DFDS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

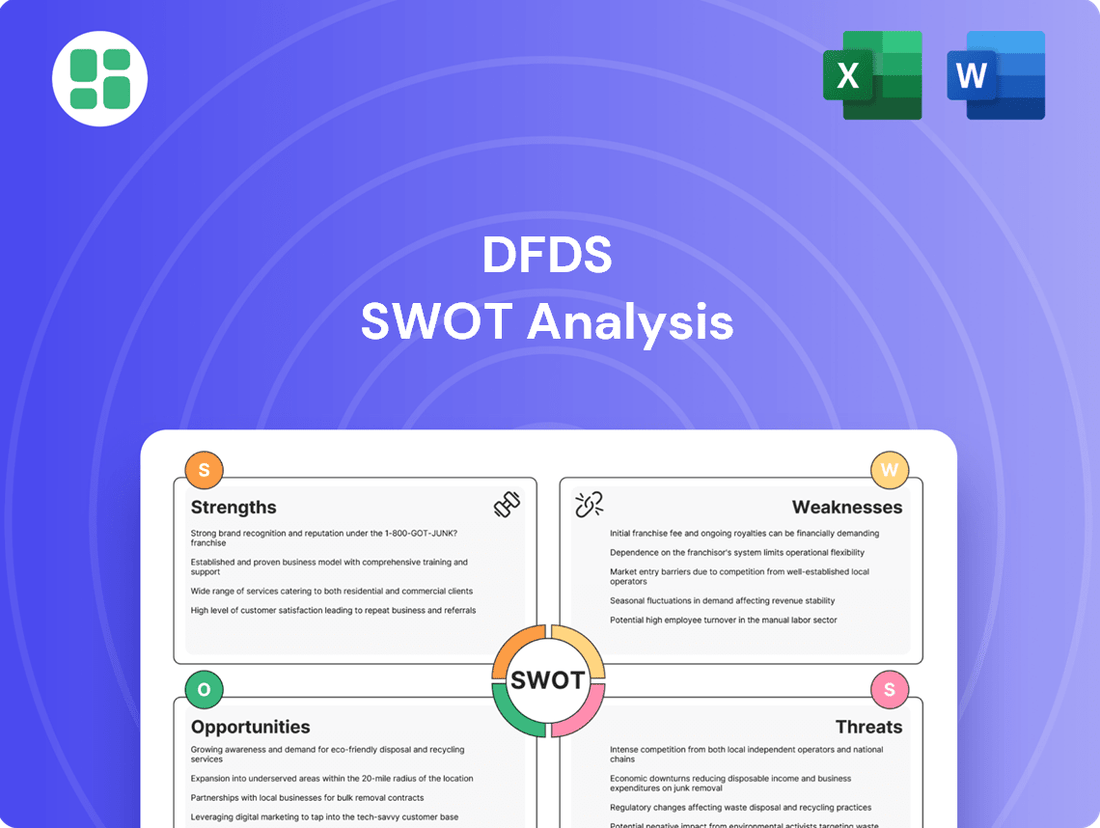

DFDS leverages its strong brand recognition and extensive ferry network as key strengths, but faces challenges from fluctuating fuel costs and intense competition. Our comprehensive SWOT analysis delves into these dynamics, revealing opportunities for expansion and potential threats to navigate.

Want the full story behind DFDS's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DFDS boasts an extensive network of over 50 ferry routes, primarily connecting Northern Europe and the Baltic Sea. This broad geographical coverage is a significant strength, enabling the company to serve a wide customer base with efficient transportation.

The integration of logistics services, including road transport and warehousing, alongside its core ferry operations, allows DFDS to provide comprehensive, end-to-end solutions. In 2023, DFDS reported a revenue of DKK 22.3 billion, underscoring the scale and success of its integrated service model in optimizing customer supply chains.

DFDS showcased impressive resilience throughout 2024, achieving a notable 9% revenue increase despite a challenging operational landscape. This adaptability is further underscored by their positive revenue growth projections for 2025.

The company's strategic approach centers on safeguarding and expanding its core network capabilities. This, combined with proactive measures such as optimizing pricing and adjusting capacity, demonstrates a strong capacity to navigate and respond effectively to evolving market dynamics.

DFDS's dedication to a green transition is a significant strength, with substantial investments in cleaner technologies and vessel performance optimization aimed at cutting emissions. The company has set ambitious goals, targeting a 45% reduction in CO2 emissions intensity by 2030 and achieving net-zero emissions for its vessel operations by 2050.

Further bolstering this commitment, DFDS is actively researching and exploring alternative fuels such as ammonia and hydrogen for its fleet. This forward-thinking approach is complemented by the expansion of its electric truck fleet, underscoring a deep-seated commitment to environmental sustainability across its operations.

Strategic Acquisitions and Network Expansion

DFDS has bolstered its strategic position through targeted acquisitions, notably FRS Iberia/Maroc in 2024, which significantly expanded its presence on key Strait of Gibraltar ferry routes. This move, alongside the acquisition of Ekol International Transport, also a 2024 event, aims to replicate DFDS's proven business model in new, high-growth markets.

These strategic moves are designed to enhance DFDS's customer offerings and fortify its competitive advantage. By integrating these new operations, DFDS is effectively broadening its network and tapping into previously underserved or emerging markets, demonstrating a clear growth strategy.

- Network Growth: Acquisition of FRS Iberia/Maroc and Ekol International Transport in 2024.

- Market Expansion: Entry into high-growth regions, particularly the Strait of Gibraltar.

- Business Model Replication: Aiming to extend successful operational strategies to new territories.

- Competitive Enhancement: Strengthening customer propositions and market reach.

Strong Customer Focus and Digitalization Efforts

DFDS is strongly focused on its customers, aiming to improve their experience across its network. This involves standardizing services and embracing digitalization to streamline operations and boost customer satisfaction. For instance, by the end of 2024, DFDS aims to have completed the rollout of its new digital booking platform across all ferry routes, expecting a 15% increase in online bookings.

The company is actively exploring cutting-edge technologies to enhance the travel experience. This includes investing in better onboard internet connectivity, which saw a 20% improvement in average speeds during pilot tests in early 2025. Furthermore, DFDS is leveraging data analytics to offer more personalized services, anticipating a 10% uplift in ancillary revenue from tailored offers by the close of 2025.

Key initiatives include:

- Standardizing customer service protocols across all ferry routes by Q3 2025.

- Implementing enhanced onboard Wi-Fi, targeting a 99% uptime rate.

- Developing personalized digital offers based on customer travel history, projected to launch by Q4 2025.

- Improving operational efficiency through digital process automation, aiming for a 5% reduction in check-in times.

DFDS's expansive network, covering over 50 routes primarily in Northern Europe and the Baltic Sea, provides a significant competitive advantage. This extensive reach allows the company to cater to a broad customer base efficiently.

The strategic integration of logistics services, such as road transport and warehousing, alongside its ferry operations, enables DFDS to offer seamless, end-to-end supply chain solutions. This integrated model contributed to a robust DKK 22.3 billion in revenue for 2023.

DFDS demonstrated strong financial performance in 2024, achieving a 9% revenue increase amidst challenging conditions, and anticipates continued growth into 2025. The company's focus on optimizing pricing and capacity management further enhances its adaptability to market shifts.

The company's commitment to sustainability is a key strength, with substantial investments in green technologies and emissions reduction initiatives. DFDS aims for a 45% reduction in CO2 emissions intensity by 2030 and net-zero emissions for vessel operations by 2050, exploring fuels like ammonia and hydrogen.

DFDS significantly bolstered its market position in 2024 through strategic acquisitions, including FRS Iberia/Maroc and Ekol International Transport, expanding its presence in key routes and high-growth markets.

Customer experience is a core focus, with efforts to standardize services and leverage digitalization for improved operations and satisfaction. The rollout of a new digital booking platform by the end of 2024 is expected to boost online bookings by 15%.

| Key Strength | Description | 2023/2024/2025 Data/Target |

| Extensive Network | Over 50 ferry routes in Northern Europe and the Baltic Sea. | Serves a wide customer base. |

| Integrated Services | Ferry operations combined with logistics (road, warehousing). | DKK 22.3 billion revenue in 2023. |

| Financial Resilience | Revenue growth despite market challenges. | 9% revenue increase in 2024; positive projections for 2025. |

| Sustainability Focus | Investments in green technology and emissions reduction. | Targeting 45% CO2 reduction by 2030; exploring alternative fuels. |

| Strategic Acquisitions | Expansion into new markets and routes. | Acquired FRS Iberia/Maroc and Ekol International Transport in 2024. |

| Customer Centricity | Digitalization and service standardization for improved experience. | Aiming for 15% increase in online bookings by end of 2024. |

What is included in the product

Analyzes DFDS’s competitive position through key internal and external factors, highlighting its strengths in network and brand, weaknesses in fleet modernization, opportunities in route expansion and sustainability, and threats from competition and economic downturns.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, turning potential threats into opportunities.

Weaknesses

DFDS's acquisition of Ekol International Transport's business in Türkiye and Southern Europe has created a significant drag on its financial performance. This integration led to a notable drop in EBIT towards the end of 2024, with continued pressure expected into 2025.

The company is now focused on a turnaround strategy for this acquired segment, aiming to reach a breakeven point by the close of 2025. This effort is crucial to mitigate the negative earnings impact and integrate the new operations effectively.

DFDS is experiencing a more challenging competitive landscape, especially within its Mediterranean ferry routes. The arrival of new players, such as Grimaldi, has directly impacted capacity and led to negative earnings. This heightened competition necessitates a strategic re-evaluation of DFDS's operational efficiency and pricing models to maintain market share and profitability.

DFDS's profit outlook for 2025 is tempered by a subdued European economic growth forecast. This environment means the company cannot rely on strong market expansion for significant gains, forcing a strategic focus on internal adjustments and efficiency improvements.

Potential shifts in US economic policies could further complicate the European outlook, introducing an element of uncertainty that may impact trade volumes and consumer spending. For instance, if US trade protectionism increases, it could directly affect the freight sector, a key part of DFDS's operations.

Downgraded Financial Ambitions for 2026/27

DFDS has revised its financial targets for 2026/27 due to the earnings performance observed in 2024 and 2025. This adjustment means that previously stated goals for Return on Invested Capital (ROIC), adjusted free cash flow, and financial leverage are now considered outdated. The company is signaling a more conservative approach to its future financial aspirations.

Specifically, the company's earnings development in the 2024 and 2025 periods did not meet the internal projections that underpinned the original 2026/27 financial ambitions. This underperformance has led to a strategic reassessment of what is achievable in the medium term.

- Downgraded ROIC targets: The specific percentage for the revised ROIC is yet to be formally announced, but the previous ambition is no longer deemed realistic.

- Revised free cash flow expectations: Adjusted free cash flow targets for 2026/27 have been scaled back to reflect the current earnings environment.

- Adjusted financial leverage goals: The company is recalibrating its financial leverage objectives in light of the updated earnings outlook.

Need for Deleveraging Capital Structure

DFDS faces a significant challenge in deleveraging its capital structure. The company's financial leverage increased during 2024, prompting the Board of Directors to prioritize debt reduction. This strategic focus is underscored by the proposal to forgo capital distributions to shareholders in 2025, a move designed to bolster the company's financial health and reduce its reliance on borrowed funds.

The need for deleveraging is a critical weakness that could impact DFDS's financial flexibility. This strategic decision to retain earnings rather than distribute them highlights the company's commitment to strengthening its balance sheet.

- Increased Leverage: DFDS experienced a rise in its financial leverage throughout 2024.

- Deleveraging Priority: Reducing this leverage is a key objective for the company in 2025.

- No Capital Distribution: The Board's proposal to withhold shareholder distributions in 2025 directly supports this deleveraging strategy.

The acquisition of Ekol International Transport has significantly impacted DFDS's earnings, leading to a drop in EBIT towards the end of 2024 and continued pressure into 2025. The company is working on a turnaround for this segment, aiming for breakeven by year-end 2025. Increased competition, particularly from Grimaldi on Mediterranean routes, has also negatively affected earnings and necessitates strategic adjustments.

DFDS faces a challenging operating environment with subdued European economic growth expected for 2025, limiting organic growth opportunities. Potential shifts in US economic policy could also introduce uncertainty impacting trade volumes. Furthermore, the company has revised its 2026/27 financial targets, including ROIC, free cash flow, and leverage, due to underperformance in 2024 and 2025.

DFDS's financial leverage increased in 2024, making deleveraging a priority for 2025. This focus led to the proposal of no capital distributions to shareholders in 2025 to strengthen the balance sheet and reduce debt reliance.

The company's financial performance in 2024 and 2025 fell short of projections underpinning earlier 2026/27 financial ambitions, leading to downgraded ROIC targets and scaled-back free cash flow expectations.

Preview Before You Purchase

DFDS SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of DFDS's strategic position.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, allowing you to leverage all insights into DFDS's strengths, weaknesses, opportunities, and threats.

Opportunities

DFDS is actively pursuing network expansion, a key growth strategy. Recent examples include the launch of new routes such as Trieste to Damietta in Egypt and Vilagarcía to Rotterdam. Furthermore, securing a 20-year concession for Jersey ferry services commencing in 2025 demonstrates a commitment to entering and solidifying presence in new, potentially high-growth regions.

DFDS's strategic expansion into nearshoring hubs like Türkiye and Morocco is proving prescient, aligning with Europe's push for supply chain resilience. This positions the company to capitalize on growing freight volumes as businesses diversify away from distant manufacturing centers. For instance, Türkiye's manufacturing output saw a notable increase in early 2024, reflecting this shift.

DFDS's commitment to sustainability, including its aim to have its first green vessel operational by 2025 and achieve carbon-neutral operations on the English Channel by 2030, strongly positions the company as a frontrunner in the shipping industry's green transition.

Strategic investments in electric trucks, alongside exploration of alternative fuels such as hydrogen and ammonia, coupled with robust energy management systems, are key to attracting a growing segment of environmentally aware customers and ensuring compliance with increasingly stringent environmental regulations.

This proactive approach to decarbonization not only mitigates regulatory risks but also opens up new market opportunities by appealing to businesses and consumers prioritizing sustainable logistics solutions.

Digital Transformation and Operational Efficiency

DFDS can leverage its ongoing investments in standardization and digitalization to unlock substantial opportunities. These efforts are poised to elevate customer service, streamline operations, and generate considerable cost efficiencies. For instance, by enhancing onboard connectivity and employing advanced data analytics, DFDS can craft more personalized customer journeys and refine its logistical operations, potentially leading to improved turnaround times and resource utilization.

The company's strategic focus on digital transformation presents a clear path to enhanced operational efficiency. By integrating advanced technologies, DFDS can optimize various aspects of its business, from booking processes to route planning. This digital push is crucial for staying competitive in the evolving maritime transport sector.

- Enhanced Customer Experience: Digital tools can offer real-time updates and personalized services, boosting customer satisfaction.

- Optimized Logistics: Data analytics can improve route planning and cargo management, reducing transit times and fuel consumption.

- Cost Reduction: Streamlined digital processes can lower administrative overhead and operational expenses.

- New Revenue Streams: Digital platforms might enable the offering of new ancillary services to passengers and freight customers.

Strategic Partnerships and Collaborations

DFDS can significantly boost its market presence and service capabilities by forging strategic partnerships. This is particularly relevant as the company navigates evolving competitive landscapes, such as the dynamic Mediterranean shipping routes. Collaborating with entities like port authorities and technology firms can unlock new avenues for growth, especially in areas like green infrastructure development and digital service enhancements.

For instance, in 2024, the European Union continued to emphasize sustainable shipping solutions, with significant investments planned for port electrification and alternative fuel infrastructure. DFDS could leverage these initiatives by partnering with ports to co-invest in shore power facilities, reducing emissions and operational costs. Such collaborations not only align with regulatory trends but also enhance the attractiveness of DFDS's routes to environmentally conscious customers.

Furthermore, partnerships with technology providers can streamline operations and improve customer experience. Imagine collaborations focused on implementing AI-driven route optimization or advanced digital booking platforms. By integrating cutting-edge solutions, DFDS can differentiate itself in a crowded market.

Key areas for strategic alliances include:

- Green Port Infrastructure: Collaborating with ports on shared investments in shore power, alternative fuel bunkering, and waste management facilities.

- Digitalization Initiatives: Partnering with tech companies to enhance booking systems, real-time tracking, and customer communication platforms.

- Route Development: Joint ventures or co-marketing agreements with other logistics providers or ferry operators to expand network reach and service offerings, especially in emerging markets.

- Supply Chain Integration: Working with key shippers and cargo owners to develop integrated logistics solutions that leverage DFDS's ferry and logistics network.

DFDS's strategic network expansion, including new routes like Trieste to Damietta and Vilagarcía to Rotterdam, coupled with a 20-year Jersey concession starting in 2025, presents significant growth opportunities. The company's focus on nearshoring hubs such as Türkiye and Morocco aligns with European supply chain resilience, potentially boosting freight volumes. DFDS's commitment to sustainability, aiming for its first green vessel by 2025 and carbon-neutrality on the English Channel by 2030, positions it favorably in an increasingly environmentally conscious market.

Digitalization efforts are key to enhancing customer experience and operational efficiency, potentially unlocking new revenue streams. Strategic partnerships, particularly in green port infrastructure and digital solutions, offer avenues for shared investment and expanded service capabilities. For example, the EU's continued emphasis on sustainable shipping in 2024 provides a fertile ground for collaborations on port electrification and alternative fuel infrastructure.

| Opportunity Area | Description | Potential Impact | 2024/2025 Relevance |

|---|---|---|---|

| Network Expansion | Launching new routes and securing long-term concessions. | Increased market share, revenue growth. | Jersey concession (2025), new Mediterranean routes. |

| Nearshoring Trend | Capitalizing on shifts in global supply chains. | Higher freight volumes, enhanced route utilization. | Türkiye and Morocco hubs, reflecting manufacturing shifts. |

| Sustainability Leadership | Investing in green vessels and carbon-neutral operations. | Attracting environmentally conscious customers, mitigating regulatory risk. | First green vessel by 2025, Channel carbon-neutral by 2030. |

| Digital Transformation | Improving customer service and operational efficiency through technology. | Cost reduction, new service offerings, enhanced customer loyalty. | Ongoing investments in standardization and data analytics. |

| Strategic Partnerships | Collaborating with ports, tech firms, and other logistics providers. | Access to new markets, shared infrastructure costs, improved service offerings. | EU sustainable shipping initiatives, potential for co-investment in green infrastructure. |

Threats

The ferry and logistics sector is seeing increased rivalry, with new players like Grimaldi entering key markets such as the Mediterranean. This influx has led to overcapacity, directly impacting pricing power and, consequently, DFDS's profitability in those areas. For instance, the Mediterranean routes have experienced significant earnings pressure due to this intensified competition.

This competitive pressure isn't a fleeting issue; it's a persistent threat that could continue to erode DFDS's market share and squeeze profit margins. The need to adapt pricing strategies and maintain service quality in the face of aggressive new entrants remains a critical challenge for the company's financial performance.

Muted expectations for European economic growth in 2025, with forecasts suggesting a modest expansion, present a significant threat to DFDS. Potential shifts in US economic policies could further dampen global trade, directly impacting demand for freight services. This economic climate could constrain revenue and profitability for DFDS.

Geopolitical tensions, exemplified by the ongoing conflict in Ukraine, pose a significant threat by disrupting global supply chains and impacting trade routes. This instability can directly affect DFDS's ferry volumes and create unforeseen operational challenges.

Regional disruptions, such as national strikes affecting key ports like Gothenburg in Sweden, further compound these risks. Such events can halt or delay crucial port operations, leading to immediate impacts on shipping schedules and overall efficiency for DFDS.

The unpredictable nature of these geopolitical and regional issues makes them inherently difficult to forecast and manage effectively. This creates a persistent layer of operational uncertainty for the company's strategic planning and day-to-day operations.

Fuel Price Volatility and Environmental Regulation Costs

DFDS faces significant challenges from fluctuating fuel prices, a persistent operational cost. For instance, in 2023, the company reported that fuel costs represented a substantial portion of its operating expenses, though specific figures are often embedded within broader cost categories.

The push towards decarbonization, while strategically vital, brings its own set of financial pressures. Complying with environmental regulations, such as the EU Emissions Trading System (ETS), and investing in green fuels like methanol or ammonia, are expected to add considerable costs. Analysts project that the maritime industry's transition to net-zero emissions by 2050 could require trillions of dollars in investment globally, impacting companies like DFDS directly.

- Fuel Price Volatility: Traditional fuel costs remain a major variable expense, directly impacting profitability.

- Decarbonization Investment: Transitioning to greener fuels and technologies requires significant capital outlay.

- Regulatory Compliance: Adhering to evolving environmental mandates, such as the EU ETS, incurs direct costs and operational complexities.

- Uncertainty in Green Fuel Costs: The future cost and availability of alternative fuels are still subject to market development and technological advancements.

Integration Risks of Acquired Businesses

The acquisition of Ekol International Transport presented significant integration challenges, evidenced by its negative earnings impact. This underscores the inherent risks in merging new businesses, especially when realizing projected profitability and operational synergies proves difficult. DFDS must navigate these complexities to avoid continued resource drain from underperforming acquisitions.

For instance, the financial performance of Ekol following its acquisition in 2018 has been a point of concern. While specific ongoing financial data for Ekol's contribution to DFDS's earnings in late 2024 or early 2025 isn't publicly detailed in a way that isolates it, the initial integration phase often involves substantial costs and a period of adjustment. DFDS's 2023 annual report noted that the integration of Ekol was progressing, but the full realization of benefits is a multi-year process.

- Integration Costs: Acquired businesses often require significant upfront investment in IT systems, operational alignment, and rebranding, impacting short-term profitability.

- Synergy Realization: Achieving expected cost savings and revenue enhancements from merged operations can be delayed or fall short of initial projections.

- Operational Disruptions: Merging logistics networks and customer bases can lead to temporary service disruptions, affecting client retention and operational efficiency.

Intensified competition, particularly from new entrants like Grimaldi in the Mediterranean, is pressuring DFDS's pricing power and profitability. Slowing European economic growth in 2025, coupled with potential global trade disruptions from shifts in US economic policy, further threatens revenue. Geopolitical instability, such as the conflict in Ukraine, and regional issues like port strikes, create operational uncertainty and impact shipping volumes.

SWOT Analysis Data Sources

This DFDS SWOT analysis is built upon a robust foundation of diverse data sources, including the company's official financial reports, comprehensive market research, and insights from industry experts. We also incorporate analysis of recent news and competitor activities to provide a well-rounded and accurate strategic overview.