Dexerials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexerials Bundle

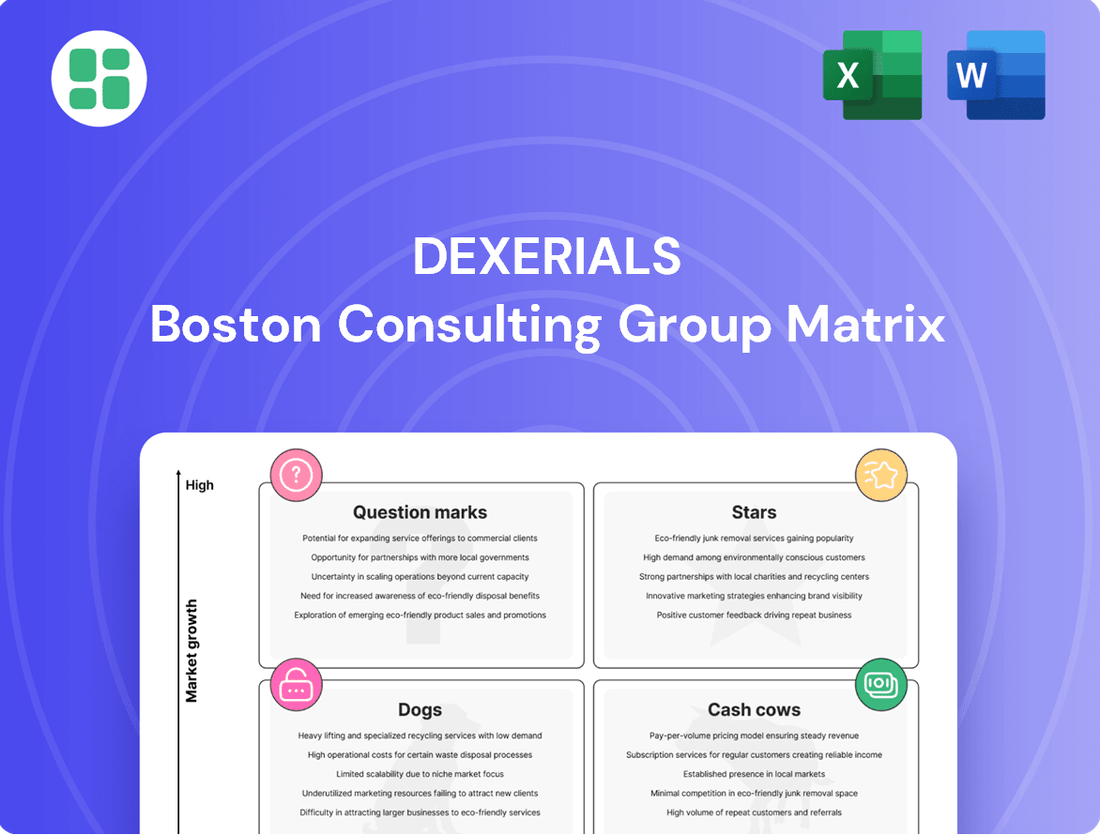

Curious about Dexerials' strategic positioning? Our BCG Matrix preview offers a glimpse into how their products are performing in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock the strategic advantage, dive into the full Dexerials BCG Matrix. Gain a comprehensive understanding of each product's quadrant placement, backed by data-driven insights and actionable recommendations for optimizing your portfolio and driving future growth.

Don't miss out on the clarity and confidence that comes with a complete strategic roadmap. Purchase the full BCG Matrix today and transform your decision-making for a competitive edge.

Stars

Dexerials commands the dominant global market share for Anisotropic Conductive Film (ACF), a vital material for flexible OLED displays, particularly in smartphones. This leadership is bolstered by the accelerating adoption of flexible OLED technology, which is driving substantial growth in the ACF market.

The ACF segment is poised for significant expansion, with projections indicating robust growth in the coming years as flexible OLED adoption continues its upward trajectory. This rapid market expansion, coupled with Dexerials' leading position, firmly establishes ACF as a Star within the BCG Matrix.

Dexerials is actively investing in expanding its ACF production capacity to cater to the escalating demand, reinforcing its competitive advantage in this high-growth area. This strategic investment is crucial for maintaining market leadership and capitalizing on the burgeoning opportunities presented by the flexible OLED market.

Dexerials' anti-reflection films for automotive displays are a prime example of a Star in their business portfolio. The company's strategic investment in a new dedicated manufacturing line, operational since April 2024, underscores their commitment to this high-growth sector. The automotive industry's increasing reliance on sophisticated in-vehicle displays fuels a robust demand for advanced display materials like these films.

Optical Elastic Resin (SVR) is a significant product for Dexerials, holding the top global market share. Its increasing adoption in vehicle displays, driven by advancements like ADAS and larger screen sizes, positions it as a strong contender for future growth.

Advanced Bonding Materials for Miniaturized Devices

Dexerials' advanced bonding materials, particularly their anisotropic conductive film (ACF) solutions, are crucial for the miniaturization trend in electronic devices. As gadgets shrink and require ever-finer pitch connectors, the demand for these high-performance bonding solutions is soaring, especially within consumer electronics and the automotive industry.

The company's strong market position and technical prowess in these specialized, high-precision bonding materials firmly place them in the Star category of the BCG Matrix. For instance, the global market for ACF films was projected to reach approximately USD 1.2 billion in 2024, with Dexerials holding a significant share due to their innovative product offerings.

- Market Growth: The demand for miniaturized electronic components continues to drive substantial growth in the advanced bonding materials sector.

- Dexerials' Strength: Dexerials' expertise in ACF and other high-precision bonding solutions positions them as a market leader.

- Key Applications: Consumer electronics and automotive sectors are major drivers of demand for these specialized materials.

- Financial Indicator: The company's revenue from its display materials segment, which includes bonding solutions, has shown consistent year-over-year growth, reflecting strong market performance.

High-Performance Thermal Conductive Sheets for Electronics

High-performance thermal conductive sheets are essential for dissipating heat in demanding electronic applications, a sector experiencing robust growth due to increasing device power and miniaturization. Dexerials strategically positions these sheets as a core offering, directly addressing the industry's need for enhanced thermal management solutions to ensure optimal performance and longevity. The market for these materials is expanding, fueled by advancements in consumer electronics, electric vehicles, and data centers, where efficient heat dissipation is paramount for reliability and speed.

These thermal conductive sheets play a critical role in enabling the performance of advanced computing systems and high-end consumer electronics. As devices become more powerful and compact, the challenge of managing heat intensifies, making these materials indispensable. Dexerials’ focus on this product category reflects its understanding of these evolving market demands. For instance, the global thermal interface materials market, which includes conductive sheets, was projected to reach over $4 billion by 2024, indicating a significant and growing demand.

- Market Driver: Increasing power density in consumer electronics and advanced computing systems.

- Dexerials' Role: Key product offering addressing critical thermal management needs.

- Market Position: Integral to evolving, high-demand applications suggesting a strong presence in a growing segment.

- Growth Indicator: The thermal interface materials market is a key indicator of demand for such products.

Dexerials' Anisotropic Conductive Film (ACF) is a prime example of a Star product. The company's dominance in the global ACF market, driven by the booming flexible OLED display sector, particularly for smartphones, solidifies its Star status. This segment is experiencing rapid expansion, with projections indicating continued robust growth as flexible OLED technology becomes more widespread.

The company's anti-reflection films for automotive displays also represent a Star. Dexerials' strategic investment in a new dedicated manufacturing line, operational since April 2024, highlights their commitment to this high-growth area. The automotive industry's increasing demand for advanced in-vehicle displays fuels the need for these specialized materials.

Dexerials' advanced bonding materials, including ACF, are crucial for the ongoing miniaturization trend in electronics. As devices become smaller and require finer pitch connectors, the demand for these high-performance solutions, especially in consumer electronics and automotive applications, is surging. The global ACF market was estimated to be around USD 1.2 billion in 2024, with Dexerials holding a significant share.

High-performance thermal conductive sheets are another Star product for Dexerials, addressing the critical need for heat dissipation in increasingly powerful and compact electronic devices. The market for these materials is expanding significantly, driven by growth in consumer electronics, electric vehicles, and data centers. The global thermal interface materials market, which includes these sheets, was projected to exceed $4 billion by 2024.

| Product Category | Market Growth | Dexerials' Strength | Key Applications | 2024 Market Insight |

| Anisotropic Conductive Film (ACF) | High (Flexible OLED Adoption) | Global Market Leader | Smartphones, Displays | Market ~USD 1.2 Billion |

| Anti-Reflection Films | High (Automotive Displays) | Strategic Investment in Capacity | Automotive In-Vehicle Displays | Growing Demand |

| Advanced Bonding Materials | High (Miniaturization) | Technical Prowess | Consumer Electronics, Automotive | Essential for Smaller Devices |

| Thermal Conductive Sheets | High (Device Power & Miniaturization) | Addressing Thermal Management Needs | Consumer Electronics, EVs, Data Centers | Market ~USD 4 Billion (TIM) |

What is included in the product

The Dexerials BCG Matrix analyzes its product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Dexerials BCG Matrix provides a clear, one-page overview, instantly clarifying each business unit's strategic position to alleviate decision-making paralysis.

Cash Cows

Dexerials' Anisotropic Conductive Film (ACF) for traditional displays, while not experiencing the rapid growth of its flexible OLED counterpart, is a solid Cash Cow. This segment benefits from Dexerials' established market dominance, holding a significant share in the ACF market for mature applications like LCD panels and other general electronic devices.

These products act as a stable revenue generator for Dexerials. They likely require minimal additional investment for market expansion, allowing them to consistently produce substantial cash flow. This steady income stream supports the company's investments in growth areas, such as the aforementioned Star product, ACF for flexible OLEDs.

Standard anti-reflection films for consumer IT represent a significant Cash Cow for Dexerials. The company holds a commanding market share in this segment, with these films being a staple in devices like laptops and many smartphones.

Despite potentially moderate growth in some parts of the consumer IT sector, Dexerials' strong market position guarantees steady profits from these films. Their widespread adoption and loyal customer base ensure reliable cash flow generation.

Dexerials' established industrial tapes are a prime example of a cash cow within their product portfolio. These tapes are utilized in a wide array of industries, from automotive to electronics, reflecting a broad market penetration.

The markets for these industrial tapes are generally mature, meaning they experience stable, albeit slower, growth compared to newer, more innovative product lines. This stability, combined with Dexerials' likely strong market share due to their long history and established customer base, solidifies their cash cow status.

For instance, in fiscal year 2023, Dexerials reported that their industrial tapes segment continued to be a significant contributor to their operating income, demonstrating their consistent ability to generate reliable profits for the company.

General-Purpose Adhesive Materials

Dexerials' general-purpose adhesive materials represent a stable revenue source within its product portfolio. These adhesives, used across numerous industrial and consumer sectors, benefit from established market positions and consistent demand. Their widespread application means they generate reliable income without the need for heavy investment in new development or marketing.

These products are likely to be mature offerings, contributing steadily to Dexerials' overall financial health. Their established nature in the market translates to predictable cash flows, a hallmark of Cash Cow businesses. For instance, in 2024, the adhesives market, encompassing general-purpose types, was projected to reach over $70 billion globally, indicating significant and ongoing demand.

- Established Market Presence: General-purpose adhesives benefit from broad adoption across diverse industries.

- Steady Revenue Generation: Consistent demand ensures predictable cash inflows for Dexerials.

- Low Investment Needs: Mature products require less R&D and marketing compared to growth-stage offerings.

- Contribution to Profitability: These Cash Cows help fund other business initiatives and maintain overall company stability.

Mature Optical Materials (Non-Advanced Displays)

Dexerials' mature optical materials, serving sectors outside of cutting-edge displays, represent a stable component of their business. These products cater to established markets with longer product lifecycles, where consistent quality and strong customer ties are paramount for maintaining market position. For instance, materials used in automotive displays or industrial equipment, while not experiencing hyper-growth, provide a dependable revenue stream. In fiscal year 2024, Dexerials reported stable performance in their functional materials segment, which encompasses these types of products, demonstrating their ongoing profitability.

These mature optical materials are considered Cash Cows within the Dexerials portfolio. They generate consistent profits with minimal need for significant reinvestment, as the markets are less dynamic. This allows Dexerials to allocate capital to higher-growth areas while still benefiting from the reliable earnings these products provide. Their contribution to overall company profitability remains substantial, underpinning financial stability.

- Stable Revenue Generation: These materials consistently contribute to Dexerials' earnings by serving established, less volatile markets.

- Low Reinvestment Needs: Unlike growth products, mature optical materials require limited R&D or capital expenditure to maintain their market share and profitability.

- Profitability Driver: They act as a reliable source of cash flow, supporting overall financial health and enabling investment in other business segments.

- Market Position: Success in these segments is often built on long-standing customer relationships and a reputation for quality, ensuring continued demand.

Dexerials' standard anti-reflection films for consumer IT are a prime example of a Cash Cow. The company holds a commanding market share in this segment, which is a staple in devices like laptops and many smartphones.

Despite potentially moderate growth in some parts of the consumer IT sector, Dexerials' strong market position guarantees steady profits from these films, ensuring reliable cash flow generation.

The company's established industrial tapes also function as a significant Cash Cow, utilized across diverse sectors like automotive and electronics, reflecting broad market penetration and stable demand.

These mature product lines, including general-purpose adhesive materials and mature optical materials, generate consistent profits with minimal reinvestment, allowing Dexerials to fund growth areas.

| Product Segment | BCG Category | Key Characteristics | Fiscal Year 2023/2024 Data Point |

| ACF for Traditional Displays | Cash Cow | Established market dominance, stable revenue generator. | Significant contributor to operating income. |

| Standard Anti-Reflection Films (Consumer IT) | Cash Cow | Commanding market share, staple in laptops and smartphones. | Ensures steady profits and reliable cash flow. |

| Industrial Tapes | Cash Cow | Broad industry utilization, mature markets, stable growth. | Continued significant contributor to operating income in FY2023. |

| General-Purpose Adhesive Materials | Cash Cow | Widespread application, established market positions, consistent demand. | Adhesives market projected over $70 billion globally in 2024. |

| Mature Optical Materials (Non-Cutting-Edge Displays) | Cash Cow | Caters to established markets, long product lifecycles, dependable revenue. | Stable performance reported in functional materials segment in FY2024. |

What You See Is What You Get

Dexerials BCG Matrix

The preview you see is the complete Dexerials BCG Matrix report you will receive upon purchase, offering a direct insight into its professional formatting and strategic content. This means no hidden surprises or watermarks—just the fully realized analysis ready for immediate deployment in your business planning. You'll gain access to the exact same meticulously crafted document, enabling you to leverage its insights for informed decision-making without delay. Once purchased, this comprehensive report is yours to edit, present, and integrate into your strategic initiatives.

Dogs

Some of Dexerials' industrial tapes, especially those without standout features or in markets where many similar products exist, might struggle. These are the ones that don't really offer anything special compared to competitors, meaning they often end up competing on price alone. This can lead to thin profit margins, making it hard to generate significant returns.

These types of tapes typically reside in markets that aren't growing much and are already quite crowded. Consequently, Dexerials might find these products holding a relatively small piece of the market pie. In 2024, the global industrial tape market, while substantial, showed varying growth rates across segments, with commoditized areas experiencing slower expansion compared to specialized, high-performance tapes.

Without a clear edge or unique selling proposition, these legacy tapes can become cash traps. They require ongoing investment for production but don't necessarily drive substantial revenue growth or high profits. This situation can tie up valuable capital that could otherwise be deployed into more promising, innovative product lines or markets.

Optical films catering to older display technologies, like specific LCD variants being phased out for OLED, would likely be classified as Dogs within Dexerials' BCG Matrix if the company holds a low market share in these niche areas. Demand for these products is shrinking, offering minimal growth potential.

Supporting these declining product lines could divert valuable resources from more promising ventures. For instance, the global market for traditional LCD panels experienced a notable slowdown in 2023, with some segments contracting as newer technologies gain traction, impacting the demand for associated components like older optical films.

Niche electronic components within Dexerials' portfolio that exhibit stagnant market share are categorized as Dogs. These are products operating in markets with minimal growth, where Dexerials holds a small, unexpanding position. For instance, if a specific type of advanced adhesive tape for a rapidly obsolescing consumer electronics device falls into this category, it would likely have low sales volume and contribute little to overall profitability.

These Dog products typically generate minimal revenue and profit, often representing underperforming assets. In 2024, Dexerials reported a slight decline in revenue for certain legacy product lines, indicative of this Dog quadrant. These components require careful management to avoid draining resources that could be better allocated to Stars or Question Marks.

Unsuccessful Product Ventures or Discontinued Lines

Unsuccessful product ventures or discontinued lines represent Dexerials' 'Dogs' in the BCG Matrix. These are initiatives that, despite investment, failed to gain traction or generate sufficient revenue. For instance, a hypothetical venture into a niche consumer electronics accessory in 2023 might have faced intense competition and low demand, leading to its discontinuation by early 2024. Such products drain resources without contributing to market share or profitability, making them prime candidates for divestment or complete withdrawal.

These ventures often struggle due to several factors:

- Market Misjudgment: Launching products for markets that proved smaller or less receptive than anticipated.

- Competitive Landscape: Inability to differentiate or compete effectively against established players.

- Execution Challenges: Product quality issues or ineffective marketing strategies hindering adoption.

Commoditized Bonding Solutions Facing Intense Competition

Commoditized bonding solutions within Dexerials, particularly those lacking unique technological advantages or a substantial foothold in intensely competitive markets, would likely be classified as Dogs in the BCG Matrix. These offerings would be subject to considerable price erosion and generate minimal profit margins.

Such products contribute little to the company's overall expansion and represent potentially inefficient uses of capital and resources. For instance, if a standard adhesive product line, widely available from multiple suppliers, sees its market share decline due to aggressive pricing by competitors, it would fit this category. In 2023, the global adhesives and sealants market, while growing, is characterized by significant competition in its more commoditized segments, with some lower-end product categories experiencing price sensitivity.

- Low Market Share: These solutions would likely hold a small percentage of their respective, highly competitive markets.

- Low Growth Rate: The demand for these commoditized bonding products would be stagnant or declining.

- Low Profitability: Intense price competition would squeeze margins, making these products unprofitable.

- Resource Drain: Continued investment in these areas would divert resources from more promising ventures.

Dexerials' 'Dogs' represent products or business units with low market share in low-growth industries. These are often legacy items or those that failed to gain traction against competitors. For example, certain older types of optical films for now-less-common display technologies would fall into this category. In 2023, the demand for some established LCD components softened as newer technologies like OLED gained market share.

These 'Dog' products typically generate minimal profits and can even become cash drains, requiring ongoing investment without substantial returns. The company must carefully manage these to avoid diverting resources from more promising 'Stars' or 'Question Marks'. In 2024, Dexerials continued to assess its product portfolio, with a focus on optimizing resources away from underperforming segments.

The challenge with 'Dogs' lies in their inability to compete effectively or capitalize on market opportunities. This often stems from a lack of differentiation or being in a market that is no longer expanding. For instance, highly commoditized industrial tapes without unique features often face intense price competition, leading to thin margins.

Dexerials' strategy likely involves either improving the competitive position of these 'Dogs' or divesting them to reallocate capital. The company's 2024 financial reports indicated a strategic review of certain product lines to enhance overall portfolio performance.

| Product Category Example | Market Growth | Dexerials' Market Share | Profitability | Strategic Implication |

|---|---|---|---|---|

| Legacy Optical Films (e.g., for older LCDs) | Low/Declining | Low | Low/Negative | Divestment or phased withdrawal |

| Commoditized Industrial Tapes | Low | Low | Low | Cost optimization or niche focus |

| Obsolete Electronic Components | Very Low/Negative | Very Low | Very Low/Negative | Immediate discontinuation |

Question Marks

Dexerials established Dexerials Photonics Solutions Corporation in April 2024, signaling a strategic pivot towards high-growth photonics markets, particularly high-speed photodiodes for optical transceivers. This move positions them to capitalize on the surging demand fueled by data center expansion and the burgeoning generative AI sector. While the market is robust, Dexerials is an emerging player in this specific product category, aiming to carve out substantial market share.

Dexerials' eye shield material for medical devices falls into the Question Mark category of the BCG matrix. This segment represents new product lines in high-growth markets where the company currently has a limited market share. The medical engineered materials market is indeed poised for significant expansion, with a projected compound annual growth rate of 13.24% between 2025 and 2034, indicating a promising future for innovative materials.

Products like the eye shield material are positioned in an attractive, rapidly expanding sector. However, their current limited market presence means they require substantial investment in research, development, and market penetration to capture a meaningful share. This strategic positioning necessitates careful consideration of resource allocation to transform these potential stars into market leaders.

Dexerials expanded its surface-mounted fuse lineup with 11 new Ag-plated terminal models in April 2025, following their online sales debut in October 2024. This move into specialized fuses and new sales channels suggests a strategy to gain traction in specific market segments, even within a mature product category.

Given the broad fuse market is well-established, Dexerials' current share is likely modest. This product line represents a Question Mark in the BCG matrix, necessitating focused investment to increase market penetration and potentially achieve higher growth rates.

Advanced Sensor Module Materials for Automotive

Dexerials' strategic focus on automotive sensor modules aligns with the industry's rapid growth, particularly driven by ADAS and autonomous driving. The company's mid-term management plan explicitly targets this sector, aiming to broaden its automotive business beyond display components. This suggests a deliberate move to capitalize on the increasing demand for sophisticated sensor technologies.

The automotive market for advanced sensor materials is experiencing significant expansion. By 2024, the global market for automotive sensors was projected to reach approximately $35 billion, with ADAS and autonomous driving being key growth drivers. Dexerials' investment in this area, especially if developing new materials for components where its current market share is low, positions these as potential Stars within its product portfolio.

- High Growth Potential: The increasing sophistication of vehicles, with features like adaptive cruise control and lane-keeping assist, directly fuels demand for advanced sensor materials.

- Strategic Investment: Dexerials' explicit targeting of automotive sensor modules in its mid-term plan indicates a commitment to capturing market share in this burgeoning segment.

- Innovation Opportunity: Developing novel materials for sensor modules, particularly in areas with limited current penetration, presents a clear pathway for future growth and market leadership.

- Market Expansion: This focus allows Dexerials to diversify its revenue streams within the automotive sector, moving beyond its traditional display-related offerings.

Materials for Next-Generation High-Speed Communication Technologies

Dexerials is heavily investing in advanced composite semiconductor devices, a key component for future high-speed communication systems. This focus on photonics and novel materials positions them to capture emerging markets driven by the demand for faster data transfer and increased bandwidth.

These materials are currently in the early stages of development, meaning Dexerials likely holds minimal to no market share. This reflects their classification as a potential 'Question Mark' in the BCG matrix, requiring significant capital for research and development with uncertain future returns.

- Target Market: Next-generation high-speed communication technologies, including 5G advanced and 6G infrastructure.

- Investment Focus: Photonics and composite semiconductor devices, crucial for optical communication.

- Market Position: Nascent, with minimal current market share, indicating high growth potential but also high risk.

- Strategic Importance: Addresses the evolving demand for faster, more efficient data transmission.

Dexerials' foray into high-speed photodiodes for optical transceivers, established through Dexerials Photonics Solutions Corporation in April 2024, represents a classic Question Mark. While the market is experiencing robust growth, driven by data center expansion and generative AI, Dexerials is an emerging player aiming to build significant market share.

The medical eye shield material is another Question Mark. The medical engineered materials market is set for substantial growth, with a projected CAGR of 13.24% from 2025 to 2034. Dexerials' limited share in this expanding sector necessitates significant investment to secure a competitive position.

Similarly, Dexerials' expanded lineup of surface-mounted fuses, particularly the new Ag-plated terminal models introduced in April 2025, falls into the Question Mark category. Despite the online sales debut in October 2024, the fuse market is mature, meaning Dexerials' current share is likely modest, requiring focused investment for penetration.

The company's strategic push into automotive sensor modules also presents Question Mark characteristics. While the automotive sensor market was projected to reach around $35 billion by 2024, with ADAS and autonomous driving as key drivers, Dexerials' success hinges on its ability to gain traction in a competitive landscape where its current market share for these specific components may be low.

BCG Matrix Data Sources

Our Dexerials BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.