D'Ieteren SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D'Ieteren Bundle

D'Ieteren, a diversified industrial group, exhibits significant strengths in its automotive aftermarket and distribution segments, coupled with a robust financial position. However, potential threats from evolving mobility trends and regulatory changes necessitate a closer look at its strategic adaptability.

Want the full story behind D'Ieteren's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

D'Ieteren Group's strength lies in its diversified business portfolio, spanning automotive distribution, vehicle glass repair and replacement (through Belron), premium accessories (MOMO), and real estate. This spread across distinct sectors significantly reduces the impact of downturns in any single market, fostering resilience.

For example, Belron, a major contributor, reported strong performance in 2023 with revenue reaching €4.5 billion, underscoring the stability that diversified operations bring to the group. This strategic approach allows D'Ieteren to capitalize on varied economic cycles and market trends, enhancing its overall financial robustness and providing a stable platform for growth.

D'Ieteren's strength lies in its commanding market leadership across its key operating segments. Belron, its automotive glass division, stands as a global titan, handling millions of vehicle glass repairs and replacements each year. This extensive operational scale underscores its dominance in a crucial automotive aftermarket service.

In Belgium, D'Ieteren Automotive solidifies its position as the undisputed number one car distributor. This sustained leadership reflects deep market penetration, strong brand loyalty, and an established network, ensuring consistent sales performance and brand equity within its home market.

D'Ieteren Group showcased exceptional financial strength in 2024, reporting a record profit and generating substantial free cash flow. This robust performance underscores the effectiveness of its diverse business segments, which consistently contribute to profitability and operational excellence. The significant cash reserves generated position D'Ieteren favorably for future strategic initiatives, including targeted investments, efficient debt reduction, and rewarding its shareholders.

Commitment to Long-Term Value Creation and Sustainability

D'Ieteren's core strategy is deeply rooted in creating lasting value for everyone involved, with sustainability as a guiding principle. This long-term vision is evident across its diverse portfolio.

D'Ieteren Immo, for instance, is actively pursuing ambitious goals, aiming for CO2 neutrality and championing sustainable practices in its property developments. This proactive approach not only meets growing environmental expectations but also fortifies the group's resilience and capacity for responsible expansion in the years ahead.

- Long-Term Focus: The group prioritizes sustained growth and value creation over short-term gains.

- Sustainability Integration: Environmental, social, and governance (ESG) factors are central to its strategic planning.

- D'Ieteren Immo's Targets: The real estate arm has set clear objectives for CO2 neutrality and sustainable building practices.

- Market Alignment: This commitment aligns with increasing investor and consumer demand for responsible business operations.

Expertise in Advanced Automotive Services

Belron's growing proficiency in Advanced Driver Assistance Systems (ADAS) recalibration is a key advantage. As vehicles become more equipped with ADAS, the need for specialized recalibration services following windshield repairs is on the rise. This expertise allows Belron to leverage the automotive industry's technological evolution.

This specialization is crucial as ADAS features like lane keeping assist and adaptive cruise control rely on precise sensor calibration. For instance, in 2024, the global ADAS market was valued at approximately $30 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, highlighting the increasing demand for these services.

- Growing ADAS Market: The global ADAS market's expansion signifies a substantial opportunity for Belron's recalibration services.

- Technological Alignment: Belron's investment in ADAS recalibration directly aligns with the increasing technological sophistication of modern vehicles.

- Specialized Skillset: The development of a specialized skillset in ADAS recalibration differentiates Belron from competitors offering more basic automotive glass services.

D'Ieteren's diversified business model is a significant strength, offering resilience against sector-specific downturns. For example, Belron, its automotive glass division, reported €4.5 billion in revenue in 2023, demonstrating its robust contribution and stability to the group's overall performance.

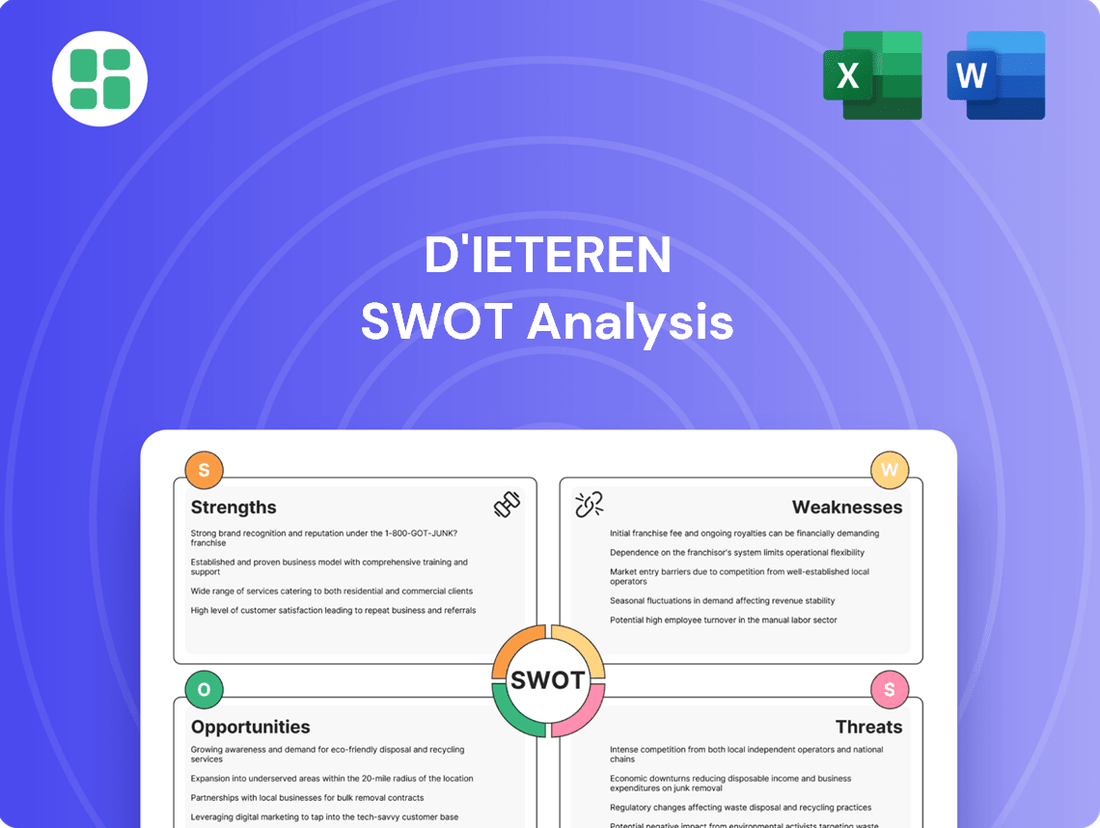

What is included in the product

Analyzes D'Ieteren’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address D'Ieteren's strategic challenges and opportunities.

Weaknesses

D'Ieteren Automotive's significant concentration in Belgium presents a key weakness. This reliance on a single market makes the company highly susceptible to Belgium's specific economic fluctuations and evolving automotive regulations. For instance, if the Belgian economy experiences a downturn, it directly impacts new car sales, a critical revenue driver for D'Ieteren Automotive.

While D'Ieteren holds a dominant share, its automotive distribution performance remains intrinsically linked to the health of the Belgian new car market. In 2023, Belgium's new car registrations saw a modest increase of 4.6% compared to 2022, reaching 463,791 units, according to Febiac, the Belgian federation of the automotive industry. This dependency means that any slowdown in this specific regional market can disproportionately affect the company's overall results.

This geographic focus inherently limits D'Ieteren Automotive's potential for global scalability and diversification. It also exposes the division to the risks associated with localized market downturns, such as increased competition or shifts in consumer preferences specific to Belgium, without the buffer of operations in other, potentially more robust, international markets.

Despite D'Ieteren's efforts to diversify, a significant portion of its income and profits still ties back to the automotive industry via D'Ieteren Automotive and Belron. Economic downturns, changes in how people buy cars, or tough times in the insurance world can hit these parts of the business hard.

For example, Belron faced difficulties in 2024 due to a tough insurance market in the United States, highlighting this vulnerability. This reliance means that broader economic and industry trends can directly affect the company's overall financial performance.

Moleskine's focus on the premium physical notebook market, while a strength, also presents a weakness. This niche is susceptible to the growing trend of digital note-taking and planning apps, which offer convenience and accessibility. For instance, the global digital transformation in office supplies is projected to reach $137.9 billion by 2026, highlighting the shift away from traditional paper products.

Despite its strong brand recognition, Moleskine must continually innovate to stay relevant against digital alternatives. Failure to adapt could lead to declining market share. Reports from 2023 indicated a slight dip in the stationery market's growth, underscoring the need for Moleskine to find new avenues for engagement beyond its core product.

Furthermore, occasional inconsistencies in the quality of Moleskine's writing instruments, such as pens and pencils, can damage its premium image. Discerning customers who invest in Moleskine products expect flawless performance, and any lapse in quality control for these accessories could alienate a key segment of its customer base.

Increased Financial Leverage and Debt Burden

Belron's substantial refinancing in 2024 significantly increased its net financial debt, nearly doubling it from 2023 to 2024. This higher debt load translates to increased financial charges for the group. Consequently, D'Ieteren's adjusted profit before tax outlook for FY2025 is impacted by these elevated financing costs. While this leverage might be a strategic move, it undeniably raises the group's overall financial risk profile.

- Increased Debt: Belron's net financial debt nearly doubled between 2023 and 2024 following its 2024 refinancing.

- Higher Financial Charges: The increased debt burden leads to a greater amount of interest and other financial expenses for the group.

- Impact on Profitability: The higher financial charges are expected to negatively affect D'Ieteren's adjusted profit before tax for FY2025.

- Elevated Financial Risk: A higher level of leverage inherently introduces greater financial risk, making the company more vulnerable to economic downturns or interest rate fluctuations.

Complexity of Managing Diverse Business Units

D'Ieteren's broad portfolio, encompassing vehicle distribution, auto services, glass repair (Belron), and industrial coatings (Colep), presents significant management challenges. Operating across such diverse sectors, from automotive to consumer goods, requires distinct expertise and tailored strategies for each segment. This can strain corporate oversight and the ability to foster cross-segment synergies. For instance, while Belron reported strong performance in 2023, achieving seamless integration and resource optimization across all units remains a constant undertaking.

The complexity is amplified by the need for specialized knowledge in each industry. Managing a high-volume, service-oriented business like Belron, which operates in over 30 countries, demands a different approach than overseeing the manufacturing and distribution of packaging solutions. This inherent diversity can make it difficult for the central management team to maintain a deep understanding of every operational nuance and market dynamic. D'Ieteren's 2023 annual report highlighted the distinct performance drivers for each segment, underscoring this point.

Key challenges include:

- Specialized Management Needs: Each business unit requires unique leadership skills and strategic focus, potentially diluting corporate attention.

- Synergy Realization: Capturing operational efficiencies and market advantages across disparate industries is inherently difficult.

- Resource Allocation: Balancing investment and support across varied business models demands sophisticated financial and strategic planning.

- Operational Oversight: Maintaining consistent quality and performance standards across a wide range of activities can be demanding for the parent company.

D'Ieteren's significant reliance on the Belgian automotive market through D'Ieteren Automotive is a considerable weakness. This geographic concentration makes the company highly vulnerable to Belgium's economic conditions and regulatory changes. For instance, a slowdown in the Belgian economy directly impacts new car sales, a crucial revenue stream.

While D'Ieteren holds a strong position, its automotive distribution performance is tightly linked to the Belgian new car market's health. In 2023, Belgium's new car registrations grew by 4.6% to 463,791 units, according to Febiac. Any downturn in this specific market can disproportionately affect the company's overall financial results, limiting scalability and diversification.

Moleskine's focus on premium physical notebooks, while a strength, also presents a weakness due to the rise of digital note-taking. The global digital transformation in office supplies is projected to reach $137.9 billion by 2026, indicating a shift away from traditional paper products. Moleskine must continuously innovate to remain relevant against these digital alternatives, as failure to adapt could lead to market share decline.

Belron's 2024 refinancing significantly increased its net financial debt, nearly doubling it from 2023 to 2024. This higher debt load results in increased financial charges for the group, impacting D'Ieteren's adjusted profit before tax outlook for FY2025 due to elevated financing costs. This increased leverage elevates the group's overall financial risk profile.

| Weakness | Description | Impact | Supporting Data/Example |

| Geographic Concentration (Automotive) | Heavy reliance on the Belgian market for automotive distribution. | Susceptibility to Belgian economic downturns and regulatory changes. Limits global scalability. | Belgian new car registrations grew 4.6% in 2023 (Febiac). |

| Digitalization Threat (Moleskine) | Focus on premium physical notebooks faces competition from digital alternatives. | Potential for declining market share if innovation falters. | Digital office supplies market projected to reach $137.9 billion by 2026. |

| Increased Financial Debt (Belron) | Significant debt increase following 2024 refinancing. | Higher financial charges negatively impact profitability and increase financial risk. | Net financial debt nearly doubled from 2023 to 2024. |

Full Version Awaits

D'Ieteren SWOT Analysis

This is the actual D'Ieteren SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing for strategic planning based on actionable insights into D'Ieteren's market position and future prospects.

Opportunities

Belron's robust performance across Europe and other international markets, even with its struggles in the U.S., highlights a significant opportunity for D'Ieteren to push further into untapped global territories and deepen its presence in rapidly expanding economies. This success suggests a replicable model for international growth.

Moleskine, in particular, can capitalize on this by extending its brand reach into emerging markets, tapping into new consumer bases eager for its distinctive products. This geographic expansion is crucial for future revenue streams.

D'Ieteren can accelerate this international push and diversify its market exposure through targeted acquisitions. Such strategic moves would not only broaden its geographic footprint but also integrate new customer segments and market insights, bolstering overall resilience and growth potential.

The global automotive market's rapid pivot to electric vehicles offers D'Ieteren Automotive a substantial growth avenue. By expanding its EV product portfolio and enhancing after-sales support for these new technologies, the company can capture a larger share of a burgeoning market. For instance, in 2024, EV sales in Europe are projected to continue their upward trajectory, with Belgium showing strong adoption rates.

D'Ieteren's strategic focus on leading the decarbonization of mobility in Belgium positions it as a key player in sustainable transport solutions. This includes not only selling EVs but also investing in and developing charging infrastructure and new mobility services, such as car-sharing or integrated transport platforms, to meet evolving consumer demands for low-carbon options.

D'Ieteren's strategic focus on digitalization and e-commerce presents a significant opportunity for revenue expansion. By channeling further investment into these areas, the group can tap into new customer segments and enhance existing relationships. For instance, Moleskine's digital strategy, which includes online sales and digital product integration, aims to broaden its market beyond physical stores, potentially capturing a larger share of the global stationery and lifestyle market.

The automotive and glass services segments can also leverage digital tools to improve operational efficiency and customer engagement. Streamlining service bookings, providing digital diagnostics, and offering personalized customer experiences through online platforms can lead to increased customer loyalty and a competitive edge. D'Ieteren's commitment to increasing digital touchpoints underscores its understanding of evolving consumer behavior and the necessity of a strong online presence in today's market.

Strategic Partnerships and Acquisitions

D'Ieteren's robust financial health, underscored by its 'invest and hold' philosophy, positions it advantageously for strategic partnerships and acquisitions. This financial strength allows the group to actively seek opportunities that either bolster its current portfolio or open doors to promising new markets. For instance, in 2023, D'Ieteren's revenue reached €4.7 billion, demonstrating its capacity for significant investment.

Belron's ongoing work with partners to develop mobile static recalibration tools is a prime example of how collaborations can elevate service offerings and technological prowess. This focus on innovation through partnership is key to maintaining a competitive edge in the automotive glass repair sector.

These strategic moves are designed to fuel inorganic growth and solidify D'Ieteren's standing in its various operating segments. The group's commitment to this strategy is evident in its consistent pursuit of value-adding ventures.

- Financial Flexibility: D'Ieteren's strong balance sheet, evidenced by its consistent revenue growth and profitability, provides the capital necessary for strategic M&A activities.

- Synergistic Opportunities: The group actively looks for partnerships and acquisitions that offer clear synergies with existing businesses, enhancing operational efficiency and market reach.

- Technological Advancement: Collaborations, such as those in recalibration technology, are crucial for staying ahead in rapidly evolving industries.

- Market Expansion: Strategic acquisitions can serve as a direct pathway into new geographic regions or adjacent market segments, diversifying revenue streams.

Sustainable Real Estate Development and Innovation

D'Ieteren Immo's strategic focus on redeveloping and transforming its real estate portfolio with a strong emphasis on sustainability presents significant opportunities. This approach allows for the creation of new, future-proof properties designed to meet the evolving market demand for flexible and environmentally conscious living and working spaces.

These sustainable developments not only boost the intrinsic value of D'Ieteren's assets but also align perfectly with growing societal and environmental imperatives. For instance, the increasing global demand for green buildings, with the global green building market projected to reach USD 3.4 trillion by 2027, offers a substantial market for D'Ieteren's forward-thinking projects.

- Enhanced Asset Value: Sustainable features often command premium rents and higher resale values, improving overall portfolio performance.

- Market Differentiation: D'Ieteren can position itself as a leader in eco-friendly real estate, attracting environmentally conscious tenants and investors.

- Regulatory Alignment: Proactive adoption of sustainable practices ensures compliance with future environmental regulations, mitigating potential risks.

- Investor Appeal: Growing interest in ESG (Environmental, Social, and Governance) investing means sustainable projects are more attractive to a wider pool of capital.

D'Ieteren can leverage its strong financial position, demonstrated by its €4.7 billion revenue in 2023, to pursue strategic acquisitions and partnerships, expanding its global reach and market segments.

The company has a clear opportunity to capitalize on the growing demand for electric vehicles by expanding its EV product offerings and enhancing after-sales services, aligning with Belgium's strong EV adoption rates in 2024.

Digitalization and e-commerce offer significant avenues for revenue growth, as seen with Moleskine's digital strategy, and can also improve operational efficiency and customer engagement across all segments.

D'Ieteren Immo's focus on sustainable real estate development aligns with the expanding green building market, projected to reach USD 3.4 trillion by 2027, enhancing asset value and market differentiation.

Threats

D'Ieteren Group operates in highly competitive arenas, with its automotive distribution arm facing rivals like Inchcape and Emil Frey. In vehicle glass repair, Belron contends with a fragmented market of global players like Safelite Solutions and numerous regional specialists. Moleskine, meanwhile, sees competition from established stationery brands such as Muji and a burgeoning digital solutions sector, impacting its traditional product lines.

The automotive industry, including D'Ieteren, faces ongoing shifts in regulations. These cover everything from emissions standards and vehicle safety to the crucial transition towards electric vehicles (EVs). For instance, the European Union's CO2 emission targets for new cars are progressively tightening, aiming for a 55% reduction by 2030 compared to 2021 levels, a significant challenge for manufacturers and distributors.

Stricter environmental policies or alterations in tax structures within Belgium or the broader EU could directly affect D'Ieteren Automotive's operational model and financial performance. A potential increase in taxes on internal combustion engine vehicles, or new incentives favoring EVs, could reshape market demand and necessitate considerable strategic adjustments.

Navigating these evolving regulatory landscapes demands significant capital investment and a high degree of strategic flexibility. D'Ieteren must be prepared to invest in EV infrastructure, retraining staff, and potentially adapting its vehicle offerings to comply with new mandates and capitalize on emerging market trends.

Economic downturns and reduced consumer spending present a significant threat to D'Ieteren's diverse portfolio. A general recession or a sharp cutback in discretionary purchases can dampen demand for new vehicles, high-end electronics like premium notebooks, and even essential services such as vehicle repairs. This widespread impact underscores the group's vulnerability to macroeconomic shifts.

Belron, D'Ieteren's automotive glass repair and replacement division, has already demonstrated this sensitivity. Experiencing challenging insurance market conditions in the U.S. throughout 2024, Belron's performance illustrates how macroeconomic factors can directly affect its operational environment and profitability.

Technological Disruptions in Automotive and Stationery

The automotive sector faces significant threats from rapid technological advancements. The ongoing development of fully autonomous vehicles, projected by some analysts to reach substantial market penetration by the late 2020s and early 2030s, could drastically reduce traffic accidents. This reduction in accidents directly impacts D'Ieteren's vehicle glass repair and replacement services, potentially leading to decreased demand. For instance, if accident frequency drops by 30% due to autonomous driving adoption, it could translate to a significant revenue impact for their Belron division.

Similarly, the stationery sector, particularly for brands like Moleskine, is threatened by the pervasive shift towards digital alternatives. While Moleskine has seen resilience, the increasing sophistication and affordability of digital note-taking apps and e-readers present a long-term challenge. Reports from 2024 indicate a continued upward trend in the adoption of digital productivity tools, with global spending on enterprise software for collaboration and note-taking projected to grow by over 15% annually through 2025. This trend could erode the market share for physical notebooks.

- Autonomous vehicle adoption: Projections suggest a significant increase in autonomous vehicle sales by 2030, potentially cutting accident rates.

- Digital stationery alternatives: The market for digital note-taking and planning tools continues to expand, impacting traditional stationery sales.

- Impact on Belron: Reduced accidents could lead to lower demand for vehicle glass repair and replacement.

- Moleskine's challenge: The growing preference for digital solutions poses a long-term threat to the traditional notebook market.

Supply Chain Vulnerabilities and Geopolitical Risks

D'Ieteren Group's automotive segments, particularly its vehicle distribution and parts businesses, face significant threats from global supply chain disruptions. For instance, the semiconductor shortage experienced in 2021-2022 severely impacted vehicle production worldwide, a trend that could resurface. The group's reliance on international sourcing for vehicles and components makes it susceptible to these global logistics challenges.

Geopolitical risks, including trade policy shifts and international conflicts, pose another substantial threat. Changes in trade agreements or the imposition of tariffs, as seen with potential trade disputes involving major automotive manufacturing regions, could increase the cost of imported goods and impact D'Ieteren's pricing strategies and market competitiveness. For example, increased tariffs on vehicle imports could directly affect profitability in its distribution businesses.

- Supply Chain Disruptions: The automotive industry, a core part of D'Ieteren's portfolio, remains vulnerable to component shortages, as evidenced by the widespread impact of the semiconductor crisis impacting millions of vehicles globally in recent years.

- Geopolitical Tensions: Escalating trade tensions between major economic blocs could lead to new tariffs or trade barriers, directly increasing the cost of vehicles and parts for D'Ieteren's operations and customers.

- Logistics Costs: Fluctuations in global shipping rates and port congestion, often exacerbated by geopolitical events, can significantly increase the cost of transporting vehicles and spare parts, impacting D'Ieteren's margins.

The increasing adoption of autonomous driving technology presents a significant threat to D'Ieteren's Belron division. As vehicles become more self-driving, the likelihood of accidents, and thus the need for glass repair, is projected to decrease. For instance, by 2030, some industry forecasts suggest a potential 20-30% reduction in accident rates due to autonomous features, directly impacting Belron's core business. This trend is further compounded by the continued growth of digital alternatives for stationery, challenging Moleskine's traditional product relevance, with digital productivity tools seeing over 15% annual growth in enterprise adoption through 2025.

| Threat Category | Specific Threat | Impact on D'Ieteren | Supporting Data/Trend |

|---|---|---|---|

| Technological Advancements | Autonomous Vehicle Adoption | Reduced demand for vehicle glass repair (Belron) | Projected 20-30% accident rate reduction by 2030 due to autonomous features. |

| Market Shifts | Digital Stationery Alternatives | Erosion of Moleskine's traditional notebook market share | Digital productivity tools adoption growing >15% annually (2024-2025). |

| Regulatory Environment | Stricter Emissions Standards | Increased compliance costs and potential shifts in vehicle demand (D'Ieteren Automotive) | EU targets 55% CO2 reduction by 2030 (vs. 2021). |

| Economic Factors | Consumer Spending Downturns | Lower demand for new vehicles and premium stationery | Sensitivity demonstrated by Belron's performance in challenging U.S. insurance markets (2024). |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide a robust and accurate strategic overview of D'Ieteren.