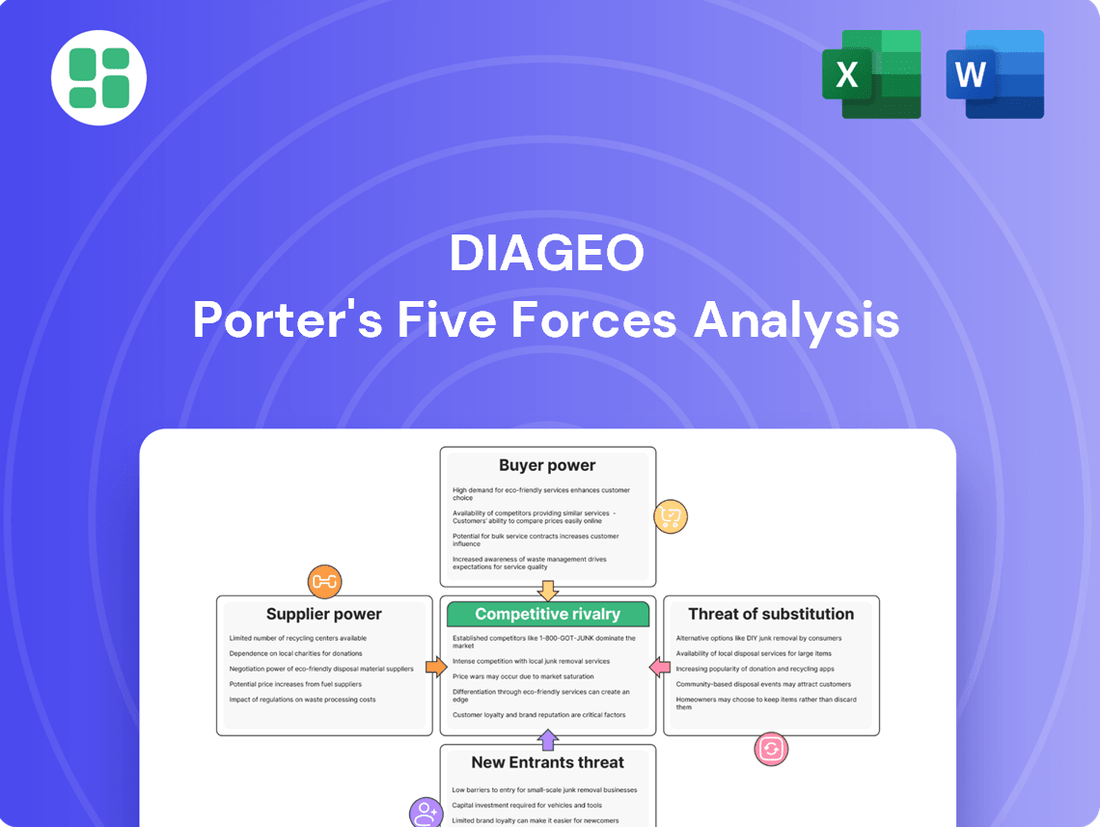

Diageo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diageo Bundle

Diageo's competitive landscape is shaped by intense rivalry, significant buyer power from distributors, and the constant threat of substitutes like craft breweries. Understanding these forces is crucial for navigating the dynamic spirits market.

The complete report reveals the real forces shaping Diageo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Diageo's bargaining power with its suppliers is typically low. This is largely because many of the raw materials it uses, like grains, water, and standard glass bottles, are commodities. This means there are many sources available, and no single supplier holds significant sway over Diageo.

Diageo's sheer size and global reach also play a crucial role. By sourcing from a wide variety of suppliers across different regions, the company significantly reduces its reliance on any one provider. This broad supplier base effectively limits the ability of individual suppliers to dictate terms or prices.

For specialized ingredients or unique botanicals crucial to certain premium spirits, supplier power can be elevated, particularly when these components are scarce or demand specific cultivation methods. For example, the sourcing of rare agave for premium tequila or unique botanicals for specific gin expressions can present a higher degree of supplier leverage.

Diageo actively counteracts this by establishing long-term supply agreements and fostering direct cultivation relationships. This strategy ensures a stable supply chain and provides greater control over input costs, a critical factor in maintaining profitability for brands like Johnnie Walker or Tanqueray.

Suppliers of advanced manufacturing equipment or specialized technology can wield moderate power, especially when their offerings are critical to Diageo's production processes and require significant capital investment. For instance, the specialized distillation or bottling machinery crucial for maintaining product quality and efficiency represents a substantial outlay for Diageo, potentially giving those suppliers leverage.

However, this power is often tempered by several factors. The existence of multiple manufacturers capable of providing similar advanced equipment, coupled with the fact that Diageo's large-scale machinery purchases are not a constant, ongoing expense, limits the suppliers' sustained influence over Diageo's operational costs and bargaining position.

Supplier Power 4

While specialized skills like master blenders or distillers are crucial for Diageo, the broader labor market for manufacturing and marketing remains competitive. This competition generally limits the ability of individual workers or even groups to exert significant upward pressure on wages, thereby mitigating a major threat to Diageo's profitability from this supplier segment.

In 2024, the global demand for skilled labor in the beverage industry, while present, did not translate into widespread wage inflation that would disproportionately impact large multinational corporations like Diageo. The company's diversified operations across numerous regions provide flexibility in sourcing talent, further reducing the bargaining power of any single labor group.

- Skilled Labor: Master blenders and distillers are unique suppliers whose expertise is vital.

- Competitive Labor Market: The overall labor market for manufacturing and marketing is generally competitive.

- Wage Pressure Mitigation: This competition limits significant upward pressure on wages impacting profitability.

- Diversified Sourcing: Diageo's global presence allows for flexible talent acquisition, reducing reliance on any single labor pool.

Supplier Power 5

Logistics and distribution service providers generally hold low to moderate bargaining power with Diageo. This is largely due to Diageo's strategy of employing a diverse mix of in-house logistics operations and numerous third-party providers. This multi-vendor approach, coupled with Diageo's substantial shipping volumes, naturally fosters competitive pricing and service standards among its logistics partners, thereby constraining the leverage any single supplier might wield.

For instance, in 2024, major global logistics firms often compete for contracts with large beverage companies like Diageo. The ability of a logistics provider to command higher prices or dictate terms is significantly reduced when faced with an alternative of similar capability ready to step in. Diageo's operational scale means it can often negotiate favorable rates, making it less susceptible to supplier-induced cost increases in its supply chain.

- Diversified Logistics Network: Diageo leverages both internal logistics capabilities and multiple external providers, reducing reliance on any single entity.

- Economies of Scale: Diageo's high shipping volumes allow it to negotiate more favorable terms and pricing with logistics suppliers.

- Competitive Bidding: The presence of numerous logistics providers ensures a competitive environment, limiting the bargaining power of individual suppliers.

Diageo's bargaining power with its suppliers is generally low due to its substantial size and the commoditized nature of many of its raw materials, such as grains and standard glass bottles. This allows Diageo to source from numerous providers, limiting any single supplier's ability to dictate terms.

While specialized ingredients or unique botanicals can give certain suppliers more leverage, Diageo mitigates this through long-term agreements and direct cultivation relationships, ensuring supply stability and cost control for its premium brands.

Suppliers of advanced manufacturing equipment hold moderate power, but this is often tempered by multiple manufacturers offering similar technology and the fact that such purchases are not constant, ongoing expenses for Diageo.

In 2024, global logistics providers, while essential, faced competitive pressure from Diageo's diversified network and high shipping volumes, enabling favorable contract negotiations and limiting individual supplier leverage.

| Supplier Type | Bargaining Power | Key Factors |

|---|---|---|

| Raw Materials (Commodities) | Low | Abundant sources, price sensitivity |

| Specialized Ingredients/Botanicals | Moderate to High | Scarcity, unique cultivation needs |

| Manufacturing Equipment | Moderate | Technological necessity, multiple providers |

| Logistics & Distribution | Low to Moderate | Diversified network, high volumes, competition |

What is included in the product

This analysis dissects the competitive forces shaping Diageo's operating environment, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a dynamic radar chart, allowing for proactive strategic adjustments.

Customers Bargaining Power

The bargaining power of customers in the spirits industry, particularly large retail chains and distributors, is a significant factor for companies like Diageo. These major buyers, such as global supermarket groups and large wholesale distributors, command substantial purchasing volumes. In 2023, major retailers like Walmart and Tesco continued to hold considerable sway over their suppliers, influencing pricing and promotional strategies.

Their ability to secure favorable terms on pricing, promotional allowances, and even prime shelf space directly impacts Diageo's profitability and market access. These powerful customers can effectively dictate terms due to their control over consumer access points.

While large retailers wield significant bargaining power, Diageo's formidable brand portfolio, featuring iconic names like Johnnie Walker and Smirnoff, acts as a crucial counterweight. Consumers' deep-seated loyalty to these premium brands makes them essential stock for retailers, limiting the latter's leverage to dictate terms or easily substitute Diageo's offerings.

In the on-trade sector, which includes bars, restaurants, and hotels, the power of customers can differ significantly. While a single small pub might have little leverage, large hospitality groups or national chains can wield considerable influence. These larger entities can negotiate better pricing and terms due to the sheer volume of their collective purchases, impacting Diageo's profitability.

For instance, a major hotel chain might represent a substantial portion of a regional sales volume for Diageo, giving them a stronger hand in price discussions. Diageo's strategy often involves cultivating robust relationships and investing in brand visibility and promotions within this segment to mitigate some of this customer power.

Customer Power 4

While end consumers collectively hold sway through their purchasing habits, their individual bargaining power over Diageo's pricing is quite limited. However, evolving consumer preferences, such as a move towards moderation, premiumization, or interest in specific segments like craft spirits, significantly impact demand and necessitate strategic adjustments in Diageo's product development and marketing efforts.

For instance, in 2024, the global spirits market continued to see growth in premium and super-premium segments, a trend that Diageo actively addresses with its extensive portfolio of high-end brands.

- Consumer Trends: Shifts towards health-consciousness and premiumization are key drivers influencing demand for Diageo's diverse product lines.

- Brand Loyalty: Strong brand recognition and consumer loyalty for brands like Johnnie Walker and Smirnoff can mitigate individual customer price sensitivity.

- Product Differentiation: Diageo's broad range of products, from accessible to luxury, allows it to cater to various consumer segments and price points, reducing direct price-based bargaining.

- Market Data Insights: Analysis of consumer purchasing data in 2024 indicated sustained interest in ready-to-drink (RTD) categories and premium whiskies, guiding Diageo's innovation and marketing spend.

Customer Power 5

The bargaining power of customers for Diageo is influenced by several factors, with switching costs for large distributors and retailers being a key consideration. While individual consumers may readily switch between spirit brands, the operational complexities for major retailers are more significant.

These complexities include the logistical challenges of altering shelf space, reconfiguring inventory systems, and the potential negative impact on consumer demand if a prominent brand like Diageo is de-emphasized. For instance, a major supermarket chain might hesitate to significantly reduce its Diageo product offerings due to the established consumer loyalty and sales volume associated with brands like Johnnie Walker or Smirnoff. This inertia, coupled with the investment required to promote alternative brands, provides Diageo with a degree of leverage.

In 2024, the global alcoholic beverage market continues to see strong demand, with premium spirits, a core segment for Diageo, showing particular resilience. Retailers, therefore, rely on established brands to drive foot traffic and sales. While consumer choice is abundant, the practicalities of managing a diverse beverage portfolio mean that wholesale delisting of major brands like those in Diageo's stable is not a simple decision.

- Moderate Switching Costs: Large distributors and retailers face moderate switching costs when dealing with Diageo, primarily due to logistical and inventory management complexities.

- Consumer Loyalty vs. Retailer Strategy: While consumers can easily switch brands, retailers must balance this with the potential loss of sales and consumer interest if they reduce their stock of popular Diageo products.

- Shelf Space Dynamics: Retailers' decisions are also influenced by the value of shelf space; removing a high-performing brand like Guinness or Captain Morgan requires a strategic rationale and often a significant investment in promoting alternatives.

- Market Share Influence: Diageo's substantial market share across various spirit categories means that its brands are often essential components of a retailer's beverage offering, limiting the customer's absolute power to dictate terms.

The bargaining power of customers for Diageo is moderate, primarily influenced by large retail chains and distributors who can leverage their purchasing volume for better terms. While individual consumers have limited power, major hospitality groups also exert influence through their collective buying power. Diageo's strong brand portfolio, however, serves as a significant countermeasure, as consumer loyalty to brands like Johnnie Walker and Smirnoff makes them essential stock for retailers.

In 2023, the concentration of retail power remained high, with major players like Walmart and Amazon continuing to dictate terms. For instance, large supermarket chains often demand promotional support and favorable pricing, impacting Diageo's margins. The on-trade sector, particularly large hotel groups, also represents a significant customer base with considerable bargaining power due to their volume purchases.

Despite this, Diageo's premium brand equity and diverse product offerings across various price points help to mitigate some of the direct price-based bargaining. Consumer trends in 2024, such as the continued growth in premium spirits and ready-to-drink (RTD) categories, further underscore the importance of brand strength in maintaining customer relationships and limiting undue leverage.

| Customer Segment | Bargaining Power Level | Key Factors |

| Large Retail Chains (e.g., Walmart, Tesco) | High | High purchasing volume, control over shelf space, ability to de-emphasize brands. |

| Major Hospitality Groups (e.g., hotel chains) | Moderate to High | Significant volume purchases, potential for exclusive deals. |

| Wholesale Distributors | Moderate | Logistical complexities in switching suppliers, inventory management. |

| End Consumers | Low (individually) | Brand loyalty, limited price sensitivity for premium products, collective influence through purchasing habits. |

Preview Before You Purchase

Diageo Porter's Five Forces Analysis

This preview shows the exact Diageo Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape impacting Diageo, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the alcoholic beverage industry. This detailed analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Competitive rivalry within the global alcoholic beverage industry, where Diageo operates, is exceptionally intense. Major multinational corporations such as Pernod Ricard, Bacardi, Beam Suntory, and Brown-Forman are significant players, constantly vying for market share. This fierce competition manifests through robust marketing campaigns, continuous product development, and strategic pricing across diverse geographical regions and product segments.

The spirits industry, including players like Diageo, faces intense competition driven by significant fixed costs. These costs stem from maintaining production facilities, managing aging inventories, and building out expansive global distribution networks. For instance, the capital expenditure for a new distillery can run into hundreds of millions of dollars, creating a high barrier to entry and a strong incentive for existing players to maximize capacity utilization.

This high fixed-cost structure compels companies to aggressively pursue market share. Operating at near-full capacity is crucial to spreading these substantial overheads, leading to price competition and promotional activities to capture consumer demand. In 2023, for example, the global spirits market saw continued promotional efforts across various categories as brands vied for consumer attention amidst economic uncertainties.

The spirits industry, where Diageo operates, is characterized by intense rivalry, primarily fought through brand building, premiumization, and continuous innovation. Companies pour significant resources into advertising campaigns, high-profile sponsorships, and the development of new products like flavored spirits and ready-to-drink cocktails. This aggressive pursuit of consumer attention and brand loyalty escalates the competitive pressure.

In 2024, the global spirits market continued to see substantial marketing investments. For instance, major players are increasingly focusing on digital marketing and influencer collaborations to reach younger demographics. Diageo itself has been active in this space, launching new brands and flavor extensions, such as its Don Julio Rosado tequila, to capture emerging consumer preferences and maintain its market share against competitors like Pernod Ricard and Beam Suntory.

Competitive Rivalry 4

The spirits industry, particularly in developed markets, is characterized by intense competition. As the market matures, growth opportunities are often found in taking share from rivals, leading to aggressive tactics. This zero-sum environment encourages price wars, heavy promotional spending, and mergers and acquisitions aimed at solidifying market dominance.

For instance, in 2024, the global spirits market continued to see significant investment in brand building and market share acquisition. Diageo, alongside competitors like Pernod Ricard and Beam Suntory, actively engaged in promotional campaigns and new product launches to capture consumer attention. The ongoing consolidation trend is evident, with major players frequently exploring strategic acquisitions to expand their portfolios and geographic reach, further intensifying the rivalry.

- Intensified Competition: Mature developed markets drive a focus on market share gains, leading to aggressive strategies.

- Aggressive Tactics: Pricing, promotions, and strategic acquisitions are common tools used by industry leaders.

- Market Consolidation: Ongoing M&A activity reflects the drive to strengthen competitive positions.

- Brand Building: Significant investment in marketing and brand development is crucial for differentiation.

Competitive Rivalry 5

The competitive rivalry within the alcoholic beverage industry, particularly for a global player like Diageo, is intense and multifaceted. The very nature of the business, operating across numerous countries, means companies must navigate a complex web of differing regulations, consumer preferences, and cultural nuances. This necessitates highly localized strategies to effectively compete.

Diageo faces a dual challenge: competing against other multinational giants with significant resources and established brand recognition, as well as confronting formidable local players who often possess deep market penetration and understanding. This dynamic creates a highly competitive landscape where market share can be hard-won and fiercely defended.

- Global Brands vs. Local Champions: Diageo competes with global powerhouses like Pernod Ricard and Beam Suntory, but also with strong regional brands that dominate specific markets. For instance, in India, United Spirits (a Diageo subsidiary) faces competition from domestic players like United Breweries.

- Market Saturation and Innovation: Many mature markets are saturated, driving intense competition on price, promotion, and product innovation. Diageo's investment in new product development and premiumization is a key strategy to stand out.

- Distribution Network Strength: The ability to secure and maintain strong distribution networks is critical. Competitors vie for shelf space and on-premise placements, impacting sales volumes.

- Acquisition and Consolidation: The industry has seen significant consolidation. Diageo itself has made strategic acquisitions, like the 2014 acquisition of United Spirits for approximately $1.9 billion, to bolster its market position and brand portfolio, a trend that continues to shape the competitive landscape.

Competitive rivalry in the alcoholic beverage sector is fierce, driven by a few dominant global players and numerous regional contenders. Diageo, a major force, constantly engages in aggressive marketing, product innovation, and strategic pricing to maintain its market position. For instance, in 2024, the company continued to invest heavily in brand building and new product launches, such as expanding its portfolio of premium spirits and ready-to-drink options, to counter competitors like Pernod Ricard and Beam Suntory.

The high fixed costs associated with production, aging, and distribution in the spirits industry compel companies to maximize sales volume, intensifying rivalry. This often translates into promotional activities and price competition, especially in mature markets where growth is primarily achieved by taking share from rivals. In 2023, the global spirits market saw continued promotional efforts as brands vied for consumer attention amidst economic fluctuations.

The battle for market share is further fueled by the need for strong distribution networks and brand loyalty. Companies like Diageo invest significantly in advertising and sponsorships to differentiate their offerings. The ongoing trend of industry consolidation, marked by strategic acquisitions, also highlights the intense competition, as players seek to bolster their portfolios and geographic reach.

| Competitor | Approximate 2023 Revenue (USD Billions) | Key Market Focus |

|---|---|---|

| Pernod Ricard | 11.4 | Global (Scotch, Cognac, Vodka) |

| Beam Suntory | 5.0 | Global (Bourbon, Japanese Whisky, Tequila) |

| Brown-Forman | 4.0 | Global (Bourbon, Jack Daniel's) |

| Diageo | 21.0 | Global (Scotch, Spirits, Beer) |

SSubstitutes Threaten

The threat of substitutes for Diageo's alcoholic beverages is substantial, particularly from the rapidly expanding non-alcoholic beverage market. Consumers are increasingly prioritizing health and wellness, leading to a greater interest in moderation and mindful consumption. This shift directly fuels demand for alternatives like non-alcoholic beers, spirits, and ready-to-drink cocktails, which are now competing for traditional drinking occasions.

The threat of substitutes for Diageo is significant because consumers readily switch between different alcoholic beverage categories. For example, a person might opt for wine or a craft beer instead of spirits for a social gathering, or vice versa. This means Diageo faces competition not just from other whiskey or vodka brands, but from the entire alcoholic beverage market.

In 2024, the global alcoholic beverage market is vast, with spirits representing a substantial portion. However, trends show increasing popularity in categories like premium wine and ready-to-drink (RTD) beverages, which directly compete for consumer spending. For instance, the RTD market alone saw considerable growth in 2023 and is projected to continue expanding, directly impacting spirit sales.

The growing acceptance and legalization of cannabis and CBD-infused products in many regions pose an emerging threat of substitutes for Diageo. These alternatives can offer consumers different ways to relax or experience altered states, potentially drawing spending away from spirits, beer, and wine. For instance, the global legal cannabis market was valued at approximately $13.2 billion in 2022 and is projected to grow significantly, indicating a substantial potential diversion of consumer expenditure.

4

The threat of substitutes for Diageo's products is significant, driven by evolving consumer preferences and lifestyle shifts. Changing social habits, like a move towards reduced alcohol consumption or a greater emphasis on experiences over tangible goods, can mean consumers seek alternatives to traditional alcoholic beverages. For instance, a growing interest in wellness and health might lead individuals to choose non-alcoholic social activities or beverages, directly impacting demand for spirits, beer, and wine. In 2023, the global non-alcoholic beverage market was valued at over $1 trillion, indicating a substantial and growing alternative for consumer spending that could otherwise go towards alcoholic drinks.

Furthermore, the rise of craft non-alcoholic options and the increasing availability of diverse mocktail recipes present compelling substitutes. These alternatives cater to consumers who still desire the social ritual of drinking but wish to avoid alcohol for health, religious, or personal reasons. This trend is evident in the rapid growth of the low- and no-alcohol (LNA) segment, with some markets seeing double-digit growth rates in this category. For example, the UK's LNA market was projected to reach £1.1 billion by 2025, showcasing a clear shift in consumer behavior that substitutes traditional alcoholic offerings.

- Evolving Consumer Lifestyles: Trends like increased focus on health and wellness can lead to reduced social drinking.

- Rise of Non-Alcoholic Alternatives: The growing market for non-alcoholic beverages and mocktails offers direct substitutes.

- Experience-Driven Consumption: A preference for activities over product consumption can divert spending away from alcoholic drinks.

- Market Data: The global non-alcoholic beverage market exceeding $1 trillion in 2023 highlights the scale of potential substitutes.

5

The threat of substitutes for Diageo's spirits and ready-to-drink beverages is moderate but growing. While alcoholic beverages offer a unique experience, other refreshment options can fulfill similar consumer needs, especially for less celebratory occasions. For instance, the availability and increasing sophistication of soft drinks, premium juices, and specialty coffees present viable alternatives, particularly for daytime consumption or when consumers are seeking non-alcoholic options. These beverages compete for consumers' disposable income, offering diverse flavors and experiences that can sway purchasing decisions away from Diageo's core products.

These substitutes are not just about quenching thirst; they offer distinct flavor profiles and social experiences. Consider the booming market for artisanal coffees and craft sodas, which have gained significant traction. In 2024, the global non-alcoholic beverage market was projected to reach hundreds of billions of dollars, indicating a substantial portion of consumer spending that could otherwise go towards alcoholic drinks. This highlights the competitive landscape where even non-alcoholic options are becoming premium and experiential.

- Growing Non-Alcoholic Beverage Market: The global non-alcoholic beverage market continues its expansion, offering diverse and premium alternatives to alcoholic drinks.

- Consumer Preferences Shift: Consumers increasingly seek varied refreshment experiences, including sophisticated soft drinks, juices, and specialty coffees, especially for daytime and casual consumption.

- Disposable Income Competition: These substitutes directly compete for consumer disposable income that might otherwise be allocated to spirits and ready-to-drink alcoholic beverages.

- Experiential Alternatives: Beyond basic refreshment, these non-alcoholic options provide distinct flavors and social experiences, acting as credible substitutes for certain occasions.

The threat of substitutes for Diageo is amplified by the expanding non-alcoholic beverage market, driven by health-conscious consumers. These alternatives, including premium sodas and mocktails, compete for consumer spending and social occasions, particularly in 2024. For instance, the global non-alcoholic beverage market is projected to continue its substantial growth, offering a significant alternative to traditional alcoholic drinks.

The rise of cannabis and CBD-infused products presents an emerging substitute threat, offering alternative relaxation methods. As these markets grow, they could divert consumer expenditure from spirits, beer, and wine. The legal cannabis market, valued at billions, demonstrates this potential diversion of consumer spending.

Consumer preferences are shifting towards moderation and experiential consumption, making substitutes like craft coffees and sophisticated soft drinks more appealing. These non-alcoholic options provide distinct flavors and social experiences, directly competing for disposable income that might otherwise be spent on Diageo's products.

| Substitute Category | 2024 Market Projection/Data | Impact on Diageo |

| Non-Alcoholic Beverages | Global market exceeding hundreds of billions USD | Direct competition for consumer spending and occasions |

| Craft Sodas & Specialty Coffees | Significant growth in premium non-alcoholic segments | Offer alternative flavor profiles and social experiences |

| Cannabis & CBD Products | Global legal cannabis market valued at billions USD (2022) | Emerging threat for relaxation and altered states |

| Low and No-Alcohol (LNA) Segment | UK market projected to reach £1.1 billion by 2025 | Caters to consumers seeking alcohol-free social rituals |

Entrants Threaten

The threat of new entrants in the global alcoholic beverage market, particularly for established players like Diageo, remains relatively low. This is largely due to the immense capital investment required to set up operations, from sourcing raw materials and building production facilities to establishing a robust global distribution network. For instance, constructing a modern brewery or distillery can easily run into tens or hundreds of millions of dollars, a substantial hurdle for any aspiring competitor.

The threat of new entrants for a global spirits giant like Diageo is generally considered low due to significant barriers. Strict regulatory hurdles, including licensing requirements, production standards, and complex taxation laws across numerous countries, pose formidable barriers to entry. For instance, obtaining an alcohol production and distribution license in the United States can be a lengthy and costly process, often involving state-specific regulations that differ significantly.

The threat of new entrants in the spirits industry, particularly for a giant like Diageo, is generally low due to significant barriers. Building a brand that resonates with consumers and achieves widespread recognition, especially against heritage brands, demands massive marketing investments and a sustained, long-term effort. For instance, in 2023, Diageo reported marketing and promotion expenses of over £2.5 billion, a figure that new, smaller players would find exceptionally difficult to match.

Newcomers face considerable challenges in overcoming the established brand equity and deep-rooted consumer loyalty that incumbents like Diageo have cultivated over decades. Without substantial capital to invest in brand building, distribution networks, and competitive pricing, new entrants will struggle to gain meaningful market share. This high cost of entry, coupled with the need for extensive regulatory navigation, further deters potential new competition.

4

The threat of new entrants for Diageo is moderately low, primarily due to the significant barriers in accessing established distribution networks. Securing shelf space in major retailers (off-trade) and partnerships with bars and restaurants (on-trade) requires substantial investment and time, as incumbents like Diageo have built decades-long relationships. For instance, in 2024, major global beverage distributors reported that securing new brand placements in key markets could cost upwards of $1 million in marketing and slotting fees, a prohibitive cost for most startups.

Economies of scale enjoyed by established players like Diageo further deter new entrants. Their vast production volumes and global supply chains allow for cost efficiencies that are difficult for smaller, newer companies to match. This makes it challenging for new brands to compete on price and availability, even with innovative products. In 2023, the average cost of goods sold as a percentage of revenue for large spirits producers was around 40%, compared to an estimated 55-60% for emerging craft distilleries, highlighting the scale advantage.

- Distribution Dominance: Diageo's extensive network of off-trade and on-trade relationships is a major hurdle for new entrants.

- Economies of Scale: Lower production costs and efficient supply chains give Diageo a competitive edge in pricing and availability.

- Brand Loyalty: Strong consumer recognition and loyalty to Diageo's established brands make it difficult for new products to gain traction.

- Regulatory Hurdles: Navigating complex alcohol regulations and licensing requirements across different geographies adds another layer of difficulty for new market entrants.

5

The threat of new entrants for a company like Diageo is generally moderate, but with nuances. While the craft spirits and beer movement has seen many small players emerge, scaling up to truly compete with a global giant like Diageo presents substantial hurdles. These include securing consistent, high-quality raw materials, achieving economies of scale in production, and establishing the widespread distribution networks necessary for national or international reach. For instance, building a distillery capable of producing millions of cases annually involves immense capital investment and regulatory navigation.

- Capital Requirements: Establishing large-scale production facilities and global distribution channels demands billions of dollars, a significant barrier for most new entrants.

- Brand Loyalty and Scale: Diageo benefits from established brands with deep consumer loyalty, built over decades, making it difficult for newcomers to gain market share quickly.

- Distribution Networks: Access to extensive distribution networks, crucial for reaching consumers worldwide, is a major advantage for incumbents like Diageo, which has invested heavily in these relationships.

- Regulatory Hurdles: Navigating complex alcohol production, distribution, and marketing regulations across multiple jurisdictions is a formidable challenge for new companies.

The threat of new entrants into the global alcoholic beverage market, particularly for a major player like Diageo, is generally low. This is primarily due to the substantial capital required for production, distribution, and marketing, along with significant regulatory barriers. For instance, building a distillery capable of producing millions of cases annually involves immense capital investment and complex regulatory navigation, making it difficult for smaller entities to compete effectively.

| Barrier Type | Description | Example Impact on New Entrants |

|---|---|---|

| Capital Investment | Establishing large-scale production facilities and global distribution channels requires billions of dollars. | A new entrant might need over $1 billion to establish a comparable operational footprint to Diageo. |

| Brand Equity & Loyalty | Diageo benefits from established brands with deep consumer loyalty built over decades. | New brands struggle to gain market share without massive marketing spend to overcome existing brand recognition. |

| Distribution Networks | Access to extensive off-trade and on-trade distribution channels is crucial for market reach. | Securing shelf space and partnerships with retailers and hospitality venues can cost millions in fees and marketing support. |

| Regulatory Hurdles | Navigating complex alcohol production, distribution, and marketing regulations across multiple jurisdictions is a major challenge. | Obtaining licenses and complying with varying tax laws in different countries can be time-consuming and expensive. |

Porter's Five Forces Analysis Data Sources

Our Diageo Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from Diageo's annual reports and investor presentations, alongside industry-specific market research from firms like Euromonitor and Statista. This approach ensures a comprehensive understanding of competitive dynamics.