DFDS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

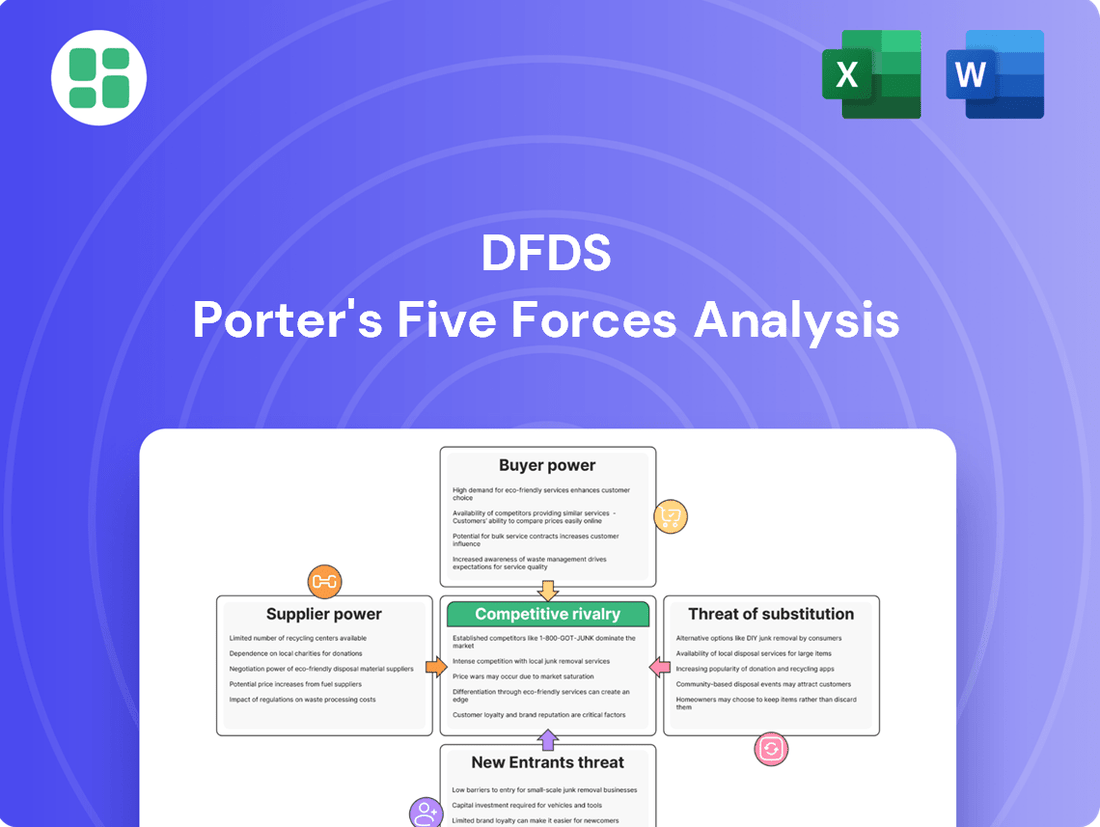

Understanding DFDS's competitive landscape is crucial, and our Porter's Five Forces analysis delves into the core pressures shaping its industry. We examine the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore DFDS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fuel suppliers wield substantial bargaining power over shipping companies like DFDS. Fuel costs can represent a significant portion of operating expenses, sometimes as much as 50%, highlighting their leverage. This is further amplified by the essential nature of fuel for maritime operations.

The marine fuel market in 2025 is anticipated to continue experiencing price volatility. Geopolitical tensions and evolving environmental regulations are key drivers of these fluctuations. Consequently, companies must engage in strategic bunkering and fuel hedging to mitigate these risks and manage their exposure to supplier pricing power.

Shipbuilding yards, especially those in China, are currently experiencing robust demand with substantial orderbooks. This high demand, coupled with stable newbuilding prices, means DFDS has fewer immediate options when looking for new vessels, granting these shipyards significant bargaining power. For instance, major Chinese shipyards like CSSC and CIMC Raffles consistently report high utilization rates, making it difficult for shipowners to negotiate favorable terms for new builds.

DFDS's strategic investment in new, greener vessels introduces another layer to supplier power. The company's focus on alternative fuel technologies, such as LNG or methanol-powered ships, necessitates engagement with specialized suppliers for these advanced systems and related infrastructure. These niche suppliers, possessing unique expertise and proprietary technology, wield considerable influence due to the limited availability of comparable alternatives.

Port service providers hold significant bargaining power over DFDS, particularly concerning the adoption of new green technologies. Their ability to offer or delay services like shore power and alternative fuel bunkering directly impacts DFDS's environmental strategy and operational costs. For instance, the availability and pricing of shore power infrastructure at key ports can dictate the pace of DFDS's fleet electrification efforts.

Furthermore, the efficiency of port infrastructure itself, including road and rail connectivity, is a critical factor. When highways are congested or rail networks are outdated, ports become bottlenecks, increasing DFDS's reliance on the services they offer. This dependency allows port service providers to exert influence over pricing and service levels, especially when DFDS has limited alternative port options.

Labor (Seafarers, Logistics Personnel)

The bargaining power of seafarers and logistics personnel is significant due to persistent labor shortages across Europe. This scarcity, particularly for skilled drivers and maritime crew, allows these workers to demand better compensation and working conditions.

Companies like DFDS are responding by increasing wages and improving benefits to attract and keep essential staff. For instance, in 2024, many European logistics firms reported wage increases of 5-10% to combat driver shortages, reflecting the heightened bargaining power of this workforce.

- Labor Shortages: Ongoing shortages in skilled labor within the maritime and logistics sectors empower seafarers and drivers.

- Wage Inflation: Companies are investing in competitive wages and benefits, with some logistics sectors seeing average wage hikes of 5-10% in 2024 to attract talent.

- Automation Investment: To mitigate reliance on manual labor, companies are exploring and implementing automation solutions.

- Retention Strategies: Enhanced benefits packages and improved working conditions are key strategies to retain existing personnel in a tight labor market.

Technology and IT System Providers

As DFDS embraces digital transformation, aiming to streamline operations and elevate customer experiences through network standardization and digitization, suppliers of cutting-edge IT systems, AI-powered analytics, and digital solutions are seeing their bargaining power increase. The growing reliance on digital tools, such as automated invoicing and online booking platforms, amplifies the influence of these technology providers.

The maritime transport sector's digital acceleration, particularly in areas like fleet management and customer relationship management, means that specialized IT providers hold significant sway. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, highlighting the substantial economic footprint of these suppliers.

- Increased Demand for Digital Solutions: DFDS's focus on digitization directly boosts demand for specialized IT and AI systems.

- Supplier Concentration: The market for advanced maritime IT solutions may have a limited number of key players, concentrating power.

- Switching Costs: Implementing and integrating new IT systems can involve substantial costs and operational disruptions, making it difficult for DFDS to switch suppliers.

- Supplier Differentiation: Providers offering unique or highly integrated digital solutions can command higher prices and better terms.

Suppliers of specialized components and services, particularly for DFDS's newer, greener vessels, possess significant bargaining power. The limited number of providers for advanced technologies like LNG or methanol fuel systems means DFDS has fewer alternatives, giving these niche suppliers leverage in negotiations.

The maritime industry's increasing reliance on advanced IT and AI solutions also empowers technology suppliers. As DFDS invests in digital transformation, providers of fleet management and customer relationship management systems benefit from high demand and potentially concentrated markets, leading to increased influence over pricing and terms.

Shipbuilding yards, especially in Asia, continue to hold strong bargaining power due to sustained high demand and full orderbooks. This situation limits DFDS's options for new builds and makes it challenging to negotiate favorable terms for vessel acquisition.

| Supplier Category | Factors Influencing Bargaining Power | Impact on DFDS |

|---|---|---|

| Fuel Suppliers | Essential commodity, price volatility, geopolitical factors | High operating costs, need for hedging strategies |

| Shipbuilding Yards | High demand, limited capacity, stable newbuilding prices | Reduced negotiation leverage for new vessel orders |

| Specialized Technology Providers (Green Tech, IT) | Niche expertise, proprietary technology, digital acceleration | Increased reliance, potential for higher costs, difficulty in switching |

| Port Service Providers | Infrastructure control, service availability (e.g., shore power) | Operational constraints, influence on environmental strategy implementation |

| Seafarers and Logistics Personnel | Labor shortages, demand for better compensation | Increased labor costs, need for retention strategies |

What is included in the product

This DFDS Porter's Five Forces analysis dissects the competitive intensity within the ferry and logistics sectors. It examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces in a single, actionable dashboard.

Customers Bargaining Power

DFDS's freight customers, primarily manufacturers of industrial goods, wield considerable bargaining power. This is amplified by their ability to ship large volumes, giving them leverage to negotiate competitive pricing, particularly as the market experiences increased capacity. For instance, in 2024, the European freight market saw a notable increase in available capacity, putting downward pressure on rates and strengthening customer negotiation positions.

The strategic advantage of aligning with efficient carriers offers substantial cost savings for these businesses. This pursuit of cost optimization means large freight customers can demand favorable terms, effectively increasing their influence over DFDS and other logistics providers. Their ability to switch providers if better rates or services are offered is a constant factor in the negotiation dynamic.

Passenger ferry demand often fluctuates with the seasons, meaning that during off-peak times, customers have more leverage. This, combined with the highly competitive nature of the ferry market, gives individual travelers significant power, especially when their trips are not essential.

DFDS's emphasis on customer satisfaction highlights how crucial it is to meet passenger expectations. For example, in 2023, DFDS reported a customer satisfaction score of 8.4 out of 10 across its ferry operations, underscoring the direct link between meeting needs and retaining business.

Logistics service buyers, particularly those seeking integrated solutions like road transport and warehousing, hold significant bargaining power. They prioritize reliability, efficiency, and capacity, and with numerous providers available, they can readily switch if their needs aren't met or if better terms are offered.

Businesses are intensely focused on cost management and building resilient supply chains. This drives them to exert pressure on logistics providers for competitive pricing and dependable service delivery. For instance, in 2024, many companies reported increased scrutiny on freight costs, with some seeking to renegotiate contracts to secure better rates amidst fluctuating fuel prices and demand.

Sensitivity to Pricing and Surcharges

Customers in the freight sector are quite sensitive to changes in freight rates, especially when these are driven by fluctuating fuel costs. This sensitivity gives them leverage, as they actively seek out providers who can offer more stable or lower overall transportation expenses. For instance, the implementation of surcharges related to environmental regulations can directly impact customer decisions.

The EU Emissions Trading System (ETS) and Fuel EU Maritime (FEUM) are prime examples of regulatory costs that DFDS, like other ferry operators, must pass on. These surcharges, while necessary for compliance, are closely examined by customers. If alternative shipping options emerge with a lower total cost of ownership, even after accounting for these surcharges, customers possess significant bargaining power to switch.

- Customer Price Sensitivity: Freight rates are directly impacted by fuel costs and regulatory surcharges, making customers highly attentive to price increases.

- Impact of Environmental Regulations: The EU ETS and Fuel EU Maritime (FEUM) add surcharges that customers scrutinize closely.

- Bargaining Power Through Alternatives: Customers can exert pressure by seeking out competitors offering lower overall transportation costs, especially when surcharges are applied.

- 2024 Cost Pressures: Fuel prices in 2024, while volatile, have seen periods of significant increase, directly feeding into the surcharges that impact customer sensitivity.

Availability of Alternative Transport Modes

The availability of alternative transport modes significantly bolsters customer bargaining power against DFDS. Customers can readily choose between road, rail, air, and even other shipping lines, meaning DFDS cannot easily dictate prices. For instance, in 2024, the global freight market saw continued diversification, with trucking and rail often providing competitive transit times and costs for shorter hauls, directly challenging maritime shipping's dominance on certain routes.

This wide array of options empowers customers to switch to competing freight forwarders or directly engage with other shipping companies if DFDS's service or pricing becomes unfavorable. In 2023, the European road freight market alone handled billions of tonne-kilometers, demonstrating the sheer scale of alternatives available to shippers who might otherwise rely on ferry services.

- Customer Choice: Access to road, rail, air, and alternative shipping lines provides significant leverage.

- Price Sensitivity: DFDS faces pressure to remain competitive on pricing to prevent customer defection.

- Market Competition: The existence of numerous freight forwarders and direct shipping options intensifies competition.

- Service Flexibility: Customers can easily shift to providers offering better service or more favorable terms.

Customers of DFDS, particularly in the freight sector, possess substantial bargaining power due to their ability to consolidate large shipment volumes and their inherent price sensitivity. This leverage is further amplified by the availability of numerous alternative transport providers and modes, allowing them to readily switch if DFDS's pricing or service terms are not competitive. For example, in 2024, the European road freight market continued to offer robust capacity, providing shippers with viable alternatives to ferry services, especially for shorter distances.

The pursuit of cost efficiency drives businesses to negotiate aggressively for favorable rates and terms, directly impacting DFDS's pricing power. This dynamic is exacerbated by regulatory costs like the EU Emissions Trading System (ETS) and Fuel EU Maritime (FEUM), which customers scrutinize closely when comparing total shipping expenses. In 2023, many companies actively sought to renegotiate logistics contracts to mitigate rising operational costs, underscoring customer pressure for predictable and lower overall expenses.

| Factor | Impact on DFDS | Customer Leverage | 2024 Data Point |

| Volume Consolidation | Reduced per-unit revenue | High | Increased capacity in European freight market |

| Price Sensitivity | Pressure on margins | High | Customer renegotiation of logistics contracts |

| Alternative Transport Modes | Competition on price and transit time | High | Robust capacity in European road freight market |

| Regulatory Surcharges (ETS, FEUM) | Increased total cost for customers | Moderate to High | Close customer scrutiny of added costs |

Preview the Actual Deliverable

DFDS Porter's Five Forces Analysis

You're previewing the final version of the DFDS Porter's Five Forces Analysis. This comprehensive document, which you see here, is precisely the same detailed report you will receive instantly after completing your purchase, offering a thorough examination of the competitive landscape for DFDS.

Rivalry Among Competitors

The European road freight market, a key segment for DFDS's logistics operations, is characterized by its intense fragmentation. Despite ongoing consolidation efforts, a vast number of companies actively compete for market share, driving down prices and margins. This highly competitive landscape means that even established players like DFDS must constantly innovate and optimize to maintain their position.

Similarly, the passenger ferry sector faces significant competitive pressures. DFDS operates in a market with numerous ferry operators, each vying for passenger and freight traffic. Challenges such as fluctuating fuel costs and seasonal demand patterns further intensify this rivalry, requiring strategic route management and efficient operations to succeed.

DFDS faces robust competition from established players such as DSV, Hapag-Lloyd, and Scandlines, all offering comparable shipping and logistics solutions across Europe.

The entry of new competitors on specific routes, particularly in the Mediterranean, has impacted DFDS's market share in certain segments.

For instance, in 2024, the European ferry and logistics market continues to see intense price competition, with companies like Stena Line also vying for market dominance on key North Sea routes.

The maritime shipping sector faces significant competitive rivalry driven by industry overcapacity and volatile demand. New vessel deliveries continue to expand capacity, while the demand for shipping services is subject to economic cycles, creating a persistent imbalance.

This oversupply intensifies competition as carriers vie for limited cargo volumes, putting downward pressure on freight rates. For instance, the global containership fleet capacity saw an increase of approximately 7% in 2023, contributing to a more challenging pricing environment.

Price Sensitivity and Cost Pressures

The shipping industry, including ferry operators like DFDS, is grappling with significant cost pressures. Rising fuel prices, which historically fluctuate but have seen upward trends, directly impact operating expenses. For instance, bunker fuel costs can represent a substantial portion of a ferry operator's total expenditure. In 2024, while specific figures for DFDS are proprietary, the global shipping industry continued to monitor volatile energy markets, with Brent crude oil prices averaging around $80-$85 per barrel for much of the year, a key input for maritime operations.

This cost escalation, coupled with a highly price-sensitive customer base, particularly in the freight sector, intensifies competitive rivalry. Customers, especially businesses relying on efficient and cost-effective logistics, are acutely aware of freight rates. This means that companies like DFDS must constantly seek ways to optimize their operations and reduce costs to offer competitive pricing. Failure to do so can lead to a loss of market share as customers opt for more economical alternatives.

- Rising Operating Costs: Fuel and labor expenses are key drivers of increased operational expenditure in the ferry and freight transport sector.

- Customer Price Sensitivity: Freight customers, in particular, are highly responsive to changes in shipping rates, creating a competitive pricing environment.

- Pressure for Cost Optimization: Companies must continuously improve efficiency and manage costs to remain competitive and retain their customer base.

- Impact on Profitability: Intense price competition, driven by cost pressures and customer demands, directly affects profit margins for operators.

Regulatory Compliance and Sustainability Efforts

New environmental regulations, such as the EU Emissions Trading System (ETS) and the FuelEU Maritime initiative, are significantly impacting the shipping industry. These regulations are designed to reduce greenhouse gas emissions and are directly increasing operational costs for all players. For instance, the EU ETS, which began covering maritime transport in January 2024, requires shipping companies to purchase emission allowances for their CO2 emissions. This compliance burden is a substantial new expense, with initial allowance prices fluctuating but generally adding a notable cost per tonne of CO2 emitted.

This regulatory shift is intensifying competitive rivalry, particularly in the green logistics space. Companies that can proactively invest in and adopt more sustainable technologies and operational practices are better positioned to absorb these rising costs. DFDS, like its competitors, faces the challenge of adapting its fleet and operations to meet these stringent requirements. Those that can achieve greater efficiency in emission reduction or develop innovative sustainable solutions may gain a significant competitive advantage by offering greener services at potentially more stable price points.

The competitive landscape is thus evolving, with a clear trend towards rewarding companies that demonstrate strong environmental stewardship. Companies are actively exploring alternative fuels, such as methanol and ammonia, and investing in energy-saving technologies. For example, by mid-2024, many major shipping lines had announced significant investments in green vessel technologies and sustainable fuel sourcing. This focus on sustainability is becoming a key differentiator, influencing customer choices and shaping market share within the industry.

- EU ETS implementation for maritime transport started in January 2024, directly increasing operational costs.

- FuelEU Maritime aims to boost the uptake of sustainable maritime fuels.

- Companies investing in green logistics and efficient compliance can gain a competitive edge.

- The drive for sustainability is becoming a critical factor in market competition.

The competitive rivalry within the European road freight and passenger ferry markets remains intense for DFDS. Numerous companies, including established players like DSV and Scandlines, vie for market share, leading to price pressures. This fragmentation means DFDS must continually innovate and optimize operations to stay ahead. For instance, in 2024, Stena Line continued to be a significant competitor on key North Sea routes, intensifying price competition.

The maritime shipping sector, which underpins DFDS's ferry operations, faces rivalry exacerbated by fleet overcapacity and fluctuating demand. Global containership fleet capacity grew by approximately 7% in 2023, contributing to a challenging pricing environment. This oversupply forces carriers to compete aggressively for cargo, driving down freight rates and impacting profitability for all operators.

Rising operating costs, particularly for fuel, further intensify this rivalry. With Brent crude oil prices averaging around $80-$85 per barrel in 2024, fuel expenses represent a substantial portion of operating costs. This, combined with highly price-sensitive freight customers, necessitates continuous cost optimization for companies like DFDS to maintain competitiveness and customer loyalty.

The introduction of environmental regulations, such as the EU Emissions Trading System (ETS) for maritime transport from January 2024, adds another layer of competitive pressure. Companies investing in sustainable technologies and efficient compliance, like those exploring alternative fuels, are better positioned to manage these increased costs and potentially gain a competitive edge.

SSubstitutes Threaten

The extensive road transport networks across Europe present a significant threat of substitution for ferry services, particularly for shorter routes and certain types of cargo. Trucks can often provide a more direct and faster door-to-door service, bypassing port congestion and customs procedures associated with sea freight.

The European road freight market is a robust and growing sector, underscoring its viability as an alternative. In 2023, road freight accounted for the largest share of goods transport within the EU, moving approximately 75% of inland freight volume, which highlights its established infrastructure and widespread use.

Rail freight presents a significant substitute for certain long-distance cargo movements that might otherwise utilize DFDS's shipping services. This alternative becomes more compelling as companies prioritize cost-effectiveness and efficiency in their supply chains.

DFDS's own involvement in integrated logistics, which includes road and rail components, underscores the reality of rail as a viable substitute. The growing importance of intermodal solutions, where rail often plays a crucial role, further solidifies its position as a competitive option for shippers.

For instance, in 2023, the European rail freight sector moved approximately 1.2 billion tonnes of goods, demonstrating its substantial capacity and reach as an alternative to other transport modes. This volume indicates a strong existing infrastructure and a willingness from businesses to utilize rail.

For highly time-sensitive or high-value goods, air freight presents a significant substitute for traditional freight services like those offered by DFDS. This alternative bypasses slower sea and road routes, albeit at a considerably higher cost. For instance, in 2024, air cargo volumes continued to demonstrate resilience, particularly for express shipments and e-commerce, underscoring its role as a viable, albeit premium, option for certain market segments.

This substitution directly impacts DFDS's competitive edge in speed for specific cargo types. While DFDS excels in cost-effective and bulk transportation, the availability of rapid air transit means that customers with urgent needs might opt for air freight regardless of the price premium. This forces DFDS to focus on its core strengths of efficiency and reliability for less time-critical shipments.

Channel Tunnel for UK-Europe Crossings

The Channel Tunnel presents a significant threat of substitution for DFDS's UK-Europe ferry routes, especially for freight and passenger traffic. This direct land link offers a compelling alternative, impacting the demand for traditional sea crossings.

In 2023, Eurotunnel reported carrying 1.7 million cars and 2.6 million passengers, highlighting its substantial market share. This direct competition means that ferry operators must continually innovate and offer competitive pricing and service levels to retain customers.

- Channel Tunnel's Direct Competition: Provides a land-based alternative for UK-Europe travel, bypassing ferry services.

- Impact on Ferry Demand: Influences passenger and freight volumes for ferry operators like DFDS.

- Eurotunnel's 2023 Performance: Transported 1.7 million cars and 2.6 million passengers, demonstrating its scale.

- Competitive Pressure: Forces ferry companies to focus on service quality and pricing to stay relevant.

Direct Shipping Lines and Other Ferry Operators

While DFDS boasts an extensive network, direct shipping lines and regional ferry operators present a significant threat of substitutes. These competitors can cater to specific routes, potentially undercutting DFDS on price or offering niche services that appeal to certain customer segments. For instance, in 2024, several smaller operators on the Baltic Sea routes have increased their capacity, directly challenging DFDS's market share on those corridors.

The availability of alternative transport modes also contributes to the threat of substitutes. For freight, rail and road transport can be viable alternatives for certain cargo types and distances, especially where port infrastructure is less developed or road networks are more efficient. For passenger services, especially on shorter routes, the convenience and cost-effectiveness of driving or even budget airlines can divert customers away from ferry services.

- Direct competitors: Other established ferry companies operating on overlapping routes, such as Stena Line or P&O Ferries, can offer similar services.

- Regional players: Smaller, localized ferry operators often serve specific communities or islands, providing a substitute for shorter, less extensive journeys.

- Alternative transport: For freight, trucking and rail are substitutes, while for passengers, driving and budget airlines can be alternatives.

- Pricing sensitivity: Customers, particularly on leisure routes, are often price-sensitive, making lower-cost alternatives a strong substitute.

The threat of substitutes for DFDS's ferry services is substantial, encompassing road, rail, and air freight, as well as alternative passenger transport methods. Road and rail transport, particularly for freight, offer direct competition due to their extensive networks and increasing efficiency. For instance, in 2023, road freight handled approximately 75% of inland freight volume in the EU, highlighting its dominance and infrastructure strength.

The Channel Tunnel also serves as a direct substitute for UK-Europe ferry routes, with Eurotunnel transporting 1.7 million cars and 2.6 million passengers in 2023. Furthermore, budget airlines and the option of driving present viable alternatives for passengers, especially on shorter routes, forcing ferry operators to remain competitive on price and service.

| Substitute Mode | Primary Impact on DFDS | Key Data Point (2023/2024) |

|---|---|---|

| Road Freight | Direct competition for shorter/medium haul cargo, faster door-to-door service | 75% of EU inland freight volume |

| Rail Freight | Alternative for long-distance cargo, focus on cost-effectiveness | 1.2 billion tonnes moved in Europe |

| Air Freight | Substitute for time-sensitive/high-value goods, premium pricing | Resilient volumes in 2024 for express shipments |

| Channel Tunnel | Direct land-based alternative for UK-Europe routes | 1.7 million cars, 2.6 million passengers transported |

| Driving/Budget Airlines | Passenger diversion on shorter routes, convenience and cost | Significant passenger volumes on key European corridors |

Entrants Threaten

The shipping and ferry industries are incredibly capital-intensive. Building and maintaining a fleet, along with the necessary port infrastructure and technology, demands a substantial financial commitment. For instance, acquiring a new large ferry can cost tens of millions of euros, and a modern, large freight ferry can easily exceed €50 million. This high barrier to entry significantly deters potential new competitors from entering markets like those DFDS operates in.

DFDS benefits from an extensive, established network of ferry routes, port terminals, and integrated logistics solutions across Northern Europe and the Baltic Sea, a significant barrier for potential new entrants. For instance, in 2024, DFDS operated a fleet of over 50 vessels and served numerous routes, facilitating substantial economies of scale in operations and marketing.

New entrants would find it incredibly difficult and capital-intensive to replicate this scale and network density. This established infrastructure provides DFDS with significant cost advantages, such as lower per-unit operating costs and better bargaining power with suppliers, alongside unparalleled customer reach and brand recognition.

The maritime sector faces substantial regulatory and environmental challenges, acting as a significant deterrent for new entrants. Compliance with evolving international and regional mandates, such as the EU Emissions Trading System (EU ETS) and FuelEU Maritime, demands considerable upfront investment in cleaner technologies and operational adjustments. For instance, the EU ETS, implemented in 2024 for maritime transport, places a carbon cost on emissions, directly impacting profitability and requiring sophisticated emissions tracking and reporting systems.

Brand Loyalty and Customer Relationships

DFDS benefits from a deeply ingrained brand loyalty and robust customer relationships, cultivated over its extensive operational history. These established connections, particularly within the freight and passenger sectors, are founded on a reputation for reliability and consistent service quality, making it difficult for newcomers to penetrate the market.

New entrants face a substantial hurdle in overcoming this existing brand loyalty and the trust DFDS has built. Acquiring customers would necessitate significant investment in marketing and service differentiation to even begin to chip away at DFDS's established market position, a considerable challenge in a mature and competitive industry.

- Brand Loyalty: DFDS has a long-standing reputation, fostering strong customer allegiance.

- Customer Relationships: Established partnerships with both freight and passenger clients are a key differentiator.

- Trust Factor: Reliability and service quality over time have built significant customer trust.

- Market Entry Barrier: Newcomers must invest heavily to overcome DFDS's established market presence and customer loyalty.

Labor Shortages and Talent Acquisition

The maritime and logistics industries are grappling with significant labor shortages, especially for skilled seafarers and truck drivers, making it tough for new companies to get their operations off the ground. For instance, the International Chamber of Shipping reported in 2024 that over 260,000 seafarers were needed to fill existing roles, highlighting the scale of the issue.

Attracting and keeping good people is a major hurdle for any new player. The competition for qualified personnel is fierce, and established companies often have better resources for training and retention, creating a substantial barrier to entry.

- Seafarer Shortage: Over 260,000 seafarers were estimated to be needed in 2024 to meet global demand.

- Driver Deficit: Many regions continue to face driver shortages, impacting the efficiency of land-based logistics.

- Talent Retention: High turnover rates in the sector mean new entrants must invest heavily in recruitment and retention strategies.

The threat of new entrants in the ferry and shipping sector, particularly for a company like DFDS, is generally considered low. This is primarily due to the immense capital required to establish operations, including fleet acquisition and port infrastructure. For example, a new large ferry can cost tens of millions of euros, and the regulatory landscape, with its increasing environmental compliance demands like the EU ETS in 2024, adds further significant upfront investment. Furthermore, DFDS's established network, brand loyalty, and existing customer relationships create substantial barriers that new players would struggle to overcome without considerable resources and time.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High cost of acquiring vessels and infrastructure. | Significant financial hurdle. | Large ferry cost: € tens of millions. |

| Network & Scale | Extensive established routes and terminals. | Difficult to replicate scale and efficiency. | DFDS operated >50 vessels in 2024. |

| Brand Loyalty & Relationships | Strong customer trust and long-term partnerships. | Challenging to attract and retain customers. | Cultivated over extensive operational history. |

| Regulatory Compliance | Adherence to evolving environmental and safety standards. | Requires substantial investment in technology and processes. | EU ETS impact on maritime transport implemented 2024. |

| Labor Shortages | Scarcity of skilled maritime personnel. | Hinders operational setup and growth. | Estimated >260,000 seafarers needed globally in 2024. |

Porter's Five Forces Analysis Data Sources

Our DFDS Porter's Five Forces analysis is built upon a robust foundation of data, drawing from DFDS's annual reports, investor presentations, and official company statements.

We supplement this internal data with comprehensive industry analysis from reputable maritime research firms and competitor financial disclosures to provide a thorough competitive landscape assessment.