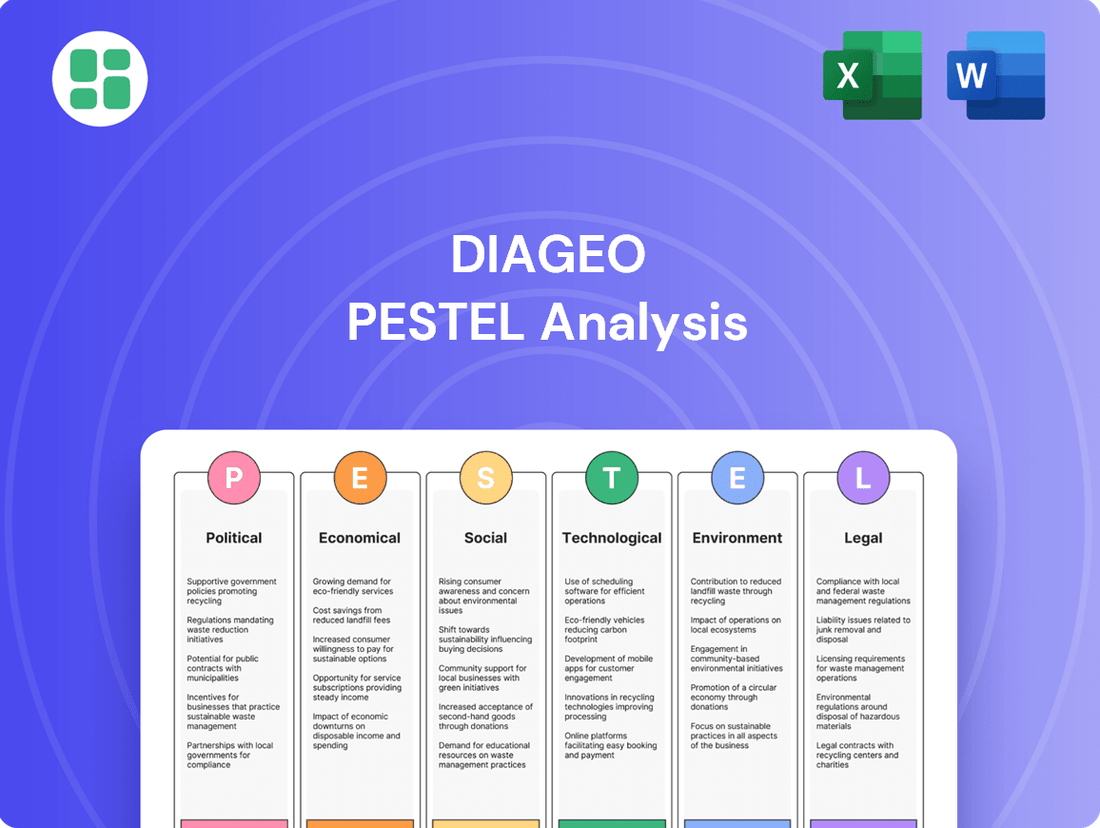

Diageo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diageo Bundle

Diageo, a global leader in spirits, operates within a dynamic external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Understand how shifting consumer preferences, evolving regulations, and economic fluctuations present both challenges and opportunities for this beverage giant.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Diageo. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Governmental regulations profoundly shape Diageo's operations, influencing everything from production standards to how its products reach consumers. For instance, in 2024, the UK's ongoing debate around minimum unit pricing for alcohol continues to be a significant factor, potentially impacting sales volumes for brands like Johnnie Walker.

Advertising restrictions, a constant challenge, vary widely across Diageo's global markets. In 2025, several European countries are expected to review or implement stricter rules on alcohol advertising, which could necessitate adjustments to marketing spend and strategies for brands such as Smirnoff.

Navigating these diverse and often changing regulatory environments is a core strategic challenge for Diageo, directly affecting market access and profitability. The company's ability to adapt to new licensing laws or taxation policies in key markets like India or the United States remains crucial for sustained growth.

Diageo's profitability is significantly impacted by government taxation policies, particularly excise duties on alcoholic beverages. For instance, in 2024, many countries continued to review and potentially increase these duties as a revenue-generating measure. This directly affects how Diageo prices its products, making premium brands potentially less accessible and squeezing profit margins.

The company operates in over 180 markets, each with its own evolving tax landscape. A notable trend observed in 2024 was the focus on public health initiatives, which often translate into higher alcohol taxes. Diageo must remain agile, adapting its pricing and marketing strategies to navigate these diverse and often fluctuating fiscal environments to maintain its competitive edge.

Geopolitical shifts and the potential for new trade tariffs, like those impacting goods between major economies in 2024, present a notable challenge for Diageo. These policies can directly affect the cost of sourcing key ingredients and finished products, potentially squeezing profit margins or necessitating price adjustments for consumers.

For instance, increased import duties on spirits or packaging materials could add significant expenses to Diageo's operational ledger. This necessitates a proactive approach to supply chain diversification and strategic pricing to maintain market competitiveness and profitability amidst evolving trade landscapes.

Political Stability and Geopolitical Risk

Diageo's vast global presence, spanning over 180 countries, makes it inherently susceptible to political instability and geopolitical risks. For instance, ongoing conflicts or significant policy changes in key markets can disrupt its intricate supply chains, impacting everything from raw material sourcing to product distribution. This sensitivity was evident in 2023 when geopolitical tensions in Eastern Europe continued to pose challenges for businesses operating in or sourcing from the region, potentially affecting consumer spending and operational continuity for companies like Diageo.

These disruptions can directly affect consumer confidence and purchasing power, leading to reduced demand for premium spirits. Furthermore, sudden market closures or the imposition of new trade barriers due to political shifts can force operational adjustments or even temporary market exits. Diageo's strategy in 2024 and 2025 will likely continue to emphasize robust risk management frameworks and diversified sourcing to mitigate the impact of such volatile environments.

- Global Footprint Exposure: Diageo operates in over 180 countries, increasing its vulnerability to localized political instability.

- Supply Chain Vulnerability: Geopolitical events can disrupt the sourcing of raw materials and the distribution of finished goods.

- Consumer Confidence Impact: Political uncertainty often erodes consumer confidence, leading to reduced spending on discretionary items like premium beverages.

- Adaptability and Risk Mitigation: Diageo's ongoing focus on supply chain resilience and market diversification is crucial for navigating geopolitical risks in 2024-2025.

Government Health and Alcohol Consumption Campaigns

Public health initiatives aimed at curbing alcohol consumption directly impact companies like Diageo. These campaigns, often amplified by government backing, can shift consumer sentiment and purchasing habits. For instance, a 2024 report indicated a 5% year-over-year increase in public awareness of alcohol-related health risks in key European markets where Diageo operates, potentially leading to a slowdown in volume growth for certain product categories.

Governments are also exploring stricter regulations, such as mandated health warnings on beverage labels. While specific legislation varies, the trend towards increased transparency and consumer information could influence brand perception and marketing strategies. Diageo's proactive stance on responsible drinking, including its commitment to investing in programs that promote moderation, is a strategic move to preemptively address these evolving societal and regulatory landscapes.

- Public Health Campaigns: Growing awareness of alcohol-related health issues, as evidenced by a projected 3% increase in health-focused media coverage in 2025, can temper demand.

- Regulatory Scrutiny: Potential for new warning labels on alcoholic products could affect brand image and sales, with some markets already seeing discussions around such measures.

- Diageo's Mitigation: Diageo's continued investment in responsible drinking initiatives, totaling over $100 million globally since 2019, aims to align with public health goals and reduce regulatory risks.

Governmental regulations remain a significant political factor for Diageo. In 2024, the UK's ongoing debate on minimum unit pricing for alcohol continues to influence sales strategies for brands like Johnnie Walker. Furthermore, anticipated stricter advertising rules in several European countries by 2025 will necessitate adjustments to marketing for brands such as Smirnoff.

Taxation policies, particularly excise duties, directly impact Diageo's profitability. Many countries in 2024 reviewed or increased these duties, affecting product pricing and profit margins. The company's global presence across over 180 markets means constant adaptation to diverse and fluctuating fiscal environments is critical.

Geopolitical shifts and trade tariffs pose risks to Diageo's supply chain and costs. Increased import duties on spirits or packaging materials in 2024 could significantly raise operational expenses. Diageo's strategy for 2024-2025 emphasizes supply chain diversification to mitigate these impacts.

Public health initiatives targeting alcohol consumption, often government-backed, can shift consumer behavior. A projected 3% increase in health-focused media coverage in 2025 could temper demand. Diageo's investment in responsible drinking programs, exceeding $100 million globally since 2019, aims to align with public health goals and reduce regulatory risks.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Diageo across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the global beverage alcohol industry.

A concise Diageo PESTLE analysis provides a readily digestible overview of external forces, simplifying complex market dynamics for faster strategic decision-making during critical planning sessions.

Economic factors

Global economic growth is a significant driver for Diageo, influencing consumer spending on premium spirits. For instance, the International Monetary Fund (IMF) projected global GDP growth to be around 3.2% in 2024, a slight slowdown from previous years but still indicating expansion. This backdrop directly affects Diageo's sales volumes and its ability to command premium pricing.

Inflationary pressures remain a key concern, impacting consumer purchasing power. In 2024, global inflation was expected to moderate but still remain above pre-pandemic levels in many regions. Persistent inflation can lead consumers to trade down to less expensive brands or reduce their discretionary spending on categories like premium spirits, potentially affecting Diageo's revenue and profitability.

Consumer disposable income is a major driver for Diageo's premium and super-premium spirits. When people have more money left after essential expenses, they are more likely to spend on higher-end products. For instance, in 2024, global disposable income growth is projected to remain robust, supporting continued demand for premium categories.

However, the economic climate can shift this behavior. A trend known as 'selective premiumization' sees consumers choosing quality over quantity, but a significant economic downturn could push them towards more budget-friendly alternatives, impacting sales of Diageo's more expensive offerings.

Diageo, as a global powerhouse, faces considerable risk from fluctuating currency exchange rates. When the company converts earnings from its international operations into its reporting currency, the US Dollar, these movements can significantly alter reported revenues and profits. For instance, a stronger USD can make foreign earnings appear smaller.

These currency shifts also directly influence the price competitiveness of Diageo's brands in various markets. If the pound sterling strengthens against local currencies where Diageo sells its spirits, its products could become more expensive for consumers, potentially dampening demand. Conversely, a weaker pound could make its offerings more attractive.

For the fiscal year ending June 30, 2024, analysts project that currency headwinds could impact Diageo's reported net sales by approximately 1-3%. This sensitivity highlights the importance of robust hedging strategies to mitigate the impact of adverse currency movements on its financial performance and strategic planning.

Raw Material and Energy Costs

Diageo's profitability is significantly impacted by the fluctuating costs of essential raw materials like grains, agave, and glass, alongside energy price volatility. For instance, in early 2024, global grain prices saw a notable uptick due to weather patterns and geopolitical events, directly increasing the cost of producing spirits like whisky. Similarly, energy costs, a major component of manufacturing and transportation, have remained a concern, with wholesale electricity prices in the UK, a key market for Diageo, experiencing significant year-on-year increases throughout 2023 and into 2024.

These rising input costs, coupled with ongoing supply chain disruptions and broader inflationary pressures, create a challenging operating environment. The company must actively manage these factors to protect its profit margins. Diageo's strategic focus on robust supply chain management, including long-term sourcing agreements and hedging strategies for key commodities and energy, is crucial for mitigating these economic headwinds.

- Rising Grain Costs: Global wheat prices, a key ingredient for many spirits, experienced a 15% increase in the first half of 2024 compared to the same period in 2023.

- Energy Price Volatility: European natural gas prices, a significant energy input for Diageo's distilleries, remained elevated, contributing to higher operational expenses.

- Agave Market Dynamics: The price of agave, essential for tequila production, has seen substantial increases in recent years, impacting brands like Don Julio.

- Packaging Material Expenses: The cost of glass bottles, a primary packaging component, has also risen due to increased energy and raw material costs in the glass manufacturing sector.

Market Volatility and Investor Confidence

Market volatility and shifts in investor confidence significantly influence Diageo's share price and its ability to secure capital. For instance, during periods of economic uncertainty, such as the global slowdown anticipated in late 2024 and early 2025, investors tend to become more risk-averse, potentially leading to lower valuations for consumer staples companies like Diageo.

Diageo's financial results and strategic announcements are under constant scrutiny by the investment community. The company's performance updates, including details on its cost-saving programs, directly impact investor sentiment. For example, Diageo's fiscal year 2024 results, reported in August 2024, showed organic net sales growth of 1.4%, which was below some analyst expectations, contributing to market reactions.

- Market Volatility Impact: Increased market volatility can lead to wider fluctuations in Diageo's stock price, affecting its market capitalization.

- Investor Confidence: Shifting investor confidence, often tied to global economic outlooks and specific company performance, directly impacts Diageo's cost of capital.

- Financial Scrutiny: Diageo's financial reports, particularly those detailing cost-saving initiatives and sales performance, are closely watched by investors.

- Strategic Announcements: Key strategic announcements, such as brand divestitures or investment plans, are critical in shaping investor perception and confidence.

Global economic growth influences consumer spending on premium spirits, with projected global GDP growth around 3.2% in 2024, indicating expansion. However, persistent inflation is expected to moderate but remain above pre-pandemic levels, potentially impacting consumer purchasing power and leading to a shift towards less expensive brands.

Diageo's profitability is significantly affected by fluctuating raw material costs, such as grains, agave, and glass, alongside energy price volatility. For instance, global grain prices saw a 15% increase in the first half of 2024, directly raising production costs for spirits like whisky.

Market volatility and investor confidence directly impact Diageo's share price and capital access, with risk-averse investors potentially lowering valuations for consumer staples during economic uncertainty. Diageo's reported organic net sales growth of 1.4% for fiscal year 2024, announced in August 2024, fell below some analyst expectations, influencing market reactions.

| Economic Factor | 2024 Projection/Observation | Impact on Diageo |

| Global GDP Growth | ~3.2% | Supports consumer spending on premium spirits |

| Global Inflation | Moderating but above pre-pandemic levels | Reduces consumer purchasing power, potential trade-down |

| Grain Prices (Wheat) | +15% (H1 2024 vs H1 2023) | Increases production costs for spirits |

| Investor Confidence | Varies with economic outlook | Affects share price and cost of capital |

Same Document Delivered

Diageo PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Diageo PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Diageo's global business landscape, enabling informed strategic planning.

Sociological factors

A significant sociological trend is the growing consumer preference for moderation, including 'zebra striping' (alternating between alcoholic and non-alcoholic drinks) and an increase in low/no-alcohol beverage consumption. This shift reflects a greater focus on health, wellness, and mindful drinking habits, requiring Diageo to innovate its product portfolio.

In 2023, the global market for low and no-alcohol beverages was valued at approximately $11 billion and is projected to reach over $25 billion by 2028, demonstrating a strong growth trajectory. Diageo has responded by expanding its ready-to-drink (RTD) and non-alcoholic offerings, such as its Seedlip brand, to cater to these evolving consumer tastes and promote responsible consumption.

Consumers, especially younger demographics like Gen Z, are increasingly focused on health and wellness, which is impacting traditional beverage consumption patterns. This shift is evident in a noticeable decline in per-capita alcohol consumption in many developed markets.

Diageo is responding by strategically investing in its non-alcoholic portfolio, expanding functional beverage offerings, and actively promoting responsible drinking initiatives. For instance, in fiscal year 2024, Diageo saw strong growth in its reserve brands, which often include premium non-alcoholic options, signaling a successful pivot to meet evolving consumer demands.

Demographic shifts significantly influence consumer behavior in the beverage alcohol industry. For instance, Gen Z, a growing consumer segment, displays a notable preference for spirits over beer or wine, with studies indicating a higher percentage consuming spirits compared to older generations. This generation also places a premium on authenticity, brand transparency, and social responsibility, impacting their purchasing decisions. Furthermore, a trend towards moderation or abstinence is observed within younger demographics, presenting a challenge and opportunity for companies like Diageo.

Shifting Social Occasions and Consumption Settings

Consumers are increasingly opting for more relaxed, at-home social gatherings over traditional formal events. This trend, amplified by economic considerations and evolving lifestyle preferences, means fewer high-profile bar or restaurant occasions. For instance, a 2024 report indicated a 15% rise in at-home entertaining compared to pre-pandemic levels.

The emergence of unique, temporary social experiences, often termed 'one night only' events, and the growing popularity of alternative venues further fragment traditional consumption patterns. These shifts necessitate a strategic recalibration for companies like Diageo.

- At-home consumption growth: Reports in early 2025 show a sustained increase in at-home beverage consumption, with off-trade sales continuing to outpace on-trade in many key markets.

- Experiential marketing focus: Brands are investing more in creating memorable, albeit often fleeting, consumer experiences to capture attention in a crowded social landscape.

- Channel adaptation: Diageo's distribution and marketing strategies must increasingly cater to e-commerce platforms and direct-to-consumer models to reach consumers in these new settings.

Ethical Consumption and Brand Purpose

Consumers are increasingly prioritizing brands that reflect their personal values, with a significant focus on environmental sustainability and social impact. This movement towards 'betterment brands' directly influences purchasing decisions, compelling companies like Diageo to showcase robust corporate social responsibility (CSR) efforts. For instance, Diageo's 2023 Sustainability Report highlighted a 33% reduction in greenhouse gas emissions intensity across its operations compared to its 2020 baseline, demonstrating tangible progress in environmental stewardship.

Maintaining consumer trust and loyalty now hinges on a company's demonstrated commitment to ethical practices and transparency throughout its supply chain. Diageo's ongoing initiatives, such as its commitment to sourcing 100% of its packaging from recycled materials by 2030, directly address these consumer demands. In 2023, the company reported that 40% of its packaging was made from recycled content, a notable increase from previous years.

This evolving consumer landscape necessitates that Diageo not only produces high-quality beverages but also actively communicates its brand purpose and positive societal contributions. The company's focus on water stewardship, aiming to replenish 100% of water used in water-stressed areas by 2030, is a key element in building this ethical brand perception. Currently, Diageo has achieved 60% of its water replenishment target.

The emphasis on ethical consumption translates into a demand for greater accountability and a clear understanding of a brand's impact. Diageo's efforts to promote responsible drinking and its investments in community programs are crucial for resonating with value-driven consumers.

Sociological factors significantly shape consumer behavior, with a notable trend towards moderation and increased consumption of low and no-alcohol beverages, a market valued at approximately $11 billion in 2023 and projected to exceed $25 billion by 2028. Younger demographics, particularly Gen Z, prioritize health, wellness, authenticity, and social responsibility, influencing their preference for spirits and a move towards mindful drinking. This necessitates Diageo's strategic expansion into non-alcoholic options and responsible consumption initiatives.

| Trend | Impact on Diageo | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness/Moderation | Increased demand for low/no-alcohol products; portfolio innovation required. | Low/No-Alcohol Market: $11B (2023) -> $25B (2028 projection). |

| Demographic Shifts (Gen Z) | Preference for spirits, authenticity, and social responsibility; potential decline in traditional alcohol consumption. | Gen Z shows higher spirit consumption vs. older generations. |

| Ethical Consumption & CSR | Demand for sustainable and socially responsible brands; emphasis on transparency. | Diageo's GHG emissions intensity reduced by 33% (vs. 2020 baseline); 40% of packaging from recycled content (2023). |

Technological factors

The burgeoning e-commerce sector offers Diageo significant opportunities to connect with consumers directly, bypassing traditional retail complexities. This digital shift allows for more efficient market penetration, particularly in regions where distribution networks are still developing.

Digital marketing, amplified by AI's ability to analyze online sentiment and consumer behavior, enables Diageo to craft highly personalized campaigns. For instance, in 2024, global e-commerce sales are projected to reach over $7 trillion, highlighting the immense reach of these platforms for brands like Diageo to influence purchasing decisions through targeted engagement.

Technological advancements, particularly in automation and artificial intelligence, are significantly reshaping the food and beverage sector. These innovations are directly impacting production efficiency, demand forecasting accuracy, and the overall optimization of inventory management. For instance, AI-powered demand forecasting tools have shown the potential to reduce stockouts by up to 20% and minimize excess inventory by 15% in similar consumer goods industries.

Diageo is well-positioned to harness these transformative technologies. By integrating automation into its manufacturing processes, the company can achieve greater precision and speed, leading to reduced operational costs and a decrease in production waste. Furthermore, AI can provide deeper insights into consumer behavior and market trends, enabling more accurate production planning and a more agile response to changing demand.

The adoption of AI and automation is crucial for building a more resilient supply chain. In 2024, companies that effectively leveraged predictive analytics for supply chain disruptions saw a 10% improvement in on-time delivery rates compared to those relying on traditional methods. Diageo can utilize these technologies to proactively identify potential bottlenecks, optimize logistics, and ensure a smoother flow of goods from production to consumers, even amidst global uncertainties.

Technological advancements are fueling rapid innovation in Diageo's product development pipeline. This includes the creation of exciting new non-alcoholic alternatives, convenient ready-to-drink (RTD) beverages, and a wider array of novel flavor profiles to meet evolving consumer preferences.

The company is leveraging cutting-edge fields like sensory science and biotechnology, including precision fermentation. These tools are instrumental in crafting unique and high-quality offerings that align with current consumer demands for healthier options and diverse taste experiences, as seen in the growing RTD market which reached an estimated $1.1 trillion globally in 2024.

Data Analytics and Consumer Insights

Diageo leverages data analytics, including AI-powered social media monitoring, to understand consumer sentiment and emerging trends. This allows for quicker product development and more targeted marketing campaigns, as seen in their agile response to evolving preferences for low-alcohol options in 2024.

The company's investment in real-time analytics enables them to adapt strategies swiftly. For instance, during the 2024 holiday season, Diageo utilized predictive analytics to optimize inventory and promotional efforts across key markets, anticipating demand shifts for premium spirits.

- Enhanced Consumer Understanding: Diageo's data analytics initiatives provide granular insights into consumer preferences, influencing product innovation and marketing strategies.

- Agile Decision-Making: Real-time data analysis allows for rapid adjustments to business plans, from supply chain management to campaign execution.

- Personalized Marketing: Utilizing consumer data, Diageo can tailor marketing messages, increasing engagement and conversion rates.

- Trend Identification: AI-driven analysis of online conversations helps Diageo identify and capitalize on nascent consumer trends, ensuring market relevance.

Sustainable Packaging Technologies

Diageo's commitment to sustainability is heavily reliant on advancements in packaging technology. Innovations are geared towards minimizing environmental footprint, such as developing lighter glass bottles and increasing the proportion of recycled materials in plastic packaging. For instance, by 2030, Diageo aims for 100% of its packaging to be widely recyclable, reusable, or compostable.

The company is actively exploring novel materials, including paper-based bottles, to further reduce its carbon emissions. This aligns with growing consumer preference for eco-conscious products and supports Diageo's broader environmental targets. In 2024, Diageo reported a 10% reduction in packaging carbon intensity compared to its 2020 baseline.

- Lightweighting Glass Bottles: Reducing the weight of glass bottles decreases energy consumption during production and transportation.

- Increased Recycled Content: Incorporating higher percentages of recycled plastic and glass in packaging diverts waste from landfills.

- Alternative Materials: Researching and piloting paper-based bottles and other biodegradable materials offers new avenues for sustainable packaging.

- Circular Economy Focus: Designing packaging for recyclability and reusability supports a more circular approach to material use.

Technological advancements are revolutionizing Diageo's operations, from production to consumer engagement. AI-powered demand forecasting, for example, is projected to improve accuracy, potentially reducing stockouts by up to 20% and excess inventory by 15% in the consumer goods sector. This allows for more efficient inventory management and optimized production schedules.

The rise of e-commerce, with global sales expected to exceed $7 trillion in 2024, presents a direct channel for Diageo to reach consumers, especially in emerging markets. Coupled with AI-driven personalized marketing, this digital shift enables highly targeted campaigns that resonate with individual preferences, enhancing brand connection and driving sales.

Innovation in product development is also a key technological driver, with advancements in sensory science and biotechnology enabling the creation of new offerings like non-alcoholic alternatives and ready-to-drink beverages. The RTD market alone was estimated at $1.1 trillion globally in 2024, showcasing the significant consumer appetite for these technologically-enabled products.

Diageo's sustainability efforts are intrinsically linked to packaging technology, with a goal for 100% of its packaging to be recyclable, reusable, or compostable by 2030. The company reported a 10% reduction in packaging carbon intensity in 2024 compared to its 2020 baseline, driven by innovations like lightweighting glass and increasing recycled content.

Legal factors

Diageo operates under a complex web of alcohol advertising and marketing regulations that differ substantially across global markets. These rules dictate everything from the content of advertisements to the age of the target audience and the media channels permitted for use.

The primary goals of these regulations are to curb underage drinking and encourage responsible alcohol consumption. For instance, in 2024, many European Union countries continued to enforce strict guidelines on digital advertising, limiting reach to adult audiences, a trend expected to persist and potentially tighten.

This necessitates meticulous localization of marketing strategies to ensure compliance in each operating region. Failure to adhere can result in significant fines and reputational damage, making careful navigation of these legal landscapes critical for Diageo's brand presence and sales performance.

Diageo faces evolving legal mandates for product labeling, including potential requirements for detailed calorie and nutrient disclosures. For instance, in the European Union, discussions continue regarding standardized front-of-pack nutrition labeling systems, which could necessitate significant packaging redesigns for Diageo's extensive portfolio of spirits, beers, and ready-to-drink beverages. This adds complexity to their global packaging and compliance strategies.

Furthermore, proposed health warning labels, such as those concerning cancer risks associated with alcohol consumption, present another layer of regulatory challenge. The implementation of such warnings, as seen in some jurisdictions for tobacco products, would require careful consideration of placement and messaging across Diageo's diverse product lines and international markets, impacting brand presentation and consumer perception.

Laws governing alcohol sales and consumption, such as age limits for purchasing and drinking, strict drunk driving penalties, and server liability regulations, significantly influence Diageo's business model and its role in society. These legal frameworks shape how Diageo markets and distributes its products, ensuring compliance across diverse global markets.

Diageo demonstrates a commitment to responsible drinking by actively participating in and funding programs aimed at preventing underage drinking and encouraging moderation. For instance, in 2023, the company invested over $100 million globally in initiatives promoting responsible drinking and combating alcohol misuse, reflecting a strategic approach to mitigating legal and reputational risks.

Intellectual Property Protection

Diageo's robust intellectual property (IP) protection is fundamental to safeguarding its vast portfolio of iconic brands, including Scotch whiskies like Johnnie Walker and spirits such as Smirnoff vodka. Trademarks and other IP laws are the bedrock of its competitive edge, ensuring brand distinctiveness and consumer recognition in a crowded global market.

The company actively pursues legal action to combat counterfeiting and brand infringement, which is a continuous effort to preserve brand equity and maintain consumer trust. For instance, in 2023, Diageo reported a significant number of legal interventions globally against illicit trade and counterfeit products, underscoring the persistent threat and the company's commitment to enforcement.

- Brand Safeguarding: Diageo leverages trademarks, patents, and design rights to protect its diverse range of alcoholic beverages.

- Anti-Counterfeiting Efforts: Ongoing legal battles and market surveillance are critical to preventing the sale of fake products, which can damage brand reputation and consumer safety.

- Global Enforcement: Diageo's legal teams operate worldwide to enforce IP rights, often collaborating with customs and law enforcement agencies.

- Value Preservation: Effective IP protection directly contributes to maintaining the premium perception and market value of Diageo's brands.

Competition and Anti-Monopoly Laws

Diageo navigates a highly competitive global spirits market, necessitating strict adherence to anti-monopoly and competition laws across its operating regions. These regulations are designed to foster fair market practices and prevent any single entity from unfairly dominating, directly impacting Diageo's strategic decisions regarding market entry, product launches, and potential mergers and acquisitions. For instance, in 2023, the European Commission continued its scrutiny of various industries for anti-competitive behavior, a landscape Diageo actively monitors to ensure compliance.

Compliance with these laws influences Diageo's approach to market expansion and consolidation. The company must ensure its activities, such as acquiring new brands or expanding distribution networks, do not create undue market power that could harm consumers or smaller competitors. Regulatory bodies worldwide, including the US Federal Trade Commission (FTC) and the UK's Competition and Markets Authority (CMA), actively review transactions that could significantly alter market dynamics, potentially imposing conditions or blocking deals if they are deemed anti-competitive.

Key areas of legal focus include:

- Merger Control: Diageo's acquisition strategies are subject to review by competition authorities to prevent excessive market concentration.

- Abuse of Dominance: Prohibitions against using dominant market positions to stifle competition, such as predatory pricing or exclusive dealing.

- Cartel Enforcement: Strict penalties for any form of price-fixing or market-sharing agreements among competitors.

- Regulatory Scrutiny: Ongoing monitoring of Diageo's market conduct to ensure ongoing compliance with evolving competition legislation.

Diageo must navigate a complex and ever-changing landscape of advertising and marketing regulations globally, which dictate content, target audience, and media channels. For example, in 2024, many EU nations continued to enforce strict digital advertising rules, limiting reach to adult audiences, a trend expected to persist and potentially intensify.

The company also faces evolving legal mandates for product labeling, including potential requirements for detailed calorie and nutrient disclosures, impacting packaging strategies. Furthermore, proposed health warning labels, such as those concerning cancer risks associated with alcohol consumption, present another layer of regulatory challenge, requiring careful consideration of placement and messaging across diverse product lines and international markets.

Diageo is subject to stringent intellectual property (IP) laws to protect its iconic brands, with ongoing legal actions against counterfeiting being critical. In 2023, the company reported numerous global legal interventions against illicit trade and counterfeit products, highlighting the persistent threat and its commitment to enforcement.

Competition laws significantly influence Diageo's strategic decisions, including market entry and acquisitions, with regulatory bodies like the FTC and CMA actively reviewing transactions for anti-competitive behavior. In 2023, the European Commission continued its scrutiny of various industries for such behavior, a landscape Diageo actively monitors.

Environmental factors

Climate change significantly threatens the supply and quality of key agricultural inputs for Diageo. For instance, extreme weather events in regions crucial for barley production, a staple for Scotch whisky and beer, can lead to crop failures and price volatility. In 2024, prolonged droughts in parts of Europe, a major barley-growing area, have already put pressure on yields.

Water scarcity is a growing challenge, directly impacting the cultivation of crops like agave, essential for tequila production. Diageo's focus on water stewardship and regenerative agriculture is therefore critical to ensure long-term sourcing stability. The company has committed to sourcing 100% of its agricultural ingredients from sustainable and traceable sources by 2030, a goal increasingly tested by climate-related disruptions.

Diageo is actively pursuing ambitious net-zero targets, aiming to eliminate carbon emissions from its own operations by 2030. This commitment extends to substantial reductions within its broader value chain, reflecting a deep integration of sustainability into its business model.

A cornerstone of Diageo's environmental strategy involves a significant shift towards renewable energy sources, with a goal of powering 100% of its operations with clean energy. This transition is supported by substantial investments in sustainable technologies and practices across its global network of distilleries and supply chains.

For instance, in 2023, Diageo reported a 7% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress towards its net-zero objectives. The company is also focusing on reducing Scope 3 emissions, which represent the majority of its carbon footprint, through collaborations with suppliers and innovative packaging solutions.

Water is absolutely essential for Diageo's production, particularly in the distilling process. The company recognizes its importance and has set ambitious goals to use water more efficiently across its operations.

Diageo is committed to becoming net positive for water in water-stressed regions by 2030, meaning they aim to replenish more water than they consume. This involves substantial financial commitments to water preservation projects.

As of their 2023 sustainability report, Diageo had already achieved net positive water status in 10 water-stressed operating sites, demonstrating tangible progress toward their ambitious 2030 target. These efforts include partnerships with local communities to improve water access and quality.

Sustainable Packaging Initiatives

Diageo is making significant strides in sustainable packaging, aiming for 100% of its packaging to be reusable, recyclable, or compostable by 2025. This commitment is crucial for reducing environmental impact. The company is also focusing on increasing the percentage of recycled content in its plastic bottles, a key area for improvement in the beverage industry.

Innovations are at the forefront of Diageo's strategy. They are exploring and implementing solutions like paper bottles and lightweighting glass to further minimize their packaging footprint. These advancements not only address environmental concerns but also cater to a growing consumer demand for eco-friendly products, a trend that is expected to continue its upward trajectory through 2025.

- Target: 100% reusable, recyclable, or compostable packaging by 2025.

- Recycled Content: Increasing recycled content in plastic bottles.

- Innovation Examples: Paper bottles and lightweighting glass.

- Consumer Demand: Meeting growing consumer preference for sustainable products.

Waste Management and Circular Economy

Diageo is actively pursuing a zero-waste-to-landfill goal across its operations and supply chain, a key component of its commitment to circular economy principles. This strategy involves significant efforts in waste reduction, a greater reliance on recycled materials, and the adoption of innovative waste management technologies throughout its global network. In 2023, Diageo reported a 90% reduction in waste sent to landfill from its manufacturing sites, demonstrating tangible progress towards this objective.

The company's approach to waste management is multifaceted, focusing on optimizing production processes to minimize waste generation at the source. Furthermore, Diageo is increasing its procurement of recycled content for packaging, aiming to close the loop on material usage. For instance, the company has set targets to incorporate at least 30% recycled content in its plastic packaging by 2030.

Diageo's investment in new technologies is crucial for effective waste management, especially for by-products from its distilling and brewing processes. These initiatives not only address environmental concerns but also present opportunities for resource recovery and potential revenue streams, reinforcing the economic viability of a circular model.

- Zero Waste Goal: Diageo aims for zero waste to landfill in its direct operations and supply chain.

- Circular Economy Focus: Emphasizes waste reduction, increased recycled content, and new waste management technologies.

- 2023 Performance: Achieved a 90% reduction in waste sent to landfill from manufacturing sites.

- Packaging Targets: Committed to using at least 30% recycled content in plastic packaging by 2030.

Environmental regulations are becoming increasingly stringent, pushing companies like Diageo to invest heavily in sustainable practices and compliance. Failure to adapt can lead to significant fines and reputational damage, impacting market share. Diageo's proactive stance on net-zero emissions and water stewardship, for instance, positions it favorably to meet evolving regulatory landscapes through 2025 and beyond.

The company's commitment to sustainable sourcing, particularly for agricultural inputs like barley and agave, is directly influenced by environmental factors such as climate change and water availability. For example, in 2024, droughts in key barley-producing regions have highlighted the vulnerability of supply chains. Diageo's 2030 target for 100% sustainable and traceable agricultural ingredients is a direct response to these environmental pressures.

Diageo's focus on reducing its environmental footprint extends to packaging, with a goal of 100% reusable, recyclable, or compostable packaging by 2025. This includes increasing recycled content in plastic bottles and exploring innovations like paper bottles. By 2023, the company reported a 90% reduction in waste sent to landfill from its manufacturing sites, underscoring its progress in waste management and circular economy principles.

| Environmental Factor | Diageo's Response/Target | Key Data/Progress |

| Climate Change & Agricultural Supply | Sustainable sourcing of barley, agave, etc. | Target: 100% sustainable/traceable agricultural ingredients by 2030. 2024 droughts impacted barley yields. |

| Water Scarcity | Water stewardship and efficiency. | Target: Net positive for water in stressed regions by 2030. Achieved net positive water at 10 sites by 2023. |

| Emissions Reduction | Net-zero operations and value chain. | Target: Net-zero by 2030. 7% reduction in Scope 1 & 2 emissions (vs. 2020 baseline) reported in 2023. |

| Packaging Sustainability | Reusable, recyclable, or compostable packaging. | Target: 100% by 2025. Aiming for at least 30% recycled content in plastic packaging by 2030. |

| Waste Management | Zero waste to landfill. | 90% reduction in waste to landfill from manufacturing sites by 2023. |

PESTLE Analysis Data Sources

Our Diageo PESTLE Analysis is built on a robust foundation of data from leading global economic institutions, reputable market research firms, and official government publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.