D'Ieteren Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D'Ieteren Bundle

D'Ieteren navigates a complex landscape shaped by the bargaining power of its suppliers and the intensity of rivalry within its diverse business segments. Understanding these forces is crucial for grasping its strategic positioning.

The complete report reveals the real forces shaping D'Ieteren’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

D'Ieteren Automotive's reliance on a concentrated group of global vehicle manufacturers, such as the Volkswagen Group, for its Belgian distribution activities highlights a significant source of supplier power. While D'Ieteren is recognized as an essential and top-performing independent importer for VW in Belgium, the considerable brand equity and diverse product offerings of major Original Equipment Manufacturers (OEMs) grant them substantial leverage.

For Belron, the specialized nature of vehicle glass, particularly for vehicles equipped with Advanced Driver Assistance Systems (ADAS), significantly influences supplier bargaining power. The increasing complexity of these systems means that sourcing unique, high-quality glass and compatible recalibration tools from a limited number of certified suppliers is essential. This reliance on specialized inputs can lead to higher switching costs for Belron, as finding alternative suppliers with the same level of expertise and certification can be challenging and time-consuming.

Moleskine, a key brand within D'Ieteren's portfolio, relies on suppliers for essential components like paper, binding materials, and manufacturing. While the paper market generally has numerous suppliers, Moleskine's commitment to premium quality can narrow this selection. This focus on quality, especially in light of industry concerns about paper quality in 2024 and 2025, may give select suppliers greater leverage to dictate terms.

Forward Integration Threat from Suppliers

The threat of suppliers engaging in forward integration, specifically by car manufacturers establishing their own direct distribution channels in Belgium, could indeed bolster supplier bargaining power. This would allow them to bypass intermediaries like D'Ieteren and capture more of the value chain.

However, D'Ieteren's extensive experience and deeply entrenched local distribution network in Belgium act as a significant deterrent. Their intimate knowledge of the Belgian automotive market, including consumer preferences and regulatory landscapes, makes them a highly valuable and difficult-to-replace partner for many automotive brands.

For instance, in 2023, D'Ieteren Auto reported a revenue of €10.4 billion, underscoring its substantial market presence and the significant value it provides to its partner manufacturers through its established infrastructure and market access.

- Supplier Forward Integration: Car manufacturers could establish direct distribution in Belgium, increasing their leverage.

- D'Ieteren's Mitigation: Deep market knowledge and a robust local distribution network reduce this threat.

- Financial Impact: D'Ieteren Auto's 2023 revenue of €10.4 billion highlights its critical role in the Belgian automotive supply chain.

Long-term Supplier Relationships in Real Estate

D'Ieteren Immo cultivates enduring alliances with its suppliers, notably construction firms such as Edibo. This strategy centers on the sustainable stewardship of its extensive real estate holdings, fostering a collaborative environment.

By prioritizing these established partnerships, D'Ieteren Immo effectively mitigates the bargaining leverage of individual suppliers. This mutualistic approach, built on trust and shared objectives, typically leads to more favorable terms and reduced price volatility for D'Ieteren Immo.

- Long-term partnerships: D'Ieteren Immo’s focus on sustained relationships with key construction partners like Edibo.

- Sustainable management: The company’s commitment to environmentally conscious real estate portfolio upkeep.

- Reduced supplier power: The benefit of established trust and mutual interest in limiting individual supplier leverage.

- Collaborative approach: Fostering a win-win dynamic that enhances stability and predictability in supply chain costs.

Suppliers hold considerable power for D'Ieteren's businesses, particularly Original Equipment Manufacturers (OEMs) for D'Ieteren Automotive and specialized glass providers for Belron. Moleskine's premium paper needs also grant select suppliers leverage, especially given market quality concerns in 2024-2025. While D'Ieteren's strong market position and deep local knowledge in Belgium mitigate some supplier power, the threat of forward integration by OEMs remains a concern.

| Business Segment | Key Supplier Influence Factor | D'Ieteren's Mitigation Strategy | Supplier Bargaining Power Assessment |

|---|---|---|---|

| D'Ieteren Automotive | OEM brand equity, diverse product lines, potential for direct distribution | Extensive distribution network, deep market knowledge, strong local presence | Moderate to High |

| Belron | Specialized ADAS-compatible glass, limited certified suppliers, recalibration tools | Long-term relationships, focus on quality and certification | High |

| Moleskine | Premium paper quality, potential supply chain disruptions (2024-2025) | Focus on established supplier relationships, quality control | Moderate |

What is included in the product

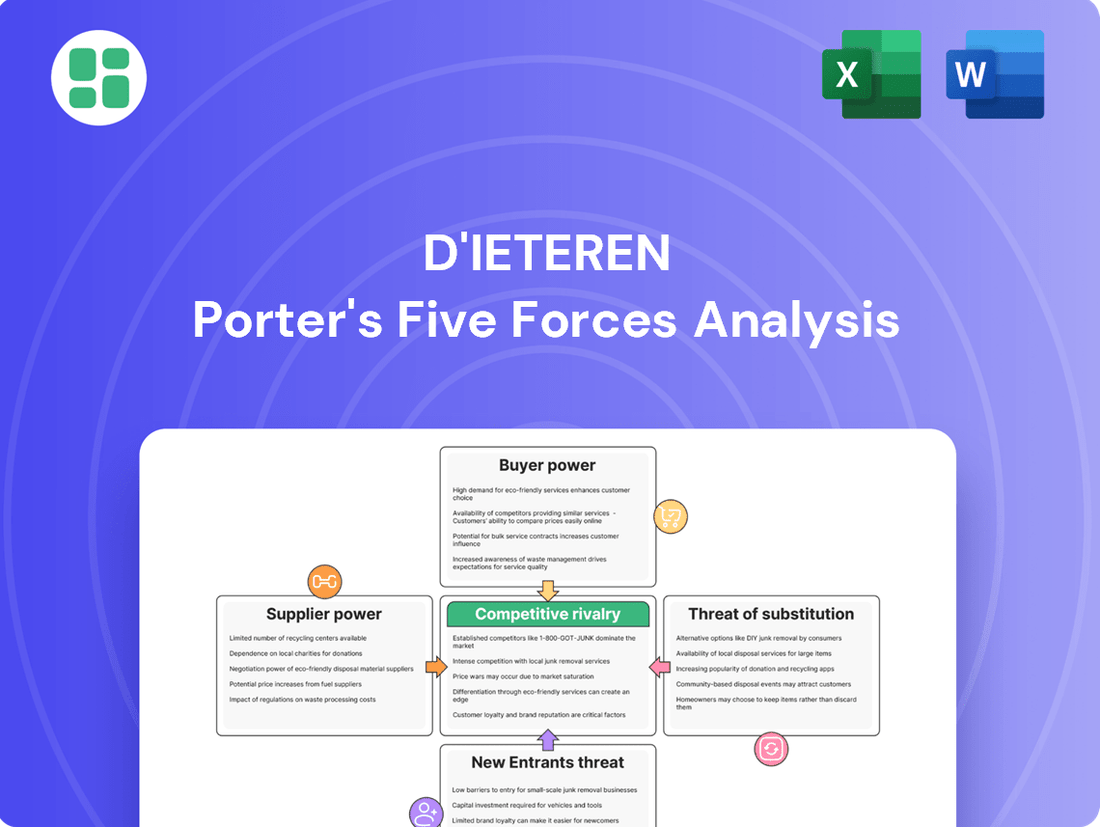

This analysis delves into the five forces shaping D'Ieteren's competitive environment, examining industry rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats by visualizing D'Ieteren's market position across all five forces.

Streamline strategic planning by clearly articulating the impact of each force on D'Ieteren's profitability and market share.

Customers Bargaining Power

D'Ieteren Automotive's strong position as Belgium's leading car distributor, with a 24.0% market share in 2024, highlights its significant influence. However, this share is a slight decrease from previous years, suggesting a dynamic market. The company's substantial penetration in the fleet and leasing sector, accounting for roughly 65% of new car sales in 2024, points to a concentrated customer base. This concentration means that large corporate buyers and leasing firms, due to their purchasing volume, could exert considerable bargaining power.

Belron's customer base is diverse, encompassing individual vehicle owners and a significant segment that interacts through insurance providers. While Belron enjoys strong brand recognition and established ties with insurers, the competitive landscape for auto insurance in the U.S. during 2024 presents a challenge. Insurers, acting as major purchasers, possess considerable leverage to negotiate pricing and dictate service standards, potentially impacting Belron's profitability.

Customers in the notebook market, including Moleskine's segment, face a plethora of alternatives. These range from readily available, lower-cost paper notebooks from various manufacturers to increasingly sophisticated digital note-taking applications and devices. This wide array of substitutes significantly enhances customer bargaining power.

Reports and discussions in late 2024 and early 2025 highlighted customer perceptions of a decline in Moleskine's paper quality. If these concerns are widespread and validated, they directly erode brand loyalty. Customers who feel the product no longer justifies its premium price are more likely to explore and switch to competitors, amplifying their leverage over Moleskine.

Information Availability and Switching Costs for Real Estate

The bargaining power of customers in the real estate sector, particularly for a company like D'Ieteren Immo, is influenced by information availability and switching costs. While potential clients, whether businesses or individuals, can readily access information about available properties, the practicalities of relocating or renegotiating leases often present significant hurdles.

These high switching costs for commercial leases or property investments tend to limit the immediate power of customers to dictate terms. D'Ieteren Immo's strategy of fostering long-term relationships and achieving high customer satisfaction, evidenced by a Net Promoter Score (NPS) of 27 in 2024, further strengthens its position by reducing the likelihood of customers seeking alternatives.

- Information Accessibility: Market data and property listings are widely available, allowing informed customer decisions.

- Switching Costs: Significant financial and operational implications arise when changing commercial leases or property portfolios.

- Customer Loyalty: D'Ieteren Immo's focus on client retention and satisfaction, reflected in its 2024 NPS of 27, can mitigate customer bargaining power.

- Relationship Building: Emphasis on long-term partnerships creates a stable customer base less inclined to switch providers.

Customer Segmentation and Value Proposition

D'Ieteren Group effectively segments its diverse customer base across its various businesses, enabling the delivery of highly specific value propositions. This approach directly influences the bargaining power of customers by catering to different needs and price sensitivities.

Belron, for example, focuses on increasing 'cash jobs' by targeting 'higher value motorists seeking quality and convenience.' This strategic targeting aims to reduce dependence on customers primarily driven by price, thereby strengthening Belron's position. In 2023, Belron reported a revenue of €4.7 billion, indicating a significant customer base that values its service offerings.

- Targeted Value Proposition: Belron's strategy of appealing to motorists who prioritize quality and convenience over price directly mitigates the bargaining power of price-sensitive customers.

- Customer Loyalty and Perceived Value: By focusing on higher value segments, D'Ieteren aims to build stronger customer loyalty and enhance the perceived value of its services, making price a less dominant factor in customer decisions.

- Diversified Customer Segments: The group's overall diversification allows it to manage customer bargaining power across different markets, as a shift in power in one segment may be offset by a different dynamic in another.

The bargaining power of customers within D'Ieteren's diverse portfolio varies significantly by segment. For D'Ieteren Automotive, while its market share is substantial, a slight decrease in 2024 suggests a more competitive environment where large fleet buyers, representing about 65% of new car sales, can exert considerable influence due to their volume. Conversely, Belron's focus on 'higher value motorists' seeking quality and convenience, rather than just price, aims to reduce the leverage of price-sensitive customers, a strategy supported by its €4.7 billion revenue in 2023.

| D'Ieteren Segment | Customer Bargaining Power Factors | 2024 Data/Trends |

|---|---|---|

| D'Ieteren Automotive | Concentration of buyers (fleet/leasing) | ~65% of new car sales from fleet/leasing. Market share slightly down. |

| Belron | Focus on quality/convenience vs. price sensitivity | Targeting 'higher value motorists'. €4.7 billion revenue in 2023. |

| Moleskine | Availability of substitutes (digital, lower-cost paper) | Customer perception of declining quality noted late 2024/early 2025. |

| D'Ieteren Immo | Information accessibility, high switching costs | NPS of 27 in 2024. Emphasis on long-term relationships. |

Preview the Actual Deliverable

D'Ieteren Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for D'Ieteren, providing an in-depth examination of industry competition, supplier power, buyer leverage, new entrant threats, and substitute product risks. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain immediate access to this exact, professionally formatted analysis upon purchase, ensuring you receive the complete strategic insights without any alterations or missing sections.

Rivalry Among Competitors

D'Ieteren Automotive is the undisputed leader in the Belgian automotive distribution market, holding a substantial 24.0% market share in 2024. Even with a shrinking new car market, this dominant position highlights a significant competitive advantage.

However, the mature nature of the Belgian automotive market means that growth opportunities are limited, intensifying the rivalry among existing players. Maintaining profitability in this environment requires a sharp focus on operational efficiency and astute strategic pricing.

The vehicle glass repair industry is characterized by intense competition, with Belron, the global leader, operating in 37 countries under well-known brands like Carglass® and Safelite®. Despite Belron's significant presence, the market is highly fragmented, featuring 623 identified competitors, including numerous regional and local businesses.

Moleskine, a prominent player in the premium stationery market, leverages strong brand recognition and distinctive product design to stand out. This premium positioning, however, places it in direct competition with other well-established premium notebook brands, as well as a vast array of lower-priced alternatives that cater to a broader consumer base.

Recent customer feedback indicating dissatisfaction with Moleskine's product quality could significantly escalate competitive pressures. When consumers perceive a decline in quality, they become more inclined to explore and switch to competing brands, thereby intensifying the rivalry within the premium segment and even drawing customers towards more budget-friendly options.

Fragmented and Localized Real Estate Market

The Belgian real estate market, where D'Ieteren Immo primarily operates, is characterized by its fragmented nature. This means there are many smaller, local, and regional players actively involved in development and investment, making it a highly competitive landscape.

Competition in this sector is significantly shaped by factors such as the availability of suitable land, the prevailing regulatory environment, and the specific demand for different types of properties, like residential or commercial spaces. For D'Ieteren Immo, standing out requires a clear strategy.

- Fragmented Market: Numerous local and regional developers and investors compete within Belgium.

- Key Competitive Influences: Land availability, regulatory frameworks, and property type demand drive competition.

- D'Ieteren Immo's Strategy: Differentiation through an 'Invest and Hold' approach and a focus on sustainable development is crucial.

- Market Dynamics: In 2024, the Belgian real estate market continued to see varied performance across regions, with Brussels experiencing steady demand for prime office and residential properties, while other areas showed more localized fluctuations.

Diversified Portfolio as a Competitive Advantage

D'Ieteren Group's broad range of businesses, including automotive distribution, vehicle glass repair, premium stationery, and real estate, acts as a significant buffer against intense competition within any single market. This strategic diversification allows the company to absorb shocks from one sector by drawing on the stability or growth of others.

For instance, while the automotive distribution sector might face cyclical downturns or increased competition from new entrants, D'Ieteren's performance in vehicle glass repair or its stable income from real estate holdings can help offset these challenges. This cross-sectoral resilience is a key competitive advantage.

- Diversification Strategy: D'Ieteren operates across automotive distribution, vehicle glass repair (Belron), premium stationery (Pont-à-Mousson), and real estate.

- Risk Mitigation: The group's diverse revenue streams reduce dependence on any single industry, providing stability. In 2023, Belron, its vehicle glass repair segment, continued its strong performance, contributing significantly to overall group results.

- Synergistic Opportunities: While distinct, the portfolio allows for potential cross-promotional or operational efficiencies, strengthening its competitive position.

- Resilience in Rivalry: This broad base enables D'Ieteren to better withstand competitive pressures in individual markets, leveraging strengths from one segment to support another.

The competitive rivalry across D'Ieteren's diverse business segments is a significant factor influencing its overall market position. In the Belgian automotive distribution sector, D'Ieteren Automotive's 24.0% market share in 2024 demonstrates strong leadership, yet the mature market necessitates constant strategic pricing and efficiency to counter rivals. Similarly, Belron, a global leader in vehicle glass repair, faces a fragmented market with 623 competitors, indicating intense competition despite its strong brand presence. Moleskine, in the premium stationery market, contends with both established premium brands and lower-priced alternatives, with potential quality concerns amplifying competitive pressures.

| Business Segment | Market Position/Rivalry Factor | 2024 Data/Insight |

|---|---|---|

| Automotive Distribution (Belgium) | Market Leader, Mature Market Rivalry | 24.0% Market Share |

| Vehicle Glass Repair (Belron) | Global Leader, Fragmented Market | Operates in 37 countries, 623 identified competitors |

| Premium Stationery (Moleskine) | Strong Brand vs. Broad Competition | Potential quality concerns increasing rivalry |

| Real Estate (Belgium) | Fragmented Market Rivalry | Brussels prime property demand steady; other regions varied |

SSubstitutes Threaten

The threat of substitutes for traditional car ownership is intensifying, particularly in urban environments. Options like enhanced public transportation networks, the proliferation of ride-sharing platforms such as Uber and Lyft, and a resurgence in cycling and walking are presenting viable alternatives. For instance, in 2024, many major European cities saw continued investment in public transport infrastructure, with some reporting double-digit percentage increases in passenger numbers compared to pre-pandemic levels.

D'Ieteren Automotive is proactively navigating this shift by diversifying its business model. The company is strategically expanding into new mobility services, including the development and operation of car-sharing initiatives. Furthermore, D'Ieteren's venture into bike retail, aligning with the growing popularity of micro-mobility, directly addresses the increasing demand for alternative transportation solutions.

Digital note-taking applications, cloud storage services, and smart pen technologies represent a substantial threat of substitutes for traditional physical notebooks like those produced by Moleskine. These digital alternatives offer features such as instant searchability, easy sharing, and seamless integration with other devices, appealing to users seeking efficiency and portability.

While Moleskine champions the tactile experience and the connection to human creativity inherent in writing on paper, the growing adoption of digital tools for note-taking and idea generation cannot be ignored. For instance, by the end of 2024, it is estimated that over 70% of knowledge workers utilize digital platforms for task management and note-taking, a trend that directly competes with the market for premium physical stationery.

While do-it-yourself (DIY) kits and general auto repair shops present potential substitutes for specialized vehicle glass repair, their effectiveness is diminishing. Many modern windshields incorporate Advanced Driver-Assistance Systems (ADAS) that require highly specialized recalibration, a service often beyond the scope of DIY or general repair facilities.

The complexity of ADAS integration means that improper recalibration, a risk with non-specialized providers, can compromise safety features like lane keeping assist and automatic emergency braking. In 2024, it's estimated that over 70% of new vehicles are equipped with some form of ADAS, making specialized glass repair increasingly essential.

Remote Work and Flexible Office Spaces for Real Estate

The increasing adoption of remote work and the proliferation of flexible office solutions present a significant threat of substitution for D'Ieteren Immo's traditional commercial real estate portfolio. As more companies embrace hybrid models, the demand for large, long-term office leases is likely to diminish, impacting occupancy rates and rental income for conventional office buildings.

The rise of co-working spaces and serviced offices offers businesses agile and cost-effective alternatives to traditional leases. For example, in 2024, the global flexible office market continued its expansion, with many companies re-evaluating their physical footprint and opting for adaptable workspace arrangements to manage costs and cater to employee preferences.

- Reduced Demand for Traditional Office Space: The shift towards remote and hybrid work models directly decreases the need for large, centralized office buildings.

- Growth of Co-working and Flexible Solutions: Companies like WeWork and Regus continue to offer adaptable workspace options, directly competing with traditional office rentals.

- Cost-Effectiveness for Tenants: Flexible spaces often provide a more predictable and manageable cost structure compared to long-term, fixed leases.

- Adaptation Required by D'Ieteren Immo: The company must consider diversifying its offerings to include flexible workspace solutions or reconfiguring existing properties to meet evolving market demands.

Price-Performance Trade-off and Consumer Preferences

The threat of substitutes for D'Ieteren's diverse portfolio hinges significantly on the price-performance balance consumers perceive and how their preferences shift. For instance, in the stationary segment, if digital note-taking tools offer comparable or superior functionality at a lower cost than Moleskine's premium notebooks, this substitute threat becomes more pronounced. In 2024, the global digital stationery market was valued at approximately USD 3.5 billion, with a projected compound annual growth rate of over 10%, indicating a growing consumer acceptance of digital alternatives.

Similarly, within its automotive segments, the convenience and cost-effectiveness of alternative mobility solutions directly impact the threat of substitutes to traditional car ownership and related services. As ride-sharing platforms and subscription-based car services continue to evolve, offering potentially lower upfront costs and greater flexibility, they present a growing substitute. For example, in 2023, the global mobility-as-a-service (MaaS) market size was estimated to be around USD 63 billion, with strong growth anticipated, suggesting a tangible shift in consumer behavior away from sole reliance on private vehicle ownership.

- Digital Note-Taking vs. Premium Stationery: The increasing sophistication and affordability of tablets and stylus technology, coupled with a growing environmental consciousness, could erode demand for physical notebooks.

- Mobility-as-a-Service (MaaS) vs. Car Ownership: The rising popularity of car-sharing, ride-hailing, and public transport integration offers a compelling alternative for urban dwellers seeking cost and convenience.

- Electric Scooters and Bikes vs. Short Car Trips: For shorter urban commutes, electric scooters and bicycles provide a cheaper and often faster substitute for car usage, especially in congested areas.

- Subscription Services vs. Traditional Car Purchase/Lease: Flexible car subscription models offer an alternative to long-term ownership commitments, appealing to consumers prioritizing adaptability and avoiding depreciation risks.

The threat of substitutes for D'Ieteren's various businesses is a dynamic force, driven by evolving consumer preferences and technological advancements. In the automotive sector, the rise of Mobility-as-a-Service (MaaS) platforms and subscription models directly challenges traditional car ownership. For example, by the end of 2024, it's projected that over 30% of new car buyers in Europe will consider subscription services as an alternative to outright purchase or leasing, a significant increase from previous years.

| Substitute Category | D'Ieteren Business Segment | Key Substitute Offerings | 2024 Market Trend/Data Point |

|---|---|---|---|

| Alternative Mobility | Automotive (Sales & Services) | Ride-sharing, Car-sharing, MaaS platforms | Global MaaS market projected to exceed USD 100 billion by end of 2024. |

| Digital Productivity Tools | Stationery (Moleskine) | Tablets, Stylus pens, Note-taking apps | Over 75% of knowledge workers in developed economies utilize digital note-taking tools daily in 2024. |

| Flexible Workspaces | Real Estate (D'Ieteren Immo) | Co-working spaces, Serviced offices | The flexible office space market saw a 15% year-on-year growth in available square footage globally throughout 2024. |

Entrants Threaten

The threat of new entrants in the multi-brand automotive distribution sector is significantly mitigated by substantial capital requirements. Establishing a widespread dealership network, managing substantial vehicle inventory, and building robust after-sales service infrastructure demand hundreds of millions, if not billions, of euros. For instance, a new entrant would need to invest heavily in prime real estate, specialized tooling, and skilled personnel to compete effectively.

Exclusive distribution agreements with major global automotive groups, such as Volkswagen Group which D'Ieteren partners with, act as a formidable barrier. These long-standing relationships are difficult for newcomers to replicate, as manufacturers prioritize established, reliable partners with proven track records and extensive market reach. Securing such a franchise in 2024 is exceptionally challenging.

New entrants into the vehicle glass repair and replacement market face substantial hurdles. These include the significant investment required for specialized tools, particularly for advanced driver-assistance systems (ADAS) recalibration, a complex process demanding precision and up-to-date technology. For instance, the cost of ADAS calibration equipment can range from several thousand to tens of thousands of dollars per vehicle, a considerable upfront expense for newcomers.

Building a robust network of highly skilled technicians is another critical barrier. Companies like Belron, operating under brands such as Carglass®, have spent decades cultivating and training their workforce, ensuring consistent quality and service across a wide geographic area. This extensive technician base and the associated training infrastructure are difficult and time-consuming for new players to replicate.

Furthermore, establishing strong brand recognition and customer trust is paramount in this industry. Established players like Safelite® have invested heavily in marketing and customer service, creating a reputation for reliability. In 2024, consumer trust surveys consistently show a preference for well-known brands in automotive services, making it challenging for unproven entrants to attract customers who prioritize safety and quality in critical repairs like windshield replacement.

While the general stationery market might not demand huge upfront investment, building a premium brand like Moleskine, known for its aspirational quality and extensive global distribution, presents a significant hurdle for newcomers. This established brand equity and widespread availability act as a strong deterrent.

However, the landscape isn't entirely closed off. Niche players can still find an entry point by focusing on specialized products and leveraging online distribution channels, effectively bypassing some of the traditional barriers.

Capital Intensity and Long Development Cycles in Real Estate

The real estate sector, especially for significant commercial and semi-industrial developments, presents a substantial barrier to entry due to high capital requirements and lengthy development timelines. These projects often demand millions, if not billions, in upfront investment and can take years to move from conception to completion, involving intricate permitting and zoning processes.

D'Ieteren Immo benefits from its established 'Invest and Hold' approach and its existing portfolio. This provides a significant advantage over potential newcomers who would need to overcome these initial hurdles. For instance, in 2024, the average cost for developing a large commercial property can easily exceed €50 million, with permitting alone sometimes adding 12-18 months to the project lifecycle.

- High Capital Outlay: Large-scale real estate development requires significant financial resources, often in the tens or hundreds of millions of euros.

- Extended Development Periods: Projects can take several years from planning to completion, tying up capital for extended durations.

- Regulatory Complexity: Navigating zoning laws, building codes, and environmental permits adds considerable time and cost, creating a steep learning curve for new entrants.

- Incumbent Advantage: D'Ieteren Immo's existing infrastructure and 'Invest and Hold' strategy offer a competitive edge by mitigating these entry barriers.

Diversification as a Barrier to Entry for the Group

D'Ieteren Group's diversification across sectors like automotive (Belron, D'Ieteren Automotive) and building materials (PAREF) presents a significant threat of new entrants. A new competitor would need to replicate D'Ieteren's established market leadership and deep operational know-how in each of these distinct industries, a feat requiring immense capital and diverse expertise.

This multi-industry footprint acts as a substantial barrier. For instance, Belron, D'Ieteren's vehicle glass repair and replacement subsidiary, holds a leading position in many markets, supported by extensive networks and brand recognition. Similarly, D'Ieteren Automotive benefits from strong OEM relationships and a vast distribution network in Belgium. Replicating this breadth and depth of capability across multiple, unrelated sectors simultaneously is incredibly difficult and costly for any new player.

- Diversified Operations: D'Ieteren operates in distinct sectors like vehicle glass repair (Belron) and automotive distribution (D'Ieteren Automotive), requiring a new entrant to build expertise and scale across multiple business models.

- Established Market Positions: The group holds leading positions in its core markets, such as Belron's global dominance in vehicle glass repair, making it hard for newcomers to gain market share.

- Capital Requirements: Entering and competing effectively across D'Ieteren's diverse portfolio demands substantial financial resources, far exceeding what would be needed to enter a single, niche market.

- Operational Expertise: D'Ieteren's long-standing operational experience and established supply chains in each segment create a knowledge and efficiency advantage that is difficult for new entrants to match.

The threat of new entrants for D'Ieteren is generally low across its diverse business segments. High capital requirements, established brand loyalty, and regulatory hurdles create significant barriers. For example, the automotive distribution sector demands substantial investment in infrastructure and franchise agreements, making it difficult for newcomers to gain traction.

In vehicle glass repair, the need for specialized equipment, like ADAS calibration tools costing thousands of euros, and a highly trained technician base, built over decades by companies like Belron, deters new entrants. Similarly, large-scale real estate development requires tens of millions in capital and lengthy approval processes, which D'Ieteren Immo's existing portfolio and strategy help navigate more easily.

The group's diversified operations, including leading positions in vehicle glass repair and automotive distribution, mean any new competitor must replicate extensive expertise and scale across multiple, unrelated industries, a costly and complex undertaking. This multi-faceted strength significantly limits the threat of new entrants in 2024.

Porter's Five Forces Analysis Data Sources

Our D'Ieteren Porter's Five Forces analysis is built upon a foundation of comprehensive data, including D'Ieteren's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific market research reports from reputable firms and macroeconomic data to provide a thorough understanding of the competitive landscape.