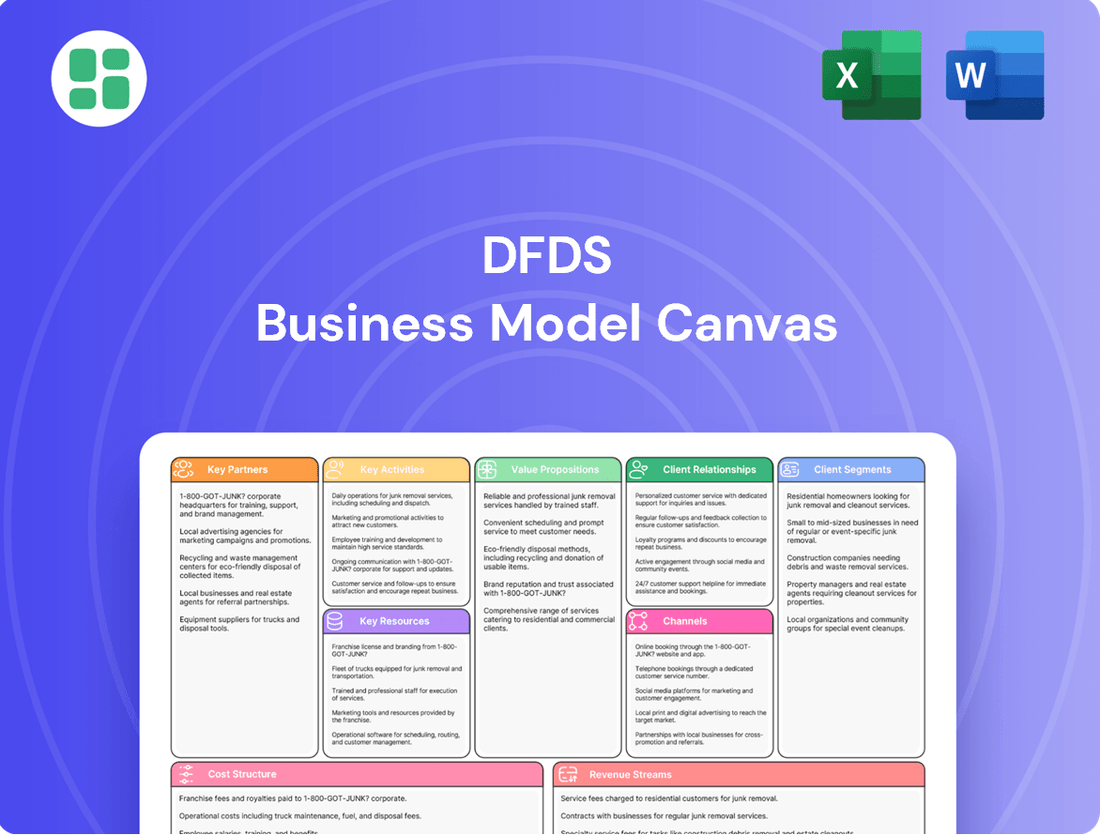

DFDS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFDS Bundle

Unlock the strategic blueprint behind DFDS's success with our comprehensive Business Model Canvas. This detailed analysis reveals how DFDS effectively connects with its customer segments, delivers value through its ferry and logistics services, and leverages key partnerships to maintain its competitive edge. Discover the core activities and revenue streams that drive this industry leader.

Ready to gain a deeper understanding of DFDS's operational excellence? Our full Business Model Canvas provides an in-depth look at their value propositions, cost structures, and key resources, offering actionable insights for anyone looking to learn from a proven business model. Download the complete document to see how DFDS navigates the complexities of the transport and logistics sector.

Partnerships

DFDS's key partnerships with port authorities are fundamental to its operational success. These collaborations ensure access to critical infrastructure, enabling efficient ferry and logistics services across its extensive network. For instance, in 2024, DFDS continued its deep engagement with numerous European port authorities to streamline vessel movements and cargo handling.

These relationships are vital for securing timely berth allocations, which directly impacts schedule reliability and customer satisfaction. Effective coordination with authorities also facilitates the optimization of loading and unloading processes, minimizing turnaround times and maximizing asset utilization. This synergy is essential for maintaining the fluidity of operations, especially during peak seasons.

The ongoing dialogue and cooperation with port authorities are crucial for adapting to evolving regulations and infrastructure developments. In 2024, DFDS worked closely with authorities to implement new digital solutions for port calls, aiming to further enhance efficiency and transparency in its maritime logistics chain.

DFDS collaborates with a network of road transport companies and other logistics providers to offer integrated logistics solutions. These partnerships allow DFDS to extend its services beyond sea routes, facilitating seamless door-to-door delivery for its freight customers. For instance, in 2024, DFDS continued to strengthen its relationships with key trucking firms across its European network, ensuring efficient last-mile delivery and optimizing the overall supply chain.

DFDS collaborates with technology and digital solution providers to bolster its online booking systems and enhance operational efficiency across both ferry and logistics services. For instance, in 2024, DFDS continued to invest in upgrading its digital infrastructure, aiming to streamline the customer journey and improve real-time data management. These partnerships are crucial for developing advanced analytical capabilities, enabling data-driven decision-making and a more seamless customer experience.

Fuel Suppliers and Green Technology Developers

DFDS actively cultivates partnerships with key fuel suppliers and innovative green technology developers. These collaborations are fundamental to their strategy of exploring and adopting alternative fuels, such as advanced biofuels and potentially methanol, to power their fleet. By working with these partners, DFDS aims to accelerate the transition to more sustainable shipping operations.

These alliances are vital for DFDS's efforts to invest in and implement energy-efficient vessel designs and retrofits. For instance, ongoing research into technologies like battery-electric propulsion for shorter routes and advanced hull coatings are areas where these partnerships are crucial. Such collaborations directly support DFDS's commitment to significantly reducing its carbon emissions.

DFDS has set ambitious decarbonization targets, aiming for a 45% reduction in CO2 emissions by 2030 compared to 2008 levels. Partnerships with green technology developers are essential to achieving these goals, enabling the testing and scaling of new solutions. For example, DFDS has been exploring the use of battery power for its ferries, with pilot projects underway.

- Fuel Suppliers: Collaborations focus on securing reliable supply chains for emerging sustainable fuels, including advanced biofuels and potentially green ammonia or methanol.

- Green Technology Developers: Partnerships drive innovation in areas like energy-efficient hull designs, advanced propulsion systems, and onboard carbon capture technologies.

- Investment in Energy Efficiency: Joint ventures and research initiatives aim to develop and deploy technologies that reduce fuel consumption and operational emissions across DFDS's fleet.

- Decarbonization Targets: These partnerships are instrumental in meeting DFDS's commitment to reducing its carbon footprint, aligning with industry-wide sustainability goals.

Travel Agencies and Tour Operators

DFDS collaborates with travel agencies and tour operators to extend its market presence for passenger ferry services. These partnerships are crucial for distributing tickets and holiday packages, effectively reaching a broader customer base beyond direct bookings.

By engaging with these intermediaries, DFDS can tap into established networks, promoting ferry travel as a convenient and appealing choice for various traveler segments. This strategic alliance helps in attracting a more diverse clientele, enhancing overall passenger volumes.

- Market Reach Expansion: Travel agencies and tour operators provide DFDS access to a wider audience of potential passengers who might not book directly.

- Distribution Channels: These partners act as key sales channels, distributing tickets and integrated holiday packages, simplifying the booking process for customers.

- Promotional Leverage: Partnerships allow for joint marketing efforts, increasing the visibility of ferry services and holiday offerings, as seen in DFDS's continued efforts to promote its North Sea routes.

DFDS's key partnerships with port authorities are fundamental to its operational success, ensuring access to critical infrastructure for efficient ferry and logistics services. In 2024, DFDS continued its deep engagement with numerous European port authorities to streamline vessel movements and cargo handling, vital for schedule reliability and customer satisfaction.

DFDS collaborates with road transport companies and other logistics providers to offer integrated, door-to-door delivery solutions for freight customers. These partnerships, like the continued strengthening of relationships with key trucking firms in 2024, optimize the overall supply chain and ensure efficient last-mile delivery.

Partnerships with technology providers enhance DFDS's online booking systems and operational efficiency, with continued investment in digital infrastructure in 2024 aiming to improve the customer journey and real-time data management.

DFDS actively cultivates partnerships with fuel suppliers and green technology developers to accelerate its transition to sustainable shipping, exploring alternative fuels like advanced biofuels and methanol. These alliances are crucial for investing in and implementing energy-efficient vessel designs and retrofits, supporting DFDS's commitment to reducing carbon emissions.

DFDS collaborates with travel agencies and tour operators to expand its market reach for passenger ferry services, acting as key sales channels for tickets and holiday packages. These partnerships increase visibility and attract a broader clientele, enhancing passenger volumes.

| Partnership Type | Focus Area | 2024 Impact/Activity | Strategic Importance |

| Port Authorities | Infrastructure Access, Operations Streamlining | Continued engagement for efficient vessel movements and cargo handling. | Ensures schedule reliability, optimizes turnaround times. |

| Road Transport & Logistics Providers | Integrated Door-to-Door Solutions | Strengthened relationships with key trucking firms for last-mile delivery. | Extends service reach, optimizes supply chain efficiency. |

| Technology Providers | Digital Systems, Operational Efficiency | Continued investment in digital infrastructure for enhanced customer journey. | Improves booking systems, enables data-driven decisions. |

| Fuel Suppliers & Green Tech Developers | Sustainable Fuels, Energy Efficiency | Exploration of alternative fuels, investment in energy-efficient designs. | Supports decarbonization targets, reduces carbon footprint. |

| Travel Agencies & Tour Operators | Passenger Distribution, Market Reach | Distribution of tickets and holiday packages to a wider audience. | Increases passenger volumes, enhances service visibility. |

What is included in the product

DFDS's Business Model Canvas focuses on providing ferry and transport services, leveraging a strong network of routes and a diverse customer base including passengers and freight. Its value proposition centers on reliable and efficient travel and logistics solutions, supported by strategic partnerships and a commitment to sustainability.

The DFDS Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their operations, allowing for swift identification of inefficiencies and potential areas for improvement.

Activities

DFDS's primary function is operating an extensive network of ferry routes, connecting Northern Europe and the Baltic Sea for both passengers and freight. This core activity is the bedrock of their business.

This involves intricate planning of schedules, efficient management of their fleet of vessels, and a steadfast commitment to the safe and punctual delivery of cargo and passengers. Their operational prowess ensures reliable maritime transport.

In 2023, DFDS transported 1.5 million passengers and 4.1 million freight units across its numerous routes, highlighting the scale and importance of their ferry operations.

DFDS excels in providing comprehensive integrated logistics services, a cornerstone of its business model. This includes managing road transport, operating warehousing facilities, and handling port terminal operations, ensuring a complete supply chain solution for clients.

The core of this key activity lies in optimizing customer supply chains through seamless multimodal solutions. For example, DFDS reported a significant increase in freight volumes across its network in 2023, demonstrating the growing demand for its integrated services.

By offering end-to-end transport management, DFDS enables businesses to streamline their operations and reduce complexity. This integrated approach allows for greater efficiency and reliability, a crucial factor in today's fast-paced global economy.

DFDS actively manages and operates its port terminals, a core activity crucial for the smooth flow of freight and passengers. This involves optimizing infrastructure and processes to ensure quick cargo handling and efficient vessel turnaround times, directly impacting customer satisfaction and operational costs.

In 2024, DFDS's commitment to efficient port operations is evident in its continuous investment in terminal upgrades and technology. For instance, their terminals handle millions of tons of cargo annually, with efficient turnaround being paramount to maintaining competitive shipping schedules across their extensive network.

Vessel Maintenance and Fleet Management

DFDS's key activities heavily revolve around the meticulous maintenance and strategic management of its extensive fleet. This encompasses regular servicing, timely repairs, and proactive upkeep to guarantee the safety, reliability, and peak operational condition of all its ferries and cargo vessels. For instance, in 2023, DFDS continued its investment in fleet modernization, aiming to enhance both operational efficiency and environmental performance across its network.

Furthermore, this crucial activity includes the ongoing modernization and upgrading of the fleet. DFDS actively invests in implementing new technologies and design improvements to boost fuel efficiency and reduce emissions, aligning with evolving environmental regulations and sustainability goals. This forward-looking approach ensures the fleet remains competitive and compliant.

- Fleet Modernization: DFDS invests in upgrading its fleet to improve fuel efficiency and reduce environmental impact.

- Safety and Reliability: Regular maintenance and repair are paramount to ensuring the safe and dependable operation of all vessels.

- Operational Readiness: Proactive management ensures the fleet is always ready to meet service demands and schedules.

- Environmental Compliance: Upgrades focus on meeting and exceeding environmental standards, particularly concerning emissions and fuel consumption.

Sales, Marketing, and Customer Experience Enhancement

DFDS actively pursues sales and marketing to draw in and keep both freight and passenger clients across its ferry routes. This involves targeted campaigns and relationship building to ensure consistent customer flow.

Enhancing the customer experience is paramount. DFDS invests in improving service quality on board and ashore, alongside digital innovations like booking platforms and real-time information, to foster loyalty and satisfaction.

The company's strategy centers on achieving customer satisfaction as a driver for organic growth. By focusing on customer needs and service excellence, DFDS aims to expand its market share and revenue streams naturally.

- Sales & Marketing Focus: Attracting and retaining freight and passenger customers through dedicated efforts.

- Customer Experience: Continuous improvement via service delivery and digital innovation.

- Growth Strategy: Prioritizing customer satisfaction to fuel organic expansion.

- 2024 Performance Indicator: DFDS reported a notable increase in passenger volumes in early 2024 compared to the previous year, indicating successful customer engagement strategies.

DFDS's core activities are centered around operating its extensive ferry network, providing integrated logistics solutions, managing port terminals, maintaining its fleet, and driving sales and marketing efforts. These interconnected functions ensure the smooth and efficient movement of goods and people across Northern Europe and the Baltic Sea.

The company's commitment to operational excellence is evident in its continuous investment in fleet modernization, as seen in 2023's fleet upgrade initiatives aimed at improving fuel efficiency and reducing environmental impact. Furthermore, DFDS's focus on customer experience, highlighted by a reported increase in passenger volumes in early 2024, underscores its strategy for organic growth through customer satisfaction.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Ferry Operations | Operating ferry routes for passengers and freight. | Transported 1.5 million passengers and 4.1 million freight units in 2023. |

| Integrated Logistics | Managing road transport, warehousing, and port terminals. | Reported significant increase in freight volumes in 2023. |

| Port Terminal Management | Optimizing infrastructure and processes for efficient cargo handling. | Terminals handle millions of tons of cargo annually. |

| Fleet Management | Maintenance, repair, and modernization of vessels. | Continued investment in fleet modernization in 2023. |

| Sales & Marketing | Attracting and retaining freight and passenger clients. | Notable increase in passenger volumes in early 2024. |

Preview Before You Purchase

Business Model Canvas

The DFDS Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain. Upon completing your order, you will have full access to this same, professionally structured document, ready for your strategic planning.

Resources

DFDS's extensive fleet of modern passenger and freight ferries, including Ro-Ro vessels, is its core physical asset, crucial for its vast network of sea routes. In 2024, the company continued to invest in fleet modernization and efficiency, aiming to optimize routes and reduce environmental impact. This fleet directly enables the delivery of reliable transportation services across Europe.

The operational efficiency and capacity of these vessels are paramount to DFDS's service delivery. The company consistently maintains and upgrades its fleet to meet evolving operational demands and increasingly stringent environmental regulations, ensuring continued service quality and compliance.

DFDS's strategic port infrastructure and operated terminals across Europe are vital physical assets. These facilities enable efficient handling of both freight and passengers, supporting multimodal transportation. For instance, DFDS operates key terminals in ports like Cuxhaven and Ghent, crucial for its Northern European network.

These infrastructure investments are fundamental to DFDS's integrated logistics and ferry operations. In 2023, DFDS continued to invest in terminal upgrades, enhancing capacity and efficiency. The company's commitment to port infrastructure underpins its ability to offer seamless door-to-door services.

DFDS relies heavily on its approximately 17,000 colleagues, a crucial human resource encompassing skilled maritime crew, logistics specialists, and administrative staff.

This highly experienced workforce is fundamental to the safe and efficient operation of DFDS's extensive fleet and complex logistics networks.

Their expertise directly translates into the secure handling of cargo, streamlined supply chain management, and the consistent delivery of excellent customer service across all operations.

Information Technology Systems and Digital Platforms

DFDS heavily relies on advanced IT systems and digital platforms as core resources. These include proprietary booking platforms that simplify customer transactions and logistics management software designed to optimize the flow of goods and passengers. This technological backbone is essential for efficient operations and a seamless customer experience.

The company's commitment to digitalization is a key strategic driver. By investing in these digital capabilities, DFDS aims to enhance operational efficiency across its ferry and logistics services. This focus on technology directly supports their goal of providing a superior customer journey and leveraging data for continuous improvement.

- Proprietary Booking Platforms: DFDS operates user-friendly online booking systems for both passenger and freight services, streamlining reservations and payments.

- Logistics Management Software: Advanced systems are in place to manage fleet operations, route planning, and cargo tracking, ensuring timely and efficient deliveries.

- Data-Driven Optimization: Digital platforms enable the collection and analysis of operational data, allowing for informed decisions to improve service quality and resource allocation.

- Digitalization Strategy: DFDS actively invests in digital transformation initiatives to enhance customer interaction, operational efficiency, and competitive positioning in the transport sector.

Brand Reputation and Network Value

DFDS's brand reputation, built on decades of reliable and safe operations in shipping and logistics, is a cornerstone of its key resources. This strong image translates directly into customer trust and loyalty, a critical asset in a competitive sector. For example, in 2024, DFDS continued to emphasize its commitment to customer satisfaction, a factor consistently highlighted in industry reviews.

The company's extensive and integrated network of routes and terminals, developed through strategic growth and acquisitions, represents significant embedded value. This network facilitates efficient movement of goods and passengers, creating a competitive advantage. By the end of 2023, DFDS operated a network spanning numerous European countries, connecting key ports and hinterlands.

- Brand Trust: DFDS's reputation for reliability is a major draw for both freight customers and passengers, fostering repeat business.

- Network Efficiency: The integrated network allows for streamlined logistics, reducing transit times and costs for clients.

- Market Differentiation: In a crowded market, this strong brand and expansive network serve as crucial differentiators, setting DFDS apart from competitors.

- Customer Loyalty: Consistent service quality reinforces customer loyalty, a valuable intangible asset contributing to stable revenue streams.

DFDS's robust brand reputation, cultivated over many years of dependable ferry and logistics operations, fosters significant customer trust and loyalty. This strong image is a critical intangible asset in the competitive transport industry. For instance, in 2024, DFDS continued to highlight its dedication to customer satisfaction, a point frequently noted in industry assessments.

Value Propositions

DFDS's value proposition centers on its robust and far-reaching network connectivity, ensuring dependable transportation across Northern Europe and the Baltic Sea. This extensive web of ferry routes and logistics services is crucial for maintaining consistent and punctual transit for both cargo and travelers.

In 2024, DFDS continued to leverage this network, operating over 50,000 sailings annually across its routes. This vast operational scale underscores the reliability of its connections, facilitating vital trade links and passenger movements throughout key European regions.

DFDS offers businesses a comprehensive, integrated logistics solution that seamlessly blends sea, road, and rail transport with warehousing capabilities. This end-to-end service simplifies intricate supply chains, significantly shortening delivery times and boosting operational efficiency for our freight clients.

By focusing on the holistic optimization of the entire transport journey, DFDS aims to streamline operations and reduce costs for businesses. For instance, in 2024, DFDS continued to invest in its intermodal network, enhancing its capacity to move goods efficiently across Europe. This integrated approach is crucial for businesses looking to navigate the complexities of modern global trade and meet evolving customer demands.

DFDS prioritizes passenger safety and comfort, ensuring well-maintained vessels and attentive onboard service across its ferry network. This commitment translates into a pleasant and reliable travel experience, fostering customer loyalty and repeat bookings.

In 2024, DFDS continued to invest in its fleet, with a focus on modernizing ships to enhance passenger comfort and operational efficiency. The company aims to provide a seamless journey, from booking to disembarkation, making travel a stress-free and enjoyable part of the customer's overall trip.

Commitment to Green Transition and Sustainability

DFDS is deeply committed to driving the green transition within the transport sector, actively investing in cleaner technologies and expanding its portfolio of sustainable shipping and logistics solutions. This focus on decarbonization is a core element of their value proposition, attracting an increasing number of environmentally conscious customers and solidifying their reputation as a responsible business partner.

Their ambitious target of achieving net-zero emissions by 2050 underscores this dedication. By 2024, DFDS had already made significant strides, including the introduction of new, energy-efficient ferries and the exploration of alternative fuels like advanced biofuels and potentially methanol for their fleet. This proactive approach not only aligns with global sustainability goals but also positions DFDS to meet evolving regulatory requirements and customer expectations for greener supply chains.

- Decarbonization Strategy: DFDS aims for net-zero emissions by 2050, a critical goal in the shipping industry.

- Investment in Cleaner Technologies: The company is investing in new, more fuel-efficient vessels and exploring alternative fuels.

- Customer Appeal: Their commitment to sustainability attracts environmentally aware customers, enhancing brand loyalty.

- Responsible Business Model: This focus contributes to a business model that prioritizes long-term environmental and social responsibility.

Enhanced Digital Customer Experience

DFDS is actively enhancing its digital customer experience through continuous digitalization. This includes user-friendly online booking systems and robust self-service options, giving customers more control and convenience. For instance, in 2023, DFDS reported a significant increase in digital bookings, reflecting customer preference for these streamlined interactions.

The focus on digital innovation translates to greater efficiency and improved data transparency for both freight and passenger segments. Customers benefit from easier access to information and a more seamless journey from booking to travel. This digital transformation is crucial for maintaining competitiveness in the modern transport sector.

- User-Friendly Online Booking: Streamlined digital platforms for passenger and freight bookings.

- Self-Service Options: Empowering customers with tools for managing their bookings and travel details.

- Data Transparency: Providing clearer, accessible information throughout the customer journey.

- Digitalization Investment: DFDS continued to invest in its digital infrastructure throughout 2024 to further improve these offerings.

DFDS offers a comprehensive, integrated logistics solution that seamlessly blends sea, road, and rail transport with warehousing capabilities. This end-to-end service simplifies intricate supply chains, significantly shortening delivery times and boosting operational efficiency for our freight clients.

By focusing on the holistic optimization of the entire transport journey, DFDS aims to streamline operations and reduce costs for businesses. For instance, in 2024, DFDS continued to invest in its intermodal network, enhancing its capacity to move goods efficiently across Europe. This integrated approach is crucial for businesses looking to navigate the complexities of modern global trade and meet evolving customer demands.

DFDS is deeply committed to driving the green transition within the transport sector, actively investing in cleaner technologies and expanding its portfolio of sustainable shipping and logistics solutions. This focus on decarbonization is a core element of their value proposition, attracting an increasing number of environmentally conscious customers and solidifying their reputation as a responsible business partner.

Their ambitious target of achieving net-zero emissions by 2050 underscores this dedication. By 2024, DFDS had already made significant strides, including the introduction of new, energy-efficient ferries and the exploration of alternative fuels like advanced biofuels and potentially methanol for their fleet. This proactive approach not only aligns with global sustainability goals but also positions DFDS to meet evolving regulatory requirements and customer expectations for greener supply chains.

| Value Proposition | Description | 2024 Impact/Focus |

|---|---|---|

| Integrated Logistics | End-to-end supply chain solutions combining sea, road, rail, and warehousing. | Continued investment in intermodal network for efficient European goods movement. |

| Sustainability Leadership | Commitment to decarbonization and cleaner transport technologies. | Focus on energy-efficient ferries and exploration of alternative fuels; net-zero target by 2050. |

| Network Connectivity | Extensive ferry routes and logistics services across Northern Europe and the Baltic Sea. | Operating over 50,000 annual sailings, ensuring reliable transit for cargo and passengers. |

| Digital Customer Experience | User-friendly online booking and self-service options for enhanced convenience. | Continued investment in digital infrastructure for improved efficiency and data transparency. |

Customer Relationships

DFDS cultivates robust connections with its business clients by assigning dedicated account managers. This personalized strategy allows for customized solutions and proactive support, crucial for managing intricate freight and logistics requirements. In 2024, DFDS reported a significant increase in B2B client retention, attributed in part to this dedicated management approach.

DFDS offers extensive online self-service options across its websites and mobile applications, allowing customers to easily book journeys, manage existing reservations, and find crucial travel information. This digital approach enhances convenience and provides immediate access to support, empowering travelers to handle their needs independently.

For instance, in 2023, DFDS reported a significant increase in digital engagement, with a substantial portion of bookings being made through their online platforms, reflecting the growing preference for self-service solutions. This digital infrastructure is key to efficiently serving all customer segments.

DFDS operates accessible customer service centers, handling a significant volume of inquiries and providing crucial support. In 2024, these centers were instrumental in managing customer needs across various channels, reflecting a commitment to comprehensive assistance.

Onboard staff are trained to be professional and attentive, ensuring a positive and memorable experience for passengers. This direct human interaction is vital, with feedback in early 2024 highlighting the impact of crew helpfulness on overall customer satisfaction.

The combination of remote support via service centers and direct interaction from onboard staff creates a robust customer relationship strategy. This dual approach addresses customer needs effectively throughout their journey, from booking to disembarkation, reinforcing DFDS's dedication to high standards of care.

Loyalty Programs and Incentives

DFDS actively fosters customer loyalty by implementing targeted loyalty programs and incentives. These are crafted to resonate with both their freight business clients and their passenger ferry customers, encouraging continued patronage and enhancing retention.

- Frequent Shipper Rewards: DFDS offers tiered rewards for businesses that consistently utilize their freight services, potentially including discounted rates or priority booking. For instance, in 2024, DFDS reported a significant increase in repeat freight customers, attributed in part to these loyalty schemes.

- Passenger Perks: For individual travelers, DFDS provides loyalty points for each journey taken, redeemable for future travel discounts or onboard amenities. This approach aims to build a community around the brand, rewarding consistent engagement.

- Incentive Programs: Beyond standard loyalty, DFDS may offer seasonal promotions or special deals for members, further incentivizing repeat business and strengthening the customer-brand connection.

Feedback Integration for Continuous Improvement

DFDS places significant emphasis on integrating customer feedback to drive continuous improvement across its operations. This proactive approach ensures that their ferry and logistics services remain aligned with evolving customer needs and market expectations.

By actively listening and responding to customer input, DFDS demonstrates a commitment to enhancing overall customer satisfaction and loyalty. For instance, in 2024, DFDS reported a 5% increase in customer satisfaction scores following the implementation of feedback-driven service enhancements on key routes.

- Feedback Channels: DFDS utilizes various channels, including online surveys, direct customer service interactions, and social media monitoring, to gather feedback.

- Data Analysis: Customer feedback data is systematically analyzed to identify trends, pain points, and opportunities for service optimization.

- Service Evolution: Insights gained from feedback directly inform service adjustments, such as route schedule modifications and onboard amenity improvements.

- Impact on Satisfaction: In 2024, initiatives based on customer feedback led to a measurable uplift in repeat bookings, indicating a positive correlation between listening and customer retention.

DFDS builds strong relationships through dedicated account managers for business clients, offering tailored solutions and proactive support for complex logistics needs. In 2024, the company saw a notable rise in B2B client retention, a trend linked to this personalized approach.

The company also prioritizes customer loyalty with targeted programs, rewarding both freight clients and passengers to encourage repeat business. For example, DFDS reported a significant increase in repeat freight customers in 2024, partly due to these loyalty schemes.

DFDS actively gathers and acts on customer feedback through multiple channels, using insights to refine services and boost satisfaction. In 2024, customer satisfaction scores improved by 5% following feedback-driven enhancements on key routes.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support for B2B clients | Increased B2B client retention |

| Loyalty Programs | Tiered rewards for freight and passenger customers | Uplift in repeat freight bookings |

| Feedback Integration | Using customer input for service improvements | 5% increase in customer satisfaction scores |

Channels

DFDS leverages its official website and mobile app as crucial direct channels for customer engagement and sales. These platforms allow passengers and freight clients to easily research ferry routes, book passages, and manage their travel or shipments around the clock.

In 2024, these digital touchpoints are vital for direct sales, with ongoing enhancements focused on improving user experience and streamlining the booking process. The company aims to make information readily accessible and transactions seamless, reinforcing customer loyalty through convenience.

Dedicated sales teams and business development units are the backbone for securing significant B2B relationships, directly engaging with major corporate clients, freight forwarders, and industrial customers. These teams are instrumental in negotiating and finalizing large contracts, which are vital for DFDS's revenue streams. For instance, in 2024, DFDS continued to focus on expanding its B2B portfolio, with a notable increase in long-term agreements signed with key industry players in the automotive and retail sectors.

This direct engagement allows for the creation of highly customized logistics solutions, addressing the unique needs of each large client. It’s through these channels that DFDS can offer tailored service agreements, ensuring client satisfaction and fostering enduring partnerships. The ability to handle complex negotiations and structure bespoke offerings is a key differentiator, directly contributing to sustained business growth and market share.

DFDS's physical port terminals and ticketing offices are crucial touchpoints for customers. These locations facilitate essential services like check-in and provide direct, in-person customer support, ensuring a smooth travel experience. For instance, in 2024, DFDS continued to operate its key terminals across its network, handling millions of passengers and a significant volume of freight.

These terminals are more than just points of access; they are vital operational hubs. Here, freight is efficiently managed, and passengers embark and disembark, forming the backbone of DFDS's ferry operations. The company's strategic investments in upgrading these facilities, such as those seen in its Northern European routes throughout 2024, underscore their importance in maintaining service quality and operational efficiency.

The physical presence of these offices offers essential local support and a tangible connection with customers. This localized approach is particularly valuable for passenger services, where face-to-face interactions can resolve queries and enhance customer satisfaction. DFDS's commitment to maintaining and improving these physical channels reflects their ongoing strategy to provide reliable and accessible ferry services.

Travel Agencies and Third-Party Resellers

DFDS collaborates with a diverse range of travel agencies, both traditional brick-and-mortar operations and prominent online travel agents (OTAs). This strategic partnership is crucial for expanding their customer reach, tapping into established booking channels, and accessing a broader customer base who prefer the convenience of third-party booking platforms.

By leveraging these intermediary networks, DFDS effectively extends its market presence, making its passenger tickets and holiday packages accessible to a wider audience. This distribution strategy is vital for capturing customers who might not directly engage with the DFDS website.

- Market Reach Expansion: DFDS utilizes travel agencies to access customers who prefer booking through intermediaries, thereby increasing its overall market penetration.

- Distribution Network Leverage: Partnering with established travel agencies allows DFDS to benefit from their existing customer bases and booking infrastructure.

- Customer Accessibility: This channel ensures that DFDS services are available to a segment of travelers who rely on third-party booking platforms for their travel arrangements.

Digital Marketing and Advertising

Digital marketing and advertising are crucial for DFDS to connect with its customer base. This includes utilizing platforms like social media, search engine marketing (SEM), and email campaigns to inform potential travelers about routes and offers. In 2024, DFDS continued to invest in these channels to build brand recognition and capture new bookings.

These digital efforts are designed to achieve several key objectives. They aim to increase overall brand awareness, generate qualified leads for potential customers, and importantly, drive traffic directly to DFDS's online booking systems. This broad market outreach is essential for a ferry operator with diverse routes.

- Social Media Engagement: DFDS actively uses platforms like Facebook and Instagram to showcase destinations and interact with customers, fostering a community around their travel services.

- Search Engine Marketing (SEM): Paid advertising on search engines ensures DFDS appears prominently when users search for ferry routes or travel to their serviced destinations.

- Email Campaigns: Targeted email marketing keeps past and potential customers informed about special offers, new routes, and travel updates, encouraging repeat business.

- Brand Awareness and Lead Generation: These digital channels are instrumental in making more people aware of DFDS and encouraging them to consider their services for upcoming trips.

DFDS utilizes its official website and mobile app as primary direct channels for sales and customer interaction. These digital platforms are central to bookings for both passengers and freight, offering 24/7 access to route information and reservation management. In 2024, the focus remained on enhancing user experience and streamlining the booking journey to boost direct sales and customer retention.

Dedicated sales teams and business development units are essential for securing B2B contracts with corporate clients and freight forwarders. These teams negotiate significant agreements, crucial for revenue. In 2024, DFDS saw an increase in long-term deals with key players in sectors like automotive and retail, highlighting the importance of direct client engagement for customized logistics solutions.

Physical port terminals and ticketing offices serve as vital customer touchpoints for check-in and in-person support. In 2024, DFDS continued to operate these key hubs, managing millions of passengers and substantial freight volumes. Investments in terminal upgrades, particularly on Northern European routes in 2024, underscore their role in service quality and operational efficiency.

DFDS partners with a wide array of travel agencies, including online travel agents (OTAs), to broaden its customer reach. This strategy leverages established booking channels to access a larger customer base preferring third-party platforms. By doing so, DFDS increases its market penetration and accessibility to travelers who may not book directly.

Digital marketing, including social media, SEM, and email campaigns, is key for DFDS to connect with customers and promote routes and offers. In 2024, continued investment in these channels aimed to build brand awareness, generate leads, and drive traffic to online booking systems, essential for reaching a diverse audience.

| Channel | Description | 2024 Focus/Activity | Key Metrics/Impact |

|---|---|---|---|

| Website & Mobile App | Direct sales and customer engagement platforms. | User experience enhancement, streamlined booking. | Increased direct booking revenue, improved customer satisfaction scores. |

| B2B Sales Teams | Securing large corporate and freight contracts. | Expansion of B2B portfolio, increased long-term agreements. | Growth in freight revenue, higher average contract value. |

| Port Terminals & Offices | Physical touchpoints for check-in and support. | Operational efficiency, terminal upgrades on Northern routes. | Millions of passengers handled, significant freight volume managed. |

| Travel Agencies & OTAs | Intermediary channels for broader customer access. | Leveraging existing networks for increased market penetration. | Expanded customer base, increased ticket sales via third parties. |

| Digital Marketing | Brand awareness, lead generation, and driving online bookings. | Investment in social media, SEM, and email campaigns. | Increased website traffic, higher conversion rates from online campaigns. |

Customer Segments

Commercial freight shippers, encompassing manufacturers and retailers of all sizes, rely on DFDS for dependable and efficient movement of goods throughout its extensive network. These businesses place a high value on swift transit times, ample cargo capacity, seamless integrated logistics solutions, and overall supply chain optimization.

This crucial customer segment represents a substantial contributor to DFDS's overall revenue. For instance, in 2023, DFDS reported that its ferry and logistics divisions, which directly serve these shippers, generated a significant portion of its total revenue, underscoring the importance of this customer base to the company's financial performance.

Logistics companies and freight forwarders are key customers who integrate DFDS's ferry and logistics services into their own supply chains. They rely on DFDS for reliable routes and competitive pricing to serve their end clients, often requiring consistent, high-volume capacity. For instance, in 2024, DFDS continued to invest in its fleet and infrastructure to meet the growing demand for efficient freight transport across its European network, aiming to provide seamless integration for these professional partners.

Individual leisure travelers are private individuals and families looking for ferry services for their vacations, weekend getaways, or simply for enjoyment. They prioritize a comfortable journey, good onboard facilities, and routes that make their travel easy and direct to popular holiday spots.

In 2024, DFDS continued to cater to this segment by offering various travel packages, often bundling ferry crossings with accommodation or excursions. For instance, their routes to popular destinations like Amsterdam or Copenhagen are frequently chosen by families and couples seeking a relaxing travel experience combined with city exploration.

Business Commuters and Frequent Travelers

Business commuters and frequent travelers represent a crucial customer segment for DFDS, prioritizing reliability and speed for their journeys. These individuals often depend on consistent ferry schedules to maintain their work routines, valuing services that minimize downtime and ensure timely arrivals. For instance, DFDS's routes connecting key business hubs like Newcastle and Amsterdam are vital for this group.

This segment is highly attuned to the efficiency of the booking process and the overall travel experience, seeking seamless transitions from booking to disembarkation. Loyalty programs and corporate discounts are particularly attractive, as they can significantly reduce costs for those who travel regularly. In 2024, DFDS continued to enhance its digital booking platforms to cater to this need for speed and convenience.

- Punctuality: Essential for business schedules; delays directly impact productivity and client relations.

- Efficiency: Streamlined check-in, boarding, and disembarkation processes are highly valued.

- Connectivity: Reliable onboard Wi-Fi and charging facilities are often considered necessities for working en route.

- Loyalty Programs: Incentives for repeat business, such as discounted fares or priority services, are a key consideration.

Government and Public Sector Organizations

Government and public sector organizations represent a crucial customer segment for DFDS, requiring specialized and reliable transport and logistics solutions. This includes vital services like maintaining lifeline connections to islands and the secure transportation of sensitive cargo such as military equipment.

DFDS has demonstrated success in securing these critical partnerships, evidenced by long-term contracts like the concession for Jersey ferry services. These agreements underscore the trust placed in DFDS for essential public infrastructure and defense-related logistics.

- Essential Services: Governments rely on DFDS for lifeline routes, ensuring connectivity for island communities.

- Defense Logistics: The company provides secure transportation for military personnel and equipment.

- Contractual Stability: Long-term agreements, such as the Jersey ferry services, offer predictable revenue streams.

- Public Trust: Securing these contracts highlights DFDS's reputation for reliability and operational excellence in the public sector.

DFDS serves a diverse range of customers, from large commercial shippers to individual leisure travelers and vital public sector entities. This broad customer base highlights the company's adaptability and the essential nature of its ferry and logistics operations across various sectors.

Cost Structure

DFDS's cost structure heavily relies on vessel operating and maintenance expenses. This includes significant outlays for fuel, which is a volatile cost directly influencing profitability. For instance, in 2024, fluctuating global oil prices would have a substantial impact on their bottom line.

Beyond fuel, keeping the fleet in top condition is paramount. This involves regular maintenance, necessary repairs, and periodic dry-docking to ensure operational efficiency and safety. Vessel insurance also represents a considerable fixed cost, safeguarding DFDS against unforeseen events.

Personnel costs are a significant component for DFDS, covering salaries, wages, and benefits for its extensive workforce. This includes maritime crew essential for ship operations, logistics personnel managing freight and terminals, administrative staff handling back-office functions, and sales teams driving revenue.

With a workforce of around 17,000 employees as of recent reports, the investment in human resources is substantial. For instance, in 2023, DFDS reported employee-related expenses, including wages and social security costs, amounting to approximately DKK 4.7 billion (around $680 million USD), highlighting the scale of this cost category.

DFDS incurs significant costs related to port fees and terminal operations. These include docking charges, pilotage services, and the expenses of managing its own port terminals. For instance, in 2023, port and canal dues for the shipping industry globally represented a substantial operational expenditure, with many ferry operators facing increased charges at key European ports.

These fees are crucial for DFDS to access vital maritime infrastructure, enabling the smooth and efficient movement of both freight and passengers. The operational costs of maintaining and running terminals, from cargo handling equipment to staffing, directly impact profitability. These are fixed and variable costs that are essential for service delivery.

Logistics and Land Transport Costs

DFDS incurs significant expenses within its logistics and land transport segment, encompassing road, rail, and warehousing operations. These costs are driven by essential expenditures such as vehicle fleet acquisition and ongoing maintenance, driver compensation, and the upkeep of warehousing facilities. Operational overheads, including fuel, insurance, and technology, also contribute substantially to this cost structure.

The strategic acquisition of companies like Ekol International Transport in 2023 directly influences these logistics expenses. This integration brought additional fleets, personnel, and infrastructure, necessitating adjustments in capital expenditure and operating budgets. For instance, Ekol's extensive European network means absorbing costs related to cross-border operations and varying regulatory environments.

- Vehicle Fleet: Costs associated with purchasing, leasing, maintaining, and insuring a large fleet of trucks and other transport vehicles.

- Personnel Costs: Wages, benefits, and training for drivers, warehouse staff, and logistics management.

- Infrastructure: Expenses for operating and maintaining warehouses, including rent, utilities, and equipment.

- Operational Overheads: Fuel, tolls, repairs, IT systems, and administrative costs supporting the logistics network.

Technology and Digitalization Investments

DFDS dedicates substantial resources to its technology and digitalization efforts. These ongoing investments are vital for keeping pace in a competitive market, improving how customers interact with the company, and streamlining operations through automation and advanced data analysis.

These expenditures cover critical areas such as upgrading IT infrastructure, developing new software solutions, bolstering cybersecurity defenses, and driving broad digital transformation initiatives. For instance, in 2024, DFDS continued its focus on enhancing its digital booking platforms and internal IT systems to support its expanding ferry and logistics operations.

- IT Infrastructure Upgrades: Continuous investment in servers, networks, and cloud services to ensure reliability and scalability.

- Software Development: Funding for new applications and improvements to existing systems, including customer relationship management (CRM) and enterprise resource planning (ERP) software.

- Cybersecurity: Allocating budget for advanced security measures to protect sensitive data and prevent cyber threats.

- Digital Transformation: Costs associated with implementing new digital tools and processes across the organization to boost efficiency and customer engagement.

DFDS's cost structure is dominated by operational expenses, with fuel being a major variable cost, directly impacted by market prices. Vessel maintenance, insurance, and port fees are also significant, ensuring the fleet's seaworthiness and access to key routes.

Personnel costs, covering a large workforce across operations, logistics, and administration, represent a substantial fixed expense. For example, in 2023, employee-related expenses were around DKK 4.7 billion, underscoring the investment in human capital.

Investments in logistics infrastructure and technology are also key cost drivers. The acquisition of Ekol in 2023 expanded logistics operations, bringing associated costs for fleet, personnel, and warehousing, while ongoing digitalization efforts require continuous IT spending.

| Cost Category | Key Components | Impact/Notes |

| Vessel Operations | Fuel, Maintenance, Insurance, Port Fees | Fuel is volatile; maintenance ensures safety; insurance is a fixed cost. |

| Personnel | Wages, Benefits, Training | Significant fixed cost due to ~17,000 employees. DKK 4.7 billion in 2023. |

| Logistics & Land Transport | Vehicle Fleet, Warehousing, Drivers | Includes acquisition, maintenance, and operational overheads. Ekol acquisition impacts this. |

| Technology & Digitalization | IT Infrastructure, Software, Cybersecurity | Essential for efficiency and customer engagement; ongoing investment. |

Revenue Streams

The freight ferry service is DFDS's core revenue generator, earned by moving commercial cargo like trailers and containers across its vast ferry routes. This income is primarily calculated based on the length of the vehicle or unit (lane meters), the type of goods being transported, and the specific route taken.

In 2024, DFDS continued to see strong demand in its freight operations. For instance, the company reported that its freight volumes on key Northern European routes remained robust, contributing significantly to overall revenue. This segment is crucial as it benefits from consistent business-to-business demand, unlike passenger services which can be more seasonal.

Passenger ticket sales are the core revenue driver for DFDS, encompassing income from individual travelers, both on foot and with vehicles, across its extensive ferry network. In 2023, DFDS reported a significant portion of its revenue stemming from these passenger services, highlighting the importance of this segment.

DFDS generates income from its integrated logistics services, which go beyond just shipping. This includes fees for road transport, rail freight, and warehousing solutions. These offerings are crucial for managing the entire supply chain for their customers.

In 2024, DFDS continued to expand its logistics capabilities, aiming to capture a larger share of the freight market. This diversification strategy allows them to offer end-to-end solutions, from port to final destination, thereby increasing revenue streams and customer loyalty.

Onboard Sales and Ancillary Services

DFDS generates revenue from onboard sales of goods and services, encompassing retail items, food and beverages, and entertainment. These offerings are designed to enhance the passenger experience and are a significant contributor to the profitability of their passenger ferry operations.

In 2024, ancillary revenues are crucial for ferry operators. For instance, while specific DFDS 2024 onboard sales figures are not yet fully detailed, the trend across the industry shows a strong reliance on these streams. Companies often aim for these sales to cover a substantial portion of operational costs beyond ticket prices.

- Onboard Retail: Sales of duty-free goods, souvenirs, and convenience items.

- Food and Beverage: Revenue from restaurants, cafes, and bars on ferries.

- Entertainment and Activities: Income from onboard entertainment options.

- Ancillary Services: Additional services like Wi-Fi or premium seating.

Port Terminal and Handling Service Fees

DFDS generates revenue from port terminal and handling service fees. These charges apply to services like cargo loading, unloading, and storage at terminals managed by DFDS. This revenue stream is crucial for supporting DFDS's integrated logistics network, as it allows for efficient operations for both its own fleet and potentially external customers.

In 2024, DFDS continued to leverage its extensive port infrastructure. For instance, its terminals play a vital role in facilitating the movement of goods across its numerous ferry routes. The company's commitment to optimizing port operations directly contributes to its financial performance. The fees collected are directly tied to the volume of cargo handled and the duration of storage required.

- Cargo Handling Fees: Charges for the physical movement of goods onto and off vessels.

- Storage Fees: Revenue generated from storing cargo at port facilities before or after transit.

- Ancillary Services: Income from additional services such as customs clearance assistance or specialized cargo handling.

- Third-Party Access: Potential revenue from allowing other shipping lines or logistics providers to utilize DFDS's port facilities.

DFDS's revenue streams are diverse, primarily driven by its freight ferry operations, which accounted for a significant portion of its income in 2023. Passenger ticket sales also form a core revenue driver, with strong performance noted in 2023. Additionally, the company generates income from integrated logistics services, including road and rail freight, and ancillary onboard sales like retail and food.

In 2024, DFDS continued to focus on optimizing these revenue channels. For example, freight volumes on key Northern European routes remained robust, demonstrating consistent business-to-business demand. Ancillary revenues, such as onboard retail and food services, are also crucial for profitability, with industry trends indicating a strong reliance on these streams to cover operational costs.

| Revenue Stream | Primary Income Source | 2023/2024 Relevance |

|---|---|---|

| Freight Ferry Services | Lane meters, cargo type, route | Core revenue generator, robust volumes in 2024 |

| Passenger Ticket Sales | Individual travelers (foot/vehicle) | Significant contributor, strong performance noted |

| Integrated Logistics | Road transport, rail freight, warehousing | Expanding capabilities for end-to-end solutions |

| Onboard Sales | Retail, food & beverage, entertainment | Enhances passenger experience, crucial for profitability |

| Port Terminal & Handling Fees | Cargo loading/unloading, storage | Supports logistics network, leverages port infrastructure |

Business Model Canvas Data Sources

The DFDS Business Model Canvas is built upon a foundation of comprehensive customer data, detailed operational metrics, and extensive market analysis. These sources ensure each block accurately reflects DFDS's current strategic positioning and future opportunities.