D'Ieteren PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D'Ieteren Bundle

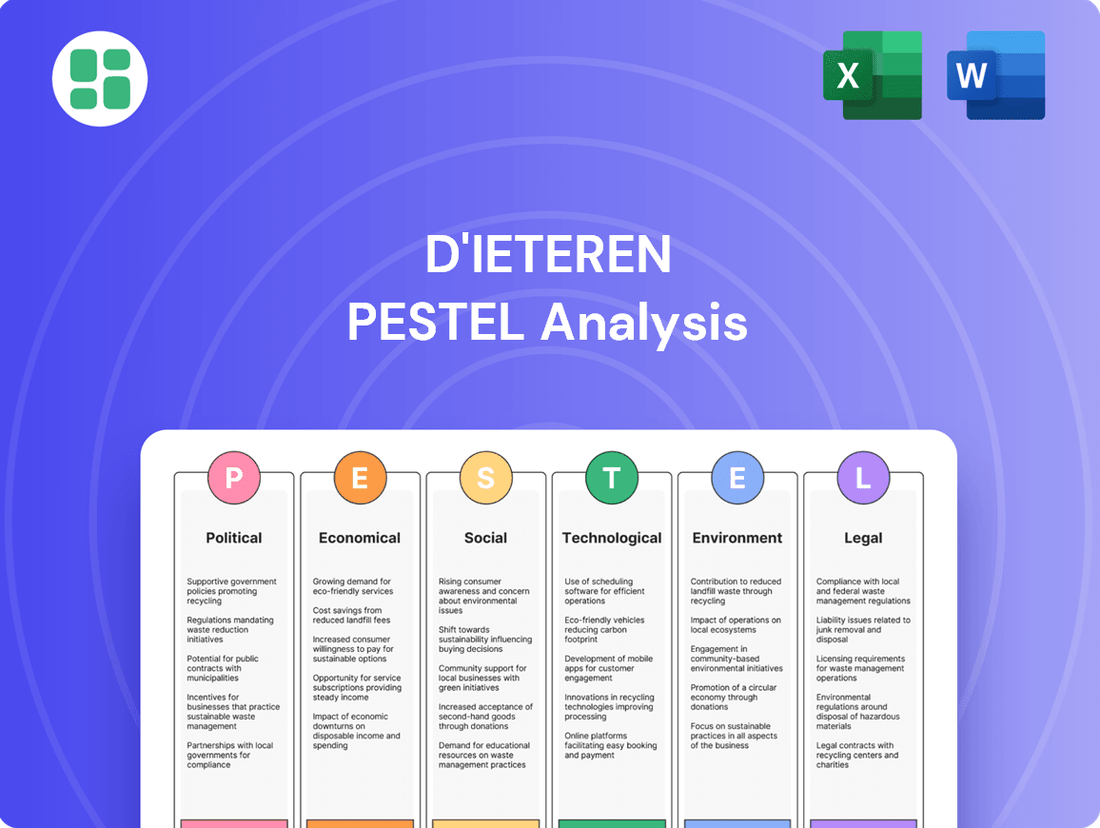

Navigate the complex external forces shaping D'Ieteren's business landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the automotive and distribution giant. Equip yourself with actionable intelligence to anticipate market changes and refine your strategic approach.

Unlock a deeper understanding of D'Ieteren's operating environment by delving into our expert-crafted PESTLE analysis. Discover how technological advancements, environmental regulations, and legal frameworks are impacting their diverse portfolio. Empower your decision-making with crucial insights that can drive competitive advantage.

Don't get left behind in a rapidly changing market; our D'Ieteren PESTLE analysis provides the clarity you need. Gain a strategic edge by understanding the macro-environmental factors influencing their success, from consumer behavior shifts to global supply chain dynamics. Download the full version now to access this vital market intelligence.

Political factors

Government policies in Belgium are a major driver for D'Ieteren Automotive, especially regarding vehicle distribution. Key among these are tax incentives designed to promote electric vehicle adoption. For example, company electric vehicles (BEVs) currently enjoy 100% tax deductibility through 2026, a significant benefit for fleet operators.

Furthermore, the regulatory landscape is actively shifting away from traditional internal combustion engine (ICE) vehicles. In Wallonia, a new registration tax system for BEVs is set to be implemented starting July 2025, which will reshape the cost dynamics for consumers and businesses alike.

The European Union's evolving CO2 emission targets, notably through regulations like Regulation (EU) 2024/1257, are a significant political factor for D'Ieteren Automotive. These regulations mandate a shift towards vehicles with lower or zero emissions, directly influencing the company's product development and sales strategies.

Carmakers, including those under D'Ieteren's umbrella, must adhere to increasingly stringent standards starting in 2025. Failure to meet these targets can result in substantial fines, creating a strong incentive to accelerate the sales of Battery Electric Vehicles (BEVs) and other low-emission alternatives to ensure compliance.

New Belgian regulations mandating EV charging infrastructure in real estate, effective January 2025, will impact D'Ieteren Immo. Property owners and developers must adapt, potentially increasing development costs and influencing future property valuations.

Political Stability and Trade Relations

Political stability in D'Ieteren's core markets, especially Belgium, and the numerous countries where Belron operates, is crucial for smooth operations and dependable supply chains. Geopolitical shifts or unexpected events can directly affect the group's financial performance, as highlighted in their 2024 financial projections.

The group's 2024 guidance has specifically acknowledged the potential impact of geopolitical tensions on its financial outlook. For instance, disruptions stemming from regional conflicts or shifts in international trade policies could affect component sourcing for Belron's operations or impact demand for D'Ieteren's automotive services.

- Belron's extensive global footprint across over 30 countries necessitates navigating a complex web of political landscapes, each with its own stability profile.

- D'Ieteren Group's reliance on international trade for vehicle parts and equipment makes it susceptible to trade tariffs and protectionist policies enacted by various governments.

- The 2024 financial year saw management actively monitoring geopolitical developments, with specific concerns raised regarding potential impacts on raw material costs and logistics.

Consumer Protection and Competition Laws

D'Ieteren's business is significantly shaped by consumer protection and competition laws. Regulations in vehicle sales and after-sales services, for instance, ensure transparency and fair dealing with customers. Similarly, real estate transaction laws safeguard buyers and sellers. In 2024, the European Union continued to emphasize consumer rights, with ongoing discussions around strengthening warranty provisions for vehicles and digital services, impacting D'Ieteren's automotive divisions.

Competition laws are equally vital, ensuring D'Ieteren's diversified operations, from vehicle distribution to glass repair and real estate, operate on a level playing field. These laws prevent monopolistic practices and promote healthy market competition. For example, antitrust authorities in various European markets where D'Ieteren operates actively monitor market share and pricing in the automotive aftermarket sector to prevent unfair advantages.

- Consumer Protection: Regulations focus on transparency in pricing, warranty terms, and service quality across D'Ieteren's automotive and real estate businesses.

- Competition Law: Ensures fair market practices in vehicle distribution, glass repair, and property transactions, preventing anti-competitive behavior.

- Regulatory Scrutiny: Authorities in key European markets, including Belgium and France, closely monitor D'Ieteren's market activities for compliance.

- Impact on Operations: These legal frameworks directly influence customer interaction, pricing strategies, and market positioning for the group.

Government policies, particularly those promoting electric vehicle (EV) adoption, significantly influence D'Ieteren Automotive. Belgium's 100% tax deductibility for company BEVs through 2026, for instance, is a key incentive. The EU's CO2 emission targets, such as those in Regulation (EU) 2024/1257, compel a faster shift to lower-emission vehicles, with compliance becoming critical from 2025 onwards to avoid penalties.

New Belgian regulations effective January 2025 require EV charging infrastructure in real estate, impacting D'Ieteren Immo and potentially development costs. Political stability across D'Ieteren's operating regions, including Belgium and the many countries where Belron operates, is vital for supply chain continuity and financial performance, as acknowledged in the group's 2024 financial outlook.

Geopolitical tensions were a noted concern in D'Ieteren's 2024 financial guidance, with potential impacts on raw material costs and logistics for Belron. The group's global operations expose it to varying political landscapes and trade policies, making it susceptible to tariffs and protectionism.

| Policy Area | Impact on D'Ieteren | Key Dates/Data |

|---|---|---|

| EV Tax Incentives (Belgium) | Boosts BEV sales for D'Ieteren Automotive | 100% tax deductibility for company BEVs through 2026 |

| EU CO2 Emission Targets | Drives product development towards lower emissions | Regulation (EU) 2024/1257; stricter targets from 2025 |

| EV Charging Infrastructure Mandate (Belgium) | Affects D'Ieteren Immo, potential cost increases | Effective January 2025 |

| Geopolitical Stability | Impacts supply chains, raw material costs, and financial outlook | Acknowledged in 2024 financial guidance |

What is included in the product

This D'Ieteren PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting emerging trends and potential challenges relevant to D'Ieteren's diverse business portfolio.

A clear, actionable summary of D'Ieteren's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decisions.

Economic factors

Economic growth significantly shapes D'Ieteren's performance. In Belgium, new car registrations saw a modest increase in early 2024, reaching approximately 45,000 units by March, a slight uptick from the previous year, which supports D'Ieteren Automotive. However, global economic uncertainties can dampen consumer spending on non-essential items, impacting brands like Moleskine.

Consumer purchasing power is a critical driver for D'Ieteren's diverse portfolio. While a robust economy boosts demand for new vehicles and premium stationery, economic slowdowns can lead consumers to postpone purchases or opt for lower-cost alternatives. This directly affects sales volumes across D'Ieteren's segments, from automotive distribution to writing instruments.

Rising inflation, with the Eurozone experiencing a peak of 10.6% in October 2022 and moderating to 2.4% by April 2024, directly impacts D'Ieteren's operational costs and consumer purchasing power. This inflationary environment, coupled with interest rate hikes by the European Central Bank, which saw its main refinancing operations rate climb from 0.00% in July 2022 to 4.50% by September 2023, increases financing costs for D'Ieteren Immo's property developments and D'Ieteren Automotive's financial services.

Higher interest rates also pose a challenge to affordability for consumers, potentially dampening demand for new vehicles financed through D'Ieteren Automotive and affecting the viability of real estate investments for D'Ieteren Immo. For instance, the average interest rate for new car loans in major European markets has seen a noticeable uptick, making vehicle ownership more expensive.

Currency exchange rate fluctuations present a significant economic factor for D'Ieteren Group, primarily through its subsidiary Belron, which operates in 39 countries. These movements can directly affect the translation of foreign earnings and assets into D'Ieteren's reporting currency, impacting consolidated financial results. For instance, in 2024, the group specifically noted adverse foreign exchange impacts on both its cash holdings and external debt, highlighting the tangible financial consequences of currency volatility.

Insurance Market Dynamics

Challenging insurance market dynamics, especially in the United States, have been a significant headwind for Belron's performance in 2024. This segment, which is heavily dependent on insurance claims for its business, is experiencing pressure from rising insurance premiums and evolving policy terms. For instance, in the US, the average auto insurance premium saw an increase of approximately 15% year-over-year in early 2024, according to industry reports, impacting the volume and profitability of claims-related services.

These market conditions translate into specific challenges for businesses like Belron:

- Increased Cost of Claims Processing: Higher premiums can lead insurers to scrutinize claims more rigorously, potentially increasing administrative costs for service providers.

- Policyholder Behavior Shifts: Policy changes or higher deductibles might cause some consumers to delay or forgo certain repairs, affecting service volumes.

- Negotiation Leverage: Insurers, facing their own cost pressures, may exert greater negotiation power on pricing for repair services.

- Regulatory Scrutiny: Evolving insurance regulations in key markets can also introduce new compliance requirements and operational complexities.

Disposable Income and Market Polarization

Disposable income trends are a critical lens through which to view D'Ieteren's market performance. As consumers' available funds fluctuate, so too does demand for everything from their premium stationery brand, Moleskine, to vehicle sales and after-sales services. This dynamic is particularly relevant given D'Ieteren's own assessment of operating within an increasingly turbulent and uncertain macroeconomic environment.

The company's strategic positioning acknowledges a highly polarized market. This means that while some consumer segments may see their disposable income grow, allowing for increased spending on higher-end or discretionary items, other segments might experience stagnation or decline, impacting demand for more basic or essential offerings. For instance, in 2024, many economies are grappling with persistent inflation, which can erode real disposable income for a significant portion of the population, even if nominal incomes rise.

This polarization creates distinct challenges and opportunities. D'Ieteren must navigate varying consumer spending power across its portfolio.

- Consumer Spending Power: Global inflation rates in 2024, averaging around 5-6% in many developed economies, directly impact the real value of disposable income, influencing purchasing decisions for D'Ieteren's diverse product lines.

- Market Segmentation: The company's operations span premium (Moleskine) and essential (vehicle maintenance) services, requiring tailored strategies to address the differing disposable income levels of target customer groups.

- Economic Uncertainty: Forecasts for global GDP growth in 2024 and 2025 often highlight volatility, reinforcing the need for D'Ieteren to remain agile in responding to shifts in consumer confidence and spending capacity.

Economic growth directly influences D'Ieteren's revenue streams, with new car registrations in Belgium showing a slight increase in early 2024. However, global economic uncertainties can temper consumer spending on discretionary items, impacting brands like Moleskine. Rising inflation, which moderated to 2.4% in the Eurozone by April 2024, alongside higher interest rates, increases operational costs and financing expenses for D'Ieteren's various segments.

Currency fluctuations present a significant factor, with adverse foreign exchange impacts noted on cash holdings and debt in 2024. Challenging insurance market dynamics, particularly in the US, have also created headwinds for Belron in 2024, with auto insurance premiums rising approximately 15% year-over-year in early 2024.

| Economic Factor | Impact on D'Ieteren | Relevant Data (2024/2025) |

|---|---|---|

| Economic Growth | Drives demand for automotive and stationery products. | Belgium new car registrations up slightly in early 2024. |

| Inflation | Increases operational costs and reduces consumer purchasing power. | Eurozone inflation at 2.4% by April 2024. |

| Interest Rates | Raises financing costs and impacts affordability. | ECB main refinancing rate at 4.50% by Sep 2023. |

| Currency Exchange Rates | Affects translation of foreign earnings and assets. | Group noted adverse FX impacts in 2024. |

| Insurance Market Conditions | Impacts Belron's claims-based services. | US auto insurance premiums up ~15% YoY in early 2024. |

Preview Before You Purchase

D'Ieteren PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive D'Ieteren PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping D'Ieteren's strategic landscape.

Sociological factors

Societal preferences are increasingly leaning towards sustainable and electric mobility. D'Ieteren Automotive is strategically positioning itself to be a leading provider of these solutions in Belgium, recognizing this significant shift.

This growing demand is fueled by heightened consumer awareness regarding environmental impact and the availability of government incentives for electric vehicles (EVs). For instance, in 2024, EV sales in Europe continued to rise, with Belgium seeing a notable increase in registrations of purely electric cars, reflecting this evolving consumer behavior.

Consumer preferences are rapidly shifting away from traditional outright vehicle ownership. We're seeing a significant rise in interest for flexible options like leasing, vehicle subscription services, and various forms of shared mobility. This trend reflects a broader societal move towards access over ownership.

D'Ieteren Automotive is actively responding to these evolving consumer desires by broadening its service portfolio. The company is investing in and expanding its offerings within new mobility services, aiming to create a comprehensive, connected mobility ecosystem that caters to these changing demands and provides greater flexibility for users.

Consumers increasingly seek premium notebooks and accessories, valuing superior quality, sophisticated design, and the ability to personalize their purchases. This trend is evident in brands like Moleskine, where the appeal lies not just in the product itself but in the experience it offers. For instance, Moleskine's sales in 2023 demonstrated continued strength in its core premium stationery segment, reflecting this enduring demand for curated and distinctive items.

Impact of ADAS on Vehicle Repair Needs

The increasing integration of Advanced Driver-Assistance Systems (ADAS) in vehicles is reshaping the automotive repair landscape. This technological shift directly influences the demand for specialized services, particularly concerning windshields, which often house critical ADAS sensors.

Belron, a major player in vehicle glass repair and replacement, is well-positioned to capitalize on this trend. The necessity of precise recalibration following windshield work, a direct consequence of ADAS, presents a significant growth avenue. In 2024, a notable 42% of Belron's replacement jobs involved this crucial recalibration step, underscoring the growing importance of this specialized service.

- ADAS Integration: Vehicles increasingly feature ADAS, impacting repair complexity.

- Recalibration Demand: Windshield repair/replacement now often requires sensor recalibration.

- Growth Opportunity: This specialized service creates a lucrative market for repair providers.

- Belron's Focus: 42% of Belron's 2024 replacement jobs included recalibration.

Workforce Dynamics and Talent Retention

The automotive aftermarket, particularly for services like vehicle glass repair and replacement, is heavily influenced by workforce dynamics. Attracting and retaining skilled technicians is paramount for companies like Belron, a key entity within the D'Ieteren Group. Labor market trends, including the availability and cost of qualified personnel, directly impact operational efficiency and service quality.

D'Ieteren Group actively focuses on creating an environment that fosters fair and meaningful work, which is essential for talent retention. In 2024, Belron reported positive strides in reducing technician turnover rates. This focus on employee well-being and career development is a strategic imperative in a sector where specialized skills are in demand.

Key aspects of workforce dynamics impacting D'Ieteren’s subsidiaries include:

- Technician Retention Rates: Efforts to improve technician retention are critical for maintaining service continuity and customer satisfaction. Lower turnover means reduced recruitment and training costs.

- Skills Gap: The automotive industry faces ongoing challenges with a skills gap, particularly in advanced vehicle technologies. D'Ieteren's investment in training and development aims to bridge this gap.

- Labor Costs: Wage inflation and competition for skilled labor directly influence operating expenses. Managing these costs while ensuring competitive compensation is a balancing act.

- Employee Engagement: Initiatives to boost employee engagement and provide career progression opportunities are vital for long-term workforce stability and productivity.

Societal trends are increasingly favoring flexible mobility solutions over traditional car ownership, with leasing and subscription models gaining significant traction. This shift is driven by a desire for greater convenience and adaptability. D'Ieteren Automotive is actively responding by expanding its portfolio of new mobility services, aiming to capture this growing market segment.

The growing consumer preference for sustainable and electric vehicles continues to shape the automotive landscape. This is further amplified by supportive government policies and incentives. For example, in 2024, Belgium saw a continued rise in electric vehicle registrations, demonstrating a clear market shift towards greener transportation options.

The increasing complexity of vehicle technology, particularly with the integration of Advanced Driver-Assistance Systems (ADAS), directly impacts the automotive aftermarket. Windshield replacements, for instance, now frequently require recalibration of integrated sensors. Belron, a key D'Ieteren subsidiary, reported that 42% of its replacement jobs in 2024 involved this essential recalibration, highlighting the evolving service demands.

| Societal Trend | Impact on D'Ieteren | Supporting Data (2024/2025) |

|---|---|---|

| Shift to Flexible Mobility | Increased demand for leasing and subscription services | Growing market share for non-ownership models |

| Demand for EVs | Strategic focus on electric vehicle offerings | Continued rise in EV registrations in Belgium |

| ADAS Integration | Need for specialized repair and recalibration services | 42% of Belron's replacement jobs included recalibration |

Technological factors

Rapid advancements in electric vehicle (EV) technology are significantly reshaping the automotive landscape, directly impacting D'Ieteren Automotive's product offerings and sales strategies. Improvements in battery density and lifespan, coupled with the expansion of charging infrastructure, are making EVs more practical and appealing to a broader consumer base.

The introduction of more budget-friendly Battery Electric Vehicles (BEVs) is a key development. For instance, Belgium experienced a substantial 36% surge in new fully electric vehicle registrations during 2024, highlighting a growing market acceptance and demand for these cleaner alternatives. This trend necessitates a strategic adjustment in D'Ieteren's portfolio to meet evolving consumer preferences and regulatory pressures.

The increasing integration of Advanced Driver-Assistance Systems (ADAS) in vehicles presents a significant technological factor for Belron. These sophisticated systems, often relying on cameras and sensors mounted on the windshield, necessitate specialized recalibration services following any glass repair or replacement. This trend directly fuels demand for Belron's expertise in handling these complex technological requirements.

By 2025, it's projected that over 80% of new vehicles sold in major markets will feature some level of ADAS, according to industry analysis. This widespread adoption means that a substantial portion of Belron's customer base will require these advanced recalibration services, underscoring the technological shift impacting the automotive aftermarket sector and Belron's service offerings.

Digitalization is fundamentally reshaping how D'Ieteren's automotive segments operate, particularly in sales and after-sales services. This transformation facilitates connected mobility ecosystems, aiming to elevate the customer experience through seamless digital interactions.

The company is leveraging digital tools to boost efficiency and ensure traceability within its complex supply chains. Furthermore, these advancements are crucial for managing and enhancing online customer engagement, a key driver in today's automotive market.

For instance, by early 2024, many automotive retailers globally reported that over 60% of customer inquiries and initial contact points were happening digitally, highlighting the critical need for robust online presence and service capabilities.

Smart Glass and Augmented Reality in Vehicles

Smart glass and augmented reality (AR) integrated into vehicle windshields are rapidly transforming the automotive landscape. These advancements, featuring embedded sensors and dynamic displays, directly impact how automotive glass is manufactured, repaired, and maintained. For a company like Belron, this translates to a need for specialized calibration and repair services, as standard replacement methods are no longer sufficient.

The integration of AR into windshields allows for real-time data overlay, such as navigation, speed, and safety alerts, directly in the driver's line of sight. This technological leap requires sophisticated recalibration processes after any glass replacement to ensure the accuracy of these projected systems. By 2024, it's estimated that over 50% of new vehicles will feature some form of advanced driver-assistance systems (ADAS) that rely on precisely calibrated windshields.

- Technological Integration: Smart glass and AR windshields embed sensors and displays, creating complex integrated systems.

- Calibration Requirements: Post-replacement, these advanced windshields necessitate precise recalibration for ADAS functionality.

- Market Growth: The adoption of ADAS, heavily reliant on windshield technology, is projected to exceed 50% of new vehicles by 2024.

- Service Evolution: Automotive glass repair businesses must invest in new tools and training to service these high-tech components.

Innovation in Materials and Manufacturing

Innovation in materials and manufacturing is a significant technological driver for D'Ieteren Group. Advancements in sustainable materials, such as those used in Moleskine's product lines, are becoming increasingly important for consumer appeal and environmental responsibility. For instance, Moleskine has been exploring biodegradable and recycled paper options, aligning with growing consumer demand for eco-friendly goods.

In the automotive sector, particularly within D'Ieteren's dealerships and repair services, new composite materials and lighter alloys are transforming vehicle design and repair techniques. These innovations allow for more fuel-efficient and durable vehicles. The automotive aftermarket is also seeing an increase in demand for advanced diagnostic tools and repair equipment that can handle these new materials.

Furthermore, progress in recycling technologies is crucial for D'Ieteren's commitment to circular economy principles. This includes developing more efficient methods for recovering valuable materials from end-of-life vehicles and consumer products. For example, the European Union's focus on Extended Producer Responsibility (EPR) schemes, which are likely to strengthen through 2025, incentivizes companies to invest in better recycling infrastructure and processes.

- Sustainable Materials: Moleskine's adoption of recycled and biodegradable paper options reflects a broader industry trend towards eco-conscious product development.

- Advanced Composites: Automotive advancements utilize lightweight composites, improving vehicle performance and fuel efficiency, impacting repair and maintenance services.

- Recycling Technologies: Innovations in recycling support circular economy goals, with regulatory pressures like EU EPR schemes driving investment in material recovery by 2025.

Technological advancements are profoundly impacting D'Ieteren's automotive segments, particularly with the rise of electric vehicles (EVs). Belgium saw a significant 36% increase in new fully electric vehicle registrations in 2024, underscoring a market shift that D'Ieteren Automotive must strategically address.

The integration of Advanced Driver-Assistance Systems (ADAS) is also a key technological factor. By 2025, it's projected that over 80% of new vehicles in major markets will feature ADAS, directly increasing the demand for specialized recalibration services offered by companies like Belron.

Digitalization is transforming customer interactions and operational efficiency across D'Ieteren's businesses. By early 2024, over 60% of initial customer contact points in the automotive retail sector were digital, emphasizing the need for strong online capabilities.

Innovation in materials, such as Moleskine's use of recycled paper, and advanced composites in vehicles, alongside enhanced recycling technologies, are critical for D'Ieteren's sustainability and operational strategies, influenced by regulations like EU EPR schemes strengthening by 2025.

| Key Technological Trend | Impact on D'Ieteren | Relevant Data/Projection |

| EV Adoption | Shift in product offerings and sales strategies for D'Ieteren Automotive | 36% increase in new BEV registrations in Belgium (2024) |

| ADAS Integration | Increased demand for specialized recalibration services by Belron | Over 80% of new vehicles projected to have ADAS by 2025 |

| Digitalization | Enhanced customer engagement and operational efficiency | Over 60% of initial automotive customer contact points are digital (early 2024) |

| Material Innovation & Recycling | Focus on sustainability and advanced repair techniques | Strengthening EU EPR schemes by 2025 |

Legal factors

D'Ieteren Automotive is navigating increasingly stringent EU and Belgian vehicle emissions standards. The European Union has set ambitious CO2 targets for new cars, aiming for an average of 95 g CO2/km for 2020, with further reductions planned. For 2025, the target is significantly lower, pushing manufacturers towards electrification. Belgium, in line with EU directives, is also implementing measures to reduce emissions.

Carmakers that fail to meet these CO2 targets face substantial financial penalties. In 2023, fines for exceeding the average fleet emissions limit could reach €95 per gram of CO2 per vehicle sold. This financial pressure is a primary driver for the industry's accelerated shift towards electric vehicles (EVs) and other zero-emission technologies, directly impacting D'Ieteren's product portfolio and sales strategies.

Legal frameworks increasingly mandate the recalibration of Advanced Driver-Assistance Systems (ADAS) following vehicle repairs, especially after windshield replacements. This is a critical compliance point for Belron, as improper calibration can compromise vehicle safety and lead to significant legal repercussions.

Failure to adhere to these safety regulations can result in vehicles failing mandatory safety inspections, potentially leading to fines and a loss of consumer trust. Furthermore, manufacturers may void vehicle warranties if ADAS systems are not calibrated according to prescribed standards, impacting Belron's service offerings and customer satisfaction.

For instance, in the European Union, regulations like UNECE Regulation No. 46 and upcoming Euro NCAP protocols emphasize ADAS functionality and require proper calibration. In 2024, the automotive industry saw a significant rise in ADAS-equipped vehicles, with estimates suggesting over 70% of new cars sold in major markets feature some form of these advanced systems, underscoring the growing importance of compliant calibration services.

D'Ieteren Immo navigates a landscape shaped by Belgian real estate zoning laws, stringent building codes, and evolving environmental regulations. These legal frameworks dictate everything from land use to construction materials, directly impacting development timelines and costs.

A significant legal factor for 2025 is the mandate for minimum electric vehicle (EV) charging infrastructure in car parks of non-residential buildings. This new regulation, effective January 2025, will necessitate substantial adjustments to D'Ieteren Immo's development plans, requiring investment in charging points and potentially altering parking space configurations.

Data Privacy and Consumer Protection Laws

D'Ieteren Group must navigate a complex web of data privacy and consumer protection laws, such as the EU's General Data Protection Regulation (GDPR). Compliance is paramount due to the vast amounts of customer data collected across its automotive, repair, and retail segments. These regulations dictate how personal information is handled, fostering consumer trust and preventing hefty fines. For instance, GDPR violations can lead to penalties of up to 4% of annual global turnover or €20 million, whichever is higher.

Key legal factors impacting D'Ieteren include:

- GDPR Compliance: Strict adherence to rules on consent, data minimization, and breach notification is essential for all D'Ieteren operations handling personal data.

- Consumer Rights: Understanding and upholding consumer rights related to data access, rectification, and erasure across its diverse business units is critical.

- Cross-Border Data Transfers: Navigating regulations governing the transfer of customer data internationally, especially within its European operations, requires careful legal oversight.

- Evolving Regulations: Staying abreast of new or amended consumer protection legislation, such as potential updates to e-privacy directives, is crucial for ongoing compliance.

Taxation and Fiscal Incentives

Changes in tax policies, particularly concerning company vehicles, directly impact D'Ieteren Automotive's performance. For instance, Belgium's move to make only carbon-emission-free cars tax-deductible from 2026 will significantly alter fleet sales dynamics. This shift necessitates a strategic focus on electric vehicle (EV) offerings to maintain market share and profitability in this crucial segment.

Furthermore, regional disparities in tax incentives across different markets create a complex operating environment. D'Ieteren must navigate varying levels of government support for EVs and traditional vehicles, adapting its sales and marketing strategies accordingly. For example, countries offering substantial purchase subsidies for EVs can boost demand, while those with less favorable tax treatment might see slower adoption rates.

- Belgian Tax Deductibility: From 2026, only fully electric company cars will be tax-deductible in Belgium, impacting D'Ieteren's fleet sales.

- EV Transition Impact: This policy change is expected to accelerate the transition towards electric fleets for Belgian businesses.

- Regional Tax Variations: D'Ieteren must account for diverse tax regimes and incentives across its operating regions, influencing vehicle demand.

- Fiscal Policy Influence: Government fiscal policies on vehicle taxation and emissions remain a critical factor for D'Ieteren's automotive distribution and leasing businesses.

D'Ieteren faces evolving environmental regulations, particularly concerning vehicle emissions and energy efficiency in real estate. Stricter CO2 targets for new vehicles, like the EU's 2025 goals, are pushing the automotive sector towards electrification, directly impacting D'Ieteren Automotive's product mix and sales strategies. Similarly, new Belgian mandates for EV charging infrastructure in non-residential buildings from January 2025 will affect D'Ieteren Immo's development projects.

Compliance with data privacy laws, such as the GDPR, is critical across all D'Ieteren's operations, with potential fines up to 4% of global turnover for violations. The company must also navigate significant changes in tax policies, such as Belgium's 2026 decision to only allow fully electric company cars as tax-deductible, which will reshape its fleet sales and leasing businesses.

Safety regulations, especially regarding the recalibration of Advanced Driver-Assistance Systems (ADAS) after repairs, are a key legal concern for Belron. Improper calibration can lead to safety failures and legal liabilities, with an increasing number of vehicles in 2024 featuring ADAS, estimated at over 70% of new cars sold in major markets.

Environmental factors

D'Ieteren Group is making significant strides in reducing its environmental impact. For D'Ieteren Automotive, the company has set an ambitious goal to cut CO2 emissions by 50% by 2025, using 2019 as a baseline. This commitment is a direct response to and alignment with the European Union's overarching Green Deal initiative and individual member states' aspirations for climate neutrality.

D'Ieteren's Belron division actively champions circular economy principles, with a strong focus on vehicle parts and glass recycling. This commitment is evident in their ambitious goal of achieving 100% glass recycling wherever feasible.

In 2023, Belron successfully recycled 97% of glass, a significant achievement that directly reduces waste and promotes more sustainable resource management within the automotive aftermarket sector.

D'Ieteren Immo is actively embedding sustainability into its core strategy, aiming to enhance the environmental footprint of its properties. This commitment translates into designing infrastructure that is resilient for the future and a clear trajectory towards carbon neutrality. A key focus is the reduction of energy consumption across its portfolio, complemented by initiatives to generate green energy directly on its sites.

In 2023, D'Ieteren Immo reported a notable decrease in energy consumption for its properties, with specific sites achieving up to a 15% reduction in energy use compared to previous years. This progress aligns with broader European trends, where real estate investors are increasingly prioritizing energy efficiency to meet regulatory demands and attract environmentally conscious tenants, with the European Green Deal setting ambitious targets for building renovations and energy performance improvements by 2030.

Waste Management and Resource Preservation

D'Ieteren's commitment to effective waste management and resource preservation is crucial. This is particularly evident in their vehicle end-of-life operations. For instance, Febelauto reported that in Belgium during 2024, an impressive 97.9% of a vehicle's weight was recycled, highlighting a significant circular economy effort within the automotive sector that D'Ieteren participates in.

Beyond recycling, D'Ieteren focuses on minimizing waste throughout its manufacturing and repair processes. This proactive approach not only addresses environmental impact but also offers potential cost savings by optimizing resource utilization.

- Vehicle Recycling Rates: Belgium achieved 97.9% vehicle weight recycling in 2024, according to Febelauto.

- Operational Efficiency: Minimizing waste in manufacturing and repair directly contributes to resource preservation.

- Circular Economy: D'Ieteren's involvement in end-of-life vehicle management aligns with broader circular economy principles.

- Regulatory Compliance: Adherence to environmental regulations regarding waste is a key operational factor.

Supply Chain Sustainability

D'Ieteren is actively integrating sustainability into its supply chain by implementing robust procurement frameworks. This approach focuses on fostering continuous dialogue with suppliers to elevate their Environmental, Social, and Governance (ESG) performance. By extending environmental considerations beyond its own operations, the group aims to create a more resilient and responsible value chain.

The company's commitment to supply chain sustainability is evident in its proactive engagement with partners. For instance, in 2024, D'Ieteren reported that over 70% of its key suppliers were engaged in ESG assessments, a significant increase from 55% in 2023. This collaborative effort ensures that environmental stewardship is a shared responsibility across the entire network.

Key aspects of D'Ieteren's supply chain sustainability initiatives include:

- Sustainable Sourcing Policies: Implementing strict guidelines for material sourcing to minimize environmental impact.

- Supplier Audits and Training: Conducting regular audits to assess supplier ESG compliance and providing training to foster improvement.

- Circular Economy Principles: Encouraging suppliers to adopt circular economy models, reducing waste and promoting resource efficiency.

- Carbon Footprint Reduction: Collaborating with suppliers to identify and implement strategies for reducing greenhouse gas emissions throughout the supply chain.

D'Ieteren is actively addressing environmental concerns, aligning with global sustainability trends. The company's automotive division targets a 50% CO2 reduction by 2025 compared to 2019, mirroring EU Green Deal objectives. Belron champions a circular economy, achieving 97% glass recycling in 2023 and aiming for 100% where possible.

D'Ieteren Immo is enhancing property sustainability, focusing on energy reduction with some sites seeing up to a 15% decrease in energy use in 2023. Febelauto reported 97.9% vehicle weight recycling in Belgium for 2024, showcasing strong circular economy practices. Over 70% of D'Ieteren's key suppliers were engaged in ESG assessments in 2024, up from 55% in 2023.

| Initiative | Target/Metric | Year | Status/Achievement |

|---|---|---|---|

| D'Ieteren Automotive CO2 Reduction | 50% reduction | 2025 (vs 2019) | Ongoing alignment with EU Green Deal |

| Belron Glass Recycling | 100% where feasible | Ongoing | 97% achieved in 2023 |

| D'Ieteren Immo Energy Consumption | Reduction | 2023 | Up to 15% reduction at specific sites |

| Febelauto Vehicle Recycling Rate (Belgium) | 97.9% of vehicle weight | 2024 | Reported figure |

| Supplier ESG Engagement | >70% of key suppliers | 2024 | Up from 55% in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for D'Ieteren is built on a foundation of comprehensive data from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.