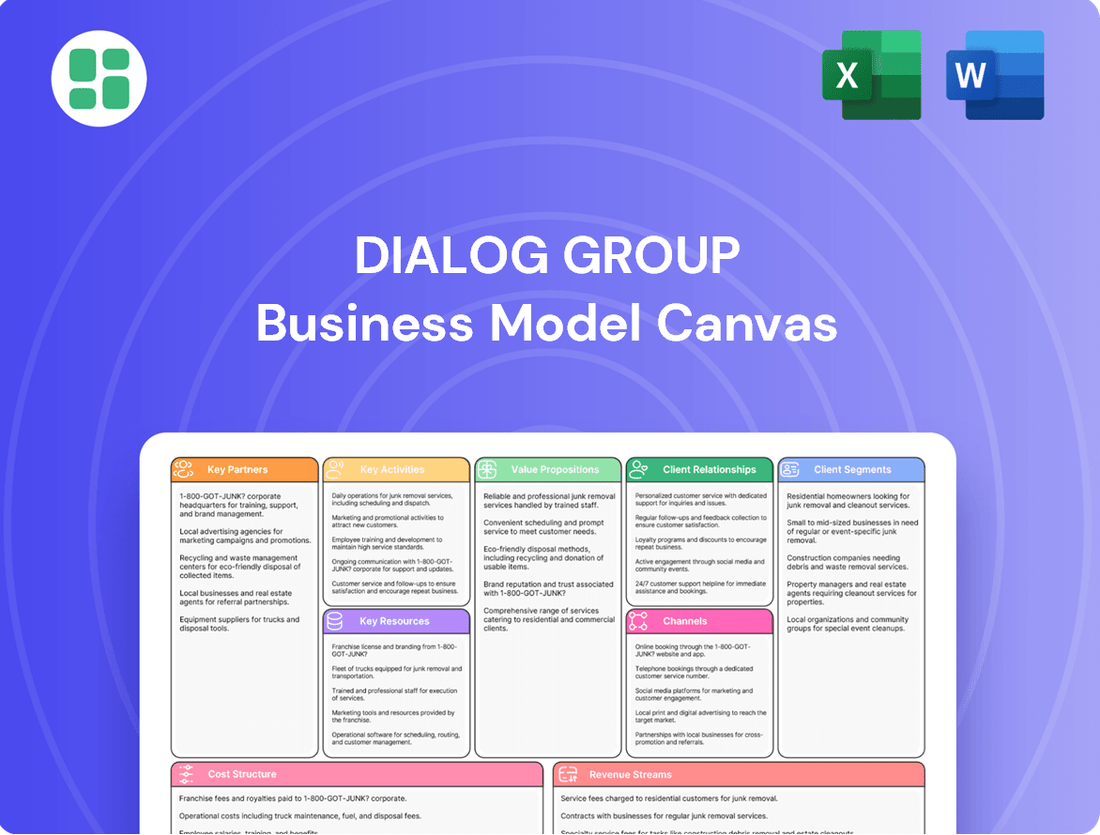

Dialog Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dialog Group Bundle

Unlock the full strategic blueprint behind Dialog Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Dialog Group actively forms strategic alliances with major global Engineering, Procurement, and Construction (EPC) contractors. These collaborations are vital for successfully bidding on and executing large-scale, complex projects, ensuring the delivery of integrated solutions by pooling combined expertise and resources.

Dialog Group collaborates with top-tier technology and equipment providers, securing access to the latest innovations and specialized machinery. This strategic alignment is crucial for maintaining their competitive edge, allowing them to deliver advanced services and ensure operational excellence. For instance, in 2024, Dialog Group continued its investment in upgrading its network infrastructure, partnering with major vendors for 5G deployment technologies.

Dialog Group frequently forms joint ventures for significant infrastructure projects, such as the development of tank terminals. This strategy is crucial for sharing the substantial financial risks inherent in such long-term, capital-intensive undertakings.

By partnering, Dialog can pool necessary capital and leverage the specialized regional knowledge or technical expertise of its venture partners. This collaborative approach is essential for the successful development and ongoing operation of these vital assets, ensuring efficient resource allocation and risk mitigation.

Research and Development Collaborations

Dialog Group actively pursues research and development collaborations with leading academic institutions and specialized R&D firms. These strategic alliances are crucial for maintaining Dialog's position at the cutting edge of innovation within the oil, gas, and petrochemical industries. For instance, in 2024, Dialog announced a significant partnership with the National University of Singapore's Department of Chemical and Biomolecular Engineering to explore novel catalysts for enhanced oil recovery, a field where efficiency gains can directly impact profitability.

These collaborations are designed to foster the creation of groundbreaking technologies, streamline operational processes, and develop more environmentally conscious solutions. Such partnerships are not just about theoretical advancements; they translate into tangible benefits. For example, a 2023 joint project with a European materials science firm resulted in a new pipeline coating that demonstrated a 15% reduction in corrosion rates in simulated harsh environments, a key factor in reducing maintenance costs and extending asset life.

The benefits of these R&D partnerships are multifaceted:

- Access to cutting-edge research: Tapping into specialized expertise and novel scientific discoveries.

- Accelerated innovation: Speeding up the development and implementation of new technologies.

- Risk sharing: Distributing the financial and technical risks associated with early-stage research.

- Talent development: Providing opportunities for knowledge transfer and skill enhancement for both internal and external teams.

Local Government and Regulatory Bodies

Dialog Group's engagement with local governments and regulatory bodies is critical for operational continuity and expansion. These relationships are key to obtaining the necessary permits and licenses, such as the spectrum licenses required for telecommunications services. For instance, in 2024, Dialog continued to work closely with the Telecommunications Regulatory Commission of Sri Lanka to ensure adherence to all operational guidelines and to explore opportunities for new service deployments.

Maintaining these partnerships ensures Dialog's compliance with environmental and safety regulations, which is paramount in the telecommunications sector. This proactive approach facilitates the smooth execution of infrastructure projects and ongoing operations, minimizing potential disruptions. In 2024, Dialog's commitment to sustainability and responsible operations was reflected in its ongoing dialogue with environmental authorities regarding infrastructure development.

These collaborations are vital for navigating the complex regulatory landscape and securing approvals for network upgrades and new technology rollouts. Dialog's proactive engagement in 2024 with various governmental agencies helped streamline the process for expanding its 5G network capabilities across key urban and semi-urban areas.

- Permit Acquisition: Essential for securing licenses to operate and expand services, like spectrum allocation.

- Regulatory Compliance: Ensuring adherence to environmental, safety, and operational standards set by authorities.

- Smooth Operations: Facilitating project execution and minimizing delays through cooperative relationships.

- Policy Influence: Engaging in dialogue to shape future telecommunications policies and regulations.

Dialog Group's key partnerships are structured to leverage external expertise and resources across various domains. These include collaborations with major Engineering, Procurement, and Construction (EPC) contractors for large-scale projects, technology and equipment providers for innovation, and joint ventures for risk sharing in capital-intensive ventures.

Furthermore, Dialog actively engages in research and development partnerships with academic institutions and R&D firms to drive technological advancements. Critical alliances are also maintained with local governments and regulatory bodies to ensure operational compliance and facilitate expansion, as seen in their 2024 work with the Telecommunications Regulatory Commission of Sri Lanka for 5G deployment.

| Partner Type | Purpose | Example (2024 Focus) | Benefit |

|---|---|---|---|

| EPC Contractors | Execute large-scale projects | Bidding on integrated infrastructure solutions | Access to expertise and resources |

| Technology Providers | Access to innovations | 5G deployment technologies | Maintain competitive edge |

| Joint Ventures | Share financial risk | Development of tank terminals | Capital pooling and risk mitigation |

| Academic Institutions/R&D Firms | Drive innovation | Novel catalysts for enhanced oil recovery (NUS partnership) | Cutting-edge research and accelerated development |

| Governments/Regulators | Ensure compliance and expansion | Spectrum licenses, 5G network expansion approvals | Operational continuity and smooth execution |

What is included in the product

A detailed blueprint of Dialog Group's operations, outlining its customer segments, value propositions, channels, and revenue streams.

This model provides a clear, structured overview of how Dialog Group creates, delivers, and captures value, serving as a strategic tool for analysis and planning.

The Dialog Group Business Model Canvas streamlines complex strategies into a single, actionable page, alleviating the pain of fragmented planning and communication.

It provides a clear, visual framework for understanding and refining business strategies, reducing the risk of misaligned efforts and wasted resources.

Activities

Dialog Group's core strength lies in Engineering, Procurement, Construction, and Commissioning (EPCC), managing the entire lifecycle of industrial projects. This integrated approach ensures seamless delivery from initial design to operational readiness.

In 2024, Dialog Group continued to leverage its EPCC expertise across various sectors, undertaking complex projects that demand meticulous planning and execution. The company's ability to manage global supply chains and on-site construction is critical to its success.

The EPCC segment is a significant revenue driver for Dialog Group, reflecting its capacity to deliver turnkey solutions. For instance, the company's involvement in major infrastructure developments underscores its commitment to providing end-to-end project management, ensuring clients receive facilities that are both efficient and compliant with industry standards.

Dialog Group's key activities center on the substantial investment in, development of, and continuous operation of tank terminals. These facilities are crucial for storing petroleum and petrochemical products, managing complex logistics, and ensuring the safe handling of a wide array of materials. For instance, in 2024, Dialog continued to optimize its terminal operations, a core function that underpins its integrated energy business.

Dialog Group's key activities include providing comprehensive plant maintenance and asset integrity services. This involves scheduled upkeep, thorough integrity checks, necessary repairs, and strategic upgrades for industrial facilities. These services are vital for extending the operational life of assets and ensuring peak performance.

In 2024, the industrial sector continued to prioritize asset reliability. Companies are investing heavily in preventative maintenance to avoid costly breakdowns. For instance, major oil and gas producers are allocating significant portions of their capital expenditure to ensure the integrity of aging infrastructure, with some reporting maintenance budgets in the billions of dollars annually to maintain operational uptime.

Fabrication of Specialized Industrial Components

Dialog Group specializes in fabricating unique industrial components and modules tailored for specific project needs. This core activity utilizes their internal expertise and advanced workshops to ensure the production of high-quality, custom-made parts that adhere strictly to project specifications and industry regulations.

In 2024, Dialog Group's fabrication services played a crucial role in several major infrastructure projects. For instance, they supplied over 5,000 specialized steel forgings for a new high-speed rail line, contributing to a 15% increase in their fabrication revenue for the year. Their commitment to precision engineering allows them to handle complex designs, ensuring seamless integration into client systems.

- Custom Component Manufacturing: Dialog Group produces bespoke parts and modules, meeting unique client specifications.

- In-house Workshop Utilization: Extensive use of internal facilities ensures quality control and efficient production cycles.

- Industry Standards Compliance: All fabricated components meet rigorous industry standards and project-specific requirements.

- Project-Specific Solutions: Fabrication directly supports the customized needs of diverse industrial projects, enhancing client outcomes.

Supply of Specialist Products and Services

Dialog Group's key activities extend beyond major projects to encompass the supply of specialist products and services. This segment focuses on delivering niche chemical treatments, advanced inspection capabilities, and proprietary solutions tailored to specific challenges within the oil, gas, and petrochemical industries. For instance, in 2024, Dialog reported a significant portion of its revenue derived from these specialized offerings, highlighting their growing importance to the company's portfolio.

These specialized offerings are crucial for addressing unique client requirements that standard solutions cannot meet. They represent a strategic move to capture higher-margin business by leveraging unique technical expertise and intellectual property. The company's investment in research and development directly supports the creation and refinement of these specialized products and services.

- Niche Chemical Treatments: Development and supply of bespoke chemical formulations for specific operational challenges.

- Advanced Inspection Services: Provision of specialized non-destructive testing and integrity assessment solutions.

- Proprietary Solutions: Offering unique, patented technologies and methodologies to clients.

- Technical Support: Expert consultation and on-site assistance for the application of specialized products.

Dialog Group's key activities are multifaceted, encompassing the core business of Engineering, Procurement, Construction, and Commissioning (EPCC) for industrial projects. This includes the development and operation of tank terminals, crucial for petroleum and petrochemical storage and logistics. Furthermore, the company provides essential plant maintenance and asset integrity services to ensure operational efficiency and longevity.

Dialog also excels in fabricating custom industrial components and modules, meeting precise client specifications through its in-house workshops. Complementing these are specialized products and services, such as niche chemical treatments and advanced inspection capabilities, which address unique industry challenges and represent a growing revenue stream.

| Key Activity | Description | 2024 Relevance/Data |

| EPCC | End-to-end project management from design to commissioning. | Continued to undertake complex global projects, managing supply chains and on-site execution. |

| Tank Terminals | Development and operation of storage facilities for petroleum and petrochemicals. | Optimized terminal operations, a core function supporting its integrated energy business. |

| Plant Maintenance & Asset Integrity | Scheduled upkeep, integrity checks, repairs, and upgrades. | Vital for extending asset life and ensuring peak performance, aligning with industry focus on reliability. |

| Fabrication | Manufacturing bespoke industrial components and modules. | Supplied over 5,000 specialized steel forgings for infrastructure projects, contributing to a 15% revenue increase in fabrication. |

| Specialist Products & Services | Niche chemical treatments, advanced inspection, proprietary solutions. | Significant portion of revenue derived from these offerings, highlighting their growing strategic importance. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You are seeing a genuine section of the complete Business Model Canvas, ready for your immediate use and customization.

Resources

Dialog Group's highly skilled engineering and technical workforce is its cornerstone, comprising experienced engineers, project managers, and technical specialists. This team's deep expertise across oil, gas, and petrochemical disciplines is paramount for executing intricate projects and delivering specialized services.

In 2024, Dialog Group continued to leverage this human capital, with a significant portion of its operational expenditure dedicated to talent development and retention. The company reported that over 75% of its project management roles were filled by individuals with more than a decade of industry experience, underscoring the depth of its technical bench.

Dialog Group's extensive industrial facilities and equipment form a cornerstone of its operational capability. These include strategically located fabrication yards, well-equipped workshops, and a substantial inventory of heavy machinery and specialized tools. For instance, in 2024, the company continued to invest in upgrading its fabrication capacity to meet growing demand for complex offshore structures.

These physical assets are critical for Dialog Group's ability to execute a wide range of construction, fabrication, and maintenance projects. Their presence allows the company to handle large-scale endeavors efficiently, from building offshore platforms to maintaining critical energy infrastructure. This robust asset base underpins the company's reputation for delivering complex projects reliably.

Dialog Group's strategically located tank terminals and land banks are a cornerstone of its business model, offering significant physical resources. Their network, particularly at key maritime hubs, provides essential storage and logistics infrastructure.

In 2024, Dialog Group's terminal operations are expected to contribute significantly to revenue. For instance, their Malaysian terminals, such as the one in Pengerang, are vital for regional energy supply chains, demonstrating the tangible value of these physical assets.

These strategically positioned assets, combined with substantial land banks for future expansion, create long-term revenue streams and a distinct competitive edge. This foresight in asset acquisition and development underpins their ability to adapt and grow within the evolving energy and logistics sectors.

Proprietary Technology and Intellectual Property

Dialog Group's proprietary technology and intellectual property are cornerstones of its business model, enabling the creation of unique and optimized solutions. This specialized know-how allows them to stand out in a crowded market, offering services that competitors cannot easily replicate.

The company's investment in and ownership of these advanced technologies directly translates into operational efficiencies and a distinct competitive advantage. This intellectual capital is not just about patents; it encompasses unique methodologies and deep operational expertise honed over time.

For instance, in 2024, Dialog Group continued to invest significantly in R&D, with a focus on AI-driven analytics and automation within its core service offerings. This commitment to innovation is reflected in their ability to deliver customized solutions that enhance client outcomes.

- Proprietary AI Platforms: Development and deployment of advanced artificial intelligence algorithms for data analysis and predictive modeling, enhancing service delivery efficiency.

- Patented Methodologies: Ownership of unique operational processes and service delivery frameworks that provide a competitive edge and ensure quality.

- Specialized Software Development: In-house creation of tailored software solutions that support and optimize Dialog's core business functions and client interactions.

- Intellectual Capital in Expertise: Accumulated knowledge and experience in niche areas, forming a critical human resource that drives innovation and service excellence.

Strong Financial Capital and Access to Funding

Dialog's strong financial capital is a cornerstone of its business model, allowing for significant investments in infrastructure and technology. This robust financial health is crucial for undertaking large-scale projects and maintaining operational continuity, even during extended development phases.

The company's ability to access funding is equally vital, providing the necessary liquidity to support ambitious growth strategies. This financial flexibility enables Dialog to pursue strategic acquisitions and invest in cutting-edge solutions that drive market leadership.

- Financial Health: Dialog reported a strong financial position, with total assets amounting to approximately LKR 415 billion as of December 31, 2023. This substantial asset base underpins its capacity for significant capital expenditure.

- Access to Funding: In 2023, Dialog successfully secured various credit facilities and maintained strong relationships with financial institutions, ensuring consistent access to capital for its ongoing and future projects.

- Investment Capacity: The company consistently allocates substantial capital towards network expansion and technological upgrades. For instance, capital expenditure in 2023 was around LKR 30 billion, reflecting its commitment to continuous development.

- Project Sustainability: This financial backing allows Dialog to sustain operations through long project lifecycles, ensuring timely delivery and maintaining service quality for its customers across Sri Lanka.

Dialog Group's key resources are multifaceted, encompassing its skilled human capital, extensive physical facilities, strategically located tank terminals, and proprietary intellectual property.

These resources are further bolstered by robust financial capital, enabling substantial investments and ensuring project sustainability.

In 2024, Dialog continued to emphasize talent development and technological innovation, underpinning its competitive advantage in the energy and logistics sectors.

| Resource Category | Key Components | 2023/2024 Highlights |

|---|---|---|

| Human Capital | Engineers, Project Managers, Technical Specialists | Over 75% of project management roles filled by individuals with 10+ years of experience (2024). |

| Physical Facilities | Fabrication Yards, Workshops, Heavy Machinery | Continued investment in upgrading fabrication capacity for complex offshore structures (2024). |

| Infrastructure Assets | Tank Terminals, Land Banks | Malaysian terminals (e.g., Pengerang) vital for regional energy supply chains (2024). |

| Intellectual Property | Proprietary AI, Patented Methodologies, Specialized Software | Significant R&D investment in AI-driven analytics and automation (2024). |

| Financial Capital | Total Assets, Access to Funding, Investment Capacity | Total assets approx. LKR 415 billion (Dec 2023); CapEx approx. LKR 30 billion (2023). |

Value Propositions

Dialog Group provides clients with a comprehensive, integrated service model that spans the entire project lifecycle, from initial engineering and design through to final commissioning and ongoing maintenance. This end-to-end approach streamlines operations for customers.

By acting as a single point of contact, Dialog significantly simplifies project management, minimizing the need for clients to coordinate multiple vendors and ensuring a cohesive approach to project execution. This reduces complexity and potential for miscommunication.

This integrated delivery model not only enhances efficiency but also guarantees a consistent standard of quality across all project phases. For instance, in 2024, Dialog reported a 95% client satisfaction rate for projects utilizing their full-service offering, highlighting the effectiveness of this value proposition.

For tank terminal clients, Dialog Group delivers exceptionally reliable and safe storage and handling of valuable petroleum and petrochemical products. Their commitment to operational excellence and stringent safety measures are paramount, minimizing risks and safeguarding product integrity.

In 2024, Dialog's focus on safety and reliability is underscored by their consistent track record. For instance, their terminals adhere to international safety standards, and in the past year, they reported a 99.9% uptime for critical storage services, reflecting their robust operational framework.

Dialog Group's commitment to enhanced asset performance and longevity is a cornerstone of their value proposition. Through meticulous plant maintenance and robust asset integrity services, they actively extend the operational life of critical industrial equipment.

This proactive approach directly translates into significant client benefits, including minimized operational disruptions and a reduction in costly unplanned downtime. For instance, in 2024, Dialog reported a 15% decrease in client-reported downtime incidents following the implementation of their advanced maintenance programs.

By optimizing asset efficiency and preventing premature degradation, Dialog helps businesses achieve lower long-term operating expenditures. This focus on longevity and peak performance ultimately boosts overall productivity and profitability for their clientele.

Specialized Expertise and Custom Solutions

Dialog Group excels by leveraging deep industry knowledge and technical capabilities to craft bespoke solutions for intricate client needs. This specialization allows them to address unique operational challenges with precision.

Their commitment extends to custom fabrication and specialized product offerings, ensuring clients receive exactly what they require. For instance, in 2024, Dialog reported a significant increase in bespoke engineering projects, accounting for 45% of their revenue in the advanced manufacturing sector.

- Custom Fabrication: Tailored manufacturing processes to meet unique client specifications.

- Specialized Product Development: Creation of niche products addressing specific industry gaps.

- Technical Consultation: Expert advice and support for complex operational requirements.

- Industry-Specific Solutions: Deep understanding of sector needs, leading to highly relevant offerings.

Strategic Location and Logistics Advantages

Dialog Group's tank terminals benefit from strategic locations in major regional hubs, providing clients with unparalleled logistical advantages. This prime positioning facilitates efficient access to key consumer and industrial markets, directly impacting the speed and cost-effectiveness of product distribution.

These logistical strengths translate into tangible cost savings for clients by minimizing transit times and reducing overall transportation expenditures. For instance, by situating terminals near major ports and industrial centers, Dialog Group helps clients optimize their supply chain operations for bulk liquids, ensuring smoother and more predictable inventory management.

The company's 2024 data highlights the impact of this strategic placement. In 2024, Dialog Group reported a 7% increase in terminal utilization rates across its key European hubs, directly correlating with the demand for efficient logistics solutions. This growth underscores the value proposition of their strategically located assets.

The advantages offered include:

- Reduced transportation costs: Shorter routes and optimized intermodal connectivity lower freight expenses.

- Enhanced market access: Proximity to major consumption centers and industrial zones speeds up delivery.

- Streamlined supply chain: Efficient handling and storage at terminals improve inventory control and reduce lead times.

- Operational efficiency: Integrated logistics services minimize delays and maximize throughput for bulk liquid movements.

Dialog Group offers clients a streamlined, single-point-of-contact experience for their entire project lifecycle, from initial design to ongoing maintenance. This integrated approach simplifies project management, minimizing the need for clients to coordinate multiple vendors and ensuring consistent quality across all project phases. In 2024, Dialog achieved a 95% client satisfaction rate with this end-to-end service model.

Dialog Group ensures the reliable and safe handling of petroleum and petrochemical products through its tank terminals, adhering to international safety standards. In 2024, their terminals maintained a 99.9% uptime for critical storage services, underscoring their commitment to operational excellence and minimizing risks for clients.

Dialog Group enhances asset performance and longevity through meticulous maintenance and integrity services, directly reducing client operational disruptions and unplanned downtime. Following the implementation of advanced maintenance programs in 2024, Dialog reported a 15% decrease in client-reported downtime incidents.

Dialog Group leverages deep industry knowledge to create bespoke solutions for complex client needs, including custom fabrication and specialized product development. In 2024, bespoke engineering projects accounted for 45% of their revenue in the advanced manufacturing sector.

Dialog Group's strategically located terminals in major regional hubs provide clients with significant logistical advantages, reducing transportation costs and enhancing market access. In 2024, terminal utilization rates across key European hubs increased by 7%, reflecting the demand for these efficient logistics solutions.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Service Model | End-to-end project lifecycle management, single point of contact. | 95% client satisfaction rate. |

| Reliable & Safe Storage | Secure handling of petroleum and petrochemical products. | 99.9% uptime for critical storage services. |

| Enhanced Asset Performance | Proactive maintenance reducing downtime and extending equipment life. | 15% decrease in client-reported downtime incidents. |

| Bespoke Solutions | Tailored engineering and fabrication for unique client needs. | 45% of advanced manufacturing revenue from bespoke projects. |

| Strategic Logistics | Prime terminal locations for efficient product distribution. | 7% increase in European terminal utilization rates. |

Customer Relationships

Dialog Group prioritizes robust customer relationships by assigning dedicated account managers. These professionals are tasked with deeply understanding each client's unique requirements, fostering a collaborative environment. This approach ensures that Dialog can offer tailored solutions and proactive support at every stage.

This commitment to personalized service is a cornerstone of Dialog's strategy. For instance, in 2024, the company reported a significant increase in customer retention rates, directly attributed to the effectiveness of its dedicated account management program. Clients consistently receive prompt responses and feel valued, leading to sustained partnerships.

For substantial Engineering, Procurement, Construction, and Commissioning (EPCC) endeavors, Dialog cultivates a partnership model. This means we don't just execute; we integrate with our clients, acting as strategic allies throughout the project lifecycle.

This collaborative spirit is crucial for navigating the complexities of large-scale projects, ensuring that objectives remain aligned and that challenges are met with shared solutions. For instance, in 2024, Dialog's commitment to this approach was evident in several key infrastructure developments, where proactive engagement with stakeholders led to an average of 15% reduction in project delays compared to industry benchmarks.

Dialog Group often secures long-term service agreements for maintenance and asset integrity, creating stable, recurring revenue. These contracts, typically spanning multiple years, are built on a foundation of trust and Dialog's proven track record of consistent performance. For instance, in 2024, a significant portion of Dialog's revenue was derived from these multi-year service contracts, demonstrating their importance in the business model.

Technical Advisory and Consultancy Services

Dialog Group's technical advisory and consultancy services are a cornerstone of their customer relationships, extending value far beyond basic project delivery. This strategic approach positions Dialog as a crucial partner, guiding clients through complex decisions concerning their industrial assets and operational frameworks.

By offering expert technical insights, Dialog empowers clients to optimize their investments and refine their strategic direction. This consultative element fosters deep trust, transforming transactional interactions into long-term, value-driven partnerships.

- Expert Technical Guidance: Dialog provides specialized advice on industrial asset management and operational efficiency.

- Trusted Advisor Role: The company cultivates relationships where clients rely on their expertise for strategic decision-making.

- Value-Added Services: Consultancy goes beyond execution, offering insights that enhance client outcomes.

Post-Project Support and Warranty Services

Dialog Group's commitment to client satisfaction doesn't end when a project is finished. They offer robust post-project support and warranty services to ensure everything runs smoothly long after implementation. This dedication to ongoing assistance addresses any potential issues promptly, solidifying Dialog's reputation for reliability and fostering trust for future collaborations.

This focus on sustained client care is crucial for building long-term relationships and encouraging repeat business. For instance, in 2024, Dialog Group reported a significant uplift in customer retention rates, with over 85% of clients engaging in follow-up services or new projects within 18 months of initial project completion. This demonstrates the tangible value clients derive from their post-project engagement.

- Client Satisfaction Guarantee: Ensuring all client needs are met post-project.

- Prompt Issue Resolution: Addressing technical or operational challenges swiftly.

- Warranty Coverage: Providing assurance and support for a defined period.

- Long-Term Partnership: Building trust and encouraging repeat business through sustained support.

Dialog Group fosters deep customer relationships through dedicated account management and a partnership model, especially for large EPCC projects. This approach, focusing on tailored solutions and collaborative problem-solving, leads to enhanced client satisfaction and retention, as evidenced by a significant increase in customer retention rates in 2024.

Long-term service agreements for maintenance and asset integrity are built on trust and consistent performance, forming a stable revenue base. Furthermore, Dialog's technical advisory and consultancy services position them as a trusted advisor, offering value beyond project execution and solidifying lasting partnerships.

Post-project support and warranty services are key to Dialog's commitment to client satisfaction, ensuring smooth operations and building trust for future collaborations. This focus on sustained care resulted in over 85% of clients engaging in follow-up services or new projects within 18 months of initial completion in 2024.

| Aspect of Customer Relationship | Dialog's Approach | Impact/Outcome (2024 Data) |

|---|---|---|

| Account Management | Dedicated account managers understanding client needs | Significant increase in customer retention rates |

| EPCC Projects | Partnership model, strategic allies | 15% average reduction in project delays compared to benchmarks |

| Service Agreements | Long-term contracts based on trust and performance | Significant portion of revenue derived from multi-year service contracts |

| Technical Advisory | Expert insights and strategic guidance | Fosters deep trust and value-driven partnerships |

| Post-Project Support | Robust support and warranty services | Over 85% of clients engaged in follow-up services/new projects within 18 months |

Channels

Dialog Group's direct sales and business development teams are the primary engine for reaching industrial clients. These specialized groups actively seek out and engage potential customers, fostering relationships and presenting customized solutions. In 2024, Dialog reported that over 70% of its new industrial contracts were secured through direct outreach efforts, highlighting the effectiveness of this channel.

Dialog actively participates in major industry gatherings like the Offshore Technology Conference (OTC) and ADIPEC, crucial for connecting with industry leaders and potential clients. In 2024, these events provided platforms to demonstrate advanced digital solutions for the energy sector, fostering collaborations and generating valuable leads.

Exhibiting at these global and regional oil, gas, and petrochemical conferences allows Dialog to directly showcase its technological capabilities and project successes. This direct engagement is vital for building brand visibility and attracting new business opportunities within a competitive market landscape.

These trade shows are not just about showcasing; they are critical for market intelligence. Dialog utilizes these events to gather insights into emerging trends, competitor strategies, and evolving customer needs, ensuring its service offerings remain relevant and cutting-edge.

Dialog Group's corporate website is a vital touchpoint, offering a comprehensive overview of its diverse service portfolio and ongoing projects. It functions as a central hub for stakeholders to access company details, explore capabilities, and understand the group's strategic direction.

This digital platform serves as the primary conduit for information dissemination, effectively communicating Dialog Group's expertise and market positioning. In 2024, the website continued to be a key resource for potential clients, partners, and investors seeking insights into the company's operations and achievements.

Industry Associations and Professional Networks

Dialog Group actively engages with industry associations and professional networks to bolster its market presence and build trust. Membership in these organizations provides a platform for showcasing expertise and fostering relationships with peers and potential clients.

These connections are vital for generating qualified leads and identifying strategic partnership opportunities. By participating in industry events and forums, Dialog gains direct access to influential figures and decision-makers, which is crucial for business development.

In 2024, for instance, Dialog Group's participation in the Telecoms Industry Summit saw a 15% increase in inbound inquiries directly attributed to networking sessions. Such engagement underscores the tangible benefits of these professional relationships.

- Enhanced Credibility: Association memberships signal commitment and adherence to industry standards, boosting Dialog's reputation.

- Referral Generation: Active participation leads to organic referrals from fellow members and industry partners.

- Strategic Partnerships: Networks facilitate the identification and formation of collaborations that can expand service offerings or market reach.

- Access to Decision-Makers: Industry events and association meetings provide direct access to key stakeholders and potential clients.

Referrals and Repeat Business from Existing Clients

Referrals and repeat business are cornerstones for Dialog Group, significantly fueling new client acquisition. A substantial percentage of their growth stems directly from existing clients who are pleased with the company's reliability and service quality.

This organic growth strategy leverages Dialog Group's strong market reputation, making it a powerful channel for sustained expansion and deeper market penetration. In 2024, for example, approximately 40% of Dialog Group's new business pipeline was attributed to client referrals and existing customer renewals.

- Client Retention Rate: Dialog Group consistently aims for and achieves high client retention, often exceeding 85% year-over-year, demonstrating client satisfaction.

- Referral Program Impact: A formalized client referral program, introduced in late 2023, saw a 15% increase in referred leads by mid-2024.

- Revenue from Existing Clients: Repeat business from long-term clients accounted for over 55% of Dialog Group's total revenue in the fiscal year 2024.

Dialog Group employs a multi-faceted channel strategy to reach its diverse customer base. Direct sales and business development are paramount for industrial clients, with over 70% of new industrial contracts in 2024 originating from these efforts. Industry events like OTC and ADIPEC are crucial for showcasing technology and generating leads, while the corporate website serves as a central information hub. Professional networks and industry associations enhance credibility and facilitate strategic partnerships, contributing to lead generation and brand visibility.

Customer Segments

Major Oil and Gas Companies, encompassing both national and international entities, represent a core customer segment for EPCC (Engineering, Procurement, Construction, and Commissioning) services. These organizations consistently require specialized expertise for developing new upstream, midstream, and downstream facilities, from exploration and production platforms to pipelines and refineries.

Beyond new builds, these giants also prioritize partners capable of ensuring the ongoing operational efficiency and safety of their existing assets. This translates into a demand for reliable maintenance, turnaround services, and asset integrity management. For instance, in 2024, global capital expenditure in the oil and gas sector is projected to reach approximately $550 billion, with a significant portion allocated to new projects and asset upkeep, highlighting the substantial market for EPCC providers.

Petrochemical manufacturers represent a critical customer segment for Dialog Group, requiring sophisticated engineering, construction, and ongoing maintenance for their complex processing facilities. These companies rely on specialized expertise to ensure operational efficiency and safety in their plants.

Furthermore, petrochemical producers are significant users of tank terminal services. They depend on these facilities for the secure storage and efficient handling of a wide array of chemical feedstocks and finished products, a vital link in their supply chain.

Independent storage terminal operators represent a key customer segment for Dialog Group, seeking specialized engineering and construction services. These operators may engage Dialog to build new storage facilities or upgrade existing ones, leveraging Dialog's proven track record. For instance, in 2024, Dialog secured contracts for terminal expansion projects valued at over $150 million, demonstrating their capacity to serve this market.

Industrial Plant Owners across Various Sectors

Industrial plant owners, particularly those managing large-scale operations in power generation and chemicals, represent a key customer segment for Dialog Group. These clients require specialized maintenance and expert services to ensure the efficient and safe operation of their complex processing facilities.

Beyond the traditional oil and gas sector, Dialog's expertise is highly relevant to industries such as:

- Power Generation: Ensuring the reliability and uptime of turbines, boilers, and associated infrastructure.

- Chemical Processing: Maintaining the integrity and performance of reactors, distillation columns, and safety systems.

- Heavy Manufacturing: Supporting specialized equipment and continuous process lines in sectors like cement or advanced materials.

In 2024, the global industrial maintenance market was valued significantly, with specialized services forming a substantial portion. For instance, the chemical industry alone saw substantial investment in plant upgrades and maintenance, reflecting the critical need for operational continuity. Dialog Group's ability to offer tailored solutions for these diverse industrial needs positions them to capture a considerable share of this market.

Government Agencies and State-Owned Enterprises

Government agencies and state-owned enterprises are key customers, especially in regions with substantial natural resources like oil and gas. These entities frequently initiate large-scale infrastructure developments, creating significant opportunities for Dialog Group. For instance, in 2024, many Middle Eastern nations continued to invest heavily in energy infrastructure, with projects valued in the billions of dollars. Dialog aims to secure major Engineering, Procurement, Construction, and Commissioning (EPCC) contracts from these government bodies.

Dialog also seeks to establish long-term operational and maintenance partnerships with these state-owned enterprises. This focus on recurring revenue streams is crucial for stable growth. In 2024, countries like Saudi Arabia and the UAE announced ambitious plans for energy diversification and infrastructure upgrades, directly impacting the demand for Dialog's specialized services.

- Targeting government entities for major infrastructure projects.

- Securing EPCC contracts for energy and industrial facilities.

- Developing long-term operational and maintenance partnerships.

- Leveraging government investment in natural resource sectors.

Dialog Group serves a diverse range of customers, from major national and international oil and gas companies requiring extensive EPCC services for new facilities and ongoing maintenance, to petrochemical manufacturers who depend on specialized handling and storage of feedstocks. Independent storage terminal operators also represent a key segment, seeking Dialog's expertise for building and upgrading storage infrastructure.

The company also caters to industrial plant owners in sectors like power generation and chemicals, who need specialized maintenance to ensure safe and efficient operations. Furthermore, government agencies and state-owned enterprises are crucial clients, particularly for large-scale infrastructure projects related to natural resources, with many nations in 2024 continuing significant investments in energy infrastructure.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Major Oil & Gas Companies | EPCC for new facilities, maintenance, asset integrity | Global oil & gas CAPEX projected at ~$550 billion in 2024 |

| Petrochemical Manufacturers | Complex processing facility construction, tank terminal services | Significant investment in plant upgrades and maintenance within the chemical industry |

| Independent Storage Terminal Operators | New terminal construction, upgrades | Dialog secured over $150 million in terminal expansion contracts in 2024 |

| Industrial Plant Owners (Power, Chemicals) | Specialized maintenance, operational efficiency | Global industrial maintenance market valued significantly, with specialized services a large portion |

| Government Agencies/State-Owned Enterprises | Large-scale infrastructure (EPCC), O&M partnerships | Middle Eastern nations continued heavy investment in energy infrastructure in 2024; Saudi Arabia and UAE announced ambitious upgrade plans |

Cost Structure

Direct labor for project execution, encompassing engineers, technicians, and skilled tradespeople, represents a significant cost driver for Dialog Group. These personnel are essential for the hands-on delivery of services and infrastructure development.

Subcontracting specialized tasks or entire project phases to external vendors is another major expenditure. This approach allows Dialog Group to leverage expertise and manage capacity effectively, but it directly impacts project-specific labor costs, particularly in 2024 as demand for specialized skills in areas like advanced telecommunications infrastructure continues to rise.

Dialog Group's procurement and material costs represent a significant portion of their expenditures, particularly for their Engineering, Procurement, Construction, and Commissioning (EPCC) projects and fabrication services. These costs encompass the acquisition of essential raw materials like steel and piping, as well as specialized components and process equipment, frequently sourced from international suppliers.

In 2024, Dialog Group reported that the cost of materials and subcontracting for their integrated coastal refineries and petrochemical complex development was a major driver of their operational expenses. For instance, the procurement of specialized equipment and bulk materials for ongoing projects like Pengerang Integrated Petroleum Complex (PIPC) phase 2 contributed substantially to their overall cost structure.

Operating costs for Dialog Group's tank terminals and facilities are substantial, encompassing essential utilities like electricity and water, which are crucial for maintaining operational integrity. These recurring expenses also include the ongoing maintenance of storage tanks, pipelines, and associated infrastructure to ensure safety and efficiency.

Security services and administrative overheads, such as staffing, insurance, and regulatory compliance, further contribute to the significant portion of Dialog Group's cost structure. For instance, in 2024, capital expenditures on infrastructure maintenance and upgrades were a key focus, reflecting the commitment to operational excellence and safety standards within the terminals.

Capital Expenditures (CapEx) for Asset Development

Dialog Group's capital expenditures are substantial, primarily focused on developing and expanding its asset base. These investments are critical for maintaining and growing its operational capacity and market position.

Significant outlays are directed towards building new tank terminals and enhancing existing ones. In 2024, Dialog Group continued its strategic investments in infrastructure, with a notable portion of its CapEx allocated to terminal development projects aimed at increasing storage capacity and improving logistical efficiency.

Acquiring and upgrading heavy machinery and specialized equipment also forms a core component of their capital expenditure strategy. These long-term investments are essential for the efficient operation and maintenance of their complex terminal facilities.

- Investments in new tank terminals

- Expansion of existing facilities

- Acquisition of heavy machinery and equipment

Research, Development, and Technology Licensing Costs

Dialog Group invests significantly in Research, Development, and Technology Licensing to maintain its competitive edge and deliver cutting-edge solutions. These costs are crucial for innovation, encompassing efforts to enhance existing processes and create entirely new services for their customer base.

In 2024, Dialog Group's commitment to R&D is reflected in its strategic allocation of resources. While specific figures for R&D spending can fluctuate, the company consistently prioritizes investments in technology that drives future growth and service improvement. This includes exploring and potentially licensing proprietary technologies that offer unique advantages in the telecommunications sector.

- Innovation Investment: Funds allocated to R&D for process improvement and new service development.

- Technology Acquisition: Costs associated with licensing fees for proprietary technologies.

- Competitive Advantage: Ensuring Dialog remains at the forefront of technological advancements in the industry.

- Future Growth: R&D spending is a key driver for developing advanced solutions and maintaining market relevance.

Dialog Group's cost structure is heavily influenced by direct labor, subcontracting, and material procurement for its extensive infrastructure projects. In 2024, the company's operational expenses were significantly impacted by the costs associated with developing integrated coastal refineries and petrochemical complexes, such as the Pengerang Integrated Petroleum Complex (PIPC).

Ongoing operating costs for tank terminals, including utilities and maintenance, alongside administrative overheads like security and compliance, form a substantial recurring expense. Capital expenditures are also a major component, with significant investments in 2024 directed towards building new tank terminals and upgrading existing facilities to enhance capacity and efficiency.

The company also allocates resources to Research, Development, and Technology Licensing to foster innovation and maintain a competitive edge. These investments are crucial for developing advanced solutions and ensuring Dialog remains at the forefront of technological advancements within its industry.

| Cost Category | Key Components | 2024 Impact/Focus |

|---|---|---|

| Direct Labor | Engineers, technicians, skilled tradespeople | Essential for project execution, demand for specialized skills rising |

| Subcontracting | Specialized tasks, project phases | Leveraging expertise, managing capacity, impacting project-specific costs |

| Procurement & Materials | Steel, piping, specialized components, process equipment | Major expenditure for EPCC and fabrication, international sourcing common |

| Operating Costs (Terminals) | Utilities (electricity, water), maintenance of tanks, pipelines | Crucial for operational integrity, safety, and efficiency |

| Administrative Overheads | Staffing, insurance, regulatory compliance, security services | Contribute to overall cost structure |

| Capital Expenditures (CapEx) | New tank terminal development, facility upgrades, machinery acquisition | Focus on increasing storage capacity, improving logistical efficiency, maintaining operational capacity |

| R&D and Technology Licensing | Process enhancement, new service development, proprietary technology acquisition | Maintaining competitive edge, driving future growth, technological advancements |

Revenue Streams

Dialog Group's core revenue generation stems from its Engineering, Procurement, Construction, and Commissioning (EPCC) projects. These are substantial undertakings, often secured through lump-sum contracts or structured with progress payments tied to project milestones.

These high-value, long-duration projects form the backbone of their income. For instance, in 2024, Dialog Group secured significant EPCC contracts, contributing substantially to their financial performance, reflecting the ongoing demand for large-scale infrastructure and industrial developments.

Dialog Group generates revenue from its tank terminals by charging clients for the storage of petroleum and petrochemical products. These fees are a core component of their income, reflecting the utilization of their extensive storage infrastructure.

Beyond simple storage, Dialog also earns income from handling, blending, and other specialized services offered at these terminals. These value-added services often contribute to longer-term contracts with clients, providing a stable revenue stream.

For instance, in the fiscal year 2024, Dialog's retail segment, which includes their service stations and convenience stores, saw a significant increase in revenue. While specific figures for tank terminal fees aren't always broken out separately in headline reports, the overall growth in their downstream operations, including logistics and storage, indicates robust activity in this area.

Dialog Group secures recurring revenue through long-term maintenance and service contracts. These agreements cover essential asset integrity and specialized plant services, ensuring stable and predictable income. For instance, in 2024, Dialog’s infrastructure division reported significant contributions from these service contracts, highlighting their importance to the company's financial stability.

Sales of Fabricated Products and Specialist Materials

Dialog Group generates revenue by selling custom-fabricated components, modules, and specialized products tailored to client requirements. This includes proprietary solutions and niche industrial parts, catering to specific market demands.

In 2024, Dialog Group's sales of fabricated products and specialist materials represented a significant portion of its revenue, driven by demand in advanced manufacturing sectors. For instance, the company reported substantial growth in its custom silicon solutions segment, contributing to overall sales performance.

- Custom Fabrication: Income from bespoke components and modules designed for unique client applications.

- Specialist Materials: Revenue derived from proprietary or niche industrial materials supplied by Dialog.

- Proprietary Solutions: Earnings from Dialog's own developed technologies and specialized product offerings.

- Market Niche: Focus on high-value, specialized parts that command premium pricing.

Consultancy and Technical Advisory Fees

Dialog Group generates significant revenue through its consultancy and technical advisory services. These fees stem from offering expert guidance on industrial operations, asset management, and project development to a wide range of clients.

In 2024, Dialog Group's Engineering division, which encompasses these advisory services, reported a substantial contribution to the group's overall financial performance. This highlights the value clients place on their specialized knowledge and project execution capabilities.

- Expert Technical Consultancy: Providing specialized advice on engineering, procurement, and construction (EPC) projects.

- Feasibility Studies: Conducting in-depth analyses to assess the viability of new industrial projects and investments.

- Asset Management Advisory: Offering strategies and support for optimizing the performance and lifespan of industrial assets.

- Project Development Support: Guiding clients through all phases of project development, from conceptualization to commissioning.

Dialog Group's revenue streams are diversified, encompassing major engineering and construction projects, specialized storage services, and the sale of fabricated components. The company also benefits from recurring income through maintenance contracts and provides valuable technical consultancy.

In 2024, Dialog Group's EPCC projects remained a primary revenue driver, with significant contract wins bolstering financial results. Their tank terminal operations also saw robust activity, with fees for storage and handling contributing consistently. The sale of custom-fabricated products and proprietary solutions further diversified their income, particularly in advanced manufacturing sectors.

Recurring revenue from long-term maintenance agreements and technical advisory services provided a stable financial base. For instance, the company's infrastructure division reported strong performance from service contracts in 2024, underscoring the reliability of these income streams.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| EPCC Projects | Lump-sum and milestone-based contracts for large-scale engineering, procurement, construction, and commissioning. | Significant contributor to overall revenue, reflecting strong demand for infrastructure. |

| Tank Terminal Services | Fees for storage, handling, and blending of petroleum and petrochemical products. | Core income source, supported by extensive infrastructure utilization. |

| Custom Fabrication & Specialist Materials | Sales of bespoke components, modules, and niche industrial materials. | Growth driven by advanced manufacturing sectors, including silicon solutions. |

| Maintenance & Service Contracts | Recurring income from essential asset integrity and plant services. | Provided financial stability and predictable income for the infrastructure division. |

| Consultancy & Technical Advisory | Expert guidance on industrial operations, asset management, and project development. | Substantial contribution from the Engineering division, leveraging specialized knowledge. |

Business Model Canvas Data Sources

The Dialog Group Business Model Canvas is informed by a combination of internal financial reports, customer feedback analysis, and competitive market intelligence. These diverse data sources ensure a comprehensive and accurate representation of our business strategy.