D'Ieteren Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D'Ieteren Bundle

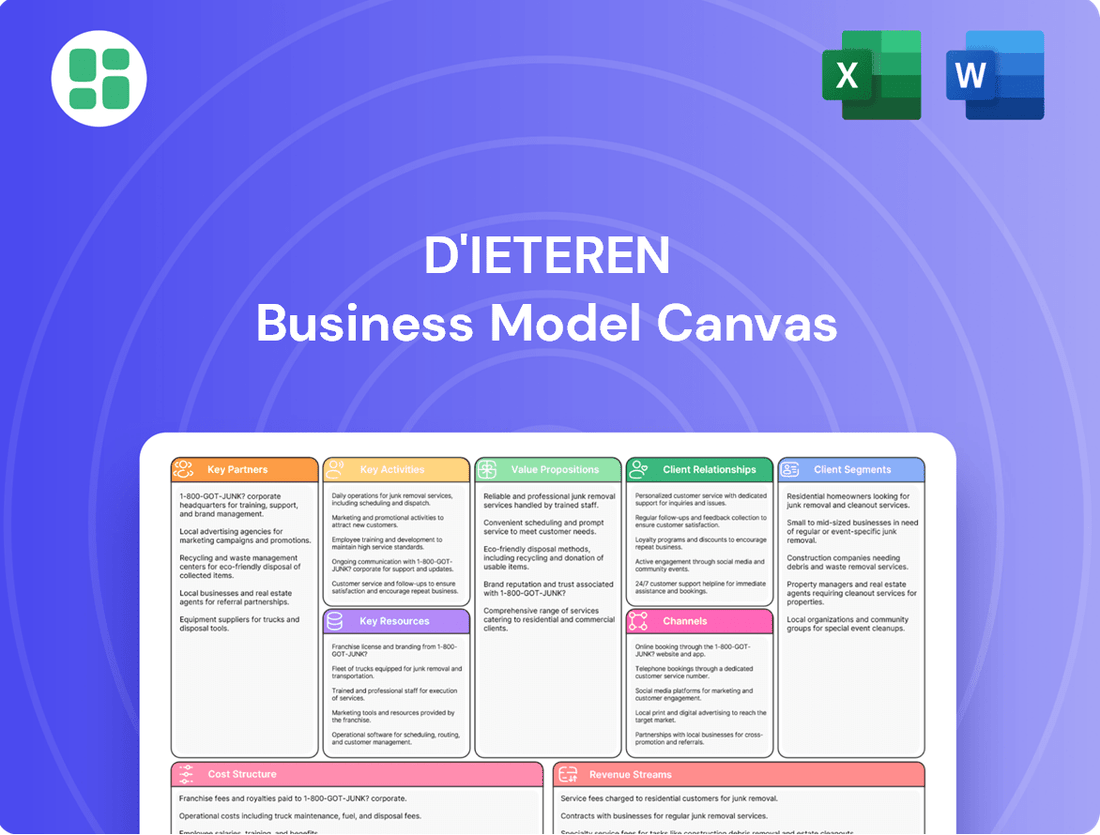

Curious about the engine driving D'Ieteren's diverse portfolio? Our Business Model Canvas dissects their approach to customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic interplay of their various ventures and gain inspiration for your own growth.

Partnerships

D'Ieteren Automotive's success hinges on robust partnerships with leading global car brands. They distribute vehicles from the Volkswagen Group, including Volkswagen, Audi, SEAT, Škoda, Bentley, Lamborghini, Bugatti, and Cupra, as well as Rimac, Maserati, and Porsche, in the Belgian market. These collaborations are vital for offering a comprehensive and desirable product portfolio to customers.

These relationships are built on licensing agreements that allow D'Ieteren to sell and service these prestigious brands. Effective supply chain management and strict adherence to each manufacturer's brand standards are critical components of these partnerships, ensuring consistent quality and customer experience across all distributed vehicles.

Belron, D'Ieteren's vehicle glass repair and replacement division, heavily relies on its relationships with insurance companies. These partnerships streamline the claims process for policyholders, making it easier for them to get their vehicles repaired. For instance, in 2024, Belron continued to solidify these relationships across its global operations, facilitating millions of claims annually.

Furthermore, Belron actively collaborates with large vehicle fleets, such as those operated by rental car companies and corporate entities. These fleet agreements guarantee a consistent flow of repair and replacement business, providing predictable revenue streams. In 2024, fleet services represented a significant portion of Belron's overall revenue, underscoring the importance of these strategic alliances.

D'Ieteren Group actively partners with technology innovators across its portfolio. For instance, Belron collaborates with tech firms to advance Advanced Driver Assistance Systems (ADAS) recalibration, a critical service for modern vehicles. In 2024, the automotive aftermarket saw continued growth in ADAS services, with an estimated global market size projected to reach over $30 billion by 2027, highlighting the importance of these tech partnerships.

Furthermore, digital platforms are crucial for D'Ieteren's automotive sales segments, enabling seamless customer experiences and efficient operations. D'Ieteren Immo also leverages smart building technologies to optimize property management and tenant services. This strategic embrace of new technologies is fundamental to maintaining a competitive edge in dynamic markets.

Material Suppliers and Manufacturers

Moleskine's commitment to premium quality hinges on its relationships with specialized paper and accessory suppliers. These partnerships are crucial for sourcing materials that meet their exacting standards, ensuring the tactile experience and durability customers expect from their notebooks and related stationery items. The company also emphasizes sustainable sourcing practices through these collaborations.

D'Ieteren Automotive's operational efficiency relies heavily on its network of parts and accessory suppliers. These partnerships are fundamental to maintaining a diverse and high-quality inventory for vehicle servicing and sales. In 2024, D'Ieteren's automotive segment continued to navigate global supply chain dynamics, reinforcing the importance of robust supplier relationships for product availability and customer satisfaction.

Belron, a global leader in vehicle glass repair and replacement, depends directly on glass manufacturers for its core product. These relationships are paramount for ensuring a consistent supply of specialized automotive glass, meeting the diverse needs of their international operations. Belron's global reach means these supplier partnerships must be resilient and adaptable to regional demands and technological advancements in automotive glass production.

- Moleskine: Partnerships with paper and accessory suppliers for premium product quality and sustainable sourcing.

- D'Ieteren Automotive: Collaborations with suppliers for vehicle parts and accessories, vital for inventory and operational stability.

- Belron: Dependence on glass manufacturers for a consistent supply of automotive glass, ensuring service delivery.

Real Estate Developers and Construction Firms

D'Ieteren Immo actively collaborates with a diverse range of real estate developers, architects, and construction firms. These partnerships are fundamental to the successful execution of its property development and management endeavors, encompassing new builds, significant renovations, and the implementation of eco-friendly construction practices.

These alliances are crucial for leveraging specialized expertise and resources, ensuring projects meet high standards of quality and sustainability. For instance, in 2024, D'Ieteren Immo continued to foster strategic relationships within the construction sector to drive its portfolio expansion and modernization efforts, particularly in urban regeneration projects.

- Strategic Alliances: D'Ieteren Immo forms joint ventures and project-specific partnerships with leading real estate developers to share risks and rewards.

- Construction Expertise: Collaborations with construction firms ensure efficient project delivery, adherence to building codes, and the integration of innovative construction techniques.

- Architectural Design: Partnerships with architectural firms are vital for creating aesthetically pleasing, functional, and sustainable building designs that align with market demands.

- Sustainability Focus: These key partnerships are instrumental in driving D'Ieteren Immo's commitment to sustainable building initiatives, incorporating green technologies and materials.

D'Ieteren's key partnerships are diverse, spanning automotive brands like Volkswagen Group and Porsche for distribution, insurance companies and fleet operators for Belron's glass services, and paper suppliers for Moleskine's premium products. These alliances are crucial for market access, operational efficiency, and maintaining product quality.

In 2024, D'Ieteren Automotive continued to strengthen its ties with manufacturers, ensuring access to new vehicle models and technologies. Belron's global network in 2024 benefited from ongoing collaborations with insurers, facilitating millions of customer claims and reinforcing its position in the vehicle glass repair market.

Moleskine's commitment to quality in 2024 was supported by its partnerships with specialized suppliers, ensuring the tactile experience and durability of its products. D'Ieteren Immo also actively engaged with real estate developers and construction firms in 2024 to drive its property portfolio expansion and modernization.

| Partner Type | D'Ieteren Segment | Key Role/Benefit | 2024 Focus/Impact |

|---|---|---|---|

| Automotive Manufacturers | D'Ieteren Automotive | Brand distribution, product portfolio | Securing new models, technology access |

| Insurance Companies | Belron | Streamlining claims, customer service | Facilitating millions of claims |

| Glass Manufacturers | Belron | Consistent supply of automotive glass | Ensuring service delivery, meeting diverse needs |

| Paper & Accessory Suppliers | Moleskine | Premium product quality, sustainable sourcing | Maintaining tactile experience and durability |

| Real Estate Developers | D'Ieteren Immo | Project execution, risk/reward sharing | Portfolio expansion, modernization efforts |

What is included in the product

A detailed breakdown of D'Ieteren's diversified business activities, mapping out its customer segments, value propositions, and revenue streams across automotive distribution, vehicle repair, and building solutions.

The D'Ieteren Business Model Canvas acts as a pain point reliver by providing a structured, visual framework that simplifies complex strategic thinking, saving valuable time and effort in articulating and refining the company's core operations and value propositions.

Activities

D'Ieteren Automotive's core activity is the import, wholesale, and retail distribution of a diverse range of vehicle brands across Belgium. This encompasses the entire supply chain, from bringing vehicles into the country to making them available to end consumers through their extensive dealership network.

The company manages complex logistics and inventory, ensuring a steady flow of vehicles to meet market demand. In 2023, D'Ieteren Automotive's operations in Belgium saw significant activity, with the group registering over 140,000 new vehicles, showcasing their substantial market presence and distribution capabilities.

Belron's core operations revolve around expert vehicle glass repair, replacement, and the essential recalibration of Advanced Driver Assistance Systems (ADAS). This multifaceted approach ensures vehicle safety and functionality.

The company's commitment to specialized technical training and a robust, geographically dispersed service network are paramount to delivering these critical services efficiently. This infrastructure is key to their market position.

With vehicle technology becoming increasingly sophisticated, recalibration services are no longer optional but a vital necessity. For instance, in 2024, ADAS systems are standard in a significant percentage of new vehicles, directly driving demand for this specialized expertise.

Moleskine's core activities revolve around the meticulous design and manufacturing of its iconic notebooks, pens, and related lifestyle accessories. This process emphasizes quality materials and a distinct aesthetic, ensuring the premium feel associated with the brand.

Global sales are driven by a multi-channel strategy, encompassing both direct-to-consumer online sales and a robust network of retail partners. In 2023, Moleskine continued to leverage its brand strength to reach customers worldwide, with a significant portion of its revenue generated through these diverse sales channels.

Real Estate Development and Portfolio Management

D'Ieteren Immo actively develops, acquires, and manages a diverse real estate portfolio, aiming for sustained long-term value creation. This encompasses meticulous strategic planning, rigorous construction oversight, and ongoing property maintenance to ensure optimal asset performance.

The company is increasingly embedding sustainable development principles into its projects, reflecting a commitment to environmental responsibility and future-proofing its assets. For instance, in 2024, D'Ieteren Immo continued to prioritize energy efficiency and green building certifications across its developments.

- Strategic Development: Identifying and executing new real estate projects, from initial concept to completion.

- Acquisition and Divestment: Proactively seeking and managing the purchase and sale of properties to optimize the portfolio.

- Property Management: Ensuring the efficient operation, maintenance, and leasing of existing assets.

- Sustainability Integration: Incorporating eco-friendly practices and materials in development and ongoing management.

Strategic Investment and Diversification Management

D'Ieteren Group actively steers its diverse business portfolio, focusing on identifying and nurturing long-term growth opportunities. This strategic approach involves carefully selecting new investments and divesting underperforming assets to maximize overall group value. The group's ambition is to hold leading positions within each of its operational segments.

In 2024, D'Ieteren continued its disciplined approach to capital allocation. For instance, its investment in automotive services, particularly through its Avis Europe operations, demonstrated a commitment to sectors with strong secular growth trends. The group's financial oversight ensures that capital is deployed efficiently, aiming for superior returns across its various pillars.

- Strategic Acquisitions and Divestitures: D'Ieteren continuously evaluates its portfolio, making strategic moves to enhance market positions and shareholder value.

- Long-Term Value Creation: The group prioritizes investments with sustainable growth potential, aiming to build leading businesses in their respective markets.

- Financial Oversight and Optimization: Robust financial management ensures efficient capital deployment and performance monitoring across all business units.

- Leadership Ambition: D'Ieteren strives for market leadership in each of its core activities, driving innovation and operational excellence.

D'Ieteren Group's key activities involve strategic management and capital allocation across its distinct business segments. This includes actively pursuing growth opportunities through acquisitions and optimizing the performance of its existing portfolio. The group's overarching goal is to foster market leadership within each of its core operational areas, ensuring long-term value creation and financial resilience.

For example, in 2024, D'Ieteren's strategic focus on automotive services, exemplified by its Avis Europe operations, underscores its commitment to sectors exhibiting robust secular growth trends. This disciplined capital deployment aims for superior returns across all business pillars.

| Business Segment | Key Activities | 2024 Strategic Focus |

|---|---|---|

| D'Ieteren Automotive | Vehicle import, wholesale, and retail distribution | Enhancing market presence and distribution capabilities |

| Belron | Vehicle glass repair, replacement, and ADAS recalibration | Expanding specialized technical training and service network |

| Moleskine | Design, manufacturing, and global sales of lifestyle accessories | Leveraging brand strength for multi-channel growth |

| D'Ieteren Immo | Real estate development, acquisition, and management | Integrating sustainable development principles and energy efficiency |

| Group Management | Portfolio steering, investment, and divestment | Disciplined capital allocation and pursuit of market leadership |

Full Version Awaits

Business Model Canvas

The D'Ieteren Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas, allowing you to immediately begin your strategic analysis.

Resources

D'Ieteren Group's key resources include a robust portfolio of strong brands like Belron (encompassing Carglass and Safelite), Moleskine, and its distributed automotive brands. These brands are not just names; they represent substantial intellectual property and deeply ingrained brand equity.

The inherent strength of these brands acts as a powerful magnet, drawing in customers and fostering unwavering market loyalty. For instance, Belron's leading positions in vehicle glass repair and replacement globally, evidenced by its significant market share in key regions, highlight the tangible value of this brand strength.

D'Ieteren Automotive boasts an impressive network of dealerships and service centers throughout Belgium, ensuring widespread customer reach and convenient access to vehicle maintenance. This robust physical infrastructure is fundamental to their operational efficiency and customer engagement.

Complementing this, Belron, a key part of D'Ieteren, manages an extensive global network of service points dedicated to vehicle glass repair. In 2023, Belron served over 11 million customers worldwide, highlighting the sheer scale and importance of its accessible service points in delivering timely and effective solutions.

D'Ieteren Group's operations across its diverse segments, from automotive services to vehicle glass repair, are underpinned by a workforce possessing specialized skills. This includes highly trained automotive technicians, expert glaziers, innovative product designers, and astute real estate professionals, all crucial for maintaining service quality and driving business success.

The group emphasizes continuous learning and development to keep its employees at the forefront of technological advancements and shifting market expectations. For instance, in 2024, D'Ieteren Auto in Belgium invested heavily in training programs focused on electric vehicle (EV) maintenance and diagnostics, ensuring their technicians are equipped for the growing EV market.

Physical Assets and Real Estate Portfolio

D'Ieteren's physical assets are crucial for its operations, encompassing vehicle showrooms and service centers vital for its automotive distribution and repair segments. The group also operates production facilities for Moleskine, its lifestyle brand, ensuring direct control over product manufacturing. These tangible resources are fundamental to delivering its services and products effectively.

The company's substantial real estate portfolio, managed by D'Ieteren Immo, represents a significant tangible asset. This includes properties used for its various business activities and potentially investment properties. Strategic management of these physical assets is key to supporting business continuity, enabling operational expansion, and potentially generating rental income.

- Vehicle Showrooms and Service Centers: Essential for customer interaction and vehicle maintenance for brands like Volkswagen, Audi, and Porsche.

- Moleskine Production Facilities: Dedicated sites for manufacturing notebooks, journals, and other stationery products.

- D'Ieteren Immo Real Estate: A diverse portfolio of properties supporting group operations and strategic investments.

Financial Capital and Investment Capacity

D'Ieteren Group's substantial financial capital underpins its role as a diversified industrial and services group, allowing for significant strategic investments and acquisitions. This financial strength is crucial for driving long-term growth and maintaining operational flexibility in evolving markets.

In 2024, D'Ieteren demonstrated this capacity through strategic capital allocation, a core element of its business model. For instance, the group reported a strong financial performance, with a reported revenue of €4.9 billion for the first half of 2024, showcasing its investment capacity.

- Financial Strength: D'Ieteren possesses considerable financial resources to fund growth, acquisitions, and innovation across its diverse portfolio.

- Strategic Investments: The group actively deploys capital into strategic initiatives, as evidenced by its consistent investment in its core businesses.

- Capital Allocation: Sound capital allocation is a fundamental pillar, ensuring resources are directed towards opportunities that maximize shareholder value and long-term sustainability.

- Market Adaptability: This financial flexibility allows D'Ieteren to adapt to market shifts and pursue new avenues for expansion and development.

D'Ieteren's key resources are its powerful brands, extensive operational networks, skilled workforce, significant physical assets, and robust financial capital. These elements collectively enable the group to deliver value across its diverse business segments.

| Resource Category | Specific Examples | Significance |

|---|---|---|

| Brand Portfolio | Belron (Carglass, Safelite), Moleskine, D'Ieteren Automotive brands | Intellectual property, brand equity, customer loyalty |

| Operational Networks | Belron's global service points, D'Ieteren Automotive's Belgian dealerships | Customer reach, service accessibility, operational efficiency |

| Human Capital | Trained technicians, glaziers, designers, real estate professionals | Service quality, innovation, business success |

| Physical Assets | Showrooms, service centers, Moleskine production facilities, real estate portfolio | Operational support, product manufacturing, strategic investment |

| Financial Capital | Strong financial performance, capital for investments and acquisitions | Growth funding, market adaptability, long-term sustainability |

Value Propositions

D'Ieteren Automotive provides a broad spectrum of vehicles and integrated mobility services, encompassing sales, financing, and maintenance. This comprehensive approach ensures customers have diverse options to meet their transportation requirements, from traditional car ownership to newer mobility solutions.

In 2024, D'Ieteren continued to expand its mobility offerings, reflecting a strategic shift towards integrated customer journeys. The company's commitment to providing end-to-end solutions aims to capture a larger share of the evolving automotive market.

Belron, through brands like Safelite in the US, offers dependable and convenient vehicle glass services. They focus on prompt, high-quality repairs and replacements, ensuring vehicle safety and functionality are quickly restored. In 2024, Safelite alone handled over 6 million customer appointments, highlighting the demand for their accessible solutions.

The extensive network and mobile service options provided by Belron underscore a commitment to customer convenience. This approach minimizes disruption, allowing customers to get back on the road safely and efficiently. Their mobile fleet, for instance, conducts a significant portion of repairs at customer locations, enhancing ease of access.

Moleskine's premium design and quality are central to its value proposition, offering iconic notebooks and accessories that serve as tangible tools for creative expression and organized thought. These products are meticulously crafted, emphasizing durability and a timeless aesthetic that resonates with users seeking sophisticated instruments for their ideas.

The brand's commitment to superior materials and distinctive design fosters a sense of elevated experience, positioning Moleskine not just as stationery, but as a companion for artistic endeavors and professional pursuits. This focus on premium attributes directly supports the creative and organizational needs of its target audience.

In 2024, Moleskine continued to leverage this reputation, with its notebooks and related accessories being a cornerstone of its offering, appealing to individuals who value both form and function in their daily lives and creative projects.

Sustainable and Value-Driven Real Estate Solutions

D'Ieteren Immo champions sustainable and value-driven real estate, focusing on future-proof developments. This commitment translates to energy-efficient buildings and intelligent urban planning, ensuring long-term benefits for everyone involved.

Their approach directly addresses growing societal and environmental expectations. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, pushing for higher energy performance standards in new and existing buildings, a trend D'Ieteren Immo is well-positioned to capitalize on.

- Focus on Energy Efficiency: Developing properties designed to minimize energy consumption, aligning with increasing utility costs and environmental regulations.

- Future-Proofing Urban Planning: Integrating smart city concepts and adaptable designs to anticipate future needs and technological advancements.

- Long-Term Value Creation: Prioritizing quality and sustainability to enhance asset value and tenant satisfaction over the lifespan of the property.

- Meeting Evolving Demands: Responding to market shifts that favor environmentally conscious and socially responsible real estate investments.

Long-term Value Creation and Diversified Stability

D'Ieteren Group focuses on building enduring value by strategically investing in market-leading companies. This approach ensures resilience and consistent performance, even when different economic sectors experience fluctuations. Their diversified portfolio, encompassing areas like automotive aftermarket (through parts and services), vehicle leasing and fleet management, and building supplies, is designed to weather various economic climates.

This diversification is a core strength. For instance, in 2024, D'Ieteren's automotive aftermarket segment, centered around parts and services, demonstrated robust performance, while other segments might have faced different market dynamics. This spread of investments allows the group to capitalize on growth wherever it appears and to cushion against downturns in specific industries.

- Strategic Investments: D'Ieteren actively seeks and manages leading businesses for sustained growth.

- Economic Resilience: Diversification across sectors like automotive aftermarket and building supplies provides stability through economic cycles.

- Risk Mitigation: A broad portfolio reduces the impact of underperformance in any single business area.

- Opportunity Capture: The group is positioned to benefit from growth trends across its varied investments.

D'Ieteren Group's value proposition centers on building lasting value through strategic investments in market-leading companies. This diversified approach across sectors like automotive aftermarket, vehicle leasing, and building supplies ensures resilience and consistent performance, allowing the group to navigate varying economic conditions effectively. For example, in 2024, D'Ieteren's automotive aftermarket segment showed strong results, demonstrating the benefit of its broad investment strategy.

The group's commitment to strategic investment and diversification underpins its ability to capture growth opportunities while mitigating risks. This balanced strategy positions D'Ieteren for sustained success by capitalizing on emerging trends and maintaining stability through economic cycles.

D'Ieteren Automotive offers a comprehensive suite of vehicles and integrated mobility services, covering sales, financing, and maintenance. This end-to-end approach provides customers with a wide array of choices to satisfy their transportation needs, from traditional car ownership to innovative mobility solutions. By expanding its mobility offerings in 2024, D'Ieteren is enhancing customer journeys and strengthening its market position.

Belron, through brands like Safelite, delivers convenient and reliable vehicle glass repair and replacement services. Their focus on prompt, high-quality service ensures vehicle safety and functionality are quickly restored. Safelite's extensive network and mobile service options, which conducted over 6 million appointments in 2024, highlight their dedication to customer convenience and accessibility.

Moleskine provides premium notebooks and accessories, recognized for their quality design and durability. These products serve as essential tools for creativity and organization, appealing to individuals who value both aesthetics and functionality. In 2024, Moleskine continued to build on its reputation for superior materials and distinctive design, reinforcing its appeal to a discerning customer base.

D'Ieteren Immo focuses on sustainable, value-driven real estate development with an emphasis on future-proof, energy-efficient buildings and smart urban planning. This strategy aligns with growing environmental expectations and regulatory trends, such as the EU's Green Deal initiatives, ensuring long-term benefits and asset value. Their developments aim to meet evolving market demands for environmentally conscious properties.

| Business Segment | Key Value Proposition | 2024 Highlight/Data Point |

| D'Ieteren Automotive | Integrated mobility solutions, broad vehicle offerings, financing, and maintenance. | Expanded mobility offerings to enhance customer journeys. |

| Belron | Convenient and dependable vehicle glass repair and replacement services. | Safelite handled over 6 million customer appointments. |

| Moleskine | Premium design, quality materials, and durability in notebooks and accessories for creativity and organization. | Continued to leverage brand reputation for form and function. |

| D'Ieteren Immo | Sustainable, future-proof real estate development with energy efficiency and smart urban planning. | Positioned to capitalize on EU Green Deal initiatives for energy performance. |

| D'Ieteren Group (Holding) | Strategic investment in market-leading companies for diversification and resilience. | Automotive aftermarket segment demonstrated robust performance. |

Customer Relationships

D'Ieteren Automotive cultivates strong customer relationships through highly personalized experiences at its dealerships. This involves offering tailored advice during the vehicle selection process, ensuring customers find the perfect fit for their needs.

Beyond the initial purchase, a comprehensive after-sales support system is in place, covering essential services like maintenance and repairs. This high-touch approach aims to build lasting loyalty and encourage repeat business.

In 2024, D'Ieteren reported that customer satisfaction scores remained a key performance indicator, with initiatives focused on enhancing the dealership experience and the efficiency of after-sales services contributing to a significant portion of their recurring revenue streams.

Belron, through its brands like Carglass, prioritizes efficient and trustworthy service delivery. This means ensuring technicians are highly trained and equipped to handle repairs and replacements promptly and professionally, whether at a service center or through mobile units. In 2024, Belron continued to invest in its workforce, aiming to maintain high customer satisfaction scores, which are crucial for repeat business and positive word-of-mouth referrals.

Moleskine fosters a vibrant brand community by connecting creative individuals and professionals through its products, events, and digital platforms. This engagement goes beyond mere transactions, aiming to build a lifestyle around creativity and self-expression.

The brand actively cultivates this community by offering engaging content, hands-on workshops, and online spaces where users can share their experiences and projects. This approach reinforces Moleskine's position as more than just a notebook provider, but a facilitator of creative journeys.

In 2024, Moleskine continued to leverage digital channels, with its social media presence reaching millions of followers who actively participate in brand-related discussions and content sharing, underscoring the strength of its community-driven strategy.

Long-Term Tenant and Partner Relationships

D'Ieteren Immo cultivates deep, long-term relationships with its tenants and development partners by actively listening to their changing requirements and offering attentive property management. This commitment often translates into tailored solutions and consistent, open communication, fostering sustainable, win-win collaborations.

- Tenant Focus: D'Ieteren Immo prioritizes understanding tenant needs, leading to higher retention rates and collaborative problem-solving.

- Partner Collaboration: By working closely with development partners, D'Ieteren Immo ensures projects align with market demands and long-term viability.

- Proactive Management: Responsive and proactive property management minimizes disruptions and enhances the value of leased spaces.

Investor Relations and Transparency

D'Ieteren Group prioritizes robust investor relations and transparency. This commitment is evident in their regular financial reporting, investor days, and consistent communication regarding strategic direction and performance.

- Proactive Communication: D'Ieteren Group actively engages with its investor base through various channels to ensure they are well-informed.

- Financial Reporting: The group adheres to strict financial reporting standards, providing timely and accurate updates on its performance.

- Strategy and Performance Updates: Investor days and other forums are utilized to clearly articulate the group's strategy and progress against key performance indicators.

- Building Confidence: As a publicly quoted entity, fostering investor confidence through transparency is paramount to maintaining its market standing. For instance, in their 2024 half-year results, D'Ieteren highlighted strong operational performance across its divisions, which was reflected in positive market reception.

D'Ieteren Automotive fosters loyalty through personalized customer journeys, from tailored sales advice to comprehensive after-sales support. This high-touch approach aims to build lasting relationships and drive repeat business, with customer satisfaction scores being a key metric in 2024.

Belron, via brands like Carglass, focuses on efficient, trustworthy service, investing in technician training in 2024 to ensure prompt, professional repairs and replacements, which is vital for customer retention and positive referrals.

Moleskine builds a strong community by connecting creative individuals through its products and digital platforms, fostering a lifestyle around creativity. In 2024, its social media engagement reached millions, highlighting the success of this community-driven strategy.

D'Ieteren Immo cultivates long-term tenant and partner relationships through attentive property management and open communication, ensuring projects align with market needs and tenant satisfaction.

| Division | Customer Relationship Strategy | 2024 Focus/Data Point |

|---|---|---|

| D'Ieteren Automotive | Personalized sales & comprehensive after-sales support | High customer satisfaction scores |

| Belron | Efficient, trustworthy service delivery & skilled technicians | Investment in workforce for customer satisfaction |

| Moleskine | Community building via products, events & digital platforms | Millions of social media followers engaged |

| D'Ieteren Immo | Attentive property management & open communication | Tenant retention and partner collaboration |

| D'Ieteren Group (Investors) | Transparency, regular reporting & proactive communication | Positive market reception to 2024 financial updates |

Channels

D'Ieteren Automotive's extensive network of authorized dealerships across Belgium is the backbone of its sales and customer engagement strategy. These physical locations are crucial for offering test drives, facilitating financing options, and providing essential after-sales support, ensuring a comprehensive and localized customer journey.

In 2024, D'Ieteren Automotive continued to leverage this robust network, which is instrumental in delivering a high-touch customer experience. The dealerships act as primary points of contact for vehicle acquisition and ongoing maintenance, reinforcing brand loyalty and driving repeat business.

Belron leverages a widespread global network of service centers and mobile units to serve its customers. This dual strategy ensures both specialized in-shop repairs and convenient on-site service, catering to diverse customer needs and preferences. In 2024, Belron continued to expand its mobile fleet, recognizing the significant customer demand for at-home convenience.

Moleskine leverages a dual-pronged strategy for product distribution: its own branded retail stores and a robust global e-commerce platform. This direct-to-consumer approach allows for brand control and a curated customer experience.

The e-commerce channel is particularly vital, offering Moleskine extensive global reach and a direct avenue for customer interaction and data collection. In 2024, Moleskine's parent company, D'Ieteren, reported continued growth in its online sales, reflecting the increasing importance of digital channels for the brand.

Direct Sales and Property Management for Real Estate

D'Ieteren Immo utilizes direct sales and leasing as primary channels for its real estate ventures, engaging directly with both commercial and residential customers. This hands-on approach facilitates a deeper understanding of client needs and allows for customized property solutions. In 2024, the company continued to refine its direct sales strategies, aiming to streamline the acquisition process for businesses seeking office or retail space.

Property management functions also serve as a crucial direct channel. D'Ieteren Immo's management teams are the frontline for tenant communication, service provision, and ongoing relationship management within their developed properties. This direct interaction ensures prompt attention to tenant needs and fosters loyalty. For instance, their focus on tenant retention in their commercial portfolios aims to minimize vacancy rates, a key performance indicator in property management.

The emphasis on direct engagement allows D'Ieteren Immo to build stronger, more personalized relationships with its clients. This strategy is particularly effective in the commercial real estate sector, where long-term partnerships are often built on trust and tailored service offerings. By cutting out intermediaries, they can offer more competitive leasing terms and responsive management, contributing to higher client satisfaction and occupancy levels.

Key aspects of these direct channels include:

- Direct Sales & Leasing: Engaging directly with businesses and individuals for property transactions.

- Property Management: Serving as the primary point of contact for tenant relations and facility services.

- Relationship Building: Fostering strong client connections through personalized interactions.

- Tailored Solutions: Offering customized property and service packages to meet specific client requirements.

Corporate Websites and Investor Relations Portals

D'Ieteren Group leverages its corporate website and dedicated investor relations portals as primary channels for communicating with its broad stakeholder base. These platforms are crucial for disseminating financial reports, strategic updates, and timely news, ensuring transparency. For instance, as of their 2023 annual report, these digital hubs provide easy access to detailed financial statements and management commentary.

- Corporate Website: Serves as the main gateway for all public information, including company history, business segments, and corporate governance.

- Investor Relations Portal: Offers specialized content for investors, such as financial calendars, stock information, and presentations.

- Press Releases: Used for immediate announcements of material information, ensuring all stakeholders receive critical updates simultaneously.

- Financial Reporting: Provides access to annual and interim reports, crucial for in-depth analysis by investors and analysts.

D'Ieteren's channels are a mix of direct and indirect approaches tailored to each business segment. D'Ieteren Automotive relies heavily on its authorized dealership network for sales and after-sales service, ensuring a localized customer experience. Belron utilizes a global network of service centers and mobile units for efficient glass repair and replacement, with a growing emphasis on mobile services in 2024 to meet customer demand for convenience.

Moleskine employs a direct-to-consumer strategy through its branded retail stores and e-commerce platform, which saw continued growth in 2024, highlighting the importance of digital channels. D'Ieteren Immo uses direct sales and leasing, alongside property management, to build strong client relationships and offer tailored real estate solutions. The group's corporate website and investor relations portals serve as key communication channels for stakeholders, providing access to financial reports and strategic updates.

| Business Segment | Primary Channels | Key Activities | 2024 Focus/Trend |

|---|---|---|---|

| D'Ieteren Automotive | Authorized Dealerships | Sales, Test Drives, Financing, After-Sales | High-touch customer experience |

| Belron | Service Centers, Mobile Units | Glass Repair & Replacement | Expansion of mobile fleet |

| Moleskine | Branded Retail Stores, E-commerce | Direct Sales, Brand Experience | Growth in online sales |

| D'Ieteren Immo | Direct Sales, Leasing, Property Management | Real Estate Transactions, Tenant Relations | Streamlining acquisition process |

| Group Communication | Corporate Website, Investor Relations Portals | Information Dissemination, Stakeholder Engagement | Transparency in financial reporting |

Customer Segments

Individual car buyers and households represent a core customer base for D'Ieteren Automotive, seeking personal transportation solutions. This segment prioritizes factors like brand prestige, fuel economy, advanced safety technologies, and dependable after-sales support to ensure a positive ownership experience.

In 2024, the European automotive market saw continued demand for SUVs and electrified vehicles, aligning with D'Ieteren's offerings. For instance, in Belgium, new passenger car registrations reached over 400,000 units by mid-2024, with a significant portion attributed to private buyers.

Corporate fleets and business clients represent a crucial customer segment for D'Ieteren, encompassing companies and organizations that acquire vehicles for their operational needs. This group prioritizes the total cost of ownership, seeking robust fleet management solutions and attractive corporate discounts. In 2024, the automotive industry saw continued demand from businesses focused on efficiency and cost-effectiveness, with fleet sales remaining a significant contributor to overall vehicle turnover.

Insurance companies are crucial customer segments for Belron, acting as vital intermediaries and referrers for vehicle glass repair and replacement services. These B2B relationships are often cemented through long-term contracts, ensuring a steady stream of business.

Automotive service providers also represent a significant customer segment, frequently outsourcing specialized vehicle glass work to Belron. This allows them to focus on their core competencies while leveraging Belron's expertise.

Creative Professionals and Students

Moleskine deeply connects with creative professionals and students, including artists, writers, designers, and academics. These individuals seek out Moleskine for its reputation for producing high-quality, durable, and visually appealing stationery that supports their creative processes and daily organization.

This segment is drawn to Moleskine's rich heritage and its association with intellectual and artistic endeavors, viewing the notebooks as essential tools for idea generation and personal expression. For example, Moleskine's 2023 financial reports indicated continued strong demand within this demographic, with a notable increase in sales of their premium notebook lines.

- Target Audience: Artists, writers, designers, academics, students.

- Key Values: High-quality, durability, aesthetic appeal, heritage, intellectual connection.

- Product Role: Tools for ideation, self-expression, and organization.

- Market Insight: Continued strong demand in 2023, particularly for premium notebooks.

Real Estate Tenants (Commercial & Residential) and Investors

D'Ieteren Immo caters to businesses needing commercial spaces such as offices, retail outlets, and logistics facilities, alongside potential opportunities for residential property offerings. These clients prioritize strategic locations and well-maintained, modern facilities.

Investors seeking stable, long-term real estate assets represent another crucial customer segment. They are drawn to properties with a focus on sustainability and responsible management practices, aiming for reliable returns on their investments.

- Commercial Tenants: Businesses requiring office, retail, or logistics spaces, valuing prime locations and contemporary amenities.

- Residential Tenants: Individuals seeking housing, likely prioritizing convenience and quality of life.

- Real Estate Investors: Individuals and entities looking for sustainable, long-term property investments with consistent returns.

D'Ieteren's customer segments are diverse, reflecting its multi-faceted business model. For D'Ieteren Automotive, individual car buyers and corporate fleets are key, with a growing emphasis on SUVs and electrified vehicles in 2024. Belron, the vehicle glass repair specialist, relies heavily on insurance companies and other automotive service providers as its primary customers.

Moleskine's customer base consists mainly of creative professionals and students who value its high-quality, aesthetically pleasing notebooks, with strong sales continuing into 2023. D'Ieteren Immo serves both commercial tenants seeking functional spaces and investors looking for stable real estate assets.

| Business Segment | Primary Customer Segments | Key Needs/Values | 2024/Recent Market Insight |

|---|---|---|---|

| D'Ieteren Automotive | Individual car buyers, Households, Corporate fleets | Personal transportation, Total Cost of Ownership, Fleet management | Continued demand for SUVs and EVs; Belgian new car registrations over 400,000 by mid-2024. |

| Belron | Insurance companies, Automotive service providers | Vehicle glass repair and replacement, Long-term contracts, Outsourced expertise | Steady business from B2B relationships. |

| Moleskine | Creative professionals, Students (artists, writers, designers, academics) | High-quality stationery, Durability, Aesthetic appeal, Ideation tools | Strong demand in 2023, especially for premium notebooks. |

| D'Ieteren Immo | Commercial tenants (businesses), Real estate investors | Commercial spaces (office, retail, logistics), Strategic locations, Stable real estate assets | Focus on well-maintained, modern facilities and sustainable property management. |

Cost Structure

D'Ieteren Group's cost structure is heavily influenced by inventory and procurement. For D'Ieteren Automotive, the acquisition of vehicles represents a substantial expense. Similarly, Belron incurs significant costs for sourcing vehicle glass and replacement parts, while Moleskine manages expenses related to the procurement of raw materials for its iconic notebooks and related products.

Efficient inventory management is therefore a critical lever for cost control across these diverse business segments. The group must navigate the complexities of global supply chains and the volatility of raw material prices, which can directly impact profit margins. For instance, in 2024, automotive manufacturers globally continued to grapple with supply chain disruptions, leading to potential increases in vehicle procurement costs for D'Ieteren Automotive.

Personnel and labor costs are a significant expenditure for D'Ieteren, encompassing salaries, wages, benefits, and training for a vast workforce across its diverse segments. This includes technicians, sales personnel, and administrative staff, all crucial for smooth operations.

Belron, D'Ieteren's automotive glass repair and replacement division, stands out with a particularly large workforce dedicated to its extensive service network. In 2023, Belron employed over 30,000 people globally, highlighting the scale of its labor-intensive operations.

Effectively managing labor efficiency and ensuring high employee retention are paramount for controlling these substantial costs and maintaining service quality across all D'Ieteren's businesses.

D'Ieteren's cost structure heavily relies on maintaining its vast operational footprint. This includes significant expenses for its extensive dealership networks, Belron service centers, and Moleskine retail stores. For instance, in 2024, the company continued to invest in upgrading and expanding these physical locations to ensure optimal customer experience and operational efficiency.

These costs encompass essential elements like rent, utilities, and ongoing maintenance for all properties. Depreciation on these assets also represents a substantial fixed cost. In 2024, D'Ieteren reported that facilities management remained a key focus area for cost optimization, with efforts concentrated on energy efficiency and preventative maintenance programs across its portfolio.

Marketing, Sales, and Distribution Costs

D'Ieteren allocates significant resources to marketing and advertising, a crucial element for promoting its diverse portfolio, which includes vehicle brands, Belron's glass repair services, and Moleskine's stationery. These investments are designed to effectively reach and engage specific customer segments across its various businesses.

Distribution costs represent another substantial part of the company's structure, encompassing the logistics and transportation necessary to get products and services to market. For instance, managing the fleet and repair network for Belron involves considerable logistical expenditure.

- Marketing Investment: D'Ieteren's commitment to brand visibility is substantial, with marketing and advertising forming a key cost driver to attract and retain customers for its automotive and lifestyle brands.

- Distribution Network: The operational efficiency of Belron's extensive network of repair centers and its vehicle distribution activities necessitate significant spending on logistics and transportation infrastructure.

- Customer Reach: Effective marketing strategies are paramount for D'Ieteren to connect with its diverse customer base, ensuring brand awareness and driving sales across all its business segments.

Research, Development, and Technology Investment

D'Ieteren Group's commitment to Research, Development, and Technology is a cornerstone of its business model, driving innovation across its diverse portfolio. While specific R&D figures for each segment aren't always detailed publicly, the group's strategic focus points to significant investment in areas like advanced driver-assistance systems (ADAS) recalibration technology, essential for its automotive services. This ongoing technological advancement necessitates continuous capital allocation to maintain a competitive edge and foster future expansion.

For example, in 2024, the automotive aftermarket sector, where D'Ieteren operates significantly through brands like Belron, continued to see substantial investment in digital tools and diagnostic equipment. This investment directly supports the development and implementation of sophisticated ADAS recalibration services, a growing demand within the industry. Moleskine, another key D'Ieteren brand, also likely dedicates resources to product innovation, exploring new materials and digital integration for its iconic notebooks and related accessories.

- ADAS Recalibration Tech: D'Ieteren's automotive segment, particularly through Belron, invests heavily in the technology and training required for advanced driver-assistance systems recalibration, a critical service for modern vehicles.

- Moleskine Product Innovation: The Moleskine brand focuses on R&D for new product designs, material advancements, and the integration of digital features into its stationery and lifestyle products.

- Sustainable Building Technologies: While less publicized, D'Ieteren's involvement in building materials and solutions suggests investment in research for more sustainable and efficient technologies within this sector.

- Continuous Capital Outlay: The dynamic nature of technology across all D'Ieteren's business areas mandates consistent capital expenditure to ensure the group remains at the forefront of innovation and market trends.

D'Ieteren's cost structure is characterized by significant investments in its operational infrastructure, including extensive networks of dealerships, service centers, and retail stores. These facilities require ongoing expenditure for rent, utilities, and maintenance, with depreciation on assets also representing a notable fixed cost. In 2024, the company continued to prioritize facility upgrades and energy efficiency programs to optimize these operational expenses.

Marketing and distribution costs are also substantial, funding brand promotion across automotive, glass repair, and lifestyle segments, alongside the logistics required to deliver products and services. For instance, managing Belron's repair network involves considerable logistical outlays. D'Ieteren's commitment to innovation is reflected in its R&D spending, particularly in areas like ADAS recalibration technology for its automotive services, and product development for Moleskine.

| Cost Category | Key Components | 2024 Focus/Examples |

|---|---|---|

| Operational Infrastructure | Dealerships, Service Centers, Retail Stores | Facility upgrades, energy efficiency |

| Marketing & Distribution | Advertising, Logistics, Transportation | Brand promotion, network management |

| Research & Development | Technology, Product Innovation | ADAS recalibration, Moleskine product development |

Revenue Streams

D'Ieteren Automotive's core revenue comes from selling new and used cars, a high-volume segment where market share and the specific models sold are key drivers. In 2024, the automotive retail sector saw continued demand, with new car registrations in Europe showing resilience despite economic headwinds.

Beyond vehicle sales, the company capitalizes on financing and insurance services tied to these purchases. These ancillary offerings provide a consistent and profitable revenue stream, enhancing the overall profitability of each transaction and contributing significantly to total income.

Belron's primary income source is the fees collected for repairing, replacing, and recalibrating vehicle glass. This revenue is generated through direct payments from vehicle owners and reimbursements from various insurance providers.

The growing adoption of Advanced Driver Assistance Systems (ADAS) in modern vehicles is a significant factor boosting revenue. These sophisticated systems often require specialized recalibration after glass replacement, leading to higher-value service charges.

In 2024, Belron's business, which heavily relies on these services, saw continued demand. For instance, the company's strong performance in its automotive glass repair and replacement segment, a core part of its operations, contributed significantly to its overall financial results, reflecting the ongoing need for these essential automotive services.

Moleskine's primary revenue stream comes from the global sale of its premium notebooks, planners, pens, bags, and other lifestyle accessories. These are distributed through a mix of owned retail stores, authorized dealers, and e-commerce platforms. For instance, in 2023, Moleskine saw continued growth in its direct-to-consumer channels, reflecting a strong brand loyalty.

Rental Income and Property Sales

D'Ieteren Immo's revenue generation primarily stems from two key activities: rental income and property sales. The company collects consistent rental income from its portfolio of commercial and residential properties, providing a stable revenue base. While property sales can contribute, the emphasis on a long-term hold strategy suggests that rental income is the more dominant and strategically prioritized revenue stream.

For instance, in 2023, D'Ieteren's real estate segment, which includes D'Ieteren Immo, reported significant contributions to the group's overall performance. While specific figures for D'Ieteren Immo's rental income versus property sales are not always broken out separately in public reports, the broader segment's success underscores the viability of these revenue streams. The strategy prioritizes steady cash flow from leases, making property sales a secondary, opportunistic revenue source.

- Rental Income: Consistent cash flow generated from leasing commercial and residential spaces.

- Property Sales: Revenue earned from the disposal of developed or acquired properties.

- Long-Term Hold Strategy: Focus on stable rental yields over capital gains from frequent sales.

- Portfolio Diversification: Revenue streams are diversified across different property types and tenant bases.

After-Sales Services and Parts Sales

Beyond the initial sale of vehicles, D'Ieteren Automotive secures substantial income through its after-sales services. This includes essential maintenance, repair work, and the sale of genuine parts and accessories, fostering a consistent revenue flow and enhancing customer retention.

Belron, another key segment, also generates revenue from the sale of parts specifically for glass repair and replacement. This specialized parts sales contributes to the overall financial health of the business.

- After-Sales Revenue: D'Ieteren Automotive's after-sales activities are crucial for recurring revenue.

- Parts Sales: Both vehicle and glass repair parts contribute significantly to income.

- Customer Loyalty: These services build strong relationships and encourage repeat business.

- Belron's Contribution: Specialized parts for glass repair are a key revenue driver for Belron.

D'Ieteren Automotive's revenue streams are multifaceted, encompassing new and used vehicle sales, which are the primary drivers of income. In 2024, the automotive market demonstrated resilience, with new car registrations in Europe remaining robust despite economic uncertainties, underpinning this core revenue source.

Ancillary services, such as financing and insurance linked to vehicle purchases, provide a consistent and profitable revenue stream for D'Ieteren Automotive. These offerings not only increase the profitability of individual transactions but also contribute significantly to the company's overall financial performance.

Belron's income is predominantly generated through vehicle glass repair, replacement, and recalibration services. This revenue is derived from direct customer payments and reimbursements from insurance companies, with the increasing complexity of Advanced Driver Assistance Systems (ADAS) driving higher-value service charges.

Moleskine's revenue relies heavily on the global sales of its premium notebooks, planners, and lifestyle accessories, distributed through retail, dealerships, and e-commerce. The company experienced continued growth in its direct-to-consumer channels in 2023, highlighting strong brand loyalty.

D'Ieteren Immo generates revenue through rental income from its property portfolio and property sales. While property sales offer opportunistic revenue, the company's long-term hold strategy emphasizes consistent rental income as the more dominant and stable revenue stream.

After-sales services, including maintenance, repairs, and genuine parts sales, are crucial for D'Ieteren Automotive's recurring revenue and customer retention. Similarly, Belron benefits from revenue generated by the sale of specialized parts for glass repair and replacement.

| Segment | Primary Revenue Streams | Key Drivers/Notes |

|---|---|---|

| D'Ieteren Automotive | New & Used Vehicle Sales | Market share, specific models, European new car registrations (resilient in 2024) |

| D'Ieteren Automotive | Financing & Insurance | Ancillary services tied to vehicle purchases, profitability enhancement |

| D'Ieteren Automotive | After-Sales Services | Maintenance, repairs, genuine parts & accessories, customer retention |

| Belron | Glass Repair & Replacement Fees | Direct payments, insurance reimbursements, ADAS recalibration services |

| Belron | Specialized Parts Sales | Components for glass repair and replacement |

| Moleskine | Notebooks, Planners, Lifestyle Accessories | Global sales via retail, dealers, e-commerce; strong direct-to-consumer growth (2023) |

| D'Ieteren Immo | Rental Income | Consistent cash flow from commercial & residential properties, stable base |

| D'Ieteren Immo | Property Sales | Revenue from property disposals, opportunistic |

Business Model Canvas Data Sources

The D'Ieteren Business Model Canvas is informed by a blend of internal financial reports, market intelligence from automotive sector analyses, and strategic insights derived from competitor benchmarking. These sources ensure each component of the canvas is grounded in robust, relevant information.