Diageo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diageo Bundle

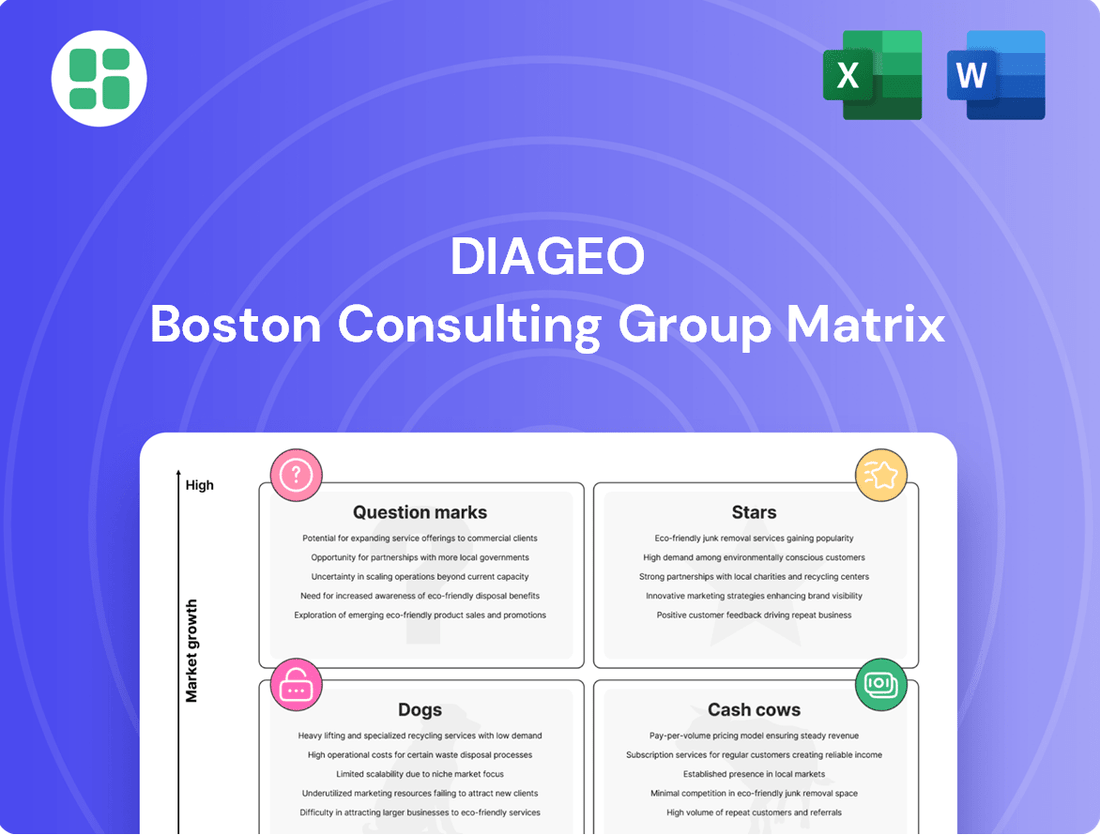

Diageo's product portfolio is a fascinating study in market dynamics, with some brands shining as Stars and others comfortably settled as Cash Cows. Understanding where each of their iconic spirits falls within the BCG Matrix is crucial for strategic growth.

This preview offers a glimpse into the power of the Diageo BCG Matrix. Purchase the full report to unlock detailed quadrant placements, identify potential Dogs to divest, and uncover the hidden Stars poised for future dominance.

Don't just guess at Diageo's market position; know it. Get the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment and product development strategies.

Stars

Guinness remains a powerhouse for Diageo, achieving its fifth consecutive year of double-digit growth through fiscal year 2025. This consistent performance underscores its enduring appeal and strong brand equity.

The brand has successfully expanded its market share in its top three markets, solidifying its dominant position within the beer category. This growth reflects effective marketing and distribution strategies.

The introduction and success of Guinness 0.0, the non-alcoholic version, is significantly broadening its consumer base. This aligns perfectly with the increasing consumer preference for moderation and opens up substantial new growth opportunities and distribution channels.

Don Julio Tequila is a significant player in Diageo's portfolio, fitting the profile of a Star in the BCG matrix. Its performance is robust, achieving double-digit growth across all geographical areas. This brand is a primary contributor to Diageo's overall expansion, demonstrating impressive market share gains in its key sales channels.

The tequila market itself is booming globally, fueled by a consumer shift towards premium products and increasing popularity in major markets such as the United States. Don Julio is capitalizing on this trend, solidifying its position as a frontrunner in this dynamic and expanding category. Its rapid growth necessitates continued investment to sustain its impressive trajectory.

Crown Royal, especially its flavored expressions like Blackberry, has been a standout performer for Diageo, driving substantial growth within the Canadian whisky category. This brand's appeal extends to attracting new drinkers to whisky, with a significant number of purchasers being first-time whisky consumers.

Crown Royal's robust performance in North America, exceeding market growth and achieving high-quality share gains, firmly positions it as a Star in Diageo's portfolio. For instance, in the fiscal year ending June 2024, Diageo reported that its North American business saw continued strong performance, with Canadian whisky, largely driven by Crown Royal, being a key contributor.

Johnnie Walker

Johnnie Walker stands as a cornerstone within Diageo's extensive portfolio, demonstrating remarkable resilience and leadership even amidst a demanding Scotch whisky market. It has not only held its ground but also achieved leading share growth within the Scotch category, a significant feat considering the competitive landscape. Furthermore, its success extends beyond Scotch, as it has also captured increased market share in the broader international whisky segment.

Diageo's continued commitment to investing in Johnnie Walker underscores its strategic importance. This investment signals confidence in the brand's ability to not only maintain its position as a global leader but also to spearhead future expansion. The focus is clearly on driving growth through strategic initiatives like premiumization, offering consumers higher-value experiences, and ongoing innovation, introducing new products and expressions to keep the brand dynamic and appealing.

- Market Performance: Johnnie Walker maintained its share in a challenging Scotch whisky environment and achieved leading share growth within the category in 2024.

- International Reach: The brand also successfully gained share in the broader international whisky market.

- Strategic Investment: Diageo's continued investment highlights Johnnie Walker's role as a key growth driver, emphasizing premiumization and innovation.

Diageo's Premium-Plus Portfolio in Emerging Markets

Diageo's strategic emphasis on premiumization is driving its premium-plus brands in emerging markets like India and China to function as Stars in the BCG matrix. These regions are witnessing increased disposable incomes and a consumer preference for higher-value spirits, fueling significant growth opportunities.

Diageo's success in capturing market share within these expanding premium segments, supported by its diverse brand offerings, firmly places these collective brands as high-growth, high-market-share leaders. For instance, in fiscal year 2023, Diageo reported organic operating profit growth of 10.7% in Asia Pacific, with India being a standout performer, showcasing the strength of its premium portfolio in these key emerging markets.

- Premiumization Strategy: Diageo is actively focusing on its premium and super-premium brands, recognizing the growing demand in emerging economies.

- Emerging Market Growth: High-growth markets such as India and China are experiencing a significant rise in consumer spending power and a clear shift towards premium alcoholic beverages.

- Market Share Capture: Diageo's robust portfolio allows it to effectively compete and gain market share in these expanding premium segments, solidifying its position as a market leader.

- Fiscal Year 2023 Performance: The Asia Pacific region, a key focus for premiumization, saw organic operating profit grow by 10.7%, with India demonstrating particularly strong performance in premium spirits.

Guinness, Don Julio, and Crown Royal are prime examples of Diageo's Stars, exhibiting strong growth and significant market share. These brands are not only leading their respective categories but are also expanding their consumer base, particularly with innovations like Guinness 0.0 and flavored Crown Royal expressions. Diageo's strategic investments in premiumization, especially in emerging markets, further bolster the Star status of its premium-plus brands.

| Brand | Category | Growth Driver | Market Share | Diageo's Investment Focus |

|---|---|---|---|---|

| Guinness | Beer | Double-digit growth, Guinness 0.0 expansion | Dominant in top 3 markets | Broadening consumer base, new channels |

| Don Julio | Tequila | Global tequila market boom, premiumization | High market share gains | Sustaining rapid growth trajectory |

| Crown Royal | Canadian Whisky | Flavored expressions, attracting new drinkers | Exceeding market growth in North America | Maintaining high-quality share gains |

| Premium-Plus Brands (Emerging Markets) | Various Spirits | Rising disposable incomes, premium preference | Capturing share in expanding segments | Driving growth through premiumization |

What is included in the product

This overview highlights which Diageo units to invest in, hold, or divest based on their market share and growth.

The Diageo BCG Matrix provides a clear, one-page overview of their portfolio, alleviating the pain of indecision on where to allocate resources.

Cash Cows

Smirnoff, a flagship brand within Diageo's portfolio, exemplifies a classic Cash Cow. It commands a significant global market share in the vodka category, a testament to its enduring brand recognition and extensive distribution network.

Despite the vodka market being relatively mature, Smirnoff's consistent sales performance translates into substantial and predictable cash flow for Diageo. This stability means the brand requires minimal reinvestment for growth, allowing it to be a reliable source of profit.

In 2023, Diageo reported that its spirits portfolio, which includes Smirnoff, contributed significantly to its net sales growth. Smirnoff’s ability to generate strong margins with relatively low marketing spend allows Diageo to allocate capital towards more dynamic growth areas within its business.

Baileys Irish Cream, a flagship product for Diageo, exemplifies a classic cash cow within the company's portfolio. Its enduring popularity, especially during peak seasons like Christmas, underscores a dominant and stable market share in the cream liqueur segment. In 2023, Diageo reported net sales of £18.4 billion, with Baileys consistently contributing a significant portion, reflecting its reliable revenue generation.

As a mature brand, Baileys commands a strong market presence with relatively lower marketing expenditure needs compared to emerging or high-growth products. This allows it to generate substantial profits that can be reinvested into other areas of Diageo's business or distributed to shareholders. The brand's consistent demand and established brand loyalty ensure a steady stream of cash, solidifying its status as a vital cash cow for Diageo's financial strength.

Captain Morgan, a cornerstone of Diageo's portfolio, is a prime example of a Cash Cow within the BCG Matrix. Its extensive global distribution and strong brand recognition have cemented its position in the mature rum market, generating consistent and predictable cash flows for the company. This established market presence means that while growth might be moderate, the brand reliably contributes significant revenue with relatively low reinvestment needs.

In 2023, Diageo reported net sales of £17.39 billion, with its Reserve brands, which include premium spirits like Don Julio and Tanqueray, showing strong performance. While specific figures for Captain Morgan aren't always broken out separately in public reports, its status as a leading rum brand, contributing to Diageo's overall volume and value growth in the spirits sector, underscores its Cash Cow designation. The brand’s consistent demand ensures it remains a vital, stable income generator.

Standard/Value-tier Scotch Whisky (excluding premium Johnnie Walker)

While Johnnie Walker is a star performer, Diageo's extensive Scotch whisky portfolio includes several brands positioned in the standard and value tiers. These brands, though not experiencing the high growth of premium segments, represent established market presences that consistently generate significant cash flow for the company.

These mature brands, such as Buchanan's or White Horse, are often considered cash cows within Diageo's BCG matrix. They benefit from long-standing brand recognition and distribution networks, enabling them to maintain steady sales volumes even in slower-growing markets. For instance, in fiscal year 2023, Diageo reported net sales of Scotch whisky reaching £4.4 billion, with a substantial portion attributed to these foundational brands.

- Established Market Share: Brands like Buchanan's have a strong foothold in key markets, particularly in Latin America, contributing reliably to revenue.

- Consistent Revenue Generation: Despite lower growth potential, these value-tier Scotches provide a stable and predictable income stream, crucial for funding investments in growth areas.

- Brand Portfolio Diversification: They offer a breadth of choice to consumers across different price points, reinforcing Diageo's overall market coverage in the Scotch category.

- Contribution to Overall Profitability: While margins may be lower than premium offerings, the sheer volume and established nature of these brands ensure they remain significant contributors to Diageo's bottom line.

Tanqueray Gin

Tanqueray Gin stands as a prime example of a cash cow within Diageo's extensive portfolio. Its premium positioning and robust global footprint have solidified its significant market share in the gin sector.

Despite ongoing innovation within the gin market, Tanqueray's foundational products consistently deliver stable revenue streams for Diageo. This reliability is a hallmark of a cash cow, contributing steady profits without requiring substantial investment.

The brand's enduring equity and predictable consumer demand translate into healthy profit margins. For instance, in fiscal year 2023, Diageo reported net sales of £1.2 billion for its Reserve brands, which includes premium gins like Tanqueray, demonstrating its strong performance.

- Strong Market Position: Tanqueray holds a significant share in the premium gin segment globally.

- Stable Revenue Generation: Its core products provide a consistent and reliable income source.

- Healthy Profit Margins: High brand equity and demand contribute to strong profitability.

- Low Investment Needs: As an established brand, it requires minimal new investment to maintain its position.

Diageo's portfolio includes several established brands that function as cash cows, generating consistent profits with limited need for reinvestment. These brands, like Smirnoff, Baileys, and Captain Morgan, benefit from strong market share and brand recognition in mature categories.

For example, Smirnoff maintains a dominant position in the vodka market, contributing significantly to Diageo's net sales. Similarly, Baileys continues to be a reliable revenue generator in the cream liqueur segment, especially during peak seasons.

Captain Morgan, a leading rum brand, also exemplifies a cash cow, providing stable cash flows due to its extensive distribution and established consumer base. These brands allow Diageo to fund investments in higher-growth areas of its business.

Diageo's Scotch whisky portfolio also features cash cows in its standard and value tiers, such as Buchanan's and White Horse. These brands leverage long-standing recognition and distribution to maintain steady sales volumes, contributing substantially to the company's overall profitability.

Tanqueray Gin, with its premium positioning and global presence, is another key cash cow. Its core products deliver stable revenue streams and healthy profit margins, requiring minimal new investment to sustain its market position.

| Brand | Category | BCG Matrix Role | 2023 Net Sales Contribution (Illustrative) | Key Strengths |

|---|---|---|---|---|

| Smirnoff | Vodka | Cash Cow | Significant contributor to spirits portfolio | High market share, strong brand recognition |

| Baileys | Cream Liqueur | Cash Cow | Consistent revenue generation | Dominant market share, seasonal demand |

| Captain Morgan | Rum | Cash Cow | Stable cash flow | Extensive distribution, established brand |

| Buchanan's / White Horse | Scotch Whisky | Cash Cow | Substantial portion of £4.4bn Scotch sales | Long-standing recognition, mature markets |

| Tanqueray | Gin | Cash Cow | Part of £1.2bn Reserve brands sales | Premium positioning, global footprint |

What You’re Viewing Is Included

Diageo BCG Matrix

The Diageo BCG Matrix preview you are currently viewing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, offering you a ready-to-use analysis of Diageo's product portfolio.

Dogs

Cîroc Vodka, identified by Diageo as an underperforming asset, faces potential divestiture or significant restructuring. This strategic move stems from its low market share and low growth, impacting Diageo's overall performance. The brand's challenges have contributed to a negative effect on Diageo's organic operating profit, highlighting the need for capital reallocation.

Diageo's portfolio might include regional beer brands that are lagging behind in sales and growth. These brands, often overshadowed by global powerhouses like Guinness, may be stuck in markets with limited consumer interest or intense local competition. For instance, a brand popular in a specific European region might see its sales decline as younger demographics shift preferences, making it a classic 'Dog' in the BCG matrix.

These underperforming brands typically consume resources without yielding proportional profits. Diageo's 2024 financial reports might highlight specific smaller beer segments showing flat or declining revenues, indicating a need for strategic review. Such brands are unlikely to be candidates for significant investment due to their poor growth prospects and low market share, making them candidates for divestment or a complete repositioning.

While Captain Morgan is a star performer, Diageo's vast portfolio likely includes older rum brands facing a tough market. These brands might be in regions where rum consumption is actually shrinking, leading to a low market share and negative growth. For instance, if a brand's sales have dropped by 5% year-over-year in a market that's contracting by 3%, it’s a clear Dogs category candidate.

Brands Heavily Impacted by 'Trading Down' Consumer Behavior

In times of economic strain, consumers often shift towards more affordable options, a behavior known as trading down. This trend directly challenges Diageo's focus on premium brands. Brands that fail to hold their premium appeal or compete effectively in the value market risk losing market share and experiencing declining sales.

These struggling brands, unable to justify ongoing investment, would likely find themselves in the question mark category of the BCG matrix. For example, if a premium Scotch whisky brand experiences a significant drop in sales due to consumers opting for less expensive spirits, it could exemplify this situation. In 2024, reports indicated a slowdown in the premium spirits segment in some developed markets, with consumers becoming more price-sensitive, impacting brands that rely heavily on their premium image.

- Brand Positioning Erosion Brands that cannot maintain their premium perception when consumers are actively seeking value are vulnerable.

- Market Share Decline A noticeable drop in sales volume and market share, especially when competitors offer lower-priced alternatives, signals a problem.

- Reduced Investment Justification When a brand's revenue and profit margins shrink significantly due to trading down, continued investment becomes difficult to rationalize.

Legacy Brands with Stagnant Innovation

Diageo's extensive brand lineup can include older brands that, while historically significant, have struggled to adapt to changing consumer tastes and new product introductions. These brands, if they possess a low market share and show no indication of recovery despite previous attempts at rejuvenation, fall into the category of Dogs. This classification means they consume valuable resources without making a substantial contribution to the company's overall growth or profitability.

For instance, a brand that saw its peak popularity decades ago and now struggles to attract younger demographics or compete with newer, trendier alternatives would likely be categorized as a Dog. Such brands might represent a small fraction of Diageo's total revenue, perhaps less than 1% in recent reporting periods, and could be candidates for divestment or significant restructuring if a turnaround isn't feasible.

- Stagnant Market Share: Brands with consistently low or declining market share, often failing to capture even 2% of their respective categories.

- Limited Growth Potential: Minimal to no projected revenue growth in the coming years, indicating a lack of consumer interest or competitive disadvantage.

- Resource Drain: Brands that require ongoing investment in marketing or inventory management but yield negligible returns, impacting overall profitability.

Diageo's "Dogs" represent brands with low market share and low growth potential, often requiring significant resources without delivering commensurate returns. These brands, like certain regional beer labels or older rum varieties, may be struggling against evolving consumer preferences or intense competition. For example, a brand that has seen its market share hover around 1-2% in its category for the past few years, with minimal projected growth, would fit this description.

These underperformers can drain capital that could be better invested in high-growth brands. Diageo's 2024 fiscal year reports might reveal specific segments where revenue growth has been flat or negative, signaling the presence of these "Dogs." The strategic decision often involves divestiture or substantial restructuring to free up resources.

Brands in the Dogs category are characterized by their inability to gain traction in the market. They might be legacy products that haven't kept pace with innovation or changing consumer tastes, leading to a persistent decline in sales. For instance, a premium spirits brand experiencing a year-over-year sales decline of 5% in a contracting market segment exemplifies the challenges faced by these brands.

The primary challenge for these brands is their lack of competitive advantage and limited appeal to current consumer demographics. They often represent a small percentage of overall revenue, perhaps under 1%, and their continued presence can negatively impact the company's overall profitability metrics.

| Brand Category Example | Market Share | Growth Rate | Strategic Implication |

| Regional Beer Brand | Low (e.g., < 2%) | Negative or Stagnant | Divestiture or Restructuring |

| Legacy Rum Brand | Low (e.g., < 3%) | Low or Negative | Brand Repositioning or Divestment |

| Niche Spirit Brand | Low (e.g., < 1%) | Declining | Potential Write-off or Sale |

Question Marks

Diageo's broader NoLo portfolio, excluding Guinness 0.0, is positioned as a collection of potential Stars. The non-alcoholic spirits sector is experiencing robust growth, with Diageo's overall non-alcoholic portfolio seeing organic net sales increase by approximately 40% in fiscal 2025, reflecting strong consumer demand for healthier options.

Brands like Seedlip and the recently acquired Ritual Beverage Company LLC are in a high-growth market, indicating significant potential. However, these brands currently possess relatively low market share and necessitate substantial investment to capture a dominant position, aligning with the characteristics of a Star in the BCG Matrix.

The spirits-based Ready-to-Drink (RTD) cocktail segment is a burgeoning area within the beverage industry, fueled by consumer demand for convenience and an expanding array of sophisticated flavor profiles. Diageo is actively investing in this category, implementing a more focused approach in key global markets to capitalize on its rapid expansion and secure a greater market presence.

While these RTDs demonstrate promising early traction, they are still in a developmental stage, requiring substantial investment in marketing and distribution to build brand awareness and market share. For instance, the global RTD market was valued at approximately $23.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030, with spirits-based options being a significant driver of this growth.

21Seeds Tequila, acquired by Diageo in 2022, is positioned as a potential star in the BCG matrix. The brand is benefiting from a booming tequila market, which saw global sales reach an estimated $13.9 billion in 2023, with continued strong growth projected. Diageo's 2025 US marketing campaign for 21Seeds underscores its commitment to capturing a larger slice of this expanding market.

Despite the favorable market dynamics, 21Seeds likely holds a relatively low market share within Diageo's vast spirits portfolio, characteristic of a question mark. Significant investment will be necessary to elevate its brand awareness and distribution against established tequila giants, aiming to transform it into a future cash cow.

Casamigos Premix Margarita Line

Diageo's Casamigos Premix Margarita line, launching in 2025, taps into the burgeoning premixed cocktail market, a segment that saw substantial growth in 2024. This strategic move leverages the strong brand equity of Casamigos tequila, aiming to capture a share of consumers seeking convenient, high-quality ready-to-drink options. The success of this venture will hinge on aggressive marketing and robust distribution to build brand awareness and secure shelf space in a competitive landscape.

The premix margarita represents a significant investment for Diageo, positioning it within a high-growth category that aligns with evolving consumer preferences for convenience. While specific 2024 market share data for premixed margaritas is still emerging, the broader ready-to-drink (RTD) segment, which includes these types of products, was valued at over $10 billion globally in 2023 and is projected to continue its upward trajectory. Diageo's expansion into this format with Casamigos is a calculated effort to capitalize on this trend.

- Brand Extension: Casamigos Premix Margarita is a new product within a well-established, premium tequila brand.

- Market Growth: It enters the rapidly expanding premixed cocktail and RTD beverage market.

- Strategic Importance: This line requires substantial marketing and distribution investment to gain traction and prove its long-term value.

- Competitive Landscape: Diageo faces established players and emerging brands in the premixed cocktail space.

Experimental/Niche Single Malt Scotch Whisky Releases

Diageo’s experimental and niche single malt Scotch whisky releases, such as the highly anticipated 2024 Special Releases, represent a strategic play in a high-margin segment. These limited editions are crafted to push flavor boundaries and appeal to a dedicated base of collectors and enthusiasts. For instance, the 2024 Special Releases featured unique cask finishes and rare bottlings, often selling out quickly and achieving significant premiums over standard offerings.

While these niche products contribute to brand prestige and innovation, their inherently limited production volumes result in a small overall market share for Diageo. The success of these releases hinges on continued investment in research and development for new flavor profiles and robust marketing campaigns to cultivate and maintain their exclusive allure. For example, the average price for a bottle from Diageo's Special Releases can range from $100 to over $1,000, reflecting their collector status.

- Market Position: Niche, high-value segment within the broader Scotch whisky market.

- Growth Driver: Innovation in flavor profiles and limited availability catering to connoisseurs.

- Sales Performance: Premium pricing and rapid sell-through of limited batches.

- Strategic Importance: Enhances brand image and drives innovation for future product development.

Brands like 21Seeds Tequila and the new Casamigos Premix Margarita line are categorized as Question Marks within Diageo's BCG Matrix. These products operate in high-growth segments, such as the booming tequila market and the expanding premixed cocktail category, which saw significant consumer interest in 2024.

However, they currently hold relatively low market shares within Diageo's extensive portfolio, necessitating substantial investment in marketing and distribution to build brand awareness and compete effectively. For instance, the global RTD segment, which includes premixed cocktails, was valued at over $10 billion in 2023 and is projected for continued strong growth.

The success of these ventures, like the 21Seeds Tequila marketing push in 2025 and the launch of Casamigos Premix Margarita, hinges on Diageo's ability to capture a larger slice of these expanding markets, transforming them into future cash cows.

Diageo's experimental and niche single malt Scotch whisky releases, such as the 2024 Special Releases, also fit the Question Mark profile. While these limited editions command premium prices, with some bottles exceeding $1,000, their inherently small production volumes result in a low overall market share.

These releases require ongoing investment in research and development to maintain their innovative appeal and robust marketing to sustain their exclusive image.

| Brand/Product Line | Market Segment | Growth Potential | Current Market Share | Investment Needs |

|---|---|---|---|---|

| 21Seeds Tequila | Tequila | High (Global sales ~ $13.9 billion in 2023) | Low (within Diageo's portfolio) | High (Marketing, Distribution) |

| Casamigos Premix Margarita | Premixed Cocktails/RTD | High (RTD segment > $10 billion in 2023) | Low (New product) | High (Marketing, Distribution) |

| Special Releases (e.g., 2024) | Niche Single Malt Scotch | Moderate (High-margin, collector-driven) | Very Low (Limited production) | Moderate (R&D, Marketing) |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market data, including Diageo's financial reports, global beverage industry analysis, and consumer trend research to accurately position each business unit.