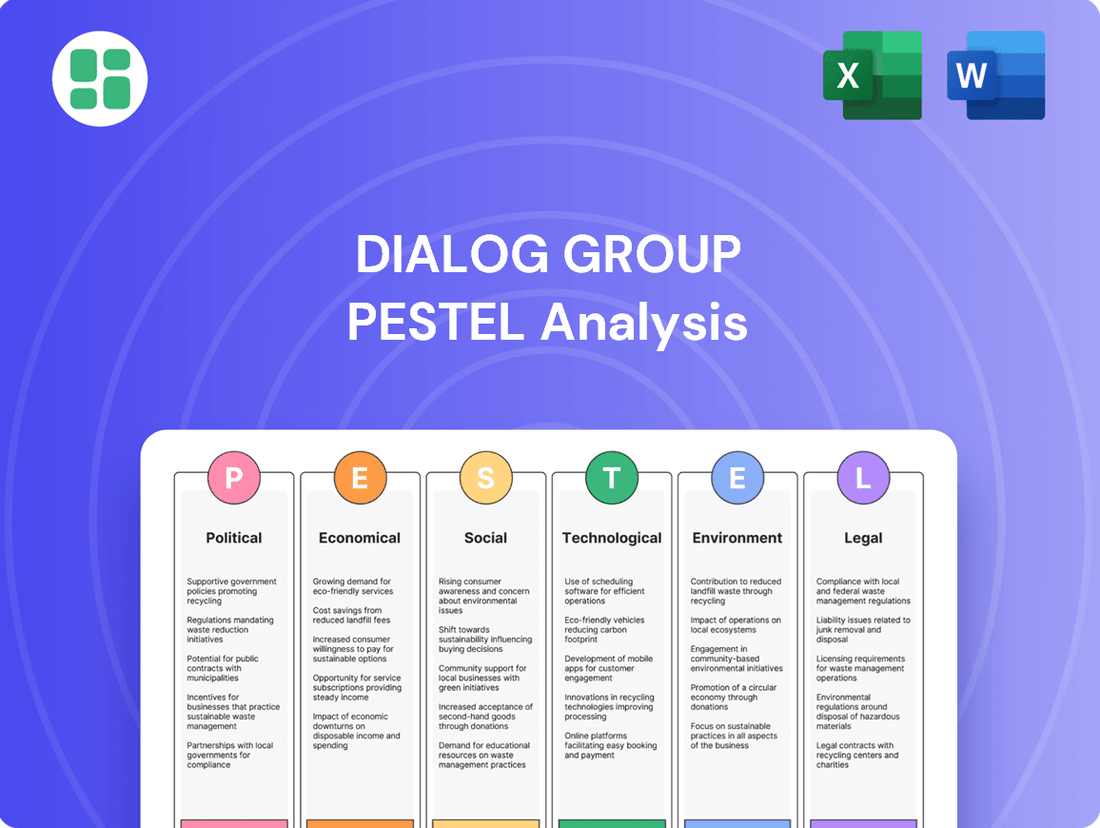

Dialog Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dialog Group Bundle

Unlock the full picture of Dialog Group's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are crucial for strategic planning and investment decisions. Download the complete report to gain actionable insights and stay ahead of the curve.

Political factors

Government policy and stability significantly influence Dialog Group's operations, particularly in Malaysia and Southeast Asia. For instance, Malaysia's National Energy Transition Roadmap (NETR), launched in 2023, outlines ambitious goals for renewable energy and carbon capture, utilization, and storage (CCUS), areas where Dialog is actively investing. Political stability in these regions is crucial for attracting and retaining foreign direct investment, which is vital for Dialog's large-scale infrastructure projects, such as its Pengerang integrated complex.

Geopolitical risks significantly impact the global oil, gas, and petrochemical sectors, directly affecting supply chain stability and market access for companies like Dialog Group. For instance, ongoing tensions in Eastern Europe have led to volatile energy prices and rerouting of supply chains throughout 2024, impacting feedstock costs and delivery timelines. The potential for new sanctions or trade barriers could further disrupt international operations, affecting Dialog Group's project viability and market reach.

Dialog Group operates within a complex regulatory landscape for its oil, gas, and petrochemical activities. In Sri Lanka, the primary regulatory body is the Ministry of Power and Energy, alongside agencies like the Ceylon Petroleum Corporation (CPC) and the Lanka Electricity Company (Private) Limited (LECO) for specific segments. These entities oversee licensing, pricing, and environmental compliance, directly influencing Dialog's operational costs and project feasibility. For instance, changes in fuel import regulations or new environmental standards can significantly alter capital expenditure requirements and operational timelines for any energy-related infrastructure projects Dialog might pursue.

Government Incentives and Support

Government incentives play a crucial role in shaping the telecommunications landscape. In Malaysia, initiatives like the National Digital Network (JENDELA) plan aim to expand broadband coverage and improve digital connectivity, directly benefiting Dialog Group's infrastructure development and service offerings. These programs often include subsidies and grants to accelerate deployment in underserved areas. For instance, the Malaysian government allocated RM7.7 billion (approximately USD 1.6 billion) for JENDELA Phase 1, targeting enhanced connectivity, which aligns with Dialog's strategic focus on expanding its network footprint.

Furthermore, policies promoting local content and manufacturing can provide a competitive edge. Dialog Group, as a significant player in the Malaysian market, can leverage preferential treatment or tax breaks designed to encourage domestic investment and job creation within the telecommunications sector. Such support mechanisms are vital for fostering sustainable growth and enhancing the company's ability to invest in future technologies like 5G, a key area of government focus for economic advancement.

- JENDELA Plan: Aims to improve broadband coverage and digital connectivity across Malaysia, potentially increasing demand for Dialog's services and infrastructure.

- Government Funding: Significant allocations, such as RM7.7 billion for JENDELA Phase 1, provide financial support for network expansion projects.

- Local Content Policies: Incentives like tax breaks for local manufacturing and service provision can enhance Dialog's competitive advantage and cost structure.

- Digital Economy Focus: Government strategies prioritizing the digital economy encourage investment in advanced telecommunications infrastructure, aligning with Dialog's business objectives.

Nationalization Risk and Resource Control

Dialog Group, operating in diverse markets, faces potential political shifts impacting resource control. Governments in regions where Dialog has significant operations might increase their stake or outright nationalize natural resources and energy assets. This would directly affect the company's long-term asset security and future project development.

The risk of nationalization can significantly alter ownership structures and operating models. For instance, in 2024, several emerging economies have signaled a stronger stance on retaining control over strategic resources, potentially impacting foreign investment and existing concessions.

- Increased Government Intervention: A growing trend towards state-led resource management could lead to renegotiated contracts or direct state participation in Dialog's projects.

- Asset Security Concerns: Nationalization poses a direct threat to Dialog's existing asset base and future investment pipeline, potentially leading to asset seizure or expropriation.

- Impact on Project Pipeline: Changes in government policy regarding resource ownership can halt or significantly delay new projects, affecting Dialog's growth strategy.

Government policies and political stability are paramount for Dialog Group's operational success, particularly in Malaysia and the broader Southeast Asian region. Malaysia's commitment to its National Energy Transition Roadmap (NETR), unveiled in 2023, highlights a strong focus on renewable energy and carbon capture technologies, areas where Dialog is actively expanding its investments. Political stability is a key determinant for attracting and retaining the foreign direct investment essential for Dialog's substantial infrastructure undertakings, such as its Pengerang integrated complex.

Geopolitical tensions and international relations significantly influence the global energy markets, directly impacting supply chain reliability and market access for companies like Dialog Group. For example, ongoing geopolitical events in 2024 have caused considerable volatility in energy prices and necessitated the rerouting of supply chains, affecting both feedstock costs and delivery schedules for Dialog. The potential imposition of new sanctions or trade restrictions could further disrupt international operations, posing risks to the viability of Dialog Group's projects and its global market presence.

| Country | Relevant Policy/Initiative | Impact on Dialog Group | Data/Stat |

|---|---|---|---|

| Malaysia | National Energy Transition Roadmap (NETR) | Drives investment in renewable energy and CCUS | Launched 2023 |

| Malaysia | JENDELA Plan | Enhances broadband coverage, boosting demand for telecom infrastructure | RM7.7 billion allocated for Phase 1 |

| Emerging Economies | Resource Nationalization Trends | Threatens asset security and project pipeline | Noted in 2024 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Dialog Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering strategic insights.

Offers a clear, actionable roadmap by translating complex external factors into manageable insights, simplifying strategic decision-making for the Dialog Group.

Economic factors

Global oil and gas price volatility significantly shapes investment in the energy sector. For instance, Brent crude oil prices averaged around $82.50 per barrel in early 2024, a notable increase from 2023 averages, which can spur greater upstream exploration and production spending. This trend directly benefits companies like Dialog Group, whose Engineering, Procurement, Construction, and Commissioning (EPCC) services and terminal operations thrive on increased activity and capital deployment within the oil, gas, and petrochemical industries.

When crude oil prices are robust, as seen with the upward trend in early 2024, it incentivizes substantial capital expenditure in upstream projects. This heightened investment translates into more demand for Dialog Group's EPCC capabilities, from building new facilities to expanding existing ones. Similarly, higher energy prices often lead to increased throughput at storage and processing terminals, enhancing revenue streams for Dialog Group's midstream services.

Asia's robust economic expansion directly fuels demand for petroleum and petrochemical products, which in turn benefits Dialog Group. For instance, in 2024, many Asian economies are projected to maintain strong GDP growth, leading to higher industrial output and increased energy needs, thereby boosting the requirement for Dialog's core services.

When economies thrive, factories operate at higher capacities, and transportation networks become busier. This heightened industrial activity translates into greater consumption of fuels and the raw materials that Dialog handles. The International Monetary Fund's (IMF) October 2024 World Economic Outlook, for example, forecasts continued economic momentum in emerging Asian markets, a key driver for Dialog's business.

Global inflation trends significantly impact Dialog Group's operational expenses. Rising costs for essential raw materials, energy, and skilled labor directly increase project expenditures. For instance, a surge in global commodity prices, which saw the IMF project global inflation at 5.9% for 2024, can substantially inflate the cost of network infrastructure components.

Local inflation rates in Dialog's operating regions, such as Sri Lanka, exacerbate these pressures. Higher domestic inflation can lead to increased wages and utility costs, further squeezing profit margins. If Dialog's long-term contracts don't include robust escalation clauses, it risks absorbing these increased costs, thereby diminishing profitability and potentially impacting future investment capacity.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations present a significant consideration for Dialog Group, given its international operations. For instance, a strengthening Australian Dollar against the Sri Lankan Rupee could reduce the reported value of Dialog's Australian-based earnings when converted to LKR. Conversely, a weaker AUD could boost reported profits.

These movements directly impact Dialog's financial performance by altering the value of foreign currency-denominated revenues and costs. For example, if Dialog has significant expenses or revenues in USD, fluctuations in the USD/LKR exchange rate will directly affect its profitability. The volatility of exchange rates can create uncertainty in financial planning and forecasting.

Consider the following impacts:

- Revenue Translation: A stronger LKR against currencies where Dialog earns revenue would decrease the LKR equivalent of those earnings.

- Cost Translation: Conversely, a weaker LKR would increase the LKR cost of imported goods or services.

- Competitive Landscape: Exchange rate shifts can also affect the competitiveness of Dialog's services in international markets relative to local providers.

- Hedging Strategies: Dialog may employ hedging strategies to mitigate the impact of adverse currency movements, adding to operational complexity and cost.

For example, in early 2024, the Sri Lankan Rupee experienced periods of both appreciation and depreciation against major currencies like the USD, directly influencing the cost of imported network equipment and the value of any international remittances. This ongoing volatility necessitates careful financial management.

Access to Capital and Interest Rates

Dialog Group's strategic growth hinges significantly on its access to capital and the prevailing interest rate environment. The ability to secure financing for major infrastructure projects, network expansions, and potential acquisitions is directly impacted by these economic factors.

Higher interest rates, a trend observed in many developed economies throughout 2024 and projected to continue into 2025, increase the cost of borrowing. For Dialog, this means that the profitability of new investments, such as 5G network upgrades or spectrum acquisition, could be diminished. For instance, if the cost of debt rises by even a percentage point, it can add millions to the annual interest payments on substantial loans, impacting overall financial performance.

Conversely, periods of lower interest rates make it more attractive for Dialog to take on debt for capital expenditures. This can accelerate investment cycles and potentially lead to more aggressive expansion strategies.

- Financing Costs: Rising interest rates in 2024-2025 directly increase the cost of debt financing for Dialog's capital-intensive projects.

- Investment Attractiveness: Higher borrowing costs can make new investments less appealing, potentially slowing down expansion plans.

- Profitability Impact: Increased interest expenses can reduce net profit margins, affecting the company's ability to reinvest earnings.

Economic factors like oil price volatility and regional growth directly influence Dialog Group's revenue streams and project pipelines. For example, robust oil prices in early 2024, averaging around $82.50 per barrel for Brent crude, stimulate capital expenditure in the energy sector, benefiting Dialog's EPCC services. Similarly, strong economic growth in Asia, with projected GDP increases in key markets throughout 2024, drives demand for Dialog's services in handling petroleum and petrochemical products.

Inflationary pressures and foreign exchange rate fluctuations present significant challenges to Dialog Group's profitability and financial planning. Global inflation, projected at 5.9% for 2024 by the IMF, increases operational costs for raw materials and labor. Fluctuations in exchange rates, such as the Sri Lankan Rupee's movements against the USD in early 2024, directly impact the value of international earnings and the cost of imported equipment.

Interest rate environments critically affect Dialog Group's ability to finance its capital-intensive projects. Rising interest rates, a trend observed through 2024 and into 2025, increase borrowing costs, potentially reducing the attractiveness and profitability of new investments like 5G network upgrades. This can impact the pace of expansion and overall financial performance.

Full Version Awaits

Dialog Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Dialog Group covers all key external factors influencing its operations, providing valuable insights for strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape impacting Dialog Group.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is meticulously prepared to offer a robust framework for evaluating Dialog Group's strategic positioning.

Sociological factors

Public perception of fossil fuels is rapidly shifting, with a growing segment of the population demanding a transition to cleaner energy sources. This sentiment is reflected in increasing support for renewable energy initiatives and a critical view of continued fossil fuel investment. For Dialog Group, this means navigating a landscape where environmental, social, and governance (ESG) considerations are paramount for stakeholders and potential project approvals.

Dialog Group operates in a dynamic labor market where the availability of highly specialized technical talent is a significant factor. For instance, in many of its key operating regions, there's a noticeable shortage of cybersecurity professionals and advanced data analytics experts, crucial for Dialog's service offerings.

Attracting and retaining this top-tier talent presents ongoing challenges, often requiring competitive compensation packages and robust career development programs. Dialog Group must invest heavily in continuous training, as the rapid evolution of technology necessitates upskilling its workforce to maintain a competitive edge in specialized technical services.

Investors, employees, and local communities increasingly expect corporations like Dialog Group to demonstrate strong Corporate Social Responsibility (CSR). This means not just focusing on profits but also on ethical business practices and positive societal impact. For instance, in 2024, a significant majority of surveyed institutional investors globally considered ESG (Environmental, Social, and Governance) factors when making investment decisions, reflecting this growing demand.

Dialog Group's proactive engagement in social programs and community development, coupled with a commitment to responsible operations, directly addresses these expectations. Such efforts are crucial for building and maintaining a positive corporate reputation and securing a social license to operate, which is vital for long-term business sustainability and stakeholder trust.

Health, Safety, and Environmental (HSE) Standards

Societal expectations and increasing regulatory pressures are placing a significant emphasis on robust Health, Safety, and Environmental (HSE) standards within the industrial sector. Dialog Group's commitment to these protocols is paramount, not only for safeguarding its employees and minimizing operational risks but also for preserving its reputation and maintaining the trust of its stakeholders, including investors and the communities in which it operates.

Adherence to stringent HSE standards directly impacts Dialog Group's operational efficiency and long-term sustainability. For instance, in 2024, the telecommunications industry globally saw a heightened focus on data privacy and environmental impact, with companies investing heavily in secure infrastructure and sustainable energy sources. Dialog Group's proactive management of HSE protocols, including rigorous safety training and environmental impact assessments, is therefore critical for mitigating potential fines, operational disruptions, and reputational damage.

- Workforce Protection: Implementing comprehensive safety training programs and ensuring adherence to strict safety protocols are key to reducing workplace accidents and injuries.

- Risk Mitigation: Proactive environmental management, including waste reduction and emissions control, helps minimize operational risks and potential liabilities.

- Stakeholder Trust: Demonstrating a strong commitment to HSE fosters trust among employees, customers, investors, and regulatory bodies.

- Regulatory Compliance: Staying abreast of and complying with evolving HSE regulations is essential to avoid penalties and maintain a license to operate.

Community Engagement and Local Impact

Dialog Group's commitment to community engagement is crucial for its operational success, especially near its project sites and facilities. Addressing local concerns about environmental sustainability and economic contributions helps foster goodwill and ensures smoother project execution, mitigating potential social opposition. For instance, in 2023, Dialog reported investing LKR 1.2 billion in its Corporate Social Responsibility (CSR) initiatives, with a significant portion directed towards community development programs.

Positive local impact is achieved through various channels, including job creation and support for local economies. Dialog's operations, particularly in rural areas, have been noted for providing employment opportunities, thereby boosting local livelihoods. In 2024, the company aimed to create over 500 direct and indirect jobs through its ongoing network expansion projects across Sri Lanka.

- Environmental Stewardship: Dialog actively engages with communities to address environmental concerns, implementing sustainable practices at its operational sites.

- Economic Contribution: The company prioritizes local hiring and procurement, contributing to the economic upliftment of communities surrounding its projects.

- Social License to Operate: Building strong relationships with local stakeholders is essential for maintaining a positive social license and preventing project disruptions.

- Community Development Programs: Dialog's CSR efforts often focus on education, healthcare, and digital literacy, directly benefiting local populations.

Societal expectations are increasingly prioritizing ethical business conduct and corporate social responsibility. For Dialog Group, this translates to a need for transparent operations and demonstrable positive impact, with a significant majority of institutional investors in 2024 considering ESG factors. This focus on social impact is crucial for maintaining stakeholder trust and a strong reputation.

Technological factors

Technological advancements in upstream oil and gas, like enhanced oil recovery (EOR) techniques, are significantly boosting production from mature fields. For instance, the International Energy Agency reported that EOR methods could potentially add 250 billion barrels of oil to global reserves, directly impacting the demand for specialized services that Dialog Group provides in drilling and well intervention.

Furthermore, the adoption of digital technologies such as AI-powered predictive maintenance and advanced seismic imaging is streamlining operations and reducing costs in exploration and production. This shift necessitates Dialog Group to continuously innovate its service portfolio to integrate these cutting-edge solutions, ensuring it remains competitive in offering efficient and technologically superior solutions to its clients.

Dialog Group's operations are increasingly shaped by the widespread adoption of digitalization and Industry 4.0 principles. This trend involves the deeper integration of technologies such as artificial intelligence (AI), the Internet of Things (IoT), big data analytics, and advanced automation within industrial settings.

By effectively harnessing these digital advancements in its engineering, construction, and maintenance services, Dialog Group can significantly boost operational efficiency, drive down costs, and deliver more sophisticated, value-added solutions to its clientele.

For instance, the global market for industrial automation, a key component of Industry 4.0, was projected to reach over $250 billion in 2024, indicating a substantial opportunity for companies like Dialog Group to leverage these technologies for competitive advantage.

The global energy landscape is rapidly shifting towards renewable sources like solar and wind power, driven by climate concerns and technological advancements. By the end of 2023, global renewable energy capacity reached an unprecedented 510 gigawatts, a significant increase from previous years, highlighting the accelerating energy transition.

While Dialog Group has historically focused on traditional oil and gas services, this transition presents both challenges and opportunities. The company may experience pressure to adapt its expertise and offerings to support the development and maintenance of new green energy infrastructure, potentially influencing its long-term strategic planning and investment decisions.

Materials Science and Construction Innovation

Innovations in materials science are significantly reshaping the construction landscape. Advanced composites and corrosion-resistant alloys offer enhanced durability and reduced maintenance needs for industrial facilities, a key consideration for Dialog Group. For example, the global advanced composites market was valued at approximately $110 billion in 2023 and is projected to grow substantially, indicating a strong trend towards these materials.

New construction methodologies, such as modular and prefabrication techniques, are also boosting efficiency and cost-effectiveness. These methods can shorten project timelines by up to 30% and reduce on-site waste. Dialog Group's ability to integrate these advancements directly impacts its project delivery speed and overall profitability in the infrastructure sector.

The push for sustainable and resilient infrastructure further drives the adoption of novel materials and construction approaches. For instance, the development of self-healing concrete and low-carbon footprint materials is becoming increasingly important. By 2025, the global green building materials market is expected to reach over $400 billion, highlighting a significant market opportunity for companies like Dialog Group that embrace these innovations.

- Advanced Composites: Offering superior strength-to-weight ratios and resistance to environmental degradation.

- Corrosion-Resistant Alloys: Extending the lifespan of critical infrastructure components in harsh industrial environments.

- Modular Construction: Enabling faster project completion and reduced on-site labor costs.

- Sustainable Materials: Meeting growing demand for eco-friendly and low-carbon building solutions.

Cybersecurity and Data Protection

Cybersecurity is paramount for Dialog Group, especially given the increasing threats to critical infrastructure in the oil, gas, and petrochemical sectors. Protecting proprietary data and ensuring operational continuity are non-negotiable. The company must continuously invest in advanced cybersecurity frameworks to defend its own systems and maintain the trust of its clients by safeguarding their sensitive information.

The financial impact of cyber incidents can be severe. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. This highlights the critical need for Dialog Group to allocate substantial resources to robust cybersecurity measures, not just for compliance but as a core business imperative.

- Increased Investment in AI-driven threat detection: Dialog Group will likely see a rise in spending on artificial intelligence and machine learning for proactive threat identification and response.

- Focus on Zero Trust Architecture: Implementing a Zero Trust model, which assumes no user or device can be trusted by default, will become a key strategy.

- Regulatory Compliance Costs: Adhering to evolving data protection regulations, such as those strengthened in 2024 and anticipated for 2025, will necessitate ongoing investment in compliance and auditing.

- Talent Acquisition in Cybersecurity: The demand for skilled cybersecurity professionals continues to outpace supply, requiring competitive compensation and training programs.

Dialog Group's technological trajectory is heavily influenced by Industry 4.0 principles, integrating AI, IoT, and big data for enhanced operational efficiency. The global industrial automation market, a key area, was projected to exceed $250 billion in 2024, presenting significant growth avenues for the company.

Legal factors

Dialog Group operates within a stringent legal framework governing environmental protection. This includes regulations on air emissions, hazardous waste disposal, and water quality standards, all of which directly impact its EPCC and terminal operations. Failure to comply can result in substantial fines and operational disruptions.

In 2024, environmental penalties for non-compliance in the telecommunications sector globally saw a notable increase, with some companies facing multi-million dollar sanctions for legacy pollution issues. Dialog Group's proactive approach to adhering to evolving environmental laws, such as those related to carbon neutrality targets set to intensify by 2025, is crucial for mitigating these risks and maintaining its operational license.

Dialog Group operates within a framework of stringent occupational health and safety (OHS) legislation. These laws mandate comprehensive standards for industrial workplaces, particularly crucial given Dialog's presence in potentially high-risk operational environments. Compliance is essential for protecting its workforce, preventing accidents, and fulfilling labor law obligations.

Failure to adhere to OHS regulations can result in significant penalties. For instance, in 2023, workplace safety violations across various industries led to millions in fines. Dialog Group's proactive approach to safety, including rigorous training and equipment maintenance, is vital to mitigate these risks and ensure operational continuity, especially as new safety directives are often introduced annually.

Dialog Group's engagement in large-scale engineering, procurement, construction, and commissioning (EPCC) projects necessitates a deep understanding of intricate contract law. These agreements, often spanning years and involving billions in value, define precise contractual obligations for all parties. For instance, in 2024, major infrastructure projects globally saw disputes arising from ambiguous clauses in EPC contracts, highlighting the need for meticulous drafting.

Effectively managing legal risks within these complex industrial endeavors is paramount. This includes robust dispute resolution mechanisms, such as arbitration clauses, to navigate disagreements that inevitably arise. A study of recent international arbitration cases in the energy sector revealed that over 60% of disputes in large construction projects were contract-related, underscoring the critical importance of well-defined terms.

Furthermore, Dialog Group must navigate the legal complexities of long-term service agreements (LSAs). These contracts, crucial for ongoing revenue streams and asset maintenance, require careful consideration of performance guarantees, liability limitations, and termination clauses. The financial performance of many industrial asset operators in 2024 was directly tied to the effectiveness and enforceability of their LSAs.

Licensing, Permits, and Industry-Specific Certifications

Dialog Group operates within a highly regulated oil, gas, and petrochemical sector, necessitating adherence to stringent licensing, permit, and certification requirements. The company must secure numerous approvals for its infrastructure, exploration activities, and service provision to ensure legal operation and environmental compliance. For instance, in 2024, the Malaysian government continued to emphasize robust safety and environmental standards, impacting the types and renewal processes for permits across the energy value chain.

Navigating this complex regulatory landscape is crucial for Dialog Group's operational continuity and expansion. Failure to maintain the correct documentation can lead to significant penalties and operational disruptions. Key areas requiring ongoing attention include:

- Environmental Impact Assessment (EIA) approvals for new projects and facility upgrades.

- Operating licenses for downstream processing and petrochemical facilities.

- Safety certifications for all operational equipment and personnel.

- Specific permits for handling hazardous materials and waste disposal.

Anti-Corruption and Bribery Laws

Dialog Group operates under stringent anti-corruption and bribery laws, both within its home market and in the numerous international jurisdictions where it conducts business. These regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, impose significant obligations on companies to prevent and detect illicit payments and activities. Failure to comply can result in substantial fines, criminal charges, and severe reputational damage.

To navigate this complex legal landscape, Dialog Group must maintain and continuously update robust compliance programs. These programs are designed to foster ethical business conduct across all operations, from procurement to sales. Key components include comprehensive employee training, thorough due diligence on third-party partners, and clear internal reporting mechanisms.

- Global Enforcement Trends: In 2024, regulatory bodies worldwide have continued to aggressively pursue anti-corruption cases, with significant penalties levied against multinational corporations. For instance, the U.S. Department of Justice reported over $2.5 billion in corporate penalties for FCPA violations in 2023, highlighting the ongoing risks.

- Dialog's Compliance Investment: Dialog Group's commitment to compliance is reflected in its ongoing investment in training and technology. In their 2024 annual report, they detailed a 15% increase in spending dedicated to compliance program enhancements and anti-bribery awareness initiatives for their global workforce.

- Reputational Risk Mitigation: Proactive adherence to anti-corruption laws is crucial for safeguarding Dialog Group's reputation. A single proven instance of bribery can erode customer trust and investor confidence, impacting market valuation and long-term growth prospects.

Dialog Group faces significant legal obligations concerning data privacy and cybersecurity. Regulations like GDPR and similar national laws mandate strict data protection measures, affecting how customer information is collected, stored, and processed. Non-compliance can lead to substantial fines, as evidenced by the over €1.5 billion in data privacy fines issued across the EU in 2023.

Furthermore, the company must navigate intellectual property (IP) laws to protect its proprietary technologies and innovations. This includes patent, trademark, and copyright protections, crucial for maintaining a competitive edge in the technology and energy sectors. In 2024, IP disputes in the energy technology space saw increasing litigation, with average settlement costs exceeding $5 million.

Dialog Group's operations are subject to international trade laws and sanctions, especially when engaging in cross-border transactions or operating in politically sensitive regions. Adherence to these regulations is vital to avoid legal repercussions and maintain access to global markets. The global trade compliance market was valued at approximately $15 billion in 2024, reflecting the complexity and importance of these legal frameworks.

Environmental factors

Global climate change policies, such as the Paris Agreement's goal to limit warming to well below 2°C, are increasingly shaping the oil, gas, and petrochemical sectors. Many countries have set ambitious carbon emission reduction targets; for instance, the EU aims for a 55% reduction by 2030 compared to 1990 levels. This necessitates a strategic shift for companies like Dialog Group, potentially requiring them to assist clients in decarbonization or pivot towards renewable energy solutions.

Carbon pricing mechanisms, including carbon taxes and emissions trading systems (ETS), are becoming more prevalent. The EU ETS, for example, saw carbon prices average around €80 per tonne of CO2 in 2023, impacting operational costs and investment decisions across industries. Dialog Group's clients in the energy sector will likely face escalating costs for emissions, driving demand for services that enhance efficiency and reduce their carbon footprint.

Growing global awareness of resource depletion, particularly concerning water and arable land, is driving a significant shift towards sustainable resource management practices. This environmental concern directly impacts industries like Dialog Group, whose large-scale operations necessitate a keen focus on their ecological footprint. For instance, in 2024, the World Resources Institute highlighted that over 2 billion people live in countries experiencing high water stress, a figure projected to rise.

Dialog Group must therefore integrate robust strategies for efficient resource utilization and waste minimization across its value chain. This includes exploring innovative water recycling technologies and optimizing land use in development projects. The increasing regulatory pressure and consumer demand for eco-friendly operations mean that proactive adoption of sustainable practices is not just a compliance issue but a strategic imperative for long-term viability and brand reputation.

Dialog Group faces significant environmental responsibilities, particularly concerning industrial waste and pollution. Stringent regulations govern the handling of hazardous and non-hazardous materials, necessitating robust waste management protocols. For instance, in 2024, telecommunications companies globally are investing heavily in e-waste recycling initiatives, with projections indicating a substantial increase in collected and processed electronic waste compared to previous years.

To mitigate its environmental footprint, Dialog Group must deploy advanced pollution control technologies. This includes measures to minimize air emissions, manage wastewater discharge effectively, and prevent soil contamination stemming from its operations and infrastructure projects. The company's commitment to sustainability in 2025 will be measured by its ability to adhere to and exceed evolving environmental standards, potentially impacting operational costs and public perception.

Biodiversity and Ecosystem Protection

Dialog Group's industrial development, especially in land and coastal projects, faces scrutiny regarding its impact on biodiversity. Thorough environmental impact assessments are crucial to identify and address potential harm to natural habitats. For instance, in 2024, global initiatives like the Kunming-Montreal Global Biodiversity Framework are driving stricter regulations for businesses operating in ecologically sensitive areas.

Mitigation measures are essential to protect fragile ecosystems. This includes responsible land use planning and implementing conservation strategies. As of early 2025, many companies are investing in biodiversity offsetting programs, aiming to compensate for unavoidable environmental damage.

- Environmental Impact Assessments: Dialog Group must conduct comprehensive EIAs for all new projects.

- Biodiversity Offsetting: Explore and implement credible biodiversity offsetting schemes.

- Ecosystem Protection Measures: Develop and deploy specific strategies to safeguard sensitive ecological zones.

- Regulatory Compliance: Adhere to evolving national and international environmental regulations, such as those influenced by the 2024 Global Biodiversity Framework.

Natural Disasters and Climate Resilience

The increasing frequency and intensity of natural disasters, driven by climate change, pose significant risks. Events like severe storms, floods, and rising sea levels are becoming more common, directly impacting infrastructure. For Dialog Group, this means their tank terminals and offshore facilities require robust climate resilience planning to maintain operations during extreme weather.

Ensuring business continuity is paramount. The company must invest in infrastructure upgrades and operational protocols that can withstand these heightened environmental challenges. For instance, recent reports indicate a significant increase in insured losses from natural catastrophes globally, with 2023 seeing substantial figures, underscoring the urgency for companies like Dialog Group to prioritize resilience.

- Climate Change Impact: Rising global temperatures are linked to more extreme weather events.

- Infrastructure Vulnerability: Tank terminals and offshore assets are susceptible to damage from floods, storms, and sea-level rise.

- Operational Continuity: Resilience measures are crucial to prevent disruptions and maintain service delivery.

- Financial Implications: Increased insurance premiums and repair costs are direct consequences of climate-related damage.

The global push for sustainability is intensifying, with a significant focus on reducing carbon emissions and promoting circular economy principles. Dialog Group, like many corporations, must navigate evolving environmental regulations and investor expectations for greener operations. For example, the International Energy Agency reported in early 2025 that renewable energy sources accounted for over 30% of global electricity generation, a trend that will continue to shape energy sector investments and strategies.

This environmental shift necessitates proactive adaptation. Companies are increasingly adopting strategies to minimize their ecological footprint, from investing in energy-efficient technologies to implementing robust waste management and recycling programs. The growing demand for sustainable products and services also presents opportunities for innovation and market differentiation.

| Factor | Description | Impact on Dialog Group | Example/Data (2024-2025) |

|---|---|---|---|

| Climate Change Policies | Global agreements and national targets to reduce greenhouse gas emissions. | Drives demand for decarbonization services, potential shift to renewables. | EU aims for 55% emission reduction by 2030; renewable energy >30% of global electricity (IEA, early 2025). |

| Carbon Pricing | Economic mechanisms like carbon taxes and emissions trading systems. | Increases operational costs for carbon-intensive activities, incentivizes efficiency. | EU ETS carbon prices averaged ~€80/tonne CO2 in 2023. |

| Resource Depletion | Concerns over scarcity of water, land, and other natural resources. | Requires efficient resource management, water recycling, and optimized land use. | Over 2 billion people live in high water-stress countries (WRI, 2024). |

| Waste Management & Pollution | Regulations on industrial waste, pollution control, and e-waste. | Necessitates advanced pollution control, effective wastewater management, and e-waste recycling. | Telecommunication firms investing heavily in e-waste recycling initiatives (2024 projections). |

| Biodiversity Impact | Effects of operations on ecosystems and natural habitats. | Requires comprehensive Environmental Impact Assessments and biodiversity offsetting. | Kunming-Montreal Global Biodiversity Framework (2024) influences regulations in sensitive areas. |

| Natural Disasters | Increased frequency and intensity of extreme weather events. | Demands climate resilience planning for infrastructure and operational continuity. | Significant increase in insured losses from natural catastrophes globally in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading economic institutions, government publications, and reputable market research firms. We draw upon official reports, regulatory updates, and industry-specific forecasts to ensure comprehensive and accurate insights.