Dialog Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dialog Group Bundle

Dialog Group operates within a dynamic market, facing significant pressures from intense rivalry and the constant threat of new entrants. Understanding the nuances of buyer power and the availability of substitutes is crucial for navigating this landscape.

The complete report reveals the real forces shaping Dialog Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil, gas, and petrochemical sector, where Dialog Group operates, frequently depends on a select group of highly specialized equipment manufacturers and technology providers. When these suppliers are few and their offerings are both critical and unique, they gain considerable leverage over Dialog Group.

This situation is amplified for proprietary technologies or vital components that lack readily available alternatives, allowing such suppliers to dictate terms. For instance, in 2024, the market for advanced subsea exploration technology saw a consolidation, with only a handful of firms possessing the necessary patents and manufacturing capabilities, giving them substantial pricing power.

The bargaining power of suppliers for Dialog Group is significantly influenced by the availability of substitute inputs. If Dialog has access to numerous alternative sources for its critical raw materials, specialized components, or essential skilled labor, the suppliers' leverage is naturally diminished. This accessibility to substitutes acts as a crucial check on any single supplier's ability to dictate terms or prices.

When substitute inputs are readily available, or when Dialog can switch between suppliers with minimal cost and disruption, the suppliers' power to exert undue influence is considerably reduced. For instance, if Dialog relies on standard electronic components that can be sourced from multiple manufacturers, no single component supplier can command excessive pricing. This flexibility empowers Dialog to negotiate more favorable terms.

Conversely, a reliance on a limited number of unique or highly specialized inputs inherently increases the bargaining power of those suppliers. If Dialog requires a proprietary chip or a specific type of rare earth mineral that only a handful of companies can provide, those suppliers gain substantial leverage. In 2024, the semiconductor industry, for example, continued to see supply chain constraints for certain advanced chips, giving those specific suppliers increased bargaining power.

Dialog Group faces significant bargaining power from suppliers due to high switching costs. These costs can manifest as substantial financial outlays for new specialized equipment or the considerable time and resources required to retrain employees on different software systems. For instance, if Dialog relies on proprietary infrastructure, migrating to an alternative could incur millions in capital expenditure and operational disruption.

Uniqueness of Supplier Offerings

Suppliers providing highly unique or patented products and services, particularly in specialized fields like advanced semiconductor design tools or proprietary manufacturing processes, hold significant leverage. Dialog Group would face substantial hurdles in attempting to replicate these offerings internally or sourcing viable substitutes, thereby increasing its reliance on these specific suppliers.

For instance, in 2024, the semiconductor industry saw continued reliance on a few key suppliers for advanced lithography equipment, with companies like ASML holding near-monopoly positions for certain cutting-edge technologies. This uniqueness translates directly into higher prices and more favorable terms for the supplier.

- High Differentiation: Suppliers offering specialized components or services that are difficult for Dialog Group to source elsewhere.

- Proprietary Technology: Reliance on suppliers with patented technologies or unique intellectual property.

- Niche Markets: Suppliers operating in niche markets where Dialog Group has limited alternative options.

- Dependence: Dialog Group's dependence on these suppliers for critical inputs increases their bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Dialog Group's operations, such as an equipment manufacturer beginning to offer Engineering, Procurement, Construction, and Commissioning (EPCC) services, significantly amplifies their bargaining power. This potential for direct competition compels Dialog to negotiate more favorable terms, lest they face a formidable rival that already possesses established industry knowledge and supply chains.

For instance, if a key telecommunications equipment provider, a major supplier to Dialog, were to announce plans for EPCC services, it would directly challenge Dialog's core business. This move would likely be underpinned by their existing relationships with component manufacturers and their deep understanding of network deployment, giving them a competitive edge.

- Supplier Forward Integration Threat: Suppliers can increase their leverage by threatening to enter Dialog's market, offering services like EPCC themselves.

- Impact on Dialog: This forces Dialog to accept less favorable terms to prevent direct competition from its own supply base.

- Example Scenario: An equipment vendor entering the EPCC space leverages existing industry knowledge and supplier relationships.

Dialog Group's bargaining power with suppliers is notably constrained by the specialized nature of many inputs within the oil, gas, and petrochemical sectors. When suppliers offer critical, unique components or proprietary technologies with few alternatives, their leverage increases significantly.

This is particularly true for advanced subsea exploration technology, where market consolidation in 2024 left only a handful of firms with essential patents and manufacturing capabilities, granting them substantial pricing power.

High switching costs, whether financial or operational, further solidify supplier influence, making it difficult for Dialog to change providers without incurring significant expense or disruption.

Suppliers in niche markets or those possessing unique intellectual property, like key lithography equipment providers in the semiconductor industry in 2024, can command higher prices due to Dialog's limited options.

| Factor | Impact on Dialog Group | 2024 Relevance |

|---|---|---|

| Supplier Specialization & Uniqueness | High leverage for suppliers | Consolidation in subsea tech |

| Availability of Substitutes | Low leverage for suppliers | Standard components offer flexibility |

| Switching Costs | High leverage for suppliers | Proprietary infrastructure migration costs |

| Supplier Forward Integration | Increased leverage for suppliers | Potential for equipment vendors to offer EPCC |

What is included in the product

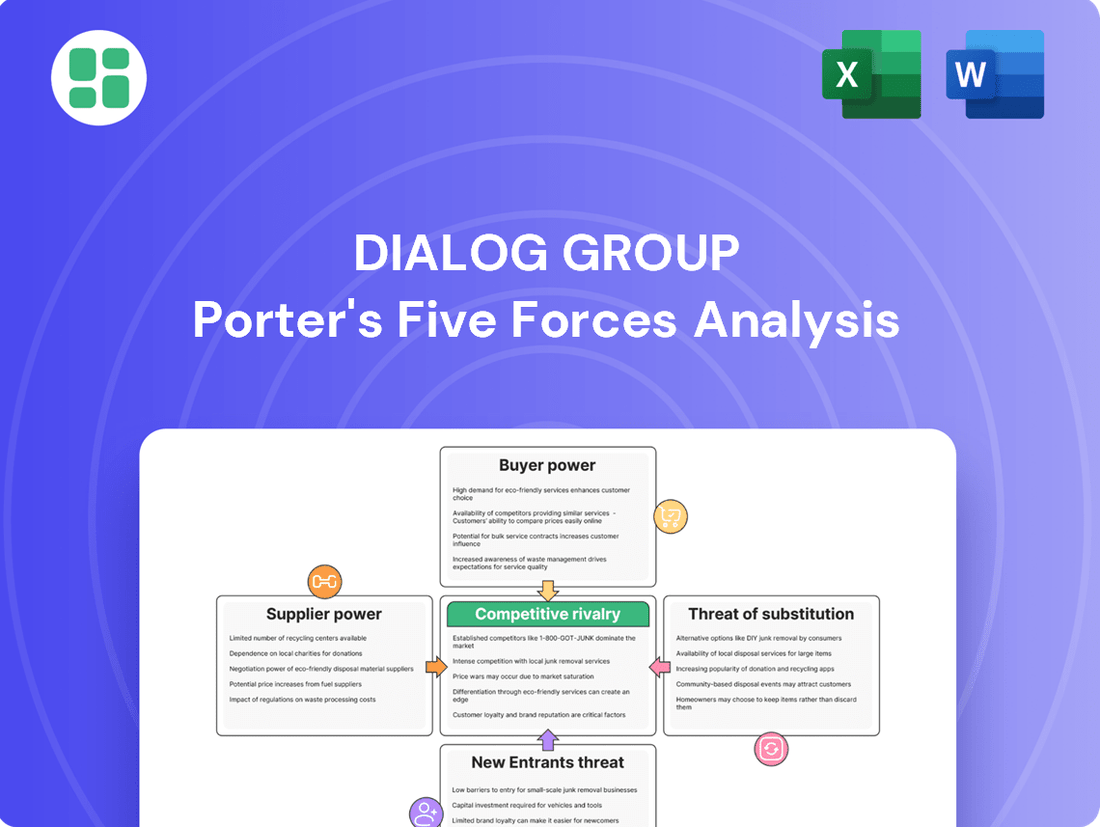

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants, and substitute products specifically for Dialog Group.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Dialog Group's customer base is notably concentrated, primarily consisting of large, integrated oil, gas, and petrochemical companies. This means a few major clients often contribute a significant portion of the company's revenue.

When a small number of clients hold such sway, their individual bargaining power becomes substantial. They can leverage this position to negotiate for lower prices or more favorable contractual terms, directly impacting Dialog's profitability.

For example, Petronas is identified as a key client for Dialog Group. The significant revenue generated from such major accounts underscores the leverage these customers possess in their dealings with Dialog.

Customer switching costs for integrated technical service providers like Dialog Group are a significant factor. These costs can be substantial due to the intricate nature of projects, the duration of existing contracts, and how deeply Dialog's services are embedded within a client's operations. For instance, a client deeply reliant on Dialog's network infrastructure and managed IT services would face considerable expense and operational upheaval to migrate to a competitor.

These high switching costs effectively curb the bargaining power of customers. The prospect of significant disruption, potential project risks, and outright financial expenditure discourages clients from seeking alternative providers. This inertia provides Dialog with a degree of pricing power and stability, as the effort and cost involved in changing suppliers are often prohibitive for many clients.

Dialog Group's customers exhibit varying price sensitivity, largely dictated by their own financial health and the relative cost of Dialog's services. When customers face profitability challenges or when Dialog's offerings represent a significant portion of their project expenses, their inclination to negotiate prices intensifies.

Furthermore, the competitive landscape in which Dialog's customers operate plays a crucial role. In 2024, many industries, particularly those tied to the volatile oil and gas sector, experienced heightened competitive pressures. This environment often translates into customers demanding greater cost efficiencies from their suppliers, including Dialog, thereby amplifying customer bargaining power.

Potential for Backward Integration by Customers

Major players in the oil, gas, and petrochemical sectors, who are key clients for Dialog Group, frequently maintain substantial in-house engineering, procurement, and construction (EPC) divisions. This internal capacity means they can potentially handle projects themselves, reducing reliance on external contractors like Dialog. For instance, in 2024, many supermajors reported billions in capital expenditures, some of which could be allocated to expanding these internal capabilities.

The credible threat of backward integration by these large clients significantly amplifies their bargaining power. They can leverage their existing or expandable internal resources as an alternative to Dialog's services, creating a powerful negotiating position. This is particularly relevant as the industry navigates cost pressures and seeks greater control over project execution.

- Internal EPC Capabilities: Major oil, gas, and petrochemical companies often possess significant in-house engineering, procurement, and construction expertise.

- Threat of Self-Performance: Clients can choose to perform Dialog's services internally, reducing demand for external providers.

- Expansion of Existing Divisions: Clients may expand their current internal divisions to take on more project work, further diminishing Dialog's market share.

- Negotiating Leverage: The potential for backward integration grants these large clients greater bargaining power over pricing and contract terms.

Importance of Dialog's Services to Customers

The perceived importance of Dialog Group’s services significantly influences customer bargaining power. For critical operations, Dialog's reliability and expertise become non-negotiable. For instance, in the oil and gas sector, where Dialog provides essential terminal and storage facilities, disruptions can lead to substantial financial losses for clients. This criticality inherently limits a customer's ability to pressure Dialog on price without risking operational continuity.

Consider Dialog's role in complex Engineering, Procurement, Construction, and Commissioning (EPCC) projects. The intricate nature of these undertakings demands specialized knowledge and a proven track record. Customers in this segment are often less inclined to switch providers or demand lower prices if it means compromising on the quality and timely delivery of these high-stakes projects. Dialog's established reputation for executing such projects effectively strengthens its position.

- Criticality of Services: Dialog's offerings, such as integrated logistics and terminal services for the energy sector, are often vital for customers' core business operations.

- Reliability and Expertise: The company's proven track record in complex EPCC projects and its specialized knowledge reduce customer willingness to compromise on quality for price.

- Operational Continuity: For sectors like oil and gas, where Dialog provides essential infrastructure, the cost of service interruption far outweighs potential price savings from alternative providers.

- Customer Dependence: In 2024, many clients rely on Dialog's integrated solutions for seamless supply chain management, making them less sensitive to price fluctuations for critical services.

Dialog Group's bargaining power of customers is influenced by several factors, including customer concentration, switching costs, price sensitivity, and the threat of backward integration. The company's key clients, often large integrated oil, gas, and petrochemical firms, hold significant leverage due to their substantial revenue contribution and potential for self-performance.

In 2024, heightened competition in the energy sector increased customer demand for cost efficiencies from suppliers like Dialog. Despite this, Dialog's critical services and established expertise in complex projects, such as EPCC, often create high switching costs for clients, mitigating their price pressure and ensuring operational continuity.

| Factor | Impact on Customer Bargaining Power | Dialog's Mitigation Strategy |

|---|---|---|

| Customer Concentration | High (few large clients) | Focus on strong client relationships and value-added services |

| Switching Costs | Low (due to project complexity and integration) | Demonstrate reliability and specialized expertise |

| Price Sensitivity | Moderate to High (depending on client profitability) | Offer competitive pricing and cost-saving solutions |

| Threat of Backward Integration | High (clients' internal EPC capabilities) | Highlight unique capabilities and long-term partnership benefits |

Preview Before You Purchase

Dialog Group Porter's Five Forces Analysis

This preview showcases the complete Dialog Group Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring no discrepancies or missing information. You can confidently rely on this preview as it represents the final, ready-to-use deliverable, providing valuable strategic insights without any hidden surprises.

Rivalry Among Competitors

The integrated technical services market for the energy sector, especially in Southeast Asia, is quite crowded. It's a mix of big global engineering, procurement, and construction (EPC) companies and smaller, specialized local businesses.

This high number and variety of competitors means rivalry is fierce. Companies are often forced to compete on price, which can squeeze profit margins. For instance, in 2023, the global oil and gas EPC market saw intense bidding wars, with some projects awarded at margins as low as 2-4% for major players.

To stand out, firms must also focus on differentiating their services. This could mean offering unique technological solutions, faster project delivery, or specialized expertise that competitors lack. The pressure to innovate and provide superior value is constant.

The oil, gas, and petrochemical industry's growth rate is a major driver of competitive rivalry. When the market expands rapidly, like the projected 4.1% compound annual growth rate (CAGR) for the global petrochemical market through 2028, there's often enough demand to satisfy most players, potentially easing intense competition.

However, in more mature or slower-growth phases, competition intensifies significantly. Companies then resort to aggressive tactics such as price reductions or enhanced marketing campaigns to capture a larger slice of a limited market. This dynamic was evident in 2023, where fluctuating energy prices and a more measured global economic outlook led to increased focus on operational efficiency and market share defense among major players.

Dialog Group operates in an industry characterized by substantial capital requirements. The need for advanced infrastructure, such as specialized vessels and onshore facilities, along with a highly trained workforce, results in significant fixed costs. For instance, the construction and maintenance of a modern offshore support vessel can easily run into tens of millions of dollars, representing a substantial upfront investment.

These high fixed costs create formidable exit barriers for companies within the sector. Once a company has invested heavily in its assets and infrastructure, it becomes economically challenging to divest or exit the market, even during periods of reduced demand. This often compels firms to remain operational and compete fiercely for market share, thereby intensifying the competitive rivalry among existing players.

Product/Service Differentiation

Dialog Group's ability to differentiate its diverse service portfolio, including specialized Engineering, Procurement, Construction, and Commissioning (EPCC), unique tank terminal solutions, and advanced plant maintenance, significantly influences competitive rivalry. When Dialog offers highly specialized or technologically advanced services that are difficult for competitors to replicate, it can command premium pricing and reduce head-to-head price wars.

Conversely, if a substantial portion of Dialog's services are perceived as standard or easily substitutable, the company faces more intense price-based competition from rivals offering similar offerings. For instance, in the competitive oil and gas services sector, the degree of innovation and proprietary technology embedded in EPCC projects can be a key differentiator.

- Differentiation Impact: Dialog's specialized EPCC services, such as those for complex petrochemical plants, reduce direct price competition.

- Commoditization Risk: Standardized tank terminal services, if not enhanced with unique logistics or digital solutions, can lead to fiercer price battles.

- Market Perception: Advanced plant maintenance offerings with predictive analytics and specialized repair techniques provide a competitive edge over basic upkeep services.

Strategic Stakes and Industry Importance

The oil, gas, and petrochemical sector is a cornerstone of Malaysia's economy, making competition intensely strategic. Dialog Group, as a key player, navigates a landscape where national interests are paramount. For instance, Petronas, the national oil company, significantly shapes the competitive environment through its extensive influence and strategic directives.

This government involvement manifests in various ways, impacting how companies like Dialog operate. Regulations, national content mandates, and the formation of strategic alliances all serve to intensify the competitive rivalry. These factors ensure that companies must not only compete on operational efficiency but also on their alignment with national economic objectives. In 2023, the energy sector contributed approximately 10% to Malaysia's GDP, highlighting its critical importance and the high stakes involved for all participants.

- Strategic Importance: The oil, gas, and petrochemical industry is vital to Malaysia's economic stability and growth.

- Government Influence: National oil companies like Petronas play a dominant role, influencing market dynamics through policy and partnerships.

- Competitive Factors: Rivalry is shaped by regulations, national content requirements, and the strategic positioning of key national entities.

- Economic Contribution: The energy sector's significant GDP contribution underscores the high stakes for companies operating within it.

The competitive rivalry within the integrated technical services market for Southeast Asia's energy sector is intense, driven by a mix of large global EPC firms and specialized local players. This crowded field often leads to price-based competition, impacting profit margins, as seen with 2-4% margins on some 2023 EPC projects. Differentiation through unique technology or faster delivery is crucial for survival and success.

High fixed costs associated with specialized infrastructure, like offshore vessels costing tens of millions, create significant exit barriers. This compels companies to remain competitive, intensifying rivalry. Dialog Group's ability to offer specialized EPCC, unique tank terminal solutions, and advanced plant maintenance, particularly with predictive analytics, provides a competitive edge and reduces direct price wars.

The strategic importance of the oil, gas, and petrochemical sector in Malaysia, contributing around 10% to GDP in 2023, further heightens competition. National entities like Petronas influence market dynamics through policies and strategic alliances, forcing companies to align with national objectives alongside operational efficiency. This environment demands constant innovation and strategic positioning.

| Competitive Factor | Impact on Rivalry | Example/Data Point |

|---|---|---|

| Number and Diversity of Competitors | High rivalry, potential price wars | Mix of global EPCs and local specialists |

| Service Differentiation | Reduced price competition for specialized services | Dialog's advanced plant maintenance vs. basic upkeep |

| Market Growth Rate | Intensifies rivalry in mature markets | Petrochemical market CAGR of 4.1% through 2028 |

| Capital Intensity & Exit Barriers | Forces existing players to compete fiercely | Offshore vessel costs in tens of millions |

| Government Influence (Malaysia) | Shapes competitive landscape through policy | Petronas's role, national content mandates |

SSubstitutes Threaten

Large oil, gas, and petrochemical companies possess the capacity to undertake certain services internally, acting as a direct substitute for Dialog Group. For instance, routine maintenance or smaller Engineering, Procurement, Construction, and Commissioning (EPCC) projects can be handled by their own skilled personnel, thereby diminishing the reliance on external contractors.

This in-house capability is particularly potent for less complex or highly standardized tasks. In 2024, many integrated energy firms continued to bolster their internal engineering and project management divisions, aiming for greater cost control and operational flexibility, which directly impacts the market for specialized outsourced services.

The global push towards renewable energy and decarbonization poses a significant long-term threat to Dialog Group's established oil, gas, and petrochemical operations. As countries and corporations increasingly invest in solar, wind, and other green energy solutions, the demand for fossil fuel-based products and services is expected to decline.

This energy transition could directly impact Dialog's revenue streams, as the market share of traditional energy sources shrinks. For instance, by 2024, renewable energy sources are projected to account for over 30% of global electricity generation, a figure that will continue to grow, directly challenging the long-term viability of fossil fuel-dependent business models.

Technological advancements present a significant threat of substitution for Dialog Group's services. New technologies offering more efficient, cost-effective, or environmentally friendly ways to operate industrial assets could directly replace Dialog's current offerings. For instance, innovations in modular construction or advanced robotics for maintenance could diminish the demand for certain traditional services Dialog provides.

Alternative Transportation and Storage Methods

While Dialog Group primarily operates tank terminals, the threat of substitutes for transporting and storing petroleum and petrochemicals is a key consideration. The expansion of extensive pipeline networks, for instance, could offer a more direct and potentially cost-effective alternative for certain product flows, bypassing the need for intermediate tank storage. In 2024, significant investments continued in global pipeline infrastructure, with projects like the Trans Mountain Expansion in Canada aiming to increase oil transport capacity, illustrating this trend.

Furthermore, advancements in alternative storage technologies, such as modular or underground storage solutions, could present substitutes to traditional large-scale tank farms. These innovations might offer greater flexibility or reduced environmental footprints, potentially impacting demand for conventional terminal services. The market for specialized storage containers and floating storage units also represents a segment where alternatives can emerge, particularly for shorter-term or more localized storage needs.

The availability and cost-effectiveness of these substitutes directly influence Dialog Group's competitive landscape. For example, if pipeline tariffs become more attractive relative to terminal fees, or if new storage technologies achieve economies of scale, customers might shift their preferences. The global energy transition also fuels innovation in storage, with growing interest in solutions for hydrogen and other alternative fuels, which could eventually compete with traditional liquid fuel storage.

- Pipeline Expansion: Continued investment in global pipeline infrastructure, such as the Trans Mountain Expansion, offers direct transport alternatives.

- Alternative Storage Technologies: Innovations in modular, underground, or specialized container storage can reduce reliance on traditional tank terminals.

- Cost-Effectiveness: The relative pricing of pipeline transport versus terminal services is a critical factor influencing customer choices.

- Energy Transition: Emerging storage solutions for new energy carriers could represent future substitutes for conventional fuel storage.

Economic Viability of Substitutes

The economic viability of substitute solutions is a key factor in assessing the threat of substitutes for Dialog Group. If alternative offerings become substantially more cost-effective or provide superior value, customers will be more inclined to switch, even if it means incurring some initial setup or transition expenses.

For instance, consider the market for advanced connectivity solutions. While Dialog Group offers integrated services, the emergence of standalone, highly specialized components or software-defined networking (SDN) solutions that can be pieced together by customers could present a viable substitute. If the total cost of acquiring and integrating these individual components is significantly lower than Dialog Group's all-encompassing package, the threat intensifies.

- Cost-Effectiveness: The primary driver is whether substitutes can deliver comparable functionality at a lower price point. For example, if the cost of implementing a DIY IoT platform using off-the-shelf sensors and open-source software becomes substantially less than Dialog Group's managed IoT services, it poses a direct threat.

- Value Proposition: Substitutes that offer enhanced features, greater flexibility, or a more tailored solution, even at a similar price, can also attract customers. A substitute might allow for greater customization, which Dialog Group's integrated model might not easily accommodate.

- Switching Costs: While higher switching costs can deter customers, if the long-term savings or benefits of a substitute are compelling enough, these costs can be overcome. For Dialog Group, this could involve customers migrating away from their proprietary platforms to more open-standard alternatives.

- Market Trends: The increasing demand for modularity and open architectures in technology sectors can make substitutes more attractive. For example, the growth of cloud-native solutions that can be deployed independently of specific hardware vendors presents a growing substitute threat to integrated service providers.

The threat of substitutes for Dialog Group's services is multifaceted, encompassing direct competition from in-house capabilities of large energy firms and the broader shift towards renewable energy sources. Technological advancements also introduce new ways to perform tasks traditionally handled by Dialog, while infrastructure developments like pipeline expansion and alternative storage solutions offer direct replacements for terminal services.

The economic attractiveness of these substitutes, driven by cost-effectiveness and evolving market trends, directly influences customer choices and Dialog's market position.

For instance, in 2024, continued investments in pipeline infrastructure, like the Trans Mountain Expansion, highlight the direct substitution threat for petroleum transport. Similarly, the growing share of renewables in global electricity generation, projected to exceed 30% by 2024, underscores the long-term substitution risk for fossil fuel-related services.

| Substitute Type | Example | Impact on Dialog Group | 2024 Trend/Data Point |

|---|---|---|---|

| In-house Capabilities | Large oil companies performing routine maintenance | Reduces demand for external contractors | Increased internal engineering divisions for cost control |

| Energy Transition | Renewable energy sources (solar, wind) | Decreases demand for fossil fuel services | Renewables >30% of global electricity generation |

| Technological Advancements | Modular construction, robotics | Replaces traditional service offerings | Innovations in efficient industrial operations |

| Infrastructure Alternatives | Pipeline networks, alternative storage | Bypasses tank storage needs | Significant global pipeline investments |

Entrants Threaten

The integrated specialist technical service provider market, encompassing areas like Engineering, Procurement, Construction, and Commissioning (EPCC), tank terminals, and intricate maintenance, demands a significant upfront capital outlay. This necessity for substantial financial resources acts as a considerable deterrent, effectively limiting the number of new players that can realistically enter the arena.

For instance, establishing a robust EPCC capability often involves investing in specialized engineering software, advanced construction equipment, and a skilled workforce, easily running into tens or even hundreds of millions of dollars. Similarly, developing and operating compliant tank terminals requires massive investment in land, storage tanks, pipelines, and safety infrastructure, with major terminal projects in 2024 often exceeding $500 million.

The services offered by Dialog Group, particularly in telecommunications and technology solutions, demand highly specialized engineering expertise and intricate technical know-how. New entrants would face a substantial hurdle in acquiring or developing this complex knowledge base, which is both time-consuming and incredibly expensive. For instance, the development and deployment of advanced 5G infrastructure, a core area for Dialog, requires significant investment in R&D and skilled personnel, a barrier that deters many potential competitors.

The oil, gas, and petrochemical sectors are characterized by significant regulatory complexities. Newcomers must navigate a labyrinth of permits, licenses, and rigorous safety and environmental compliance. For instance, in 2024, the energy sector globally saw continued emphasis on ESG (Environmental, Social, and Governance) regulations, increasing the upfront investment and operational scrutiny for any new player.

These substantial regulatory barriers and associated compliance expenses act as a powerful deterrent to potential new entrants. Such high entry costs and the need for extensive expertise in regulatory affairs inherently favor established companies like Dialog Group, which already possess the necessary infrastructure and experience to manage these demands effectively.

Established Customer Relationships and Contracts

Dialog Group leverages its deep-rooted ties with key clients, particularly national oil companies like Petronas, to create significant barriers to entry. These long-standing relationships, often solidified through multi-year contracts, provide a stable revenue stream and a demonstrable history of successful project execution. Newcomers struggle to replicate this level of trust and proven capability, making it difficult to secure the substantial, long-term projects that are crucial in the industry.

For instance, Dialog's ability to secure repeat business and extensions on major projects underscores the strength of these established relationships. In fiscal year 2024, the company continued to benefit from its strong partnerships, which are essential for securing the large-scale, capital-intensive projects characteristic of the oil and gas sector.

- Established Client Trust: Dialog's history with major players like Petronas fosters a high degree of trust, making it difficult for new entrants to gain similar confidence.

- Contractual Lock-ins: Multi-year contracts with key clients create a predictable revenue base and limit opportunities for new competitors to break in.

- Proven Track Record: Dialog's consistent delivery on large projects serves as a significant competitive advantage, a benchmark new entrants must meet.

Economies of Scale and Experience Curve Effects

Existing players like Dialog Group benefit significantly from economies of scale, particularly in procurement and operational efficiency. This allows them to achieve lower per-unit costs that new entrants would find challenging to replicate quickly. For instance, Dialog's extensive network infrastructure, built over years, provides a substantial cost advantage in service delivery compared to a newcomer needing to build a similar footprint from scratch.

The experience curve effect further solidifies this advantage. As Dialog has accumulated more operational experience, its processes have become more streamlined and cost-effective. This learning-by-doing phenomenon means that for every doubling of cumulative output, costs typically fall by a predictable percentage. In 2023, the telecommunications industry saw continued investment in network upgrades, where established players could leverage existing supply chains and expertise to manage these costs more efficiently than new market entrants.

- Economies of Scale: Dialog's large customer base and extensive infrastructure allow for bulk purchasing of equipment and shared operational costs, reducing per-subscriber expenses.

- Experience Curve: Years of operation have refined Dialog's service delivery, network management, and customer support, leading to lower operating costs and improved efficiency over time.

- Capital Investment Barrier: The substantial capital required to build a competitive network and achieve similar economies of scale presents a significant hurdle for potential new entrants in the Sri Lankan market.

The threat of new entrants for Dialog Group is relatively low due to significant capital requirements, especially in areas like EPCC and tank terminals, where initial investments can run into hundreds of millions of dollars. Furthermore, the need for specialized technical expertise, particularly in telecommunications and advanced infrastructure deployment, presents a substantial learning curve and cost barrier for newcomers. For instance, in 2024, the global energy sector's increasing ESG compliance requirements added to the upfront investment and operational scrutiny for any new player.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dialog Group is built upon a robust foundation of data, integrating information from Dialog's official investor relations website, annual reports, and public financial statements. We also leverage industry-specific market research reports and analyses from reputable financial news outlets to capture a comprehensive view of the competitive landscape.