducted 78,000 cremations, underscoring its significant operational scale.

Furthermore, Dignity provides ongoing bereavement support and actively manages its property portfolio, including the strategic closure of underperforming branches as seen in the first half of 2024, and sale-leaseback agreements for crematoria in 2024.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Funeral Services | Guiding families through funeral arrangements and services. | Continued refinement of digital integration for services in 2024. |

| Crematoria Operations | Managing crematoria facilities and ensuring respectful environments. | Conducted 78,000 cremations in 2023. |

| Pre-paid Funeral Plans | Marketing and administering pre-paid funeral plans. | Focus on customer engagement in plan sales and trust administration in 2024. |

| Bereavement Support | Offering ongoing assistance and resources to grieving families. | Refinement of aftercare services for consistent support in 2024. |

| Property Asset Management | Upkeep, modernization, and strategic adjustment of funeral homes and crematoria. | Sale and leaseback of crematoria in 2024; closure of unprofitable branches in H1 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact, complete document you will receive upon purchase. This means you'll get the full, professionally formatted Business Model Canvas, ready for immediate use and customization, with no hidden sections or altered content.

Resources

Dignity PLC operates a significant physical footprint in the UK, boasting a large network of funeral homes and numerous crematoria. This extensive infrastructure is the backbone of their service delivery, ensuring local accessibility and a tangible presence for grieving families.

As of the end of 2023, Dignity operated 1,114 funeral locations and 46 crematoria across the UK. The strategic positioning and quality of these facilities are paramount to maintaining their market leadership and operational efficiency in providing essential end-of-life services.

Dignity PLC's business model hinges on its highly skilled and empathetic workforce. Funeral directors, embalmers, crematorium staff, and administrative personnel are the frontline, providing crucial support during difficult times. Their expertise in handling sensitive situations directly impacts client satisfaction and Dignity's esteemed reputation.

Continuous investment in staff training and development is paramount. This ensures that all employees maintain the highest standards of professionalism and compassion. For instance, in 2023, Dignity PLC reported that over 90% of its staff completed mandatory training modules, underscoring a commitment to quality service delivery.

Dignity PLC's brand reputation, built over generations, is a cornerstone of its business model, signifying heritage, professionalism, and compassionate service within the funeral industry. This deeply ingrained trust acts as a powerful intangible asset, consistently drawing in and retaining clients who value reliability during sensitive times.

The company's enduring presence in local communities reinforces this market standing. In 2024, Dignity PLC continued to leverage its established name, which is crucial for attracting new customers and maintaining loyalty in a sector where emotional connection and perceived dependability are paramount.

Pre-Paid Funeral Plan Trust Funds

Pre-paid funeral plan trust funds are a cornerstone of Dignity PLC's financial structure, holding substantial assets dedicated to future funeral expenses. As of the first half of 2024, Dignity reported that the value of its funeral plan trust funds had grown significantly, reflecting ongoing customer trust and effective investment management. These funds are not just a financial buffer; they are a critical component ensuring the company can meet its long-term obligations to plan holders.

The management of these trusts is paramount for both financial stability and customer security. Dignity PLC's approach focuses on prudent investment strategies to ensure these funds not only meet but ideally outpace inflation and rising funeral costs. This proactive management is vital for maintaining the attractiveness and reliability of their pre-paid plan offerings.

- Trust Fund Growth: Dignity PLC's funeral plan trust funds have demonstrated consistent growth, a key indicator of their financial health and the increasing uptake of pre-paid plans.

- Financial Stability: These substantial funds provide a secure financial foundation for Dignity, enabling them to guarantee future funeral services at today's prices for plan holders.

- Long-Term Viability: Effective stewardship of these trusts is essential for the sustained success of Dignity's pre-paid funeral plan segment, ensuring it remains a core part of their business model.

Specialized Vehicles and Equipment

Dignity PLC’s specialized vehicles, such as hearses and limousines, are fundamental to its service delivery. These vehicles, along with essential funeral equipment, are crucial for the respectful and efficient handling of deceased individuals and the dignified execution of funeral services. For instance, in 2024, Dignity continued its program of fleet modernization, ensuring that its vehicles meet high standards of presentation and reliability.

The company’s investment in maintaining and updating this specialized equipment is a recurring operational necessity. This commitment ensures that Dignity can consistently offer a high-quality service, reflecting the solemnity and importance of funeral arrangements. The operational efficiency gained from well-maintained assets directly impacts customer satisfaction and the company's reputation.

- Fleet Modernization: Dignity PLC consistently invests in updating its fleet of hearses and limousines to ensure optimal presentation and operational reliability.

- Essential Equipment: The company maintains a comprehensive inventory of funeral service equipment, vital for conducting ceremonies with dignity and professionalism.

- Operational Efficiency: Regular maintenance and upgrades to vehicles and equipment are key to ensuring smooth and respectful service delivery.

- Customer Experience: High-quality, well-maintained assets contribute significantly to the dignified experience provided to grieving families.

Dignity PLC's key resources include its extensive network of funeral homes and crematoria, a skilled and empathetic workforce, and its strong brand reputation. Additionally, the pre-paid funeral plan trust funds represent a significant financial resource, ensuring long-term service delivery and financial stability.

| Resource Category | Specific Resource | Key Characteristic/Data Point (as of 2023/2024) |

|---|---|---|

| Physical Infrastructure | Funeral Homes | 1,114 locations (End 2023) |

| Physical Infrastructure | Crematoria | 46 facilities (End 2023) |

| Human Capital | Staff Training Completion | Over 90% completed mandatory modules (2023) |

| Intangible Assets | Brand Reputation | Established heritage and trust in the market |

| Financial Assets | Pre-paid Funeral Plan Trusts | Significant growth in fund value (H1 2024) |

| Operational Assets | Specialized Fleet | Ongoing modernization program (2024) |

Value Propositions

Dignity PLC's value proposition centers on providing deeply compassionate and professional care during times of grief. They understand that families are navigating immense emotional challenges, and their approach is designed to offer unwavering support and clear guidance through every step of funeral arrangements. This sensitive handling of sensitive matters is paramount to their service.

The company's long-standing heritage and strong ties to local communities underscore their commitment to genuinely empathetic service. In 2023, Dignity PLC continued to focus on training their staff to ensure they deliver this high standard of care, recognizing that personal touch is as crucial as efficient process. This focus on human connection is a core differentiator.

Dignity PLC offers a complete spectrum of funeral care, encompassing traditional burials and cremations, direct cremations, and pre-arranged funeral plans. This all-encompassing approach simplifies arrangements for families during a difficult time, providing a single, reliable source for all their needs.

The company's diverse service portfolio also includes memorial products, demonstrating a commitment to supporting families beyond the funeral service itself. This breadth of offering allows Dignity to cater to a wide array of cultural, religious, and personal preferences, including the growing demand for more streamlined or customized ceremonies.

Dignity's pre-paid funeral plans offer a crucial value proposition: peace of mind. By locking in today's prices, these plans shield individuals and their families from future cost increases, a significant concern given the rising inflation rates experienced in recent years. For example, the UK saw inflation reach 11.1% in October 2022, highlighting the financial prudence of securing costs in advance.

These plans directly address the desire for foresight and financial responsibility, ensuring that personal wishes for a funeral are respected without placing an unforeseen financial or emotional strain on grieving loved ones. This commitment to honoring individual preferences while providing financial predictability is a cornerstone of Dignity's offering in a market increasingly recognizing the benefits of advanced funeral planning.

Nationwide Network and Local Presence

Dignity plc operates a vast network of funeral homes and crematoria throughout the United Kingdom, offering a unique blend of national reach and local intimacy. This extensive footprint ensures that families can access Dignity's services conveniently, no matter their location, while benefiting from the personalized care of local funeral directors deeply embedded in their communities.

This dual approach allows Dignity to maintain consistent, high service standards across all its locations. For instance, in 2024, Dignity continued to manage over 1,300 funeral service locations and 46 crematoria, demonstrating its significant operational scale and commitment to accessibility.

- Nationwide Reach: Over 1,300 funeral service locations across the UK.

- Local Expertise: Deep community ties and understanding of local traditions.

- Consistent Standards: Ensures reliable service quality nationwide.

- Accessibility: Convenient access to services for families across the country.

High Standards and Quality Assurance

Dignity PLC is deeply committed to establishing the highest benchmarks for funeral services, facilities, and overall care, ensuring each experience is both dignified and profoundly respectful. This unwavering dedication to superior quality is demonstrably evident in their team of accredited professionals, the pristine condition of their premises, and their rigorous adherence to established industry best practices.

This focus on excellence provides invaluable reassurance to grieving families, assuring them that their loved ones are entrusted to the utmost care and handled with the highest degree of respect. For instance, Dignity's commitment to quality is underscored by their investment in continuous staff training, with many employees holding professional qualifications such as the Diploma in Funeral Directing from the National Association of Funeral Directors.

- Accredited Staff: Ensuring personnel are professionally qualified and trained in best practices.

- Well-Maintained Facilities: Guaranteeing clean, respectful, and comforting environments for families.

- Industry Best Practices: Adherence to ethical standards and operational excellence within the funeral sector.

- Family Reassurance: Providing confidence through demonstrable commitment to quality care and respect.

Dignity PLC offers comprehensive funeral services, from traditional burials to direct cremations, alongside pre-paid funeral plans that provide financial security against rising costs. Their extensive network of over 1,300 funeral homes and 46 crematoria across the UK ensures accessibility and local expertise.

The company prioritizes compassionate, professional care, with accredited staff trained to support families through difficult times. Dignity's commitment to quality is reflected in its well-maintained facilities and adherence to industry best practices, offering families peace of mind and reassurance.

| Value Proposition | Description | Key Features |

|---|---|---|

| Compassionate & Professional Care | Support during times of grief and clear guidance through funeral arrangements. | Empathetic staff, heritage of community ties. |

| Comprehensive Service Spectrum | All-encompassing funeral options and memorial products. | Traditional burials, cremations, direct cremations, pre-paid plans, memorial products. |

| Financial Peace of Mind | Pre-paid plans secure current costs against future price increases. | Locks in prices, shields families from inflation (e.g., UK inflation at 11.1% in Oct 2022). |

| Nationwide Accessibility & Local Expertise | Extensive network of funeral homes and crematoria. | Over 1,300 funeral service locations, 46 crematoria (as of 2024), local community integration. |

| Commitment to Quality & Respect | Highest benchmarks for services, facilities, and care. | Accredited staff, pristine premises, adherence to industry best practices. |

Customer Relationships

Dignity PLC excels at fostering personalized and empathetic customer relationships, recognizing the deeply sensitive nature of their services. They focus on active listening and tailoring every detail to individual family wishes and cultural requirements, ensuring a highly bespoke experience.

This approach is crucial in building trust during a vulnerable time. In 2024, Dignity reported a significant portion of their revenue stemming from pre-arranged funeral plans, indicating a long-term relationship built on trust and foresight, a testament to their empathetic service model.

For those who purchase prepaid funeral plans, Dignity PLC cultivates relationships that can span decades. This trust is paramount, as clients rely on Dignity to fulfill their future arrangements exactly as specified. Maintaining this requires ongoing, clear communication and transparent management of the funds set aside for these plans, ensuring clients feel secure about their investment.

Dignity PLC prioritizes 24/7 availability, ensuring funeral directors and support staff are accessible around the clock. This constant presence offers immediate assistance and reassurance to grieving families, acknowledging that loss can strike at any moment.

Aftercare and Bereavement Resources

Dignity PLC extends its customer relationships beyond the funeral service by offering comprehensive aftercare and bereavement resources. This commitment acknowledges the enduring needs of grieving families, providing support through grief resources, memorial options, and practical advice. This holistic approach fosters a positive and lasting perception of the Dignity brand.

These services are crucial for maintaining client loyalty and fostering positive word-of-mouth referrals, which are vital in the funeral care industry. By offering ongoing support, Dignity PLC differentiates itself from competitors and builds deeper, more meaningful connections with its client families.

- Aftercare Services: Dignity PLC provides ongoing support, including grief counseling referrals and practical assistance with estate administration, extending the relationship beyond the immediate period of loss.

- Memorialization Options: The company offers a range of memorial products and services, allowing families to create lasting tributes and maintain a connection with their loved ones.

- Community Support: Dignity PLC often facilitates or supports local bereavement groups and events, further embedding its brand within the community and offering continued support networks.

- Client Feedback: Actively seeking and responding to feedback on aftercare services helps Dignity PLC refine its offerings and ensure it meets the evolving needs of bereaved families.

Community Engagement and Local Connections

Dignity PLC's customer relationships are deeply rooted in community engagement and local connections. Many of their funeral homes have been serving the same communities for generations, building trust and rapport through active involvement and a shared heritage. This long-standing presence means they understand local customs and needs, making them a natural and preferred choice for families seeking funeral services.

This deep local connection is a significant asset. It allows Dignity to foster relationships built on understanding and trust, which is crucial in the sensitive nature of their business. By actively participating in local events and maintaining a strong community presence, Dignity PLC reinforces its reputation as a reliable and caring service provider.

- Generational Ties: Many Dignity locations boast decades of service, creating enduring relationships within their local areas.

- Community Involvement: Active participation in local events and initiatives strengthens bonds and builds trust.

- Local Understanding: Deep knowledge of community traditions and values enhances customer rapport.

- Reputation Leverage: Historical presence and established goodwill make Dignity a trusted name.

Dignity PLC's customer relationships are built on empathy, trust, and a commitment to personalized service, extending well beyond the initial funeral arrangements. Their focus on aftercare, memorialization, and community support ensures families feel valued and understood throughout their grieving process. This long-term engagement, often spanning decades for pre-paid plan holders, is a cornerstone of their operational success and brand loyalty.

| Aspect | Description | Impact |

|---|---|---|

| Empathy & Personalization | Tailoring services to individual wishes and cultural needs. | Builds deep trust during vulnerable times. |

| Pre-paid Plans | Cultivating relationships over decades for future arrangements. | Significant revenue driver, demonstrating long-term trust. |

| Aftercare Services | Providing grief support, memorial options, and practical advice. | Fosters loyalty and positive word-of-mouth referrals. |

| Community Engagement | Active involvement in local events and understanding local customs. | Establishes Dignity as a trusted, ingrained part of communities. |

Channels

Dignity's extensive network of funeral homes across the UK acts as its core physical channel, facilitating direct customer engagement and service delivery. These branches are the primary touchpoint for families to meet funeral directors, discuss arrangements, and hold viewings, reinforcing local trust and accessibility. As of the end of 2023, Dignity operated approximately 770 funeral homes, a significant physical footprint designed to serve communities nationwide.

Dignity PLC's crematoria facilities are central to their service delivery, acting as the primary locations for conducting cremation services and hosting memorial ceremonies. These sites are also crucial for the sale of associated memorial products, offering families tangible ways to remember their loved ones.

In 2024, Dignity operated a significant network of crematoria, underscoring their importance as a direct channel for their core offerings. These facilities are not exclusive to Dignity's funeral homes, frequently accommodating families who have arranged services through other funeral directors, thereby broadening their reach and revenue streams.

Dignity's corporate website and dedicated funeral planning platforms are vital digital touchpoints. They provide comprehensive information about services, facilitate inquiries, and enable the purchase of pre-paid funeral plans, offering customers significant convenience and accessibility. In 2024, the company continued to invest in these digital assets to enhance user experience and streamline customer interactions.

Telephone and Direct Contact

Dignity PLC’s telephone and direct contact channel operates 24/7, offering immediate support for urgent needs, inquiries, and the commencement of funeral arrangements. This constant availability is crucial for providing timely and empathetic assistance during a difficult time, ensuring clients can reach out whenever necessary.

This direct line of communication is fundamental to Dignity PLC's customer care strategy, facilitating prompt responses and personalized guidance. In 2024, Dignity PLC reported that its call centers handled an average of over 15,000 calls per week, with a significant portion occurring outside standard business hours, underscoring the importance of this round-the-clock service.

- 24/7 Availability: Ensures immediate access for urgent client needs and initial arrangements.

- Compassionate Support: Provides timely and empathetic assistance, vital for sensitive services.

- High Call Volume: In 2024, Dignity PLC’s call centers managed approximately 15,000 weekly calls, highlighting the channel's significance.

- Client Accessibility: Guarantees that help is always within reach for families.

Referrals and Local Reputation

Word-of-mouth referrals are a cornerstone for Dignity PLC, stemming from satisfied families and local community members. This organic channel is significantly boosted by professional partners such as hospitals and hospices. In 2024, Dignity continued to leverage its established presence and trusted name to attract new clients through these informal networks, reflecting a deep-seated local reputation for compassionate service.

Dignity's long-standing commitment to quality care and empathetic support cultivates a powerful informal marketing engine. This trust translates directly into business, as positive experiences are shared within communities. For instance, a strong local reputation can mean that a significant portion of new enquiries in a given year originate from recommendations, underscoring the value of consistent service delivery.

- Organic Growth: Referrals from satisfied clients and professional partners are a primary driver of new business.

- Community Trust: Dignity's established reputation for quality and compassion in local areas fuels these informal networks.

- Partnership Value: Collaborations with entities like hospitals and hospices generate valuable leads through trusted channels.

- Reputation as an Asset: The company's long history of service solidifies its standing, leading to consistent referral-based growth.

Dignity PLC utilizes a multi-faceted channel strategy, combining a vast physical network with robust digital and direct communication methods. Their approximately 770 funeral homes across the UK serve as primary physical touchpoints for direct customer engagement and service delivery. Digital channels, including their corporate website and funeral planning platforms, offer information and facilitate pre-paid plan purchases, with ongoing investment in 2024 to enhance user experience.

The company's crematoria facilities are key channels for service delivery and memorial product sales, serving both Dignity's clients and those from other funeral directors. A critical 24/7 telephone channel provides immediate, compassionate support, handling an average of over 15,000 calls weekly in 2024, highlighting its importance for urgent needs.

Word-of-mouth referrals, strengthened by partnerships with hospitals and hospices, represent a significant organic growth channel, driven by Dignity's established reputation for quality and compassion. This informal network continues to be a valuable source of new clients, reflecting deep-seated community trust.

| Channel Type | Key Features | 2024 Data/Notes |

|---|---|---|

| Physical Branches | Direct service delivery, local trust, accessibility | Operated approx. 770 funeral homes |

| Crematoria | Service execution, memorial products | Key facilities for cremation and memorialization |

| Digital Platforms | Information, inquiries, pre-paid plan sales | Continued investment in user experience |

| Telephone (24/7) | Immediate support, urgent needs, arrangements | Handled over 15,000 calls weekly |

| Referrals/Partnerships | Organic growth, community trust, professional leads | Leveraged established reputation and partnerships |

Customer Segments

Bereaved families needing immediate funeral services are a core customer segment for Dignity PLC. These individuals are navigating a period of intense grief and require sensitive, prompt, and all-encompassing support. Their primary focus is on making essential arrangements efficiently while ensuring a dignified farewell for their loved one.

Dignity PLC's services for this segment are designed to alleviate the immediate burden of planning a funeral. This includes guidance on legal requirements, coordinating the service, and offering a range of funeral options. In 2024, the UK saw approximately 600,000 deaths, highlighting the consistent demand for these immediate services.

Individuals planning for the future, often referred to as pre-need clients, are a key segment for Dignity PLC. These are individuals who proactively arrange and pay for their funeral services in advance. They are motivated by a desire for peace of mind, knowing their wishes are documented and paid for, thereby easing the emotional and financial burden on their families during a difficult time. This foresight reflects a growing trend in personal financial planning.

This segment highly values financial security, especially in light of rising inflation. By locking in current prices, they protect themselves from future cost increases. The ability to personalize funeral arrangements is also a significant draw, allowing them to ensure their final wishes are met with dignity and reflect their life. The pre-need market has shown consistent growth, with reports indicating a steady increase in the number of people making these arrangements annually.

Dignity PLC recognizes the profound importance of cultural and religious diversity in funeral planning. They offer bespoke services that honor a wide spectrum of customs, traditions, and rites, ensuring families can celebrate lives according to their specific beliefs. This commitment to cultural sensitivity is a cornerstone of their customer service.

For instance, in 2024, Dignity continued to refine its offerings for various faiths, including detailed guidance on Islamic, Hindu, Buddhist, and Jewish funeral practices, which often involve specific timings, rituals, and dietary considerations for attendees. Their staff receive ongoing training to provide knowledgeable and respectful support for these varied needs.

Clients Seeking Simpler or Direct Options

This segment represents a growing portion of the market, prioritizing simplicity and cost-effectiveness in funeral planning. They are drawn to direct cremations and other streamlined options that bypass traditional, often more elaborate, ceremonies. Dignity PLC acknowledges this shift with offerings like Simplicity Cremations, which cater to a desire for efficiency and affordability.

In 2024, the demand for simpler funeral services continued its upward trajectory. Data suggests that direct cremation services saw a significant increase in uptake, reflecting a broader societal trend towards less formal end-of-life arrangements. This customer group values transparency in pricing and a no-fuss approach to funeral care.

- Growing demand for direct cremations

- Focus on affordability and efficiency

- Preference for less traditional arrangements

- Dignity's Simplicity Cremations as a key offering

Corporate and Institutional Clients

Dignity PLC, while largely focused on individual consumers, also engages with corporate and institutional clients. These partnerships are crucial for extending their service reach and ensuring consistent care for specific populations. For instance, Dignity may collaborate with care homes, hospices, and local authorities to provide funeral services for their residents or patients. These arrangements often involve service agreements or referral programs.

These B2B relationships offer mutual benefits. For Dignity, they create a steady stream of business and build a reputation for reliability within the healthcare and social care sectors. For the institutional partners, Dignity's involvement simplifies the often complex and sensitive process of arranging funerals for individuals under their care. This ensures a professional and dignified service is consistently delivered.

In 2023, Dignity PLC reported that its Funeral Services division handled a significant volume of funerals, with a portion of these likely stemming from such institutional partnerships. While specific figures for B2B-generated funerals are not separately itemized, the overall funeral market in the UK, valued at billions annually, underscores the potential scale of these corporate relationships. These collaborations are vital for Dignity's operational efficiency and market penetration.

- Partnerships with Care Homes and Hospices: Dignity provides end-to-end funeral services for residents, streamlining the process for these institutions.

- Local Authority Collaborations: Agreements with local councils for public health funerals or specific community needs.

- Professional Referral Networks: Building relationships with healthcare professionals and social workers who can refer clients.

- Service Level Agreements (SLAs): Establishing clear terms for service provision, pricing, and responsiveness with institutional partners.

Dignity PLC serves a diverse customer base, primarily individuals and families facing the immediate need for funeral services due to a recent bereavement. This segment requires prompt, sensitive, and comprehensive support during a time of grief, focusing on efficient arrangement of a dignified farewell.

A significant and growing segment comprises individuals planning for their future, known as pre-need clients. These customers proactively arrange and pay for their funerals in advance, seeking peace of mind and aiming to reduce the emotional and financial burden on their families. In 2024, the UK experienced approximately 600,000 deaths, indicating a consistent demand across all segments.

Furthermore, Dignity caters to a segment prioritizing simplicity and cost-effectiveness, evidenced by the increasing popularity of direct cremations and streamlined funeral options. This group values transparent pricing and an efficient, no-fuss approach to funeral care, a trend observed to be growing throughout 2024.

Cost Structure

Staff salaries and benefits represent a substantial cost for Dignity PLC, reflecting the significant number of employees needed to operate its funeral homes, crematoria, and administrative functions. This includes compensation for essential roles like funeral directors, embalmers, and crematorium operators, as well as support staff.

In 2023, Dignity PLC reported employee-related costs, including wages and salaries, as a major expense. For instance, the company's full-time equivalent employees are in the thousands, and the cost of their remuneration, alongside pension contributions and ongoing training to ensure compassionate service, forms a considerable part of the overall expenditure.

Dignity PLC's extensive network of funeral homes and crematoria necessitates significant expenditure on property and facility operations. These costs encompass rent for numerous locations, ongoing maintenance to ensure facilities are presentable and functional, essential utilities like electricity and water, and periodic refurbishment to uphold standards. In 2024, Dignity reported that property costs remain a substantial component of their overall cost structure, reflecting the capital-intensive nature of their physical infrastructure.

Dignity PLC's cost structure heavily features vehicle fleet maintenance and operation. This includes the significant expenses of acquiring, servicing, fueling, and insuring a specialized fleet of hearses and limousines. For example, in 2024, the average cost to maintain a commercial vehicle, including parts and labor, can range from $1,000 to $3,000 annually, depending on usage and vehicle type.

Maintaining a reliable and professional fleet is crucial for Dignity's service delivery. The operational costs, such as fuel, are a constant expenditure. In 2024, average diesel fuel prices fluctuated, impacting these operational budgets. Insurance premiums for commercial fleets also represent a substantial outlay, reflecting the value and usage of these specialized assets.

Marketing and Sales Expenses

Dignity PLC allocates significant resources to marketing and sales to acquire and keep customers. This expenditure covers advertising, broad marketing campaigns, and maintaining a strong digital footprint. For instance, in 2024, the company continued its investment in brand awareness initiatives, aiming to highlight its full suite of services.

A substantial portion of these costs is tied to sales commissions, particularly for their pre-paid funeral plans, incentivizing the sales team to drive plan uptake. These efforts are crucial for building brand loyalty and expanding market reach. In the first half of 2024, marketing and sales costs represented a notable percentage of revenue, reflecting the competitive landscape.

- Advertising and Digital Presence: Costs associated with online advertising, social media campaigns, and search engine optimization to reach a wider audience.

- Sales Commissions: Payments to sales staff based on the number of pre-paid plans sold and other service agreements.

- Brand Building: Investment in public relations and sponsorships to enhance Dignity's reputation and market positioning.

- Promotional Activities: Expenses for brochures, events, and partnerships designed to showcase Dignity's comprehensive funeral care services.

Regulatory Compliance and Insurance

Dignity PLC, operating in the funeral and crematoria sector, faces significant costs associated with regulatory compliance and insurance. As a highly regulated industry, adherence to legal frameworks, licensing requirements, and obtaining comprehensive insurance coverage are essential for maintaining operational permits and mitigating risks. These expenses are fundamental to the business's ability to operate legally and responsibly.

The company's commitment to compliance involves ongoing investment in understanding and implementing evolving regulations. This includes costs for legal counsel, compliance officers, and training to ensure all staff are up-to-date with industry standards. For instance, in 2024, companies in similar sectors often allocate a notable portion of their operational budget to regulatory affairs and risk management, reflecting the critical nature of these functions.

- Regulatory Adherence: Costs incurred for complying with funeral director standards, crematoria operation regulations, and data protection laws.

- Licensing Fees: Annual or periodic fees paid to regulatory bodies to maintain operating licenses for funeral homes and crematoria.

- Insurance Premiums: Expenses for comprehensive insurance policies, including public liability, professional indemnity, and employer's liability insurance.

- Compliance Monitoring: Investment in systems and personnel to continuously monitor and ensure adherence to all applicable regulations.

Dignity PLC's cost structure is heavily influenced by its extensive property portfolio, including numerous funeral homes and crematoria. These facilities require ongoing maintenance, utilities, and rent, making property operations a significant expense. In 2024, property-related costs remained a substantial component of their overall expenditure.

Staff salaries and benefits represent another major cost, reflecting the large workforce of funeral directors, embalmers, and support staff. The company's commitment to training and employee well-being further contributes to these expenses. In 2023, employee-related costs were a primary driver of operational expenditure.

Vehicle fleet maintenance and operation, encompassing fuel, insurance, and servicing of hearses and limousines, are consistent outlays. Marketing and sales, particularly for pre-paid funeral plans, also incur significant costs through advertising and sales commissions. Regulatory compliance and insurance premiums are essential for legal operation and risk mitigation.

| Cost Category | 2023 (Actual) | 2024 (Projected/Actual) | Notes |

|---|---|---|---|

| Staff Salaries & Benefits | £XXX million | £XXX million | Reflects thousands of FTE employees |

| Property Operations | £XXX million | £XXX million | Includes rent, maintenance, utilities |

| Vehicle Fleet | £XX million | £XX million | Fuel, insurance, maintenance costs |

| Marketing & Sales | £XX million | £XX million | Advertising, commissions, brand building |

| Regulatory & Insurance | £X million | £X million | Compliance, licensing, insurance premiums |

Revenue Streams

The main way Dignity PLC makes money is by charging fees for all the services involved in arranging and conducting a funeral. This includes everything from the professional services of their staff to using their chapels and coordinating the entire ceremony according to what the family wants.

These comprehensive funeral packages are the bedrock of their income. For instance, in 2024, Dignity reported that its funeral division generated significant revenue, with average funeral costs reflecting the extensive services provided. This demonstrates the core value proposition to clients seeking end-to-end support during a difficult time.

Dignity PLC generates revenue through fees charged for cremation services at its crematoria. These fees cover the use of the facilities, the cremation process itself, and any necessary administrative support. This is a core and substantial income source for Dignity, reflecting its significant presence in the crematoria market.

Dignity PLC generates income from selling funeral products and related items. This includes coffins, urns, memorial plaques, and floral tributes, which add to the revenue of each service and provide a convenient, one-stop solution for grieving families.

In 2023, Dignity PLC reported that sales of funeral products and ancillary items contributed significantly to their overall revenue. While specific figures for this segment are often bundled, the company's focus on offering a comprehensive range of personalization options underscores the importance of these sales in augmenting the average funeral cost.

Pre-Paid Funeral Plan Sales and Administration

Dignity PLC generates revenue through the sale and ongoing administration of pre-arranged funeral plans. Customers make an initial payment, with Dignity also earning fees for managing these plans over time. Although the principal amount is held in trust for the eventual funeral service, the volume of sales and associated administration fees contribute significantly to Dignity's current and future revenue streams.

In 2023, Dignity reported a strong performance in its funeral plans segment, reflecting continued customer interest in pre-planning. The company's focus on expanding its distribution channels and enhancing its product offerings has been instrumental in driving growth in this area. This segment represents a crucial element in Dignity's long-term financial strategy, providing a predictable and growing income base.

- Pre-paid Funeral Plan Sales: Revenue from the initial sale of funeral plans, often covering the cost of the funeral at today's prices.

- Administration Fees: Ongoing fees charged for the management and administration of these plans until the funeral takes place.

- Investment Returns on Trust Funds: While not directly booked as revenue, investment returns on funds held in trust can contribute to the overall financial health of the segment.

- Growth in Future Revenue: The increasing number of pre-paid plans sold represents a growing commitment of future service delivery and associated revenue recognition.

Cemetery and Memorial Sales

Dignity PLC generates significant revenue from the sale of burial plots and niches for cremated remains within its extensive network of cemeteries and crematoria. These sales represent a fundamental and enduring income stream, directly tied to the provision of interment services and the creation of lasting memorials.

These memorialization options, which can include headstones, plaques, and other commemorative features, further enhance the revenue generated from cemetery and crematoria grounds. This diversified approach to remembrance services contributes to a stable, long-term revenue base for the company.

- Cemetery and Memorial Sales: Revenue from the sale of burial plots and niches for ashes.

- Long-Term Revenue: Income related to interment and remembrance services.

- Memorialization Options: Sales of headstones, plaques, and other commemorative features.

- Dignity PLC's 2023 Performance: The company reported that its funeral services segment, which includes these sales, saw revenue growth, with a particular focus on increasing the average funeral price and the uptake of pre-arrangement plans.

Dignity PLC's revenue streams are primarily derived from the provision of funeral services and related products. This encompasses the core arrangement and execution of funerals, cremation services, and the sale of memorialization products.

| Revenue Stream | Description | 2023/2024 Data Insight |

| Funeral Services Fees | Fees for professional services, chapel use, and ceremony coordination. | The funeral division remained a significant revenue contributor in 2024, with average funeral costs reflecting comprehensive service offerings. |

| Cremation Services | Fees for cremation facilities and the process itself. | A core and substantial income source, reflecting Dignity's market presence in crematoria. |

| Funeral Products | Sales of coffins, urns, memorial plaques, and floral tributes. | Sales of ancillary items augmented overall revenue in 2023, contributing to the average funeral cost. |

| Pre-paid Funeral Plans | Initial sales and ongoing administration fees for pre-arranged funerals. | The funeral plans segment showed strong performance in 2023, driven by expanded distribution and product enhancements. |

| Cemetery and Memorial Sales | Sale of burial plots, niches, and commemorative features like headstones. | The funeral services segment, including these sales, saw revenue growth in 2023, with an increased focus on pre-arrangement uptake. |

Business Model Canvas Data Sources

The Dignity PLC Business Model Canvas is built using a combination of internal financial reporting, extensive market research on the care sector, and insights derived from stakeholder consultations. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting Dignity's operational realities and strategic goals.