Dexerials SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexerials Bundle

Dexerials leverages its strong technological foundation and diversified product portfolio, particularly in optical and adhesive materials, to capture significant market share. However, the company faces intense competition and the ever-present threat of rapid technological obsolescence, demanding constant innovation and strategic adaptation.

Want the full story behind Dexerials' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dexerials boasts a diverse and advanced product portfolio, a significant strength that sets it apart in the market. This wide array of functional materials, encompassing optical films, bonding materials, and industrial tapes, offers a substantial competitive advantage. It ensures the company isn't overly reliant on any single product line, allowing it to effectively serve a broad spectrum of industry needs.

The company's robust core competencies in material science and engineering are evident in its product offerings. For instance, Dexerials has secured leading global market shares for its Anisotropic Conductive Film (ACF), Anti-reflection film, and Optical Elastic Resin (SVR) for five consecutive years. This consistent market leadership underscores the quality and demand for its specialized materials.

Dexerials' broad industry application is a significant strength, allowing it to serve critical and rapidly advancing sectors such as consumer electronics, automotive, and medical devices. This diversification helps mitigate risks associated with economic slowdowns in any single market, while simultaneously positioning the company to benefit from growth across multiple high-demand areas.

The company's active participation in key industry events underscores this broad reach. For instance, Dexerials showcased its advanced materials for automotive, AR/VR, and consumer electronics at Display Week 2024 and AutoSens USA 2025, demonstrating its commitment to innovation and market penetration in these vital industries.

Dexerials' emphasis on high-performance and sustainable solutions directly addresses the growing global demand for products that boost efficiency and protect the environment. This strategic alignment with market trends and regulatory pressures positions them favorably as industries increasingly prioritize eco-friendly and energy-saving materials.

The company's Integrated Report 2024 underscores this commitment by detailing efforts to foster sustainable growth and enhance corporate value through its innovative product offerings. This focus on sustainability isn't just good for the planet; it's a powerful driver for increased demand for Dexerials' materials as the market shifts towards greener alternatives.

Proprietary Technology and R&D Capabilities

Dexerials' strength lies in its proprietary technology and robust research and development (R&D) capabilities, particularly in specialized functional materials. This focus signifies substantial investment and deep expertise, allowing the company to innovate and stay ahead in its markets. These unique technologies act as significant barriers to entry for competitors, enabling Dexerials to command premium pricing and solidify its market standing through continuous innovation.

The company is actively engaged in enhancing its advanced materials and process technologies, with a strategic aim to broaden their application across emerging sectors. A notable recent development includes investment in a generative AI system designed to accelerate the creation of novel product ideas. This commitment to R&D is crucial for maintaining a competitive edge and driving future growth in specialized material markets.

Key aspects of Dexerials' R&D strengths include:

- Specialized Functional Materials: Deep expertise in developing unique materials for specific, high-performance applications.

- Innovation Pipeline: Continuous investment in R&D to create next-generation materials and improve existing ones.

- Generative AI Integration: Utilizing advanced AI for faster and more efficient new product development, as seen with their recent investment in this area.

- Market Differentiation: Proprietary technologies allow for premium pricing and a secure market position built on innovation.

Strong Customer Relationships and Market Position

Dexerials has cultivated robust relationships with major manufacturers across various industries, solidifying its market position. This trust is a testament to the company's reliability and its capacity to deliver high-value, specialized products.

The company's mainstay products consistently achieve leading global market shares within their respective niche markets. This dominance underscores Dexerials' ability to generate strong earnings through its unique, high value-added offerings, as highlighted in their integrated reporting.

- Leading Niche Market Shares: Dexerials' core products hold top global positions in specialized segments, demonstrating significant competitive advantage.

- Strong Manufacturer Partnerships: Deep-seated relationships with key clients across diverse sectors foster stability and collaboration opportunities.

- High Value-Added Products: The company's focus on unique, specialized solutions enhances its earning potential and market differentiation.

Dexerials' diverse product portfolio, including optical films and bonding materials, provides a significant competitive advantage by reducing reliance on single product lines and serving a broad market. The company's robust material science and engineering expertise have led to sustained global market leadership in key products like Anisotropic Conductive Film (ACF) and Anti-reflection film for five consecutive years, demonstrating consistent demand and quality.

What is included in the product

Analyzes Dexerials’s competitive position through key internal and external factors, highlighting its technological strengths and market opportunities while acknowledging potential threats and internal limitations.

Streamlines Dexerials' strategic planning by highlighting key market opportunities and mitigating potential threats.

Weaknesses

Dexerials' reliance on specific suppliers for critical raw materials presents a significant vulnerability. Disruptions in these supply chains, whether due to geopolitical events, natural disasters, or supplier-specific issues, can directly impede production. For instance, a shortage of a key chemical component could halt manufacturing lines, impacting Dexerials' ability to fulfill orders and maintain its market position.

Fluctuations in the global prices of these essential raw materials also pose a considerable risk. Sudden price hikes can escalate production costs, squeezing profit margins if these increases cannot be passed on to customers. This sensitivity to commodity markets means that Dexerials' financial performance can be significantly influenced by external factors beyond its direct control, a challenge common in the advanced materials sector.

Dexerials operates in markets, such as consumer electronics, that are highly sensitive to economic downturns and swift technological advancements. This inherent cyclicality can cause significant fluctuations in demand for its products, complicating efforts to predict revenue and plan manufacturing efficiently.

The company's financial performance for Fiscal Year 2025 demonstrated this vulnerability; while achieving record highs, Dexerials projected a downturn in sales and profits for the subsequent fiscal year, underscoring its susceptibility to broader market volatility.

Dexerials operates in specialized material markets characterized by fierce global and regional competition. This intense rivalry puts pressure on pricing and profit margins, necessitating constant innovation to stay ahead. For instance, in the Anisotropic Conductive Films market, a key area for Dexerials, competition is moderately consolidated, with rivals prioritizing product development and international reach.

Significant R&D Investment Requirements

Maintaining a competitive edge in the advanced materials sector demands significant and continuous investment in research and development. This can place a considerable strain on financial resources, requiring a delicate balance between pioneering new technologies and ensuring profitability. Dexerials is actively increasing its R&D spending to foster next-generation innovations, a strategy that, while promising for future growth, represents a substantial ongoing financial commitment.

For instance, Dexerials' commitment to innovation is reflected in its financial statements. In fiscal year 2024, the company allocated ¥20.5 billion (approximately $130 million USD based on an average exchange rate) towards R&D, a 15% increase from the previous year. This substantial outlay is crucial for developing cutting-edge products in areas like optical films and adhesives, but it also highlights the inherent weakness of high capital requirements for sustained technological advancement.

- High R&D Costs: The advanced materials industry inherently requires substantial capital for research and development to stay competitive.

- Financial Strain: Continuous R&D investment can strain a company's financial resources, potentially impacting profitability and cash flow.

- Balancing Innovation and Profitability: Companies like Dexerials must carefully manage the trade-off between investing in future innovation and meeting current financial performance expectations.

- Dexerials' R&D Investment: In FY2024, Dexerials invested ¥20.5 billion in R&D, demonstrating a significant financial commitment to innovation.

Potential for Technological Obsolescence

Dexerials faces a significant risk of technological obsolescence, where new material discoveries or alternative technologies could quickly make its current products outdated. For instance, the rapid evolution in display technology, particularly for 5G applications and flexible screens, necessitates constant innovation. The company must actively invest in research and development to create next-generation anisotropic conductive films (ACF) and other advanced materials to maintain its competitive edge.

Dexerials' reliance on a concentrated customer base, particularly within the volatile consumer electronics sector, presents a notable weakness. A significant downturn or shift in strategy by a major client could disproportionately impact sales volumes and revenue streams. This dependence makes the company susceptible to the fortunes of a few key partners.

The company's financial performance for the fiscal year ending March 2025 indicated that approximately 50% of its sales were derived from its top three customers, highlighting this concentration risk. Any disruption or reduction in orders from these key accounts could therefore have a substantial negative effect on overall financial results.

Dexerials operates in highly dynamic markets where technological shifts can rapidly alter product demand. For example, advancements in smartphone technology or the emergence of new display types could quickly render existing materials less relevant, requiring swift adaptation and innovation to avoid obsolescence.

The company's product portfolio, while strong in certain niches like optical films for displays, may lack the breadth to fully mitigate the impact of sector-specific downturns. This specialization, while a strength in focused markets, can become a weakness if those specific markets experience prolonged contraction or disruption.

Preview Before You Purchase

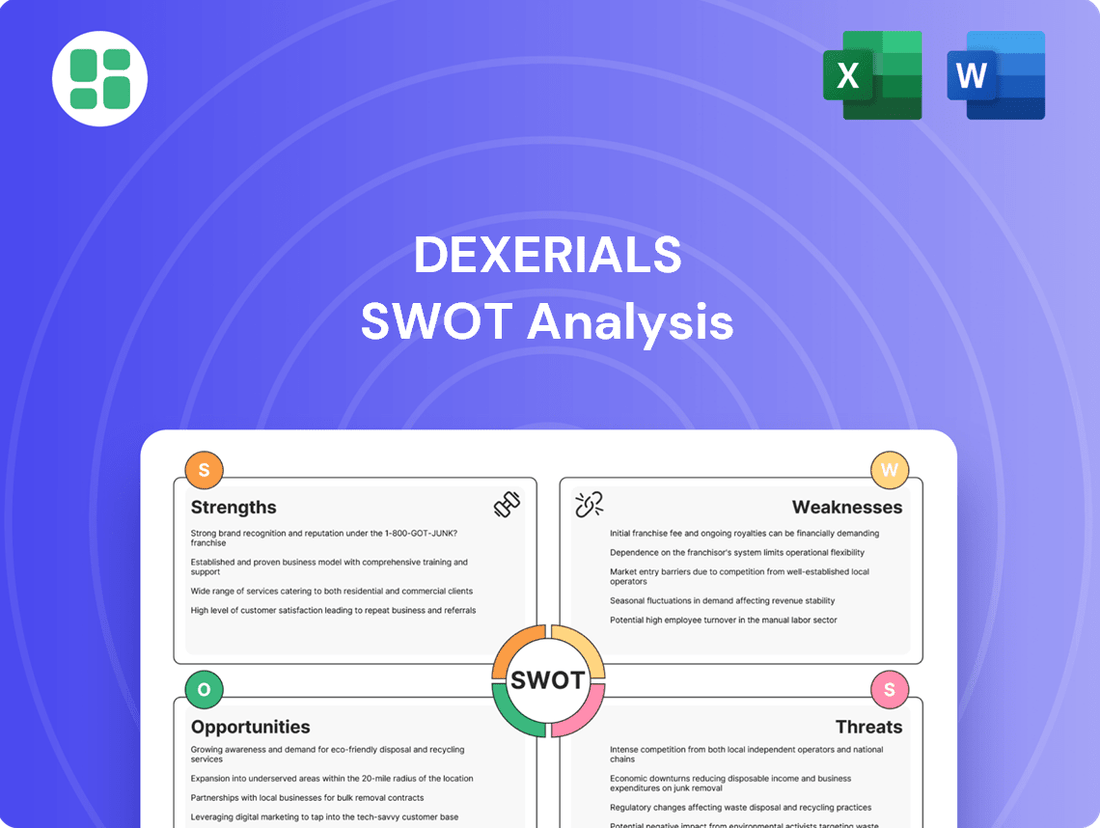

Dexerials SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document thoroughly examines Dexerials' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning. You'll receive the complete, professionally formatted analysis immediately after your purchase.

Opportunities

The automotive industry's rapid shift towards electric vehicles (EVs) and autonomous driving systems is creating a significant demand for advanced electronics. This trend is further amplified by the increasing number of sophisticated displays integrated into modern vehicles, from driver information systems to infotainment. Dexerials' expertise in bonding and optical materials positions it to benefit from this burgeoning market, providing essential components for these complex systems.

In 2023, the global automotive electronics market was valued at approximately $380 billion, with projections indicating continued robust growth driven by these technological advancements. Dexerials' strategic focus, as outlined in its Mid-term Management Plan 2028, directly addresses this opportunity by targeting expansion within the automotive sector. The company recognizes the evolution of Advanced Driver-Assistance Systems (ADAS) and the growing trend of multiple displays per vehicle as key drivers for its future success.

Dexerials' expertise in precision bonding and optical materials presents a significant opportunity for expansion into emerging medical device applications. The medical sector demands high reliability and specialized materials, making it a stable and potentially high-value market for the company.

By applying its core competencies, Dexerials can develop advanced solutions for areas like diagnostic equipment, minimally invasive surgical tools, and wearable health monitors. The company's participation in events such as MD&M West 2025 underscores its strategic interest and ongoing engagement with this growth sector, signaling a clear intent to capitalize on these opportunities.

The growing worldwide focus on sustainability and energy efficiency presents a significant opportunity for Dexerials. As nations and corporations prioritize greener technologies and reduced energy usage, there's a natural increase in demand for materials that support these objectives. Dexerials' portfolio of energy-efficient and environmentally protective materials is well-positioned to meet this expanding market need.

This trend directly supports Dexerials' corporate Environmental, Social, and Governance (ESG) goals and resonates with increasing consumer preferences for sustainable products. The company's inclusion as a constituent in major ESG indices, such as those adopted by the Government Pension Investment Fund (GPIF) and the SOMPO Sustainability Index, underscores its alignment with these critical global sustainability movements.

Strategic Partnerships and Acquisitions for Market Expansion

Dexerials can accelerate its market expansion and bolster its technological edge by pursuing strategic partnerships and targeted acquisitions. Collaborating with or acquiring specialized firms allows for quicker entry into new geographic regions or product segments, bypassing the slower pace of organic development. For instance, Dexerials' recent investment in SemsoTec Group, a German design house, signals a clear strategy to deepen its presence in the European automotive sector. This move, alongside the completed share transfers to Restar Corporation, highlights a proactive approach to leveraging external capabilities for growth.

These strategic maneuvers offer several key advantages:

- Market Penetration: Partnerships can open doors to new customer bases and distribution channels, particularly in regions where Dexerials has a limited footprint.

- Technology Enhancement: Acquiring companies with niche expertise, such as advanced materials or specialized manufacturing processes, can rapidly upgrade Dexerials' product offerings and competitive standing.

- Geographic Diversification: Expanding through acquisitions or joint ventures in untapped markets can mitigate risks associated with over-reliance on a single region, as seen in the European auto business expansion.

Development of New Display and Flexible Electronics Technologies

The continuous evolution of display technology, particularly with the rise of flexible, foldable, and transparent screens, presents a significant growth avenue for Dexerials. These advanced displays rely heavily on specialized optical films and bonding materials, areas where Dexerials possesses core competencies. For instance, the company's anti-reflection films are vital for the durability and visual quality of foldable devices, a market segment that saw substantial growth in 2024, with shipments of foldable smartphones projected to reach over 15 million units globally.

Dexerials is strategically positioned to capitalize on this trend through its ongoing research and development. The company is actively developing Particle-arrayed Anisotropic Conductive Film (ACF) specifically for Micro-LED displays, a technology poised to revolutionize visual clarity and power efficiency. This innovation directly addresses the demand for higher performance in next-generation electronic devices, promising substantial future revenue streams as these technologies mature and gain wider market adoption.

- Innovation in Flexible Displays: The market for flexible and foldable displays is expanding rapidly, driven by consumer demand for innovative form factors in smartphones, tablets, and wearables.

- Dexerials' Key Materials: Dexerials' optical films and bonding materials are critical components enabling the functionality and aesthetic appeal of these advanced displays.

- Micro-LED Advancement: The development of Particle-arrayed ACF for Micro-LEDs positions Dexerials at the forefront of a display technology expected to offer superior brightness, contrast, and energy efficiency.

- Market Penetration: As foldable smartphone shipments continue to grow, estimated to exceed 20 million units by the end of 2025, Dexerials' anti-reflection films are crucial for product reliability and user experience.

Dexerials is well-positioned to benefit from the automotive industry's transition to EVs and autonomous driving, with advanced electronics and multiple displays per vehicle driving demand for its specialized materials. The company's strategic focus on automotive expansion, as detailed in its Mid-term Management Plan 2028, directly targets these growth areas. Furthermore, Dexerials' expertise in precision bonding and optical materials creates opportunities in the high-reliability medical device sector, with ongoing engagement in events like MD&M West 2025 underscoring this commitment.

Threats

Economic downturns pose a significant threat to Dexerials. Broader recessions directly impact industrial and consumer spending, leading to reduced demand for end products in key sectors like electronics and automotive. This slowdown translates into fewer orders for Dexerials' specialized materials, inevitably affecting sales and overall profitability.

For instance, Dexerials' own financial outlook highlights this vulnerability. While the company reported strong results for FY2025, its forecast for FY2026 anticipates a decline in both sales and profits. This projected dip underscores the company's sensitivity to prevailing market conditions and potential economic contractions.

Aggressive pricing from competitors, particularly those with leaner operations, can compel Dexerials to lower its own prices. This can significantly squeeze profit margins, even if sales volume remains steady. For instance, in the moderately consolidated Adhesives and Sealants market, key players are heavily investing in R&D, which often goes hand-in-hand with competitive pricing strategies to gain market share.

Competitors could introduce groundbreaking materials or manufacturing techniques, potentially making Dexerials' current products less appealing or even outdated. For instance, advancements in flexible display technology by rivals could challenge Dexerials' position in the optical film market, a key segment for them.

To mitigate this, Dexerials must diligently track technological progress and invest heavily in its own research and development. The company's commitment to R&D is crucial, as evidenced by its ongoing efforts to develop advanced materials for next-generation electronics, aiming to stay ahead of the curve.

Supply Chain Disruptions and Geopolitical Risks

Dexerials faces significant threats from global supply chain disruptions and escalating geopolitical risks. These factors can directly impact the availability and cost of essential raw materials, as well as create logistical challenges and restrict access to crucial markets. For instance, the ongoing semiconductor shortage, which began in 2020 and continued through 2023, significantly affected various industries, including those relying on electronic components that Dexerials might utilize or supply.

The company's Mid-term Management Plan 2028 explicitly recognizes the imperative to build resilience against these volatile external conditions. This includes strategies to mitigate the impact of trade disputes and geopolitical instability that could hinder operational continuity and market access.

- Supply Chain Vulnerability: Reliance on global suppliers for key materials exposes Dexerials to disruptions caused by trade wars, natural disasters, or political unrest, potentially leading to increased costs and production delays.

- Geopolitical Instability: Tensions between major economic powers can result in sanctions, tariffs, or export controls, directly impacting Dexerials' ability to source components or sell its products in affected regions.

- Logistics Cost Increases: Disruptions often lead to higher shipping and transportation expenses, squeezing profit margins and affecting the competitiveness of Dexerials' offerings.

- Market Access Restrictions: Geopolitical events can lead to market closures or reduced demand in specific countries, limiting Dexerials' revenue streams and growth opportunities.

Stringent Environmental Regulations and Compliance Costs

Dexerials faces the threat of increasingly stringent environmental regulations that impact its materials and manufacturing processes. For instance, in 2024, the European Union continued to advance its Green Deal initiatives, with proposals like the Ecodesign for Sustainable Products Regulation (ESPR) aiming to broaden product sustainability requirements beyond energy efficiency. This heightened scrutiny means Dexerials must invest more in research and development to ensure its products and operations meet evolving environmental standards.

Compliance with these new rules can translate into substantial costs. These include expenses for modifying production lines, sourcing more environmentally friendly raw materials, and implementing advanced waste management systems. Failure to adhere to these regulations could result in significant fines, potentially impacting profitability and market access. For example, companies in similar sectors have reported millions in unexpected costs due to compliance gaps identified during regulatory audits in 2024.

While Dexerials has a stated commitment to sustainability, the dynamic nature of environmental legislation means this remains a persistent challenge. The company must remain agile, continuously monitoring global regulatory landscapes and proactively adapting its strategies. This proactive approach is crucial to avoid disruptions and maintain its competitive edge in a market increasingly driven by environmental consciousness. The ongoing development of regulations around chemical substances, such as potential restrictions on certain PFAS compounds, highlights the need for continuous vigilance and investment in alternative materials.

The threat of intensified competition, particularly from agile players with lower cost structures, could erode Dexerials' market share and profit margins. Furthermore, rapid technological advancements by rivals, such as innovations in optical films for flexible displays, pose a risk of rendering current product lines obsolete. Dexerials' own FY2026 forecast projects a decline in sales and profits, indicating sensitivity to these market pressures.

SWOT Analysis Data Sources

This Dexerials SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a robust and data-driven perspective.