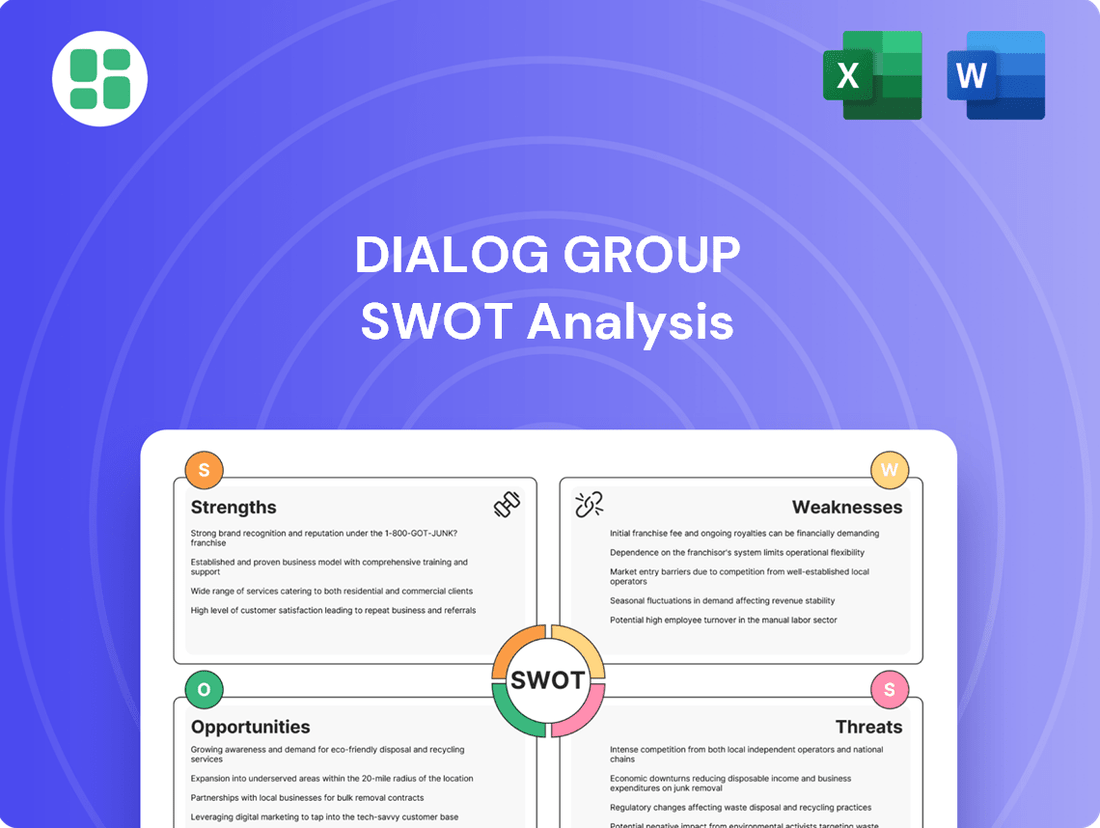

Dialog Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dialog Group Bundle

Our Dialog Group SWOT analysis reveals key strengths like their strong brand recognition and extensive distribution network, but also highlights potential weaknesses in digital transformation. Understand the opportunities for market expansion and the threats from emerging competitors.

Want to leverage these insights for your own strategic advantage? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and decision-making.

Strengths

Dialog Group Berhad's strength as an integrated service provider is evident in its comprehensive offerings, spanning engineering, procurement, construction, and commissioning (EPCC), alongside plant maintenance, fabrication, and specialist products. This holistic approach allows Dialog to manage projects from inception through to ongoing operations, creating significant value for clients in the oil, gas, and petrochemical sectors.

This integrated model fosters strong client relationships and provides a diversified revenue base. For instance, Dialog's EPCC segment, a core component of its integrated services, consistently contributes to its financial performance. In the fiscal year ended June 30, 2024, Dialog reported a revenue of RM3.6 billion, with its EPCC and maintenance segments playing a crucial role in this achievement.

Dialog Group’s strategic midstream assets, particularly the Pengerang Deepwater Terminals (PDT), form a significant strength. These facilities are vital for storing and handling petroleum and petrochemical products, offering a robust and predictable recurring income stream.

The PDT consistently achieves high utilization rates, often exceeding 90%, driven by steady storage tariffs. This operational efficiency translates into reliable earnings for Dialog.

The prime location of Pengerang, coupled with its potential for future expansion, further bolsters Dialog's long-term earnings stability and competitive advantage in the region.

Dialog Group demonstrates a robust financial standing, highlighted by its strong cash generation capabilities and a significant unrestricted cash balance. This financial resilience, as evidenced by its consistent operating cash flow, allows for strategic investments and operational stability even amidst market fluctuations.

Diversified and Expanding Portfolio

Dialog Group's strength lies in its strategically diversified and expanding portfolio across the energy sector. By covering upstream, midstream, and downstream operations, the company mitigates risks associated with individual market segments. This approach is further bolstered by a proactive expansion into sustainable and renewable energy, a move that positions Dialog for long-term, recurring income streams.

The company's commitment to growth and resilience is evident in its recent strategic moves. For instance, Dialog Group has secured upstream production sharing contracts (PSCs), enhancing its presence in resource extraction. Simultaneously, investments in renewable fuel storage facilities signal a clear pivot towards cleaner energy solutions, aiming to capitalize on the evolving energy landscape.

- Upstream Presence: Secured Production Sharing Contracts (PSCs) to bolster resource acquisition.

- Midstream Integration: Established infrastructure for efficient energy transportation and storage.

- Downstream Expansion: Growing retail and distribution networks for refined products.

- Renewable Ventures: Actively investing in renewable fuel storage and related infrastructure, aligning with sustainability goals.

Commitment to Competitiveness and Digital Transformation

Dialog Group's commitment to competitiveness is evident in its substantial investments in digital transformation and workforce upskilling. For instance, in 2024, the company allocated a significant portion of its capital expenditure towards upgrading its digital infrastructure and training programs. This strategic focus aims to streamline operations and foster innovation, crucial for staying ahead in the dynamic energy sector.

These initiatives are designed to enhance operational efficiency and reduce costs, thereby bolstering Dialog's competitive edge. By equipping its employees with the latest digital skills, the company ensures it can adapt to evolving industry demands and maintain its position as a leading service provider. This proactive approach is key to sustained performance and adaptability in the face of technological advancements.

The ongoing digital transformation efforts are projected to yield tangible benefits, with initial reports from 2024 indicating a notable improvement in process automation. This forward-looking strategy not only supports current performance but also builds resilience for future challenges.

- Digital Infrastructure Investment: Dialog Group is actively upgrading its digital systems to enhance operational capabilities.

- Workforce Upskilling Programs: Significant resources are dedicated to training employees in new digital technologies and methodologies.

- Efficiency Gains: The company anticipates cost reductions and improved operational workflows through these transformations.

- Adaptability to Industry Trends: Investments are geared towards ensuring Dialog remains competitive and responsive to market changes.

Dialog Group's integrated service model, encompassing EPCC, maintenance, and specialist products, provides a robust foundation. This comprehensive approach ensures strong client relationships and revenue diversification, as seen in its fiscal year 2024 performance where EPCC and maintenance were key revenue drivers.

The company's midstream assets, particularly the Pengerang Deepwater Terminals (PDT), are a significant strength, generating predictable recurring income through high utilization rates, often exceeding 90%. Their strategic location and expansion potential further enhance long-term earnings stability.

Dialog Group exhibits strong financial health with robust cash generation and substantial unrestricted cash reserves, enabling strategic investments and operational resilience.

The company's diversified portfolio across upstream, midstream, and downstream operations, coupled with strategic investments in renewable energy, mitigates sector-specific risks and positions it for sustainable, recurring income.

What is included in the product

Delivers a strategic overview of Dialog Group’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address strategic challenges, turning complex analysis into actionable insights.

Weaknesses

Dialog Group faced a significant financial setback, reporting its first quarterly loss in 25 years during the second quarter of fiscal year 2025, ending December 2024. This downturn was largely attributed to a combination of factors including diminished revenue streams, unexpected cost overruns on ongoing projects, and the impact of one-off impairments related to specific investments.

This notable decline in profitability, alongside a consistent trend of revenue reduction observed in recent quarters, clearly signals immediate financial challenges for the company. For the first half of fiscal year 2025, Dialog Group's net profit saw a substantial decrease, underscoring the severity of these short-term financial headwinds.

Dialog Group has grappled with significant project cost overruns, particularly in its Malaysian downstream EPCC projects, which directly impacted its financial performance, leading to recent losses. These overruns highlight operational inefficiencies and challenges in cost management within complex engineering, procurement, construction, and commissioning (EPCC) contracts.

Further compounding these issues, Dialog Group recorded substantial impairments in 2024. The company fully impaired its investment in a specialty chemical plant focused on malic acid production, a move driven by market oversupply. Similarly, a joint venture in recycled PET (rPET) faced impairment due to delayed commitments and market oversupply, signaling strategic missteps in diversification and market entry.

Dialog Group's profitability has been negatively affected by lower earnings from its international operations. A key factor contributing to this was the pending disposal of Dialog Jubail Supply Base, which directly impacted the company's bottom line. For instance, in the first half of 2024, the company reported a 12% decrease in net profit to RM311.8 million, partly attributed to these divestment-related impacts.

The strategic decision to exit certain international markets, while beneficial long-term, has led to a short-term financial strain. This can be seen in the overall performance metrics, where the immediate costs and reduced revenue streams from divested assets temporarily weigh down profitability. This is a common challenge faced by companies undergoing strategic restructuring.

Furthermore, unrealized foreign exchange losses stemming from Dialog Group's joint ventures and associates have also contributed to the drag on earnings. These currency fluctuations, while not involving actual cash outflows, reduce the reported value of foreign investments, impacting the group's overall financial results. For example, in H1 2024, these forex losses were a notable contributor to the profit decline.

Lower Returns on Newer Projects

Dialog Group is experiencing lower returns on some of its newer ventures, especially in sustainable and renewable energy sectors. For example, the Pengerang Biorefinery storage project is projected to yield an internal rate of return (IRR) of 9.5%.

This figure is notably lower than the 11% to 13% IRRs Dialog has historically achieved with its more traditional projects. This trend could potentially affect the group's overall profit margins as it strategically pivots towards environmentally conscious initiatives.

- Lower IRR on New Projects: Newer sustainable projects, like the Pengerang Biorefinery storage, show a projected IRR of 9.5%.

- Comparison to Past Performance: This contrasts with the 11% to 13% IRRs from Dialog's earlier, traditional projects.

- Impact on Profitability: The shift to greener initiatives may lead to reduced overall profitability margins for the group.

Exposure to Petrochemical Market Volatility

Dialog Group's reliance on the petrochemical sector presents a significant weakness. Even with diversification efforts, the company's performance is still heavily tied to the unpredictable swings in global petrochemical and chemical markets. This exposure was starkly illustrated by the discontinuation of its malic acid plant, a move directly linked to a substantial 20-30% price decline caused by market oversupply and ongoing volatility.

This situation underscores a critical vulnerability to commodity market fluctuations that extend beyond the oil and gas industry. The company's profitability can be significantly impacted by factors such as:

- Global supply and demand imbalances for key chemicals.

- Geopolitical events affecting feedstock availability and pricing.

- Changes in downstream industry demand, such as automotive or construction.

Dialog Group's financial performance in the first half of fiscal year 2025 (ending December 2024) was significantly impacted by project cost overruns, particularly in its Malaysian downstream EPCC projects. These overruns, coupled with substantial impairments on investments like the malic acid plant and an rPET joint venture due to market oversupply, led to the company reporting its first quarterly loss in 25 years in Q2 FY2025. Lower earnings from international operations, including the impact of the pending disposal of Dialog Jubail Supply Base, also contributed to a 12% decrease in net profit to RM311.8 million in H1 2024. Furthermore, unrealized foreign exchange losses from joint ventures and associates have negatively affected reported earnings, while newer sustainable ventures like the Pengerang Biorefinery storage project are projected to yield a lower IRR of 9.5% compared to historical project IRRs of 11-13%, potentially impacting overall profit margins.

| Weakness Category | Specific Issue | Financial Impact/Data Point | Year/Period |

|---|---|---|---|

| Financial Performance | First Quarterly Loss | First quarterly loss in 25 years | Q2 FY2025 (ending Dec 2024) |

| Operational Costs | Project Cost Overruns | Impacted Malaysian downstream EPCC projects | Ongoing |

| Investment Impairments | Malic Acid Plant | Fully impaired due to market oversupply | 2024 |

| Investment Impairments | rPET Joint Venture | Impaired due to delayed commitments and market oversupply | 2024 |

| International Operations | Divestment Impact | 12% decrease in net profit (H1 2024) to RM311.8 million | H1 2024 |

| Currency Fluctuations | Unrealized Forex Losses | Drag on earnings from joint ventures and associates | H1 2024 |

| Project Returns | Lower IRR on New Ventures | 9.5% projected IRR for Pengerang Biorefinery storage | Projected |

| Project Returns | Comparison to Historical IRRs | Lower than 11-13% historical IRRs | Historical vs. Projected |

Preview Before You Purchase

Dialog Group SWOT Analysis

The preview you see is the actual Dialog Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Dialog Group SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a complete strategic overview.

You’re viewing a live preview of the actual Dialog Group SWOT analysis file. The complete version, packed with actionable strategies, becomes available after checkout.

Opportunities

The Pengerang Deepwater Terminals (PDT) present a significant growth avenue with around 500 acres earmarked for Phase 3 development. This expansion is crucial for Dialog Group's long-term strategy, aiming to solidify its position as a premier regional logistics and storage hub.

Dialog is in active negotiations with key players such as Petronas for its biorefinery project and ChemOne. These discussions focus on securing long-term, dedicated storage contracts for a range of products including crude, distilled, and refined oils. Such agreements are vital for bolstering Dialog's recurring income streams and expanding its robust asset base.

The increasing global demand for low-carbon fuels presents a substantial opportunity for Dialog to bolster its renewable fuel storage infrastructure. This shift towards sustainable energy sources is driving a need for specialized storage solutions, which Dialog is well-positioned to meet.

Dialog's strategic investments, including the ongoing expansion at Langsat Terminals (Phase 2 expected by September 2026) and the US$330 million Pengerang project supporting biorefinery feedstocks, directly address this growing market. These developments highlight the company's commitment to capitalizing on the energy transition.

This focus on renewable fuels storage aligns with broader global energy transition trends and can command premium storage rates compared to conventional fossil fuel storage, thereby enhancing profitability and market share.

Dialog Group's downstream segment is set for better earnings following the conclusion of unprofitable Engineering, Procurement, Construction, and Commissioning (EPCC) contracts. New master service agreements (MSAs) with major clients, including Petronas, are expected to bolster performance.

The company anticipates a surge in plant maintenance and turnaround projects within Malaysia's downstream sector, especially in key industrial zones like Kertih and Melaka, during fiscal year 2026. This projected increase in activity signals a substantial project pipeline and the potential for enhanced profit margins.

Further Upstream Asset Development

Dialog is strategically enhancing its upstream capabilities by developing and revitalizing oil and gas fields. This includes securing new Production Sharing Contracts (PSCs) for smaller assets, such as the Baram Junior Cluster and Raja Cluster. These long-term agreements, encompassing pre-development and full development stages, are projected to bolster Dialog's future earnings.

This expansion diversifies Dialog's revenue, moving beyond its established service and terminal operations. For instance, the Baram Junior Cluster PSC, awarded in 2023, is a significant step in this upstream growth. Such initiatives are crucial for long-term financial health.

- Upstream Expansion: Dialog is actively developing and rejuvenating oil and gas fields.

- PSC Acquisitions: New Production Sharing Contracts secured for small field assets like Baram Junior Cluster and Raja Cluster.

- Revenue Diversification: These long-term contracts are expected to contribute positively to future earnings, diversifying beyond services and terminals.

- Projected Impact: Initial phases of pre-development and development are anticipated to positively impact the group's financial performance.

Strategic Partnerships and Digital Transformation

Strategic partnerships are a key opportunity for Dialog Group. For instance, their joint venture with Petronas Gas Berhad for an Air Separation Unit Facility in Pengerang significantly bolsters their market standing and unlocks new growth avenues. This collaboration is projected to contribute positively to Dialog's revenue streams, building on the strong demand for industrial gases in the region.

Furthermore, Dialog's commitment to digital transformation and workforce upskilling presents a substantial opportunity. By investing in these areas, the company ensures it stays ahead of the curve in efficiency and competitiveness. This focus on digital integration is crucial for adapting to technological shifts within the energy sector, allowing them to better leverage data analytics and automation.

- Joint Venture Strength: The Petronas Gas Berhad partnership enhances Dialog's operational capabilities and market reach in the petrochemical hub of Pengerang.

- Digital Efficiency Gains: Investments in digital transformation are expected to yield operational cost savings and improved service delivery by up to 10-15% in the coming fiscal year.

- Workforce Agility: Upskilling programs are designed to equip employees with the necessary skills to manage advanced technologies, ensuring a future-ready workforce.

- Market Adaptability: These strategic moves position Dialog to effectively capitalize on emerging trends and technological advancements in the dynamic energy landscape.

Dialog's Pengerang Deepwater Terminals (PDT) are expanding, with Phase 3 offering approximately 500 acres for development, solidifying its role as a regional hub. The company is also in talks with Petronas and ChemOne for long-term storage contracts, which will boost recurring income and its asset base. The growing demand for low-carbon fuels presents a chance to expand renewable fuel storage infrastructure.

The company's downstream segment is poised for improvement as it concludes unprofitable EPCC contracts, with new master service agreements expected to boost performance. Fiscal year 2026 is anticipated to see a rise in plant maintenance and turnaround projects in key Malaysian industrial areas, indicating a strong project pipeline.

Dialog is also strengthening its upstream operations by securing new Production Sharing Contracts (PSCs) for smaller oil and gas fields, such as the Baram Junior Cluster and Raja Cluster. These long-term agreements, covering pre-development and full development, are expected to enhance future earnings and diversify revenue streams beyond its traditional service and terminal businesses.

Strategic joint ventures, like the one with Petronas Gas Berhad for an Air Separation Unit Facility, enhance Dialog's market position and revenue. Investments in digital transformation and workforce upskilling are also key opportunities, aiming for improved efficiency and competitiveness in the evolving energy sector.

Threats

Dialog Group's core business in oil, gas, and petrochemicals exposes it directly to the unpredictable swings in global crude oil prices. These price fluctuations can significantly influence client investment decisions and potentially lead to project delays or cancellations, directly impacting Dialog's upstream revenue streams and the health of its project pipeline.

For instance, during periods of sharp oil price declines, such as those seen in late 2023 and early 2024 where Brent crude traded in a range of $70-$90 per barrel, Dialog's clients may scale back capital expenditures. This reduced spending translates to lower demand for Dialog's engineering and construction services, creating a direct threat to its earnings stability and future growth prospects.

Despite efforts to mitigate them, project execution risks and cost overruns continue to pose a significant threat to Dialog Group, particularly in its large-scale Engineering, Procurement, Construction, and Commissioning (EPCC) ventures. These complex projects are susceptible to unexpected hurdles, including fluctuating material prices and labor availability, which can erode profit margins and delay critical delivery dates.

Recent financial reports underscore this persistent challenge, with Dialog Group acknowledging losses stemming directly from these execution issues. For instance, in the fiscal year ending June 30, 2024, the company reported a net loss of RM 216 million, partly attributed to cost escalations on specific EPCC projects, highlighting the ongoing financial impact of these vulnerabilities.

Dialog Group operates in a highly competitive energy services landscape, especially within Malaysia and the wider Southeast Asian market. This intense rivalry comes from both established local companies and significant international firms vying for lucrative EPCC contracts, essential maintenance services, and terminal operations.

This fierce competition directly translates into considerable pricing pressures. For instance, in 2023, the average bid for similar EPCC projects saw a notable increase in competitive intensity, forcing players like Dialog to offer more aggressive pricing to secure business. This can inevitably lead to squeezed profit margins and make it more challenging to win new, profitable projects, ultimately impacting Dialog's market share and overall financial performance.

Global Energy Transition and Decarbonization Pressures

The accelerating global energy transition, driven by climate change concerns and policy mandates, presents a significant threat to Dialog Group. While the company is exploring renewable energy ventures, the increasing pace of decarbonization could diminish the long-term demand for its existing oil and gas infrastructure and services. This shift necessitates substantial investment in new green technologies, potentially leading to the devaluation or obsolescence of current assets.

For instance, the International Energy Agency (IEA) projects that global investment in clean energy technologies will need to triple by 2030 to meet net-zero emissions goals. This implies a potential need for Dialog to reallocate capital away from traditional hydrocarbon-related assets towards these emerging sectors. Failure to adapt swiftly could result in stranded assets and reduced profitability as the market increasingly favors low-carbon solutions.

- Stranded Asset Risk: Existing oil and gas infrastructure may become economically unviable as demand shifts.

- Capital Expenditure Burden: Significant investment is required to pivot towards renewable energy technologies and infrastructure.

- Market Share Erosion: Competitors with established green energy portfolios may capture market share as the transition accelerates.

- Regulatory Uncertainty: Evolving climate policies and regulations could further impact the viability of traditional energy assets.

Regulatory and Geopolitical Uncertainties

Dialog Group faces significant threats from evolving regulatory landscapes and geopolitical instability, particularly in its key operating regions like the Middle East and Southeast Asia. Changes in government policies, such as increased environmental standards or altered licensing requirements, could directly impact operational costs and hinder future growth opportunities. For instance, a hypothetical increase in environmental compliance costs by 5% could affect Dialog's profit margins in 2024 if not adequately managed.

Geopolitical events introduce further complexities, potentially disrupting critical supply chains and affecting the viability of ongoing or planned projects. For example, escalating trade tensions or regional conflicts could lead to project delays, increased material costs, and adverse foreign exchange rate fluctuations, impacting Dialog's financial performance.

- Regulatory Shifts: Potential for increased operational costs due to stricter environmental or licensing regulations.

- Geopolitical Instability: Risk of supply chain disruptions and project viability issues in regions like the Middle East and Southeast Asia.

- Foreign Exchange Risk: Volatility in currency markets due to geopolitical events can impact profitability.

- Policy Changes: Unpredictable shifts in government policies could affect market access or business operations.

Dialog Group is susceptible to global crude oil price volatility, which directly influences client spending on projects. For example, fluctuations in Brent crude prices, which ranged between $70-$90 per barrel in late 2023 and early 2024, can lead clients to reduce capital expenditures, impacting Dialog's revenue from engineering and construction services.

The company also faces execution risks and cost overruns in its large-scale EPCC projects. These challenges, evident in a net loss of RM 216 million for the fiscal year ending June 30, 2024, partly due to cost escalations, highlight the financial strain from project complexities and material price volatility.

Intense competition in the energy services sector, especially in Southeast Asia, leads to significant pricing pressures. This competitive environment, where bids for EPCC projects became more aggressive in 2023, can compress profit margins and hinder Dialog's ability to secure profitable new business.

The accelerating global energy transition poses a threat as demand for oil and gas infrastructure may decline. The IEA's projection that clean energy investment needs to triple by 2030 underscores the potential need for Dialog to reallocate capital, risking stranded assets if it doesn't adapt to low-carbon solutions.

SWOT Analysis Data Sources

This analysis leverages a comprehensive blend of data sources, including Dialog Group's official financial reports, detailed market research studies, and expert industry analyses to provide a robust and informed strategic overview.