Dignity PLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dignity PLC Bundle

Uncover the critical external forces shaping Dignity PLC's future with our comprehensive PESTLE analysis. From evolving social attitudes towards death to intricate legal frameworks governing funeral services, this analysis provides essential insights for strategic planning. Don't get left behind; download the full version now to gain a competitive edge and make informed decisions.

Political factors

Government regulations significantly shape the UK funeral industry, impacting Dignity PLC's operations through policies on funeral plans and consumer protection. For instance, the Financial Conduct Authority's (FCA) oversight of pre-paid funeral plans, which came into effect in July 2022, mandates stricter conduct and capital requirements, adding compliance burdens and potentially altering the competitive landscape by raising entry barriers.

Changes in legislation, such as those related to environmental standards for crematoria or data privacy for client information, directly influence Dignity's operational procedures and necessitate ongoing investment in compliance. The regulatory environment, overseen by bodies like the Competition and Markets Authority (CMA) which has investigated pricing in the sector, aims to foster fair competition and ensure consumer trust, thereby setting operational benchmarks that all providers, including Dignity, must adhere to.

Political stability in the UK is crucial for Dignity PLC, as shifts in government or policy can significantly impact its operations. For instance, a change in administration could lead to altered regulations regarding funeral services or public health, potentially affecting demand or imposing new operational requirements. The general election scheduled for 2024, with the Labour Party currently leading in most polls, could signal a potential policy re-evaluation concerning the funeral industry, which is a key area of focus for Dignity.

Government policies concerning healthcare and end-of-life care can significantly influence Dignity PLC's market. For instance, increased NHS investment in palliative care services, as seen in recent UK budget discussions, might lead to a greater public focus on advanced care planning, potentially boosting pre-need funeral arrangements. Conversely, shifts in healthcare funding could indirectly affect consumer spending power on funeral services.

Competition Policy and Market Oversight

Competition authorities are increasingly scrutinizing the funeral services market, a sector where Dignity PLC holds a significant share. This oversight focuses on potential anti-competitive practices, pricing strategies, and the impact of industry consolidation. For instance, the UK's Competition and Markets Authority (CMA) has previously investigated pricing in the sector, and any new investigations could lead to regulatory interventions impacting Dignity's operations and profitability.

Regulatory interventions aimed at fostering greater competition or ensuring fairer pricing could directly influence Dignity PLC's market position. Such actions might include measures to prevent excessive pricing or to encourage new entrants into the market. The CMA's ongoing commitment to market studies, as evidenced by its work in other sectors, suggests a continued focus on areas where consumer choice or pricing may be restricted.

- CMA Scrutiny: The Competition and Markets Authority actively monitors markets for potential breaches of competition law.

- Pricing Investigations: Past inquiries into funeral pricing highlight regulatory concern over potential consumer harm.

- Consolidation Impact: Mergers and acquisitions within the funeral sector are subject to review to prevent undue market concentration.

- Potential Interventions: Future regulatory actions could involve price caps, divestitures, or new market access rules.

International Relations and Trade Policies

While Dignity PLC's core operations are firmly rooted in the United Kingdom, international relations and trade policies can still cast an indirect shadow. Global economic stability, often influenced by geopolitical events and trade agreements, can impact the UK's overall economic health. For instance, a significant global recession, potentially triggered by international conflicts or trade disputes, could lead to reduced consumer discretionary spending in the UK, affecting demand for funeral services, even if indirectly.

The UK's position within international trade frameworks also matters. Changes to import tariffs or regulations on goods used in funeral services, such as caskets or embalming fluids, could potentially affect costs for Dignity PLC, although the impact is likely to be minimal given the domestic focus. Furthermore, any shifts in international attitudes towards death care practices or regulations could, over the long term, subtly influence domestic consumer expectations or industry standards.

- Indirect Economic Impact: Global economic slowdowns, exacerbated by international tensions, could reduce UK consumer confidence and disposable income, potentially affecting spending on premium funeral services. For example, the IMF projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, indicating a cautious global economic outlook that could spill over into the UK.

- Supply Chain Vulnerability: While most supplies for Dignity PLC are domestically sourced, any reliance on imported components for specialized services or products could face minor disruptions or cost increases due to international trade policy shifts.

- Regulatory Alignment: Evolving international standards or ethical considerations in end-of-life care could eventually influence UK regulations or consumer preferences, though this is a slow-moving factor.

The UK government's regulatory approach to the funeral industry, particularly concerning pre-paid funeral plans and competition, directly impacts Dignity PLC. The Financial Conduct Authority's (FCA) supervision of funeral plans, effective from July 2022, imposes stricter rules, potentially increasing compliance costs and altering market dynamics.

Ongoing scrutiny by competition authorities like the Competition and Markets Authority (CMA) over pricing and market concentration in the funeral sector presents a significant political factor. Past investigations into pricing indicate a regulatory focus on consumer protection, which could lead to future interventions affecting Dignity's operational strategies and profitability.

Political stability and potential policy shifts following the 2024 UK general election could influence the funeral services landscape. A change in government might lead to re-evaluations of industry regulations or public health policies, impacting demand and operational requirements for companies like Dignity.

Government investment in healthcare and end-of-life care services can indirectly affect Dignity PLC by influencing consumer focus on advanced care planning. For instance, budget allocations for palliative care might encourage more pre-need funeral arrangements, a key business area for Dignity.

What is included in the product

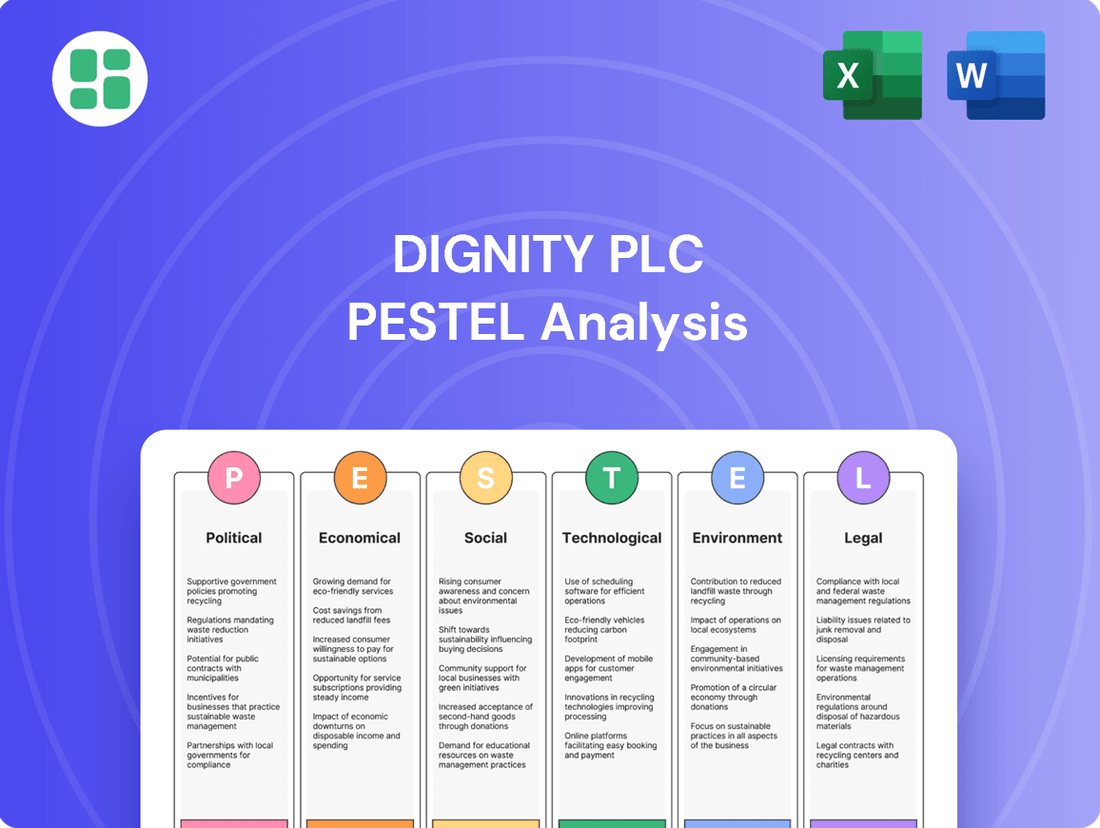

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Dignity PLC.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within these external macro-environmental dimensions.

A clear, actionable breakdown of Dignity PLC's external environment, transforming complex PESTLE factors into manageable insights for strategic decision-making.

This analysis serves as a pain point reliever by providing a structured framework to identify and address external challenges and opportunities impacting Dignity PLC's operations.

Economic factors

Rising inflation in the UK directly impacts Dignity PLC's operational expenses. For instance, the Office for National Statistics reported that the Consumer Price Index (CPI) stood at 2.3% in April 2024, a slight increase from 2.2% in March. This means increased costs for energy powering crematoria, essential supplies like embalming fluids, and potentially higher wages to retain staff in a competitive labor market.

The broader cost of living pressures also affect consumer affordability for Dignity's services. As households grapple with higher prices for essentials, their discretionary spending power diminishes. This could lead to more customers opting for lower-tier funeral packages or foregoing optional extras, impacting Dignity's revenue streams and potentially shifting demand towards more basic service offerings.

Interest rates significantly influence Dignity PLC's pre-paid funeral plan business. As of early 2024, the Bank of England base rate has remained elevated, impacting the investment returns on funds held in trust for these plans. For instance, if these funds are invested in gilts or bonds, higher rates generally mean better returns, which can bolster the solvency of the plans and improve profitability.

Conversely, fluctuating or declining interest rates can reduce the yield on these investments, potentially creating a need for Dignity PLC to adjust pricing or contribution levels to maintain plan solvency. The company's ability to generate sufficient returns on its trust assets is crucial for meeting future funeral costs, especially given the long-term nature of these plans.

Furthermore, changes in interest rates directly affect Dignity PLC's borrowing costs for capital expenditures, such as crematoria upgrades or new funeral home acquisitions. Higher rates increase the expense of servicing debt, potentially slowing down expansion plans or requiring more conservative financial strategies.

Consumer spending in the UK, a key driver for Dignity PLC, is directly influenced by the nation's economic health and disposable income levels. During periods of economic growth, consumers tend to have more confidence and financial security, which can lead to increased spending on funeral services, potentially favoring more comprehensive or premium options.

Conversely, economic downturns or periods of high inflation, like those experienced in late 2023 and early 2024, can put pressure on household budgets, potentially leading to a more cautious approach to funeral expenses. For instance, the Office for National Statistics reported a 2.4% increase in average weekly earnings in real terms for the period September to November 2023, suggesting a gradual improvement in disposable income, though consumer confidence remains a significant factor.

Demographic Economic Impact

The UK's aging demographic presents a consistent demand for Dignity PLC's services, underpinning long-term economic stability. As of 2023, the proportion of the UK population aged 65 and over reached 19%, a figure projected to rise. This trend, coupled with mortality rates, directly influences the volume of funerals, providing a predictable revenue stream for the company.

While demand is stable, economic factors within these age groups can affect purchasing decisions. For instance, the ability of older individuals to afford pre-paid funeral plans is influenced by their disposable income and pension stability. In 2024, average UK pension incomes continue to be a key consideration for such financial planning.

- Aging Population: The UK's over-65 population continues to grow, ensuring a sustained need for funeral services.

- Mortality Rates: Fluctuations in mortality rates, while variable, contribute to the overall volume of business for Dignity PLC.

- Pre-paid Plans: Economic conditions directly impact the uptake of pre-paid funeral plans, influencing future revenue predictability.

- Economic Capacity: The financial capacity of the aging population to afford funeral arrangements remains a key economic consideration.

Competitive Pricing and Market Share

Competitive pricing significantly shapes Dignity PLC's performance in the UK funeral market. Competitors, ranging from independent funeral directors to other large providers, often employ varied pricing strategies that directly impact Dignity's market share and its revenue generated per funeral service. This intense price competition necessitates a constant focus on cost efficiencies to remain competitive, especially given the sensitive nature of the industry.

The pressure on pricing is a persistent economic factor. Dignity PLC must balance offering competitive rates with maintaining profitability. For instance, while specific 2024/2025 pricing data for all competitors isn't publicly aggregated, industry reports from 2023 indicated that independent funeral directors can sometimes offer more flexible or lower-cost options, putting pressure on larger, more standardized providers like Dignity.

- Price Sensitivity: The UK funeral market, while not immune to economic downturns, is characterized by a degree of price sensitivity, particularly as consumers seek value for money during emotionally challenging times.

- Competitor Pricing Strategies: Variations in competitor pricing, from budget-friendly options to premium services, directly influence consumer choice and, consequently, Dignity's market share.

- Cost Efficiency Imperative: To counter pricing pressures and maintain margins, Dignity PLC must continually seek operational efficiencies across its network of crematoria and funeral homes.

- Market Share Dynamics: Shifts in market share are often correlated with a provider's ability to offer competitive pricing while upholding service quality, a delicate balance for Dignity PLC.

Economic factors significantly shape Dignity PLC's operating environment, influencing both costs and consumer demand. Rising inflation in the UK, with CPI at 2.3% in April 2024, increases operational expenses for energy and supplies. Simultaneously, cost of living pressures can reduce consumer affordability for funeral services, potentially shifting demand towards more basic packages.

Interest rates impact Dignity's pre-paid funeral plans; higher rates in early 2024 generally benefit investment returns on trust funds, bolstering plan solvency. Conversely, elevated rates also increase borrowing costs for capital expenditures, potentially slowing expansion. Consumer spending, driven by economic health and disposable income, directly affects demand, with real earnings showing a gradual improvement in late 2023.

| Economic Factor | Impact on Dignity PLC | 2024/2025 Data/Trend |

|---|---|---|

| Inflation (CPI) | Increases operational costs (energy, supplies) | 2.3% in April 2024, slight increase from March |

| Consumer Spending Power | Affects affordability of funeral services | Real earnings improvement in late 2023, but consumer confidence remains key |

| Interest Rates | Influences pre-paid plan investment returns and borrowing costs | Bank of England base rate remained elevated in early 2024 |

| Aging Population | Provides stable, long-term demand for services | 19% of UK population aged 65+ in 2023, projected to rise |

| Competitive Pricing | Pressures market share and revenue per service | Industry reports suggest independents offer flexible/lower-cost options |

Same Document Delivered

Dignity PLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Dignity PLC covers all key external factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain an in-depth understanding of the Political, Economic, Social, Technological, Legal, and Environmental forces shaping Dignity PLC's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis provides actionable insights for strategic decision-making regarding Dignity PLC.

Sociological factors

Societal views on death and funerals in the UK are undergoing significant shifts. Increasing secularism means fewer people identify with traditional religious ceremonies, leading to a greater desire for personalized and non-religious services. This is reflected in a growing demand for direct cremations, which bypass traditional funeral directors, and eco-friendly options like natural burials.

Multiculturalism also plays a role, with diverse communities bringing their own customs and preferences for funeral rites. Furthermore, there's a noticeable trend towards 'celebrations of life' rather than somber occasions, emphasizing remembrance and joy. For example, a 2023 survey indicated that over 60% of adults would consider a direct cremation, highlighting a move away from elaborate, traditional funerals.

The UK's demographic shift towards an aging population presents a consistent demand for Dignity PLC's core services. With the proportion of individuals aged 65 and over projected to increase significantly, the need for funeral arrangements is expected to remain robust.

In 2023, the UK's population aged 65 and over was approximately 14.6 million, representing around 22% of the total population. This figure is forecast to rise, directly impacting the volume of funerals Dignity PLC handles.

Changes in life expectancy and mortality rates are crucial. While increasing life expectancy generally implies fewer deaths in the short term, the growing elderly cohort means a higher absolute number of deaths is inevitable in the coming years, supporting steady service volumes for Dignity PLC.

The increasing cultural and religious diversity within the UK presents a significant opportunity and challenge for Dignity PLC. As of the latest available data, the UK's population is more diverse than ever, with a growing proportion identifying with non-Christian faiths and varied cultural backgrounds. This necessitates a flexible approach to funeral services.

Dignity PLC must actively adapt its service offerings to accommodate a wider spectrum of customs, traditions, and religious requirements for funeral rites. This includes providing culturally sensitive options, potentially specific facilities for prayer or ritual cleansing, and a deep understanding of diverse mourning practices and post-funeral traditions, ensuring all clients feel respected and understood.

Pre-planning and Awareness of Funeral Services

Societal attitudes towards death significantly influence the uptake of pre-paid funeral plans. As of early 2024, a growing segment of the UK population is becoming more proactive in planning their final arrangements, driven by a desire to ease the burden on loved ones and control costs. Dignity PLC, a major player in the sector, has been actively engaged in public education campaigns to demystify funeral planning and highlight its benefits.

The propensity for pre-planning is closely tied to financial literacy and comfort levels discussing mortality. Research from 2023 indicated that while awareness is increasing, a substantial portion of the public still finds it difficult to broach the subject of death and associated financial planning. Marketing efforts by companies like Dignity often focus on the peace of mind and financial security these plans offer, aiming to normalize the conversation.

Public education and targeted marketing are crucial in driving the adoption of pre-paid funeral plans. Dignity PLC's strategy includes providing clear, accessible information online and through financial advisors, emphasizing the long-term value and protection against rising funeral costs. For instance, the average cost of a funeral in the UK has seen consistent increases, making pre-planning an attractive financial consideration.

- Increased Awareness: Surveys in late 2023 and early 2024 showed a notable rise in consumer awareness regarding pre-paid funeral plans, with over 60% of adults having heard of them.

- Financial Prudence: A significant driver is the desire to fix funeral costs at today's prices, protecting against inflation which saw funeral costs rise by an average of 4.5% in 2023.

- Generational Shift: Younger generations, influenced by digital information and a more open discussion of life events, are showing a greater inclination towards early financial planning.

- Industry Marketing Impact: Dignity PLC's investment in digital marketing and partnerships with financial institutions aims to reach a broader audience, with their pre-need sales seeing a steady increase in the 2023-2024 financial year.

Family Structures and Support Networks

Changing family structures in the UK, with a rise in single-person households and smaller family units, mean that Dignity PLC may see increased demand for comprehensive funeral planning services. As of 2023, approximately 31% of UK households were single-person households, a figure that has steadily grown.

This societal shift can lead to a greater reliance on professional funeral directors like Dignity PLC for guidance and emotional support during difficult times. Traditional, extended family networks that might have previously managed arrangements are becoming less common, placing more responsibility on the individual or a smaller circle of support.

- Increased reliance on professional services: As family support diminishes, individuals are more likely to turn to funeral directors for end-to-end support.

- Demand for personalized services: Smaller families may seek more tailored and bespoke funeral arrangements to honor their loved ones.

- Geographical dispersion: Families spread across different regions can find it challenging to coordinate, increasing the need for centralized professional assistance.

Societal views on death are evolving, with a growing preference for personalized, secular, and eco-friendly funeral options. This shift, evidenced by a 2023 survey showing over 60% of adults considering direct cremation, indicates a move away from traditional, elaborate services and a greater demand for flexible, culturally sensitive arrangements.

The UK's aging demographic, with 14.6 million individuals aged 65+ in 2023, ensures a consistent demand for funeral services. While life expectancy is increasing, the sheer number of older individuals means a higher absolute death rate, supporting stable service volumes for Dignity PLC.

Public awareness and acceptance of pre-paid funeral plans are rising, driven by financial prudence and a desire for peace of mind. Dignity PLC's marketing efforts highlight the benefits of fixing costs against inflation, which saw funeral costs rise by 4.5% in 2023, with pre-need sales showing steady increases in the 2023-2024 financial year.

Changing family structures, with a rise in single-person households (31% in 2023), increase reliance on professional funeral directors like Dignity PLC for comprehensive planning and support.

Technological factors

The funeral industry is increasingly embracing digitalization, with platforms for online arrangements and virtual consultations becoming more common. Dignity PLC can enhance customer convenience and streamline operations by adopting user-friendly online booking systems and digital document management. This shift towards paperless processes and online payments, which saw a significant increase in digital transaction adoption across various sectors in 2024, can also lead to cost efficiencies.

The demand for virtual and live-streamed funeral services is a significant technological factor. Dignity PLC, a major player in the UK funeral care market, has been investing in these capabilities to serve a wider audience. This addresses the growing need for remote participation, especially for families spread across different locations.

Implementing live-streaming for ceremonies and virtual memorial platforms makes funeral services more accessible than ever before. This caters to evolving communication preferences, allowing loved ones who cannot attend in person to still participate and pay their respects. Online tribute pages further enhance this accessibility, creating lasting digital memorials.

For instance, during the COVID-19 pandemic, the uptake of live-streamed funerals surged. While specific 2024/2025 figures for Dignity PLC's adoption are still emerging, industry reports from late 2023 indicated that over 70% of funeral directors were offering or considering live-streaming options, reflecting a clear market trend.

Technological advancements are significantly reshaping the funeral industry, impacting both cremation and embalming processes for companies like Dignity PLC. Improvements in crematory technology are focusing on increased efficiency and reduced environmental impact. For instance, modern cremators are designed for lower energy consumption, with some models boasting a 15-20% reduction in fuel use compared to older units, contributing to cost savings and a smaller carbon footprint.

Embalming techniques are also evolving, with a growing emphasis on more environmentally friendly solutions. Innovations include the development of biodegradable fluids and alternative preservation methods that aim to reduce the reliance on traditional formaldehyde-based chemicals. These advancements cater to a consumer base increasingly concerned with the ecological impact of funeral arrangements, potentially influencing service offerings and client preferences for Dignity PLC.

Data Analytics and Customer Relationship Management (CRM)

Dignity PLC leverages data analytics to deeply understand customer preferences, aiming to optimize service delivery and refine marketing strategies. By analyzing customer data, the company can identify patterns in demand for specific services, like pre-paid funeral plans, allowing for more targeted product development and promotion.

Customer Relationship Management (CRM) systems are central to Dignity PLC's approach to managing client interactions. These systems enable personalized communication and tailored service offerings, enhancing the customer experience. For instance, in 2023, Dignity reported a significant increase in the adoption of digital services for funeral arrangements, a trend likely fueled by improved CRM insights into customer needs.

- Data-driven insights: Dignity uses analytics to pinpoint customer needs, such as the growing demand for eco-friendly funeral options observed in late 2024.

- Personalized services: CRM allows for customized communication and offerings, improving client satisfaction and loyalty.

- Optimized marketing: Understanding customer journeys through data helps Dignity PLC to allocate marketing spend more effectively, targeting specific demographics with relevant services.

- Trend identification: Analyzing CRM data helps anticipate shifts in consumer preferences, like the increasing interest in direct cremation services noted in early 2025.

Emerging Technologies in Memorialization

Emerging technologies are reshaping how people commemorate loved ones. Innovations like QR codes embedded in headstones can link to online tributes, offering a digital space for memories and stories. In 2024, the adoption of such digital memorialization is growing, with an increasing number of families seeking more interactive ways to remember the deceased.

Augmented reality (AR) experiences present another frontier, allowing virtual memorials to be overlaid onto physical locations, enhancing the sensory and emotional connection to a memorial site. This could offer a more immersive and personalized remembrance. Companies like Aura are already exploring AR memorial experiences, indicating a market readiness for these advanced solutions.

Furthermore, advancements in cremation technology, such as bio-cremation or alkaline hydrolysis, offer more environmentally friendly alternatives to traditional methods. This process, which uses alkaline solutions to break down the body, is gaining traction as a sustainable option. By 2025, we anticipate further regulatory approvals and increased consumer awareness of these eco-conscious memorialization choices.

- QR codes on headstones for digital memory sharing.

- Augmented reality for immersive virtual memorial experiences.

- Bio-cremation (alkaline hydrolysis) as an eco-friendly alternative.

- Dignity PLC's potential to integrate these technologies for competitive advantage.

Technological factors are profoundly influencing Dignity PLC's operations and service offerings. The company is actively integrating digital solutions, from online booking systems to virtual consultations, enhancing customer convenience and operational efficiency. This digital transformation is crucial as consumer preferences increasingly lean towards paperless transactions and accessible online services, a trend that accelerated significantly in 2024.

Legal factors

The Funeral Plans Act 2021, implemented in July 2022, brought pre-paid funeral plans under the direct regulation of the Financial Conduct Authority (FCA). This shift means Dignity PLC, like other providers, must now adhere to stringent rules regarding financial soundness, sales practices, and consumer protection. For instance, FCA authorisation requires firms to demonstrate adequate capital reserves and robust governance structures, impacting operational costs and potentially the pricing of new plans. The FCA's oversight aims to enhance trust and transparency in the sector, a significant change from the previous self-regulatory environment.

Competition law significantly impacts Dignity PLC by scrutinizing market practices within the funeral industry, focusing on fair competition and pricing. The Competition and Markets Authority (CMA) actively investigates potential issues like pricing transparency, market dominance, and anti-competitive behaviors. For instance, the CMA's ongoing focus on funeral pricing, highlighted by its 2021 market study, means companies like Dignity must ensure their practices are compliant to avoid substantial fines and reputational harm.

Dignity PLC must adhere to stringent health and safety regulations across its funeral homes, mortuaries, and crematoria. This includes ensuring workplace safety for its staff, particularly concerning the handling of deceased individuals and the operation of specialized equipment. Public safety within its facilities is also paramount, requiring measures to prevent accidents and maintain hygienic environments.

Compliance with regulations like the Health and Safety at Work etc. Act 1974 in the UK is critical. This legislation mandates risk assessments, provision of adequate training, and the implementation of safe systems of work, especially for tasks involving biohazards. Failure to comply can result in significant fines and reputational damage, impacting Dignity's ability to operate smoothly.

The safe handling and disposal of human remains are governed by specific laws and guidelines, ensuring respect for the deceased and preventing public health risks. Dignity's commitment to these standards, including proper embalming, storage, and cremation or burial procedures, is essential for maintaining public trust and avoiding legal repercussions. For instance, the Cremation (England and Wales) Regulations 2008 and similar Scottish legislation set strict protocols.

Data Protection and Privacy (GDPR)

Dignity PLC must navigate a complex legal landscape concerning data protection and privacy, particularly with the General Data Protection Regulation (GDPR) in effect. This involves stringent requirements for handling sensitive personal information of clients and deceased individuals, covering data storage, consent management, and robust security protocols. Failure to comply can result in significant penalties, impacting both reputation and financial standing.

The company's commitment to data integrity and privacy is paramount for fostering trust with its customers and ensuring legal adherence. This includes implementing measures to safeguard personal data against breaches and unauthorized access. For instance, GDPR mandates clear consent for data processing and robust mechanisms for data subject rights, such as the right to access and erasure.

Key considerations for Dignity PLC's GDPR compliance include:

- Data Minimisation: Collecting and processing only the data that is absolutely necessary for providing services.

- Consent Management: Ensuring explicit and informed consent is obtained for all data processing activities.

- Security Measures: Implementing appropriate technical and organizational measures to protect personal data.

- Data Breach Notification: Having procedures in place to report data breaches to supervisory authorities and affected individuals without undue delay.

Environmental Regulations and Licensing

Dignity PLC must navigate a complex web of environmental regulations, particularly concerning emissions from crematoria. Compliance with air quality standards, such as those set by the Environment Agency in the UK, is paramount. For instance, the Mercury Emission Limit for cremation processes is a critical factor, requiring advanced filtration systems.

Waste disposal regulations also present a significant legal challenge. The handling and disposal of medical waste and general refuse generated from crematoria operations must adhere to strict guidelines to prevent environmental contamination. Failure to comply can result in substantial fines and reputational damage.

Licensing requirements for operating crematoria are stringent and subject to periodic review. Dignity PLC's facilities require specific environmental permits that dictate operational parameters and monitoring protocols. Changes in environmental law, such as potential tightening of emissions standards in the coming years, could necessitate significant capital expenditure for technological upgrades or operational modifications to maintain compliance. For example, upcoming EU directives impacting incineration processes could influence UK regulations post-Brexit.

Key legal factors for Dignity PLC include:

- Compliance with UK emissions standards for crematoria, including mercury limits.

- Adherence to waste management and disposal regulations for crematoria operations.

- Maintaining current environmental licenses and anticipating future regulatory changes.

- Potential investment in new technologies to meet evolving environmental legislation.

The Funeral Plans Act 2021, effective July 2022, places pre-paid funeral plans under direct FCA regulation, necessitating stringent compliance for Dignity PLC regarding financial health and consumer protection. Competition law, enforced by the CMA, scrutinizes pricing and market practices, with a 2021 study highlighting funeral pricing transparency as a key area of focus. Dignity must also navigate health and safety laws like the Health and Safety at Work etc. Act 1974, ensuring safe operations and compliance with regulations for handling remains, such as the Cremation (England and Wales) Regulations 2008.

Environmental factors

The carbon footprint of cremation services is a growing concern for Dignity PLC, as the process releases greenhouse gases like carbon dioxide and nitrogen oxides. In 2023, the UK average cremation was estimated to produce around 245 kg of CO2 equivalent, a figure Dignity aims to reduce. The company is exploring greener alternatives and investing in more efficient cremation technology to lower its environmental impact.

Dignity PLC is actively reviewing its waste management strategies across its extensive network of funeral homes and crematoria. This includes the responsible disposal of medical waste, general refuse, and specific by-products generated during funeral services. The company is also focusing on reducing its environmental footprint by minimizing energy and water consumption in its facilities.

In line with sustainability goals, Dignity PLC is exploring enhanced recycling programs and is committed to promoting sustainable procurement practices for its operations. These initiatives are crucial for aligning with increasing environmental regulations and consumer expectations for responsible business conduct.

Consumers are increasingly seeking funeral options that minimize environmental impact, reflecting a broader societal shift towards sustainability. This includes a growing interest in natural burials, biodegradable coffins, and cremation methods with lower emissions. For instance, reports from 2024 indicate a significant uptick in inquiries about green funeral packages across the UK, with some providers seeing a 15% year-on-year increase.

Dignity PLC must adapt its service portfolio to cater to this evolving demand. By offering and actively promoting eco-friendly alternatives, such as woodland burials or coffins made from sustainable materials like bamboo or wicker, the company can align with consumer preferences. This strategic adaptation not only meets current market trends but also positions Dignity PLC as a forward-thinking and responsible provider in the funeral industry, potentially capturing a larger market share as these preferences solidify.

Land Use and Green Spaces for Burials

The environmental impact of land use for cemeteries is a growing concern, particularly in densely populated urban areas where space is at a premium. Dignity PLC, as a major provider of funeral services, must navigate these challenges by considering sustainable land management practices for its burial grounds.

Limited space in urban environments necessitates innovative solutions, such as vertical burial or shared family plots, to conserve land. Furthermore, policies promoting green spaces and conservation efforts can directly affect Dignity PLC's operational strategies and land acquisition plans. For instance, in the UK, the National Planning Policy Framework (NPPF) emphasizes the importance of protecting and enhancing the natural environment, which could influence the development of new cemeteries or the management of existing ones.

- Land Scarcity: Urban cemeteries face increasing pressure from development, potentially limiting expansion and increasing land costs.

- Sustainable Practices: Promoting natural burials or eco-friendly embalming methods can reduce the environmental footprint of funeral services.

- Green Space Policies: Government initiatives to increase urban green spaces might restrict cemetery development or encourage integration with parkland.

- Conservation Efforts: Dignity PLC may need to align its land management with local conservation goals, potentially preserving biodiversity within its sites.

Climate Change Adaptation and Resilience

Climate change poses significant operational risks for Dignity PLC, particularly concerning its funeral logistics and infrastructure. Extreme weather events, such as severe flooding or heatwaves, could disrupt transportation networks, impacting the timely delivery of services and potentially affecting the condition of facilities. For instance, the UK experienced its hottest July on record in 2023, with temperatures reaching 32.2°C in some areas, highlighting the increasing likelihood of such disruptive events.

Dignity PLC must continue to develop robust adaptation strategies to ensure business continuity. This includes investing in resilient infrastructure, diversifying supply chains for essential resources like vehicles and embalming fluids, and potentially exploring alternative operational models that are less susceptible to climate-related disruptions. The company's commitment to sustainability, as evidenced by its ongoing efforts to reduce its carbon footprint, is crucial in mitigating these long-term environmental risks.

Key considerations for Dignity PLC's climate change adaptation include:

- Infrastructure Resilience: Assessing and reinforcing facilities against extreme weather impacts, such as enhanced cooling systems for chapels and crematoria.

- Logistical Contingency Planning: Developing alternative transport routes and methods to counter potential disruptions from severe weather.

- Resource Management: Ensuring stable access to necessary supplies and utilities, even during climate-induced shortages or disruptions.

- Stakeholder Communication: Maintaining clear communication with clients and families regarding potential service adjustments due to environmental factors.

Dignity PLC faces increasing scrutiny over its environmental impact, particularly its carbon footprint from cremation. The company is investing in greener technologies and exploring sustainable practices to meet evolving regulations and consumer expectations. As of 2024, there's a notable rise in demand for eco-friendly funeral options across the UK.

The company is also addressing waste management and resource consumption across its facilities, aiming to reduce its overall environmental footprint. This includes enhancing recycling programs and promoting sustainable procurement, aligning with a broader societal shift towards environmental responsibility.

Land use for cemeteries presents a challenge, especially in urban areas, prompting Dignity PLC to consider sustainable land management and innovative burial solutions. Government policies focused on green spaces and conservation also influence land acquisition and management strategies for the company.

Climate change poses operational risks through extreme weather events, impacting logistics and infrastructure. Dignity PLC is developing adaptation strategies, including infrastructure resilience and contingency planning, to ensure business continuity amidst these environmental challenges.

| Environmental Factor | Dignity PLC Impact/Response | Data/Trend (2023-2025) |

|---|---|---|

| Carbon Footprint (Cremation) | Exploring greener alternatives, investing in efficient technology. | UK average cremation CO2e ~245 kg (2023 estimate). Growing consumer demand for low-emission options. |

| Waste Management | Reviewing strategies for medical, general, and funeral by-product waste. | Focus on reducing energy and water consumption. Enhanced recycling programs in development. |

| Land Use & Urbanization | Considering sustainable land management for cemeteries. | Pressure from urban development on cemetery space. UK NPPF emphasizes protecting natural environment. |

| Climate Change Risks | Developing adaptation strategies for infrastructure and logistics. | Increased likelihood of extreme weather events (e.g., heatwaves in 2023). Need for resilient infrastructure and contingency planning. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Dignity PLC is meticulously constructed using data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.