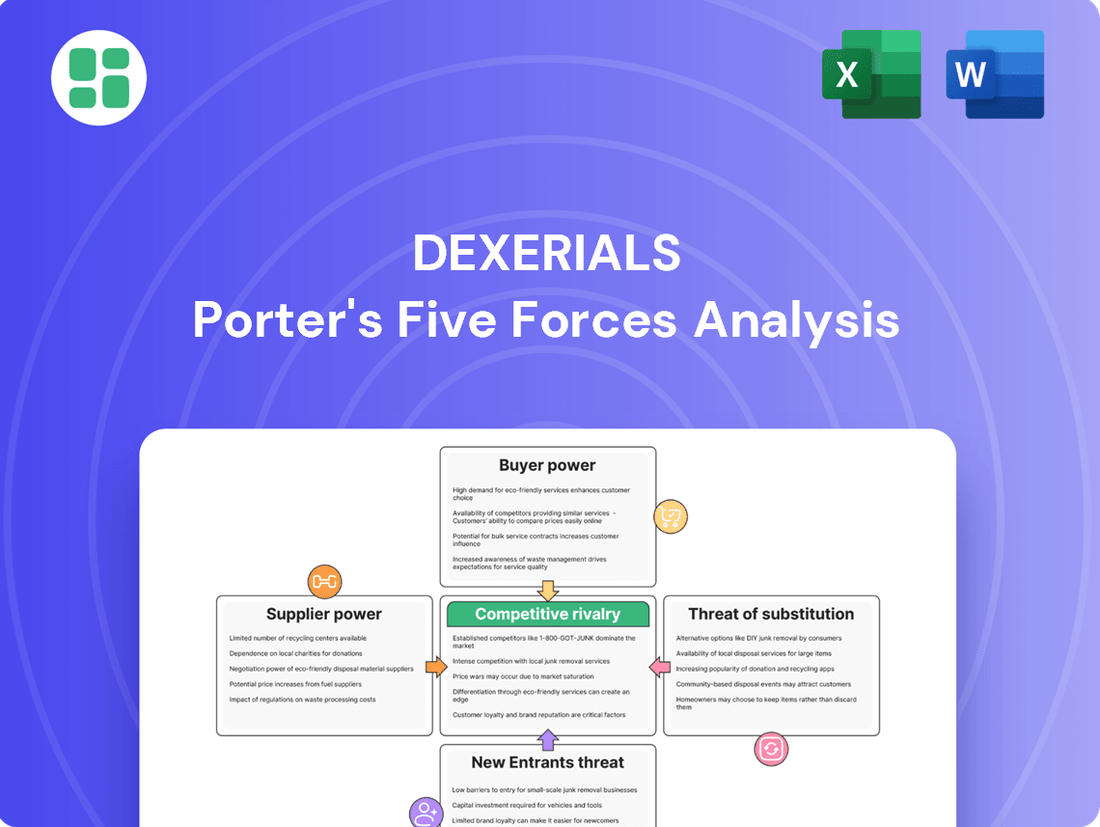

Dexerials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexerials Bundle

Dexerials navigates a landscape shaped by intense rivalry, potent supplier relationships, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp their competitive edge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dexerials’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dexerials' reliance on highly specialized functional materials and components, such as raw materials for optical films and bonding materials, places it in a position where supplier concentration can significantly impact its bargaining power. If a substantial portion of these critical inputs comes from a small number of providers, especially those with unique or proprietary manufacturing processes, these suppliers gain considerable leverage.

The nature of Dexerials' business, which centers on high-value-added products, inherently demands specialized inputs. This specialization can limit the available alternatives for Dexerials, thereby amplifying the bargaining power of its suppliers. For instance, in the advanced materials sector, a single supplier might hold patents or unique chemical formulations essential for product performance, giving them a strong negotiating position.

While specific supplier concentration data for Dexerials isn't publicly detailed, industry trends in specialty chemicals and advanced materials often show a degree of supplier consolidation. For example, in 2023, the global optical films market, a key area for Dexerials, was characterized by a few dominant players holding significant market share, indicating potential supplier leverage.

Dexerials faces significant switching costs when sourcing critical, specialized materials. These costs can include lengthy supplier qualification processes, the need for re-tooling manufacturing equipment, and the potential for significant production disruptions. For example, if a key adhesive formulation is deeply integrated into their display technologies, finding and validating a new supplier could take many months and incur substantial engineering expenses.

These high switching costs inherently strengthen the bargaining power of Dexerials' suppliers. When it's difficult and expensive for Dexerials to change providers, they become more dependent on their current suppliers, giving those suppliers leverage in price negotiations and contract terms. This is especially true for unique or proprietary components that are essential to Dexerials' product performance and differentiation.

Dexerials' product quality, particularly in demanding sectors like consumer electronics and automotive, hinges directly on the caliber of its raw materials. For instance, their Anisotropic Conductive Films (ACF), critical for display bonding, require exceptionally pure and precisely formulated chemical inputs. If suppliers provide these foundational materials, the bargaining power of those suppliers increases significantly.

When suppliers provide inputs that are essential for Dexerials' product differentiation and overall performance, their leverage grows. This is particularly true for specialized materials that are difficult to source elsewhere or require unique manufacturing processes. The company's strategic focus on high-value-added products, such as their advanced optical films, amplifies the importance of consistent, superior input quality from their supply chain.

Threat of Forward Integration by Suppliers

Suppliers with the ability or motivation to move into producing finished goods themselves can significantly boost their leverage. This forward integration threat means suppliers could potentially compete directly with Dexerials, impacting its market share and profitability.

While raw material suppliers typically don't integrate forward, those offering highly specialized components might consider it. This could lead to a reduction in Dexerials' market control if these suppliers decide to capture more value by entering Dexerials' own operational space.

- Specialized Component Suppliers: The threat is more pronounced for suppliers of unique, high-value sub-components rather than bulk raw materials.

- Dexerials' Deterrent: Dexerials' deep-rooted expertise in advanced material formulation and manufacturing processes serves as a significant barrier against potential supplier integration.

- Market Impact: Successful forward integration by a key supplier could potentially limit Dexerials' access to critical inputs or force them to pay higher prices.

Supplier's Ability to Differentiate Inputs

Suppliers who can differentiate their raw materials or components through unique properties, patents, or superior quality will possess greater bargaining power. This differentiation can limit Dexerials' options and necessitate stronger relationships with these key suppliers. For instance, in 2024, the demand for specialized optical films, a key component for advanced displays, saw a significant increase, empowering suppliers with unique formulations. Companies relying on these specialized materials often face higher costs due to the limited availability of alternatives.

Dexerials' reliance on advanced materials means its suppliers might offer proprietary formulations or processes that are not easily replicated by competitors. This exclusivity grants these suppliers a stronger hand in negotiations. In the semiconductor industry, a sector where Dexerials operates, the lead times for highly specialized chemicals and substrates can extend for months, giving suppliers considerable leverage. This situation was particularly acute in early 2024, with supply chain disruptions impacting the availability of critical inputs.

- Differentiated Inputs: Suppliers offering unique or patented materials gain significant leverage.

- Limited Alternatives: When few suppliers can provide a specific component, their bargaining power increases.

- Proprietary Processes: Suppliers with exclusive manufacturing techniques or formulations can command higher prices.

- Industry Dependence: Sectors like advanced electronics, where Dexerials is active, often rely on highly specialized and differentiated inputs.

Dexerials' bargaining power with its suppliers is influenced by the concentration of suppliers for its specialized materials. When few suppliers can provide critical inputs like advanced bonding materials or optical film components, these suppliers gain significant leverage. This is particularly true if these suppliers possess unique manufacturing processes or patents, as seen in the specialty chemicals sector where a handful of companies often dominate niche markets. In 2023, the global optical films market, a key area for Dexerials, was characterized by a few dominant players holding significant market share, indicating potential supplier leverage.

The specialized nature of Dexerials' products means that switching suppliers for critical components can be costly and time-consuming. High switching costs, including the need for re-qualification, potential equipment modifications, and production downtime, strengthen the negotiating position of existing suppliers. For example, integrating a new adhesive formulation into their display technologies could involve months of testing and significant engineering expenses, making it difficult for Dexerials to change providers. This dependence allows suppliers to exert greater influence on pricing and contract terms.

Suppliers who provide inputs essential for Dexerials' product differentiation and performance, such as high-purity chemicals for Anisotropic Conductive Films (ACF), hold considerable power. In 2024, the demand for specialized optical films, a key component for advanced displays, saw a significant increase, empowering suppliers with unique formulations. This reliance on quality and proprietary inputs means Dexerials must maintain strong relationships with these key providers, as limited alternatives amplify supplier leverage.

The threat of forward integration by suppliers, though less common for raw material providers, is a consideration for those supplying highly specialized components. If a key supplier were to enter Dexerials' market, it could disrupt supply chains and potentially increase costs. While Dexerials' deep expertise in material formulation acts as a deterrent, any successful integration by a critical supplier could limit access to essential inputs or force higher prices, impacting Dexerials' market control.

| Factor | Impact on Dexerials | Supporting Data/Trend (as of mid-2025) |

|---|---|---|

| Supplier Concentration | High leverage for few providers of specialized materials. | Few dominant players in the global optical films market (2023 data). |

| Switching Costs | Increases supplier dependency and negotiation power. | Significant engineering and qualification time for new advanced materials. |

| Input Differentiation | Suppliers with unique or patented materials gain leverage. | Increased demand for specialized optical films in 2024 empowered unique formulation suppliers. |

| Forward Integration Threat | Potential for increased costs or supply disruption if suppliers enter Dexerials' market. | Considered more for specialized component suppliers than bulk raw material providers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Dexerials' position in the advanced materials sector.

Navigate competitive pressures effortlessly with a visual breakdown of each force, allowing for swift identification of strategic opportunities and threats.

Customers Bargaining Power

Dexerials' customer base spans critical industries like automotive, consumer electronics, and medical devices, featuring many large, well-established players. This diversity, while a strength, also means that if a few major clients represent a substantial chunk of Dexerials' revenue, those clients gain significant leverage. For example, a leading smartphone manufacturer or a major automotive OEM could demand more favorable pricing or contract terms due to their high purchase volumes.

Customer switching costs for Dexerials are a significant factor in their bargaining power. For instance, switching to a different supplier for Anisotropic Conductive Films (ACF), a key product for Dexerials, often necessitates extensive redesign and re-qualification of the customer's manufacturing processes. These technical hurdles, coupled with the risk of performance degradation in the final product, make changing suppliers a costly and time-consuming endeavor.

This high barrier to switching effectively limits the ability of Dexerials' customers to demand lower prices or more favorable terms. The investment required to validate a new material supplier, often involving months of testing and integration, means customers are less likely to explore alternatives unless the price differential is substantial or there are significant quality issues. This creates a degree of customer loyalty rooted in practical and financial considerations.

Customers gain significant leverage when numerous alternative products or components can fulfill the same needs. This abundance of substitutes directly challenges a company's ability to dictate prices, as customers can easily switch to a competitor if prices rise or quality falters. For instance, in the electronics sector, the constant evolution of display technologies means that if Dexerials' specialized bonding materials become too expensive, manufacturers might explore newer, albeit potentially less refined, adhesive solutions available from other suppliers.

While Dexerials is known for its advanced functional materials, particularly in areas like optical films and adhesives for displays, the underlying threat of substitution remains. Even if alternatives aren't perfectly equivalent, the sheer availability of other bonding technologies or display materials can erode Dexerials' pricing power. In 2024, the global market for display adhesives, a key area for Dexerials, saw continued competition from both established chemical companies and emerging material science innovators, all vying for market share by offering cost-effective or performance-differentiated solutions.

The landscape of materials science is perpetually shifting, meaning new substitute products can emerge with surprising speed. Companies that invest heavily in research and development, like many of Dexerials' competitors, are constantly exploring novel materials that could potentially disrupt existing markets. This dynamic environment necessitates continuous innovation and competitive pricing strategies from Dexerials to mitigate the risk of customers migrating to newer, potentially more attractive, alternative offerings that become available in the market.

Importance of Dexerials' Product to Customer's End Product

Dexerials' materials are often integral to enhancing the performance, energy efficiency, and environmental sustainability of their customers' final products. This inherent value means customers are less likely to switch suppliers based on price alone, thereby reducing their bargaining power.

When Dexerials' products are critical for the core functionality or unique selling proposition of a customer's offering, it significantly limits the customer's ability to negotiate lower prices. For instance, their advanced anti-reflection films are indispensable for high-end displays, making customers highly reliant on Dexerials' specialized materials.

- Critical Functionality: Dexerials' materials often enable key features in end products, such as enhanced display clarity or improved battery life.

- Differentiation: The unique properties of Dexerials' products can be a primary differentiator for their customers' offerings in competitive markets.

- Switching Costs: The integration of specialized materials like Dexerials' into complex manufacturing processes can create high switching costs for customers.

- Performance Enhancement: Dexerials' materials contribute directly to tangible benefits like energy savings or extended product lifespan, justifying their value.

Customer's Threat of Backward Integration

Large customers, especially those in high-volume sectors like consumer electronics and automotive, might explore backward integration if producing certain functional materials in-house becomes strategically advantageous or cost-effective. For instance, a major automotive manufacturer could consider developing its own adhesives or coatings if the cost savings and supply chain control outweigh the substantial investment in R&D and manufacturing capabilities.

While the development of specialized material production is capital-intensive and requires significant research and development, the *potential* for this threat can still shape Dexerials' pricing and service strategies. This is particularly true as major players in these industries, like Samsung or Toyota, possess the financial muscle to undertake such ventures, even if it's a long-term consideration.

Dexerials' advantage lies in its proprietary technologies and deep expertise in functional materials, which act as a significant barrier to entry for customers considering in-house production. The complexity and specialized nature of these materials, often involving advanced polymer chemistry or precise formulation, make it challenging for even large buyers to replicate Dexerials' offerings without considerable time and investment.

- Customer Integration Threat: Large customers in electronics and automotive may consider in-house production of functional materials if economically viable.

- Capital and R&D Barriers: Developing specialized material production is highly capital-intensive and requires substantial R&D, deterring immediate integration.

- Strategic Influence: The potential for backward integration can still influence Dexerials' pricing and service offerings to key clients.

- Dexerials' Proprietary Edge: Dexerials' advanced, proprietary technologies serve as a crucial barrier against customer integration efforts.

Dexerials' customers possess moderate bargaining power, primarily influenced by the criticality of its specialized materials and the associated switching costs. While large clients like major automotive manufacturers and consumer electronics giants can exert pressure due to volume, the technical complexity and integration challenges of Dexerials' products, such as Anisotropic Conductive Films (ACF), create significant barriers to switching. This reliance on Dexerials' proprietary technology and the investment required for qualification limit customers' ability to demand substantial price concessions.

The threat of customer backward integration is currently low, as the capital expenditure and R&D investment needed to replicate Dexerials' advanced material science expertise are substantial. For instance, a company like Apple or Toyota would face immense challenges in developing comparable optical films or specialized adhesives internally. However, the potential for such integration, especially for high-volume components, remains a strategic consideration that influences Dexerials' customer relationship management and pricing strategies.

In 2024, the demand for high-performance materials in sectors like electric vehicles and advanced displays continued to grow, underscoring the value Dexerials provides. For example, the automotive sector's push for lighter, more energy-efficient components directly benefits Dexerials' offerings, strengthening its position against customer price demands. The global market for advanced adhesives and films, a key segment for Dexerials, was projected to see continued growth, driven by innovation in these end-use industries.

| Factor | Dexerials' Position | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Moderate (diverse but some large clients) | Moderate leverage for large clients |

| Switching Costs | High (technical integration, R&D) | Lowers customer bargaining power |

| Product Differentiation | High (proprietary technology) | Lowers customer bargaining power |

| Threat of Backward Integration | Low (high capital & R&D barriers) | Minimizes customer bargaining power |

What You See Is What You Get

Dexerials Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Dexerials provides an in-depth examination of the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Gain actionable insights into Dexerials' strategic position and market dynamics.

Rivalry Among Competitors

The functional materials and components market, which includes optical materials and bonding solutions, is characterized by a mix of large, diversified chemical corporations and highly specialized niche firms. This diverse competitive landscape means Dexerials faces rivals of varying scales and strategies.

The sheer number of competitors, including global powerhouses, significantly escalates rivalry. These companies actively compete for market share in crucial sectors such as consumer electronics and the automotive industry. For instance, in the anisotropic conductive film (ACF) market, Dexerials contends with established players like 3M and Showa Denko, indicating a moderately consolidated competitive environment.

The specialty chemicals and advanced functional materials sector, where Dexerials operates, is expected to see moderate but consistent growth. For instance, the global advanced materials market was valued at approximately $250 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5-7% through 2030. This steady expansion fuels a competitive environment as companies vie for a larger piece of the market.

In such moderately growing industries, the rivalry among existing players tends to be quite intense. Companies often engage in aggressive strategies, including price competition, accelerated product innovation, and enhanced customer service, to capture and retain market share. This dynamic is particularly evident as firms seek to establish a strong foothold in emerging, high-potential segments.

Dexerials is strategically positioning itself to capitalize on this growth by focusing on expanding its presence in key domains like photonics and the automotive sector. These areas are recognized as significant growth drivers within the broader industry. Simultaneously, the company is committed to reinforcing its existing business segments, ensuring a balanced approach to market penetration and consolidation.

Dexerials focuses on creating specialized, high-value products such as Anisotropic Conductive Films (ACF) and Anti-reflection films. These materials offer distinct performance advantages, setting them apart in the market and making it difficult for customers to switch to alternatives.

The strong differentiation of Dexerials' offerings, coupled with the significant effort and cost involved for customers to change suppliers for these critical components, effectively reduces competitive rivalry. This strategy fosters customer loyalty and creates a barrier for competitors trying to gain market share.

Dexerials' ongoing commitment to research and development, including securing patents, is crucial for sustaining this product differentiation. For instance, in fiscal year 2024, Dexerials reported significant investments in R&D, aiming to further enhance the unique properties of their films and maintain their technological edge.

Exit Barriers for Competitors

High exit barriers can trap competitors in the market, intensifying rivalry. For Dexerials, specialized assets like advanced chemical synthesis equipment and proprietary manufacturing processes represent substantial sunk costs. These make it difficult and expensive for rivals to simply shut down operations and leave the specialized materials sector.

These significant capital investments and the unique nature of their technology mean that competitors might continue operating even at low profitability, rather than abandon their investment. This can lead to prolonged periods of aggressive pricing and market overcapacity, as struggling firms fight to survive. For instance, the chemical industry, where Dexerials operates, often sees companies with highly specialized, capital-intensive facilities continuing production to spread fixed costs, even when demand is weak.

- Specialized Assets: Dexerials' competitors often operate highly specialized, capital-intensive manufacturing facilities, making them difficult and costly to divest or repurpose.

- Proprietary Technology: Investments in unique, proprietary technologies create significant sunk costs, discouraging competitors from exiting the market.

- Long-Term Contracts: Existing long-term supply agreements can obligate competitors to continue production, even in less favorable market conditions.

- Industry Dynamics: The specialized nature of materials often means that there are few alternative uses for the specialized equipment and expertise, increasing the cost of exit.

Diversity of Competitors

Dexerials navigates a competitive arena populated by companies with varied strategic approaches, origins, and goals. This heterogeneity fuels unpredictable and often fierce rivalry. For instance, in 2024, the advanced materials sector, where Dexerials operates, saw significant investment from both established chemical giants and nimble startups, each vying for market share through distinct strategies.

The company contends with large, diversified chemical conglomerates that possess substantial resources and broad product portfolios. Simultaneously, Dexerials faces competition from smaller, highly specialized firms that excel in particular niche markets. This dual pressure means rivals may compete on cost leadership, cutting-edge innovation, or a deep focus on specific customer needs, creating a multifaceted and challenging competitive environment.

- Diverse Competitor Strategies: Rivals may focus on low-cost production, rapid product development, or catering to highly specific market segments.

- Global Reach: Dexerials competes with both multinational corporations and localized players across different geographic regions.

- Varying Objectives: Competitors' goals can range from broad market dominance to capturing niche segments, influencing their competitive tactics.

- Impact on Rivalry: This diversity leads to unpredictable competitive actions and necessitates a flexible strategic response from Dexerials.

Dexerials operates in a competitive landscape marked by numerous players, from large chemical conglomerates to specialized niche firms, all vying for market share in sectors like consumer electronics and automotive. The advanced materials market, valued at approximately $250 billion in 2023 and projected for steady growth, fuels this intense rivalry, leading companies to employ aggressive strategies such as price competition and accelerated innovation.

The company's strategy of offering highly differentiated products, like Anisotropic Conductive Films (ACF) and Anti-reflection films, creates significant switching costs for customers, thereby mitigating direct competitive pressure. This focus on unique, high-value offerings, supported by substantial R&D investments in fiscal year 2024, aims to maintain Dexerials' technological edge and customer loyalty.

High exit barriers, stemming from specialized assets and proprietary technology, can keep competitors engaged even at lower profitability, potentially leading to prolonged market competition. The diverse strategic objectives and global reach of competitors, ranging from cost leadership to niche specialization, further contribute to a dynamic and unpredictable competitive environment for Dexerials.

SSubstitutes Threaten

The threat of substitutes for Dexerials' functional materials hinges on their ability to match the price-performance ratio of alternatives. While cheaper options might be available, they often fall short in critical areas like performance, miniaturization, and reliability, especially for demanding sectors such as high-end electronics and automotive manufacturing.

For example, in 2024, the demand for advanced adhesives in smartphones continued to grow, with suppliers needing to balance cost with the need for ultra-thin bonding and heat dissipation. Cheaper, less sophisticated adhesives simply cannot provide the necessary structural integrity or thermal management for these devices, making them poor substitutes despite a lower upfront cost.

Customers' willingness to switch to substitutes hinges on factors like perceived value, how easy it is to switch, and how critical the component is. For vital functional materials, such as anisotropic conductive films (ACFs) in intricate electronic assemblies, the risk associated with a less dependable substitute is substantial, making customers hesitant to switch unless there are compelling cost or performance benefits. Dexerials' established relationships and deep product integration effectively diminish this propensity to substitute.

Technological advancements present a significant threat of substitution for Dexerials. Emerging material science innovations could introduce entirely new solutions that bypass the need for current film-based products, such as novel bonding techniques that don't rely on adhesives or advanced optical technologies offering alternative functionalities. For instance, the development of self-healing materials or advanced additive manufacturing processes could create components that serve similar purposes without using Dexerials' specialized films.

Switching Costs for Customers to Adopt Substitutes

The threat of substitutes for Dexerials is significantly mitigated by high switching costs for its customers. These costs often involve substantial investments in re-engineering product designs, implementing new manufacturing processes, and undergoing rigorous re-qualification procedures.

Dexerials' advanced materials, such as optical films and adhesives, are frequently integrated at a fundamental level within their clients' product architectures. This deep embedding means that a shift to a substitute product would necessitate extensive and costly redesigns and validation cycles, creating a formidable barrier to entry for potential alternatives.

For instance, in the automotive sector, where Dexerials supplies critical components for displays and lighting, the cost of re-validating a new material supplier can easily run into millions of dollars and extend product development timelines by months, if not years. This complexity effectively locks in customers, reducing the allure of readily available substitutes.

- High Re-engineering Costs: Customers must redesign products to accommodate substitute materials.

- New Process Implementation: Significant investment in new manufacturing equipment and training is often required.

- Re-qualification Burden: Extensive testing and certification are necessary to ensure substitute materials meet stringent performance standards.

- Embedded Technology: Dexerials' materials are often integral to the core functionality of customer products, making substitution technically challenging.

Innovation in Substitute Products

Ongoing advancements in material science present a persistent threat of substitution for Dexerials' products. For instance, breakthroughs in conductive inks or alternative direct bonding technologies could directly challenge the market position of Anisotropic Conductive Films (ACFs). The global conductive ink market, valued at approximately USD 4.5 billion in 2023, is projected to grow significantly, indicating a competitive landscape where new materials can emerge rapidly.

Dexerials must maintain a proactive stance by continuously innovating its product offerings and adapting its technological roadmap. This includes investing in research and development to stay ahead of emerging substitute materials and applications. The company's ability to anticipate and respond to these evolving technological trends is crucial for sustaining its market share and profitability.

- Advancements in conductive inks could offer lower-cost alternatives to ACF.

- Direct bonding technologies may reduce the need for specialized adhesive films.

- The materials science sector sees consistent innovation, creating new threats.

- Dexerials' R&D investment is key to mitigating the impact of substitutes.

The threat of substitutes for Dexerials' functional materials remains moderate, largely due to the high performance requirements and switching costs in their target industries. While cheaper alternatives might exist, they often fail to meet the stringent demands of sectors like advanced electronics and automotive, where reliability and specific functionalities are paramount.

For example, in 2024, the market for display adhesives in smartphones continued to demand materials offering precise bonding and excellent thermal management. Lower-cost adhesives, unable to match these capabilities, are not viable substitutes for premium devices, highlighting the performance gap.

The deep integration of Dexerials' materials into customer product designs, coupled with the significant expense and time involved in re-engineering and re-qualifying new components, acts as a strong deterrent against substitution. This makes it difficult for alternative materials to gain traction unless they offer a substantial leap in either performance or cost-effectiveness.

| Threat of Substitutes | Key Factors | Dexerials' Mitigation Strategies | Example (2024) |

| Moderate | High performance demands, significant switching costs (re-engineering, re-qualification) | Deep product integration, focus on R&D for advanced materials | Automotive display adhesives: Re-qualification costs can reach millions, delaying product launches. |

| Advanced electronics adhesives: Need for miniaturization and heat dissipation limits cheaper alternatives. |

Entrants Threaten

Entering the advanced functional materials sector, where Dexerials operates, demands significant upfront capital. Think substantial investments in research and development, highly specialized manufacturing equipment, and rigorous quality assurance processes. These high entry costs act as a considerable deterrent for many aspiring competitors.

Dexerials' own strategic focus on expanding into growth areas such as photonics further elevates this capital barrier. For instance, the development of advanced optical films for displays, a key area for Dexerials, requires specialized cleanroom facilities and sophisticated deposition technologies, costing millions of dollars to establish and maintain.

Dexerials' strong portfolio of proprietary technologies, particularly in areas like anisotropic conductive films (ACF) and advanced optical films, acts as a formidable barrier. The company actively secures global patents, as evidenced by its consistent patent filings for innovative materials and manufacturing processes. For instance, in 2023, Dexerials continued to invest in R&D, with a significant portion of its revenue allocated to developing next-generation optical solutions, further solidifying its technological lead.

These patents and the associated unique know-how make it exceptionally difficult and costly for new entrants to match Dexerials' product quality and performance. Replicating their specialized manufacturing techniques and achieving comparable product efficacy would require substantial upfront investment in research and development, alongside navigating complex intellectual property landscapes, thereby deterring potential competitors.

Newcomers face significant hurdles in securing access to established distribution channels, particularly within the competitive consumer electronics, automotive, and medical device industries. Dexerials leverages its long-standing relationships and strategic partnerships, creating a formidable barrier for any new player attempting to replicate its market reach.

Building these essential networks takes considerable time and investment, making it difficult for new entrants to gain traction. Dexerials' recent expansion into North America with a new marketing office underscores its commitment to solidifying and broadening its market access, further intensifying the challenge for potential competitors.

Economies of Scale and Experience Curve

Existing players in the advanced materials sector, such as Dexerials, leverage significant economies of scale in both manufacturing and raw material procurement. This allows them to achieve lower per-unit production costs compared to potential newcomers. For instance, Dexerials' established global supply chain and high-volume production capacity for optical films and adhesives, critical components in displays and semiconductors, would be difficult and expensive for a new entrant to replicate quickly.

New entrants would likely face a substantial cost disadvantage until they reach comparable production volumes. This barrier is amplified by the experience curve effect. Years of accumulated knowledge in specialized material formulation, process optimization, and application development provide incumbents like Dexerials with an edge in efficiency and product quality that is hard to match without significant investment and time.

- Economies of Scale: Dexerials' large-scale production facilities for optical films and adhesives contribute to lower manufacturing costs per unit.

- Procurement Advantage: Established relationships and bulk purchasing power allow Dexerials to secure raw materials at more favorable prices.

- Experience Curve: Decades of R&D and manufacturing refinement in areas like anisotropic conductive films (ACF) give Dexerials a competitive edge in product performance and cost-efficiency.

- Cost Disadvantage for New Entrants: Start-ups would need to invest heavily to achieve similar production efficiencies and material quality, making initial market entry costly.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants. Industries with stringent environmental, safety, and performance standards, such as automotive and medical devices, present substantial barriers. For instance, the automotive sector in 2024 continues to grapple with evolving emissions standards and safety mandates, requiring new players to invest heavily in compliance and advanced technology from the outset. This regulatory landscape necessitates considerable capital expenditure and specialized knowledge, making it challenging for less-established companies to compete effectively.

Dexerials navigates these complexities through its established commitment to sustainability and robust quality management systems. These frameworks not only ensure adherence to current regulations but also position the company to adapt to future policy changes. For example, Dexerials' proactive approach to REACH compliance (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the European Union, a key market, demonstrates its ability to manage regulatory burdens that deter new entrants.

- High Compliance Costs: New entrants face substantial upfront investments to meet rigorous environmental, safety, and performance standards in sectors like automotive and electronics.

- Regulatory Expertise Required: Navigating complex and evolving regulations demands specialized knowledge and dedicated resources, which can be a significant hurdle for startups.

- Industry-Specific Mandates: For example, the automotive industry's increasing focus on electric vehicle (EV) battery safety and recycling regulations adds layers of complexity for potential new manufacturers.

- Dexerials' Advantage: Dexerials' established quality management systems and sustainability initiatives provide a competitive edge in meeting and exceeding these regulatory demands, thereby limiting new entrants.

The threat of new entrants for Dexerials is generally low due to several significant barriers. High capital requirements for R&D and specialized manufacturing, coupled with strong intellectual property protection, make market entry costly and difficult. Furthermore, established distribution networks and economies of scale enjoyed by Dexerials create substantial cost disadvantages for newcomers.

In 2023, Dexerials continued its investment in advanced materials, with a notable portion of its revenue dedicated to developing next-generation optical solutions, further solidifying its technological lead. This ongoing commitment to innovation and patent acquisition deters potential competitors who would need to invest heavily to replicate Dexerials' product quality and performance.

Navigating stringent government regulations, particularly in sectors like automotive and medical devices, adds another layer of complexity. For instance, the automotive industry in 2024 faces evolving safety and environmental mandates, requiring significant capital and specialized knowledge for compliance, which can be a major hurdle for new entrants.

| Barrier Type | Description | Impact on New Entrants | Dexerials' Position |

|---|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and quality assurance. | Significant deterrent due to high upfront costs. | Established infrastructure and ongoing R&D investment. |

| Intellectual Property | Proprietary technologies and patents in areas like ACF and optical films. | Difficult and costly to replicate specialized know-how and processes. | Strong patent portfolio and continuous innovation. |

| Economies of Scale | Lower per-unit costs due to high-volume production and procurement. | New entrants face a cost disadvantage until achieving comparable volumes. | Efficient global supply chain and high production capacity. |

| Distribution Channels | Long-standing relationships and strategic partnerships in key industries. | Challenging to gain market access and replicate Dexerials' reach. | Extensive network and recent market expansion efforts. |

| Government Regulations | Stringent standards in automotive, medical, and electronics sectors. | Requires substantial investment in compliance and specialized knowledge. | Robust quality management systems and proactive regulatory adherence. |

Porter's Five Forces Analysis Data Sources

Our Dexerials Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Dexerials' official annual reports, investor presentations, and public financial statements. We supplement this with industry-specific market research reports and data from reputable financial news outlets to capture current market dynamics and competitive landscapes.