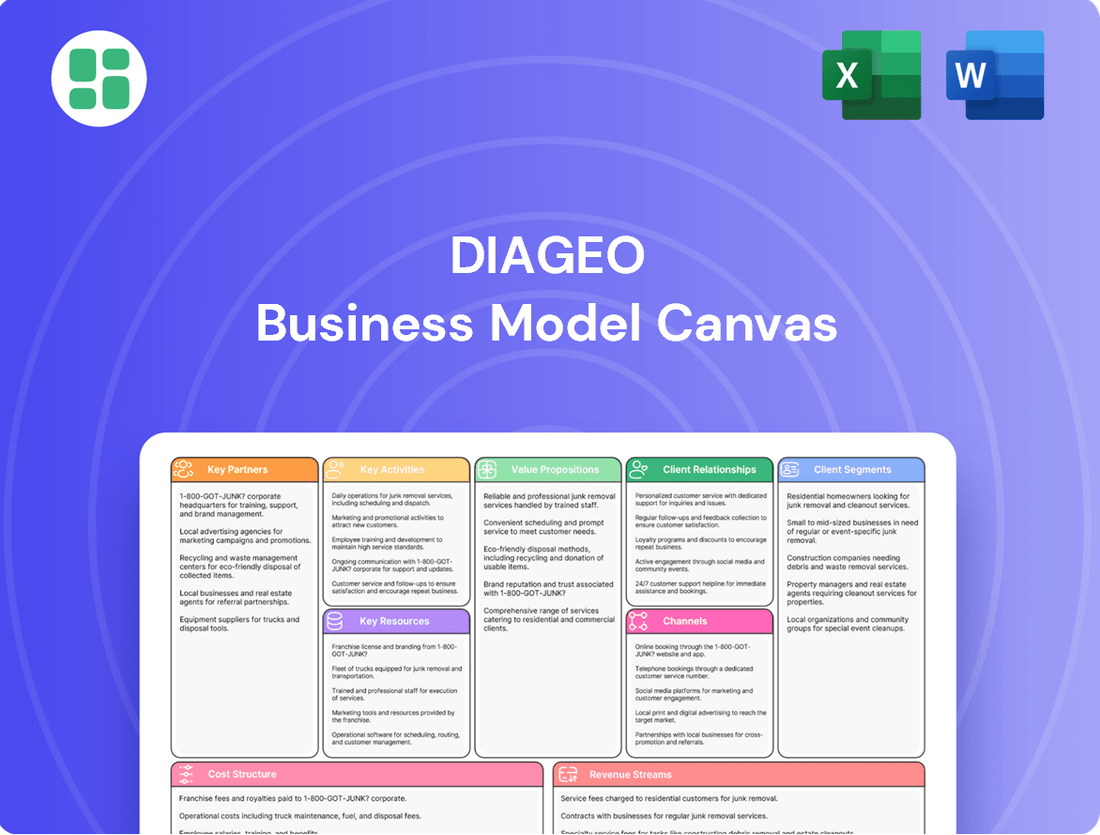

Diageo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diageo Bundle

Unlock the strategic blueprint behind Diageo's global success with our comprehensive Business Model Canvas. This in-depth analysis reveals how Diageo leverages its premium brand portfolio, extensive distribution network, and strategic partnerships to create and capture value in the competitive spirits market. Discover the key customer segments, value propositions, and revenue streams that drive their industry leadership.

Ready to dissect the engine of Diageo's market dominance? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their operations, from key resources and activities to cost structure and customer relationships. Gain actionable insights into how they build and maintain their competitive advantage.

See how the pieces fit together in Diageo’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Diageo's global success hinges on its vast network of distributors and wholesalers. These partners are essential for getting Diageo's wide array of brands, from Johnnie Walker to Smirnoff, into the hands of consumers across the globe, ensuring efficient movement from production to countless retail locations.

This intricate distribution web is a cornerstone of Diageo's strategy, enabling the company to navigate diverse market complexities and maintain a strong presence everywhere. The effectiveness of these relationships was evident in Diageo's 2024 performance, where robust net sales underscored the critical role of its distribution channels.

Diageo maintains robust relationships with a wide array of retailers, from major supermarket chains to specialized liquor stores, ensuring broad consumer access to its diverse product portfolio. These partnerships are critical for shelf space and point-of-sale visibility.

The company also cultivates strong ties with on-premise partners, including bars, pubs, and restaurants, which serve as key channels for brand experience and trial. In 2024, the on-trade sector continued its recovery, with premium spirits like Johnnie Walker and Tanqueray driving significant growth in these venues.

Diageo relies heavily on a global network of suppliers for essential raw materials like barley, wheat, corn, and agave, along with packaging components such as glass bottles and labels. These partnerships are critical for ensuring the consistent quality and availability of their diverse product portfolio.

Maintaining robust relationships with these suppliers is paramount for Diageo's commitment to responsible and sustainable sourcing practices, a key element in their brand reputation and long-term operational strategy.

The company's significant expenditure on the cost of sales, which includes substantial payments to these suppliers, underscores their vital role in Diageo's value chain and overall financial performance.

Marketing and Advertising Agencies

Diageo's relationships with marketing and advertising agencies are fundamental to cultivating its extensive portfolio of well-known brands and connecting with consumers worldwide. These partnerships are instrumental in executing sophisticated marketing initiatives, encompassing digital engagement and tailored consumer outreach, which in turn bolster brand allegiance and yield crucial consumer data.

These collaborations are vital for crafting impactful campaigns that drive brand recognition and consumer connection. For instance, Diageo's substantial marketing spend underscores the importance of these alliances in reaching diverse global audiences and adapting to evolving consumer preferences. In 2023, Diageo reported marketing and distribution expenses of approximately £3.4 billion, highlighting a significant commitment to these strategic partnerships.

- Brand Building: Agencies are key to developing and maintaining the strong brand identities that define Diageo's products.

- Consumer Engagement: Partnerships facilitate innovative digital and personalized marketing strategies to foster deeper consumer relationships.

- Market Insights: Collaborations provide valuable data and analysis on consumer behavior, informing future marketing efforts.

- Global Reach: Agencies help tailor campaigns to resonate with diverse cultural nuances across international markets.

Technology and Innovation Partners

Diageo actively partners with technology and innovation leaders to accelerate its digital transformation journey. These collaborations are crucial for enhancing supply chain visibility and efficiency, as well as pioneering new solutions, particularly in the realm of sustainability.

Leveraging artificial intelligence is a key focus, as seen in Diageo's use of AI for content production and optimizing advertising spend. This agile approach to marketing and promotion aims to maximize return on investment.

These strategic alliances are instrumental in developing innovative new products and enriching consumer experiences. For instance, in 2024, Diageo continued to invest in digital marketing capabilities, with a significant portion of its marketing budget allocated to data-driven initiatives and personalized consumer engagement.

- AI-driven content creation: Enhancing marketing material efficiency and personalization.

- Supply chain optimization: Utilizing technology for greater transparency and reduced waste.

- Digital marketing innovation: Focusing on agile methods to improve advertising ROI.

- Sustainability tech integration: Partnering for environmentally conscious solutions.

Diageo’s key partnerships extend to regulatory bodies and industry associations, crucial for navigating complex global alcohol regulations and advocating for responsible industry practices. These collaborations ensure compliance and shape favorable market conditions.

Collaborations with financial institutions and investors are also vital for securing capital for expansion, acquisitions, and ongoing operations. These relationships are fundamental to Diageo's financial stability and growth trajectory.

In 2024, Diageo continued to emphasize strategic alliances for innovation and market penetration, particularly in emerging markets. The company's financial reports for the fiscal year ending June 30, 2024, highlighted ongoing investments in partnerships that drive both brand equity and operational efficiency.

What is included in the product

A comprehensive, pre-written business model tailored to Diageo's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Diageo Business Model Canvas offers a streamlined approach to identifying and addressing market gaps, acting as a pain point reliever by clearly outlining customer segments and their unmet needs.

Activities

Diageo's brand management is centered on cultivating strong consumer connections through sophisticated marketing. This includes substantial spending on advertising and promotions, utilizing digital channels and data analytics for tailored campaigns. In fiscal year 2023, Diageo's marketing investment contributed to a 9.4% organic net sales growth, demonstrating its effectiveness in driving brand preference and market share.

Diageo's core activities revolve around continuous product development and innovation, a crucial element for staying ahead in the dynamic beverage alcohol market. This involves a constant effort to create new and exciting offerings that resonate with changing consumer tastes and preferences.

The company actively pursues this through introducing novel flavors, extending existing product lines, and strategically exploring the growing non-alcoholic beverage segment. For instance, in 2024, Diageo continued to expand its portfolio of premium spirits and ready-to-drink options, reflecting a commitment to meeting diverse consumer demands.

Furthermore, Diageo places a strong emphasis on pioneering sustainable packaging solutions as part of its innovation pipeline. This commitment not only addresses environmental concerns but also aligns with the increasing consumer demand for eco-conscious brands. Significant investments in research and development fuel this innovation, ensuring revenue growth and sustained market relevance.

Diageo’s production and manufacturing are centered on distilling, brewing, and bottling its extensive portfolio of spirits and beers. This global operation emphasizes local production where feasible, ensuring adherence to stringent quality and manufacturing standards across all facilities.

A key focus for Diageo in 2024 and beyond is the decarbonization of its production sites. For instance, the company aims to achieve net-zero emissions from its own operations by 2030, investing in renewable energy sources and efficiency improvements. This commitment extends to building a resilient and environmentally sustainable supply chain.

Global Distribution and Logistics

Diageo's key activity involves managing a vast global distribution network to ensure its diverse portfolio of spirits and beverages reaches consumers in over 180 countries. This intricate operation demands constant refinement of supply chains and strategic alliances with local retailers and distributors.

The company focuses on optimizing its distribution channels to enhance efficiency and expand market penetration across various sales platforms. This includes leveraging technology to track inventory and manage delivery routes effectively.

- Global Reach: Serves consumers in more than 180 countries, demonstrating an unparalleled distribution footprint in the beverage alcohol industry.

- Network Optimization: Continuously invests in streamlining logistics and supply chain management to improve delivery times and reduce costs.

- Partnership Development: Cultivates strong relationships with thousands of distributors and retailers worldwide to ensure product availability and visibility.

- Market Adaptation: Tailors distribution strategies to meet the unique regulatory environments and consumer preferences of diverse local markets.

Sales and Customer Relationship Management

Diageo's sales and customer relationship management centers on empowering its teams with data and digital tools to enhance sales reach and operational effectiveness. This approach focuses on cultivating robust, long-term partnerships with trade entities, actively supporting their growth initiatives. For instance, in fiscal year 2023, Diageo reported net sales of £17.1 billion, underscoring the scale of their customer interactions.

The company actively engages consumers directly through various channels, including experiential events and digital platforms, aiming to build memorable and impactful customer experiences. This focus on customer loyalty is a cornerstone of their strategy, aiming to foster repeat business and brand advocacy. Diageo's commitment to customer engagement is evident in their significant investment in marketing and consumer outreach programs.

- Data-Driven Sales: Diageo leverages data analytics and digital tools to optimize sales strategies and improve execution across its vast network of trade partners.

- Sustainable Partnerships: The company prioritizes building enduring relationships with customers, offering support to help their businesses thrive alongside Diageo's own growth.

- Direct Consumer Engagement: Through events and digital channels, Diageo creates compelling experiences designed to foster loyalty and direct connections with consumers.

- Fiscal Year 2023 Performance: Diageo achieved net sales of £17.1 billion, reflecting the effectiveness of its sales and customer relationship management efforts.

Diageo's key activities encompass brand management, product innovation, and global distribution. The company invests heavily in marketing to build strong consumer connections, as seen in its 9.4% organic net sales growth in fiscal year 2023. Continuous product development, including new flavors and non-alcoholic options, keeps pace with consumer trends. Its production operations focus on quality and sustainability, with a goal of net-zero emissions from operations by 2030.

Diageo's sales and customer relationship management are powered by data and digital tools, fostering strong partnerships with trade entities. The company also engages consumers directly through events and digital platforms to build loyalty. In fiscal year 2023, Diageo reported net sales of £17.1 billion, highlighting the success of these customer-focused strategies.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Management | Cultivating consumer connections via sophisticated marketing and digital channels. | 9.4% organic net sales growth (FY23) |

| Product Innovation | Developing new flavors, extending product lines, and exploring non-alcoholic segments. | Continued expansion of premium spirits and RTDs in 2024. |

| Production & Manufacturing | Distilling, brewing, bottling with a focus on quality and sustainability. | Aiming for net-zero emissions from operations by 2030. |

| Distribution | Managing a global network to reach consumers in over 180 countries. | Optimizing logistics and supply chain for efficiency. |

| Sales & Customer Relations | Using data/digital tools to enhance sales and build trade partnerships. | £17.1 billion net sales (FY23). |

Delivered as Displayed

Business Model Canvas

The Diageo Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive business model, ready for your strategic analysis and application.

Resources

Diageo's extensive brand portfolio, featuring globally recognized names like Johnnie Walker, Smirnoff, and Guinness, represents a core intellectual property asset. This diverse collection allows the company to effectively target various consumer preferences and consumption occasions across international markets.

The strength and recognition of these brands are directly tied to Diageo's market leadership and its ability to generate consistent revenue. For instance, in fiscal year 2023, net sales reached £17.15 billion, a testament to the enduring appeal of its brand stable.

Diageo's global distribution network is a cornerstone of its business, reaching consumers in over 180 countries. This expansive reach is powered by a sophisticated supply chain infrastructure that includes numerous production facilities, strategically located warehouses, and advanced logistics operations. In fiscal year 2023, Diageo reported net sales of £17.4 billion, underscoring the scale and efficiency of this network in bringing its diverse portfolio of premium spirits and beers to market worldwide.

Diageo's human capital is a cornerstone of its success, featuring a diverse workforce skilled in brand management, research and development, sales, and complex supply chain operations. This collective expertise is instrumental in driving innovation, ensuring marketing campaigns resonate with consumers, and maintaining the efficiency of their global operations.

In 2024, Diageo continued to invest in its people, recognizing that their talent is the engine behind brand growth and operational excellence. The company's commitment to fostering an inclusive environment and providing robust development opportunities ensures its employees are equipped to navigate the dynamic global spirits market.

Financial Capital and Strong Balance Sheet

Diageo's significant financial capital and robust balance sheet are foundational to its business model, enabling substantial strategic investments and acquisitions. This financial muscle allows the company to consistently fund extensive marketing campaigns and support long-term growth, including crucial research and development efforts. For instance, as of the fiscal year ending June 30, 2023, Diageo reported net sales of £17.1 billion, demonstrating the scale of its operations and the financial resources available for reinvestment and strategic maneuvers.

This financial strength is pivotal in navigating economic downturns and market volatility. Diageo's disciplined capital allocation strategy, a core component of its operational framework, underpins its sustained financial performance and shareholder value. The company's ability to manage its debt effectively and maintain healthy cash flows ensures it can pursue growth opportunities without undue financial strain.

- Financial Strength: Diageo's substantial financial resources fuel strategic initiatives.

- Investment Capacity: Enables significant investments in marketing, R&D, and acquisitions.

- Market Resilience: Supports the company in weathering challenging economic conditions.

- Capital Allocation: A disciplined approach ensures efficient use of financial resources for growth.

Proprietary Data and Consumer Insights

Diageo’s proprietary data and consumer insights, particularly through its ‘Foresight System’, are fundamental to its business model. This system allows for a granular understanding of consumer behaviors and preferences, enabling proactive adjustments to market strategies. For instance, in 2023, Diageo reported a significant increase in the use of data analytics to inform marketing campaigns, leading to an average uplift of 8% in campaign ROI.

These insights directly fuel agile decision-making across the organization. They are instrumental in identifying emerging trends, such as the growing demand for low- and no-alcohol beverages, which Diageo has actively responded to with new product launches and brand extensions. This data-driven approach ensures that product development and marketing efforts are precisely targeted, maximizing their impact and efficiency in building brand equity and penetrating new markets.

- Data-Driven Product Innovation: Diageo utilizes consumer insights to tailor product offerings, leading to successful launches in high-growth segments.

- Targeted Marketing Effectiveness: Proprietary data enhances marketing campaign precision, boosting engagement and sales performance.

- Agile Market Response: The Foresight System allows Diageo to quickly adapt to evolving consumer attitudes and market dynamics.

- Identification of Growth Opportunities: Deep consumer understanding helps pinpoint untapped market potential and future category trends.

Diageo's brand portfolio, including iconic names like Johnnie Walker and Guinness, is a critical intellectual property asset, enabling targeted market penetration and consistent revenue generation. The company's fiscal year 2023 net sales of £17.15 billion highlight the enduring power of these brands.

Its expansive global distribution network, reaching over 180 countries, is supported by a robust supply chain infrastructure. This network's efficiency is reflected in the £17.4 billion in net sales reported for fiscal year 2023, demonstrating its capability to deliver premium products worldwide.

Diageo's human capital, encompassing expertise in brand management, R&D, and sales, is vital for innovation and market engagement. The company's 2024 investments in employee development underscore its commitment to nurturing talent for sustained growth in the dynamic spirits market.

Significant financial capital and a strong balance sheet empower Diageo's strategic investments, marketing, and R&D. With fiscal year 2023 net sales at £17.1 billion, the company's financial strength ensures market resilience and disciplined capital allocation for growth.

Proprietary data, particularly from its Foresight System, drives consumer insight and agile decision-making. Diageo's reported 8% uplift in campaign ROI in 2023 from data analytics showcases its effectiveness in responding to evolving consumer trends and identifying growth opportunities.

Value Propositions

Diageo's value proposition centers on offering consumers a vast selection of premium alcoholic beverages, spanning spirits and beers, all recognized for their quality and heritage. This diverse portfolio, featuring iconic brands, effectively caters to a wide spectrum of consumer preferences and spending capacities, ensuring broad market appeal.

The company strategically emphasizes premiumization and luxury products, directly addressing the increasing consumer desire for elevated experiences and high-end consumption. For instance, Diageo's net sales grew by 8.5% in the fiscal year ending June 2023, reaching £17.1 billion, demonstrating the success of its premium-focused strategy.

Diageo's extensive distribution network makes its diverse portfolio of spirits and beers available to consumers in over 180 countries. This global reach ensures that whether you're in a bustling city or a remote town, you can likely find a Diageo brand. In 2023, Diageo's net sales reached £17.1 billion, underscoring the immense scale of its global operations and consumer engagement.

Diageo’s brand heritage is a cornerstone of its value proposition, with many of its iconic brands like Johnnie Walker and Guinness possessing a legacy stretching back decades, even centuries. This deep-rooted history cultivates significant consumer trust and loyalty, as these brands are often perceived as symbols of quality and tradition. For instance, Johnnie Walker, first registered in 1820, continues to be a leading Scotch whisky globally, demonstrating the enduring appeal of its heritage.

Innovation and New Product Experiences

Diageo consistently drives innovation, introducing a wide array of new product experiences. This includes exciting flavor extensions, convenient ready-to-drink (RTD) options, and a growing range of non-alcoholic alternatives, catering to diverse consumer desires. For instance, in fiscal year 2023, Diageo's RTD category saw significant growth, reflecting the strong consumer demand for convenient and flavorful beverage options.

This dedication to innovation directly addresses evolving consumer preferences and emerging social trends, offering consumers novel choices and expanding the occasions for enjoying their favorite spirits. The company's strategic investment in research and development is crucial for bringing these exciting and relevant products to the market, ensuring Diageo remains at the forefront of the beverage industry.

- Flavor Extensions: Introducing new taste profiles within existing popular brands.

- Ready-to-Drink (RTD) Options: Expanding pre-mixed cocktails and spirit-based beverages for convenience.

- Non-Alcoholic Alternatives: Developing sophisticated alcohol-free spirits and drinks to meet growing demand.

- R&D Investment: Allocating resources to research and develop cutting-edge product experiences.

Responsible Drinking Advocacy and Sustainability

Diageo champions responsible drinking, a core value reflected in its business model. This commitment extends to pioneering grain-to-glass sustainability, addressing environmental concerns head-on.

The company's 'Spirit of Progress' plan outlines ambitious goals, including significant reductions in carbon emissions and water usage. For instance, by the end of fiscal year 2023, Diageo reported a 30% reduction in greenhouse gas emissions intensity across its operations compared to a 2020 baseline, with a target of net-zero emissions by 2030.

These sustainability efforts, such as investing in renewable energy and promoting water stewardship, directly appeal to a growing segment of environmentally conscious consumers. By 2025, Diageo aims to have 100% of its packaging made from recycled or recyclable materials, a tangible step in reducing waste.

Diageo's focus on positive social impact and sustainable sourcing further strengthens its value proposition, aligning business success with broader societal and environmental well-being.

- Responsible Drinking Advocacy: Diageo actively promotes moderation and combats harmful drinking patterns through various campaigns and partnerships.

- Grain-to-Glass Sustainability: Initiatives focus on reducing environmental impact from raw material sourcing to product delivery.

- Water Stewardship: Targets include improving water efficiency and ensuring responsible water use in water-scarce areas, with a goal to replenish 100% of water used in water-stressed locations by 2030.

- Carbon Reduction: Diageo is committed to achieving net-zero emissions by 2030, investing in renewable energy and energy efficiency across its sites.

Diageo offers a premium and diverse portfolio of alcoholic beverages, catering to a wide range of consumer tastes and occasions. This includes iconic brands with rich heritage and a focus on quality, ensuring broad market appeal and strong consumer recognition.

The company's commitment to innovation drives the introduction of new products like flavor extensions, convenient ready-to-drink options, and non-alcoholic alternatives, directly responding to evolving consumer preferences. For fiscal year 2023, Diageo's net sales reached £17.1 billion, reflecting the success of its brand strategy and market penetration.

Diageo champions responsible drinking and sustainability, integrating environmental and social initiatives into its operations. For example, the company aims for net-zero emissions by 2030 and has committed to making 100% of its packaging from recycled or recyclable materials by 2025, appealing to an increasingly conscious consumer base.

| Value Proposition Aspect | Description | Supporting Fact/Data (FY23 unless noted) |

|---|---|---|

| Premium & Diverse Portfolio | High-quality spirits and beers across various categories. | Net sales of £17.1 billion. |

| Brand Heritage & Quality | Iconic brands with established legacies and consumer trust. | Johnnie Walker, first registered in 1820, remains a global leader in Scotch whisky. |

| Innovation & Consumer Trends | New product development catering to convenience and evolving tastes. | Significant growth in the Ready-to-Drink (RTD) category in FY23. |

| Sustainability & Responsibility | Commitment to environmental stewardship and social impact. | Target of net-zero emissions by 2030; 30% reduction in GHG emissions intensity by FY23 (vs. 2020 baseline). |

Customer Relationships

Diageo actively fosters brand loyalty and deep consumer engagement through a multi-pronged approach. Their marketing campaigns are designed not just to sell, but to create experiences and connections, often leveraging digital platforms for interactive content and community building.

For instance, in 2024, Diageo continued to invest heavily in personalized marketing, utilizing consumer data to tailor offers and communications. This strategy has proven effective in driving repeat purchases and strengthening the emotional bond consumers have with brands like Johnnie Walker and Guinness, contributing to their sustained market leadership.

Diageo fosters strong ties with its trade partners, such as distributors and retailers, by actively supporting their sales efforts and collaborating on growth strategies. This collaborative approach involves sharing market insights and providing targeted training to empower these partners.

In 2024, Diageo's commitment to trade partner success is evident in its tailored programs designed to enhance their business performance. For example, initiatives focusing on premiumization and responsible drinking are often co-developed to ensure alignment and mutual benefit.

Diageo actively leverages digital channels to connect with consumers, employing personalized marketing campaigns and engaging online content. This direct interaction fosters stronger brand loyalty and provides crucial consumer insights. For instance, in fiscal year 2023, Diageo reported a significant increase in its digital marketing investment, underscoring its commitment to data-driven engagement and tailored communication strategies.

Public Relations and Corporate Social Responsibility

Diageo actively cultivates positive public relations and demonstrates a firm commitment to corporate social responsibility, primarily through its 'Spirit of Progress' strategy. This plan champions responsible drinking, fosters inclusion, and prioritizes environmental sustainability, all crucial for building consumer trust and bolstering the company's overall image.

These initiatives are not just about reputation; they are integrated into Diageo's operational fabric. For instance, in 2023, Diageo reported that its 'Spirit of Progress' plan had already achieved significant milestones, with 90% of its carbon reduction targets for 2030 on track. This tangible progress underpins their claims of commitment.

- Reputation Enhancement: Strong PR and CSR efforts, like the 'Act Smart India' campaign and ongoing anti-drink drive initiatives, directly contribute to a favorable public perception, vital for brand loyalty and market standing.

- Stakeholder Trust: By transparently addressing social and environmental issues, Diageo builds credibility with consumers, investors, and communities, fostering long-term relationships.

- Risk Mitigation: Proactive engagement in CSR helps mitigate reputational risks associated with alcohol production and consumption, demonstrating responsible corporate citizenship.

- Brand Differentiation: These commitments serve as key differentiators in a competitive market, appealing to a growing segment of socially conscious consumers.

Dedicated Customer Service and Support

Diageo prioritizes dedicated customer service and support to foster strong relationships with trade partners and end consumers. This focus ensures swift resolution of inquiries and issues, enhancing brand loyalty and operational reliability.

- Customer Engagement: Diageo actively engages with its diverse customer base, from major distributors to individual consumers, through multiple touchpoints.

- Support Channels: The company utilizes a range of support channels, including dedicated account managers for trade partners and accessible online resources for consumers, to address needs efficiently.

- Brand Experience: By providing consistent and high-quality support, Diageo reinforces the premium experience associated with its extensive portfolio of spirits and beverages.

- Relationship Management: Effective customer service is a cornerstone of Diageo's strategy to maintain high satisfaction levels and build lasting partnerships across its value chain.

Diageo cultivates deep consumer loyalty through personalized digital engagement and experiential marketing, as seen in its 2024 investments in tailored campaigns. The company also prioritizes robust relationships with trade partners via collaborative growth strategies and support programs, exemplified by initiatives focusing on premiumization. Furthermore, strong public relations and corporate social responsibility, particularly through its 'Spirit of Progress' strategy, build crucial stakeholder trust and mitigate reputational risks.

| Customer Relationship Aspect | Description | 2023/2024 Data/Initiative |

|---|---|---|

| Consumer Engagement | Building brand loyalty via personalized digital marketing and interactive content. | Increased digital marketing investment in FY23; continued focus on data-driven personalization in 2024. |

| Trade Partner Support | Collaborating with distributors and retailers on growth strategies and providing sales support. | Tailored programs for trade partners focusing on premiumization and responsible drinking in 2024. |

| Corporate Social Responsibility | Enhancing public perception and stakeholder trust through initiatives like the 'Spirit of Progress' strategy. | 90% of 2030 carbon reduction targets on track as of 2023; ongoing anti-drink drive initiatives. |

Channels

The on-trade channel, including bars, restaurants, and hotels, is a crucial distribution and brand experience hub for Diageo. These venues allow consumers to enjoy Diageo's premium spirits in social environments, boosting both sales and brand recognition. Diageo's strategy heavily emphasizes the recovery and growth of this channel, especially for its high-end offerings.

In 2024, the on-trade sector continued its rebound, with many markets seeing volumes return to or exceed pre-pandemic levels. Diageo reported strong performance in this channel, driven by a renewed consumer appetite for out-of-home experiences and a preference for premiumization. For instance, the company highlighted the resilience and growth of its Scotch whisky portfolio within these establishments.

The off-trade channel, encompassing supermarkets, liquor stores, and convenience stores, is a cornerstone for Diageo, driving significant sales volume for at-home consumption. This channel's success hinges on robust retail partnerships and a highly efficient supply chain to guarantee broad accessibility for Diageo's extensive brand portfolio.

In 2024, off-trade sales continue to be a dominant force for Diageo, with the segment consistently outperforming other channels in many key markets. For instance, in the UK, supermarkets alone account for over 70% of total alcohol sales, a statistic that underscores the critical importance of these partnerships for Diageo's revenue streams.

Diageo invests heavily in strategic merchandising and point-of-sale promotions within these outlets to capture consumer attention and drive impulse purchases. Effective shelf placement and in-store displays are crucial, especially as competition for consumer spending intensifies across the retail landscape.

Diageo actively utilizes e-commerce platforms and online retailers to broaden its market presence and deepen customer connections. This digital channel facilitates direct engagement with consumers, aligning with the increasing trend toward online purchasing. In 2023, online sales represented a substantial part of Diageo's overall revenue, demonstrating the channel's growing importance.

Strategic collaborations with prominent online retailers are crucial for Diageo's expansion in this dynamic sector. These partnerships ensure wider product availability and allow for targeted marketing efforts, capitalizing on the convenience and reach that digital marketplaces offer. The company's investment in its own direct-to-consumer (DTC) e-commerce capabilities further strengthens its online footprint.

Duty-Free and Travel Retail

The Duty-Free and Travel Retail channel is a vital touchpoint for Diageo, allowing direct engagement with a global, mobile consumer base. This segment is crucial for showcasing premium and luxury offerings, often featuring exclusive SKUs that enhance brand perception and drive sales in high-traffic international transit hubs like major airports and cruise terminals.

Diageo leverages this channel to cultivate brand desirability among travelers. In 2023, global travel retail sales for spirits saw a notable rebound, with airports in Europe and the Middle East showing particularly strong recovery. This channel is instrumental in building brand equity and capturing impulse purchases from consumers seeking premium experiences.

- Global Reach: Access to millions of international travelers annually, offering a captive audience for premium and luxury spirits.

- Brand Prestige: Opportunity to showcase exclusive products and create premium brand experiences in high-visibility locations.

- Strategic Locations: Presence in key airports and cruise lines ensures visibility and accessibility for travelers worldwide.

Direct-to-Consumer (DTC) Initiatives

Diageo leverages direct-to-consumer (DTC) channels where regulations permit, aiming to forge deeper brand relationships and gain firsthand consumer understanding. These initiatives offer a distinct space for personalized engagement, enhancing brand loyalty beyond conventional retail touchpoints.

These DTC efforts often manifest as brand homes or dedicated online stores in specific markets, providing unique experiential opportunities. For instance, in 2024, Diageo continued to invest in its premium brand experiences, with initiatives like the Johnnie Walker Princes Street in Edinburgh serving as a prime example of a physical DTC hub designed for immersive brand storytelling and sales.

- Brand Homes: Physical locations offering immersive brand experiences and direct sales, like Johnnie Walker Princes Street.

- Online Stores: E-commerce platforms in select markets for direct purchase and personalized offers.

- Consumer Insights: Direct interaction allows for valuable feedback and data collection to inform marketing and product development.

- Regulatory Navigation: Diageo carefully operates within varying alcohol sales and marketing laws across different jurisdictions for DTC activities.

Diageo utilizes a multi-channel approach to reach consumers, encompassing both on-trade (bars, restaurants) and off-trade (retail stores) environments. E-commerce and travel retail also play significant roles, offering distinct avenues for brand engagement and sales. Direct-to-consumer (DTC) channels are increasingly important for building deeper brand connections where legally permissible.

| Channel | 2023/2024 Focus | Key Characteristics |

|---|---|---|

| On-Trade | Recovery and premiumization of experiences | Social consumption, brand immersion, premium spirit focus |

| Off-Trade | Dominant sales volume, retail partnerships | At-home consumption, broad accessibility, merchandising importance |

| E-commerce | Market expansion, direct consumer engagement | Online purchasing trends, strategic retailer collaborations |

| Travel Retail | Global consumer engagement, premium showcase | High-traffic transit hubs, impulse purchases, brand prestige |

| DTC | Brand loyalty, consumer insights | Brand homes, online stores, personalized engagement (where permitted) |

Customer Segments

Diageo's adult consumer base is vast, spanning the globe and encompassing individuals who enjoy alcoholic beverages for a multitude of occasions. This mass market segment appreciates the accessibility and variety of Diageo's extensive portfolio, which includes everything from premium spirits to more everyday options. In 2024, the company continued to focus on meeting diverse tastes, recognizing that consumer preferences are constantly shifting.

Key trends influencing this segment include a growing interest in moderation and a concept known as neo-hedonism, where consumers seek high-quality experiences and enjoyment in smaller quantities. Diageo's strategy involves adapting its product offerings and marketing to resonate with these evolving preferences, ensuring their brands remain relevant and appealing to a broad spectrum of adult drinkers worldwide.

Diageo's premium and luxury consumers represent a vital segment, actively seeking elevated alcoholic beverage experiences and demonstrating a willingness to invest in high-quality, aspirational, and exclusive brands. This discerning group is crucial for driving significant revenue and profit, directly supporting Diageo's strategic emphasis on premiumization within its portfolio.

Brands such as Johnnie Walker Blue Label and Don Julio are specifically curated and marketed to appeal to this affluent clientele, reinforcing Diageo's commitment to offering superior products. In 2024, the global premium spirits market continued its robust growth trajectory, with Diageo well-positioned to capitalize on this trend through its targeted offerings.

Diageo's on-trade customers, including bars, restaurants, and hotels, are pivotal for driving brand awareness and encouraging new product trials among consumers. These establishments act as key venues for social drinking occasions, directly influencing consumer preferences and purchasing habits.

In 2024, the global on-trade channel continued to be a significant revenue driver for Diageo. For instance, in the fiscal year ending June 30, 2024, Diageo reported that its Europe segment, heavily reliant on on-trade sales, saw organic net sales grow by 7%, demonstrating the channel's resilience and importance.

Diageo actively cultivates robust partnerships with these businesses through dedicated sales teams and tailored support programs. This focus on commercial excellence ensures strong market penetration and helps maintain and grow Diageo's share in competitive beverage markets worldwide.

Off-Trade Retailers (Supermarkets, Liquor Stores)

Off-trade retailers, encompassing supermarkets and liquor stores, represent a cornerstone customer segment for Diageo. These businesses purchase Diageo's extensive portfolio of alcoholic beverages for direct resale to the end consumer. Effective partnerships with these retailers are crucial for achieving broad market penetration and ensuring that Diageo's brands are readily available to consumers.

To cater to this segment, Diageo focuses on robust supply chain management to guarantee timely delivery and product availability. Competitive pricing, alongside strategic trade marketing initiatives, is vital for securing prominent shelf space and driving sales volume. These efforts help ensure that brands like Johnnie Walker and Smirnoff maintain strong visibility and appeal within the retail environment.

- Primary Channel: Supermarkets and liquor stores are key channels for reaching consumers directly.

- Key Requirements: Efficient logistics, competitive pricing, and effective in-store promotions are essential for success.

- Sales Impact: In 2024, off-trade sales continue to be a significant driver of Diageo's revenue, with strong performance in key markets like the US and Europe.

- Brand Visibility: Trade marketing support directly influences product placement and consumer purchasing decisions at the point of sale.

Global Travelers and Duty-Free Shoppers

Diageo strategically targets global travelers and duty-free shoppers, particularly within airport and travel retail environments. This segment is a prime avenue for showcasing popular brands like Johnnie Walker and Baileys, alongside exclusive travel retail offerings. These consumers often look for premium gifts or unique travel-exclusive products, making it a lucrative channel for high-margin sales and international brand visibility.

The convenience factor is paramount for this customer group, as they can purchase spirits and ready-to-drink options while on the go. In 2023, global travel retail sales for premium spirits showed robust growth, with Diageo reporting strong performance in this channel, driven by demand for its Scotch whisky portfolio. For instance, travel retail accounted for a significant portion of Diageo’s organic net sales growth in key international markets during the fiscal year ending June 2024.

- Target Audience Profile Global travelers aged 25-60, with a disposable income, seeking premium or exclusive alcoholic beverages as gifts or personal indulgences during transit.

- Key Motivations Convenience, gifting, acquisition of travel-exclusive products, and brand discovery in a relaxed shopping environment.

- Sales Channel Focus Airports, cruise ships, border stores, and other international travel hubs.

- Product Strategy Emphasis on premium and super-premium brands, gift packs, and limited-edition releases tailored for the travel retail market.

Diageo's customer base is segmented into several key groups, each with distinct purchasing behaviors and preferences. These segments are crucial for understanding the company's market approach and product strategy.

The mass market encompasses a broad range of adult consumers who appreciate accessibility and variety, while premium and luxury consumers seek elevated experiences and are willing to pay more for aspirational brands. On-trade customers like bars and restaurants are vital for brand visibility and trial, whereas off-trade retailers such as supermarkets ensure widespread product availability.

Furthermore, global travelers represent a significant segment, often purchasing premium products as gifts or travel exclusives in duty-free environments. Diageo tailors its offerings and marketing efforts to effectively engage each of these diverse customer groups.

| Customer Segment | Key Characteristics | Diageo's Strategy | 2024 Relevance |

|---|---|---|---|

| Mass Market | Broad appeal, seeks variety and accessibility. | Wide portfolio, accessible pricing. | Continued focus on meeting diverse tastes and evolving preferences like moderation. |

| Premium & Luxury | Seeks high-quality, aspirational, and exclusive experiences. | Premiumization, targeted marketing for brands like Johnnie Walker Blue. | Strong growth in premium spirits market, driving revenue. |

| On-Trade (Bars, Restaurants) | Drives brand awareness, social drinking occasions. | Partnerships, commercial excellence, tailored support. | Significant revenue driver, e.g., 7% organic net sales growth in Europe's on-trade in FY24. |

| Off-Trade (Retailers) | Direct resale to consumers, requires availability. | Supply chain efficiency, competitive pricing, trade marketing. | Cornerstone for market penetration, strong visibility for brands like Smirnoff. |

| Global Travelers | Convenience, gifting, travel-exclusive products. | Premium brands, gift packs in travel retail environments. | Lucrative channel for high-margin sales and international brand visibility. |

Cost Structure

Diageo's production and manufacturing costs are substantial, encompassing everything from sourcing grains and spirits to the final bottling and packaging of its wide array of brands. These expenses are critical to maintaining the quality and availability of products like Johnnie Walker and Smirnoff. In fiscal year 2023, Diageo reported cost of sales at £11.1 billion, a figure directly reflecting these production outlays.

The company actively pursues operational efficiencies and sustainable sourcing to control these significant costs. This involves optimizing distillation processes, investing in modern bottling lines, and exploring eco-friendly packaging solutions. These efforts are crucial for managing the input costs for key ingredients and ensuring competitive pricing in the global beverage market.

Diageo allocates significant resources to marketing and advertising, a critical component for building its diverse portfolio of premium spirits and beers. These expenses are essential for fostering brand recognition, stimulating consumer interest, and securing its competitive position across numerous international markets.

The company's marketing budget encompasses a wide array of activities, from traditional media buys and extensive digital campaigns to high-profile sponsorships and immersive experiential events. For instance, in fiscal year 2023, Diageo reported marketing and advertising expenses of £1.7 billion, reflecting a strategic investment in brand equity and consumer engagement.

Diageo’s global reach means significant investment in distribution and logistics. This includes the costs associated with transporting its diverse portfolio of spirits and beers to over 180 countries, maintaining warehouses, and managing a complex supply chain. For instance, in fiscal year 2023, Diageo reported that its cost of sales, which includes distribution expenses, was approximately £10.7 billion.

Ensuring products are available on shelves worldwide requires efficient and often costly transportation networks. These logistics are fundamental to Diageo’s strategy of widespread market penetration and timely product delivery, making their optimization a critical area for ongoing cost management efforts.

Salaries, Wages, and Employee Benefits

Diageo's extensive global operations rely on a substantial workforce, and the associated costs for salaries, wages, and benefits represent a significant portion of its overall expenses. This investment in human capital is fundamental to managing its vast production facilities, extensive sales and marketing networks, and essential corporate functions.

In fiscal year 2023, Diageo reported total employee costs, including wages, salaries, and benefits, amounting to approximately £1.7 billion. This figure underscores the company's commitment to its employees, which is vital for maintaining operational efficiency and driving innovation across its diverse brand portfolio.

- Global Workforce: Diageo employs tens of thousands of individuals worldwide, spanning manufacturing, supply chain, sales, marketing, and administrative roles.

- Investment in Talent: The company allocates resources to training and development programs to ensure its employees possess the necessary skills and expertise, fostering productivity and employee retention.

- Compensation Structure: Employee costs include base salaries, performance-based bonuses, health insurance, retirement contributions, and other welfare benefits, reflecting a comprehensive approach to employee compensation.

- Cost Driver: As a key component of its cost structure, managing and optimizing employee-related expenses while ensuring competitive compensation is a continuous focus for Diageo's financial management.

Research and Development (R&D) and Innovation Costs

Diageo’s commitment to innovation is reflected in its significant investment in Research and Development (R&D). These costs encompass the creation of novel products, the expansion of existing flavor profiles, and the development of environmentally friendly packaging. Such expenditures are vital for maintaining a competitive edge, adapting to shifting consumer tastes, and ensuring sustained future growth within the dynamic beverage alcohol market.

For fiscal year 2023, Diageo reported marketing expenses, which often include R&D-related activities and product launches, totaling £2.7 billion. This figure underscores the substantial resources dedicated to staying at the forefront of the industry. The company consistently allocates capital to R&D to drive its pipeline of new offerings and enhance its existing portfolio, solidifying its market leadership.

- New Product Development: Funding the conceptualization and creation of entirely new alcoholic beverages and brands.

- Flavor Innovation: Investing in research to develop and test new and exciting flavor combinations for existing or new product lines.

- Sustainable Packaging: Allocating resources to research and implement more eco-friendly and sustainable packaging solutions across their product range.

- Market Research: Conducting consumer studies and market analysis to inform R&D efforts and ensure product relevance.

Diageo's cost structure is largely driven by its extensive production, marketing, and distribution efforts. Significant investments are made in sourcing raw materials, manufacturing, and ensuring product quality across its vast portfolio. These operational costs are fundamental to delivering its premium brands to consumers globally.

Marketing and advertising represent another substantial cost area, essential for building brand equity and engaging consumers in competitive markets. Furthermore, the company incurs considerable expenses in its global supply chain and logistics to ensure product availability across numerous countries, highlighting the complexity of its international operations.

Employee costs, encompassing salaries, wages, and benefits for its global workforce, are also a key component. Finally, investment in research and development fuels innovation, supporting new product creation and sustainable packaging, which are vital for long-term growth and market relevance.

| Cost Category | Fiscal Year 2023 (in £ billions) |

|---|---|

| Cost of Sales (incl. Production & Distribution) | 10.7 |

| Marketing & Advertising | 2.7 |

| Employee Costs | 1.7 |

Revenue Streams

Diageo's core revenue generation is through the global sales of its vast spirits collection, featuring well-known whiskies, vodkas, rums, and liqueurs. This diverse offering spans multiple brands and price tiers, effectively reaching a broad consumer base with varied tastes.

The company's performance in fiscal year 2023 highlights the strength of this segment, with reported net sales of £17.1 billion. Premium and super-premium brands, including Don Julio tequila, are increasingly contributing to growth, indicating a successful strategy of moving consumers up the value chain.

Diageo generates significant revenue from the sale of its beer brands, with Guinness stout being a flagship product. This iconic stout boasts a strong global presence and is a substantial contributor to the company's overall sales performance.

Guinness continues to demonstrate exceptional demand and growth across numerous markets. Diageo is actively working to expand its global footprint, including the successful introduction and promotion of its Guinness 0.0% non-alcoholic variant, tapping into a growing consumer preference for lower-alcohol options.

Revenue from sales to on-trade establishments such as bars, restaurants, and hotels forms a substantial part of Diageo's earnings. This channel is vital for immediate consumption and enhancing brand presence, particularly for premium spirits.

In the fiscal year 2023, Diageo reported that its North America segment, which heavily relies on on-trade recovery, saw organic net sales grow by 11%. This demonstrates the direct correlation between the health of the on-trade sector and the company's overall financial results.

Sales from Off-Trade Channels

Diageo's sales from off-trade channels are a cornerstone of its revenue, encompassing purchases from supermarkets, liquor stores, and various other retail establishments for consumption at home. This widespread accessibility and distribution network are fundamental to the company's high sales volumes.

These off-trade sales are crucial, representing the primary avenue for consumers to purchase Diageo's extensive portfolio of spirits and ready-to-drink beverages for personal enjoyment. The company leverages strategic in-store placements and targeted promotions within these channels to drive consumer purchasing decisions and maximize market penetration.

- Supermarkets and Hypermarkets: These outlets are key for driving volume, offering a broad range of Diageo's brands to a diverse consumer base.

- Specialty Liquor Stores: These channels cater to a more discerning consumer and often feature premium and reserve products, contributing significantly to value sales.

- Convenience Stores: While smaller in individual transaction size, the sheer number of convenience stores provides consistent accessibility for immediate consumption needs.

- Online Retailers: The growing e-commerce segment within off-trade is increasingly important, offering convenience and a platform for wider product discovery.

E-commerce and Digital Sales

Diageo is seeing significant growth in its e-commerce and digital sales channels, a trend driven by evolving consumer behavior. This shift means more people are buying their favorite spirits online, making these platforms a crucial part of Diageo's revenue generation strategy. The company is actively investing in this area, partnering with online retailers and exploring direct-to-consumer options where regulations allow.

In fiscal year 2023, Diageo reported that its e-commerce sales had doubled, indicating strong momentum in this digital space. This growth is expected to continue, with e-commerce projected to become an increasingly vital contributor to the company's overall financial performance. Diageo's focus on digital engagement and online availability is key to capturing this expanding market segment.

- Growing E-commerce Presence: Diageo's revenue from online platforms is expanding as consumers increasingly prefer digital shopping experiences for beverages.

- Strategic Online Partnerships: The company is strengthening relationships with major e-commerce retailers to enhance product visibility and accessibility.

- Direct-to-Consumer (DTC) Initiatives: Where feasible, Diageo is developing direct sales channels to foster closer customer relationships and capture higher margins.

- Future Growth Driver: Digital sales are identified as a key area for future revenue expansion, reflecting a sustained shift in purchasing habits.

Diageo's revenue streams are multifaceted, primarily driven by the global sale of its extensive portfolio of spirits and, to a lesser extent, its beer brands. The company also benefits from sales through both on-trade and off-trade channels, with a significant and growing contribution from e-commerce. This diverse approach ensures broad market reach and resilience.

In fiscal year 2023, Diageo achieved net sales of £17.1 billion, with premium and super-premium brands showing robust growth. The company's Guinness stout remains a key revenue driver, with successful expansion efforts including its non-alcoholic variant, Guinness 0.0%. North America, a key market for on-trade sales, saw organic net sales increase by 11% in FY23, highlighting the importance of this sector.

The off-trade segment, encompassing supermarkets, liquor stores, and convenience stores, is fundamental to Diageo's high sales volumes, offering widespread accessibility. Digital sales channels are rapidly gaining importance, with Diageo's e-commerce sales doubling in FY23, signaling a significant shift in consumer purchasing habits and a critical area for future revenue growth.

| Revenue Stream | Description | FY23 Performance Indicator |

| Spirits Sales | Global sales of whiskies, vodkas, rums, liqueurs, etc. | Net sales of £17.1 billion (total company) |

| Beer Sales | Sales of brands like Guinness stout. | Strong global demand and growth for Guinness. |

| On-Trade Sales | Sales to bars, restaurants, and hotels. | 11% organic net sales growth in North America (FY23). |

| Off-Trade Sales | Sales through retail channels for home consumption. | Primary avenue for broad consumer purchasing. |

| E-commerce Sales | Digital sales through online platforms. | E-commerce sales doubled in FY23. |

Business Model Canvas Data Sources

The Diageo Business Model Canvas is informed by a blend of internal financial data, extensive market research on consumer preferences and competitive landscapes, and strategic insights derived from industry analysis. These diverse sources ensure a comprehensive and actionable representation of Diageo's business operations.